Global Rapid RNA testing kits Market By Product Type (Influenza A & B Testing Kits, Herpes Virus I Testing Kits, and Adenovirus Testing Kits), By End-user (Pharmaceutical & Biotech Companies, Academic & Research Institutions, and Diagnostic Centres), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166036

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

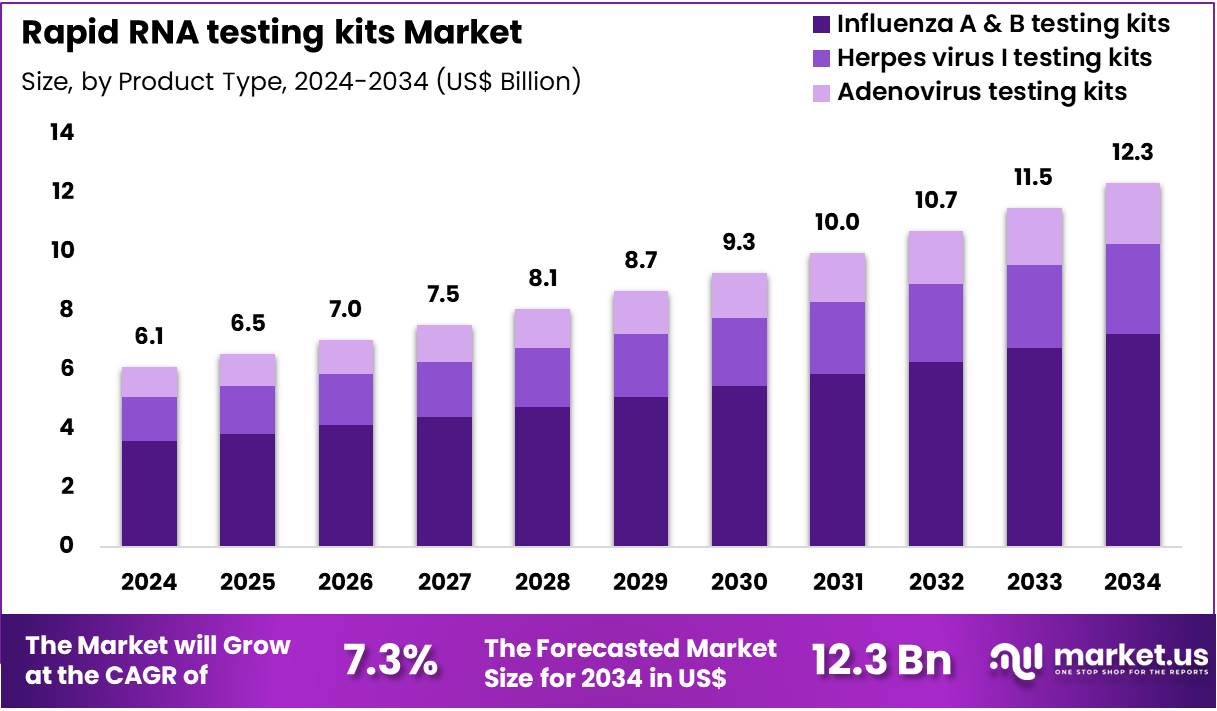

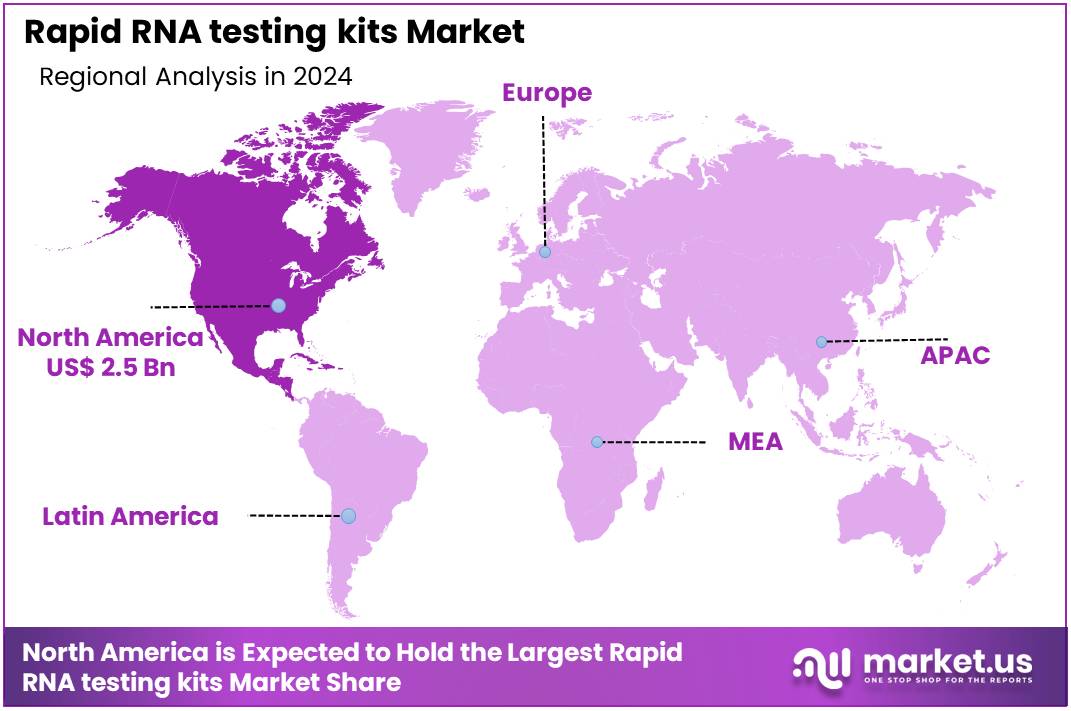

Global Rapid RNA testing kits Market size is expected to be worth around US$ 12.3 Billion by 2034 from US$ 6.1 Billion in 2024, growing at a CAGR of 7.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.4% share with a revenue of US$ 2.5 Billion.

Increasing demand for immediate infectious disease detection drives the Rapid RNA Testing Kits market, as healthcare facilities require swift, on-site results to initiate targeted interventions without laboratory delays. Diagnostic developers incorporate isothermal amplification techniques that bypass thermal cycling for faster RNA target detection. These kits enable outbreak containment through field-deployable pathogen identification, intraoperative viral clearance verification, bedside sepsis etiology determination, and emergency department respiratory panel triage.

Portable, user-friendly formats create opportunities for non-specialist operators to perform high-sensitivity testing in diverse care settings. Starkey and LG advanced accessibility in May 2025 by partnering to integrate Auracast™ Streaming into hearing solutions, though this primarily enhances user experience rather than direct RNA diagnostics; it indirectly supports market growth by improving device connectivity for health monitoring applications. This collaboration underscores the trend toward seamless technology integration in diagnostic ecosystems.

Growing need for decentralized molecular diagnostics accelerates the Rapid RNA Testing Kits market, as point-of-care providers adopt battery-powered devices that deliver laboratory-equivalent accuracy in under an hour. Biotechnology firms refine lyophilized reagent cartridges that maintain stability at ambient temperatures for extended shelf life. Applications span veterinary herd surveillance for avian influenza RNA, agricultural crop pathogen screening via leaf extracts, environmental water quality monitoring for enterovirus contamination, and travel medicine pre-departure checks for tropical fever agents.

Supply chain resilience through ready-to-use kits opens avenues for global health emergency stockpiling and rapid response deployment. Cochlear and GN reinforced innovation in March 2025 by expanding their Smart Hearing Alliance to incorporate AI and deep neural networks, focusing on bimodal hearing solutions that parallel advancements in rapid diagnostic connectivity. This partnership highlights collaborative R&D driving multifunctional health technologies.

Rising integration of artificial intelligence in signal processing propels the Rapid RNA Testing Kits market, as manufacturers embed onboard algorithms that automate result interpretation and reduce user error. Electronics specialists design microfluidic systems with real-time fluorescence detection for quantitative RNA load assessment. These advanced kits support cancer recurrence monitoring via circulating tumor RNA, transplant rejection surveillance through donor-derived cell-free RNA, prenatal non-invasive screening for fetal anomalies, and biothreat agent identification in security operations.

AI-enhanced specificity creates opportunities for multiplex panels that simultaneously quantify multiple RNA targets from minimal sample volumes. Phonak launched the Audéo Sphere Infinio in August 2024, featuring the DEEPSONIC AI Chip for ultra-fast speech processing in noisy environments, demonstrating parallel AI applications that inspire similar real-time enhancements in RNA detection platforms. This award-winning innovation signals the market’s shift toward intelligent, high-performance diagnostic tools.

Key Takeaways

- In 2024, the market generated a revenue of US$ 6.1 Billion, with a CAGR of 7.3%, and is expected to reach US$ 12.3 Billion by the year 2034.

- The product type segment is divided into influenza A & B testing kits, herpes virus I testing kits, and adenovirus testing kits, with influenza A & B testing kits taking the lead in 2024 with a market share of 58.6%.

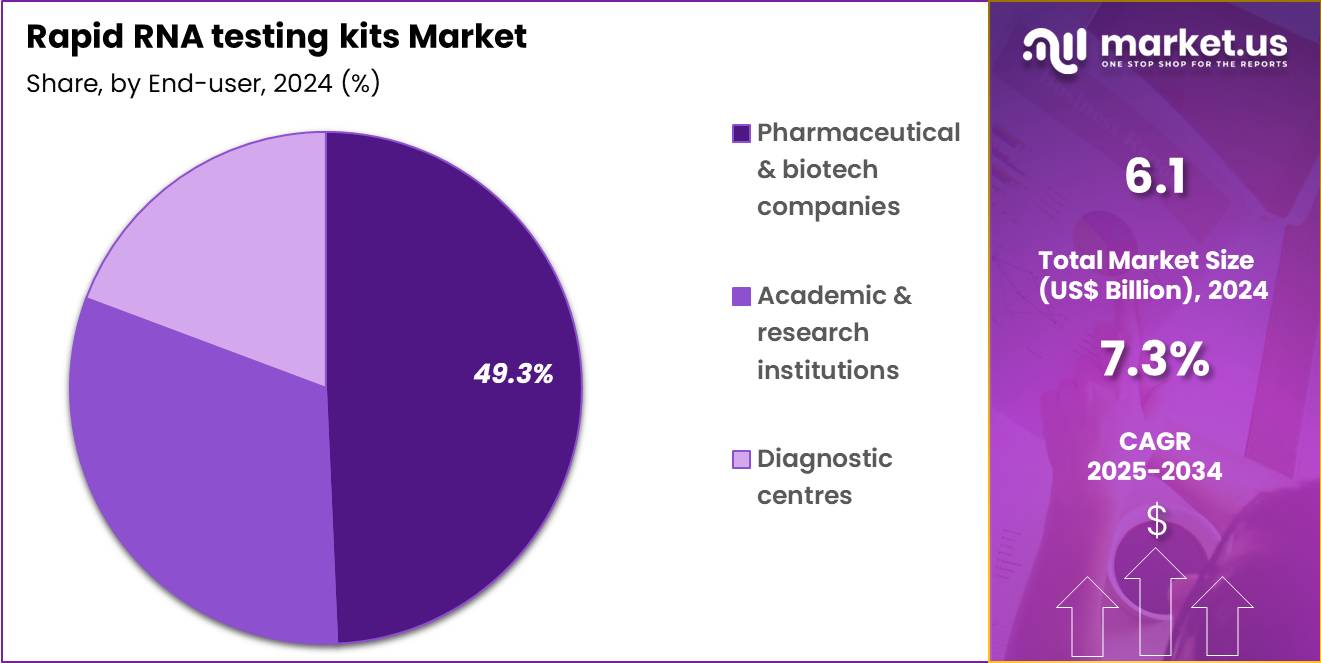

- Considering end-user, the market is divided into pharmaceutical & biotech companies, academic & research institutions, and diagnostic centres. Among these, pharmaceutical & biotech companies held a significant share of 49.3%.

- North America led the market by securing a market share of 40.4% in 2024.

Product Type Analysis

Influenza A & B testing kits account for 58.6% of the Rapid RNA Testing Kits market and are projected to dominate due to the high global incidence of seasonal flu outbreaks and pandemic preparedness initiatives. These kits enable early viral RNA detection within minutes, supporting immediate clinical and public health responses. Increasing government funding and international health surveillance programs are driving large-scale adoption.

The growing demand for decentralized and point-of-care testing solutions in hospitals, airports, and workplaces is further accelerating market growth. Advances in molecular assay design, such as multiplex PCR and loop-mediated isothermal amplification, are improving accuracy and turnaround time.

Pharmaceutical firms are integrating influenza RNA tests into vaccine efficacy monitoring and clinical trials. Moreover, recurring flu epidemics and emerging viral strains are intensifying the need for rapid screening. As global health systems strengthen infectious disease preparedness, influenza A & B testing kits are anticipated to remain the cornerstone of rapid RNA testing.

End-User Analysis

Pharmaceutical and biotech companies hold 49.3% of the Rapid RNA Testing Kits market and are anticipated to sustain dominance due to their growing reliance on RNA testing in vaccine and antiviral drug development. These companies increasingly use rapid RNA testing kits to validate viral gene expression, assess therapeutic efficacy, and monitor trial endpoints in real time. The surge in RNA-based drug pipelines, including mRNA vaccines and gene therapies, reinforces demand for efficient viral RNA quantification tools. Collaborations between biotech firms and diagnostic developers are producing portable testing solutions tailored for clinical research.

The integration of automated molecular testing platforms in R&D laboratories enhances throughput and reliability. Additionally, the focus on pandemic preparedness and surveillance programs has prompted pharmaceutical companies to expand internal RNA testing capacities. Strategic investments in multiplex testing kits capable of detecting multiple viral pathogens simultaneously are improving workflow efficiency. As RNA therapeutics and molecular biology applications expand, pharmaceutical and biotech companies are projected to remain pivotal in driving innovation and demand across this market.

Key Market Segments

By Product Type

- Influenza A & B Testing Kits

- Herpes Virus I Testing Kits

- Adenovirus Testing Kits

By End-user

- Pharmaceutical & Biotech Companies

- Academic & Research Institutions

- Diagnostic Centres

Drivers

Increasing Global Prevalence of Hepatitis C Virus Infections is Driving the Market

The persistent rise in chronic hepatitis C virus infections globally serves as a primary driver for the rapid RNA testing kits market, compelling widespread deployment of sensitive detection tools to identify cases early and prevent liver complications. This viral RNA pathogen’s asymptomatic nature often delays recognition until advanced fibrosis develops, heightening the necessity for scalable, point-of-care diagnostics in endemic areas.

Public health authorities emphasize routine screening in high-risk groups, such as injection drug users and blood transfusion recipients, to interrupt transmission chains. Diagnostic developers prioritize nucleic acid amplification technologies for their superior specificity in detecting low viral loads. Integration into national elimination programs amplifies procurement volumes, stabilizing supply chains for kit manufacturers. Collaborative initiatives with international donors facilitate technology transfers to low-resource settings, broadening application scopes.

The economic burden of untreated infections, including cirrhosis and transplants, justifies investments in rapid assays that enable same-day results. Educational outreach targets healthcare workers, enhancing test utilization in outpatient clinics. This driver aligns with broader goals of viral eradication by 2030, incentivizing innovation in user-friendly formats.

The World Health Organization reports that 50 million people were living with chronic hepatitis C infection globally in 2022. Such prevalence underscores the critical demand for efficient RNA-based screening solutions. Overall, this epidemiological pressure ensures sustained market expansion through policy-backed adoption.

Restraints

Low Diagnosis and Treatment Coverage is Restraining the Market

Suboptimal diagnosis and subsequent treatment access for hepatitis C continue to constrain the rapid RNA testing kits market, as undiagnosed individuals evade curative interventions and sustain community transmission. In many regions, fragmented healthcare infrastructures limit test availability, particularly in primary care where most infections are initially encountered. Stigma associated with the virus discourages voluntary screening, resulting in reliance on opportunistic testing rather than systematic approaches.

High kit costs relative to per capita incomes deter bulk purchases by public sectors in developing nations. Variability in assay performance across viral genotypes complicates standardization, eroding clinician confidence in results. Logistical hurdles, such as cold chain requirements for reagents, exacerbate distribution challenges in remote locales.

Reimbursement policies often overlook rapid formats, favoring slower laboratory methods despite their timeliness advantages. This restraint perpetuates health inequities, with marginalized populations bearing disproportionate burdens. Global monitoring reveals stagnant progress, impeding market maturation.

The World Health Organization indicates that only 36% of people living with chronic hepatitis C knew their diagnosis in 2022. These coverage gaps highlight systemic barriers that must be dismantled for equitable growth. Addressing them demands integrated strategies encompassing affordability and awareness enhancement.

Opportunities

Regulatory Approvals for Point-of-Care RNA Testing are Creating Growth Opportunities

Accelerated regulatory clearances for point-of-care platforms targeting RNA viruses are forging key expansion avenues in the rapid testing kits market, enabling decentralized diagnostics in diverse clinical environments. These approvals validate cartridge-based systems that deliver quantitative viral load results within an hour, ideal for resource-limited facilities. Developers seize this by pursuing validations for multiplex detection, combining hepatitis C with co-infection markers for comprehensive profiling.

Partnerships with health ministries streamline tender processes, securing long-term contracts for deployment in elimination campaigns. Cost efficiencies from localized production reduce import tariffs, enhancing competitiveness in emerging markets. Training modules accompanying approvals empower non-specialist users, facilitating rollout in community health posts. This opportunity extends to integration with digital health records, supporting real-time surveillance and contact tracing.

Philanthropic funding bolsters pilot programs, generating evidence for scaled reimbursements. The resultant ecosystem promotes innovation in portable instrumentation, diversifying beyond single-analyte kits. On June 27, 2024, the U.S. Food and Drug Administration granted marketing authorization to Cepheid for the Xpert HCV test and GeneXpert Xpress System, the first point-of-care hepatitis C RNA test using a fingertip blood sample. Such milestones catalyze broader therapeutic linkages and revenue diversification.

Impact of Macoeconomic / Geopolitical Factors

Budget constraints from high interest rates and austerity measures in healthcare spending force diagnostic labs to defer investments in rapid RNA testing kits, slowing deployment in resource-strapped public systems. Booming private sector funding and global health security mandates, however, accelerate kit adoption as manufacturers target point-of-care solutions for outbreak response.

Supply chain fractures from escalating tensions in the South China Sea block vital RNA polymerase imports from Asian refineries, driving up production delays and component premiums for international assemblers. These geopolitical rifts, nonetheless, inspire agile firms to establish redundant sourcing networks and invest in synthetic biology alternatives that enhance kit stability.

U.S. tariffs under Section 301 impose 25% levies on Chinese-manufactured diagnostic consumables, burdening American importers with elevated acquisition costs and complicating volume contracts for hospital networks. Distributors cleverly circumvent this by qualifying for duty drawbacks through U.S. re-export programs and aligning with tariff-free ASEAN partners to maintain pricing equilibrium. All told, these variables compel sharper forecasting and diversified strategies across the board.

Latest Trends

Development of Multiplex Rapid Assays for Respiratory Pathogens is a Recent Trend

The emergence of multiplex nucleic acid tests capable of simultaneously detecting multiple RNA-based respiratory viruses has defined a key trend in the rapid testing kits market throughout 2024, optimizing triage in high-volume emergency settings. These assays consolidate detection of SARS-CoV-2, influenza A/B, and RSV into single workflows, minimizing sample requirements and turnaround times. Regulatory endorsements prioritize near-patient utility, aligning with seasonal outbreak management protocols.

Manufacturers refine lyophilized reagents for ambient stability, easing logistics in outpatient clinics. This trend intersects with antimicrobial stewardship, curbing unnecessary antibiotic prescriptions through precise viral identification. Clinical validations demonstrate concordance with reference methods, bolstering adoption in pediatric and geriatric care. Integration with electronic health systems enables automated reporting, enhancing epidemiological insights.

Competitive pressures drive miniaturization, yielding handheld devices for field use. The focus on inclusivity ensures applicability across age groups and comorbidities. On June 10, 2024, the U.S. Food and Drug Administration granted Emergency Use Authorization for Roche’s cobas liat SARS-CoV-2, Influenza A/B & RSV nucleic acid test, a four-in-one molecular assay for rapid respiratory pathogen detection. This advancement exemplifies the trend’s pivotal role in fortifying diagnostic resilience.

Regional Analysis

North America is leading the Rapid RNA testing kits Market

The Rapid RNA testing kits market in North America captured 40.4% of the global share in 2024, sustained by heightened preparedness for seasonal respiratory outbreaks that necessitated versatile platforms for influenza, RSV, and emerging variants. Manufacturers like Cepheid and Hologic refined loop-mediated isothermal amplification methods, delivering results in under 20 minutes to support urgent care decisions in overcrowded emergency rooms.

The Biomedical Advanced Research and Development Authority disbursed targeted grants for multiplex assays capable of distinguishing multiple viral RNAs, enhancing surveillance in border states and urban centers. Hospital systems adopted integrated workflow software that automated sample-to-result pipelines, minimizing errors and accelerating turnaround for high-throughput labs amid flu season peaks. Venture-backed startups introduced user-friendly cartridge systems compatible with portable analyzers, empowering field deployments in rural clinics and disaster response teams.

Reimbursement expansions from private insurers covered expanded indications beyond COVID-19, incentivizing widespread procurement for pediatric and geriatric screenings. Cross-sector alliances with pharmacy chains facilitated over-the-counter distribution channels, broadening access for symptomatic individuals without physician visits. Quality assurance standards from the College of American Pathologists validated kit stability under variable storage conditions, bolstering confidence in decentralized testing networks.

Export regulations eased technology transfers to allied nations, reinforcing domestic production incentives through tariff protections. The U.S. Food and Drug Administration issued three new Emergency Use Authorizations for molecular diagnostic tests for SARS-CoV-2 between 2022 and 2024, signaling continued innovation in RNA detection capabilities.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Forecasters project the nucleic acid amplification diagnostics sector in Asia Pacific to accelerate during the forecast period, driven by national strategies to fortify outbreak detection in densely populated megacities. China mobilizes provincial health bureaus to deploy subsidized benchtop devices for real-time surveillance of avian influenza strains along migration routes. Japan engineers compact analyzers through its Pharmaceuticals and Medical Devices Agency collaborations, targeting elderly care facilities vulnerable to norovirus surges.

India equips district hospitals via the Integrated Disease Surveillance Programme with heat-stable reagents suited for tropical climates, enabling monsoon-season responses. South Korea pioneers smartphone-linked readers under Korea Disease Control directives, streamlining data uploads for contact tracing in transit hubs. Governments harmonize approval processes across the ASEAN bloc, slashing validation times for imported platforms adapted to local pathogens.

Bio-parks in Taiwan incubate hybrid kits merging CRISPR with traditional PCR, attracting joint ventures from Silicon Valley pioneers. Community health workers in the Philippines receive training on simplified extraction protocols, extending reach to archipelago outposts prone to dengue co-infections.

Economic incentives spur local assembly of consumables, curbing costs and fostering job creation in biotech corridors. The World Health Organization estimates that only 13% of individuals living with chronic hepatitis B in the Western Pacific Region received a diagnosis in 2022, underscoring the imperative for expanded RNA-based confirmatory testing infrastructures.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the rapid RNA diagnostics sector drive growth by launching cartridge-based multiplex platforms that detect multiple pathogens in under 30 minutes, securing exclusive tenders with global health organizations and hospital chains. They acquire niche isothermal amplification firms to integrate low-cost, battery-powered devices ideal for remote clinics, while establishing regional manufacturing hubs to customize kits for endemic strains and ensure uninterrupted supply.

Executives forge co-commercialization deals with antiviral developers to align testing with treatment pathways, embedding AI result validation to boost accuracy and payer trust. These moves consolidate leadership in decentralized surveillance. F. Hoffmann-La Roche Ltd., headquartered in Basel since 1896, leads through its Diagnostics division with fully automated, high-throughput systems and portable analyzers that deliver lab-grade RNA insights at the point of need, sustaining dominance via continuous chemistry refinements and EHR-integrated workflows that empower real-time clinical decisions worldwide.

Top Key Players

- Thermo Fisher Scientific, Inc.

- Quidel Corporation

- QIAGEN N.V.

- PerkinElmer, Inc.

- Illumina, Inc.

- Hoffmann‑La Roche AG

- Danaher Corporation

- Bio‑Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Abbott Laboratories

Recent Developments

- In August 2025, Earways Medical and AuDNet Hearing Group (AHG) announced a partnership to broaden the adoption of the EarWay Pro cerumen removal technologies throughout the US. This collaboration aims to provide healthcare professionals and consumers with enhanced access to advanced, non-invasive earwax removal solutions.

- In July 2024, Eosera launched a new single-use delivery system for one of its doctor-recommended, over-the-counter ear care products. The design focuses on one-handed operation to make the product application predictable and simpler for the user.

Report Scope

Report Features Description Market Value (2024) US$ 6.1 Billion Forecast Revenue (2034) US$ 12.3 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Influenza A & B Testing Kits, Herpes Virus I Testing Kits, and Adenovirus Testing Kits), By End-user (Pharmaceutical & Biotech Companies, Academic & Research Institutions, and Diagnostic Centres) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., Quidel Corporation, QIAGEN N.V., PerkinElmer, Inc., Illumina, Inc., F. Hoffmann‑La Roche AG, Danaher Corporation, Bio‑Rad Laboratories, Inc., Agilent Technologies, Inc., Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Rapid RNA Testing Kits MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Rapid RNA Testing Kits MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific, Inc.

- Quidel Corporation

- QIAGEN N.V.

- PerkinElmer, Inc.

- Illumina, Inc.

- Hoffmann‑La Roche AG

- Danaher Corporation

- Bio‑Rad Laboratories, Inc.

- Agilent Technologies, Inc.

- Abbott Laboratories