Global Railway Pantograph Market Report By Type (Pure Carbon Slider Type Pantograph, Metallic Carbon Slider Type Pantograph), By Train Type (High-Speed Train, Mainline Train, Freight Train, Metro Train), By Application (Electric Locomotive, Electric Multiple Unit (EMU), Subway/Light Rail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132167

- Number of Pages: 305

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

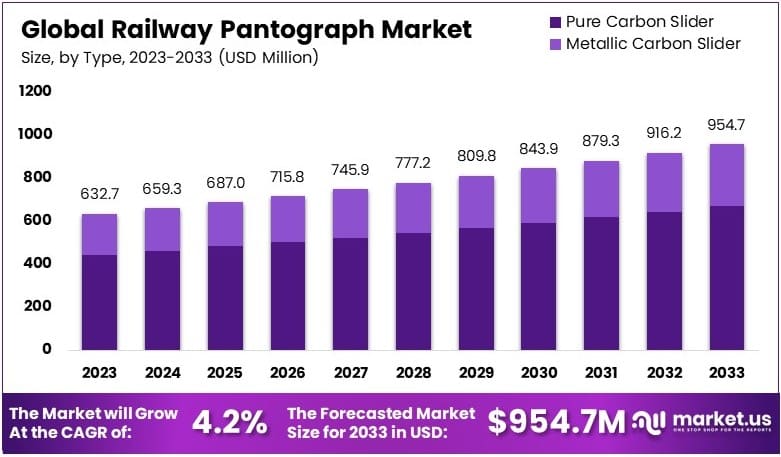

The Global Railway Pantograph Market size is expected to be worth around USD 954.7 Million by 2033, from USD 632.7 Million in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

A railway pantograph is a device mounted on the roof of electric trains to connect with overhead lines and draw electric power for traction. It is essential for the operation of electrified rail networks, allowing trains to receive consistent electricity while in motion.

The railway pantograph market encompasses the production, distribution, and servicing of pantographs for rail systems. This market caters to the demand for efficient and reliable electric traction in urban, regional, and high-speed rail networks, adapting to various environmental and operational requirements.

The primary growth factors for the railway pantograph market include the global increase in railway electrification projects and advances in bullet train high-speed rail technologies. As countries modernize their transportation infrastructure, the demand for pantographs, which facilitate efficient electric energy transfer to trains, is rising.

For high-speed rail, single-arm pantographs are preferred due to their aerodynamic properties, essential for maintaining stability at speeds exceeding 300 km/h. Conversely, double-arm pantographs are prevalent in robust industrial applications for their enhanced stability.

Innovations aimed at reducing operational noise and improving contact reliability are critical in markets such as India’s Shinkansen Series N700, where such features are crucial for safety and efficiency in diverse railway environments.

There is significant opportunity in the railway pantograph market due to the surge in metro and urban transit projects worldwide. Additionally, the push towards sustainable and smart transport solutions has heightened the need for advanced, eco-friendly pantographs in both new and retrofit rail systems.

The market saturation level for railway pantographs is relatively low, suggesting ample room for growth and entry of new competitors. This is driven by continuous innovations and expansions in rail infrastructure across various regions.

Key Takeaways

- The Railway Pantograph Market was valued at USD 632.7 million in 2023 and is expected to reach USD 954.7 million by 2033, with a CAGR of 4.2%.

- In 2023, Pure Carbon Slider Type Pantograph dominates the type segment, driven by its durability and efficiency.

- In 2023, Mainline Train leads the train type segment due to its extensive deployment in long-distance routes.

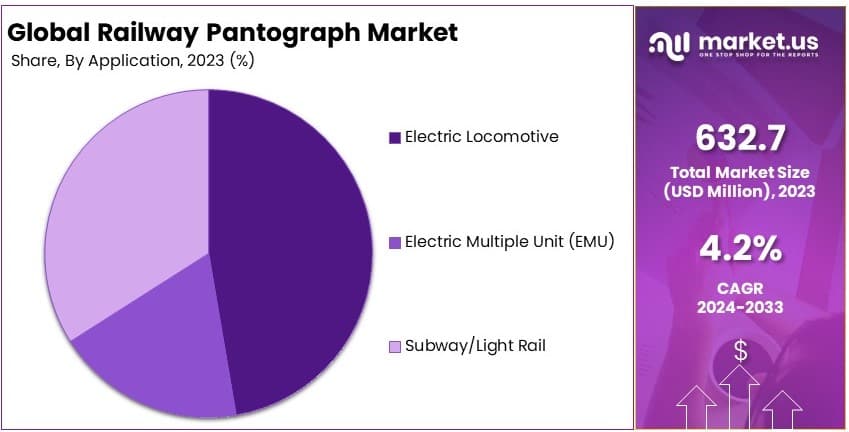

- In 2023, Electric Locomotive is the leading application segment, propelled by the growth in electrified rail networks.

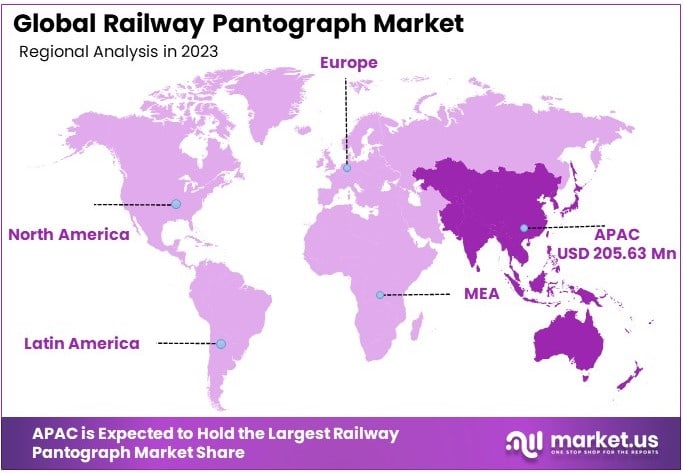

- In 2023, Asia-Pacific holds the dominant regional share at 32.5%, reflecting significant railway infrastructure investments.

Type Analysis

Pure Carbon Slider Type Pantograph Dominates Due to Superior Electrical Conductivity

In the “Type” segment of the Railway Pantograph Market, the Pure Carbon Slider Type Pantograph leads, primarily due to its superior electrical conductivity and reduced wear on overhead wires.

This type is favored for its durability and efficiency, making it a popular choice for railway operators aiming to reduce maintenance costs and enhance operational reliability.

Conversely, the Metallic Carbon Slider Type Pantograph, while also utilized, is less dominant. This type integrates metal additives to improve conductivity and strength. However, it can lead to increased overhead wire wear compared to pure carbon types. Still, its role is critical in specific applications where additional conductivity is required, supporting overall market diversity and technological advancement.

Train Type Analysis

Mainline Train Leads in Usage of Pantographs due to Extensive Rail Networks

Within the “Train Type” segment, Mainline Trains dominate the use of pantographs, largely due to the extensive networks these trains operate over, which require reliable overhead contact systems.

Mainline trains, which include intercity and long-distance travel services, prioritize the efficiency and durability of pantographs to minimize downtime and maintenance.

High-Speed Trains also significantly utilize pantographs but require more specialized designs to cope with higher speeds and increased electrical demands. Freight Trains and Metro Trains, although essential parts of the rail transport system, have less complex requirements.

Thus they contribute differently to the pantograph market. Freight trains focus on robustness due to heavy loads, whereas metro trains require frequent but shorter operations, influencing their pantograph design and material choices.

Application Analysis

Electric Locomotive Dominates Pantograph Application due to Broad Electrification Efforts

In the “Application” segment, Electric Locomotives hold the largest market share. This dominance is driven by global electrification efforts where electric locomotives are increasingly preferred for their efficiency and lower environmental impact.

These locomotives rely heavily on pantographs for continuous power supply, making this application critical for the overall market.

Electric Multiple Units (EMUs) and Subway/Light Rail vehicles also rely on pantographs but have varying operational demands. EMUs are commonly used in suburban rail services and require reliable pantographs for frequent stops and starts.

Subway and light rail systems, while similar, often operate in urban environments with frequent acceleration and deceleration, impacting pantograph design and material specifications.

Key Market Segments

By Type

- Pure Carbon Slider Type Pantograph

- Metallic Carbon Slider Type Pantograph

By Train Type

- High-Speed Train

- Mainline Train

- Freight Train

- Metro Train

By Application

- Electric Locomotive

- Electric Multiple Unit (EMU)

- Subway/Light Rail

Drivers

Increasing Adoption of Electric Trains Drives Market Growth

The rising adoption of electric trains is a primary driver for the Railway Pantograph Market. As countries strive to reduce their carbon footprint and transition to sustainable transportation, electric trains offer a greener alternative to diesel-powered locomotives.

Additionally, advancements in electric train technology have improved efficiency and performance, making them more attractive to railway operators. Furthermore, government initiatives and subsidies aimed at promoting clean energy transportation are accelerating the shift towards electric trains.

This increased demand for electric railways directly boosts the need for reliable pantograph systems that can efficiently transfer electricity from overhead lines to the trains.

Consequently, the combination of environmental goals, technological progress, and supportive policies creates a robust growth environment for the Railway Pantograph Market. As electric train fleets expand, manufacturers are compelled to innovate and enhance pantograph designs to meet the evolving demands of the industry, further driving market growth.

Restraints

High Initial Installation Costs Restraints Market Growth

High initial installation costs present a significant restraint to the growth of the Railway Pantograph Market. The procurement and installation of pantograph systems require substantial capital investment, which can be a barrier for railway operators, especially in emerging markets with limited budgets.

Additionally, the complexity of integrating pantographs with existing railway infrastructure often necessitates specialized labor and equipment, further escalating costs.

Furthermore, the lack of standardized pantograph designs across different regions can lead to increased costs due to the need for customized solutions and additional training for maintenance personnel. This financial strain may deter some railway operators from upgrading or expanding their pantograph systems, thereby slowing market growth.

Moreover, economic fluctuations and budget constraints in various countries can impact the allocation of funds towards railway infrastructure projects, limiting the potential for market expansion

Opportunity

Expansion in Emerging Markets Provides Opportunities

The expansion of railway networks in emerging markets presents significant growth opportunities for the Railway Pantograph Market. Rapid urbanization and economic development in countries such as India, China, and Brazil are driving the construction of new railway lines and the modernization of existing ones.

This expansion creates a substantial demand for pantograph systems that are essential for the efficient operation of electric powertrains. Additionally, government investments in infrastructure projects aimed at enhancing connectivity and reducing traffic congestion further boost the need for advanced pantograph technologies.

Furthermore, the increasing focus on improving public transportation systems to support sustainable urban growth opens up avenues for innovation and the deployment of smart pantograph solutions. The integration of renewable energy sources with railway systems also presents opportunities for developing pantographs.

Moreover, partnerships between local governments and international manufacturers can facilitate technology transfer and the adoption of best practices, fostering market growth. Consequently, the burgeoning railway infrastructure projects in emerging economies offer a fertile ground for manufacturers and service providers to expand.

Challenges

Stringent Safety Regulations Challenges Market Growth

Stringent safety regulations pose a significant challenge to the growth of the Railway Pantograph Market. Governments and regulatory bodies impose strict standards to ensure the safety and reliability of railway systems, including the performance of pantograph systems.

Compliance with these regulations often requires manufacturers to invest heavily in research and development to meet the necessary safety criteria, which can increase production costs and extend time-to-market for new products.

These regulatory requirements can be particularly burdensome for smaller manufacturers who may lack the resources to comply fully, limiting their ability to compete effectively. Furthermore, variations in safety standards across different countries and regions can complicate the production and distribution of pantograph systems.

This lack of harmonization can lead to increased costs and operational inefficiencies, hindering market growth. To navigate these challenges, industry players must prioritize compliance and invest in advanced technologies that enhance the safety and performance of pantograph systems while maintaining cost-effectiveness.

Growth Factors

Increasing Focus on Sustainable Transportation Are Growth Factors

Increasing focus on sustainable transportation serves as a crucial growth factor for the Railway Pantograph Market. As global awareness of environmental issues intensifies, there is a strong push towards reducing carbon emissions and promoting eco-friendly transportation alternatives.

Electric trains, which rely on pantograph systems to draw power from overhead lines, are at the forefront of this shift towards sustainability. Governments and international organizations are implementing policies and incentives to encourage the adoption of electric railways, thereby boosting the demand for reliable and efficient pantograph systems.

Additionally, the development of renewable energy sources, such as wind and solar power, is complementing the growth of electric railways by providing cleaner energy options for powering trains.

Furthermore, the increasing investment in green infrastructure projects and the modernization of existing railway networks are creating ample opportunities for market expansion. Collaborations between pantograph manufacturers and railway operators are also fostering the development of advanced, eco-friendly pantograph solutions that align with the broader goals of sustainable transportation.

Emerging Trends

Adoption of IoT and AI in Pantograph Systems Is Latest Trending Factor

The adoption of Internet of Things (IoT) and Artificial Intelligence (AI) technologies in pantograph systems is one of the latest trending factors driving the Railway Pantograph Market. These advanced technologies enable real-time monitoring and data analysis, enhancing the performance and reliability of pantograph systems.

IoT integration allows pantographs to collect and transmit data on various parameters such as current flow, temperature, and wear levels, providing valuable insights for predictive maintenance and reducing downtime.

Additionally, the use of IoT and AI facilitates the optimization of energy consumption and the improvement of overall system efficiency, contributing to cost savings and sustainability goals. Furthermore, these technologies support the development of smart pantographs that can adapt to varying environmental conditions and operational demands.

Consequently, manufacturers that incorporate these advanced technologies into their pantograph systems are well-positioned to capitalize on the growing demand for smart and efficient railway solutions, driving market growth and fostering innovation.

Regional Analysis

Asia-Pacific Dominates with 32.5% Market Share

Asia-Pacific leads the Railway Pantograph Market with a 32.5% share, valued at USD 205.63 million. This dominance is driven by extensive rail infrastructure developments and government investments aimed at expanding electrified rail networks. Countries like China, India, and Japan play pivotal roles, focusing on high-speed rail systems and sustainable transport.

The region’s market dynamics benefit from rapid urbanization, large-scale industrialization, and a growing demand for efficient public transportation. Key characteristics, such as high population density and increasing government spending on infrastructure, significantly boost the adoption of pantograph technology to meet high energy transfer needs in dense urban areas.

Looking ahead, Asia-Pacific’s influence in the Railway Pantograph Market is projected to strengthen. As countries continue to prioritize eco-friendly transport solutions, the demand for high-performance pantographs is expected to rise, reinforcing the region’s leadership. Technological advancements in noise reduction and stability at high speeds will further drive growth, securing Asia-Pacific’s market dominance.

Regional Mentions:

- North America: North America plays a growing role in the Railway Pantograph Market, fueled by investments in urban transit and high-speed rail. Increasing environmental regulations and emphasis on sustainable transportation support steady market expansion, particularly in the United States.

- Europe: Europe maintains a strong position, led by a commitment to sustainable rail transport. Countries such as Germany and France focus on integrating advanced pantograph technology into electrified rail systems, aligning with the EU’s green transition goals to reduce emissions and enhance efficiency.

- Middle East & Africa: The Middle East and Africa regions are emerging players in the Railway Pantograph Market, driven by new infrastructure projects and urban transit expansions. Investments in rail electrification for enhanced energy efficiency contribute to gradual market growth.

- Latin America: Latin America shows potential in the Railway Pantograph Market as urbanization drives the need for reliable and efficient public transportation. Efforts to modernize rail infrastructure, especially in Brazil and Argentina, support gradual adoption of advanced pantograph systems in the region.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Railway Pantograph Market is dominated by a few key players known for their innovation, technological expertise, and market reach. These companies focus on delivering reliable and efficient pantograph systems, essential for electric train networks globally.

Schunk Group is recognized for its durable, high-performance pantograph solutions that support high-speed and heavy-duty applications. With a focus on advanced materials and aerodynamic designs, Schunk caters to high-speed rail networks worldwide, meeting industry standards for energy efficiency and stability. Its emphasis on research and development (R&D) strengthens its position as a leader in pantograph technology.

Wabtec Corporation brings its extensive experience in rail systems to the pantograph market. The company focuses on integrating modern technologies and safety features in its pantograph products, appealing to operators seeking reliable solutions for demanding environments. Wabtec’s commitment to innovation and efficiency in rail transportation supports its strong market presence, particularly in North America and Europe.

Alstom, a significant player in rail infrastructure, also excels in the pantograph market. Alstom provides highly efficient pantograph solutions that align with its broader focus on sustainable and electric rail solutions. Known for its robust manufacturing infrastructure and commitment to environmentally friendly transport, Alstom contributes to the market’s growth by supporting high-speed and urban rail projects.

These top players drive the Railway Pantograph Market through continuous innovation, superior product quality, and strategic partnerships that address the evolving needs of global rail networks. Together, they set industry standards for durability, efficiency, and safety, which define the competitive landscape of the market.

Top Key Players in the Market

- Schunk Group

- Wabtec Corporation

- Alstom

- Stemmann-Technik

- Faiveley Transport

- Strömberg & Co.

- Kiepe Electric

- Brecknell Willis

- Mersen Group

- Secheron SA

- Delachaux Group

- Knorr-Bremse

- Hitachi Rail

- Siemens Mobility

- ABB Group

Recent Developments

- CAF: In March 2024, CAF’s hydrogen-powered train completed an 804 km journey across Spain without refueling, highlighting its efficiency and extended range. The train traveled from Madrid to Mérida, stopping in cities such as Talavera de la Reina, Monfragüe, and Cáceres, and retained hydrogen reserves at the journey’s end. This €14 million project, part of the FCH2Rail consortium, aims to develop eco-friendly rail transport solutions, featuring a hybrid engine with hydrogen fuel cells integrated into the CAF Civia 463 electric train.

- Transmission Dynamics: In April 2024, Transmission Dynamics announced the RADAR project, co-funded by Innovate UK, to advance rail infrastructure monitoring using AI and automation. Collaborating with Komodo Digital, Network Rail, Angel Trains, and Avanti West Coast, the project focuses on creating self-learning systems that detect and respond to anomalies in pantographs and overhead lines. This initiative seeks to improve safety, efficiency, and reliability across global rail networks through real-time data and automated infrastructure responses.

Report Scope

Report Features Description Market Value (2023) USD 632.7 Million Forecast Revenue (2033) USD 954.7 Million CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pure Carbon Slider Type Pantograph, Metallic Carbon Slider Type Pantograph), By Train Type (High-Speed Train, Mainline Train, Freight Train, Metro Train), By Application (Electric Locomotive, Electric Multiple Unit (EMU), Subway/Light Rail) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schunk Group, Wabtec Corporation, Alstom, Stemmann-Technik, Faiveley Transport, Strömberg & Co., Kiepe Electric, Brecknell Willis, Mersen Group, Secheron SA, Delachaux Group, Knorr-Bremse, Hitachi Rail, Siemens Mobility, ABB Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Schunk Group

- Wabtec Corporation

- Alstom

- Stemmann-Technik

- Faiveley Transport

- Strömberg & Co.

- Kiepe Electric

- Brecknell Willis

- Mersen Group

- Secheron SA

- Delachaux Group

- Knorr-Bremse

- Hitachi Rail

- Siemens Mobility

- ABB Group