Bullet Train High-Speed Rail Market Report By Speed (200-299 km/hr, 300-399 km/hr, 400-499 km/hr, Above 500 km/hr), By Propulsion (Electric, Diesel, Dual Power), By Component (Traction Motor, Axle, Wheelset, Converter, Transformer), By Application (Passenger Train, Freight Train), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 83247

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

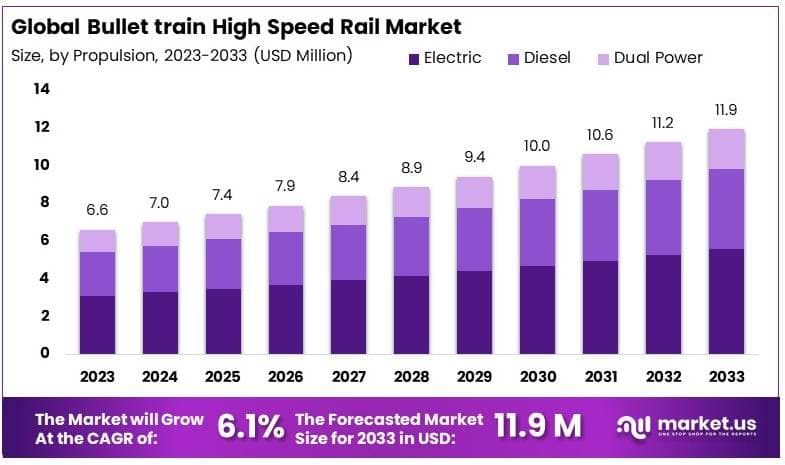

The Global Bullet Train High-Speed Rail Market size is expected to be worth around USD 11.9 Million by 2033, from USD 6.6 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033.

The Bullet Train High-Speed Rail Market refers to the industry involved in developing and operating high-speed rail services that utilize bullet trains. These trains are designed for rapid transit, significantly reducing travel times between major cities compared to traditional rail services.

The market encompasses various components, including train manufacturing, infrastructure development, and technology integration for safety and efficiency. Key market players focus on innovations that enhance speed, comfort, and environmental sustainability. This market is crucial for executives and managers in transportation and infrastructure sectors, providing advanced solutions for urban and intercity mobility.

The Bullet Train High-Speed Rail Market is a pivotal segment within the global transportation sector, characterized by rapid advancements in technology and increasing passenger demands for speed and efficiency. This market has demonstrated significant growth, driven by the successful models established in regions like Japan and China. The Shinkansen network in Japan, a cornerstone of high-speed rail, has achieved a commendable safety record, transporting over 10 billion passengers since 1964 without a single train passenger fatality. Such statistics underscore the high reliability and safety standards that define this market.

In terms of operational capabilities, China leads with top speeds of up to 350 km/h and possesses the largest network, extending over 40,000 km. This expansive infrastructure supports a staggering ridership, with over 3.6 billion trips recorded in 2022. Japan, while having a smaller network of 3,041 km, still facilitated 364 million passenger rides in 2019 through its Shinkansen lines, emphasizing the dense utilization of its network.

Emerging markets like India are also entering the high-speed rail arena. The Vande Bharat Express, India’s fastest train, reaches speeds up to 180 kmph, marking a significant step forward in India’s rail technology. Meanwhile, the Shanghai Maglev in China represents the zenith of high-speed travel, cruising at 460 km/h, the fastest recorded speed for any commercial service globally.

These data points highlight the diverse and dynamic nature of the Bullet Train High-Speed Rail Market. Innovations such as magnetic levitation technology and the continuous push for faster and safer rail services are likely to drive further growth. As urbanization intensifies and the need for efficient intercity travel increases, the market’s trajectory remains robust, offering numerous opportunities for industry leaders and investors to forge new paths in high-speed transportation.

Key Takeaways

- The global bullet train high-speed rail market is expected to reach USD 11.9 Million by 2033, growing from USD 6.6 Million in 2023, with a CAGR of 6.1% during the forecast period from 2024 to 2033.

- The 300-399 km/hr segment dominates with 57.3% due to its optimal balance of speed and operational efficiency. This speed range is favored for high-speed travel while maintaining energy efficiency and cost-effectiveness, particularly in densely populated regions.

- The Electric segment leads with 46.8% market share, driven by its higher efficiency and alignment with global environmental sustainability goals. It is essential for meeting stringent emissions regulations and reducing reliance on fossil fuels.

- The Traction Motor segment holds 28.9% market share, critical for enhancing train performance and efficiency by converting electrical energy into mechanical energy.

- The Passenger Train segment dominates with 73.8% due to high demand for efficient inter-city travel, supporting economic connectivity and meeting rising passenger expectations.

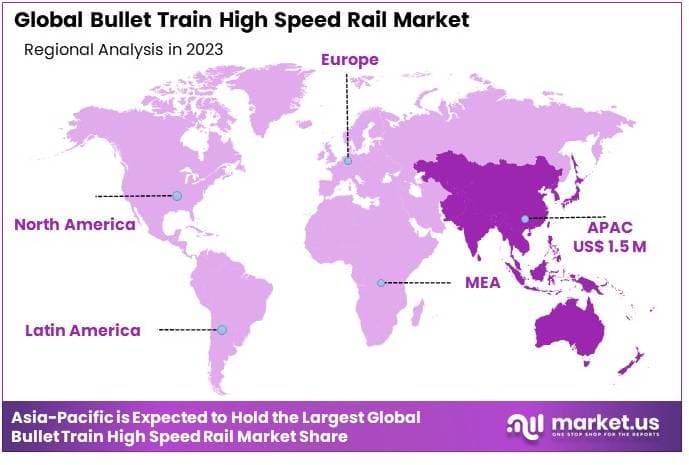

- APAC dominates with a 22.8% market share, highlighting its strong adoption of high-speed rail technology and rapid urbanization driving demand.

- North America holds a significant share of 17.5%, focusing on modernizing existing rail infrastructure to accommodate high-speed rail and meet growing passenger demand.

Driving Factors

Rising Urbanization and Population Growth Drives Market Growth

As urban centers expand and populations rise, the demand for efficient and scalable transportation options becomes critical. The Bullet Train High-Speed Rail Market directly benefits from this trend, as these trains offer a swift and eco-friendly alternative to traditional road and air travel. In China, the rapid development of over 40,000 km of high-speed rail lines has been instrumental in connecting sprawling urban regions, supporting not only daily commutes but also economic exchanges between cities.

This infrastructure development is closely linked to urban growth, driving both regional connectivity and economic prosperity. The efficiency of bullet trains in handling large volumes of passengers effectively reduces congestion and enhances the accessibility between metropolitan areas, making them an integral component of urban planning and development.

Environmental Concerns and Sustainability Initiatives Drives Market Growth

Global efforts to combat climate change have led to a heightened focus on sustainable transportation solutions. Bullet trains, known for their energy efficiency, play a significant role in this shift. They offer a substantial reduction in carbon emissions compared to planes and automobiles, aligning with international goals to lower greenhouse gases.

For instance, the European Union’s aggressive targets to cut transport emissions have spurred the expansion of high-speed rail networks across member states. This environmental advantage not only supports compliance with regulatory frameworks but also appeals to the growing consumer preference for green travel options, further stimulating investment and development in the high-speed rail sector.

Technological Advancements and Innovation Drives Market Growth

Technological innovations have been pivotal in enhancing the appeal and performance of high-speed rail systems. Developments in aerodynamics, the use of lightweight materials, and sophisticated signaling technologies have enabled bullet trains to operate at unprecedented speeds while maintaining high safety standards.

Japan’s Shinkansen trains, capable of reaching speeds up to 320 km/h, exemplify the industry’s push towards faster and more efficient rail services. These technological enhancements not only improve the operational efficiency of high-speed trains but also bolster their competitiveness against other transportation modes, such as air travel. As these technologies evolve, they continue to drive down operational costs and improve the reliability of services, attracting more passengers and securing the market’s growth trajectory.

Restraining Factors

High Initial Investment and Infrastructure Costs Restrains Market Growth

The development of high-speed rail systems demands substantial initial investments, often posing a significant barrier. These costs encompass the construction of specialized tracks, sophisticated signaling systems, and the procurement of advanced rolling stock.

Such financial requirements can deter many countries or regions, particularly those with constrained budgets or other critical spending needs. The California High-Speed Rail project serves as a poignant example, where extensive funding challenges and cost overruns have led to prolonged delays and heightened skepticism about the project’s viability. This factor substantially slows market growth as it limits the feasibility and expansion of new high-speed rail initiatives.

Geographic and Topographic Challenges Restrains Market Growth

Geographical and topographical hurdles present major challenges in the construction and maintenance of high-speed rail networks. Areas with complex terrains, such as mountains or densely populated urban environments, necessitate expensive engineering solutions like tunneling and elevated tracks.

These obstacles not only escalate the costs but also extend the construction timelines, complicating the integration of high-speed rails into existing transportation frameworks. For example, countries like Switzerland and Italy, known for their mountainous landscapes, face significantly higher costs and engineering complexities. This factor restricts the market expansion by increasing the logistical and financial burdens associated with high-speed rail projects.

Speed Analysis

The 300-399 km/hr segment dominates with 57.3% due to its optimal balance of speed and operational efficiency.

The Bullet Train High-Speed Rail Market, categorized by speed, reveals a dominant sub-segment in the 300-399 km/hr range. This segment captures 57.3% of the market due to its appeal in providing high-speed travel while maintaining considerable energy efficiency and cost-effectiveness. Trains operating within this speed range offer rapid transit times that significantly reduce journey durations compared to conventional rail services, yet avoid the exponential rise in operational and maintenance costs associated with speeds exceeding 400 km/hr. The 300-399 km/hr speed segment is particularly popular in densely populated countries where reducing travel time is crucial but where the extreme speeds of over 400 km/hr are not yet justified by passenger volumes or are limited by geographic constraints.

The remaining speed segments, including 200-299 km/hr, 400-499 km/hr, and above 500 km/hr, each play a role in the market based on specific regional needs and technological capabilities. The 200-299 km/hr range is typically suited for regions just beginning to adopt high-speed technologies or for routes that do not justify higher speeds due to close city proximities or lower demand. Conversely, the 400-499 km/hr and above 500 km/hr segments are emerging in markets driven by cutting-edge technological advancements and high demand for ultra-fast travel, although these are currently less common due to their higher infrastructural and operational demands.

Propulsion Analysis

The Electric segment dominates with 46.8% due to its higher efficiency and alignment with global environmental sustainability goals.

In the propulsion category, electric trains hold the largest market share at 46.8%. This dominance is primarily due to their high efficiency, reliability, and lower environmental impact compared to diesel or dual-power alternatives. Electric high-speed trains are capable of maintaining consistent speeds and performance, essential for the effective operation of bullet trains. Furthermore, as global environmental regulations tighten and the push towards sustainability strengthens, electric propulsion stands out as a crucial factor in new high-speed rail projects. It aligns with international goals to reduce greenhouse gas emissions and decrease reliance on fossil fuels.

Diesel and dual-power propulsion systems, while important in specific contexts, generally see less usage in high-speed rail applications. Diesel trains are often employed in regions lacking sufficient electrical infrastructure or where initial investment costs need to be minimized. Dual-power systems, which can operate on both electric and diesel power, provide flexibility for routes that partially include non-electrified tracks, though they are more complex and costly to maintain.

Component Analysis

The Traction Motor segment dominates with 28.9% due to its critical role in enhancing train performance and efficiency.

The traction motor is the dominant component in high-speed rail, holding a 28.9% share of the market. This component is essential for the conversion of electrical energy into mechanical energy, thus driving the train’s wheels. The efficiency, reliability, and power output of the traction motor directly influence the performance and operational capabilities of high-speed trains. Advances in traction motor technology have enabled higher speeds and more efficient energy use, contributing significantly to the overall appeal and feasibility of high-speed rail systems.

Other critical components include axles, wheelsets, converters, and transformers. Each plays a vital role in the safety, efficiency, and reliability of high-speed trains. Axles and wheelsets are crucial for the stable and smooth operation of trains at high speeds, while converters and transformers are integral to the effective distribution and utilization of electrical power within the train systems.

Application Analysis

The Passenger Train segment dominates with 73.8% due to high demand for efficient inter-city travel.

In terms of application, the Passenger Train segment overwhelmingly dominates the market with a 73.8% share. This dominance is driven by the global increase in urbanization and the need for efficient, reliable, and fast transportation solutions between cities. High-speed trains fulfill this need by significantly reducing travel time compared to other modes of transport, thus enhancing commuter convenience and supporting economic connectivity between urban centers. The segment’s growth is further bolstered by rising passenger expectations for comfort and service quality, which high-speed trains are well-positioned to meet.

The Freight Train segment, while smaller, plays a crucial role in the transport of goods over long distances quickly and efficiently. This segment benefits from the same technological advancements as passenger trains but is tailored towards the logistics and supply chain needs of various industries, highlighting the versatility and broad impact of high-speed rail technology in different market contexts.

Key Market Segments

By Speed

- 200-299 km/hr

- 300-399 km/hr

- 400-499 km/hr

- Above 500 km/hr

By Propulsion

- Electric

- Diesel

- Dual Power

By Component

- Traction Motor

- Axle

- Wheelset

- Converter

- Transformer

By Application

- Passenger Train

- Freight Train

Growth Opportunities

Integration with Other Transportation Modes Offers Growth Opportunity

The integration of high-speed rail with other transportation modes, such as airports, regional trains, and urban transit systems, presents significant growth opportunities within the Bullet Train High-Speed Rail Market. This seamless connectivity offers a more efficient travel ecosystem, improving the overall user experience by facilitating easy transfers and reducing total travel time.

For example, the Arlanda Express in Sweden directly connects Stockholm’s city center with Arlanda Airport, enhancing accessibility and convenience for air travelers. This integration not only attracts more passengers but also opens up new revenue streams by broadening the service offering of high-speed rail operators. By linking with other transport networks, high-speed rail can become the backbone of a comprehensive and integrated transport solution, driving increased usage and expanding market reach.

Development of Smart Rail Technologies Offers Growth Opportunity

The adoption of smart technologies such as the Internet of Things (IoT), artificial intelligence (AI), and predictive maintenance systems in the Bullet Train High-Speed Rail Market provides a substantial avenue for growth. These technologies enhance the operational efficiency and safety of high-speed rail services, while also improving the passenger experience.

For instance, Japan’s Shinkansen trains utilize IoT for advanced monitoring and AI for predictive maintenance, which significantly reduces downtime and operational costs. These innovations not only ensure higher reliability and performance but also lead to cost savings that can be reinvested into further technological enhancements. As these technologies continue to advance, they will drive the market by improving service offerings and attracting a tech-savvy passenger demographic, fostering a cycle of continuous improvement and expansion in the high-speed rail industry.

Trending Factors

Sustainability and Decarbonization Initiatives Are Trending Factors

Sustainability and decarbonization efforts are driving trends within the Bullet Train High-Speed Rail Market as global concerns about climate change and environmental degradation escalate. Bullet trains, known for their energy efficiency and reduced carbon emissions, are increasingly viewed as crucial elements of sustainable transportation strategies.

Governments and international bodies are championing high-speed rail to achieve broader environmental goals. The European Union, through its Green Deal and Sustainable and Smart Mobility Strategy, highlights high-speed rail as a key component in reaching carbon neutrality by 2050. This push for sustainability not only enhances the environmental credentials of high-speed rail but also aligns it with global policy shifts and funding priorities, positioning it as a future-proof solution in the transportation sector.

Smart City Development and Urban Mobility Are Trending Factors

The integration of high-speed rail into smart city projects represents a significant trend in urban development, reflecting a shift towards more sustainable and efficient urban mobility solutions. High-speed rail networks are integral to the concept of smart cities, facilitating the rapid and eco-friendly movement of large numbers of people between urban centers.

This is evident in projects like Saudi Arabia’s Neom, where a planned high-speed rail network is a cornerstone of the city’s infrastructure, designed to boost connectivity and support the city’s futuristic vision. The role of high-speed rail in smart cities not only promotes enhanced urban planning but also supports the seamless integration of various modes of transport, making it a key trend in the development of new urban landscapes.

Regional Analysis

APAC Dominates with 22.8% Market Share

Asia Pacific (APAC) holds a dominant 22.8% share in the Bullet Train High-Speed Rail Market, primarily due to extensive investments in rail infrastructure and a strong governmental push towards modern transportation solutions. Countries like China and Japan are leaders in high-speed rail technology, with China having the world’s largest network of high-speed rails exceeding 40,000 km and Japan renowned for its Shinkansen system. The commitment to expanding and upgrading rail systems in response to rising population densities and urbanization significantly contributes to this dominance.

The APAC region’s dominance is also driven by its rapid urbanization and economic growth, which fuel the demand for efficient public transport systems. High-speed trains in APAC not only connect major economic hubs efficiently but also promote regional integration and economic development. The region’s focus on sustainable transportation to alleviate urban congestion and reduce air pollution further enhances the market’s growth.

Regional Market Shares in the Bullet Train High-Speed Rail Market

North America: North America, currently holding a smaller market share of about 4.2%, is gradually expanding its high-speed rail capabilities, with projects like the California High-Speed Rail in the United States. The market’s growth is tempered by high infrastructure costs and regulatory challenges but shows potential due to increasing environmental concerns and urban mobility needs.

Europe: Europe accounts for approximately 34.1% of the market. The continent’s well-established high-speed rail networks and strong governmental support for sustainable transit solutions drive this substantial share. Countries like France, Germany, and Spain continue to invest in expanding their high-speed rail lines, which are integral to the European Union’s transportation framework.

Middle East & Africa: This region holds a modest market share of around 5.6%, influenced by infrastructural developments in Gulf countries like Saudi Arabia, which are integrating high-speed rail into broader economic diversification plans. Projects like the planned rail network in the Neom smart city project indicate potential growth.

Latin America: Latin America, with a market share of 2.3%, has been slower in adopting high-speed rail due to economic constraints and other priorities. However, interest in improving transport infrastructure for better regional connectivity and economic benefits is rising, pointing to future growth opportunities.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Bullet Train High-Speed Rail Market is shaped by a dynamic array of key players, each contributing unique technological advancements and strategic innovations. Companies like Siemens, Hitachi, and Alstom SA stand at the forefront due to their extensive experience and proven capabilities in high-speed train production and infrastructure solutions. Siemens and Alstom, for instance, are known for their cutting-edge rail technology and significant contributions to Europe’s high-speed rail networks, influencing market trends through competitive technological advancements.

CRRC Corporation Ltd, a major player from China, dominates with its massive production capacity and state-backed projects, supporting China’s extensive national high-speed rail network. This not only strengthens its domestic market position but also its competitive edge globally. Similarly, Hitachi leverages its advanced engineering to supply high-speed trains worldwide, enhancing its international footprint.

Companies like Bombardier and Kawasaki Rail Car, Inc. contribute with specialized solutions and services, from rolling stock to comprehensive maintenance and operation services. Meanwhile, ABB Ltd and Thales Group enrich the market with high-tech signaling and electrical solutions, crucial for the safety and efficiency of high-speed rail operations.

Emerging players like Hyundai Rotem Company and Flytoget are also making significant strides, introducing innovative technologies and expanding their geographical reach. Caterpillar, though traditionally associated with heavy machinery, has been venturing into the rail sector, potentially bringing robust engineering expertise to high-speed rail.

Together, these companies drive competitive dynamics, technological innovation, and market expansion within the global high-speed rail industry, positioning themselves strategically to leverage upcoming opportunities and address the evolving demands of rapid transit solutions.

Market Key Players

- Bombardier

- Siemens

- Hitachi

- ABB Ltd

- Alstom SA

- Thales Group

- CRRC Corporation Ltd

- Kawasaki Rail Car, Inc

- Caterpillar

- Flytoget

- Hyundai Rotem Company

Recent Developments

- On May 2024, the National High-Speed Rail Corporation Limited (NHSRCL) is determined to finish India’s inaugural bullet train project, connecting Mumbai and Ahmedabad, by 2026. To achieve this goal, the corporation is focusing on indigenous technological solutions for constructing the infrastructure.

- On May 2024, more than 200 industry leaders, politicians, academics, and labor representatives gathered in Washington, D.C. for the U.S. High Speed Rail annual conference. Notable attendees included U.S. Transportation Secretary Pete Buttigieg, House Speaker Emerita Nancy Pelosi, former White House Infrastructure Coordinator Mitch Landrieu, and other advocates for high-speed rail in America.

- On April 2024, construction commenced on the $12 billion high-speed rail project, Brightline West, connecting Las Vegas and the Los Angeles area. This project, led by Brightline Holdings, aims to construct 218 miles of new track between terminals in Las Vegas and Rancho Cucamonga, California, with plans to have trains operational by the 2028 Summer Olympics in Los Angeles.

Report Scope

Report Features Description Market Value (2023) USD 6.6 Million Forecast Revenue (2033) USD 11.9 Million CAGR (2024-2033) 6.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Speed (200-299 km/hr, 300-399 km/hr, 400-499 km/hr, Above 500 km/hr), By Propulsion (Electric, Diesel, Dual Power), By Component (Traction Motor, Axle, Wheelset, Converter, Transformer), By Application (Passenger Train, Freight Train) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bombardier, Siemens, Hitachi, ABB ltd, Alstom SA, Thales Group , CRRC Corporation ltd, Kawasaki Rail Car, Inc, Caterpillar, Flytoget, Hyundai Rotem Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Global Bullet Train High-Speed Rail Market by 2033?The market size is expected to reach USD 11.9 Million by 2033. The market is expected to grow at a CAGR of 6.1% during this period.

How does the market in North America compare to APAC in terms of share?North America holds a significant share of 17.5%, while APAC dominates with 22.8%.

What technological advancements are influencing the market?Innovations in aerodynamics, lightweight materials, and advanced signaling technologies are key advancements driving the market.

Who are the key players in the Bullet Train High-Speed Rail Market?Key players include Bombardier, Siemens, Hitachi, ABB Ltd, Alstom SA, Thales Group, CRRC Corporation Ltd, Kawasaki Rail Car, Inc., Caterpillar, Flytoget, and Hyundai Rotem Company.

Bullet Train High-Speed Rail MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Bullet Train High-Speed Rail MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-