Global Pyridine Market By Form (Liquid, Solid, Gas), By Production Method (Chemical Synthesis, Biotechnological Processes, Catalytic Processes, Extraction Methods), By Application (Pesticides, Herbicides, Vitamins, Solvents, Resins, Others), By End Use (Agriculture, Pharmaceuticals, Chemical Synthesis, Food Additives, Dyes and Pigments, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177071

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

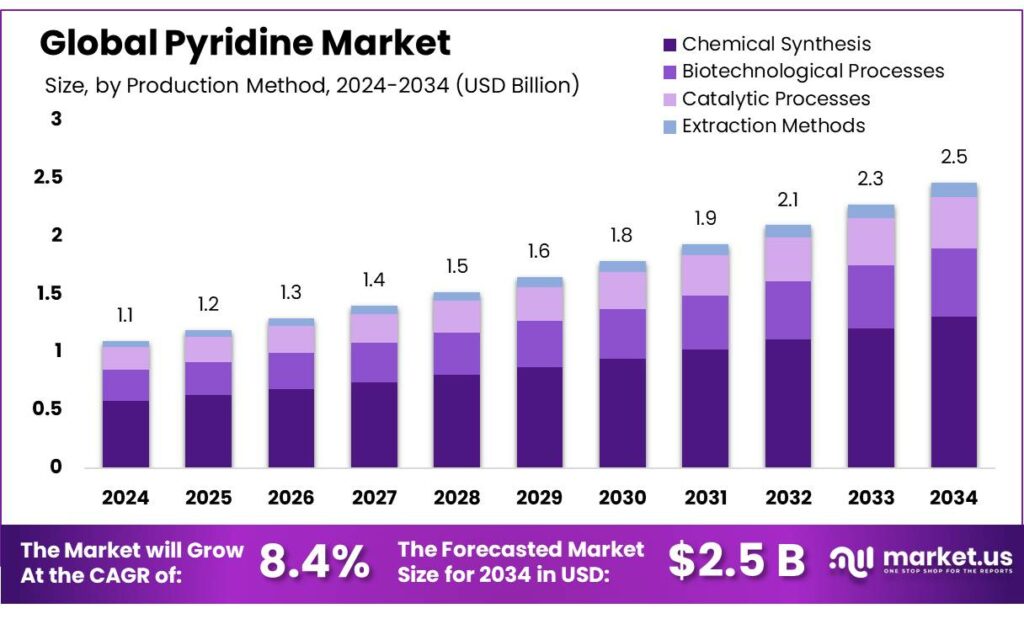

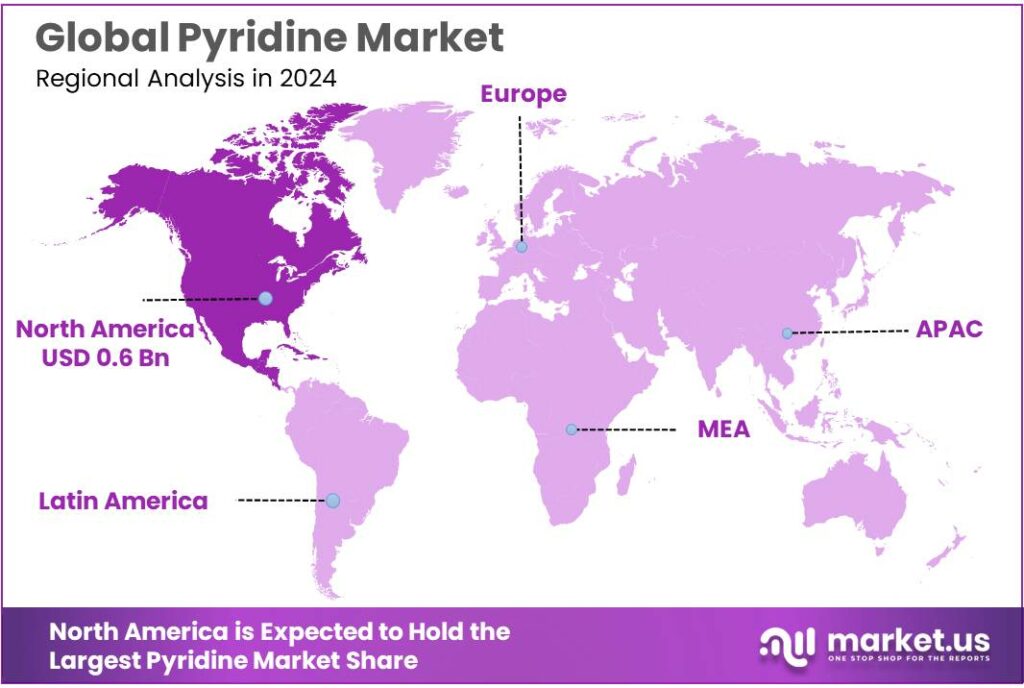

The Global Pyridine Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 8.4% from 2025 to 2034. The North America segment maintained 46.1%, supporting a pyridine market value of USD 0.6 Bn.

Pyridine is a basic nitrogen-containing heterocycle used mainly as a chemical building block rather than an end-consumer ingredient. Industrially, it is valued for its reactivity, enabling downstream manufacture of agrochemical actives, pharmaceutical intermediates, vitamins, specialty solvents, and performance additives.

The current industrial scenario is shaped by two simultaneous pressures: steady volume pull from agriculture-related chemistries and rising compliance expectations around emissions, worker exposure, and trace-impurity control. On the demand side, global farm-input intensity remains structurally high. For example, total pesticide use in agriculture reached 3.73 million tonnes in 2023, and pesticide intensity averaged 2.40 kg per hectare of cropland, indicating sustained formulation and intermediate requirements across crop systems.

Food and feed industry dynamics also matter because pyridine chemistry is tied to vitamin and nutrition value chains used in animal production systems. The scale of global feed manufacturing provides a useful indicator: the Alltech global feed survey estimated 1.396 billion metric tons of total feed production in 2024, up 1.2% year over year.

Government initiatives increasingly influence the “quality and compliance” side of pyridine demand by expanding nutrition delivery systems and tightening safety frameworks. In India, the Ministry of Women and Child Development’s allocation for Saksham Anganwadi and POSHAN 2.0 is shown at ₹21,960 crore and ₹23,100 crore (Budget 2026–27), signaling sustained public-sector focus on nutrition infrastructure and outcomes.

Key Takeaways

- Pyridine Market is expected to be worth around USD 2.5 billion by 2034, up from USD 1.1 billion in 2024, and is projected to grow at a CAGR of 8.4%.

- Liquid held a dominant market position, capturing more than a 78.1% share.

- Chemical Synthesis held a dominant market position, capturing more than a 53.7% share.

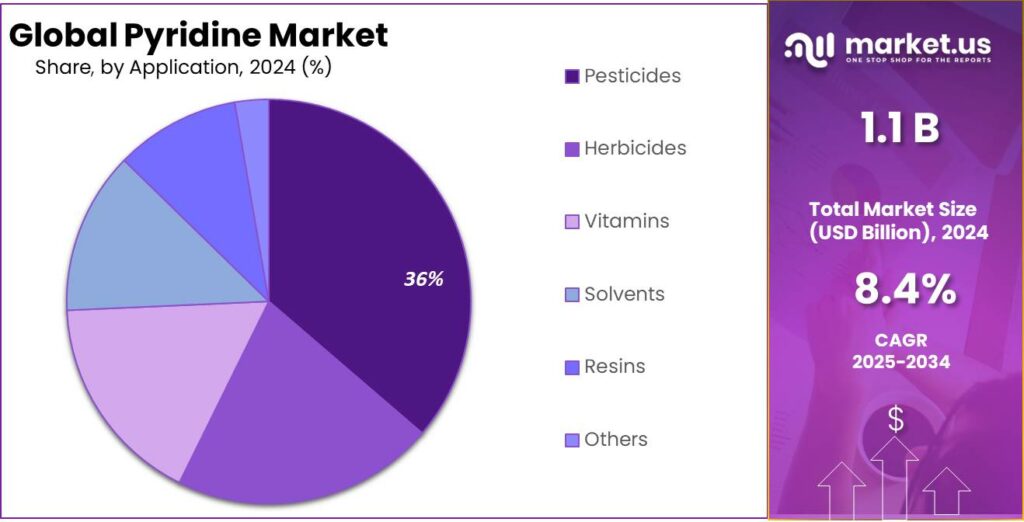

- Pesticides held a dominant market position, capturing more than a 36.3% share.

- Agriculture held a dominant market position, capturing more than a 38.8% share.

- North America dominates the Pyridine Market with a market share of 46.10%, valued at USD 0.6 Bn.

By Form Analysis

Liquid Form Leads the Pyridine Market with a Strong 78.1% Share

In 2024, Liquid held a dominant market position, capturing more than a 78.1% share. This leadership is mainly due to its wide industrial acceptance, easier blending properties, and suitability for large-scale chemical synthesis. Liquid pyridine is commonly used as a solvent and intermediate in agrochemicals, pharmaceuticals, and food-grade vitamin derivatives, making it the preferred form for continuous production processes. Its fluid nature enables smoother handling, faster reactivity, and consistent output, which supports manufacturers aiming for efficiency and reduced operational downtime.

By Production Method Analysis

Chemical Synthesis Leads the Market with a Strong 53.7% Share

In 2024, Chemical Synthesis held a dominant market position, capturing more than a 53.7% share. This method remains the preferred route for pyridine production because it offers better control over purity levels, consistency, and large-scale output. Industries relying on pyridine—especially pharmaceuticals, agrochemicals, and food-grade intermediates—continue to choose chemically synthesized material due to its predictable performance and compatibility with stringent quality standards. The ability to regulate reaction conditions also helps producers manage costs and maintain efficiency across high-volume manufacturing lines.

By Application Analysis

Pesticides Lead the Pyridine Market with a Strong 36.3% Share

In 2024, Pesticides held a dominant market position, capturing more than a 36.3% share. This strong demand is driven by the continued use of pyridine as a key intermediate in the production of widely used crop-protection chemicals. Its role in synthesizing herbicides, insecticides, and fungicides makes it essential for modern farming practices that depend on higher yield and crop security. With agriculture facing rising pressure from pests, climate variability, and food-supply requirements, the pesticides segment naturally remains the largest consumer of pyridine-based intermediates.

By End Use Analysis

Agriculture Leads the Pyridine Market with a Solid 38.8% Share

In 2024, Agriculture held a dominant market position, capturing more than a 38.8% share. This leadership comes from pyridine’s essential role in producing agrochemical intermediates that support large-scale farming. Pyridine is widely used in the synthesis of herbicides, insecticides, and other crop-protection products, making it a key ingredient that helps farmers safeguard crops and maintain productivity. As global food demand rises and farming practices become more intensive, the agricultural sector continues to rely heavily on pyridine-driven chemistry to achieve consistent output and protect harvests from pests and disease.

Key Market Segments

By Form

- Liquid

- Solid

- Gas

By Production Method

- Chemical Synthesis

- Biotechnological Processes

- Catalytic Processes

- Extraction Methods

By Application

- Pesticides

- Herbicides

- Vitamins

- Solvents

- Resins

- Others

By End Use

- Agriculture

- Pharmaceuticals

- Chemical Synthesis

- Food Additives

- Dyes and Pigments

- Others

Emerging Trends

Cleaner, compliance-ready production is the latest trend shaping Pyridine

A clear latest trend in the pyridine industry is the shift toward cleaner production and tighter quality control, mainly because pyridine sits upstream of products that face strict checks in agriculture and food-linked supply chains. Buyers increasingly want pyridine grades with more consistent purity, better documentation, and fewer trace impurities, not just for performance, but for smoother regulatory acceptance and safer handling at plants.

One reason this trend is strengthening is the continuing scale of pesticide use, which keeps regulators and food chains highly alert. The Food and Agriculture Organization reports that total pesticide use in agriculture was 3.73 million tonnes in 2023, and pesticide use intensity was 2.40 kg per hectare of cropland. When pesticide volumes remain this large, governments and large food buyers tend to tighten residue monitoring and safety expectations.

Government programs are also reinforcing the demand for measurable quality and monitoring, which indirectly supports this trend. In India, the Press Information Bureau noted that 2 lakh Anganwadi Centres were approved for upgradation as Saksham Anganwadi under Mission Poshan 2.0, and 94,077 centres had been upgraded with improved infrastructure. Separately, PRS Legislative Research reports Saksham Anganwadi and POSHAN 2.0 was allocated Rs 21,960 crore in 2025–26.

Drivers

Rising crop-protection and nutrition supply chains are a key driver for Pyridine demand

One major driving factor for pyridine is its deep link with agriculture-led chemical demand, especially where pyridine is used as a building block to make crop-protection intermediates and related functional molecules. When farm systems become more intensive, the chemical input chain expands with them. That keeps pyridine relevant, because manufacturers want steady, high-purity feedstocks that work reliably in large, continuous production lines.

A clear signal comes from global pesticide activity. The Food and Agriculture Organization (FAO) reports that total pesticide use in agriculture reached 3.73 million tonnes in 2023, and pesticide use intensity averaged 2.40 kg per hectare of cropland. These figures show that crop protection remains a scaled, ongoing requirement rather than a short-term spike. For pyridine, this matters because its biggest pull typically comes when pesticide producers and their upstream suppliers keep running plants at stable rates to meet seasonal and multi-crop needs.

Fertilizer use supports the same story: farms are still pushing yield and consistency, and that usually goes together with crop-protection programs. FAO also notes that global agricultural use of inorganic fertilizers increased to 190 million tonnes in 2023, up from 142 million tonnes in 2002. Higher fertilizer use is not “pyridine demand” by itself, but it is a strong indicator of input-intensive farming. In practical terms, where fertilizers rise and productivity targets tighten, farmers and governments typically become less tolerant of pest-related yield loss, which keeps pesticide manufacturing active and, in turn, supports pyridine-linked intermediate demand.

Food and animal nutrition supply chains add another layer. A large share of industrial feed relies on consistent micronutrient and health-support inputs produced through regulated chemical value chains. The Alltech global feed survey estimates world feed production increased to 1.396 billion metric tons in 2024. This scale suggests that animal protein systems are still operating at massive volumes. When feed output stays high, suppliers prefer stable sourcing and predictable chemistry upstream, which supports demand visibility for pyridine-derived intermediates used in nutrition-related manufacturing.

Government nutrition programs can also strengthen “quality-first” procurement and compliance culture across the broader food ecosystem. In India, analysis of the Ministry of Women and Child Development’s demand for grants shows Saksham Anganwadi and POSHAN 2.0 allocated ₹21,960 crore in 2025–26.

Restraints

Tightening safety regulations and chemical-use scrutiny are becoming a major restraint for Pyridine

One major restraining factor for the pyridine market is the growing regulatory pressure on chemical use, especially in agriculture and food-linked industries. Pyridine is deeply tied to crop-protection intermediates, and as governments tighten rules on pesticide residues, worker exposure, and environmental toxicity, upstream intermediates such as pyridine face more detailed scrutiny. This does not remove demand completely, but it slows approvals, raises compliance costs, and makes production more complex for manufacturers that already operate in a tightly regulated environment.

Agriculture itself is becoming more regulated each year. The Food and Agriculture Organization (FAO) Food and Agriculture Organization highlights that global pesticide use reached 3.73 million tonnes in 2023, with an average intensity of 2.40 kg per hectare. Numbers like these have pushed many governments to act, introducing stricter monitoring systems and active-ingredient reviews. When nations see pesticide volumes staying high, authorities tend to impose stronger residue limits and worker-safety norms. These rules directly affect pyridine producers because the intermediates used to make modern pesticides must meet stricter purity and trace-impurity specifications, increasing operational costs and slowing the launch of new formulations.

Food and nutrition supply chains also influence regulatory environments. The scale of industrial livestock and feed production has brought more attention to contamination risks, traceability, and compliance in nutritional ingredients. The Alltech Global Feed Survey Alltech reports 1.396 billion metric tons of global feed output in 2024. Public nutrition programs also influence the regulatory environment. India’s national nutrition initiative Saksham Anganwadi and POSHAN 2.0, with an allocation of ₹21,960 crore for FY 2025–26, reflects the government’s emphasis on safety, quality, and transparency in nutrition delivery.

Opportunity

Expansion of regulated agri-inputs and nutrition chains creates a clear growth opportunity for pyridine

A major growth opportunity for pyridine is the rising demand for high-purity, consistent intermediates used in agriculture-linked chemicals and nutrition value chains. Pyridine is not bought by consumers, but it sits upstream in products that must meet strict performance and safety expectations. When downstream buyers want stable quality, they prefer reliable chemical inputs, and that keeps pyridine in the conversation for long-term supply contracts and plant expansions.

The strongest pull comes from modern crop protection. Global farming is still heavily dependent on pesticides to protect yields, and the scale is clear in official statistics. The Food and Agriculture Organization reports total pesticide use in agriculture was 3.73 million tonnes (active ingredients) in 2023, and pesticide use per cropland area averaged 2.40 kg per hectare. For pyridine producers, this matters because large pesticide volumes usually translate into steady, repeat demand for key intermediates and solvents that can be produced at industrial scale with controlled impurities.

Fertilizer trends point in the same direction: more input-intensive agriculture typically needs stronger crop-protection support. FAO reports global agricultural use of inorganic fertilizers rose to 190 million tonnes in 2023, up from 142 million tonnes in 2002. This long upward curve signals that many regions are still pushing yield and cropping intensity. In practical market terms, higher cropping pressure increases the value of dependable agrochemical supply, and that creates room for pyridine suppliers that can deliver stable grades for downstream synthesis.

The second growth lane is nutrition and animal production systems, where scale forces standardization. The Alltech global feed survey estimates world feed production increased in 2024 by 1.2% to 1.396 billion metric tons. When feed is produced at this size, manufacturers lean toward tightly controlled sourcing for vitamins and functional additives.

Government nutrition initiatives add another supportive layer because they increase monitoring, procurement discipline, and safety expectations across the supply chain. In India, the PRS Legislative Research budget analysis shows Saksham Anganwadi and POSHAN 2.0 was allocated Rs 21,960 crore in 2025–26.

Regional Insights

North America dominates the Pyridine Market with a market share of 46.10%, valued at USD 0.6 Bn

In 2024–2025, demand strength in the United States and Canada is closely linked to steady crop-protection chemistry and high-value drug production, both of which use pyridine as a practical intermediate and solvent. On the pharma side, North America remains the world’s largest pharmaceutical market by share; industry data for 2023 places the North American market at a 53.3% share of global pharmaceutical sales, underlining the scale of regulated manufacturing that typically prefers consistent, specification-driven inputs.

In parallel, healthcare spending conditions continue to support volumes: the Centers for Medicare & Medicaid Services reports prescription drug spending of $467.0 billion in 2024, reinforcing the region’s role as a high-consumption, high-production center for medicines and related chemical intermediates.

Agriculture-linked chemical pull is another key regional support. The United States Department of Agriculture farm production expenditures summary shows that, in 2023, crop-farm spending on combined inputs—chemicals, fertilizers, and seeds—totaled $75.1 billion, indicating sustained purchasing power for input-intensive farming systems that depend on crop-protection supply chains.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The company supports growers with aquaponic systems, nutrients, and operational tools. With a product portfolio of 200+ grow components and serving hobbyists and small farms across all 50 U.S. states, it indirectly influences pyridine-linked inputs used in specialty nutrients. Its training programs engage over 5,000 learners annually, strengthening demand for regulated and consistent agricultural chemistries.

The company manages a strong distribution network supplying 600+ SKUs in controlled-environment agriculture. With access to 8 distribution centers in North America and partnerships with over 1,500 retailers, Hydrofarm’s scale supports downstream demand for chemical intermediates used in plant nutrients and crop-care inputs. Annual revenue exceeding USD 300 million reinforces its market influence in agricultural supply chains.

Greenlife Cyclopentanone specializes in eco-aligned ketone derivatives with a portfolio of 15+ specialty intermediates used in crop-care and fine-chemical applications. Operating across 3 production facilities, the company delivers optimized yields and stable supply for downstream synthesis. Its annual output capacity surpasses 5,000 metric tons, enhancing its role in sustainable chemical ingredient markets.

Top Key Players Outlook

- Jubilant Life Sciences Ltd.

- Resonance Specialties Limited

- Shandong Luba Chemical Co., Ltd.

- Koei Chemical Co., Ltd.

- Red Sun Group

- Mitsubishi Chemical Corporation

- BASF SE

- Chang Chun Petrochemical Co., Ltd.

- Novasyn Organics Pvt. Ltd.

- ProChem, Inc.

Recent Industry Developments

For 2025 Aquaponic Source, its published commercial contact lines include 303-720-6604 (general) and 303-800-2398 (orders), signaling an active sales and fulfillment setup.

In 2024, Hydrofarm Holdings Group’s reported net sales of $190.3 million and a gross profit margin of 16.9%, showing it still operates at meaningful scale even in a softer grow-equipment cycle.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 2.5 Bn CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Solid, Gas), By Production Method (Chemical Synthesis, Biotechnological Processes, Catalytic Processes, Extraction Methods), By Application (Pesticides, Herbicides, Vitamins, Solvents, Resins, Others), By End Use (Agriculture, Pharmaceuticals, Chemical Synthesis, Food Additives, Dyes and Pigments, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Jubilant Life Sciences Ltd., Resonance Specialties Limited, Shandong Luba Chemical Co., Ltd., Koei Chemical Co., Ltd., Red Sun Group, Mitsubishi Chemical Corporation, BASF SE, Chang Chun Petrochemical Co., Ltd., Novasyn Organics Pvt. Ltd., ProChem, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Jubilant Life Sciences Ltd.

- Resonance Specialties Limited

- Shandong Luba Chemical Co., Ltd.

- Koei Chemical Co., Ltd.

- Red Sun Group

- Mitsubishi Chemical Corporation

- BASF SE

- Chang Chun Petrochemical Co., Ltd.

- Novasyn Organics Pvt. Ltd.

- ProChem, Inc.