Global Protective Clothing Market by Product Type (Durable and Disposable), Protection Type (Thermal/Heat, Mechanical, Chemical, Biological, and Others), By End-Use Industry (Construction and Manufacturing, Oil and Gas, Medical, Military and Defense, Law Enforcement, Firefighting, Mining, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 123375

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

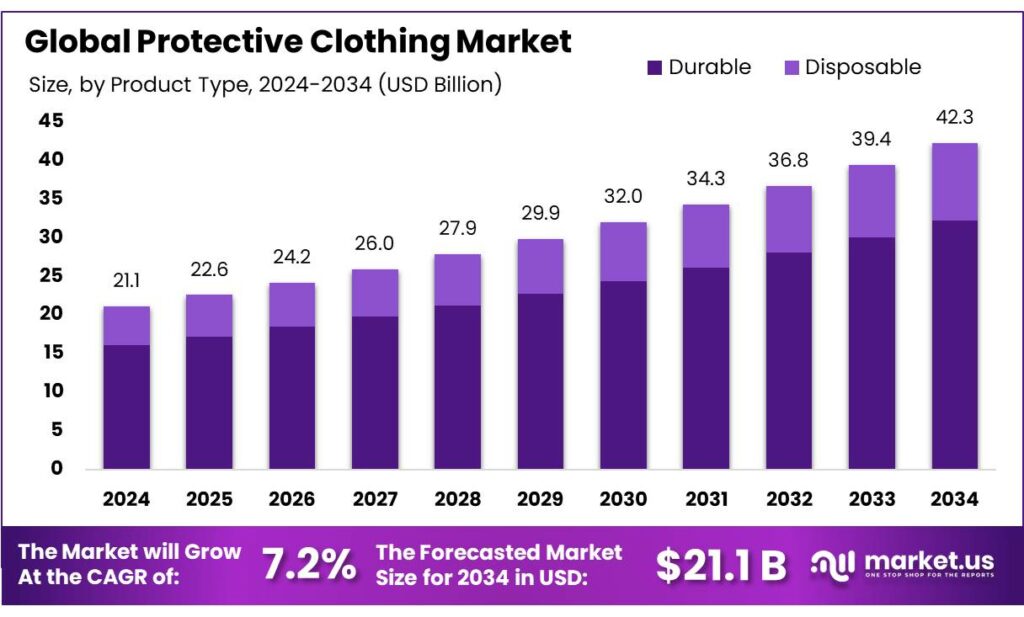

The Global Protective Clothing Market size is expected to be worth around USD 42.3 Billion by 2034, from USD 21.1 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 52.1% share, holding USD 1.52 Billion in revenue.

Protective clothing is specialized clothing or apparel designed to shield workers from various hazards in the workplace that can cause injuries or illnesses. These injuries and illnesses may result from contact with chemical, radiological, physical, electrical, or mechanical danger.

As this concerns the wellness of many workers, there are regulatory bodies, such as the Occupational Safety and Health Administration (OSHA) and the European Union (EU), monitoring the market. The laws and directives by these bodies are the major drivers of the protective clothing market.

- According to the Bureau of Labor Statistics (BLS), proper use of PPE can reduce workplace injuries by up to 60%. As industries expand, there is demand for multifunctional clothing in industries where workers might be exposed to several hazards simultaneously.

However, the protective clothing available in the market does not mitigate all the risks, which creates a gap in the market, allowing emerging players to develop products. But as inflation increases, the price of protective clothing increases, posing a challenge in the industry.

- The Occupational Safety and Health Administration (OSHA) reports that companies can face fines ranging from US$7,000 for each serious violation to US$70,000 for each willful or repeated violation.

Key Takeaways

- The global protective clothing market was valued at USD 21.1 billion in 2024.

- The global protective clothing market is projected to grow at a CAGR of 7.1% and is estimated to reach USD 42.3 billion by 2034.

- Among the product types, durable protective clothing comprised the largest market with around 76.3% of the total market share.

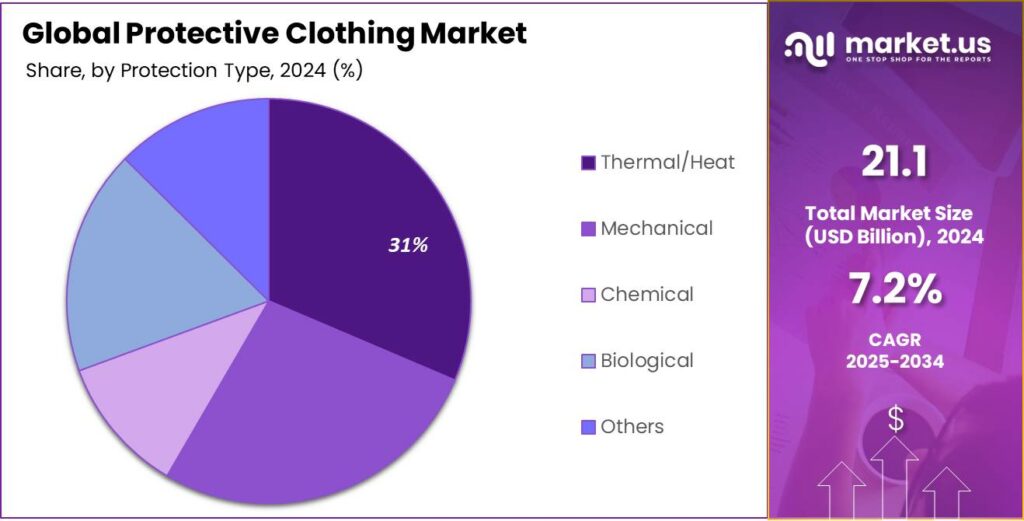

- On the basis of protection, thermal/heat protective clothing held the majority of revenue share in 2024 at 31.4%.

- Based on end-use industry, the protective clothing market was led by the construction and manufacturing industry with a market share of 23.8% in 2024.

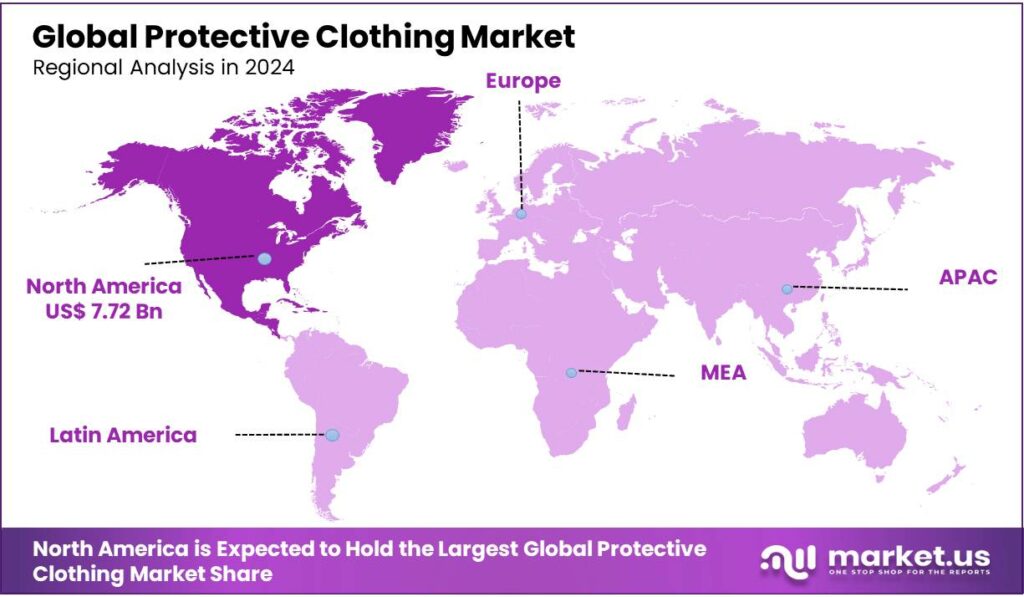

- In 2024, North America was the biggest market for protective clothing, constituting around 33.6% of the total market share, valued at approximately USD 7.7 billion.

Product Type Analysis

Durable Protective Clothing Dominates the Market

The protective clothing market is segmented based on product type into durable and disposable. In 2024, durable protective clothing held a dominant market position, capturing more than a 76% share of the global market. Durable protective clothing is often preferred over disposable options due to its longer lifespan, cost-effectiveness over time, and potential for better protection in certain situations. While disposable clothing offers convenience and contamination control, durable clothing can be more sustainable and provide enhanced protection against specific hazards like chemicals, flames, and sparks.

Disposable clothing is more suitable for applications where the risk of contamination is very high, such as in healthcare or pharmaceutical industries. But in harsh environments with heat, chemicals, or radioactive particles, such as during welding, mining, or construction, durable protective clothing made from fabrics is preferred.

Protection Type Analysis

The Protective Clothing that is Thermal or Heat Resistant Dominates the Market with 31.4% of the Total Market Share.

Based on the type of protection the clothing can offer, the market can be segregated into thermal/heat, mechanical, chemical, biological/radiation, and others. In 2024, heat-resistant protective clothing dominated the global protective clothing market with a market share of 31.4%. The dominance of the segment is attributed to the rapid expansion of the construction and manufacturing industry, and the demand from the firefighting industry.

According to the Center for Disaster Philanthropy, up to mid-July, more than 2.8 million acres in the United States and 5.5 million acres in Canada have been burned in the fires. Such extremity of fires requires governments and organizations around the world to prepare for high-quality fire-resistant protective clothing. Additionally, as the world population grows and globalization rises, the need for the construction and manufacturing industries grows. As the construction and manufacturing industries grow, there is a constant demand for protective clothing.

End-Use Industry Analysis

Construction and Manufacturing Industry Dominate the Protective Clothing Market with 23.8% of the Total Market Share.

Based on the end-use industries, the market can be segregated into construction and manufacturing, oil and gas, medical, military and Defence, law enforcement, firefighting, mining, and others. In 2024, the construction and manufacturing industry dominated the global protective clothing market, valued at around US$ 5 billion. Protective clothing in the construction and manufacturing industries is a crucial aspect of workplace safety, designed to minimize exposure to various hazards. This includes items like hard hats, safety glasses, hearing protection, gloves, high-visibility clothing, and safety shoes.

These items are specifically chosen to address the potential risks present in each industry, such as falling objects, noise, chemical exposure, and visibility issues. Due to urbanization and industrialization, the construction and manufacturing industry is expanding exponentially. According to the World Bank Group, in 2024, the manufacturing industry added value of around US$ 16.8 trillion and industries (including construction) of about US$28.91 trillion to the global economy.

Key Market Segments

By Product Type

- Durable

- Disposable

By Protection Type

- Thermal/Heat

- Mechanical

- Chemical

- Biological

- Others

By End-Use Industry

- Construction and Manufacturing

- Oil and Gas

- Medical

- Military and Defence

- Law Enforcement

- Firefighting

- Mining

- Others

Drivers

Government Regulations Drive the Protective Clothing Market.

Government regulations that ensure personal protective equipment in several industries are the major drivers of the protective clothing market. Stringent safety standards and regulations set by bodies such as OSHA and the European Union mandate the use of protective clothing in various industries, boosting market growth.

For instance, in the U.S., federal law mandates that employers provide and pay for required PPE to protect employees from workplace hazards. The Occupational Safety and Health Administration (OSHA) standards outline specific requirements for PPE, including eye, face, head, and extremity protection, protective clothing, respiratory devices, and protective shields.

Similarly, the European Union’s Regulation (EU) 2016/425 governs the design, manufacture, and marketing of personal protection equipment to ensure the safety of users. Compliance with these regulations directly increases the demand for protective clothing.

Restraints

High Cost of Equipment Remains a Significant Challenge to the Protective Clothing Market.

A study by the International Safety Equipment Association (ISEA) revealed that the high production cost of protective clothing remains a significant challenge in the market. Several companies during the study stated that finding high-quality PPE that fits within a company’s budget continues to be a challenge, especially due to inflation. This challenge is particularly acute for smaller facilities and those with limited budgets.

The cost of only protective apparel for construction workers available in the market can vary from US$16 to US$70. Specialized protective clothing for some manufacturing industries might be more expensive. These budgetary constraints can force organizations to choose cheaper, potentially less protective options, increasing the risk of injuries and accidents.

Opportunity

Advancements in Protective Clothing are Expected to Create Opportunities for Emerging Players.

Personal protective equipment is mandatory for industries related to contamination, heat, chemicals, and radioactive materials. However, the PPE available in the market does not suffice in several settings.

For instance, high temperatures and harsh climate conditions add to cognitive and physical decline in humans, particularly in physically demanding industries. In 2024, the Department of Labor Occupational Safety and Health (OSHA) published a Notice of Proposed Rulemaking (NPRM) to prevent injury and illness caused by extreme heat in outdoor and indoor workspaces, emphasizing the growing regulatory attention in this context.

Hence, it was stressed that physiologically based safety precautions and customized hydration are essential for reducing the hazards of stress and heat exhaustion. Leveraging on the concept, in May 2025, Epicore Biosystems, a digital health solutions leader developing advanced sweat-sensing wearables, and DuPont Personal Protection, a global leader in personal protection solutions, agreed to work on exploring opportunities to potentially enhance worker safety and well-being.

Trends

Increased Demand for More Multifunctional and Seasonally Versatile Garments.

The demand for protective clothing that offers both multi-functionality and seasonal versatility is increasing. Occupations often expose workers to multiple hazards. Multi-functional protective apparel addresses this by offering protection against various risks in a single garment, reducing the need for multiple layers or clothing changes.

For instance, individuals working in oil and gas may require protection from both fire as well as electricity. For such environments, many players such as DuPont and Workwear Outfitters have launched products that are multifunctional and comfortable to wear. There are passive smart textiles that offer static functionalities, such as ultraviolet protection, moisture-wicking, antibacterial protection, and insulation.

Additionally, there are active smart textiles, such as thermochromic and photochromic fabrics, which change color in high temperatures or levels of UV light to provide a visual indicator.

Geopolitical Impact Analysis

Geopolitical Tensions Disrupt the Supply Chains of Protective Clothing and Affect the Prices of the Product

Geopolitical factors such as trade wars, regulatory changes, and conflicts between countries heavily affect the global trade routes and sourcing of raw materials for protective clothing. These macroeconomic shifts can disrupt these supply chains, leading to increased costs, delays in products, and uncertainties. For instance, several major companies source their raw materials, such as rubber and dyes, for the PPE from China. However, the tariffs imposed by the United States on China have led to increased prices in the country.

Similarly, the tariffs on European goods have also disrupted the supply chain in the PPE market. Furthermore, instability in the Red Sea route, which is a major sea route for the transport of several raw materials for the PPE, has led to delayed turnaround times. Moreover, in 2024, China imposed a partial ban on exports of antimony, which is used to manufacture the mod acrylic fiber that is used in technical fire-resistant fibers. This had put great pressure on the entire supply chain within the PPE industry.

Regional Analysis

North America Held the Largest Share of the Global Protective Clothing Market.

In 2024, North America dominated the global protective clothing market, holding about 33.6%, valued at approximately USD 7.7 billion. The region is at the forefront of industries, such as construction and manufacturing, medical, military and Defence, law enforcement, and firefighting. As the region’s spending on these industries grows, there will be consistent demand for protective clothing in the region. Additionally, the market in North America is characterized by stringent laws from the Occupational Safety and Health Administration (OSHA) regarding protective clothing.

Another major region in the protective clothing market is Europe, which is characterized by its focus on workplace safety and environmental protection. Several public and commercial organizations in the EU are financially committed to upholding personal protective equipment (PPE) standards in the workplace. Additionally, the laws in the region imply the need for PPE and the materials used in the manufacturing of PPE equipment.

- According to the S. Census Bureau, construction spending in the United States during December 2024 was estimated at a seasonally adjusted annual rate of $2,192.2 billion. This figure represents a 0.5% increase from the revised November 2024 estimate and a 4.3% increase over December 2023. Of this total, private construction spending accounted for $1,688.5 billion, while public construction spending was s.

- Similarly, according to the United States Senate Committee on Armed Services, the legislation authorized US$ 841.4 billion for the Department of Defence (DOD) in the fiscal year 2024.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

L. Gore & Associates, Protective Industrial Products, Honeywell International, Lakeland Industries, PBI Performance Products, Kimberly-Clark, Ansell, Teijin Aramid, and DuPont are the major global players in the protective clothing market. As protective clothing is a very competitive and regulated industry, many players engage in strategic activities, such as product development, partnerships, and acquisitions.

- For instance, in May 2025, Honeywell announced that it had completed the sale of its personal protective equipment business to Protective Industrial Products, Inc. for US$1.325 billion in an all-cash transaction.

Honeywell International is a major provider of personal protective equipment, including a wide range of protective clothing. With a long history in PPE manufacturing, it has developed a deep understanding of industry-specific needs and challenges, which helps it manufacture innovative products.

Lakeland Industries specializes in the design and manufacture of a wide range of protective clothing for various industrial and safety applications. It emphasizes comfort, safety, and control over manufacturing and materials in their product development.

Kimberly-Clark offers a wide range of protective clothing, particularly within its KleenGuard brand, designed for worker safety and productivity. The company is known for its expertise in nonwoven materials, especially innovative SMS fabric.

Ansell is also a global leader in providing safety solutions for industrial and healthcare workplaces. Its proprietary tool, Ansell Guardian, utilizes data and expertise to provide recommendations for the most appropriate PPE for specific chemical and application needs.

The major players in the industry

- L. Gore & Associates, Inc.

- Protective Industrial Products, Inc.

- Honeywell International Inc.

- Lakeland Industries, Inc.

- PBI Performance Products, Inc.

- Kimberly-Clark

- Bennett Safetywear

- Ansell Ltd.

- Teijin Aramid

- Workwear Outfitters, LLC

- DuPont de Nemours, Inc.

- TenCate Protective Fabrics

- Other Key Players

Key Developments

- In May 2025, Several players in the Protective Clothing industry focus on applications where demand for the product is consistently growing, such as nutraceuticals and dietary supplements, functional foods and beverages, cosmetics and skincare, and pet food and animal nutrition. In most cases, brands form exclusive partnerships so as to secure supply, reduce competition.

- In April 2025, at the FDIC trade show, W. L. Gore & Associates announced the expansion of its Gore-Tex Crosstech product portfolio with the launch of three moisture barriers: Gore-Tex Crosstech Endure Moisture Barrier, Gore-Tex Crosstech Prime Moisture Barrier, and Gore-Tex Crosstech Innovate Moisture Barrier.

Report Scope

Report Features Description Market Value (2024) USD 21.1 Bn Forecast Revenue (2034) USD 42.3 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Product Type (Durable and Disposable), Protection Type (Thermal/Heat, Mechanical, Chemical, Biological, and Others), By End-Use Industry (Construction and Manufacturing, Oil and Gas, Medical, Military and Defence, Law Enforcement, Firefighting, Mining, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape W. L. Gore & Associates, Inc., Protective Industrial Products, Inc., Honeywell International Inc., Lakeland Industries, Inc., PBI Performance Products, Inc., Kimberly-Clark, Bennett Safetywear, Ansell Ltd., Teijin Aramid, Workwear Outfitters, LLC, DuPont de Nemours, Inc., TenCate Protective Fabrics, Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- L. Gore & Associates, Inc.

- Protective Industrial Products, Inc.

- Honeywell International Inc.

- Lakeland Industries, Inc.

- PBI Performance Products, Inc.

- Kimberly-Clark

- Bennett Safetywear

- Ansell Ltd.

- Teijin Aramid

- Workwear Outfitters, LLC

- DuPont de Nemours, Inc.

- TenCate Protective Fabrics

- Other Key Players