Global Processed Cheese Market By Cheese Type (Cheddar Cheese, Blue Cheese, Brick Cheese, Camembert Cheese, Cottage Cheese, Cream Cheese, Mozarella Cheese, Romano Cheese, Swiss Cheese, Others), By Form (Cheese Slices, Cheese Blocks, Cheese Spreads, Cheese Cubes, Others), By Source (Cattle Milk, Goat Milk, Sheep Milk), By End-Use (Foodservice (HoReCa), Retail / Household, Food and Beverage Processors, Snacks Manufacturer, Others), By Distribution (Hypermarkets and Supermarkets, Club Stores, Discounters Grocery Retailers, Convenience Stores, Online Stores, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148175

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

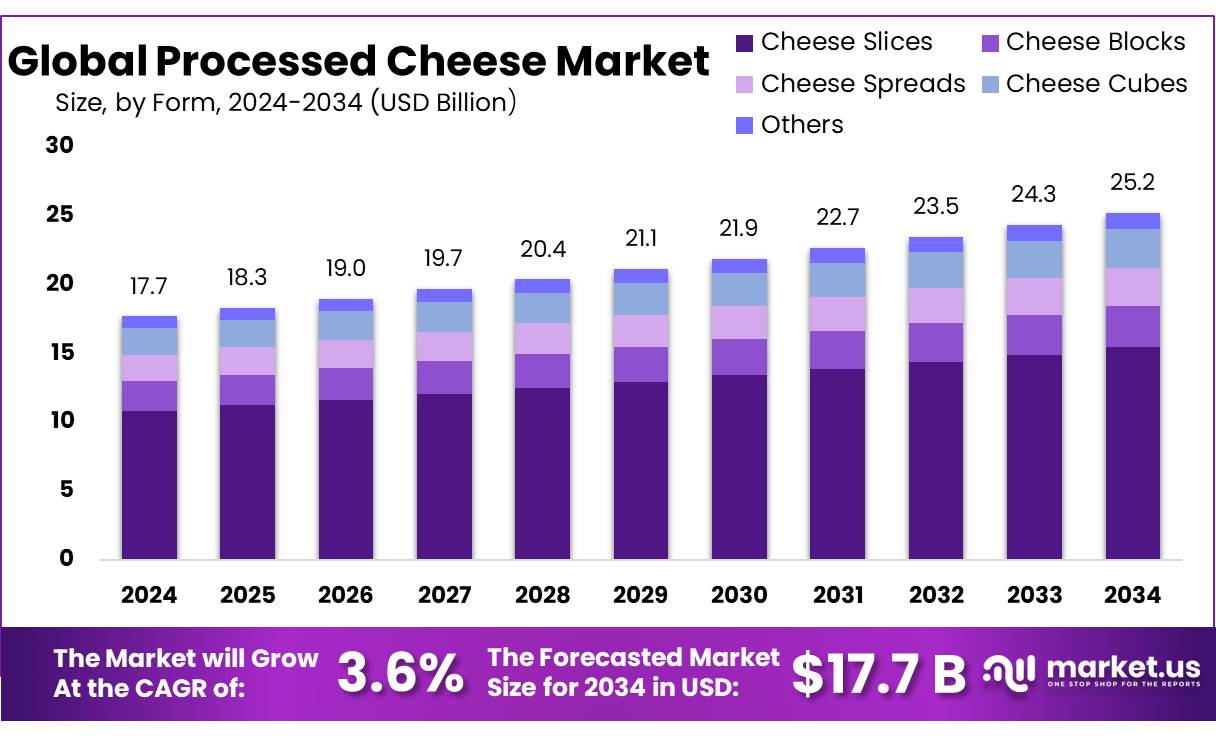

The Global Processed Cheese Market size is expected to be worth around USD 25.2 Billion by 2034, from USD 17.7 Billion in 2024, growing at a CAGR of 3.6% from 2025 to 2034.

The processed cheese concentrate industry is experiencing significant growth, driven by advancements in food processing technologies, evolving consumer preferences, and supportive government policies. Processed cheese concentrates are concentrated forms of cheese that offer intense flavor profiles, extended shelf life, and cost-effectiveness, making them ideal for use in various food applications such as sauces, ready-to-eat meals, snacks, and bakery products.

Processed cheese concentrates are utilized in various applications, including ready-to-eat meals, sauces, soups, and snacks, owing to their enhanced shelf life, cost-effectiveness, and consistent flavor profiles. These concentrates are available in powder and paste forms, with a shelf life ranging from 6 to 12 months, making them suitable for both industrial and consumer use. The versatility of cheese concentrates allows for their incorporation into a wide array of food products, catering to diverse culinary needs.

Government initiatives play a crucial role in supporting the processed cheese concentrate industry. For instance, the U.S. Department of Agriculture (USDA) has implemented programs to promote dairy innovation and support domestic dairy producers. In 2024, the USDA allocated $350 million under its Dairy Business Innovation Initiatives to foster innovation and marketing strategies in the dairy industry, including processed cheese products. Such initiatives not only boost production but also support sustainability and technological advancements in dairy processing.

Key Takeaways

- Processed Cheese Market size is expected to be worth around USD 25.2 Billion by 2034, from USD 17.7 Billion in 2024, growing at a CAGR of 3.6%.

- Cheddar Cheese held a dominant market position, capturing more than a 36.4% share of the processed cheese market.

- Cheese Slices held a dominant market position, capturing more than a 61.3% share of the processed cheese market.

- Cattle Milk held a dominant market position, capturing more than an 89.1% share of the processed cheese market.

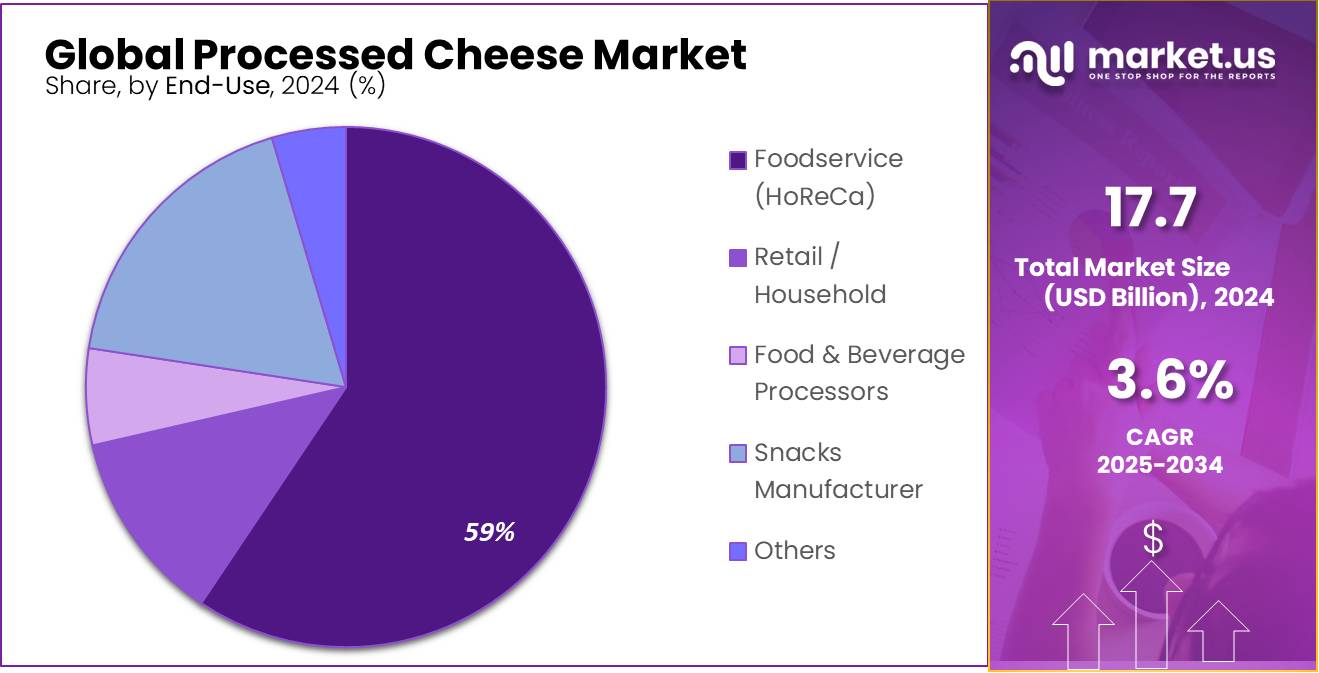

- Foodservice (HoReCa) held a dominant market position, capturing more than a 59.4% share of the processed cheese market.

- Hypermarkets and Supermarkets held a dominant market position, capturing more than a 52.9% share.

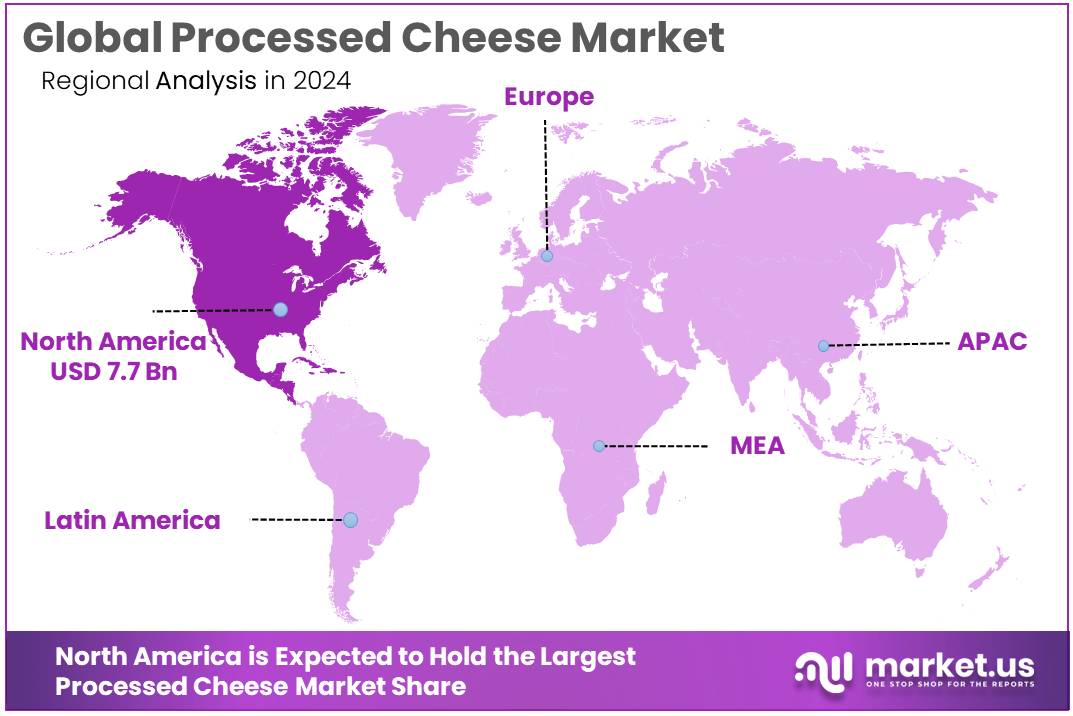

- North America held a dominant position in the global processed cheese market, capturing more than a 43.9% share, equivalent to approximately USD 7.7 billion.

By Cheese Type

Cheddar Cheese Leads Processed Cheese Market with 36.4% Share

In 2024, Cheddar Cheese held a dominant market position, capturing more than a 36.4% share of the processed cheese market. The preference for Cheddar Cheese can be attributed to its rich flavor profile, widespread availability, and versatile applications across both household and commercial food segments. Consumers favor Cheddar Cheese for its balanced taste, making it a popular choice for sandwiches, burgers, and various culinary dishes.

Moreover, its long shelf life and ease of melting further enhance its appeal in the processed cheese category. The strong market presence of Cheddar Cheese is also supported by a continuous rise in demand from the fast-food and snack food industries, which frequently use it as a primary ingredient. As the processed cheese market continues to expand, Cheddar Cheese remains a staple, driven by consistent consumer preferences and its established position in both retail and food service sectors.

By Form

Cheese Slices Capture 61.3% Market Share in 2024

In 2024, Cheese Slices held a dominant market position, capturing more than a 61.3% share of the processed cheese market. The popularity of Cheese Slices is driven by their convenience, uniform portioning, and ready-to-use format, making them a preferred choice for quick meals and snacks. They are widely used in burgers, sandwiches, and wraps, contributing significantly to their robust market share. The retail sector has also played a pivotal role in boosting demand for Cheese Slices, as consumers increasingly seek pre-packaged and easily accessible cheese products.

Additionally, the food service industry continues to utilize Cheese Slices due to their consistent meltability and rich taste, reinforcing their strong position in the processed cheese segment. As consumer demand for quick-serve and ready-to-eat meals grows, the prominence of Cheese Slices in the processed cheese market is expected to remain substantial.

By Source

Cattle Milk Secures 89.1% Share in Processed Cheese Market in 2024

In 2024, Cattle Milk held a dominant market position, capturing more than an 89.1% share of the processed cheese market. The extensive use of cattle milk in processed cheese production is attributed to its availability, cost-effectiveness, and favorable fat composition, which enhances the texture and flavor profile of cheese products. Manufacturers prefer cattle milk for its consistent quality and nutrient content, making it the primary source for producing a wide range of processed cheese products, including slices, spreads, and blocks.

Additionally, consumer familiarity with cattle milk-based cheese reinforces its dominant market share, particularly in regions where dairy consumption remains high. As demand for processed cheese continues to grow, the prevalence of cattle milk as the primary source is expected to maintain its strong market position.

By End-Use

Foodservice (HoReCa) Dominates Processed Cheese Market with 59.4% Share in 2024

In 2024, Foodservice (HoReCa) held a dominant market position, capturing more than a 59.4% share of the processed cheese market. The substantial demand from hotels, restaurants, and cafes is driven by the consistent use of processed cheese in fast food, sandwiches, and baked goods. With a surge in quick-service restaurants and increasing consumer preference for cheese-based meals, the Foodservice segment continues to be a key revenue contributor.

Additionally, the convenience of using pre-portioned and easy-to-melt processed cheese products aligns well with the operational needs of HoReCa establishments. The expanding food delivery and takeaway culture further propels the demand for processed cheese in this segment, reinforcing its dominant market share in 2024.

By Distribution

Hypermarkets and Supermarkets Capture 52.9% Share in 2024 Processed Cheese Market

In 2024, Hypermarkets and Supermarkets held a dominant market position, capturing more than a 52.9% share of the processed cheese market. The widespread availability of diverse processed cheese products, coupled with attractive promotional offers, has positioned these retail formats as preferred purchasing channels for consumers. Shoppers gravitate toward hypermarkets and supermarkets for their extensive product variety, enabling easy comparison of brands and price points.

Additionally, the growing trend of bulk purchasing and the rising number of organized retail outlets contribute significantly to the stronghold of hypermarkets and supermarkets in the processed cheese segment. The inclusion of ready-to-eat cheese products and convenient packaging further enhances consumer appeal, sustaining the leading market share in 2024.

Key Market Segments

By Cheese Type

- Cheddar Cheese

- Blue Cheese

- Brick Cheese

- Camembert Cheese

- Cottage Cheese

- Cream Cheese

- Mozarella Cheese

- Romano Cheese

- Swiss Cheese

- Others

By Form

- Cheese Slices

- Cheese Blocks

- Cheese Spreads

- Cheese Cubes

- Others

By Source

- Cattle Milk

- Goat Milk

- Sheep Milk

By End-Use

- Foodservice (HoReCa)

- Retail / Household

- Food & Beverage Processors

- Snacks Manufacturer

- Others

By Distribution

- Hypermarkets and Supermarkets

- Club Stores

- Discounters Grocery Retailers

- Convenience Stores

- Online Stores

- Others

Drivers

Convenience and Shelf Stability Fuel Processed Cheese Growth

One of the primary drivers behind the expanding processed cheese market is its unparalleled convenience and extended shelf life. These attributes make processed cheese a preferred choice for consumers seeking quick, easy-to-use, and long-lasting dairy options. Unlike traditional cheeses, processed varieties undergo a manufacturing process that incorporates emulsifiers and stabilizers, resulting in products that maintain their quality over extended periods without refrigeration.

The versatility of processed cheese further contributes to its popularity. It serves as a key ingredient in various culinary applications, including sandwiches, burgers, pizzas, and ready-to-eat meals. Its consistent melting properties and ability to blend seamlessly into dishes make it a staple in both household kitchens and foodservice establishments.

In regions like North America, processed cheese holds a significant market share, accounting for over 40% of global consumption. This dominance is attributed to the widespread incorporation of processed cheese in fast-food chains, convenience foods, and the growing trend of snacking. The emphasis on convenience aligns with the fast-paced lifestyles prevalent in these areas.

Restraints

Regulatory Pressures and Consumer Health Concerns

A significant challenge facing the processed cheese industry is the increasing regulatory scrutiny and shifting consumer preferences towards healthier, more natural food options. Governments worldwide are tightening food safety standards, particularly concerning additives, preservatives, and labeling requirements. For instance, the U.S. Food and Drug Administration (FDA) enforces stringent guidelines on food labeling, ingredient disclosures, and permissible additives in processed foods. Similarly, the European Food Safety Authority (EFSA) regulates the use of emulsifying salts and preservatives in cheese products.

Concurrently, there is a noticeable shift in consumer behavior, with a growing preference for natural, organic, and artisanal cheese products. Health-conscious consumers are increasingly avoiding highly processed foods, opting instead for products perceived as healthier and more authentic. This trend poses a direct challenge to the processed cheese market, as it competes with natural cheese varieties that are often perceived as more wholesome.

In response to these challenges, some manufacturers are exploring alternatives such as clean-label products, which minimize the use of artificial additives and preservatives. By aligning with consumer demand for transparency and natural ingredients, these companies aim to regain consumer trust and market share.

Opportunity

Government Support and Infrastructure Development

A significant opportunity for the growth of the processed cheese market lies in government support and infrastructure development, particularly in emerging economies like India. The Indian government has been actively promoting the dairy sector through various initiatives aimed at enhancing production, improving quality, and expanding market access.

One of the key programs is the National Dairy Plan (NDP), which focuses on increasing milk production and productivity in a sustainable manner. The plan emphasizes the development of dairy infrastructure, including cold storage facilities, transportation networks, and processing units, which are crucial for the growth of the processed cheese segment. By improving these facilities, the government aims to reduce post-production losses and ensure the availability of quality dairy products to consumers.

Additionally, the government has been facilitating access to finance for dairy farmers and cooperatives through schemes like the Dairy Processing and Infrastructure Development Fund (DIDF). This fund provides financial assistance for setting up new dairy processing units and upgrading existing ones, thereby enhancing the capacity to produce value-added products like processed cheese.

The implementation of these initiatives has led to a steady increase in milk production and processing capabilities. According to the Department of Animal Husbandry and Dairying, India produced over 210 million tonnes of milk in 2021, making it the largest producer globally. This abundant supply of milk serves as a strong foundation for the growth of the processed cheese industry.

Trends

Growth of Processed Cheese Concentrates in Emerging Markets

In countries like India, China, and Brazil, the adoption of processed cheese concentrates is accelerating due to the increasing popularity of Western-style fast foods such as pizzas, burgers, and sandwiches. These products offer convenience, longer shelf life, and consistent quality, making them attractive to both consumers and food manufacturers. The rise of quick-service restaurants (QSRs) and the growing trend of home cooking are further fueling the demand for processed cheese concentrates in these regions.

Government initiatives aimed at promoting dairy production and food processing are also contributing to the growth of the processed cheese concentrate market in emerging economies. For instance, India’s National Dairy Development Board (NDDB) has been implementing programs to enhance milk production and processing capabilities, thereby supporting the dairy industry’s expansion and the availability of processed dairy products .

The increasing availability of processed cheese concentrates in retail outlets and online platforms is making these products more accessible to a broader consumer base. As consumer preferences continue to evolve, the processed cheese concentrate market in emerging markets is expected to experience sustained growth, driven by factors such as urbanization, changing dietary habits, and supportive government policies.

Regional Analysis

In 2024, North America held a dominant position in the global processed cheese market, capturing more than a 43.9% share, equivalent to approximately USD 7.7 billion. The United States was the primary contributor, accounting for about 78% of the regional revenue, driven by high per capita cheese consumption and a robust foodservice industry. The popularity of processed cheese in fast food items like burgers and sandwiches, along with its convenience and extended shelf life, has fueled its demand across the region.

Canada contributed approximately 13% to the North American processed cheese market in 2024. The Canadian market benefits from a growing preference for specialty and premium cheese varieties, driven by rising consumer interest in gourmet cuisine and natural ingredients. Government support for the domestic dairy industry, along with strict quality regulations, ensures high standards in cheese production.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Almarai-Joint Stock Company remains a key player in the processed cheese market, leveraging its extensive dairy production capabilities across the Middle East and North Africa. The company’s processed cheese products are widely recognized for their quality and affordability, catering to both retail and foodservice sectors. In 2024, Almarai reported a substantial increase in sales driven by growing demand for processed cheese in convenience food formats. The company continues to invest in product diversification and regional market expansion.

Arla Food Ingredients capitalizes on its expertise in dairy production to offer high-quality processed cheese solutions. The company’s focus on innovation and sustainable sourcing has positioned it as a trusted supplier for both retail and industrial cheese segments. In 2024, Arla introduced new reduced-fat and plant-based processed cheese products, targeting health-conscious consumers. Its strong presence in Europe and expanding footprint in Asia support its continued market growth in processed cheese.

Associated Milk Producers, Inc. (AMPI) is a major dairy cooperative in the U.S., actively supplying processed cheese to foodservice and retail markets. The company’s product portfolio includes cheese slices, blocks, and spreads tailored for bulk and individual consumers. In 2024, AMPI invested in expanding its cheese processing facilities to meet rising demand for processed cheese in quick-service restaurants. AMPI’s commitment to sustainable farming practices further strengthens its brand reputation.

Top Key Players in the Market

- Almarai-Joint Stock Company

- Arla food ingredients

- Associated Milk Producers, Inc.

- Associated Milk Producers, Inc.

- Fonterra Foods

- Kraft Heinz Foods

- Lactalis group

- Mondelez International Inc.

- Sargento Foods Inc.

- Savencia Fromage & Dairy

- The Bel Group

Recent Developments

In 2024, Arla Foods experienced a strong year, with revenue increasing to EUR 13.8 billion and strong profit levels enabling the highest dividend payout to farmer-owners in the company’s history.

In 2024, Associated Milk Producers Inc. (AMPI), the largest farmer-owned cheese cooperative in the U.S., reported annual sales of approximately $2 billion, processing 5.8 billion pounds of milk from its 1,100 member farms across the Midwest.

Report Scope

Report Features Description Market Value (2024) USD 17.7 Bn Forecast Revenue (2034) USD 25.2 Bn CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Cheese Type (Cheddar Cheese, Blue Cheese, Brick Cheese, Camembert Cheese, Cottage Cheese, Cream Cheese, Mozarella Cheese, Romano Cheese, Swiss Cheese, Others), By Form (Cheese Slices, Cheese Blocks, Cheese Spreads, Cheese Cubes, Others), By Source (Cattle Milk, Goat Milk, Sheep Milk), By End-Use (Foodservice (HoReCa), Retail / Household, Food and Beverage Processors, Snacks Manufacturer, Others), By Distribution (Hypermarkets and Supermarkets, Club Stores, Discounters Grocery Retailers, Convenience Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Almarai-Joint Stock Company, Arla food ingredients, Associated Milk Producers, Inc., Associated Milk Producers, Inc., Fonterra Foods, Kraft Heinz Foods, Lactalis group, Mondelez International Inc., Sargento Foods Inc., Savencia Fromage & Dairy, The Bel Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Almarai-Joint Stock Company

- Arla food ingredients

- Associated Milk Producers, Inc.

- Associated Milk Producers, Inc.

- Fonterra Foods

- Kraft Heinz Foods

- Lactalis group

- Mondelez International Inc.

- Sargento Foods Inc.

- Savencia Fromage & Dairy

- The Bel Group