Global Preoperative Bathing Solution Market By Product (Bath Solutions, Antiseptic Wash Lotions, Antiseptic Wipes, Preoperative Bath Kits and Others), By End-User (Surgical Wards, Intensive Care Units (ICU), General Medical Wards, and Outpatient), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170508

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

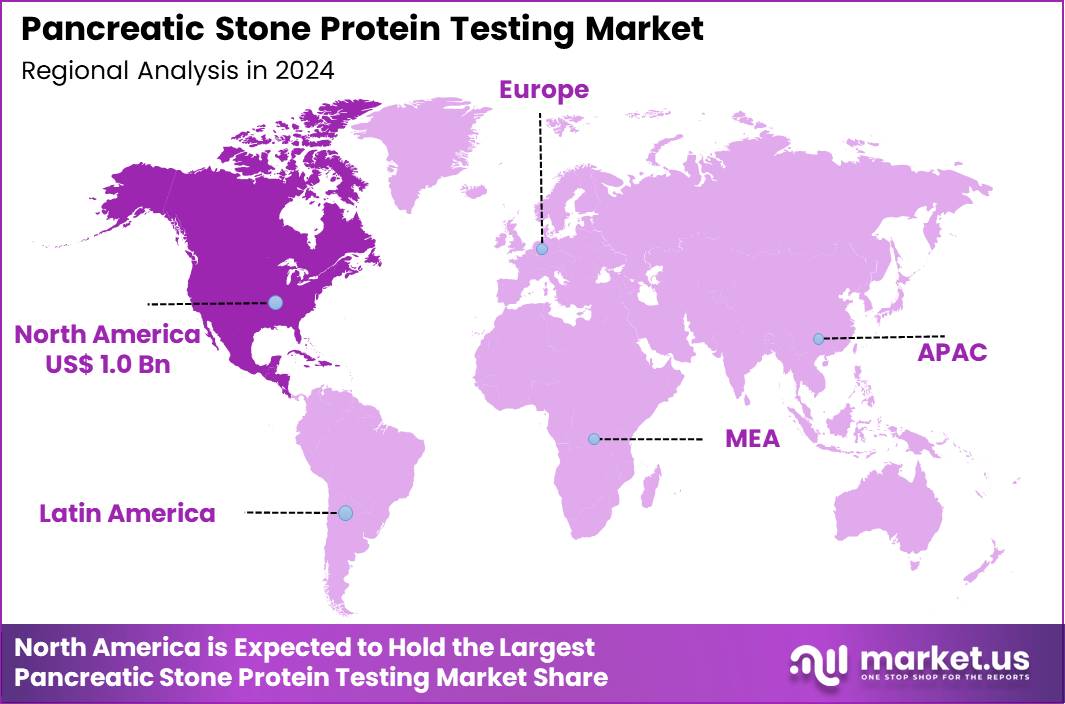

The Global Preoperative Bathing Solution Market size is expected to be worth around US$ 2.04 billion by 2034 from US$ 1.35 billion in 2024, growing at a CAGR of 4.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.0% share with a revenue of US$ 1.0 Billion.

Preoperative bathing solutions involve using antiseptic agents, such as chlorhexidine gluconate (CHG), to cleanse the skin before surgery, aiming to reduce bacterial load and prevent surgical site infections (SSIs). This practice is widely recommended by organizations like the WHO as good clinical hygiene to minimize skin flora at incision sites, though evidence on SSI reduction varies.

The goal is to remove transient and resident bacteria, with antiseptics outperforming plain soap in lab tests by progressively lowering microbial counts over multiple applications. Systematic reviews show mixed results: CHG bathing yields no statistically significant SSI drop versus placebo (RR 0.91), but outperforms no washing in some trials (RR 0.36). Daily or repeated CHG use raises skin concentrations, supporting its theoretical benefits.

The Preoperative Bathing Solution Market plays a critical role in supporting global surgical safety by reducing microbial load on patients’ skin before procedures. Hospitals and surgical centers increasingly rely on antiseptic bathing protocols due to rising surgical volumes and global efforts to minimize surgical site infections (SSIs). Organizations such as the WHO, CDC, and NHS emphasize preoperative antiseptic bathing in their SSI-prevention bundles, boosting product adoption. Examples include widespread use of chlorhexidine-based washes in US hospitals and preoperative shower kits implemented across European OR units.

Growing emphasis on infection control, rising prevalence of chronic disease surgeries, and expanding hospital infrastructure in Asia and Latin America continue to strengthen market penetration. Manufacturers are advancing ready-to-use antiseptic wipes, rapid-dry CHG cloths, and single-use kits for standardized protocol compliance.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.35 Billion, with a CAGR of 4.2%, and is expected to reach US$ 2.04 Billion by the year 2034.

- The Product segment is divided into Bath Solutions, Antiseptic Wash Lotions, Antiseptic Wipes, Preoperative Bath Kits, and Others, with Bath Solutions taking the lead in 2024 with a market share of 59.3%

- The End-User segment is divided into Surgical Wards, Intensive Care Units (ICU), General Medical Wards, and Outpatient, with Surgical Wards taking the lead in 2024 with a market share of 62.1%

- North America led the market by securing a market share of 40.0% in 2024.

Product Analysis

Bath solutions held the dominant product share of 59.3% in 2024 due to their routine use in preoperative showers and compatibility with hospital hygiene protocols. Many healthcare systems mandate preoperative washing with antiseptic soaps at least once before surgery, with some European facilities advising two or more applications. Bath solutions remain widely preferred because they are cost-efficient, easy to distribute, and familiar to patients.

Hospitals often stock liquid CHG solutions in pre-op units, and large public health programs distribute them for community-based surgical camps. Their ability to significantly reduce skin bioburden has been validated in multiple infection-control studies, encouraging sustained adoption. BD shared in May 2024 that it upgraded applicator designs used with its preoperative antiseptic solutions to ensure uniform coverage and reduced preparation time. This enhancement aims to standardize skin-prep outcomes in both inpatient and ambulatory surgical environments.

Antiseptic wash lotions gain traction due to increasing patient demand for gentler formulations, especially in dermatology-sensitive populations. These lotions are frequently used in orthopedic, cardiac, and obstetric surgeries, where skin integrity is closely monitored. Several hospitals use wash lotions for elderly patients or those with compromised skin barriers. Antiseptic wipes are increasingly adopted in intensive care units, emergency departments, and preoperative holding areas. They enable effective skin cleansing for non-ambulatory patients and minimize water usage important for regions with infrastructure limitations.

End-User Analysis

Surgical wards represent the largest end-user segment accounting for 62.1% market share in 2024 due to high global surgical activity across cardiology, orthopedics, gynecology, neurology, and general surgery. Over 300 million surgeries occur worldwide each year, and many hospitals incorporate preoperative bathing into mandatory pre-surgery checklists. Studies have shown reductions in SSI incidence when patients undergo preoperative CHG bathing, reinforcing widespread implementation. Standardized OR workflows also ensure consistent demand in tertiary and specialty hospitals.

ICUs increasingly adopt antiseptic wipes and wash solutions because critically ill patients cannot perform water-based bathing. ICUs in the US and EU commonly use CHG wipe-downs to reduce bloodstream infections, indirectly strengthening the adoption of preoperative antiseptic bathing when ICU patients are transferred for surgery. General wards utilize preoperative bathing solutions for patients awaiting scheduled or emergency surgeries. Hospitals with large inpatient populations rely on bathing protocols to prepare patients who may be admitted days before surgery.

Outpatient and ambulatory surgery centers are growing rapidly as minimally invasive procedures increase worldwide. Preoperative instructions often include at-home antiseptic showers, and clinics distribute CHG bottles or single-use packets to ensure compliance. In September 2023, Clorox Healthcare launched a clinical-grade CHG-compatible cleansing system for surgical facilities.

Key Market Segments

By Product

- Bath Solutions

- Antiseptic Wash Lotions

- Antiseptic Wipes

- Preoperative Bath Kits

- Others

By End-User

- Surgical Wards

- Intensive Care Units (ICU)

- General Medical Wards

- Outpatient

Drivers

Rising need to reduce surgical site infections

The primary driver for the Preoperative Bathing Solution Market is the global push to reduce surgical site infections, supported by large-scale public health evidence. SSIs account for nearly 20% of all healthcare-associated infections, according to the CDC, and significantly increase recovery time, antibiotic usage, and hospitalization costs. Because more than 300 million surgeries are performed worldwide each year, hospitals increasingly rely on antiseptic bathing protocols to reduce skin microbial load before procedures.

Countries such as the US, UK, Germany, and Australia mandate or strongly recommend preoperative CHG bathing for orthopedic, cardiac, and general surgeries. For instance, NHS England implemented routine preoperative CHG showering in joint-replacement pathways after audits showed measurable decreases in postoperative infection risk. Similarly, US hospitals report reduced Staphylococcus aureus colonization when patients use CHG solutions the night before surgery.

In India and Southeast Asia, rising surgical volumes in multispecialty hospitals have created demand for low-cost antiseptic washes and standardized kits. ICU departments also contribute to market expansion through widespread use of CHG-based wipe-downs to prevent catheter-related bloodstream infections, reinforcing user familiarity. These combined health-system initiatives, global infection-prevention guidelines, and demonstrated clinical benefits fuel sustained product adoption across surgical environments.

In July 2024, Medline announced a reformulated CHG bath solution created for sensitive-skin patients, addressing rising dermatological concerns in preoperative routines. Hospitals began adopting the formulation for elderly, bariatric, and long-stay patients who require repeated cleansing.

Restraints

Concern surrounding skin irritation, allergic responses, and inconsistent patient compliance

A major restraint is the concern surrounding skin irritation, allergic responses, and inconsistent patient compliance with preoperative bathing guidelines. Chlorhexidine (CHG), while widely effective, can cause dryness or dermatitis in certain populations, particularly elderly patients and individuals with eczema or compromised skin barriers. Reports from dermatology clinics note increasing sensitivity to antiseptic agents due to prolonged exposure across healthcare settings.

Additionally, iodine-based formulations may trigger allergic reactions in a small percentage of patients, leading clinicians to provide alternative products. Compliance challenges also limit effectiveness. Studies show that up to 40% of patients fail to follow preoperative bathing instructions correctly when asked to perform them at home. Many skip steps, rinse the product off too quickly, or do not use the required amount of solution, reducing antiseptic effectiveness.

Hospitals in Europe and North America have responded by adopting supervised in-facility bathing, but this increases staffing burden. In low-resource regions, inadequate water supply and lack of patient education complicate implementation. Moreover, antimicrobial resistance concerns prompt caution regarding overuse of antiseptic agents.

Opportunities

Rising adoption in emerging markets

Significant opportunities arise from expanding adoption in emerging markets, development of standardized surgical-prep kits, and rising demand for gentler formulations suitable for sensitive skin. Healthcare investments across Asia, Africa, and Latin America continue to increase surgical capacity. Countries such as India and Vietnam report double-digit growth in elective procedures, creating new demand for preoperative antiseptic supplies in both public and private hospitals.

International NGOs conducting high-volume surgical missions increasingly use single-use CHG kits to ensure consistency across decentralized setups. Another major opportunity lies in the creation of sensitive-skin CHG variants, low-irritation wash lotions, and pediatric-friendly formulations. Many hospitals seek products that balance antimicrobial efficacy with improved skin tolerability to reduce withdrawal from standard protocols.

Standardized preoperative kits also present strong growth potential, as they simplify patient preparation by including solutions, sponges, wipes, and step-by-step multilingual instructions. Healthcare systems adopting digital surgical-prep apps often integrate QR codes linked to these kits, improving compliance. Waterless antiseptic technologies offer further expansion potential in drought-prone regions, where water scarcity affects hospital operations. With rising surgical tourism in countries such as Thailand, Malaysia, and Turkey, demand for high-quality, protocol-driven preoperative hygiene solutions is expected to expand steadily.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical conditions play a significant role in shaping the Preoperative Bathing Solution Market by influencing healthcare spending patterns, supply chain resilience, and access to critical input materials. During periods of economic slowdown, consumer expenditure typically shifts toward essential healthcare products. This trend supports demand for preventive and preparatory care solutions, as they are viewed as cost-effective measures that help reduce downstream clinical risks and expenses.

At the same time, inflationary pressures increase the cost of raw materials, packaging, and transportation. These cost escalations can translate into higher product prices, which may constrain adoption in price-sensitive regions and emerging markets. Profit margins across the value chain are also affected, particularly for manufacturers with limited pricing flexibility.

Geopolitical instability further impacts market dynamics through its effect on global supply chains. Key inputs such as chemical formulations, antimicrobial agents, and packaging components are often sourced from multiple countries. Trade disruptions, export controls, or restrictions on chemical supplies can delay production schedules and reduce product availability across hospital, retail, and distribution channels.

Public health and regulatory policies responding to geopolitical developments also influence market demand. Heightened concerns around healthcare system efficiency and infection prevention encourage greater emphasis on preoperative hygiene standards. Additionally, structural changes in labor markets, including the expansion of remote work, are reshaping patient behavior by increasing preference for convenient, at-home or outpatient preparatory solutions.

Meanwhile, stricter regulations related to cross-border data handling and healthcare compliance may affect operational strategies for companies operating across multiple regions, particularly in areas involving digital health integration and patient data management.

Latest Trends

Shift toward waterless, wipe-based, and protocol-standardized preoperative bathing systems

A key trend shaping the market is the shift toward waterless, wipe-based, and protocol-standardized preoperative bathing systems. ICUs worldwide increasingly use CHG wipes for daily antiseptic cleansing, normalizing wipe-based approaches and encouraging their expansion into preoperative workflows. Wipes reduce dependency on water supply and ensure consistent application useful in rural hospitals, mobile surgical units, and emergency settings.

Evidence from US and European hospitals shows improved compliance when patients use prepackaged CHG wipes instead of traditional soap-based showers. Another trend is the rise of digital patient-preparation pathways. Many hospitals deliver preoperative instructions through mobile apps, SMS reminders, and video demonstrations, significantly increasing compliance rates. Facilities in Japan, South Korea, and the UAE have begun distributing QR-enabled kits linking patients to preparation tutorials. Sensitive-skin formulations also reflect a strong trend, driven by rising awareness of dermatological health.

Manufacturers increasingly design skin-soothing or fragrance-free antiseptic products to meet regulatory expectations and patient comfort requirements. Sustainability pressures are also influencing trends, encouraging recyclable packaging and reduced-plastic wipe formats. Collectively, these innovations reflect a movement toward more patient-friendly, standardized, and environmentally conscious preoperative bathing practices across surgical care systems globally.

Regional Analysis

North America is leading the Preoperative Bathing Solution Market

North America represents the largest share of the Preoperative Bathing Solution Market due to its high surgical volume, strong adoption of SSI-prevention guidelines, and widespread use of CHG-based products. The US alone performs more than 40 million surgical procedures annually, creating consistent demand across surgical wards, ICUs, and ambulatory centers.

The CDC estimates that SSIs account for nearly 20% of all healthcare-associated infections, prompting hospitals to enforce mandatory preoperative bathing protocols. Large health networks such as Kaiser Permanente and Mayo Clinic integrate CHG-based showers into electronic pre-surgery checklists, improving compliance rates documented in clinical audits. Canada’s national safety initiatives also include CHG showering in orthopedic and cardiac pathways.

ICU departments across the region commonly utilize daily CHG wipe-downs to reduce bloodstream infection risk, further increasing product familiarity. Additionally, growing outpatient surgery volumes exceeding 60% of all U.S. procedures support continued use of take-home antiseptic kits and pre-surgical wipes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region due to rapid expansion in hospital infrastructure, rising elective surgery demand, and government-backed infection-control programs. Countries such as China and India collectively perform more than 70 million surgeries annually, creating substantial demand for preoperative hygiene products. Japan and South Korea maintain strict SSI-prevention frameworks requiring preoperative antiseptic bathing, especially for orthopedic and cardiovascular procedures.

In India, public and private hospitals increasingly distribute CHG kits to patients scheduled for minimally invasive surgeries. Southeast Asian nations, including Thailand, Malaysia, and Vietnam, report a surge in outpatient surgeries driven by medical tourism, prompting ambulatory centers to adopt standardized preoperative bathing instructions and wipes.

Water scarcity in regions such as rural Indonesia strengthens demand for waterless antiseptic wipes. In April 2023, Cipla expanded its hospital hygiene portfolio with antiseptic bathing solutions for pre- and post-surgical care. The launch strengthens Cipla’s position in hospital-focused hygiene offerings across India and emerging markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include 3M, Unilever, Medline Industries, Becton, Dickinson and Company (BD), Stryker, Ecolab, Mölnlycke Health Care, Perrigo, HiCare Health, Clorox, B. Braun, Reckitt Benckiser, Johnson & Johnson, Schülke & Mayr, Cardinal Health, and Others.

3M develops a wide portfolio of infection-prevention products used widely in surgical preparation workflows, including CHG-based skin cleansing solutions and preoperative bathing accessories. The company supports global SSI-reduction initiatives, and its antiseptic technologies are frequently integrated into hospital-standardized pre-surgery pathways. Large US and European healthcare networks adopt 3M solutions due to their proven antimicrobial performance in orthopedic, cardiac, and general surgeries.

Unilever participates in this market through hygiene and skin-care formulations used by hospitals, community clinics, and pre-surgery patient-preparation programs. Its mild surfactant technologies and dermatology-tested lotions are used in settings requiring low-irritation antiseptic bathing options, particularly for sensitive-skin or elderly patient groups.

Medline Industries is one of the most prominent players, supplying CHG solutions, waterless bathing wipes, and complete preoperative kits used across surgical wards and ICUs. Many hospitals depend on Medline’s standardized kits to improve compliance and reduce variability in patient preparation.

Becton, Dickinson and Company contributes through antimicrobial solutions, CHG-based preparations, and infection-control consumables integrated into surgical workflows. BD’s broad presence in hospital safety protocols strengthens adoption of its antiseptic products in preoperative environments, particularly in high-acuity units such as ICUs and pre-op holding areas.

Top Key Players

- 3M

- Unilever

- Medline Industries

- Becton, Dickinson and Company (BD)

- Stryker

- Ecolab

- Mölnlycke Health Care

- Perrigo

- HiCare Health

- Clorox

- Braun

- Reckitt Benckiser

- Johnson & Johnson

- Schülke & Mayr

- Cardinal Health

- Others

Recent Developments

- In November 2025, 3M launched a new alcohol-free 2% chlorhexidine gluconate (CHG) cloth product aimed at preoperative patients and surgical settings. The cloth is positioned as a ready-to-use antiseptic wipe alternative to traditional bathing, targeting surgical wards, ICUs, and preoperative units. This development reflects growing demand for easy-to-use, waterless antiseptic solutions, especially useful in settings where showers are impractical or compliance needs to be simplified.

- In January 2025, Ecolab announced that it has enhanced its CHG antiseptic wash formulation to improve skin tolerance for frequent preoperative bathing. The updated product focuses on reducing irritation while maintaining broad-spectrum antimicrobial protection, and it is already being adopted in several North American and European surgical centers.

- In September 2024, Mölnlycke launched a new preoperative body cleansing kit for orthopedic and cardiac procedures. Mölnlycke Health Care revealed a comprehensive pre-surgical bathing kit in September 2024, incorporating CHG wash, applicators, and step-by-step usage guides to improve protocol compliance.

- In November 2023, Paul Hartmann AG released a next-generation antiseptic foam wash for preoperative clinics.

Report Scope

Report Features Description Market Value (2024) US$ 1.35 Billion Forecast Revenue (2034) US$ 2.04 Billion CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Bath Solutions, Antiseptic Wash Lotions, Antiseptic Wipes, Preoperative Bath Kits and Others), By End-User (Surgical Wards, Intensive Care Units (ICU), General Medical Wards, and Outpatient) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3M, Unilever, Medline Industries, Becton, Dickinson and Company (BD), Stryker, Ecolab, Mölnlycke Health Care, Perrigo, HiCare Health, Clorox, B. Braun, Reckitt Benckiser, Johnson & Johnson, Schülke & Mayr, Cardinal Health, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Preoperative Bathing Solution MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Preoperative Bathing Solution MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Unilever

- Medline Industries

- Becton, Dickinson and Company (BD)

- Stryker

- Ecolab

- Mölnlycke Health Care

- Perrigo

- HiCare Health

- Clorox

- Braun

- Reckitt Benckiser

- Johnson & Johnson

- Schülke & Mayr

- Cardinal Health

- Others