Global Anorexiants Market By Drug Class (Catecholamines, Serotonin) By Route of Administration (Oral, Subcutaneous) By End User (Institutional Sales, Hospitals & Clinics, Retail Sales, Online Pharmacies, Others) and by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137503

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

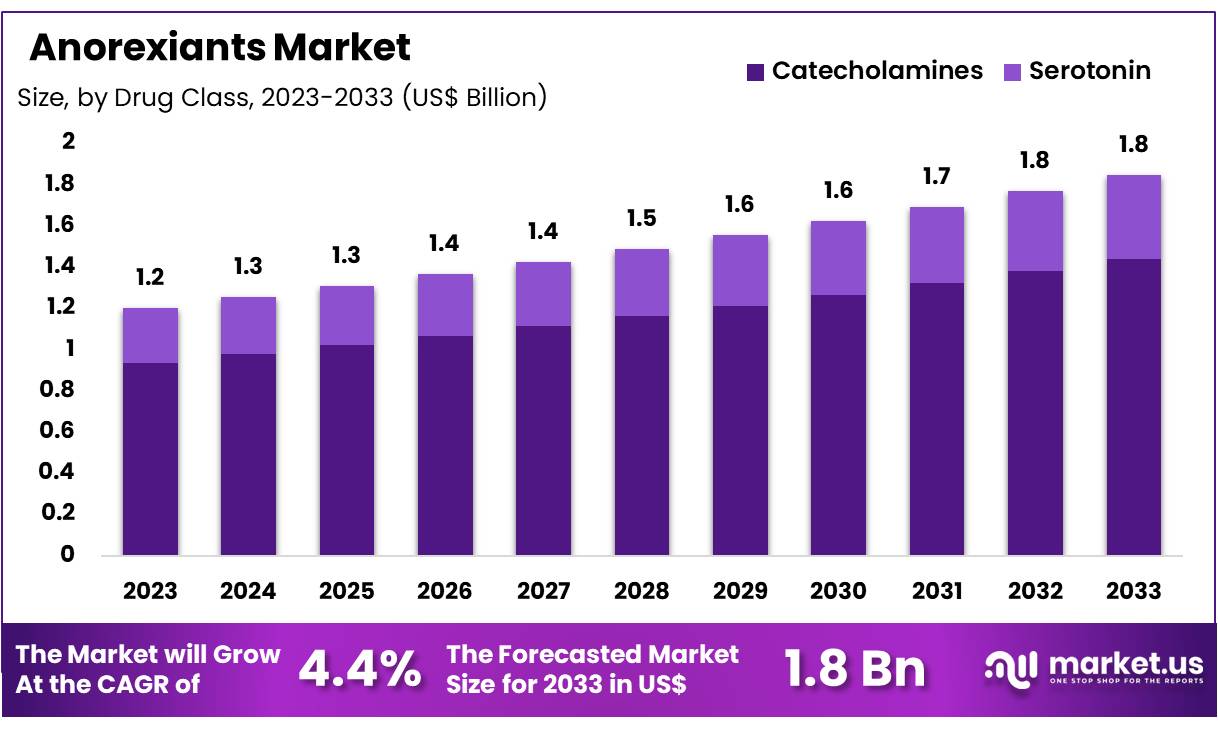

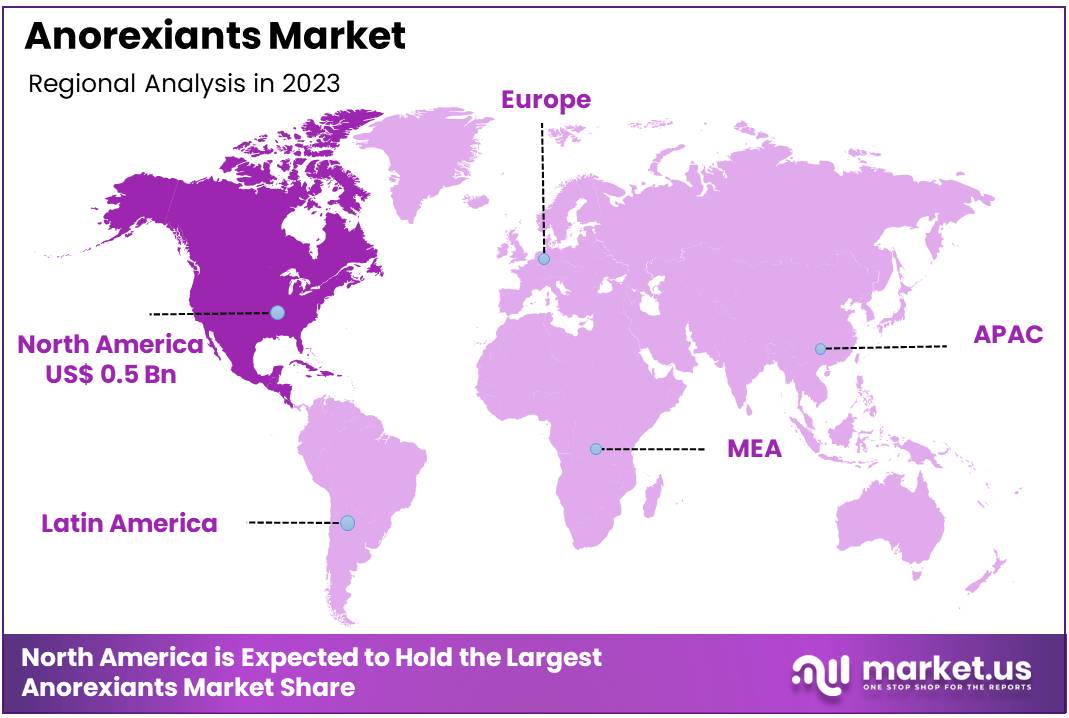

Global Anorexiants Market size is expected to be worth around US$ 1.8 Billion by 2033 from US$ 1.2 Billion in 2023, growing at a CAGR of 4.4% during the forecast period from 2024 to 2033. With a market share over 42%, North America held a strong lead in 2023, reaching US$ 0.5 Billion in revenue.

Anorexiants, commonly referred to as appetite suppressants or weight loss medications, are pharmaceutical compounds designed to aid individuals in managing weight by reducing appetite and enhancing satiety. The growing prevalence of obesity, driven by sedentary lifestyles, unhealthy dietary habits, and physical inactivity, is significantly contributing to the market’s expansion.

Global healthcare expenditure aimed at addressing obesity-related health conditions, such as cardiovascular diseases (CVDs), diabetes, and hypertension, is further bolstering the demand for anorexiants. According to the World Health Organization (WHO), approximately 2.8 million individuals die annually due to complications arising from overweight or obesity. In addition, the WHO reported in 2021 that around 115 million people in developing countries are grappling with obesity-related health issues.

The rising incidence of obesity and its associated comorbidities is a primary driver of the anorexiants market. These medications work by targeting the hypothalamus and limbic system in the brain to regulate satiety, making them an effective tool for obesity management. Popular FDA-approved anorexiants include lorcaserin, naltrexone/bupropion ER, orlistat, liraglutide, and phentermine/topiramate ER.

The global burden of obesity is underscored by WHO’s report that approximately 650 million adults and 41 million children under five years old were classified as obese in 2017. With the approval of several weight management drugs by regulatory agencies, the anorexiants market is poised for robust growth in the coming years, supported by increasing awareness and advancements in treatment options.

Key Takeaways

- Market Size: Anorexiants Market size is expected to be worth around US$ 1.8 Billion by 2033 from US$ 1.2 Billion in 2023.

- Market Growth: The market growing at a CAGR of 4.4% during the forecast period from 2024 to 2033.

- Drug Class Analysis: Catecholamines, which include stimulants like phentermine and phentermine/topiramate ER, dominate the market with a substantial 78% share.

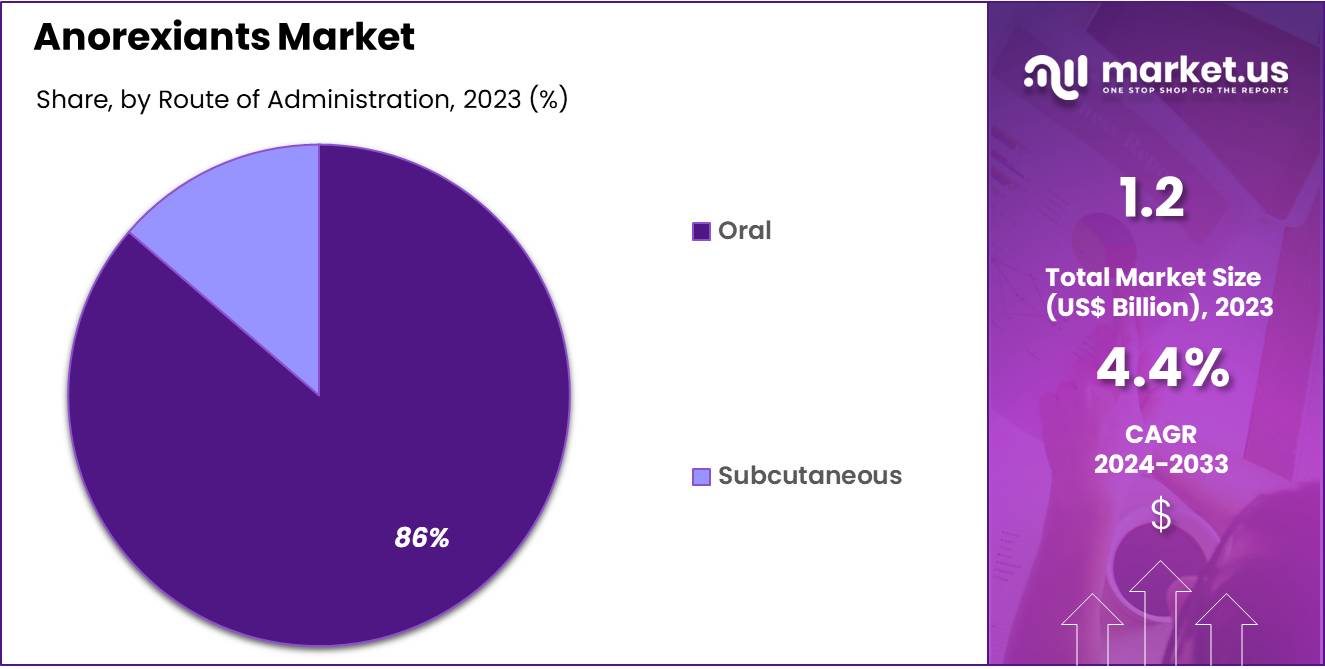

- Route of Administration Analysis: Oral administration dominates the market with a significant 86% market share.

- End-Use Analysis: Hospitals & clinics dominate the market with a 29% market share.

- Regional Analysis: North America held a dominant 42% share of the anorexiants market in 2023.

Drug Class Analysis

The anorexiants market is segmented based on drug class, including catecholamines, serotonin-based drugs, and other appetite suppressants. Catecholamines, which include stimulants like phentermine and phentermine/topiramate ER, dominate the market with a substantial 78% share. These drugs act by stimulating the central nervous system, increasing energy expenditure, and suppressing appetite. Their high efficacy, affordability, and widespread availability contribute to their leading position in the market.

Serotonin-based drugs, such as lorcaserin, represent another significant segment. These medications work by modulating serotonin levels in the brain to enhance feelings of satiety and reduce food cravings. Although serotonin-based drugs hold a smaller market share compared to catecholamines, their role in addressing obesity, particularly in patients with contraindications to stimulants, is growing.

The increasing prevalence of obesity, coupled with advancements in drug formulations and FDA approvals, continues to drive the growth of these segments, ensuring a robust market outlook for anorexiants.

Route of Administration

The anorexiants market is segmented by the route of administration, primarily into oral and subcutaneous methods. Oral administration dominates the market with a significant 86% market share, owing to its convenience, ease of use, and widespread patient preference. Oral formulations, such as tablets and capsules, include popular drugs like phentermine, lorcaserin, and naltrexone/bupropion ER. These medications are accessible, cost-effective, and can be easily integrated into daily routines, making them the preferred choice for both patients and healthcare providers.

Subcutaneous administration, which involves injectable drugs like liraglutide, constitutes a smaller yet growing segment. This route offers advantages in terms of sustained drug release and higher bioavailability, making it suitable for long-term obesity management. Subcutaneous drugs are often recommended for patients who require enhanced efficacy or cannot tolerate oral medications.

The continued dominance of oral anorexiants, coupled with rising adoption of injectables for specific patient groups, ensures robust growth across both segments in the coming years.

End User Analysis

The anorexiants market is segmented by end users, including hospitals & clinics, institutional sales, retail sales, online pharmacies, and others. Hospitals & clinics dominate the market with a 29% market share, attributed to their role as primary care centers for diagnosing and managing obesity-related conditions. These settings facilitate patient monitoring and access to comprehensive care, driving demand for anorexiants through prescription-based sales.

Institutional sales also represent a notable segment, driven by large-scale procurement for healthcare facilities, weight management programs, and specialized treatment centers. Meanwhile, retail sales account for a significant portion of the market, as they cater to patients with recurring prescriptions for long-term obesity management.

Online pharmacies are witnessing rapid growth, supported by increasing internet penetration, patient convenience, and competitive pricing. The others segment includes wellness centers and alternative care providers, which contribute to niche but growing demand. The rising prevalence of obesity and increasing adoption of anorexiants across these end-user segments are expected to fuel market growth.

Key Market Segments

By Drug Class

- Catecholamines

- Serotonin

By Route of Administration

- Oral

- Subcutaneous

By End User

- Institutional Sales

- Hospitals & Clinics

- Retail Sales

- Online Pharmacies

- Others

Driver

Rising Prevalence of Obesity and Related Diseases

The growing global prevalence of obesity and associated health conditions, such as cardiovascular diseases, diabetes, and hypertension, is a key driver of the anorexiants market. According to the World Health Organization (WHO), around 650 million adults were obese in 2017. This epidemic has created a substantial demand for effective weight management solutions, including anorexiants. Governments and healthcare organizations are investing heavily in obesity prevention and treatment programs, further boosting the market.Additionally, increasing awareness of the health risks linked to obesity is encouraging more individuals to seek medical intervention, driving the adoption of anorexiants as part of obesity management plans.

Trend

Growing Adoption of Non-Stimulant Anorexiants

The anorexiants market is witnessing a shift toward non-stimulant appetite suppressants, driven by patient demand for safer alternatives with fewer side effects. Drugs like naltrexone/bupropion ER and liraglutide are gaining traction due to their improved safety profiles and long-term effectiveness. These medications target metabolic pathways and satiety centers without the stimulating effects of traditional anorexiants, appealing to a broader patient base.Additionally, ongoing research and development in non-stimulant formulations are paving the way for innovative products. This trend aligns with a growing preference for personalized medicine, where patients are offered options tailored to their medical histories and lifestyle needs.

Restraint

Side Effects and Safety Concerns

Despite their benefits, anorexiants face challenges related to potential side effects and safety concerns. Common issues include nausea, dizziness, and increased heart rate, which can deter long-term use among patients. In some cases, stimulant-based anorexiants may pose risks of dependency or cardiovascular complications, limiting their appeal.Regulatory scrutiny also impacts market growth, as stringent approval processes and safety evaluations delay product launches. Furthermore, public skepticism about the effectiveness and safety of weight-loss drugs can hinder adoption. Overcoming these barriers requires continued research into safer formulations, robust clinical trials, and awareness campaigns to build patient confidence in these medications.

Opportunity

Growth in Online Pharmacies and Emerging Markets

The rise of online pharmacies and expanding healthcare access in emerging markets present significant growth opportunities for the anorexiants market. Online platforms provide convenience, competitive pricing, and access to a wide range of weight-loss medications, driving sales among tech-savvy consumers.In developing regions, increasing healthcare investments and awareness of obesity-related risks are boosting demand for medical interventions, including anorexiants. Regulatory reforms in these markets are also facilitating the introduction of FDA-approved drugs, creating untapped potential for growth. By leveraging digital platforms and targeting underserved regions, manufacturers can expand their market presence and meet the rising demand for effective weight management solutions.

Regional Analysis

North America held a dominant 42% share of the anorexiants market in 2023, driven by the region’s high prevalence of obesity and associated health conditions. According to the CDC, over 40% of adults in the United States are classified as obese, creating a significant demand for effective weight management solutions. Advanced healthcare infrastructure, widespread availability of FDA-approved anorexiant medications, and strong awareness campaigns further support market growth.

The region also benefits from robust investments in obesity research and treatment programs. Additionally, the growing adoption of non-stimulant anorexiants and innovative weight-loss therapies in the U.S. and Canada contributes to the region’s leading position. These factors ensure sustained growth and dominance in the global anorexiants market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The anorexiants market is characterized by the presence of several established players offering a wide range of weight-loss medications. These companies focus on developing innovative formulations, such as non-stimulant and combination therapies, to cater to diverse patient needs. Many key players invest heavily in research and development to improve drug efficacy and safety while minimizing side effects.

Partnerships with healthcare providers and distribution networks, including retail and online pharmacies, are integral to their strategies. Furthermore, players actively seek regulatory approvals for new drugs and expand their presence in emerging markets to capitalize on the growing global demand for obesity management solutions.

Market Key Players

- Pfizer Inc.

- Johnson & Johnson

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceuticals

- Arena Pharmaceuticals GmbH

- Abbott

- Epic Pharma LLC.

- Novo Nordisk A/S

- Novartis AG

- Merck & Co., Inc.

- Catalent Pharma Solutions LLC

- AstraZeneca

- Takeda Pharmaceutical Company Limited

Recent Developments

- Pfizer Inc.In December 2024: Pfizer announced the discontinuation of further trials for its oral weight-loss drug, danuglipron, due to high dropout rates and side effects such as nausea and vomiting in a mid-stage trial.

- Johnson & Johnson F. Hoffmann-La Roche Ltd. In July 2024: Roche acquired CT-388 as part of its $2.7 billion buyout of Carmot Therapeutics. CT-388 is a once-a-week injection belonging to the same class as Eli Lilly’s Mounjaro.

- Novo Nordisk A/S In August 2024: Novo Nordisk reported data from a large study showing that its weight-loss drug, Wegovy, also had a clear cardiovascular benefit.

- Catalent Pharma Solutions LLC In February 2024: Novo Nordisk announced plans to acquire three of Catalent’s fill-finish sites in Anagni, Italy; Brussels, Belgium; and Bloomington, Indiana, for $11 billion to boost production of its weight-loss drug, Wegovy.

Report Scope

Report Features Description Market Value (2023) US$ 1.2 Billion Forecast Revenue (2033) US$ 1.8 Billion CAGR (2024-2033) 4.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drug Class (Catecholamines, Serotonin) By Route of Administration (Oral, Subcutaneous) By End User (Institutional Sales, Hospitals & Clinics, Retail Sales, Online Pharmacies, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Pfizer Inc. , Johnson & Johnson, F. Hoffmann-La Roche Ltd., Teva Pharmaceuticals, Arena Pharmaceuticals GmbH, Abbott, Epic Pharma LLC., Novo Nordisk A/S, Novartis AG, Merck & Co., Inc. , Catalent Pharma Solutions LLC, AstraZeneca, Takeda Pharmaceutical Company Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Pfizer Inc.

- Johnson & Johnson

- F. Hoffmann-La Roche Ltd.

- Teva Pharmaceuticals

- Arena Pharmaceuticals GmbH

- Abbott

- Epic Pharma LLC.

- Novo Nordisk A/S

- Novartis AG

- Merck & Co., Inc.

- Catalent Pharma Solutions LLC

- AstraZeneca

- Takeda Pharmaceutical Company Limited