Global Potato Soup Market Size, Share, Report Analysis By Flavor (Unflavoured, Flavored), By Type (Ready-to-Eat, Powdered, Canned, Organic, Low Sodium, Cream-based, Dehydrated), By Application (Retail, Foodservice, Institutional, Convenience Stores, Restaurants, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156457

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

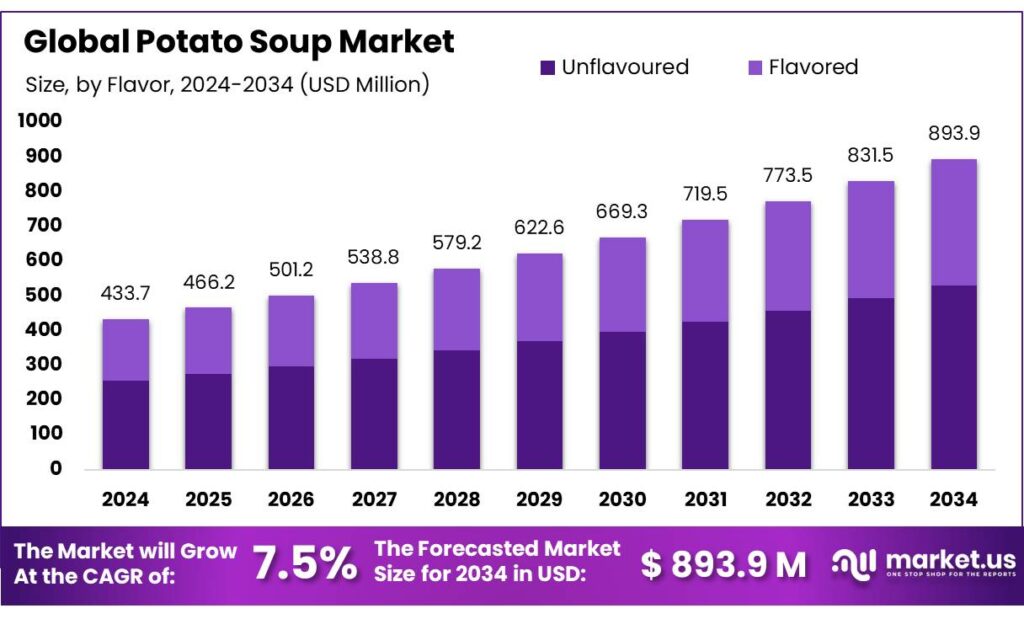

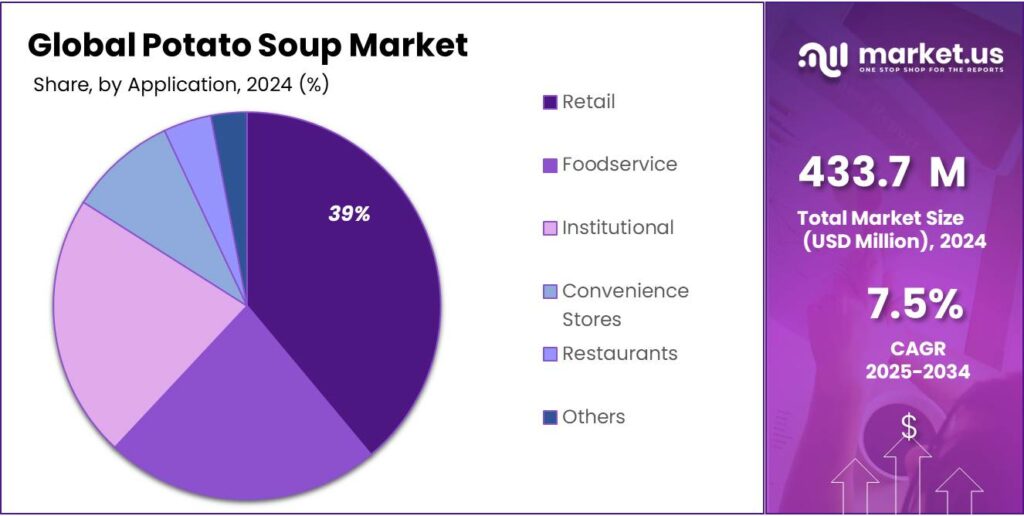

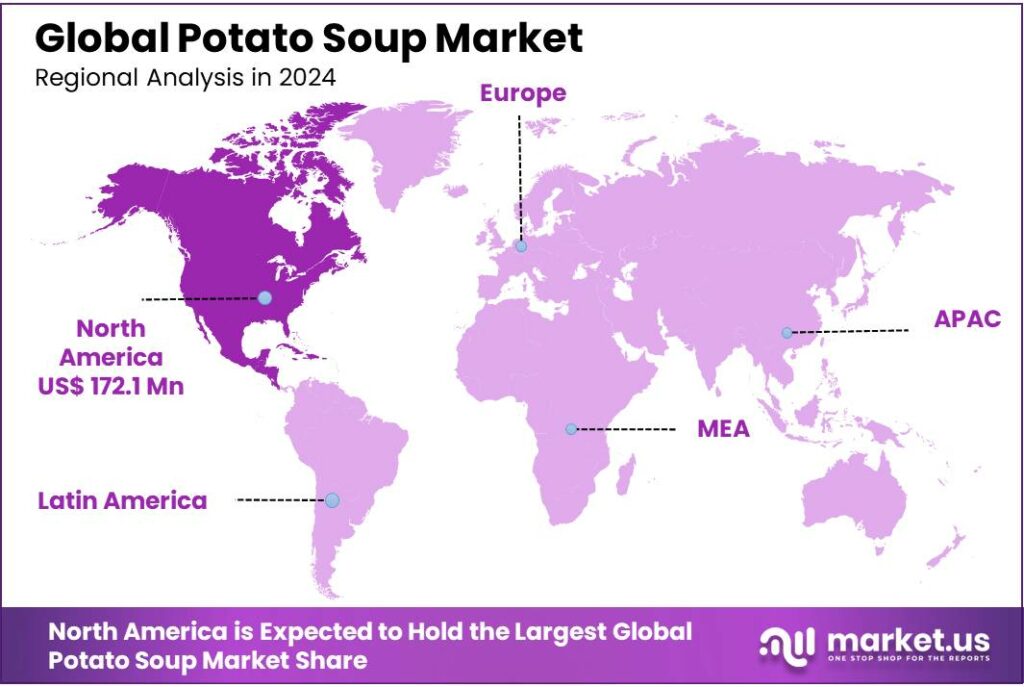

The Global Potato Soup Market size is expected to be worth around USD 893.9 Million by 2034, from USD 433.7 Million in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 39.70% share, holding USD 172.1 Million revenue.

The potato soup industry is experiencing significant growth, driven by evolving consumer preferences, technological advancements, and supportive government initiatives. Potatoes, a staple crop in India, are integral to various processed food products, including soups. The Indian government’s focus on enhancing potato farming infrastructure and promoting value-added products has bolstered the industry’s development.

India’s potato production is concentrated in states like Uttar Pradesh, West Bengal, and Bihar. In 2024–25, Uttar Pradesh produced 244 lakh metric tonnes of potatoes over 6.96 lakh hectares, with Agra alone cultivating potatoes on 76,000 hectares. This substantial production base supports the growing demand for processed potato products, including soups.

The government’s initiatives play a pivotal role in the industry’s expansion. The Operation Greens scheme, introduced in the 2018–2019 Union budget, aims to stabilize the supply of tomato, onion, and potato crops (TOP crops) in India. With an allocation of ₹500 crore, the scheme promotes the development of Farmer Producer Organizations (FPOs), agri-logistics, processing facilities, and professional management.

Additionally, the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) Scheme, launched in June 2020, provides financial, technical, and business support to micro food processing enterprises, fostering the growth of small-scale potato soup producers.

Key Takeaways

- Potato Soup Market size is expected to be worth around USD 893.9 Million by 2034, from USD 433.7 Million in 2024, growing at a CAGR of 7.5%.

- Unflavoured held a dominant market position, capturing more than a 59.3% share in the Potato Soup Market.

- Ready-to-Eat held a dominant market position, capturing more than a 34.8% share in the Potato Soup Market.

- Retail held a dominant market position, capturing more than a 38.9% share in the Potato Soup Market.

- North America emerged as the dominant region in the Potato Soup Market, capturing 39.70% of global sales, equating to approximately USD 172.1 million.

By Flavor Analysis

Unflavoured Leads with 59.3% Share in 2024

In 2024, Unflavoured held a dominant market position, capturing more than a 59.3% share in the Potato Soup Market. This strong lead reflects consumer preference for a base product that can be customized with spices, herbs, or seasonings according to individual taste. Foodservice outlets and household consumers both rely on unflavoured potato soup as a versatile option, using it as a foundation for traditional recipes or fusion-style meals. Its neutral profile also appeals to health-conscious buyers who prefer low-sodium or additive-free choices.

By 2025, demand for unflavoured potato soup is expected to remain strong as packaged and ready-to-cook meals continue to grow in popularity. Manufacturers are focusing on clean-label formulations, highlighting natural ingredients to attract consumers seeking simple yet wholesome food options. The unflavoured segment also benefits from its wide adaptability across different cuisines, making it a consistent favorite in both retail and foodservice markets. Overall, the unflavoured category remains the backbone of the potato soup market, ensuring its sustained dominance into the next year.

By Type Analysis

Ready-to-Eat Leads with 34.8% Share in 2024

In 2024, Ready-to-Eat held a dominant market position, capturing more than a 34.8% share in the Potato Soup Market. This segment gained strength as busy consumers increasingly turned to convenient meal solutions that require little or no preparation. Ready-to-eat potato soup, available in canned, packaged, and microwaveable formats, is widely preferred in urban areas where fast-paced lifestyles demand quick yet wholesome food choices. The segment also benefits from extended shelf life, portion control, and consistent taste, making it a reliable option for both households and foodservice.

By 2025, the ready-to-eat category is expected to maintain its growth momentum, supported by rising demand for premium soup varieties with clean-label and low-sodium options. Manufacturers are innovating with packaging formats such as resealable pouches and single-serve bowls, enhancing consumer convenience. The trend of on-the-go eating, coupled with the increasing popularity of comfort foods, further supports the dominance of this segment. Overall, the ready-to-eat type continues to anchor the potato soup market, combining convenience, quality, and availability to meet evolving consumer needs.

By Application Analysis

Retail Dominates with 38.9% Share in 2024

In 2024, Retail held a dominant market position, capturing more than a 38.9% share in the Potato Soup Market. The retail segment thrives on the rising demand for packaged soups available in supermarkets, hypermarkets, and convenience stores. Consumers prefer retail channels because they provide easy access to a wide range of potato soup options, from ready-to-eat cans to dehydrated mixes. Attractive packaging, promotions, and the ability to compare multiple brands in one place further support strong retail sales.

By 2025, the retail segment is expected to maintain its dominance as more consumers continue to rely on packaged foods for daily meals. With the growing popularity of online grocery platforms, retail distribution is also expanding beyond physical stores, ensuring greater reach for potato soup brands. Retail formats also cater to diverse income groups by offering both budget-friendly and premium product ranges. Overall, the retail application remains the strongest growth driver in the potato soup market, combining accessibility and variety to keep its leading position intact.

Key Market Segments

By Flavor

- Unflavoured

- Flavored

By Type

- Ready-to-Eat

- Powdered

- Canned

- Organic

- Low Sodium

- Cream-based

- Dehydrated

By Application

- Retail

- Foodservice

- Institutional

- Convenience Stores

- Restaurants

- Others

Emerging Trends

Premium Comfort Food Movement Drives Potato Soup Innovation

The most significant trend reshaping the potato soup landscape in 2024 centers around the premium comfort food movement, where traditional potato soup recipes are being elevated with gourmet ingredients and restaurant-quality preparation methods. This trend represents a fundamental shift from standard canned offerings to sophisticated, artisanal potato soup varieties that deliver both nostalgic comfort and culinary excellence.

The movement has gained remarkable momentum across American dining establishments, with industry data revealing that 37.19% of restaurants now feature soup options on their menus, representing a strategic response to consumer demands for elevated comfort foods that maintain familiar flavors while incorporating premium ingredients and preparation techniques.

The premium potato soup trend has emerged as restaurants and food manufacturers recognize that consumers are increasingly willing to pay higher prices for quality comfort foods that remind them of home-cooked meals but with professional culinary expertise.

- According to the National Restaurant Association, restaurant sales reached a historic milestone of $1 trillion in 2023, growing by 8.6% from the previous year, with comfort food categories like premium soups contributing significantly to this growth trajectory. The association projects continued expansion with sales expected to reach $1.1 trillion in 2024, representing a 5.4% increase that reflects consumer appetite for elevated comfort dining experiences.

Food price dynamics have also influenced the premium potato soup trend, as evidenced by USDA Economic Research Service data showing that food prices grew by 2.3% in 2024, encouraging consumers to seek value-driven premium options that justify higher costs through superior quality and satisfaction.

The ready-to-eat wet soup segment, which includes many premium potato soup varieties, dominated the American soup market with a 28.8% revenue share in 2024, indicating strong consumer preference for convenient yet high-quality soup options that require minimal preparation while delivering restaurant-style taste experiences. This preference aligns perfectly with the premium potato soup trend, where manufacturers and restaurants focus on creating products that combine convenience with gourmet appeal.

Drivers

Government Initiatives Driving the Growth of the Potato Soup Industry in India

The potato soup industry in India is experiencing significant growth, largely due to supportive government initiatives aimed at enhancing potato production and processing capabilities. These efforts are not only boosting the supply chain but also creating a conducive environment for the development of value-added products like potato soups.

Uttar Pradesh, India’s leading potato-producing state, accounts for approximately 35% of the nation’s total potato output. In the 2024–25 season, the state produced 244 lakh metric tonnes of potatoes over 6.96 lakh hectares, with Agra alone cultivating potatoes on 76,000 hectares. Despite this substantial production, challenges such as the shortage of quality seeds and processing-grade varieties persist.

To address these issues, the Union Cabinet approved the establishment of the International Potato Centre’s South Asia Regional Centre (CSARC) in Agra, with an investment of ₹111.50 crore. This centre aims to enhance seed quality, promote sustainable farming practices, and improve post-harvest management, thereby strengthening the potato supply chain for processed products like soups.

Complementing these efforts, the Indian government launched the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) Scheme in June 2020. This centrally sponsored scheme, with an outlay of ₹10,000 crore over five years, aims to formalize and modernize the food processing sector. It provides credit-linked subsidies, technical support, and infrastructure development to micro food processing units, including those involved in potato-based products. Under this scheme, individual units can avail of a 35% capital subsidy, up to ₹10 lakh, to upgrade their facilities.

Additionally, the Operation Greens scheme, introduced in the 2018–19 Union Budget with an allocation of ₹500 crore, focuses on stabilizing the supply of tomato, onion, and potato crops (TOP crops). The scheme promotes the development of Farmer Producer Organizations (FPOs), agri-logistics, processing facilities, and professional management. By enhancing the efficiency of the potato supply chain, Operation Greens contributes to the consistent availability of raw materials for the potato soup industry.

Restraints

Cold Storage Limitations Hindering Potato Soup Production in India

One of the significant challenges facing the potato soup industry in India is the inadequate cold storage infrastructure. Despite being the second-largest producer of potatoes globally, India struggles with post-harvest losses due to insufficient and outdated cold storage facilities. This deficiency not only affects the shelf life of potatoes but also impacts the quality of raw materials essential for producing processed items like potato soup.

According to the National Centre for Cold-chain Development (NCCD), India’s cold storage capacity is limited, with many facilities being outdated and inefficient. These legacy cold storage units often lack proper temperature control and ventilation, leading to quality degradation of stored produce. For instance, in Haryana, approximately 90% of the cold storage units are legacy facilities, primarily serving potatoes, and remain underutilized during off-seasons, contributing to high operational costs and carbon emissions.

The lack of modern cold storage infrastructure results in significant post-harvest losses. Studies indicate that a substantial portion of India’s horticultural produce, including potatoes, is lost due to inadequate storage facilities. This not only leads to financial losses for farmers but also affects the supply chain for processed food industries, including potato soup manufacturers.

To address these challenges, the Indian government has initiated several schemes aimed at improving cold storage infrastructure. The National Centre for Cold-chain Development (NCCD) has been established to promote the development of cold-chain infrastructure in the country. Additionally, the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) Scheme provides financial assistance for upgrading food processing units, including cold storage facilities, to enhance the shelf life and quality of perishable products.

Opportunity

Government Support for Potato Soup: A Growing Opportunity

The potato soup market is experiencing significant growth, driven by increasing consumer demand for convenient, nutritious, and comforting meal options. This trend is particularly evident in India, where the government has introduced initiatives to stabilize the supply of key crops, including potatoes, thereby supporting the growth of the potato-based food industry.

In 2018, the Indian government launched Operation Greens, a scheme aimed at stabilizing the supply of tomato, onion, and potato (TOP) crops. With an allocation of ₹500 crore, the initiative focuses on promoting farmer producer organizations (FPOs), enhancing agri-logistics, establishing processing facilities, and ensuring professional management. The goal is to reduce price volatility and ensure the year-round availability of these essential crops across the country.

This governmental support has led to a more stable and increased supply of potatoes, which is crucial for the production of potato-based products like soups. As a result, manufacturers are better positioned to meet the rising consumer demand for ready-to-eat and ready-to-cook potato soups.

Regional Insights

North America Leads with 39.70% Share (USD 172.1 Million) in 2024 Potato Soup Market

In 2024, North America emerged as the dominant region in the Potato Soup Market, capturing 39.70% of global sales, equating to approximately USD 172.1 million in revenue. This preeminence stems from several deeply human-sized trends: a fondness for comforting, familiar dishes; a well-established retail network; and consumer expectations for convenience without compromising taste.

Consumers across the U.S. and Canada consistently turn to potato soup for warmth and simplicity—be it classic cream of potato or more adventurous hearty blends. The widespread availability of ready-to-eat and ready-to-heat formats in grocery aisles, combined with the appeal of clean-label and lower-sodium recipes, resonates strongly with busy families and health-conscious individuals alike.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ConAgra Foods, a U.S.-based packaged food leader, maintains a strong presence in the potato soup market through its well-known brands like Healthy Choice and Birds Eye. In 2024, ConAgra reported revenues of USD 12.3 billion, benefiting from growing consumer interest in convenient, shelf-stable meals. Its potato soup offerings cater to both retail and foodservice, emphasizing taste and affordability. By leveraging broad distribution and marketing strength, ConAgra continues to serve mainstream consumers seeking comfort foods with quick preparation.

Kraft Heinz, one of the largest global food companies, drives growth in the potato soup segment through its Campbell-inspired ranges and popular Heinz-branded soups. In 2024, the company generated USD 26.6 billion in sales, with prepared foods playing a key role. Its potato soup products highlight familiar flavors that resonate strongly in North America and Europe. Focused on convenience, taste, and affordability, Kraft Heinz aligns its soup portfolio with evolving consumer demand for ready-to-serve comfort meals at home.

Nestlé, the world’s largest food company, leverages its strong soup and meal solutions portfolio under brands like Maggi and Stouffer’s. In 2024, Nestlé posted revenues exceeding CHF 93 billion, with a significant portion from prepared foods and culinary products. Its potato soup offerings are positioned as quick, wholesome meal options, often fortified with added nutrition. Nestlé’s scale, R&D focus, and global distribution enable it to adapt flavors to regional preferences, keeping potato soup relevant across diverse international markets.

Top Key Players Outlook

- ConAgra Foods

- Kraft Heinz

- Nestlé

- Unilever

- Amy’s Kitchen

- Hain Celestial Group

- Pacific Foods

- B&G Foods

- Hormel Foods

- Knorr

- McCain Foods

Recent Industry Developments

In 2024, Unilever achieved total group revenue of €60.761 billion, underscoring its status as a consumer goods heavyweight.

In 2024, Hain Celestial Group, a leading natural and organic foods company, achieved annual net sales of USD 1.736 billion, a 3% decline from the previous year.

Report Scope

Report Features Description Market Value (2024) USD 433.7 Mn Forecast Revenue (2034) USD 893.9 Mn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Flavor (Unflavoured, Flavored), By Type (Ready-to-Eat, Powdered, Canned, Organic, Low Sodium, Cream-based, Dehydrated), By Application (Retail, Foodservice, Institutional, Convenience Stores, Restaurants, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ConAgra Foods, Kraft Heinz, Nestlé, Unilever, Amy’s Kitchen, Hain Celestial Group, Pacific Foods, B&G Foods, Hormel Foods, Knorr, McCain Foods Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ConAgra Foods

- Kraft Heinz

- Nestlé

- Unilever

- Amy’s Kitchen

- Hain Celestial Group

- Pacific Foods

- B&G Foods

- Hormel Foods

- Knorr

- McCain Foods