Global Polyquaternium 7 Market By Form (Liquid, Powder), By Application (Hair Care, Skin Care, Personal Hygiene, Cosmetic Formulations, Others), By End-Use Industry (Personal Care And Cosmetics, Pharmaceuticals, Industrial Applications, Others), By Distribution Channel (Direct Sales, Indirect Sales) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139572

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

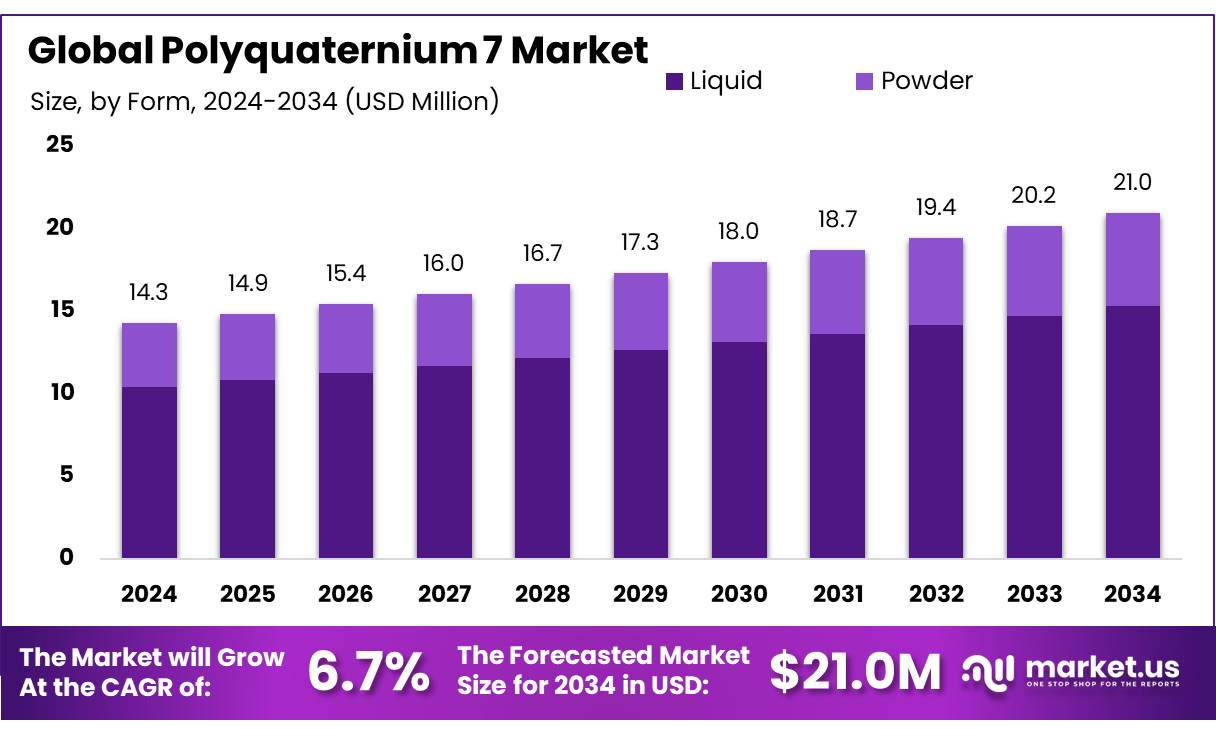

The Global Polyquaternium 7 Market size is expected to be worth around USD 21.0 Mn by 2034, from USD 14.3 Mn in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

Polyquaternium-7 is a water-soluble, cationic copolymer primarily used as a conditioning agent in personal care and cosmetic products, including shampoos, conditioners, hair styling products, and skincare formulations. It is valued for its film-forming, anti-static, and moisture-retention properties, making it a preferred ingredient in formulations that require enhanced texture and smoothness.

Investments in cosmetic ingredient research and development (R&D) are accelerating the adoption of Polyquaternium-7. Leading manufacturers are focusing on biodegradable and eco-friendly derivatives that align with sustainability initiatives in the cosmetics sector. As regulatory bodies impose stricter guidelines on the use of synthetic polymers and microplastics, companies are directing resources toward the development of improved formulations that maintain the conditioning efficacy of Polyquaternium-7 while ensuring environmental compliance.

Several key factors are propelling the growth of the Polyquaternium-7 market. The increasing disposable income in developing economies is a major driver, as consumers are willing to spend more on premium hair and skincare products. In addition, the expansion of e-commerce platforms has facilitated greater accessibility to a wide range of hair care and cosmetic products, increasing the consumption of formulations containing Polyquaternium-7.

The future of the Polyquaternium-7 market will be shaped by technological advancements and product innovations in the cosmetic ingredients sector. As consumer preferences shift toward clean beauty and sustainable ingredients, manufacturers are expected to explore bio-based alternatives and hybrid polymer blends that offer enhanced performance while reducing environmental impact.

Key Takeaways

- Polyquaternium 7 Market size is expected to be worth around USD 21.0 Mn by 2034, from USD 14.3 Mn in 2024, growing at a CAGR of 6.7%.

- liquid form of Polyquaternium 7 held a dominant market position, capturing more than a 73.3% share.

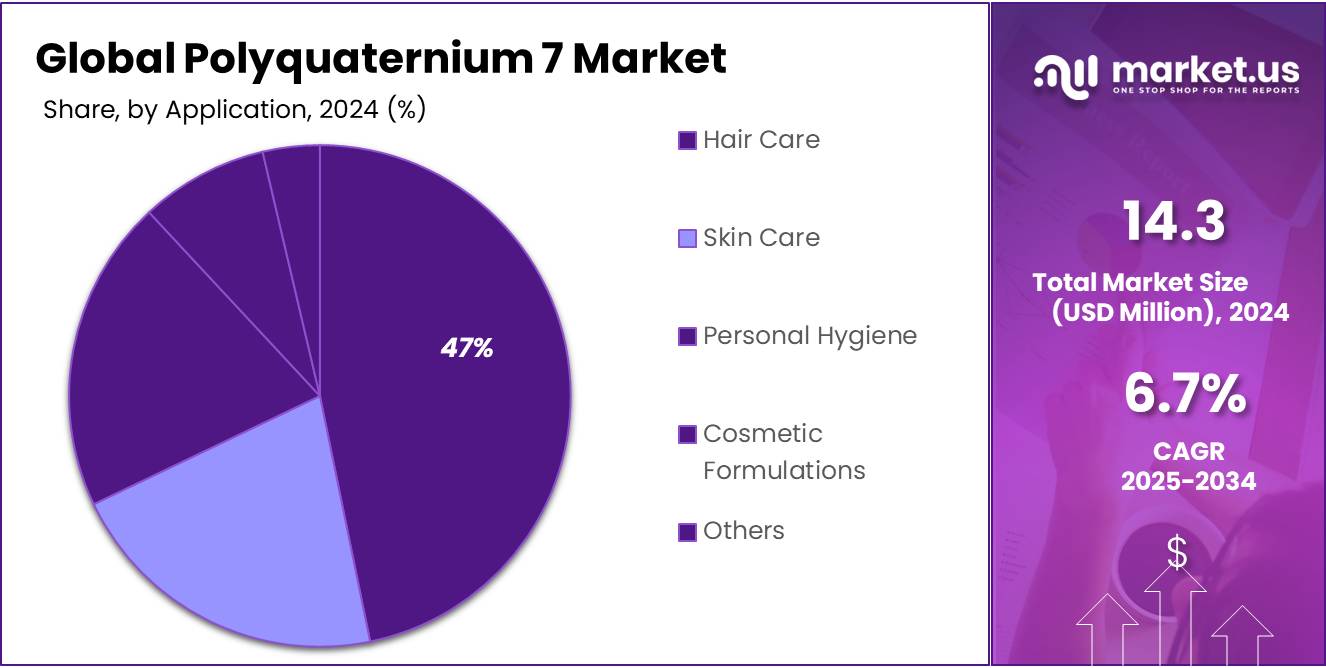

- Hair Care segment held a dominant position in the Polyquaternium 7 market, capturing more than a 47.4% share.

- Personal Care & Cosmetics industry held a dominant position in the Polyquaternium 7 market, capturing more than a 76.3% share.

- Indirect Sales held a dominant market position in the Polyquaternium 7 market, capturing more than a 73.3% share.

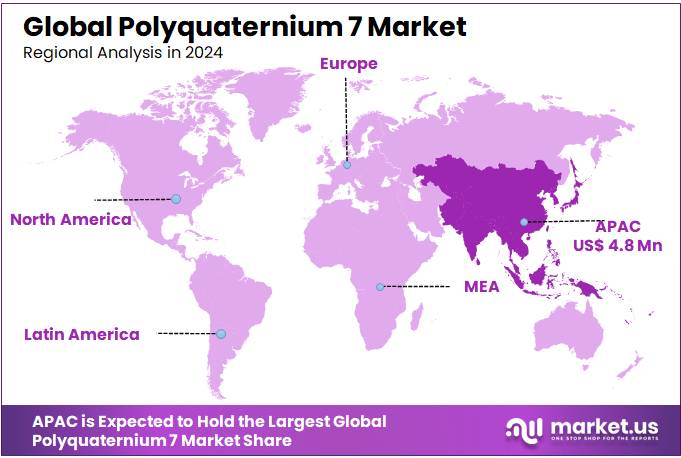

- Asia Pacific region (APAC) led the global Polyquaternium 7 market, commanding a dominant 34.8% share, which equates to $4.8 million.

By Form

In 2024, the liquid form of Polyquaternium 7 held a dominant market position, capturing more than a 73.3% share. This prevalence is attributed to the ease of application and formulation versatility that liquid Polyquaternium 7 offers in various consumer products. Predominantly used in the personal care industry, liquid Polyquaternium 7 is a favorite among manufacturers for its superior solubility and efficacy in hair care products like shampoos and conditioners, where it functions as a conditioning agent.

On the other hand, the powder form, while less prevalent, is utilized for its longer shelf life and stability, which are advantageous in certain formulations that require dry components. Although it represents a smaller portion of the market, powdered Polyquaternium 7 is valued in areas where precise dosing and weight considerations are critical, such as in cosmetic formulations and specialized skincare products.

By Application

In 2024, the Hair Care segment held a dominant position in the Polyquaternium 7 market, capturing more than a 47.4% share. This prominence is largely due to Polyquaternium 7’s conditioning and smoothing properties that make it a staple in shampoos, conditioners, and hair styling products. Its ability to improve texture and manageability while reducing static makes it highly favored in formulations designed to enhance hair health and appearance.

The Skin Care segment also significantly utilizes Polyquaternium 7, particularly in products aimed at moisturizing and skin conditioning. Its film-forming capabilities help retain moisture and provide a soft, smooth finish, which is essential in lotions and creams.

In Personal Hygiene products, including bath gels and hand sanitizers, Polyquaternium 7 is valued for its antimicrobial properties and its ability to enhance the sensory attributes of products, contributing to a more luxurious user experience.

Cosmetic Formulations make use of Polyquaternium 7 for its viscosity-controlling and film-forming properties. It is incorporated into a variety of cosmetics where it aids in improving the texture and stability of products such as makeup or sunscreens.

By End-Use Industry

In 2024, the Personal Care & Cosmetics industry held a dominant position in the Polyquaternium 7 market, capturing more than a 76.3% share. This overwhelming market share is largely attributed to the widespread use of Polyquaternium 7 in various personal care products such as hair conditioners, shampoos, shower gels, and face cleansers. Its excellent conditioning and film-forming properties enhance the performance and appeal of these products, making it a favored ingredient among manufacturers aiming to improve product quality and consumer satisfaction.

The Pharmaceuticals sector also utilizes Polyquaternium 7, particularly in formulations where its antimicrobial properties and skin conditioning capabilities are beneficial. In this industry, Polyquaternium 7 is often found in topical ointments and as an excipient in various dermatological products where it aids in moisture retention and protects the skin barrier.

In Industrial Applications, Polyquaternium 7 is used for its film-forming abilities, particularly in the production of specialty coatings and in water treatment processes. Here, it helps in forming films that can encapsulate materials, aiding in processes like water purification and the production of coated materials.

By Distribution Channel

In 2024, Indirect Sales held a dominant market position in the Polyquaternium 7 market, capturing more than a 73.3% share. This channel’s supremacy is largely due to its extensive network of distributors and resellers who ensure wide accessibility and availability of Polyquaternium 7 across various industries globally.

Direct Sales, while smaller in comparison, involve transactions directly between the manufacturer and the end-user or large industrial buyers. This channel is favored by entities requiring bulk purchases, tailored formulations, or specific technical support that direct interaction with the manufacturer can provide. Direct sales are particularly significant in establishing strong customer relationships and ensuring a high level of service and customization, which are often required in niche applications or specialized industrial sectors.

Key Market Segments

By Form

- Liquid

- Powder

By Application

- Hair Care

- Skin Care

- Personal Hygiene

- Cosmetic Formulations

- Others

By End-Use Industry

- Personal Care & Cosmetics

- Pharmaceuticals

- Industrial Applications

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

Drivers

Growing Demand in Personal Care and Cosmetic Industries

One major driving factor for the Polyquaternium 7 market is its growing demand within the personal care and cosmetics industries. This surge is driven by the increased consumer awareness of the benefits of advanced hair and skin care products. Polyquaternium 7 is highly valued in these industries due to its excellent conditioning and moisturizing properties, making it a key ingredient in formulations aimed at improving product performance and consumer satisfaction.

The rise in consumer spending on personal care products, along with a growing preference for high-quality cosmetic items, significantly contributes to the expansion of the Polyquaternium 7 market. This trend is supported by economic growth in emerging markets where personal grooming and beauty care are seeing an increase in consumer expenditure. Additionally, the shift towards products that offer additional benefits such as UV protection, pollution defense, and anti-aging properties encourages the inclusion of multifunctional ingredients like Polyquaternium 7.

Government initiatives and regulations promoting the use of safe and environmentally friendly personal care products also play a crucial role. In regions like Europe and North America, stringent regulations govern the inclusion of ingredients in cosmetic products, favoring those that are both effective and safe for long-term use. This regulatory environment pushes manufacturers to opt for high-quality ingredients that comply with safety standards, thereby boosting the demand for Polyquaternium 7.

These factors combined depict a robust market outlook for Polyquaternium 7, as industry players respond to the evolving consumer preferences and regulatory landscapes. The ongoing innovation in product formulations, driven by consumer and regulatory demands, continues to open new avenues for the application of Polyquaternium 7, ensuring its growth in the global market. For detailed statistics and trends, reviewing market research reports from reputed agencies or visiting regulatory bodies’ websites like the FDA (U.S. Food and Drug Administration) could provide deeper insights into industry regulations and consumer trends.

Restraints

Regulatory Challenges and Alternative Product Development

A major restraining factor in the growth of the Polyquaternium 7 market is the stringent regulatory landscape concerning the formulation and use of chemicals in personal care products. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Chemicals Agency (ECHA) impose strict guidelines on the usage of certain chemicals in consumer products, which include detailed safety assessments and approval processes. These regulations ensure that ingredients used in personal care and cosmetic products are safe for consumers and the environment, but they can also limit the use of Polyquaternium 7 by requiring extensive toxicity testing and environmental impact assessments.

Another significant challenge is the development of alternative products that are perceived as more natural or environmentally friendly. The rising consumer preference for “green” and “clean” beauty products has led to increased competition from alternative ingredients that fulfill similar functions as Polyquaternium 7 but with a more natural profile. This shift is influenced by market trends towards sustainability and consumer demand for products free from synthetic chemicals.

These factors contribute to a competitive and restricted market environment for Polyquaternium 7. Manufacturers face not only regulatory hurdles but also a need to innovate and reformulate products to meet changing consumer preferences. Despite these challenges, the versatility and effectiveness of Polyquaternium 7 continue to sustain its demand in various applications, although growth might be tempered by these ongoing industry dynamics.

Opportunity

Expansion into Emerging Markets and Diverse Application Areas

A major growth opportunity for the Polyquaternium 7 market lies in expanding into emerging markets, particularly in Asia, Africa, and Latin America. These regions are experiencing rapid urbanization and growth in middle-class populations, leading to increased consumer spending on personal care and cosmetic products. As lifestyles evolve and awareness of personal grooming increases, the demand for sophisticated products containing ingredients like Polyquaternium 7 is expected to rise significantly.

Another significant opportunity is the diversification into various application areas beyond the traditional personal care and cosmetics sector. Polyquaternium 7 has potential uses in industrial applications such as water treatment, paper production, and textile manufacturing due to its excellent film-forming and conditioning properties. Developing products tailored for these industries could open new revenue streams for manufacturers of Polyquaternium 7.

Governments in emerging markets are also supporting the growth of their domestic manufacturing sectors, including personal care products, through incentives and regulatory support. This governmental backing could facilitate easier market entry for Polyquaternium 7 products into these regions, enhancing their accessibility and adoption.

Capitalizing on these opportunities requires manufacturers to adapt their products to meet local consumer preferences and regulatory standards, which can vary significantly from one region to another. Establishing local partnerships and understanding regional market dynamics are crucial for successfully leveraging these growth opportunities.

Trends

Eco-friendly and Clean Label Trends in Polyquaternium 7 Formulations

One of the most significant trends in the Polyquaternium 7 market is the shift towards eco-friendly and clean label products. As consumers become more environmentally conscious, they are increasingly seeking out personal care and cosmetic products that are not only effective but also sustainable and free from harmful chemicals. This trend is influencing manufacturers to reformulate their products to include ingredients that meet these clean label standards.

Polyquaternium 7, known for its conditioning and film-forming properties, is being scrutinized under this trend. Manufacturers are exploring ways to source and produce Polyquaternium 7 more sustainably. This includes reducing energy consumption in production processes, minimizing waste, and ensuring that all raw materials are obtained through responsible practices. Additionally, there is a push to ensure that Polyquaternium 7 can be safely broken down by the environment after use, reducing its ecological footprint.

Another aspect of this trend is transparency in labeling. Consumers today want to know exactly what’s in their products and prefer ingredients that are safe and beneficial. This demand for transparency is prompting companies to provide more detailed information about the source and safety of their ingredients, including Polyquaternium 7.

These eco-friendly and clean label trends are not only shaping consumer preferences but are also becoming part of regulatory frameworks globally. Governments and international bodies are increasingly setting standards that promote sustainability in the cosmetics sector, influencing market dynamics and encouraging innovation in product development.

Regional Analysis

In 2024, the Asia Pacific region (APAC) led the global Polyquaternium 7 market, commanding a dominant 34.8% share, which equates to $4.8 million. This region’s leadership is driven by rapid industrial growth, increasing consumer spending on personal care and cosmetic products, and an expanding middle-class population. Countries like China, India, and South Korea are key contributors, with their robust manufacturing bases and thriving personal care industries.

North America follows suit, where awareness about sustainable and high-quality personal care products drives the demand for Polyquaternium 7. The region benefits from advanced technological infrastructure, which supports sophisticated research and development activities aimed at enhancing product formulations.

Europe remains a significant market, with stringent regulations promoting the use of safe and effective ingredients in cosmetic products. European consumers are highly conscious of the ingredients in their personal care products, which supports the demand for Polyquaternium 7 due to its safety profile and effectiveness.

The Middle East & Africa and Latin America are emerging regions in the market. These areas are experiencing gradual growth due to rising awareness about personal hygiene and the gradual expansion of local industries. Economic development and urbanization in these regions are expected to increase market penetration and create new opportunities for Polyquaternium 7 in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Polyquaternium 7 market features a competitive landscape with several key players contributing to its growth and innovation. Among these, Clariant and Dow are prominent figures, renowned for their extensive product portfolios and technological advancements in the field of specialty chemicals, including personal care ingredients. Clariant is well-known for its focus on sustainable and high-performance products, catering to the rising demand for environmentally friendly personal care solutions.

Other significant players in the market include Lubrizol and Nouryon, which are recognized for their specialized chemical solutions that improve product efficacy and consumer satisfaction in personal care applications. Lubrizol’s innovations often focus on creating multifunctional and high-quality ingredients that respond to the evolving needs of the cosmetics industry. Nouryon emphasizes sustainability and safety in its products, aligning with global regulatory standards and consumer preferences.

Companies like Solvay and TINCI further enrich the market dynamics by offering unique formulations that cater to niche segments within personal care, enhancing the texture and sensory attributes of cosmetic products. KCI Limited and Samboo Biochem also contribute significantly, particularly in Asian markets, with their localized expertise and tailored product offerings that meet specific regional demands.

Top Key Players

- Clariant

- Dow

- Guangzhou Tinci Materials

- KCI

- KCI Limited

- Lubrizol

- Nouryon

- Samboo Biochem

- Solvay

- TINCI

- TOHO Chemical

- TRI-K Industries

Recent Developments

In 2024, Dow continues to be a significant player in the Polyquaternium 7 market, which is a part of its wider specialty chemicals portfolio.

In 2024, Guangzhou Tinci Materials continues to play a vital role in the Polyquaternium 7 market. The company is well-known for its commitment to the research and development of high-quality chemical products, with a strong focus on the personal care and cosmetics industries.

Report Scope

Report Features Description Market Value (2024) USD 14.3 Mn Forecast Revenue (2034) USD 21.0 Mn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Powder), By Application (Hair Care, Skin Care, Personal Hygiene, Cosmetic Formulations, Others), By End-Use Industry (Personal Care And Cosmetics, Pharmaceuticals, Industrial Applications, Others), By Distribution Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Clariant, Dow, Guangzhou Tinci Materials, KCI, KCI Limited, Lubrizol, Nouryon, Samboo Biochem, Solvay, TINCI, TOHO Chemical, TRI-K Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Clariant

- Dow

- Guangzhou Tinci Materials

- KCI

- KCI Limited

- Lubrizol

- Nouryon

- Samboo Biochem

- Solvay

- TINCI

- TOHO Chemical

- TRI-K Industries