Global Polymyxin Resistance Testing Market By Product Type (Testing Systems, Test Kits & Identification Panels, and Reagents & Consumables), By Testing Methods (Broth Microdilution (BMD), Disk Diffusion, Etest (Broth Microdilution + Disk Diffusion), and Polymerase Chain Reaction (PCR)), By End-user (Clinical Laboratories, Academic & Research Institutions, Pharmaceutical/Biotech Companies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168985

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

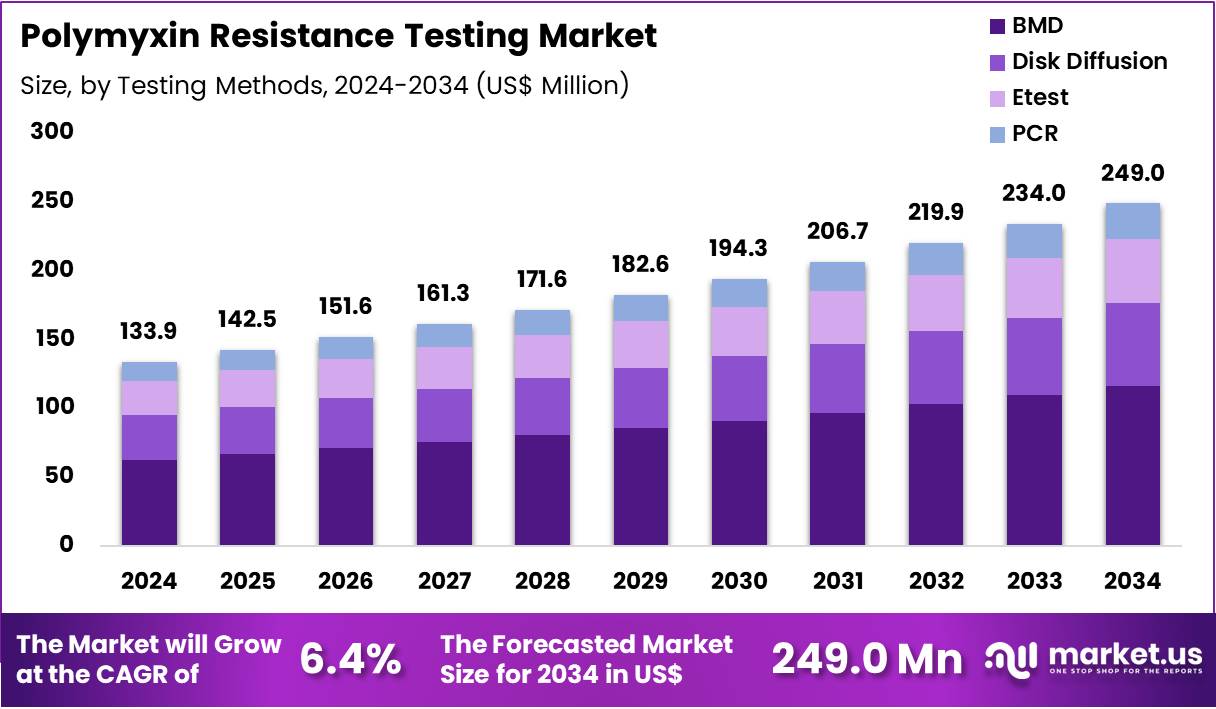

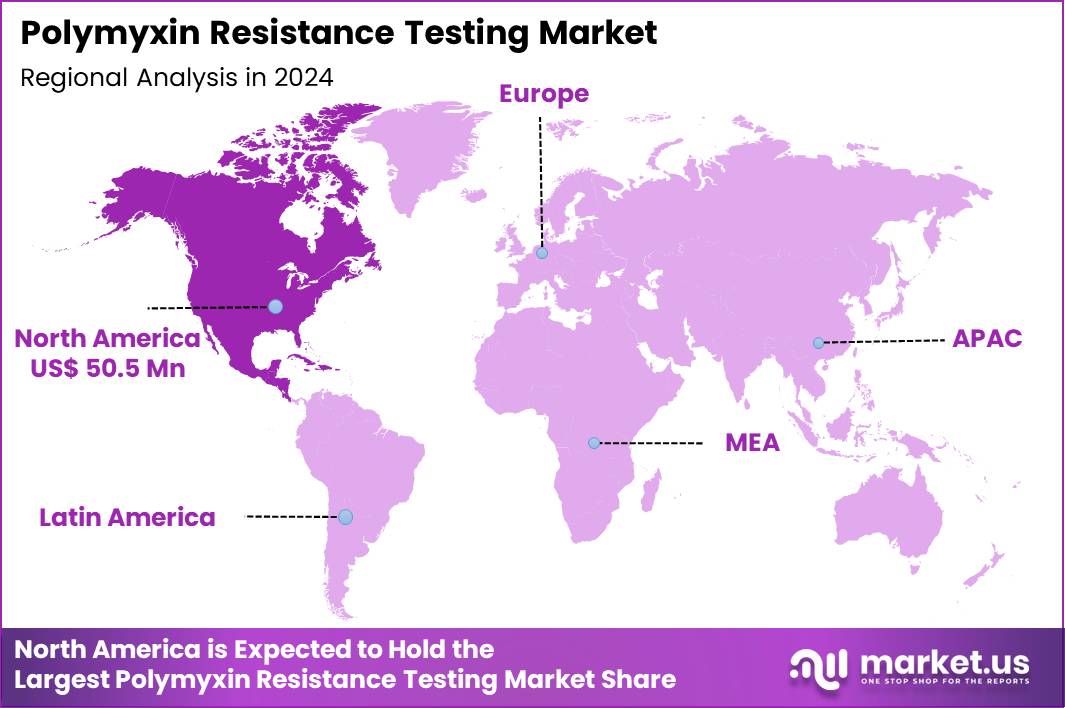

Global Polymyxin Resistance Testing Market size is expected to be worth around US$ 249.0 Million by 2034 from US$ 133.9 Million in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.7% share with a revenue of US$ 50.5 Million.

Increasing incidence of multidrug-resistant Gram-negative infections propels the Polymyxin Resistance Testing market, as clinicians confront limited therapeutic options against carbapenemase-producing Enterobacterales and Acinetobacter baumannii. Microbiology laboratories adopt broth microdilution as the gold-standard method to detect colistin minimum inhibitory concentrations with precision.

These tests guide salvage therapy selection in ventilator-associated pneumonia caused by extensively drug-resistant pathogens, optimize dosing in septic shock from urinary tract sources, confirm susceptibility in cystic fibrosis patients with chronic Pseudomonas aeruginosa colonization, and validate synergy testing with novel beta-lactamase inhibitors.

Regulatory updates create opportunities for standardized reporting that aligns laboratory results with clinical outcomes. EUCAST revised colistin clinical breakpoints in December 2023 based on pharmacokinetic and efficacy data, enhancing interpretive accuracy and reinforcing appropriate polymyxin use across healthcare settings. This adjustment directly strengthens confidence in resistance testing and drives broader implementation of reliable methodologies.

Growing adoption of rapid molecular diagnostics accelerates the Polymyxin Resistance Testing market, as hospitals integrate PCR-based assays that target mcr genes responsible for plasmid-mediated colistin resistance. Diagnostic developers engineer cartridge systems that deliver results within hours from positive blood cultures or rectal surveillance swabs.

Applications encompass outbreak investigation for mcr-1 harboring Escherichia coli clones, pre-transplant screening to prevent donor-derived resistant infections, infection control cohorting in burn units, and epidemiological surveillance in livestock-associated transmission chains.

Genotypic platforms open avenues for proactive decolonization strategies and real-time resistance tracking. Biotechnology firms increasingly combine phenotypic and genotypic approaches to resolve discordant results and improve predictive value.

Rising focus on antimicrobial stewardship programs invigorates the Polymyxin Resistance Testing market, as institutions mandate confirmatory testing before initiating last-resort polymyxins to preserve their clinical utility. Reference laboratories deploy automated systems that incorporate cation-adjusted media to eliminate false resistance due to technical artifacts.

These assays support therapeutic drug monitoring in critically ill patients receiving colistin methanesulfonate, risk stratification in hematopoietic stem cell transplant recipients, susceptibility confirmation for inhaled colistin in bronchiectasis management, and validation of combination regimens against hypervirulent Klebsiella pneumoniae.

Stewardship integration creates opportunities for decision-support algorithms that flag inappropriate polymyxin orders. Collaborative networks actively standardize testing protocols to combat the global threat of pan-resistant Gram-negative pathogens. This disciplined approach ensures sustainable use of polymyxins while advancing diagnostic precision.

Key Takeaways

- In 2024, the market generated a revenue of US$ 133.9 million, with a CAGR of 6.4%, and is expected to reach US$ 249.0 million by the year 2034.

- The product type segment is divided into testing systems, test kits & identification panels, and reagents & consumables, with testing systems taking the lead in 2024 with a market share of 44.3%.

- Considering testing methods, the market is divided into BMD, disk diffusion, Etest, and PCR. Among these, BMD held a significant share of 46.8%.

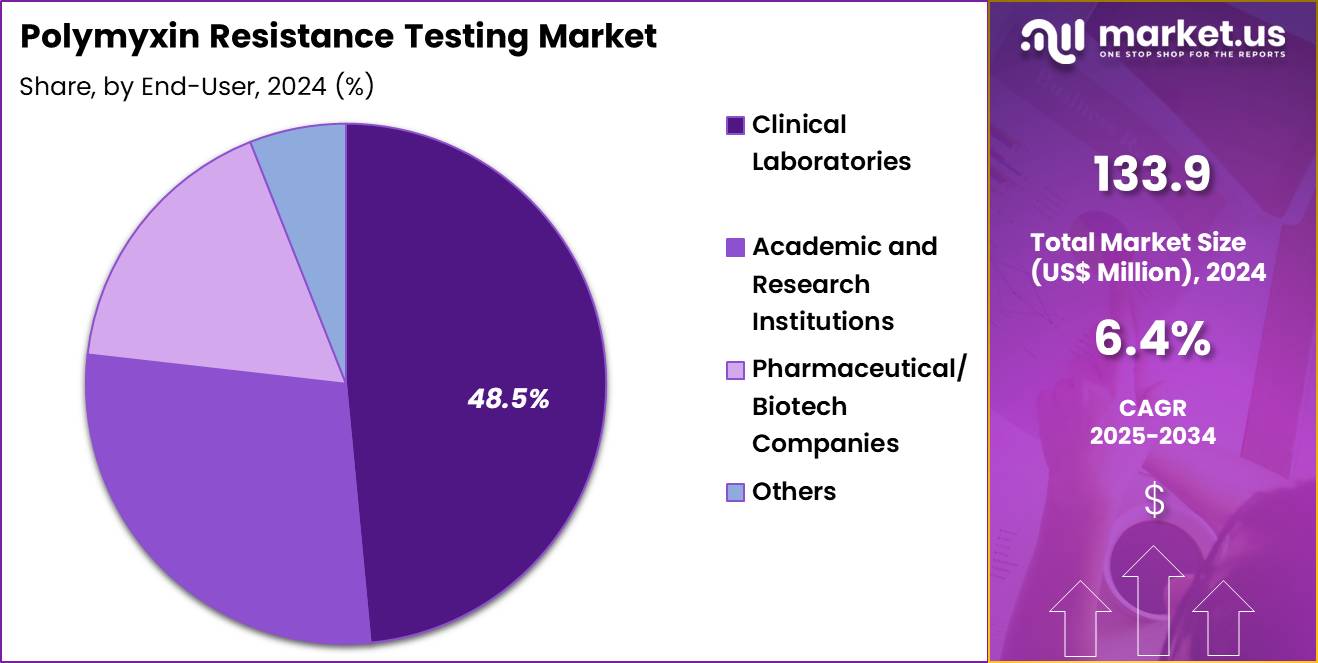

- Furthermore, concerning the end-user segment, the market is segregated into clinical laboratories, academic & research institutions, pharmaceutical/biotech companies, and others. The clinical laboratories sector stands out as the dominant player, holding the largest revenue share of 48.5% in the market.

- North America led the market by securing a market share of 37.7% in 2024.

Product Type Analysis

Testing systems, holding 44.3%, are expected to dominate due to increasing global focus on detecting polymyxin resistance accurately and efficiently. Laboratories prefer automated testing systems that reduce manual workload and deliver standardized results for high-risk pathogens. Rising prevalence of multidrug-resistant Gram-negative infections strengthens demand for reliable resistance-detection platforms.

Manufacturers introduce systems designed for MIC determination, enhancing data precision. Hospitals integrate automated systems into antimicrobial stewardship programs to improve treatment decisions. Surveillance networks depend on standardized testing systems for large-scale resistance monitoring.

High-throughput capabilities support rapid processing during outbreak situations. Centralized labs adopt integrated platforms to streamline workflows. Advances in system software improve interpretation accuracy. These factors keep testing systems anticipated to lead the product category.

Testing Methods Analysis

BMD, holding 46.8%, is anticipated to dominate testing methods because it remains the gold-standard approach for determining polymyxin MIC values with high accuracy. Clinical laboratories rely on BMD to differentiate borderline susceptibility profiles, especially in critical infections. Researchers studying resistance mechanisms depend on BMD for validated phenotypic data. Regulatory bodies recommend BMD for reliable polymyxin susceptibility reporting, strengthening adoption.

Pharmaceutical companies use BMD during drug-development studies involving Gram-negative pathogens. Automated BMD platforms improve throughput and reduce user variability. Public-health institutions incorporate BMD into resistance-surveillance programs. Global rise in carbapenem-resistant Enterobacterales increases testing demand. Increased clinical awareness of mcr-mediated resistance fuels reliance on accurate methods. These factors keep BMD projected to remain the most influential testing method.

End-User Analysis

Clinical laboratories, holding 48.5%, are expected to dominate due to their central role in diagnosing polymyxin resistance across hospitals and regional healthcare systems. Rising incidence of multidrug-resistant infections increases routine susceptibility testing. Laboratories adopt automated phenotypic methods and standardized BMD workflows to ensure reliable reporting. Hospitals depend on clinical labs for timely results that support optimal antimicrobial therapy.

Public-health agencies partner with clinical labs for continuous resistance monitoring. High patient volume strengthens daily polymyxin testing requirements. Labs integrate molecular and phenotypic testing to capture emerging resistance mechanisms, increasing workload.

Investment in advanced equipment improves throughput and accuracy. Collaboration with infection-control teams increases testing frequency during outbreaks. These factors keep clinical laboratories anticipated to remain the dominant end-user segment in the polymyxin resistance testing market.

Key Market Segments

By Product Type

- Testing Systems

- Test Kits & Identification Panels

- Reagents & Consumables

By Testing Methods

- Broth Microdilution (BMD)

- Disk Diffusion

- Etest (Broth Microdilution + Disk Diffusion)

- Polymerase Chain Reaction (PCR)

By End-user

- Clinical Laboratories

- Academic & Research Institutions

- Pharmaceutical / Biotech Companies

- Others

Drivers

Increasing Prevalence of Colistin Resistance is Driving the Market

The rising prevalence of colistin resistance among gram-negative bacteria has emerged as a fundamental driver for the polymyxin resistance testing market, as this last-resort antibiotic’s diminishing efficacy necessitates advanced detection methods to guide alternative therapies. This trend is particularly alarming in critical pathogens like Klebsiella pneumoniae and Acinetobacter baumannii, where resistance compromises treatment for severe infections.

Healthcare facilities are prioritizing molecular and phenotypic assays to identify resistant strains promptly, integrating them into antimicrobial stewardship programs. Regulatory agencies are emphasizing surveillance to track resistance patterns, supporting the development of standardized testing protocols. Manufacturers are innovating with high-throughput kits that detect mobile colistin resistance genes like mcr-1, aligning with global health security priorities.

Collaborative networks between laboratories facilitate data sharing, informing regional testing needs and resource allocation. The economic consequences of untreated resistant infections, including extended hospital stays, justify increased investments in diagnostic infrastructure. Professional guidelines recommend routine polymyxin susceptibility testing in high-risk settings, embedding products in clinical workflows. This driver accelerates research into next-generation sequencing for comprehensive resistance profiling.

Educational efforts for microbiologists highlight the assays’ role in preserving polymyxin utility. A systematic review and meta-analysis reported a pooled colistin resistance prevalence of 9% (95% CI: 6–14%) among gram-negative isolates, based on data up to 2022. Consequently, the market is propelled by the imperative for reliable, scalable testing solutions.

Restraints

Challenges in Accurate Detection are Restraining the Market

The inherent difficulties in accurately detecting polymyxin resistance continue to restrain market growth, as current methods suffer from limitations in sensitivity and reproducibility across bacterial species. Broth microdilution, the reference standard, is labor-intensive and prone to errors from polymyxin adsorption on plastic surfaces, leading to falsely low MIC values.

Commercial automated systems like VITEK 2 exhibit unacceptable error rates, including false-susceptible results for mcr-harboring strains, eroding clinician confidence. Heteroresistance in pathogens like Enterobacter spp. further complicates detection, with subpopulation variability causing inconsistent outcomes. This restraint delays the adoption of routine testing, confining it to reference laboratories rather than frontline use.

Regulatory requirements for rigorous validation exacerbate development timelines, increasing costs for innovators. Laboratories in resource-limited settings face additional barriers from scarce specialized materials like cation-adjusted Mueller-Hinton broth. The issue perpetuates over-reliance on clinical judgment, potentially exacerbating resistance spread through inappropriate prescribing.

Manufacturers must invest in overcoming these technical hurdles, diverting resources from expansion. Mitigation through harmonized guidelines remains slow, hindering market maturation. The Rapid Polymyxin NP Test demonstrated a sensitivity of 25% for Enterobacter spp., illustrating detection challenges. Such limitations underscore the need for improved methodologies to unlock broader utilization.

Opportunities

Development of Novel Molecular Diagnostics is Creating Growth Opportunities

The advent of novel molecular diagnostics for polymyxin resistance detection is forging significant growth opportunities, offering rapid, gene-specific identification of mcr variants to inform precise interventions. These PCR-based assays enable same-day results, surpassing phenotypic methods in speed and specificity for outbreak management.

Opportunities lie in integrating molecular tests with automated platforms, supporting high-volume screening in hospital networks. Regulatory fast-tracks for breakthrough diagnostics accelerate market entry, linking tests to stewardship initiatives. Partnerships with global health organizations facilitate validations in endemic regions, expanding geographic reach. This innovation diversifies portfolios toward multiplex formats detecting multiple resistance genes simultaneously.

Economic models project cost savings from reduced empirical therapy failures, appealing to payers for reimbursement expansions. Emerging applications in veterinary surveillance broaden utility, addressing one-health resistance dynamics. The resultant ecosystem promotes point-of-care adaptations, democratizing access in ambulatory settings.

Sustained clinical evidence will drive guideline inclusions, solidifying molecular tools’ role. The World Health Organization’s 2024 Bacterial Priority Pathogens List includes 24 antibiotic-resistant bacterial pathogens, with polymyxin-resistant Enterobacteriaceae classified as critical, highlighting the demand for advanced testing. This prioritization exemplifies the fertile ground for diagnostic innovations.

Impact of Macroeconomic / Geopolitical Factors

Economic pressures from persistent inflation and healthcare austerity measures compel microbiology labs to curtail orders for polymyxin resistance testing kits, prioritizing core diagnostics in strained budgets. Heightened AMR surveillance mandates and pharmaceutical R&D commitments, however, sustain kit demand as labs integrate rapid assays to combat superbug threats.

Geopolitical clashes in Southeast Asian ports snarl exports of critical colistin analogs from regional producers, dragging out supply timelines and bumping up raw material fees for test developers. These snarls, nonetheless, spur North American firms to cultivate alternative synthesis routes and bolster inventory buffers that ensure uninterrupted testing workflows.

U.S. Section 301 tariffs at 25% on Chinese-origin in vitro diagnostic reagents, upheld through November 2025, inflate import expenses for American facilities and complicate cost projections for high-volume users. Labs deftly mitigate this by shifting to USMCA-compliant suppliers and applying for exclusion relief that restores fiscal balance.

Broadly, these headwinds enforce prudent sourcing and adaptive planning across the sector. The polymyxin resistance testing market gains ground with determination, channeling these trials into fortified defenses against antimicrobial crises that safeguard public health for generations.

Latest Trends

Introduction of CRISPR-Based mcr-1 Detection Assay is a Recent Trend

The emergence of CRISPR/Cas13a-based assays for detecting the mcr-1 polymyxin resistance gene has defined a transformative trend in 2025, providing visual, equipment-free readouts for field-deployable testing. This technology leverages collateral cleavage activity to amplify signals from target RNA, achieving high sensitivity without thermal cycling.

The trend emphasizes portability, with lateral flow strips enabling on-site confirmation in low-resource environments. Developers are optimizing the system for multiplex detection of multiple mcr variants, aligning with surveillance needs. Regulatory validations confirm its specificity for clinical isolates, accelerating adoption in microbiology labs. This innovation intersects with smartphone apps for quantitative analysis, enhancing data portability.

Competitive advancements include adaptations for wastewater monitoring, supporting environmental resistance tracking. Broader implications encompass integration with syndromic panels for comprehensive AMR profiling. The trend fosters collaborations for scale-up production, addressing global testing gaps.

Ethical frameworks address accessibility to prevent inequities in deployment. A 2025 study established a CRISPR/Cas13a detection method for the mcr-1 gene, enabling visual readouts without complex equipment. This development signals the trend’s potential to revolutionize rapid resistance diagnostics.

Regional Analysis

North America is leading the Polymyxin Resistance Testing Market

North America accounted for 37.7% of the overall market in 2024, and the region saw measurable growth as hospitals strengthened antimicrobial-resistance surveillance and expanded confirmatory testing for last-line agents such as polymyxins. Clinical laboratories increased adoption of broth-microdilution and rapid molecular workflows to identify colistin-resistant Enterobacterales in high-risk patients.

Demand rose further as infection-control teams prioritized early detection of mobile colistin-resistance genes to prevent hospital outbreaks. Intensive-care units increased screening frequency due to a rising burden of multidrug-resistant Gram-negative infections.

The CDC Antimicrobial Resistance Laboratory Network detected 69 mcr-positive isolates in the United States in 2022 (CDC – AR Lab Network 2022 Annual Report), and this detection rate significantly accelerated laboratory adoption of validated resistance-testing methods. Academic centers expanded AMR research, while public-health programs encouraged standardized susceptibility testing. These integrated advancements reinforced the region’s strong market expansion throughout 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record robust growth during the forecast period as healthcare systems strengthen AMR preparedness and expand laboratory capacity for detecting colistin-resistant pathogens. Hospitals invest in modern microbiology platforms to improve turnaround times for susceptibility assessments in critical-care settings.

Public-health authorities intensify surveillance for plasmid-mediated resistance genes across community and hospital environments, which increases demand for accurate diagnostic workflows. Clinical laboratories upgrade MIC-determination tools as resistant Gram-negative infections become more prevalent in densely populated regions. Research institutes broaden molecular-epidemiology initiatives to support regional AMR containment strategies.

The Indian Council of Medical Research reported colistin resistance in 1.5% of Klebsiella pneumoniae isolates in 2022 (ICMR – AMR Surveillance Report 2022), highlighting escalating diagnostic needs. Diagnostic manufacturers strengthen supply chains across Southeast Asia, enabling wider access to advanced testing reagents. These developments collectively position Asia Pacific for sustained long-term growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key firms build their growth by launching rapid, high-throughput assays and automated platforms that detect resistance to last-line antibiotics, thereby helping hospitals respond quickly to drug-resistant infections and reinforcing clinical adoption. They expand their reach by forming partnerships with regional distributors and hospital networks in emerging economies, targeting areas where antimicrobial resistance concerns grow fastest.

They integrate molecular diagnostics and next-generation sequencing into their offerings to enhance sensitivity and detect resistance mechanisms at genetic level, meeting rising demand for precision in susceptibility profiling. They invest in R&D and strategic acquisitions to add niche technologies or specialised reagent panels, accelerating time-to-market for advanced resistance testing solutions.

They embed their tools into public health surveillance programs and infection-control frameworks to secure stable demand from institutional buyers. One of the leading companies in this space, bioMérieux SA, operates globally under a large distributor network, offers a broad portfolio of in-vitro diagnostics covering infectious diseases, leverages decades of experience in microbial diagnostics, and uses its global footprint and robust diagnostic infrastructure to support expansion of polymyxin resistance testing services.

Top Key Players

- BioMérieux SA

- Becton, Dickinson and Company (BD)

- Thermo Fisher Scientific, Inc.

- Danaher Corporation

- Roche Diagnostics

- Bio‑Rad Laboratories, Inc.

- Bruker Corporation

- Accelerate Diagnostics

Recent Developments

- In March 2024, Accelerate Diagnostics reported new advancements in its upcoming rapid AST platform, Accelerate Wave™. The system is being designed to deliver faster and more reliable susceptibility results for roughly 200 organism–antibiotic pairs, with an expected average turnaround time of under 4.5 hours once a blood culture turns positive.

- In December 2024, EUCAST released an updated set of recommendations highlighting the need for precise polymyxin susceptibility testing. While the broth microdilution method was reaffirmed as the reference approach, the guidelines also acknowledged practical difficulties laboratories face when using it and introduced updated measures to help improve consistency and accuracy in routine testing.

Report Scope

Report Features Description Market Value (2024) US$ 133.9 Million Forecast Revenue (2034) US$ 249.0 Million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Testing Systems, Test Kits & Identification Panels, and Reagents & Consumables), By Testing Methods (Broth Microdilution (BMD), Disk Diffusion, Etest (Broth Microdilution + Disk Diffusion), and Polymerase Chain Reaction (PCR)), By End-user (Clinical Laboratories, Academic & Research Institutions, Pharmaceutical/Biotech Companies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BioMérieux SA, Becton, Dickinson & Company, Thermo Fisher Scientific, Danaher Corporation, Roche Diagnostics, Bio‑Rad Laboratories, Bruker Corporation, Accelerate Diagnostics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polymyxin Resistance Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Polymyxin Resistance Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BioMérieux SA

- Becton, Dickinson and Company (BD)

- Thermo Fisher Scientific, Inc.

- Danaher Corporation

- Roche Diagnostics

- Bio‑Rad Laboratories, Inc.

- Bruker Corporation

- Accelerate Diagnostics