Global Polymer Electrolyte Membrane Fuel Cells (PEMFCs) Market Size, Share, And Industry Analysis Report By Type (Low-Temperature, High-Temperature), By Application (Transportation, Transport and Battery Replacement, Residential Power Generation, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173953

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

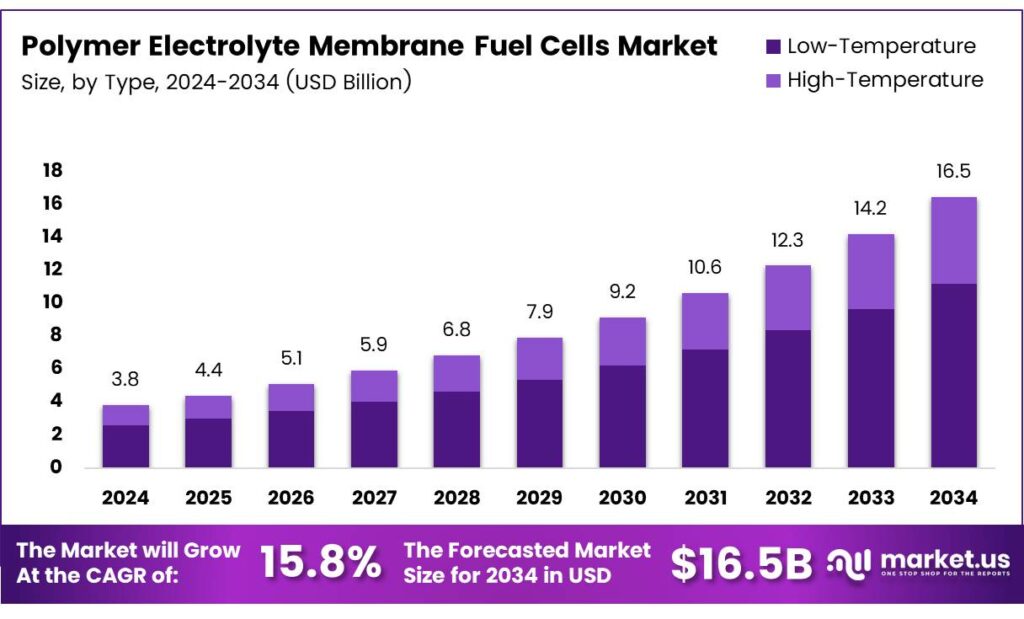

The Global Polymer Electrolyte Membrane Fuel Cells (PEMFCs) Market size is expected to be worth around USD 16.5 billion by 2034, from USD 3.8 billion in 2024, growing at a CAGR of 15.8% during the forecast period from 2025 to 2034.

The Polymer Electrolyte Membrane Fuel Cells (PEMFCs) market represents the commercial ecosystem around fuel cell systems that convert hydrogen into electricity efficiently. These systems support clean power generation for transportation, stationary power, and backup energy applications. As industries pursue decarbonization, PEMFCs increasingly align with sustainability, energy security, and long-term cost reduction goals.

PEMFCs stand out because they deliver high power density and fast start-up. Consequently, they suit mobility and distributed energy systems where responsiveness matters. Moreover, growing demand for zero-emission solutions strengthens their relevance across industrial, commercial, and public infrastructure projects worldwide. Market growth is strongly influenced by energy transition policies and rising investments in hydrogen economies.

- Material and catalyst innovations reinforce scalability prospects. Fully doped PBI membranes achieve proton conductivity of 0.07 S·cm⁻¹ at 200 °C, comparable to hydrated perfluorinated membranes without relying on humidity control. Meanwhile, thin-film platinum phosphate catalysts applied at 0.08 mg/cm² demonstrate stable electrochemical behavior, supporting cost-efficient system optimization.

Opportunities are increasingly emerging through high-temperature polymer electrolyte membrane fuel cells (HT-PEMFCs). Operating at 150–180 °C, these systems tolerate contaminants such as carbon monoxide and hydrogen sulfide. Consequently, hydrogen purity requirements decline, reducing operational complexity and lowering entry barriers for industrial and distributed power applications.

Design advancements further strengthen commercial readiness. To overcome water-management limitations, HT-PEMFCs use phosphoric acid instead of water as the proton-conducting medium. Because phosphoric acid remains stable above 100 °C, it ensures reliable proton transport, enhances durability, and supports consistent performance under sustained high-temperature conditions.

Key Takeaways

- The Global Polymer Electrolyte Membrane Fuel Cells (PEMFCs) Market is projected to grow from USD 3.8 billion in 2024 to USD 16.5 billion by 2034, registering a 15.8% CAGR during 2025–2034.

- Low-Temperature PEMFCs dominate the market by type, accounting for a leading share of 79.1% due to proven performance and faster start-up.

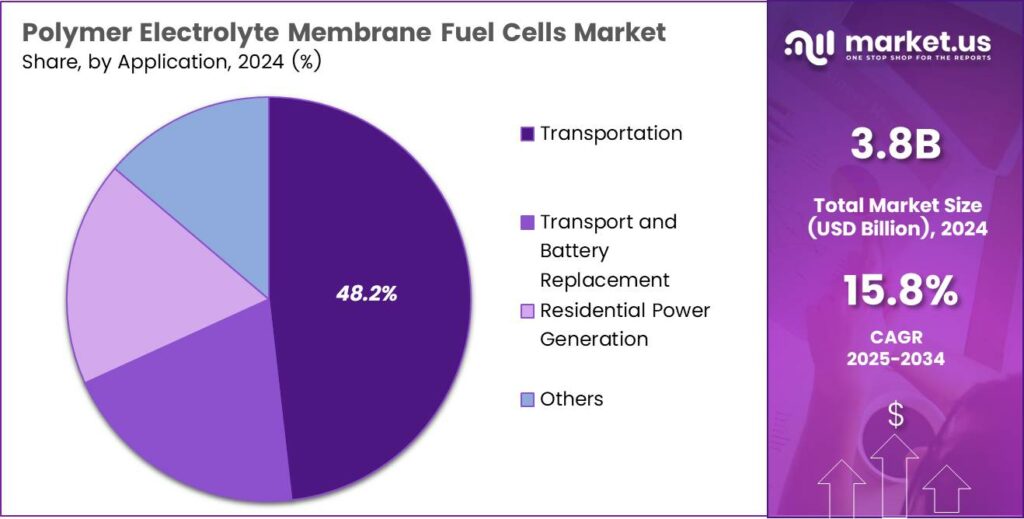

- Transportation represents the largest application segment with a market share of 48.2%, supported by rising fuel cell vehicle adoption.

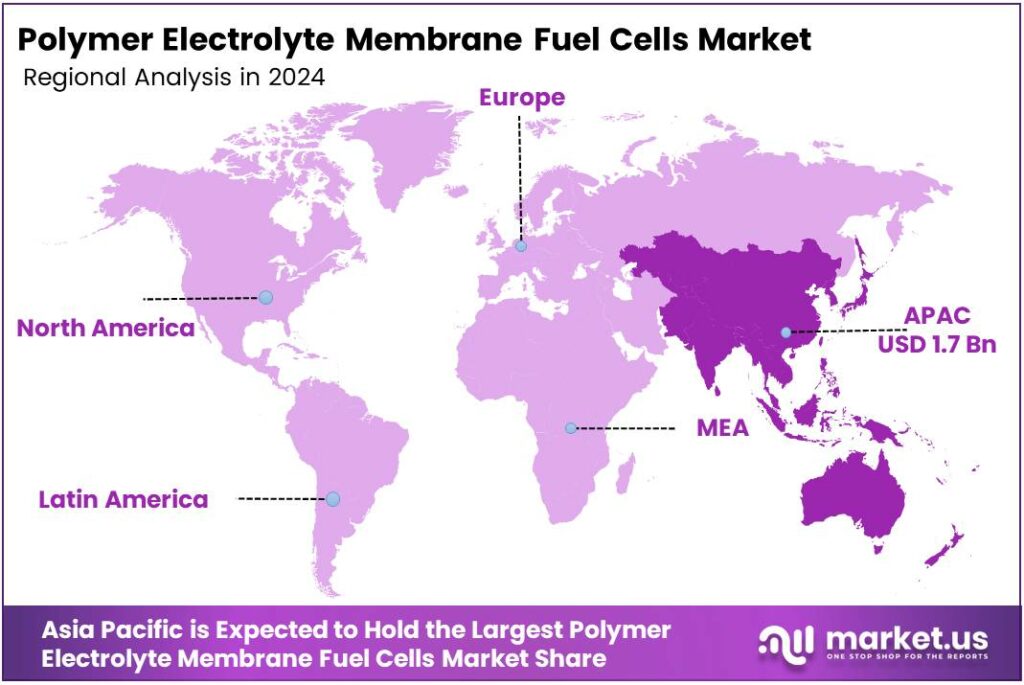

- Asia Pacific leads the regional landscape, holding a dominant share of 43.8%, equivalent to approximately USD 1.7 billion in market value.

By Type Analysis

Low-Temperature dominates with 79.1% due to its proven performance, faster start-up, and strong adoption across mobility and stationary uses.

In 2024, Low-Temperature held a dominant market position in the By Type analysis segment of the Polymer Electrolyte Membrane Fuel Cells (PEMFCs) Market, with a 79.1% share. This leadership continues as manufacturers prioritize quick response times, compact system design, and compatibility with existing hydrogen infrastructure.

Low-temperature PEMFCs operate efficiently under moderate conditions, therefore supporting reliable performance in vehicles and backup power systems. Moreover, continuous improvements in membrane durability and catalyst utilization strengthen cost control. As a result, these systems remain preferred for commercial deployment where operational stability and scalability are essential.

High-Temperature PEMFCs maintained a growing presence within the By Type segment, driven by their ability to tolerate fuel impurities. Additionally, higher operating temperatures simplify water management and reduce system complexity, enabling interest from industrial and distributed power users.

By Application Analysis

Transportation dominates with 48.2% due to rising fuel cell vehicle deployment and decarbonization efforts in mobility.

In 2024, Transportation held a dominant market position in the By Application analysis segment of the Polymer Electrolyte Membrane Fuel Cells (PEMFCs) Market, with a 48.2% share. This dominance reflects strong demand for fuel cell passenger vehicles, buses, and commercial fleets seeking zero-emission solutions.

Transportation adoption benefits from high energy efficiency and fast refueling advantages. Consequently, PEMFCs increasingly replace conventional powertrains in long-range mobility. Moreover, improving hydrogen refueling networks supports wider vehicle deployment, reinforcing the segment’s leadership across developed and emerging automotive markets.

The Transport and Battery Replacement segment continues to expand as fuel cells supplement or replace batteries in material handling and logistics equipment. Therefore, operators gain extended runtime and reduced downtime. This application supports efficiency improvements in warehouses, ports, and industrial transport environments.

Residential Power Generation and other applications showed steady progress through micro-CHP systems and backup power solutions. These segments benefit from quiet operation and clean energy output. Gradually, decentralized energy needs encourage adoption, although volumes remain smaller compared to transportation-led demand.

Key Market Segments

By Type

- Low-Temperature

- High-Temperature

By Application

- Transportation

- Transport and Battery Replacement

- Residential Power Generation

- Others

Emerging Trends

Technological Advancements and Policy Support Shape Market Trends

A key trend in the PEMFC market is continuous technological improvement. Manufacturers are focusing on reducing platinum loading in catalysts while maintaining performance. This directly lowers costs and improves commercial feasibility. The shift toward high-temperature PEMFCs which can tolerate fuel impurities and simplify system design.

- In accelerated testing meant to mimic harsh, stop-start operating conditions, the team reported 1.1% power loss after 90,000 square-wave voltage cycles. They also reported projections of fuel-cell lifetimes beyond 200,000 hours, which signals a very different durability ceiling than what the industry has lived with historically.

These systems reduce the need for complex water management and improve operational stability. Policy support also shapes market trends. Governments promote fuel cells through subsidies, pilot projects, and public-private partnerships. Increasing integration of PEMFCs with renewable energy and smart grids reflects a broader trend toward flexible, low-carbon energy systems.

Drivers

Rising Demand for Clean and Efficient Energy Drives PEMFC Market Growth

The Polymer Electrolyte Membrane Fuel Cells (PEMFCs) market is mainly driven by the global push for clean and low-emission energy systems. Governments and industries are actively reducing carbon emissions, and PEMFCs offer a reliable solution because they produce electricity with water as the only by-product. This makes them suitable for transport, backup power, and distributed energy systems.

The growing adoption of hydrogen-based technologies. PEMFCs work efficiently with hydrogen and support national hydrogen strategies focused on energy security. Their fast start-up time and high power density make them ideal for fuel-cell vehicles, buses, and material-handling equipment.

Restraints

High System Costs and Infrastructure Gaps Restrain Market Expansion

Despite strong interest, the PEMFC market faces restraints linked to high initial costs. PEMFC systems rely on advanced membranes, platinum-based catalysts, and precise manufacturing processes. These factors increase system prices, especially for large-scale commercial deployment, slowing adoption in cost-sensitive markets.

- DOE targets include a direct-hydrogen fuel cell power system for heavy-duty trucks that can be mass-produced at $80/kW (with an ultimate goal of $60/kW), while also achieving 68% peak efficiency and 25,000 hours of durability (ultimately 30,000 hours).

Many regions lack sufficient hydrogen production, storage, and refueling facilities. Without easy access to hydrogen, end users hesitate to invest in PEMFC systems, particularly for transportation applications. PEMFC components can degrade under fluctuating temperatures and operating conditions.

Growth Factors

Expanding the Hydrogen Economy Creates Strong Growth Opportunities

Growth opportunities for the PEMFC market are closely tied to the expanding hydrogen economy. Large investments in green hydrogen production open new pathways for a clean fuel supply. As renewable electricity powers hydrogen generation, PEMFCs become more sustainable and cost-competitive.

- DOE targets include a direct-hydrogen fuel cell power system for heavy-duty trucks that can be mass-produced at $80/kW (with an ultimate goal of $60/kW), while also achieving 68% peak efficiency and 25,000 hours of durability (ultimately 30,000 hours).

The transportation sector offers a major opportunity. Fuel-cell buses, trucks, and fleet vehicles benefit from fast refueling and long driving range. PEMFCs also support port equipment, warehouses, and airport operations where electric batteries face limitations.

Regional Analysis

Asia Pacific Dominates the Polymer Electrolyte Membrane Fuel Cells (PEMFCs) Market with a Market Share of 43.8%, Valued at USD 1.7 Billion

Asia Pacific leads the PEMFCs market due to strong government-backed hydrogen strategies, expanding clean mobility programs, and rapid industrial decarbonization efforts. Countries across the region are investing heavily in fuel-cell-based transportation, distributed power generation, and backup energy systems. The region accounted for 43.8% of global demand, translating to nearly USD 1.7 billion, supported by large-scale manufacturing capacity and growing hydrogen infrastructure.

North America shows steady growth driven by fuel cell adoption in material handling equipment, data centers, and stationary power applications. Policy support for hydrogen hubs and emission reduction targets continues to encourage PEMFC deployment. The region also benefits from early technology adoption and strong demand for resilient, low-emission energy systems across commercial and industrial sectors.

Europe’s PEMFC market is shaped by strict climate regulations and ambitious net-zero goals. Fuel cells are increasingly integrated into public transport, residential cogeneration, and grid-support applications. Strong emphasis on green hydrogen production and cross-border energy cooperation further supports gradual but consistent market expansion across the region.

The U.S. market is driven by federal incentives for clean hydrogen, defense-related power needs, and growing interest in fuel-cell-based backup systems. PEMFCs are gaining attention for their fast response times and reliability in critical infrastructure. Continued funding for hydrogen supply chains is expected to strengthen long-term adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nedstack Fuel Cell Technology stands out for its steady focus on PEMFC stacks and integrated modules that fit real-duty operation, especially where uptime and serviceability matter. From an analyst lens, its value is in the engineering discipline—long-life stack design, tighter balance-of-plant integration, and field learning that helps customers reduce unexpected downtime.

Intelligent Energy is positioned well in “power-as-a-solution” style deployments where compact PEMFC systems can replace or reduce diesel use in off-grid and mobility-adjacent applications. The near-term advantage is not just efficiency, but simplified packaging, faster commissioning, and clear pathways to scale through modular system design and partner-led manufacturing.

Pragma Industries remains closely linked to light mobility and pragmatic hydrogen adoption, where total cost, refueling convenience, and everyday reliability decide success. Analyst-wise, the opportunity is in repeatable use cases—fleet operations, last-mile movement, and controlled corridors—because these segments can build demand without waiting for nationwide infrastructure.

Plug Power continues to push vertical integration across PEMFC systems and hydrogen supply, which can reduce buyer risk when customers want a complete package rather than components. The key watch item is execution—delivering consistent system performance, expanding service coverage, and aligning production volumes with hydrogen availability so deployments scale smoothly instead of in bursts.

Top Key Players in the Market

- Nedstack Fuel Cell Technology

- Intelligent Energy

- Pragma Industries

- Plug Power

- ITM Power

- Ballard Power Systems

- ElringKlinger

- Horizon Fuel Cell Technologies

- Nuvera Fuel Cells, LLC

- Johnson Matthey

- W.L. Gore & Associates

Recent Developments

- In 2024, Nedstack specializes in high-power PEM fuel cell applications, with a focus on mission-critical systems, such as stationary power plants and maritime solutions. Nedstack partnered with Groeneveldt Marine Construction B.V. to deliver a sustainable workboat equipped with a mobile PEM fuel cell system (MPU 20-400-AC) for the Province of Overijssel.

- In 2025, Intelligent Energy deployed its first in-house developed microgrid solution and signed a strategic agreement to advance hydrogen power in Korea, thereby enhancing the adoption of PEMFCs in stationary applications. The company launched the HEIGHTS programme, an initiative to fast-track the development of zero-emission PEM fuel cell systems for commercial aircraft.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Billion Forecast Revenue (2034) USD 16.5 Billion CAGR (2025-2034) 15.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Low-Temperature, High-Temperature), By Application (Transportation, Transport and Battery Replacement, Residential Power Generation, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Nedstack Fuel Cell Technology, Intelligent Energy, Pragma Industries, Plug Power, ITM Power, Ballard Power Systems, ElringKlinger, Horizon Fuel Cell Technologies, Nuvera Fuel Cells, LLC, Johnson Matthey, W.L. Gore & Associates Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Polymer Electrolyte Membrane Fuel Cells (PEMFCs) MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Polymer Electrolyte Membrane Fuel Cells (PEMFCs) MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Nedstack Fuel Cell Technology

- Intelligent Energy

- Pragma Industries

- Plug Power

- ITM Power

- Ballard Power Systems

- ElringKlinger

- Horizon Fuel Cell Technologies

- Nuvera Fuel Cells, LLC

- Johnson Matthey

- W.L. Gore & Associates