Global Plant Breeding And Crispr Plants Market Size, Share Analysis Report By Type (Conventional Method, Biotechnological Method, Genetic Engineering), By Trait (Herbicide Resistance, Insect Resistance, Disease Resistance, Abiotic Stress Tolerance, Yield Improvement, Nutritional Enhancement), By Application (Agriculture, Food Production, Bioenergy, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155266

- Number of Pages: 367

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

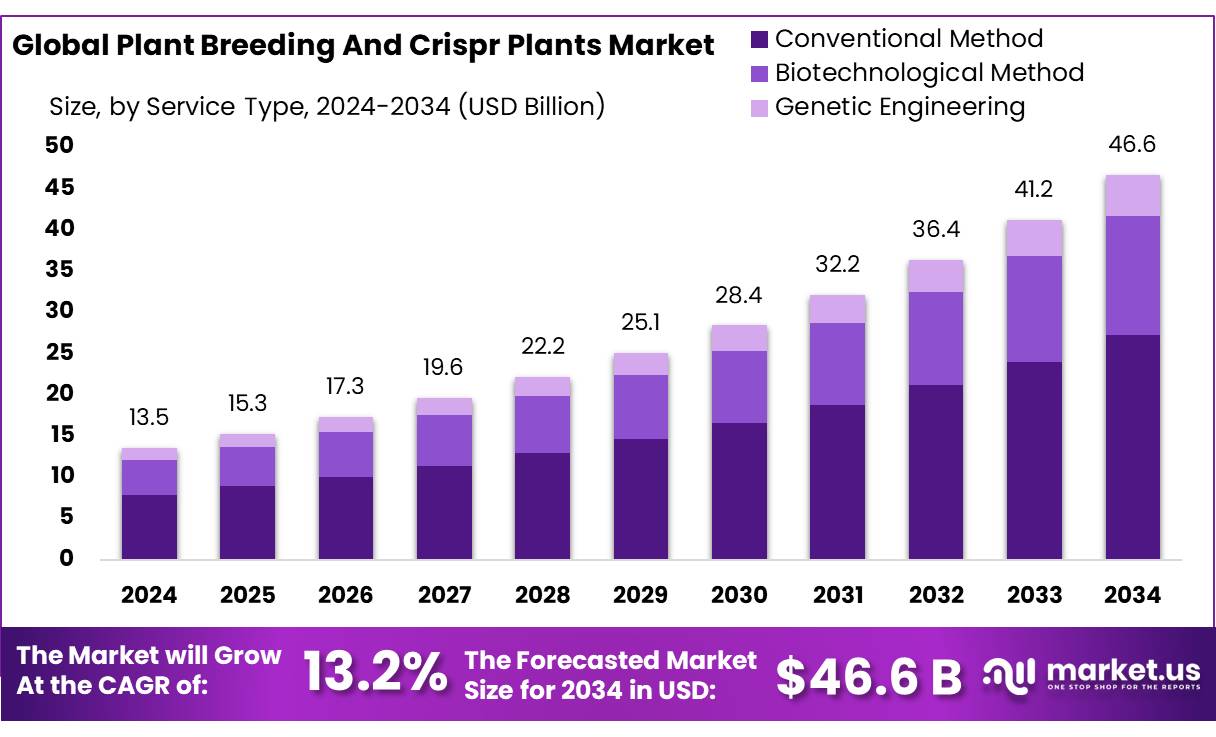

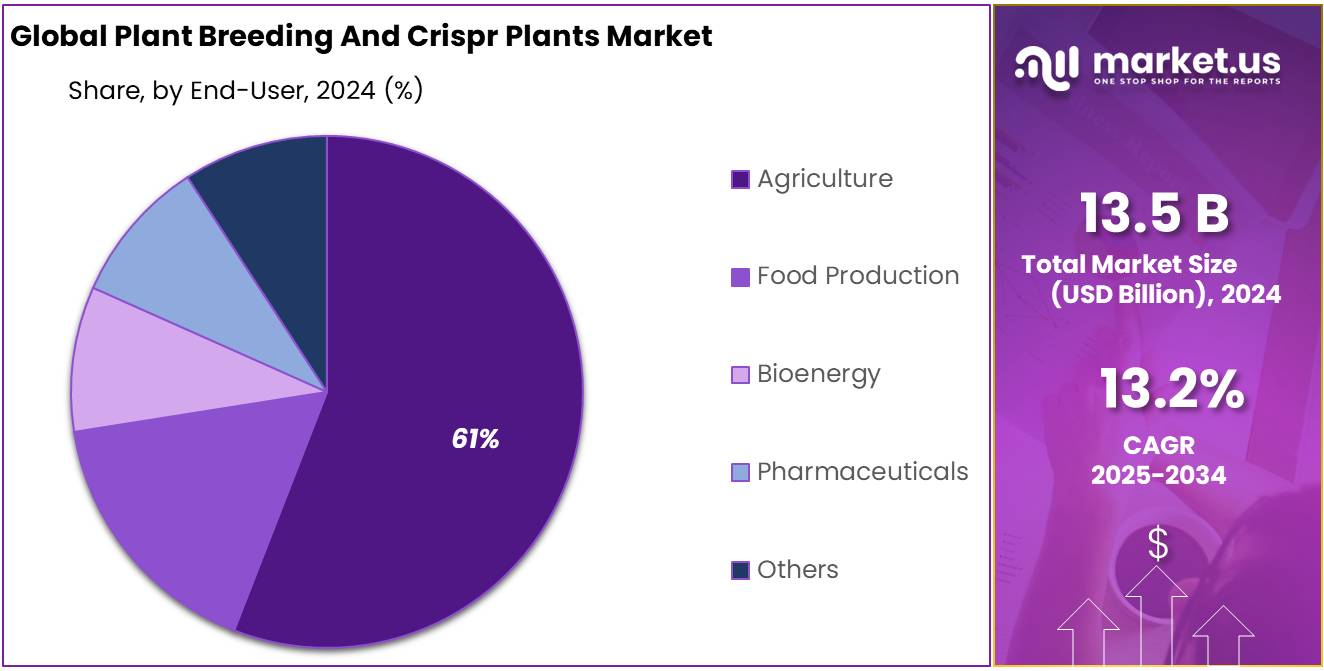

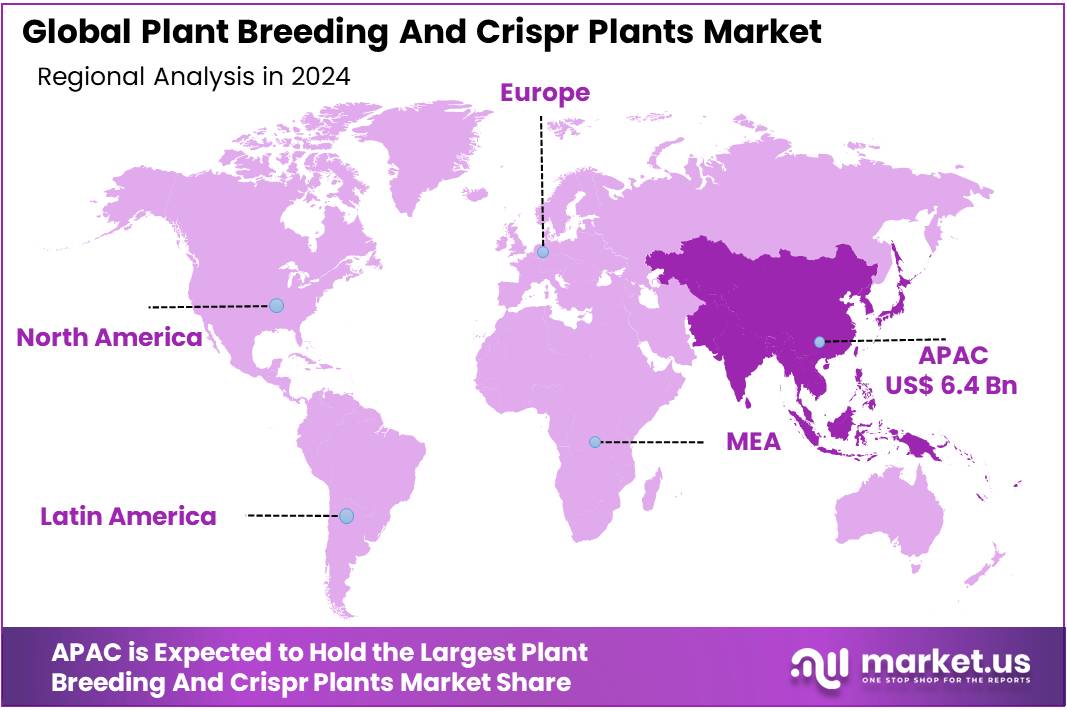

The Global Plant Breeding And Crispr Plants Market size is expected to be worth around USD 46.6 Billion by 2034, from USD 13.5 Billion in 2024, growing at a CAGR of 13.2% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 47.8% share, holding USD 6.4 Billion revenue.

The plant breeding and CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats) technology market has experienced significant advances due to its potential to revolutionize agriculture. CRISPR gene-editing technology allows for precise alterations to the genetic makeup of plants, leading to improved crop yields, resistance to diseases, and better adaptation to changing environmental conditions.

According to the U.S. Department of Agriculture (USDA), CRISPR technology has enabled the creation of crops that are more resistant to pests, diseases, and climate change, which is expected to help mitigate the impact of global food insecurity.

The driving factors for the growth of this industry include increasing demand for food production, climate change, and the need for sustainable agricultural practices. As global population growth continues, there is heightened pressure on the agricultural sector to produce more food with fewer resources.

According to the United Nations (UN), the global population is expected to reach 9.7 billion by 2050, which will require a 70% increase in food production. Furthermore, agricultural production is under threat due to the effects of climate change, with unpredictable weather patterns, soil degradation, and water scarcity. CRISPR technology offers a potential solution by improving crop resilience and resource-use efficiency, making it an essential tool for modern agriculture.

The Indian government has recognized the potential of CRISPR technology in addressing challenges such as climate change, food security, and the need for sustainable farming practices. Through the Department of Biotechnology (DBT), the government is funding interdisciplinary research to harness genome editing tools for crop improvement. For instance, the DBT has launched a Rs 4 crore project at Punjab Agricultural University focused on predictive breeding of guava, aiming to enhance fruit quality and shelf life using genomic tools.

Regulatory frameworks have also evolved to facilitate the adoption of genome-edited crops. In 2022, the Ministry of Environment, Forest and Climate Change exempted genome-edited plants without foreign genes from biosafety assessments, streamlining the approval process for such crops. This policy shift has paved the way for field trials of CRISPR-modified rice varieties, such as DRR Rice 100 (Kamala) and Pusa DST Rice 1, demonstrating India’s commitment to advancing agricultural biotechnology.

Key Takeaways

- Plant Breeding And Crispr Plants Market size is expected to be worth around USD 46.6 Billion by 2034, from USD 13.5 Billion in 2024, growing at a CAGR of 13.2%.

- Conventional Method held a dominant market position, capturing more than a 58.3% share.

- Herbicide Resistance held a dominant market position, capturing more than a 31.7% share.

- Agriculture held a dominant market position, capturing more than a 59.4% share.

- Asia–Pacific (APAC) was the clear demand center for plant breeding and CRISPR-enabled crops, holding a dominant 47.8% share, valued at roughly USD 6.4 billion.

By Type Analysis

Conventional Method dominates with 58.3% Share

In 2024, Conventional Method held a dominant market position, capturing more than a 58.3% share. This lead reflects the method’s wide breeder adoption, mature seed-production networks, and predictable regulatory pathways that keep development costs and timelines manageable. Companies favor conventional breeding for traits where field performance is proven and intellectual-property clarity is high, allowing faster variety release and broad regional fit.

The segment’s depth—elite germplasm pools, testing infrastructure, and farmer familiarity—also supports steady royalty and licensing flows. In 2025, Conventional Method remains the anchor of product portfolios as firms pair it with marker-assisted selection and targeted screening to derisk pipeline decisions, while reserving genome-editing for traits needing precision or speed. Overall, conventional approaches continue to set the commercialization pace, with CRISPR lines scaling selectively alongside them.

By Trait Analysis

Herbicide Resistance leads with 31.7% driven by weed-control efficiency.

In 2024, Herbicide Resistance held a dominant market position, capturing more than a 31.7% share. This strong presence is linked to the growing need for efficient weed management, which directly impacts crop yields and farm profitability. Farmers value herbicide-resistant varieties for their ability to simplify weed control, reduce manual labor, and optimize herbicide applications, particularly in large-scale farming systems.

The segment’s dominance is further supported by consistent performance in diverse agro-climatic zones and compatibility with conservation tillage practices. In 2025, demand for herbicide resistance traits is expected to remain steady as growers seek solutions to tackle evolving weed pressures, including herbicide-tolerant weed species, while maintaining sustainable farming practices and meeting environmental compliance standards.

By Application Analysis

Agriculture dominates with 59.4% backed by global food demand.

In 2024, Agriculture held a dominant market position, capturing more than a 59.4% share. This leadership stems from the sector’s continual need for high-yield, resilient crop varieties to meet rising food demand driven by population growth and changing diets. Plant breeding and CRISPR technologies are increasingly applied in agriculture to develop crops with improved resistance to pests, diseases, and climate stress, ensuring consistent yields under challenging conditions.

Farmers benefit from these innovations through reduced input costs, better resource efficiency, and enhanced profitability. In 2025, agriculture is expected to maintain its dominance as governments and private players invest heavily in breeding programs that support food security, sustainable farming, and adaptation to shifting climate patterns.

Key Market Segments

By Type

- Conventional Method

- Biotechnological Method

- Genetic Engineering

By Trait

- Herbicide Resistance

- Insect Resistance

- Disease Resistance

- Abiotic Stress Tolerance

- Yield Improvement

- Nutritional Enhancement

By Application

- Agriculture

- Cereals

- Fruits and Vegetables

- Oilseeds and Pulses

- Cash Crops

- Others

- Food Production

- Bioenergy

- Pharmaceuticals

- Others

Emerging Trends

Capacity Building and International Collaboration in CRISPR Plant Breeding

A significant recent development in India’s plant breeding landscape is the intensified focus on capacity building and international collaboration in CRISPR-based genome editing. Recognizing the transformative potential of CRISPR technology in enhancing crop resilience and productivity, the Indian government, through the Indian Council of Agricultural Research (ICAR), has been actively fostering partnerships with global institutions to equip researchers with advanced skills and knowledge.

In early 2025, ICAR, in collaboration with the Innovative Genomics Institute (IGI) at the University of California, Berkeley, organized an international training workshop titled “Genome Editing in Plants — Advanced Tools and Techniques.” Held at the ICAR Indian Agricultural Research Institute (IARI) in New Delhi, the workshop aimed to enhance the capabilities of Indian plant biologists in utilizing CRISPR technology for crop improvement.

Supported by the Gates Foundation, the training saw the participation of 54 plant biotechnology researchers, including early-career scientists and graduate students from 22 different institutes across India. The program covered various aspects of genome editing, including gene targeting, CRISPR/Cas9 system optimization, and practical applications in crop breeding.

This initiative is part of a broader effort by the Indian government to integrate CRISPR technology into agricultural research and development. Through the ICAR EFC Sub-scheme on ‘Enhancing Climate Resilience and Ensuring Food Security with Genome Editing Tools,’ the government is investing in genome editing research to develop crop varieties with improved yield, nutritional quality, and climate resilience. The establishment of specialized facilities, such as the M.S. Swaminathan Genome Editing Laboratory, funded by the CRISPR EFC grant, further underscores this commitment.

Drivers

Government Support for Climate-Resilient Agriculture

One of the most compelling drivers for the adoption of CRISPR-based plant breeding in India is the government’s proactive support aimed at enhancing climate resilience in agriculture. Recognizing the escalating challenges posed by climate change, such as erratic rainfall, prolonged droughts, and rising temperatures, the Indian government has committed substantial resources to bolster agricultural research and development.

In 2024, the Indian government allocated ₹500 crores (approximately USD 60 million) to the Indian Council of Agricultural Research (ICAR) for the development of climate-resilient crops. This funding is directed towards harnessing advanced biotechnological tools, including CRISPR-Cas9, to engineer crop varieties that can withstand extreme weather conditions and ensure food security. For instance, the Indian Agricultural Research Institute (IARI) has initiated projects focusing on developing drought-tolerant rice varieties using CRISPR technology.

Furthermore, the Department of Biotechnology (DBT) has been instrumental in promoting genome editing research. Over the past five years, the DBT has supported more than 80 individual and multi-institutional R&D projects on genome editing technologies and their applications in healthcare, with a significant portion dedicated to agricultural improvements. These initiatives aim to develop crops with enhanced traits such as improved yield, nutritional content, and resistance to biotic and abiotic stresses.

The government’s efforts are further complemented by regulatory advancements. In 2022, the Ministry of Environment, Forest and Climate Change exempted genome-edited plants without foreign genes from biosafety assessments, facilitating faster approval processes for field trials and commercialization of such crops.

Restraints

Regulatory Complexity and Approval Delays

One of the significant challenges hindering the widespread adoption of CRISPR-based plant breeding in India is the intricate and often delayed regulatory approval process. Despite the government’s efforts to streamline regulations, the pathway from research to commercialization remains complex and time-consuming.

In 2022, the Indian Ministry of Environment, Forest and Climate Change (MoEF&CC) issued guidelines exempting certain genome-edited plants without foreign genes (SDN-1 and SDN-2) from stringent biosafety assessments. This move aimed to expedite the approval process for such crops. However, even with this exemption, the requirement for Institutional Biosafety Committees (IBSCs) to certify that the gene-edited crop is devoid of any foreign DNA before commercialization introduces additional layers of oversight and potential delays.

Moreover, the Standard Operating Procedures (SOPs) for regulatory review necessitate comprehensive documentation, including detailed molecular data, phenotypic expression assessments, and evidence of the absence of exogenous introduced DNA. This extensive documentation process can prolong the approval timeline, particularly for public-sector research institutions with limited resources.

The regulatory landscape is further complicated by the absence of a unified and autonomous regulatory body. The proposed Biotechnology Regulatory Authority of India (BRAI), intended to streamline the approval process, has faced delays and opposition, leaving the existing framework under the MoEF&CC and other agencies in place.

Opportunity

Expansion of Climate-Resilient Crop Development

One of the most promising avenues for the advancement of CRISPR-based plant breeding in India is the government’s concerted effort to develop climate-resilient crop varieties. This initiative is not only a response to the escalating challenges posed by climate change but also a strategic move to ensure food security and enhance agricultural sustainability across the nation.

In the 2023-24 Union Budget, the Government of India allocated ₹500 crores (approximately USD 60 million) to the Indian Council of Agricultural Research (ICAR) for genome editing research in agricultural crops. This funding is earmarked for developing crops that can withstand extreme climatic conditions, thereby safeguarding farmers’ livelihoods and ensuring consistent food production.

Institutions like ICAR have already made significant strides in this domain. Between 2014 and 2024, ICAR developed over 2,900 location-specific improved field crop varieties, including 1,380 cereals, 412 oilseeds, 437 pulses, and 376 fiber crops. Among these, 537 varieties were specifically developed to tackle extreme climatic challenges using advanced precision phenotyping tools.

Moreover, the establishment of specialized research facilities further underscores the commitment to this cause. For instance, the M.S. Swaminathan Genome Editing Laboratory, funded by ICAR’s CRISPR EFC grant, aims to enhance capabilities for large-scale genome editing work, particularly in rice improvement.

Regional Insights

In 2024, Asia–Pacific (APAC) was the clear demand center for plant breeding and CRISPR-enabled crops, holding a dominant 47.8% share, valued at roughly USD 6.4 billion. Scale and crop mix drive this lead: Asia accounts for the bulk of global rice output, with India and China alone producing about 28% and 27% of world rice in 2024/25, anchoring sustained seed and trait spending across irrigated and rainfed systems. Policy tailwinds are strengthening pipelines. India’s 2022 guidelines exempt SDN-1/SDN-2 genome-edited plants (no foreign DNA) from key GMO rules and provide SOPs for review—cutting time and uncertainty for public institutes and seed firms.

APAC’s growth outlook remains solid as governments seek yield stability, lower input intensity, and climate resilience in staples and horticulture. Rising farm adoption of edited herbicide-, pest-, and disease-tolerance traits—paired with conventional and marker-assisted breeding—supports multi-season ROI for growers while expanding trait licensing opportunities for developers. Medium-term demand is underpinned by cereals; OECD-FAO expects robust Asian rice output through 2034, reinforcing investment cases for stress-tolerance and quality traits tuned to regional processing and consumer preferences.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Bayer AG remained a leader in plant breeding and CRISPR crop development, leveraging its global seed brands and strong R&D network. The company focuses on high-yield, stress-tolerant traits in key crops like corn, soybeans, and vegetables. Bayer’s investment in precision breeding platforms, including CRISPR, enables faster product cycles and tailored solutions for diverse markets. Strategic partnerships with research institutes strengthen its innovation pipeline, while sustainability targets drive breeding for reduced input needs and improved climate resilience across major agricultural regions.

Corteva holds a prominent position in the global plant breeding and CRISPR plants market, combining advanced trait technologies with extensive germplasm resources. In 2024, the company emphasized genome-edited traits for herbicide tolerance, pest resistance, and nutrient efficiency, especially in row crops. Corteva’s breeding programs integrate digital phenotyping and molecular tools to speed selection and deployment. Expansion in APAC and Latin America supports market penetration, while collaborative research with universities ensures a steady flow of novel traits for both conventional and gene-edited seed products.

Syngenta Group continues to be a key innovator in plant breeding, focusing on integrating CRISPR into commercial seed lines for improved yield stability and crop protection. In 2024, the company prioritized traits that align with regenerative agriculture, such as drought tolerance and nitrogen-use efficiency. Syngenta’s strong regional networks in APAC, EMEA, and the Americas enhance its reach, while targeted investments in molecular breeding accelerate development timelines. Its collaborative partnerships and licensing models expand the availability of advanced traits to growers worldwide.

Top Key Players Outlook

- Bayer AG

- Corteva

- Syngenta Group

- KWS SAAT SE & Co. KGaA

- Limagrain

- BASF

- SAKATA SEED CORPORATION

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- PacBio

- Evogene Ltd.

Recent Industry Developments

Corteva is leaning into gene editing with crisp focus—in September 2024, it committed USD 25 million through its Corteva-Catalyst platform to take an equity stake in Pairwise and launch a five-year joint venture to fast-track CRISPR-backed crop innovation—especially in corn, soy, and specialty crops—aimed at raising yields and climate resilience.

Limagrain leans into genome editing as a smart partner to its classic breeding, dedicating over 10% of its research effort to plant biotechnologies like GMOs and New Genomic Techniques (NGTs) in countries where they’re allowed.

Report Scope

Report Features Description Market Value (2024) USD 13.5 Bn Forecast Revenue (2034) USD 46.6 Bn CAGR (2025-2034) 13.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Conventional Method, Biotechnological Method, Genetic Engineering), By Trait (Herbicide Resistance, Insect Resistance, Disease Resistance, Abiotic Stress Tolerance, Yield Improvement, Nutritional Enhancement), By Application (Agriculture, Food Production, Bioenergy, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bayer AG, Corteva, Syngenta Group, KWS SAAT SE & Co. KGaA, Limagrain, BASF, SAKATA SEED CORPORATION, Rijk Zwaan Zaadteelt en Zaadhandel B.V., PacBio, Evogene Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plant Breeding And Crispr Plants MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Plant Breeding And Crispr Plants MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bayer AG

- Corteva

- Syngenta Group

- KWS SAAT SE & Co. KGaA

- Limagrain

- BASF

- SAKATA SEED CORPORATION

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- PacBio

- Evogene Ltd.