Global Pinoxaden Market Size, Share, Report Analysis By Formulation Type (Suspension Concentrate, Emulsifiable Concentrate, Granules, Wettable Powder), By Crop Type (Cereal Crops, Oilseed Crops, Vegetables, Fruits, Others)), By Application Method (Foliar Spray, Soil Application, Seed Treatment), By Application Timing (Post Emergence, Pre Emergence) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156169

- Number of Pages: 216

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

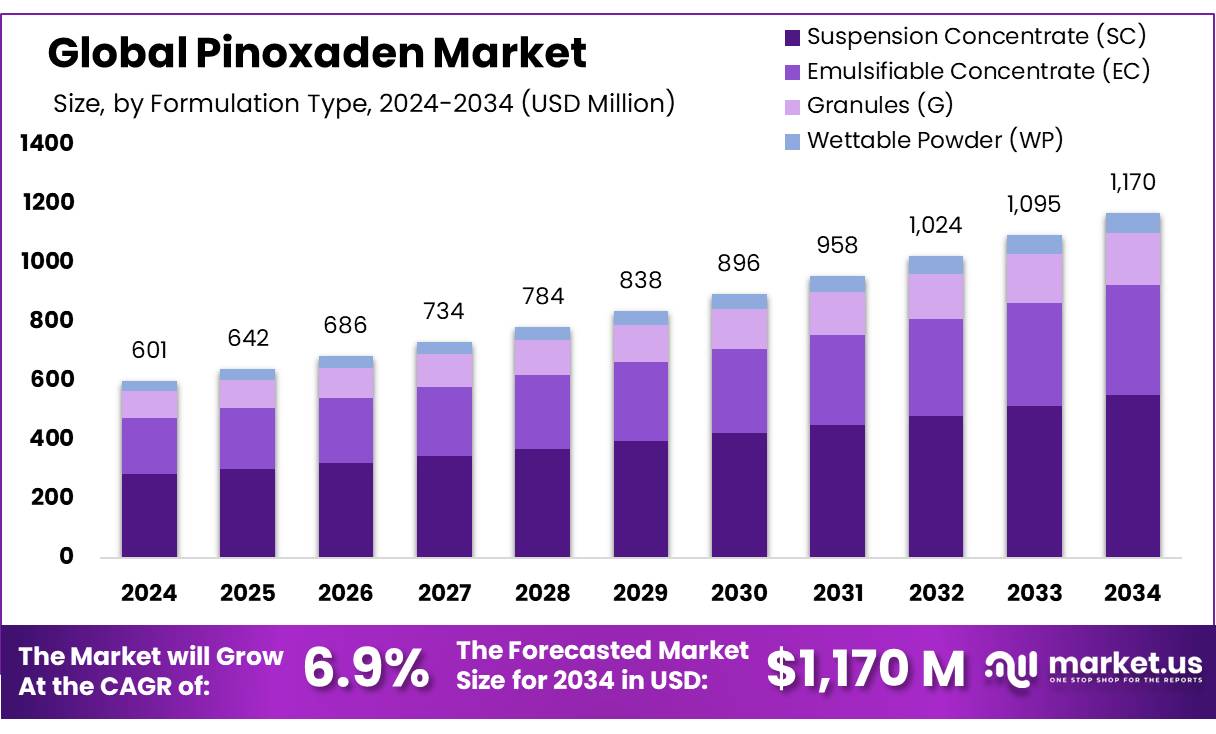

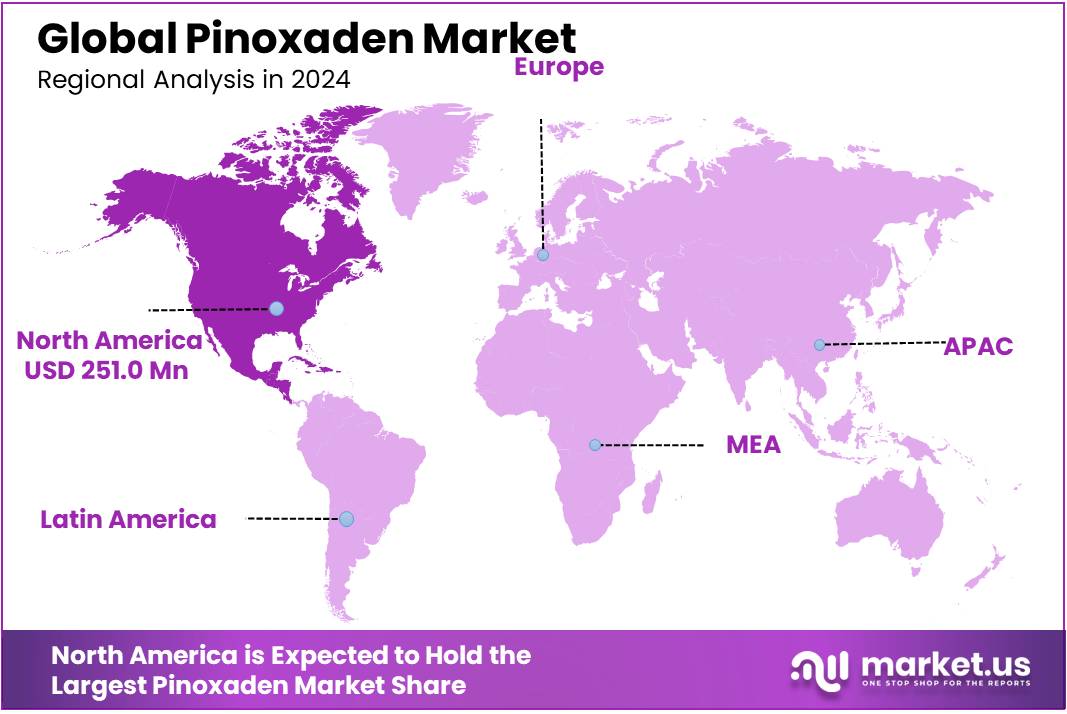

The Global Pinoxaden Market size is expected to be worth around USD 1170 Million by 2034, from USD 601 Million in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.80% share, holding USD 251.0 Million revenue.

Pinoxaden is a selective post-emergence herbicide primarily used to control grass weeds in cereal crops such as wheat and barley. Classified as a phenylpyrazoline compound, it functions by inhibiting the enzyme acetyl-CoA carboxylase (ACCase), which is vital for fatty acid synthesis in plants. This inhibition disrupts cell membrane formation, leading to the death of the targeted weeds. Pinoxaden’s efficacy against challenging grass weeds like wild oats and canary grass has made it a valuable tool in modern agriculture.

In the regulatory frameworks provide clear residue tolerance thresholds. The U.S. Environmental Protection Agency (EPA), under 40 CFR Part 180 effective July 27, 2005, set tolerances for combined residues (active and relevant metabolites) on cereals and animal commodities—for example, wheat grain at 1.3 ppm, wheat straw at 1.5 ppm, barley grain at 0.9 ppm, and barley straw at 1.0 ppm. Residues in animal products are also regulated—for example, milk at 0.02 ppm, cattle meat byproducts at 0.04 ppm, and poultry meat byproducts at 0.06 ppm.

In India, the agrochemical industry is experiencing significant growth, with the chemical sector contributing approximately 7% to the country’s GDP as of 2022. India stands as the world’s sixth-largest producer of chemicals and the third-largest in Asia. The industry encompasses over 80,000 different chemical products and employs around five million people. This robust industrial backdrop provides a conducive environment for the production and adoption of specialized herbicides like Pinoxaden.

Regarding environmental and safety considerations, U.S. EPA data indicates Pinoxaden poses minimal cancer risk, with application rates representing only 0.9% of the chronic population‑adjusted dose (cPAD) for the general population and 2.1% for children aged 1–2 years. Yet, environmental fate studies raise awareness about potential mobility—while the parent compound degrades rapidly (soil aerobic half‑life less than 1 day), certain metabolites (such as M3) may persist for over 200 days, raising concerns about groundwater contamination from runoff or leaching.

Key Takeaways

- Pinoxaden Market size is expected to be worth around USD 1170 Million by 2034, from USD 601 Million in 2024, growing at a CAGR of 6.9%.

- Suspension Concentrate (SC) held a dominant market position, capturing more than a 47.1% share.

- Cereal Crops held a dominant market position, capturing more than a 58.2% share in the pinoxaden market.

- Foliar Spray held a dominant market position, capturing more than a 69.5% share in the pinoxaden market.

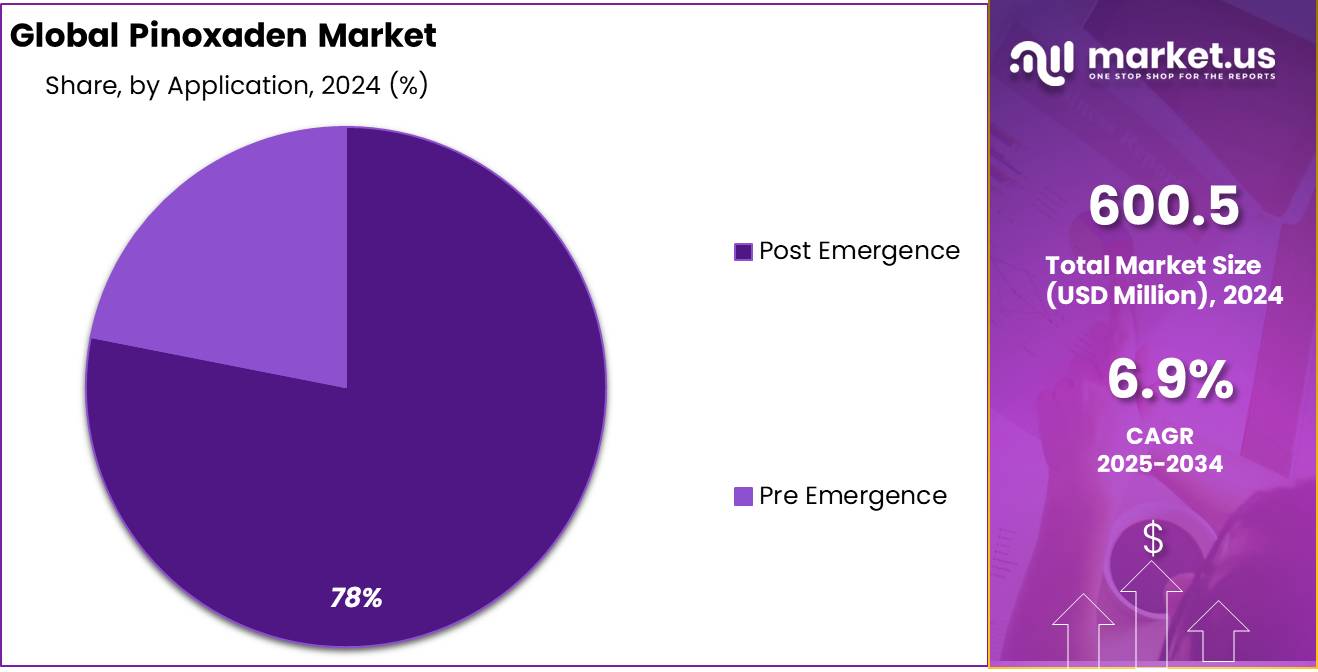

- Post Emergence held a dominant market position, capturing more than a 78.4% share in the pinoxaden market.

- North America stood tall as the powerhouse of the Pinoxaden market, securing a leading 41.80% share—translating to approximately USD 251.0 million.

By Formulation Type Analysis

Suspension Concentrate (SC) leads with 47.1% thanks to easy handling and strong field performance.

In 2024, Suspension Concentrate (SC) held a dominant market position, capturing more than a 47.1% share. SC stayed ahead because it is water-based, simple to measure, and stable in storage, which fits the day-to-day needs of cereal growers targeting tough grass weeds. Applicators value SC for its consistent droplet quality and good leaf coverage at typical spray volumes, while agronomy teams prefer the lower solvent load versus older solvent-heavy formats.

The formulation also travels well through the distribution chain, with less risk of crystallization or phase separation during seasonal temperature swings. On farm, SC mixes cleanly in the tank with common adjuvants and partner herbicides, helping growers run broader, resistance-minded programs without clogging filters or wasting time on re-mixing. In 2024 this practical reliability made SC the “default” choice for large acreage passes where timing windows are tight.

By Crop Type Analysis

Cereal Crops dominate with 58.2% as farmers prioritize effective weed control in staple grains.

In 2024, Cereal Crops held a dominant market position, capturing more than a 58.2% share in the pinoxaden market. This leadership stems from the heavy reliance on wheat and barley across major agricultural regions, where grass weeds such as wild oats and ryegrass continue to threaten yields. Farmers in North America, Europe, and parts of Asia have steadily adopted pinoxaden-based herbicides because they deliver selective action against these weeds while protecting the crop. The strong foothold of cereals in global diets also fuels demand; with wheat alone accounting for a major portion of caloric intake for billions, growers cannot afford weed-related losses.

By Application Method Analysis

Foliar Spray dominates with 69.5% due to its precision and quick action on weed control.

In 2024, Foliar Spray held a dominant market position, capturing more than a 69.5% share in the pinoxaden market. This method is preferred because it delivers the herbicide directly onto the leaves of target weeds, ensuring fast absorption and visible results within a short time. Farmers across major wheat and barley growing regions rely on foliar sprays to manage stubborn grasses like wild oats and ryegrass, which are difficult to control with soil-applied options. The ease of application through boom sprayers, coupled with the ability to cover large acreages within narrow growth windows, further strengthens the appeal of foliar treatments.

By Application Timing Analysis

Post Emergence dominates with 78.4% as farmers target weeds at their most vulnerable stage.

In 2024, Post Emergence held a dominant market position, capturing more than a 78.4% share in the pinoxaden market. This timing remains the most widely adopted because it allows farmers to apply the herbicide directly after weeds have emerged and are actively competing with cereal crops such as wheat and barley. Pinoxaden shows its highest effectiveness when applied at this stage, targeting grass weeds like wild oats, foxtail, and ryegrass without harming the main crop. Growers appreciate the flexibility of post-emergence use, as it enables them to assess actual weed pressure in the field before investing in herbicide sprays, ensuring resources are used efficiently.

Key Market Segments

By Formulation Type

- Suspension Concentrate (SC)

- Emulsifiable Concentrate (EC)

- Granules (G)

- Wettable Powder (WP)

By Crop Type

- Cereal Crops

- Oilseed Crops

- Vegetables

- Fruits

- Others

By Application Method

- Foliar Spray

- Soil Application

- Seed Treatment

By Application Timing

- Post Emergence

- Pre Emergence

Emerging Trends

Adoption of Integrated Weed Management (IWM) Practices Incorporating Pinoxaden

In recent years, Indian agriculture has seen a notable shift towards Integrated Weed Management (IWM) practices, combining chemical, mechanical, and cultural methods to control weeds effectively. This holistic approach aims to reduce reliance on single herbicide applications and mitigate the development of herbicide-resistant weed populations. Pinoxaden, a selective post-emergence herbicide, has become a key component in these integrated strategies, particularly in cereal crops like wheat.

The Food and Agriculture Organization (FAO) emphasizes the importance of IWM in sustainable agriculture. According to FAO guidelines, IWM involves using a combination of practices such as crop rotation, use of resistant varieties, mechanical cultivation, and judicious application of herbicides like Pinoxaden to manage weed populations effectively. This approach not only controls weeds but also minimizes environmental impact and delays the onset of herbicide resistance.

The Indian government’s support for IWM is evident through various initiatives. Programs like the National Food Security Mission (NFSM) and the Rashtriya Krishi Vikas Yojana (RKVY) promote sustainable agricultural practices, including IWM. These programs provide subsidies for the purchase of herbicides, machinery for mechanical weed control, and training for farmers on IWM techniques. Such support encourages farmers to adopt a more integrated approach to weed management, incorporating products like Pinoxaden.

Drivers

Increasing Wheat Production and Need for Effective Weed Management

India’s agricultural landscape is undergoing significant transformations, with wheat production reaching new heights. In the 2023–24 crop year, the country achieved a record wheat production of 113.3 million metric tons, marking an 8% increase from the previous year . This surge in production underscores the nation’s commitment to enhancing food security and meeting the dietary needs of its growing population.

Wheat, being a staple food, occupies a central role in India’s agricultural sector. The expansion of wheat cultivation areas, particularly in states like Uttar Pradesh, Punjab, and Madhya Pradesh, has been instrumental in this growth. However, with increased cultivation comes the challenge of managing weeds that compete with crops for nutrients, water, and sunlight. Weeds such as wild oats, foxtail, and barnyardgrass are prevalent in wheat fields and can significantly reduce yields if not controlled effectively.

The Indian government’s proactive measures further bolster the importance of effective weed management. In response to climatic challenges and to encourage higher wheat production, the government increased the minimum support price (MSP) for wheat by 6.6% to ₹2,425 per 100 kg for the 2025 season . Additionally, the government has been promoting sustainable agricultural practices through initiatives like the Soil Health Card Scheme and the National Mission on Sustainable Agriculture. These programs aim to enhance soil fertility and promote judicious use of agrochemicals, ensuring long-term agricultural productivity.

Restraints

High Cost of Pinoxaden Herbicide

One of the significant challenges hindering the widespread adoption of Pinoxaden herbicide in India is its relatively high cost compared to other herbicides. For instance, Syngenta’s Axial Pinoxaden 5.1% EC is priced at approximately ₹1,090 for a 400 ml bottle, which is designed to treat about 1 acre of wheat crop . This translates to a cost of around ₹1,090 per acre, making it a considerable expense for small-scale farmers.

In contrast, other commonly used herbicides in India, such as Glyphosate and 2,4-D, are available at significantly lower prices. For example, Glyphosate-based herbicides like Roundup are priced at approximately ₹180–₹225 for 1 liter. Similarly, 2,4-D herbicides are available in the range of ₹135–₹150 for 100 grams. These cost-effective alternatives make it challenging for farmers, especially those with limited financial resources, to justify the higher expenditure on Pinoxaden.

The high cost of Pinoxaden is particularly burdensome for smallholder farmers who cultivate wheat on limited acreage. According to the Food and Agriculture Organization (FAO), small-scale farmers constitute approximately 80% of India’s farming community. For these farmers, the cost of inputs like herbicides can significantly impact their overall profitability.

Recognizing the financial constraints faced by farmers, the Indian government has implemented various subsidy schemes to make agricultural inputs more affordable. For instance, the National Food Security Mission (NFSM) and the Rashtriya Krishi Vikas Yojana (RKVY) provide subsidies on seeds, fertilizers, and plant protection chemicals to encourage their use among farmers . While these initiatives aim to reduce input costs, the high price of specialized herbicides like Pinoxaden remains a significant barrier.

Opportunity

Expansion of Wheat Cultivation and Enhanced Weed Management

India’s agricultural sector is experiencing a significant transformation, with wheat production reaching unprecedented levels. In the 2024–25 crop year, the country achieved a record wheat production of 113.3 million tonnes, marking an 8% increase from the previous year . This surge in production underscores the nation’s commitment to enhancing food security and meeting the dietary needs of its growing population.

The government’s proactive measures have played a pivotal role in this achievement. In response to climatic challenges and to encourage higher wheat production, the government increased the minimum support price (MSP) for wheat by 6.6% to ₹2,425 per 100 kg for the 2025 season . Additionally, the government has been promoting sustainable agricultural practices through initiatives like the Soil Health Card Scheme and the National Mission on Sustainable Agriculture. These programs aim to enhance soil fertility and promote judicious use of agrochemicals, ensuring long-term agricultural productivity.

This scenario presents a significant growth opportunity for Pinoxaden, a selective post-emergence herbicide that targets monocotyledonous grass weeds without affecting broadleaf crops. Its mode of action involves inhibiting acetyl-CoA carboxylase, an enzyme crucial for fatty acid synthesis in plants, leading to the death of the weed . The adoption of such herbicides is essential for maintaining the health of wheat crops and ensuring optimal yields.

To further bolster wheat production and ensure effective weed management, the government has been increasing its budget allocation for the agriculture sector. In 2025, the government plans to raise spending for the agriculture sector by about 15% to around $20 billion, marking the biggest increase in six years. The additional funds would be directed to developing high-yielding seed varieties, increasing storage and supply infrastructure, and boosting production of pulse crops, oilseeds, vegetables, and dairy products .

Regional Insights

North America dominates with a commanding 41.80% share, accounting for USD 251.0 million in 2024

In 2024, North America stood tall as the powerhouse of the Pinoxaden market, securing a leading 41.80% share—translating to approximately USD 251.0 million. This dominance wasn’t by chance. Farmers across the U.S. and Canada leaned heavily on Pinoxaden to tackle grass weed challenges in cereal crops like wheat and barley, with its proven efficacy and compatibility with modern spraying systems making it a trusted choice.

That year, the region’s advanced agricultural infrastructure played a pivotal role in supporting that volume. Precision application tools, agrochemical distribution networks, and favorable regulatory frameworks combined to reinforce North America’s strong grip on the herbicide’s overall market.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Sumitomo Chemical appears among the key players associated with the Pinoxaden market, recognized by multiple industry sources. While specific product launches or formulations involving Pinoxaden aren’t publicly detailed, Sumitomo’s listing indicates its role in either producing intermediates, supplying formulations, or participating in distribution chains. Its inclusion alongside peers like UPL and Nufarm hints at a meaningful but less publicly spotlighted presence in the broader value chain of Pinoxaden herbicide offerings.

Helena AgriEnterprises doesn’t produce Pinoxaden, but it plays a critical role as a distributor—especially in North America—helping bridge the gap between manufacturers and end‑users. With a well‑established network spanning farms and regional distribution centers, Helena ensures growers can readily access Pinoxaden-based products, shaping regional market penetration and adoption by making supply reliable and responsive to agricultural seasons and demands.

UPL Limited is cited among the key companies involved in the Pinoxaden space, as listed by credible industry sources. Additionally, its North American affiliate (UPL NA Inc., Arysta LifeScience) is indicated on product labels—suggesting it offers tank‑mix guidance and legal frameworks for combining Pinoxaden with other herbicides. This points to UPL’s operational involvement in formulating or supporting Pinoxaden use through blending, regulatory compliance, or advisory services.

Top Key Players Outlook

- Bayer CropScience

- Corteva Agriscience

- Sumitomo Chemical

- Helena AgriEnterprises

- UPL Limited

- Nufarm

- Syngenta

- BASF

- FMC Corporation

Recent Industry Developments

In 2024, Sumitomo Chemical stood on solid footing as a diversified chemical player, with total revenue reaching approximately USD 16,884 million—about ¥2.6 trillion, depending on exchange rates at the time.

In 2024, Helena AgriEnterprises stood out as a trusted American agribusiness partner, generating more than USD 1 billion in annual revenue, with around 40% of that coming from crop protection—an arena where Pinoxaden-based formulations often fall—meaning roughly USD 400 million of its income goes into agrochemicals.

Report Scope

Report Features Description Market Value (2024) USD 601 Mn Forecast Revenue (2034) USD 1170 Mn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Formulation Type (Suspension Concentrate, Emulsifiable Concentrate, Granules, Wettable Powder), By Crop Type (Cereal Crops, Oilseed Crops, Vegetables, Fruits, Others)), By Application Method (Foliar Spray, Soil Application, Seed Treatment), By Application Timing (Post Emergence, Pre Emergence) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bayer CropScience, Corteva Agriscience, Sumitomo Chemical, Helena AgriEnterprises, UPL Limited, Nufarm, Syngenta, BASF, FMC Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bayer CropScience

- Corteva Agriscience

- Sumitomo Chemical

- Helena AgriEnterprises

- UPL Limited

- Nufarm

- Syngenta

- BASF

- FMC Corporation