Global Pet Food Packaging Market By Material Type (Paper & Paper Board, Plastics, Metal, Others), By Product Type (Pouches, Folding Carton, Metal cans, Bags, Others), By Animal (Dog food, Cat Food, Fish food, Others), By Food Type (Dry food, Wet food, Pet treats, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 22132

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

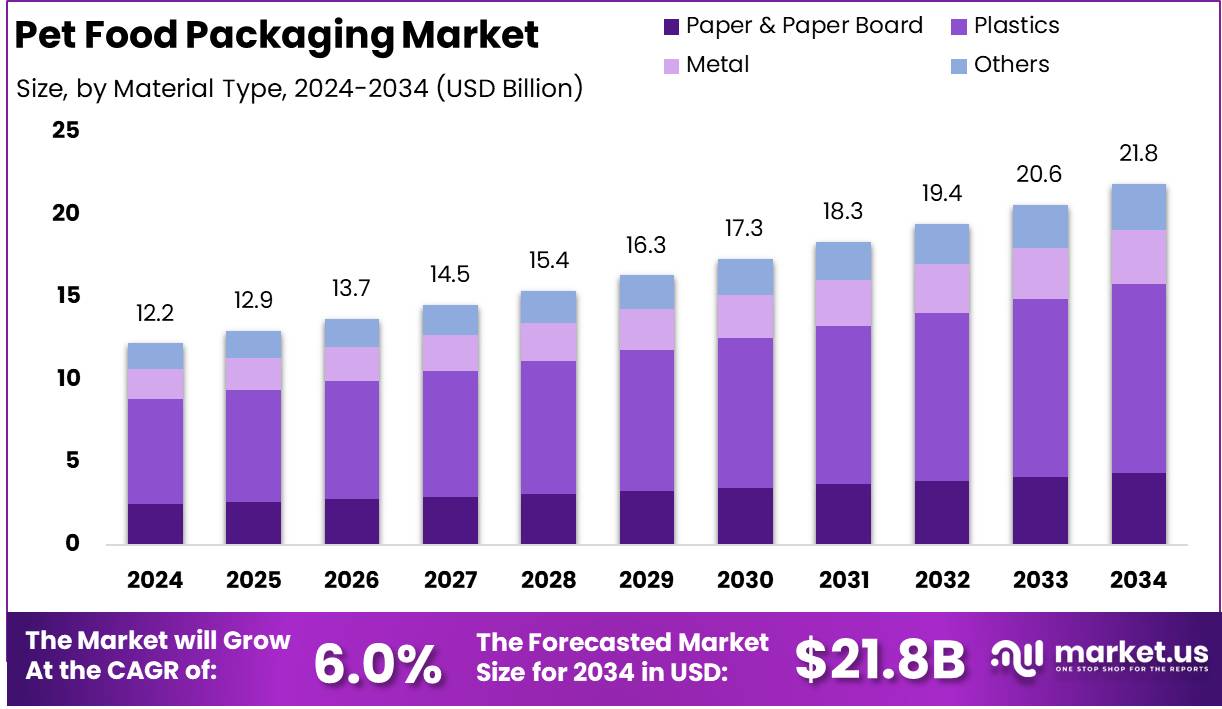

The Global Pet Food Packaging Market size is expected to be worth around USD 21.8 Billion by 2034 from USD 12.2 Billion in 2024, growing at a CAGR of 6.0% during the forecast period from 2025 to 2034.

Pet food packaging refers to the specialized materials and solutions designed to store, protect, and distribute pet food while maintaining its freshness, nutritional integrity, and safety. It encompasses various formats, including bags, pouches, cans, trays, and cartons, each tailored to different product types such as dry kibble, wet food, treats, and supplements.

These packaging solutions not only serve functional purposes like moisture and oxygen resistance but also enhance branding, sustainability, and convenience for pet owners.

The pet food packaging market represents the industry focused on developing, manufacturing, and supplying packaging solutions for pet food products. It is a dynamic sector influenced by evolving consumer preferences, regulatory requirements, and advancements in packaging technology. With rising pet ownership and increasing demand for premium and natural pet food, the market is characterized by innovation in sustainable materials, smart packaging, and user-friendly designs.

The expansion of the pet food packaging market is primarily driven by the rising pet population and the humanization of pets, leading to increased spending on high-quality food and packaging. Innovations in eco-friendly materials, such as biodegradable films and recyclable packaging, are reshaping the industry as sustainability concerns grow.

The demand for pet food packaging is experiencing steady growth, driven by a surge in premium and specialized pet food categories. Consumers are increasingly seeking packaging that aligns with their values, including recyclable and reusable options, as well as those that ensure portion control and ease of use.

The e-commerce boom has further elevated the need for durable and lightweight packaging that withstands shipping conditions while maintaining product integrity. Brand differentiation through innovative designs and digital integration, such as QR codes for traceability, is also shaping purchasing decisions.

Significant opportunities exist in the development of sustainable packaging solutions that address both environmental concerns and regulatory pressures. The adoption of flexible packaging formats, such as stand-up pouches with resealable zippers, presents an avenue for growth due to their convenience and reduced material usage. Advancements in intelligent packaging, including freshness indicators and interactive labels, offer potential for enhanced consumer engagement and product safety.

The Pet Food Packaging Market is witnessing a strong shift toward sustainability, driven by rising consumer awareness and regulatory pressures. Plastic packaging contributes to nearly 40% of global plastic waste, with 40% being single-use, yet only 14% is collected for recycling.

The Conscious Insider reports that 43% of consumers consider environmental impact crucial when choosing packaging, while 50% are willing to pay a premium for sustainable options. Notably, reusing just 10–20% of plastic packaging could reduce ocean plastic waste by 50%, underscoring the critical need for sustainable innovations in pet food packaging solutions.

According to Business Waste, the Pet Food Packaging Market is facing mounting pressure to adopt sustainable solutions as plastic waste concerns intensify. Food and drink packaging alone contributes to 83% of plastic waste in UK households, while packaging accounts for 40% of global plastic waste.

The world generates 141 million tonnes of plastic packaging annually, with the EU responsible for 84 million tonnes of waste. Fast food packaging makes up 88% of coastline litter, while just 10 plastic products, including coffee cup lids, account for 75% of ocean debris. These statistics underscore the urgent need for eco-friendly pet food packaging innovations.

Key Takeaways

- The global pet food packaging market is projected to reach USD 21.8 billion by 2034, up from USD 12.2 billion in 2024, expanding at a CAGR of 6.0% (2025–2034).

- Plastics held the largest market share in 2024, accounting for 52.4% of total revenue.

- Pouches emerged as the leading product type, capturing 39.2% of the market share in 2024.

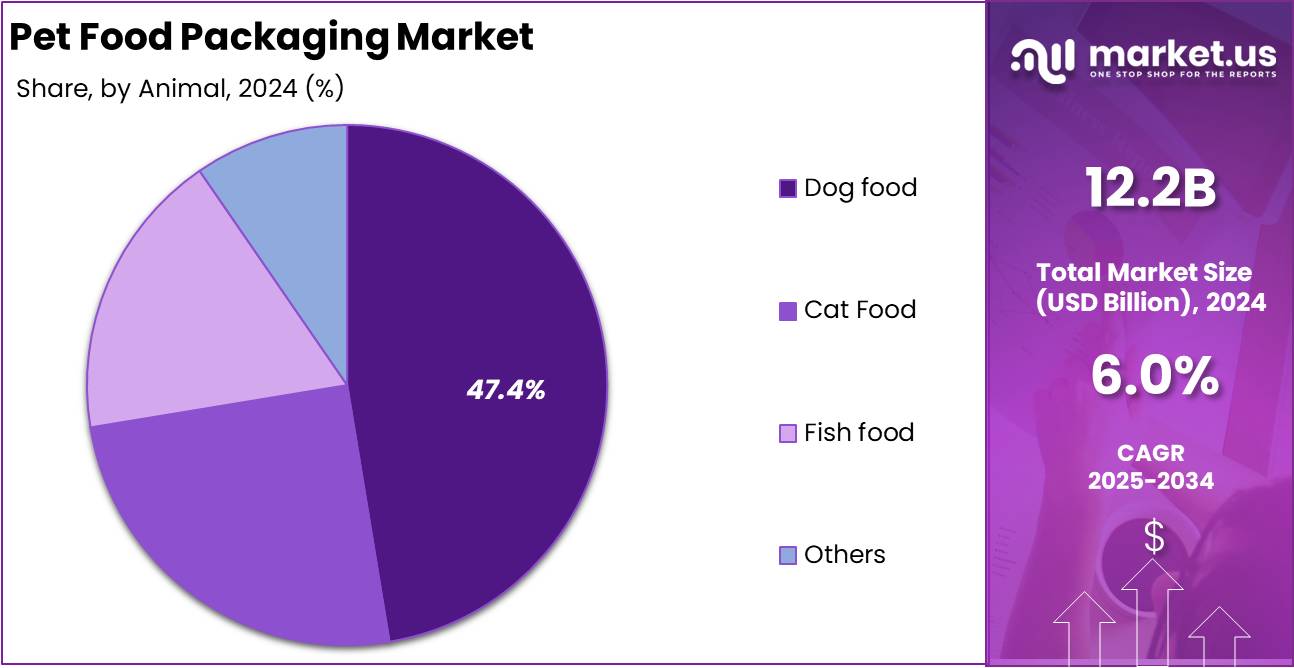

- Dog food dominated the market, representing 47.4% of the total share in 2024.

- Dry pet food led the segment, accounting for 43.3% of the market in 2024.

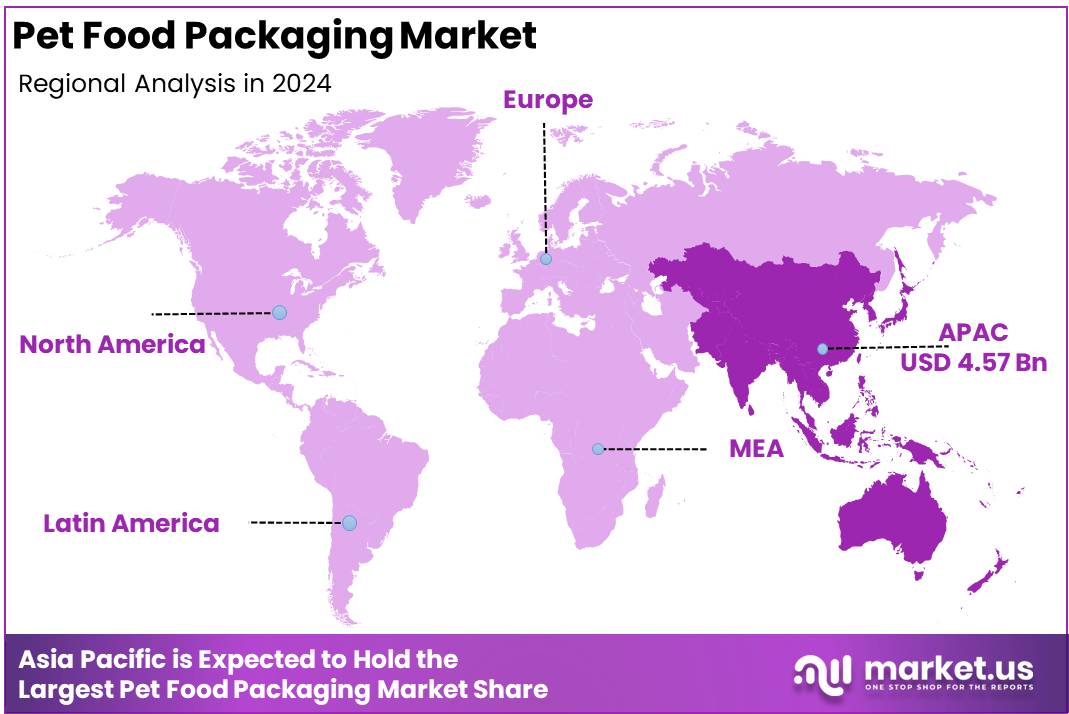

- Asia Pacific remained the dominant region, holding 37.5% of the market share in 2024, valued at approximately USD 4.57 billion.

By Material Type Analysis

Plastics Dominate the Pet Food Packaging Market with a 52.4% Share

In 2024, plastics held a dominant position in the pet food packaging market by material type, capturing more than a 52.4% share. The segment’s growth is driven by its cost-effectiveness, durability, lightweight properties, and ability to offer extended shelf life for pet food products. Flexible pouches, resealable bags, and barrier films are widely adopted due to their convenience and protective qualities, making plastics the preferred choice among manufacturers.

Paper & paperboard hold a significant share of the pet food packaging market, driven by the increasing preference for sustainable and recyclable packaging solutions. Growing consumer awareness of environmental concerns and stringent regulations on plastic usage have encouraged manufacturers to explore eco-friendly alternatives such as kraft paper bags and coated paperboard cartons. The segment continues to expand as brands prioritize biodegradable and renewable packaging options.

Metal packaging, including aluminum and steel cans, remains a crucial segment in pet food packaging, primarily catering to wet pet food products. The segment benefits from its superior preservation capabilities, ensuring freshness and extended shelf life.

Alternative packaging materials, including biodegradable films, glass, and composite materials, are steadily gaining attention in the pet food packaging market. The segment is fueled by increasing innovation in sustainable packaging solutions, as brands align with eco-conscious consumer preferences.

While currently occupying a niche space, advancements in compostable and plant-based materials are expected to drive further growth, catering to the rising demand for environmentally friendly packaging alternatives.

By Product Type Analysis

Pouches Dominate the Pet Food Packaging Market with a 39.2% Share

In 2024, pouches held a dominant position in the pet food packaging market by product type, capturing more than a 39.2% share. The segment’s growth is driven by its lightweight nature, cost efficiency, and convenience features such as resealability and easy storage.

Pouches offer excellent barrier protection, preserving pet food freshness while minimizing material usage, making them a preferred choice among manufacturers and consumers.

Folding cartons represent a notable portion of the pet food packaging market, driven by increasing consumer demand for eco-friendly and recyclable solutions. These cartons are widely used for dry pet food and treats, offering strong structural integrity and effective branding opportunities through high-quality printing and customization. Their sustainable appeal continues to attract manufacturers seeking environmentally responsible packaging options.

Metal cans continue to be a preferred choice in pet food packaging, primarily catering to wet pet food products. The segment benefits from superior preservation qualities, extended shelf life, and tamper resistance. Additionally, metal cans provide strong protection against external contaminants and are fully recyclable, making them a popular option for premium pet food brands focusing on product integrity.

Bags hold a significant share of the pet food packaging market, driven by their affordability, ease of transportation, and ability to store large volumes of pet food. Multi-layered bags with barrier coatings help maintain product freshness while offering durability. The segment continues to expand as manufacturers introduce resealable closures and sustainable material alternatives to meet evolving consumer preferences.

Other packaging formats, including rigid containers, biodegradable packaging, and advanced flexible solutions, are gaining attention in the pet food packaging market. As brands explore new materials and technologies, these alternatives are becoming increasingly relevant for enhancing sustainability, convenience, and premium appeal in pet food packaging.

By Animal Analysis

Dog Food Dominates the Pet Food Packaging Market with a 47.4% Share

In 2024, dog food held a dominant position in the pet food packaging market by animal type, capturing more than a 47.4% share. The segment’s growth is driven by the rising pet adoption rates, increasing demand for premium and specialized dog food, and the need for convenient and durable packaging solutions.

Flexible pouches, bags, and folding cartons are widely used due to their ability to preserve freshness and enhance portability.

Cat food remains a key segment in the pet food packaging market, supported by the growing preference for wet and specialty diets among cat owners. Metal cans, pouches, and resealable bags are widely used due to their superior preservation and portion control benefits.

The increasing demand for sustainable and premium packaging solutions is further driving innovation in this category.

Fish food packaging continues to expand, driven by the rising number of aquarium enthusiasts and the growing demand for specialized nutrition for ornamental fish. The segment favors small, moisture-resistant packaging formats such as plastic tubs, resealable pouches, and laminated sachets to maintain product quality and enhance ease of use.

Other pet food categories, including bird, reptile, and small mammal food, represent a niche but steadily growing segment in the pet food packaging market. The demand for resealable pouches, biodegradable materials, and customized portion sizes is increasing as brands focus on providing tailored solutions for diverse pet dietary needs.

By Food Type Analysis

Dry Food Dominates the Pet Food Packaging Market with a 43.3% Share

In 2024, dry food held a dominant position in the pet food packaging market by food type, capturing more than a 43.3% share. The segment’s growth is driven by its long shelf life, ease of storage, and cost-effectiveness. Packaging formats such as multi-layered bags, pouches, and folding cartons are widely used to ensure product freshness, convenience, and durability.

Wet food remains a key segment in the pet food packaging market, supported by the rising demand for high-moisture and nutrient-rich pet diets.

Metal cans, single-serve trays, and pouches are the preferred packaging formats due to their superior preservation, extended shelf life, and portion control benefits. The growing interest in premium and organic wet food products is further driving packaging innovations.

Pet treats continue to capture a notable share in the pet food packaging market, fueled by the increasing trend of pet humanization and the demand for functional treats.

Resealable pouches, plastic tubs, and stand-up bags are widely used to maintain product freshness and enhance convenience. The segment is expanding as pet owners seek healthier and customized treat options.

Other pet food categories, including specialty and medicated diets, represent a steadily growing segment in the pet food packaging market. The demand for sustainable, resealable, and premium packaging solutions is increasing as brands focus on catering to niche pet nutrition needs and evolving consumer preferences.

Key Market Segments

By Material Type

- Paper & Paper Board

- Plastics

- Metal

- Others

By Product Type

- Pouches

- Folding Carton

- Metal cans

- Bags

- Others

By Animal

- Dog food

- Cat Food

- Fish food

- Others

By Food Type

- Dry food

- Wet food

- Pet treats

- Others

Driver

Rising Pet Ownership and Humanization Fueling Packaging Demand

The global pet food packaging market has experienced significant growth, primarily driven by the increasing rates of pet ownership worldwide. This trend has led to a heightened demand for pet food products, subsequently boosting the need for diverse and innovative packaging solutions.

As more households welcome pets, the emphasis on providing high-quality nutrition has intensified, prompting manufacturers to seek packaging that ensures product freshness, safety, and convenience. This surge in pet ownership has created a robust market for pet food packaging, encouraging continuous innovation and expansion within the industry.

The humanization of pets, where pets are increasingly considered family members, has further propelled the demand for premium pet food products. This shift has led to a preference for packaging that reflects the quality and care associated with human food products.

Consumers now seek packaging that is not only functional but also aesthetically pleasing, mirroring the trends seen in human food packaging. This evolution in consumer behavior has compelled manufacturers to invest in packaging designs that resonate with pet owners’ sensibilities, thereby driving the growth of the pet food packaging market.

Restraint

Stringent Regulatory Standards Challenging Packaging Innovations

The pet food packaging industry faces significant challenges due to stringent regulatory standards aimed at ensuring pet food safety and quality. These regulations impose rigorous requirements on packaging materials and processes to prevent contamination and preserve nutritional value.

While essential for consumer protection, these stringent standards can limit the flexibility of manufacturers in adopting innovative packaging solutions. Compliance with diverse regional regulations necessitates substantial investments in research and development, as well as modifications to existing packaging lines, thereby restraining the pace of innovation within the industry.

Moreover, the need to adhere to these stringent regulations can lead to increased operational costs for manufacturers. Ensuring that packaging materials meet safety standards often requires sourcing specialized materials and implementing advanced quality control measures.

These additional expenses can pose financial challenges, particularly for smaller companies, potentially hindering their competitiveness in the market. Consequently, while regulatory standards are crucial for maintaining pet food safety, they also present obstacles that can impede the growth and diversification of packaging solutions within the industry.

Opportunity

E-Commerce Expansion Driving Innovative Packaging Solutions

The rapid expansion of e-commerce presents a significant opportunity for the pet food packaging market. As consumers increasingly turn to online platforms for pet food purchases, there is a growing demand for packaging solutions tailored to the unique requirements of e-commerce.

This shift necessitates the development of packaging that ensures product integrity during transit, offers convenience in handling, and aligns with sustainability goals. Manufacturers have the opportunity to innovate by creating packaging designs that are both durable and lightweight, optimizing shipping efficiency and enhancing the consumer unboxing experience.

Additionally, e-commerce platforms provide a direct channel for brands to engage with consumers, allowing for personalized packaging solutions that cater to specific preferences. This direct interaction enables the collection of consumer feedback, facilitating continuous improvement in packaging designs.

By leveraging the e-commerce boom, pet food packaging manufacturers can expand their market reach, adapt to evolving consumer behaviors, and capitalize on the growing trend of online shopping, thereby driving growth and differentiation in the competitive pet food packaging landscape.

Trends

Sustainability Initiatives Shaping Packaging Innovations

A prominent trend influencing the pet food packaging market is the increasing emphasis on sustainability. Consumers are becoming more environmentally conscious, leading to a demand for eco-friendly packaging solutions. This shift has prompted manufacturers to explore recyclable, biodegradable, and compostable materials, reducing the environmental footprint of pet food packaging.

The adoption of sustainable packaging not only appeals to eco-conscious consumers but also aligns with global efforts to reduce plastic waste and promote environmental stewardship. Incorporating sustainable practices into packaging design has also become a key differentiator for brands. Companies that prioritize sustainability are perceived more favorably, enhancing brand loyalty and attracting a broader customer base.

This trend has led to innovations such as the use of plant-based materials, reduced packaging weight, and the development of reusable packaging options. By embracing sustainability, the pet food packaging industry is not only responding to consumer demands but also contributing to global environmental initiatives, thereby ensuring long-term market growth and relevance.

Regional Analysis

Asia Pacific Leads Pet Food Packaging Market with Largest Market Share of 37.5% in 2024

The Asia Pacific region dominates the pet food packaging market, accounting for 37.5% of the total market share in 2024, with a market valuation of approximately USD 4.57 billion. The region’s growth is driven by rising pet ownership, particularly in countries like China, India, and Japan, coupled with increasing consumer spending on premium pet food products.

Additionally, the demand for sustainable and flexible packaging solutions has surged, further propelling market expansion. The growing presence of e-commerce platforms has also contributed to increased sales of packaged pet food, thereby driving packaging demand.

North America holds a significant share in the pet food packaging market, supported by strong pet ownership trends and a high preference for premium and organic pet food. The growing inclination toward sustainable packaging solutions and the use of recyclable materials are key factors influencing market growth.

The United States remains the primary contributor within the region, where consumer demand for innovative packaging formats, including resealable pouches and single-serve packs, continues to rise.

Europe exhibits a robust demand for pet food packaging, with countries such as Germany, the United Kingdom, and France leading the market. The increasing focus on eco-friendly and biodegradable packaging solutions aligns with stringent regulatory frameworks that promote sustainability.

The rising demand for high-quality pet food products and convenient packaging formats further supports the market’s growth.

The Middle East & Africa region is experiencing steady market expansion, driven by increasing pet adoption rates and urbanization in key markets such as the UAE and South Africa. The growing middle-class population and higher disposable income levels have led to greater expenditure on pet food products, subsequently boosting packaging demand.

Latin America is witnessing moderate growth in the pet food packaging market, with countries like Brazil, Mexico, and Argentina contributing to the regional market’s expansion. The increasing trend of pet humanization and the rising adoption of premium pet food products are key drivers of packaging innovations and material advancements in this region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The competitive landscape of the Global Pet Food Packaging Market in 2024 is characterized by the presence of several established players focusing on innovation, sustainability, and strategic expansions.

Amcor Plc, Berry Global Inc., and Mondi plc are leading the market with their advancements in flexible and recyclable packaging solutions, responding to increasing consumer demand for sustainable alternatives. Ardagh Group S.A. and Crown continue to strengthen their positions in metal packaging, ensuring product freshness and extended shelf life.

Sonoco Products Company, Smurfit Kappa, and Sealed Air are leveraging their expertise in paper-based and protective packaging to meet evolving market needs. Constantia Flexibles, ProAmpac, and Printpack Inc. are expanding their product portfolios with high-barrier films and lightweight materials, enhancing product convenience and durability.

Meanwhile, ePac Holdings, LLC and Uniflex are capitalizing on digital printing technologies to offer customization and small-batch production capabilities, catering to niche pet food brands.

KM Packaging Services Ltd., Goglio S.p.A., and Winpak Ltd. are focusing on retortable pouches and vacuum-sealed packaging for wet pet food applications, ensuring product safety and extended shelf life. H.B. Fuller Company plays a critical role as a supplier of advanced adhesives, supporting the overall structural integrity of pet food packaging.

Huhtamaki Oyj and Transcontinental Inc. are reinforcing their market presence through investments in circular economy initiatives, promoting compostable and recyclable packaging solutions. As consumer preferences shift toward premium, sustainable, and functional packaging, these key players are expected to drive innovation and market growth through strategic partnerships, acquisitions, and technological advancements.

Top Key Players in the Market

- Amcor Plc

- Ardagh Group S.A.

- Berry Global Inc.

- Sonoco Products Company

- Constantia Flexibles

- Crown

- ePac Holdings, LLC

- Goglio S.p.A.

- H.B. Fuller Company

- Huhtamaki Oyj

- KM Packaging Services Ltd.

- Mondi plc

- Printpack Inc.

- ProAmpac

- Sealed Air

- Silgan Holdings Inc.

- Smurfit Kappa

- Sonoco Products Company

- Transcontinental Inc.

- Uniflex

- Winpak Ltd.

Recent Developments

- In 2025, Nestlé Purina PetCare expands its presence in the premium pet food segment by acquiring a majority stake in a leading European natural pet food brand. This acquisition strengthens its portfolio in the rapidly growing natural and organic pet nutrition market. The deal, valued at approximately $850 million, aligns with the company’s strategy to meet increasing consumer demand for high-quality, sustainable pet food products.

- In 2024, Mars Petcare strengthens its veterinary business with the acquisition of a regional animal healthcare network in North America. The move enhances its service capabilities and expands access to pet wellness solutions. The newly acquired network includes over 120 clinics, positioning Mars Petcare for further growth in preventive pet healthcare services.

- In 2023, Champion Petfoods broadens its global distribution by entering new Asian markets. The company launches its premium ORIJEN and ACANA brands in South Korea and Thailand, responding to rising demand for biologically appropriate pet diets. This expansion supports its long-term strategy of reaching new pet owners seeking high-protein, natural nutrition options.

- In 2025, Blue Buffalo introduces an innovative fresh pet food line, targeting pet owners looking for refrigerated, minimally processed meal options. The new product range, developed in partnership with veterinary nutritionists, focuses on high-quality ingredients and functional benefits, reinforcing Blue Buffalo’s commitment to pet health and wellness.

Report Scope

Report Features Description Market Value (2024) USD 12.2 Billion Forecast Revenue (2034) USD 21.8 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Paper & Paper Board, Plastics, Metal, Others), By Product Type (Pouches, Folding Carton, Metal cans, Bags, Others), By Animal (Dog food, Cat Food, Fish food, Others), By Food Type (Dry food, Wet food, Pet treats, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amcor Plc, Ardagh Group S.A., Berry Global Inc., Sonoco Products Company, Constantia Flexibles, Crown , ePac Holdings, LLC, Goglio S.p.A., H.B. Fuller Company, Huhtamaki Oyj, KM Packaging Services Ltd., Mondi plc, Printpack Inc., ProAmpac, Sealed Air, Silgan Holdings Inc., Smurfit Kappa, Sonoco Products Company, Transcontinental Inc., Uniflex, Winpak Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pet Food Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Pet Food Packaging MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor Plc

- Ardagh Group S.A.

- Berry Global Inc.

- Sonoco Products Company

- Constantia Flexibles

- Crown

- ePac Holdings, LLC

- Goglio S.p.A.

- H.B. Fuller Company

- Huhtamaki Oyj

- KM Packaging Services Ltd.

- Mondi plc

- Printpack Inc.

- ProAmpac

- Sealed Air

- Silgan Holdings Inc.

- Smurfit Kappa

- Sonoco Products Company

- Transcontinental Inc.

- Uniflex

- Winpak Ltd.