Global Pet Antibody Testing Market By Product Type (Kits, Instruments & Readers, and Reagents & Controls), By Animal Type (Companion Animals and Livestock Animals), By Application (Chronic Conditions and Infectious Diseases), By End-user (Veterinary Clinics, Veterinary Hospitals & Specialty Centers, and Diagnostic Laboratories), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164398

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

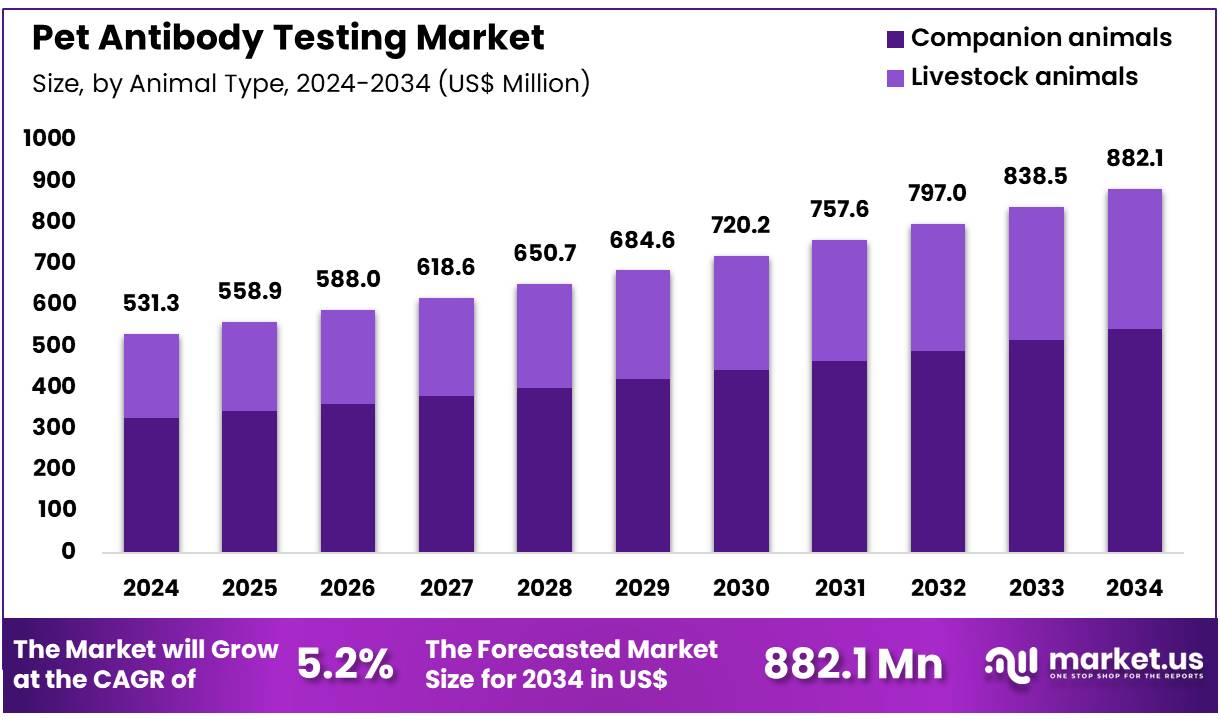

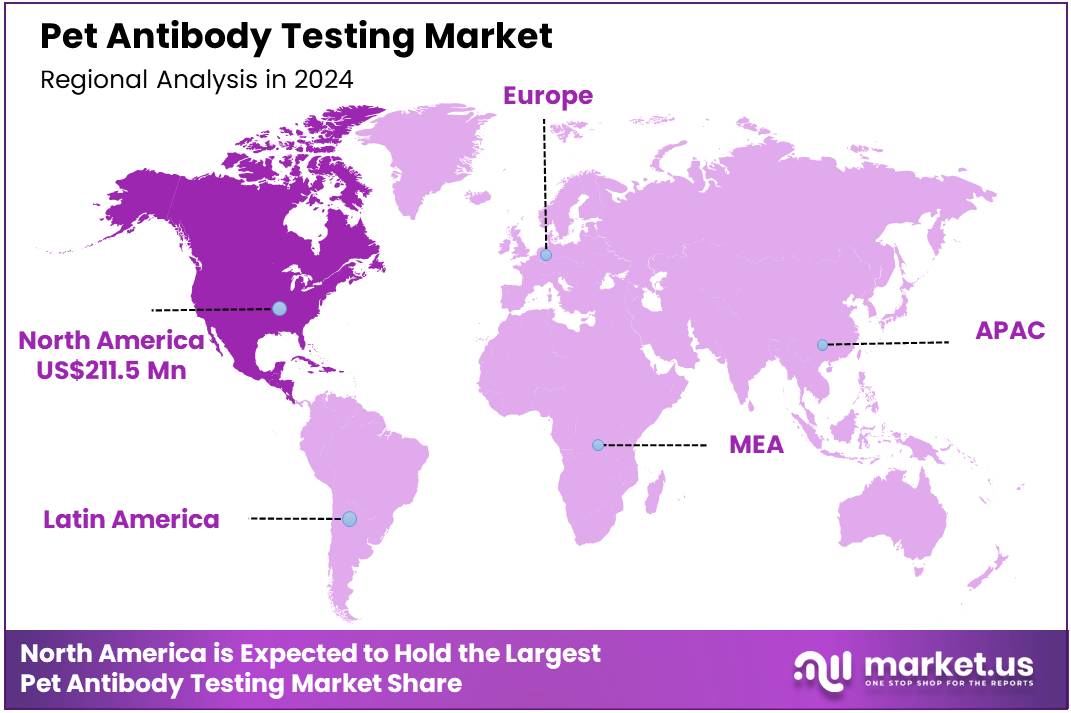

The Global Pet Antibody Testing Market size is expected to be worth around US$ 882.1 Million by 2034 from US$ 531.3 Million in 2024, growing at a CAGR of 5.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.8% share with a revenue of US$ 211.5 Million.

Increasing development of monoclonal antibody therapies drives the Pet Antibody Testing Market, as veterinary pharmaceutical companies require precise immunogenicity assessments. Biologics manufacturers apply antibody testing to evaluate therapeutic monoclonal antibodies in canine oncology, ensuring specificity and minimal cross-reactivity.

These assays support vaccine potency validation by measuring humoral responses in companion animals post-immunization. Research facilities utilize them to monitor adverse immune reactions during preclinical safety studies. In April 2025, Virbac partnered with MabGenesis to co-develop monoclonal antibodies for canine diseases, heightening demand for advanced antibody testing in precision veterinary biologics. This collaboration fuels market growth by aligning diagnostics with innovative therapeutic pipelines.

Growing focus on immunotherapy clinical trials creates opportunities in the Pet Antibody Testing Market, as multi-center studies demand standardized biomarker validation. Veterinary nephrologists employ antibody assays to assess treatment efficacy in feline chronic kidney disease models, guiding dose optimization. These tests aid in patient stratification by detecting pre-existing antibodies against novel biologics, reducing trial risks.

Point-of-care serology kits enable real-time monitoring in hospitalized pets undergoing experimental therapies. In June 2025, the Institute for AIM Medicine launched a multi-center trial for injectable AIM treatment in feline chronic kidney disease across 26 hospitals. This initiative drives market expansion through increased need for validated antibody testing in immunotherapy research.

Rising regulatory approvals for passive immunity products propel the Pet Antibody Testing Market, as conditional licenses mandate companion diagnostic accuracy. Veterinarians integrate antibody testing with parvovirus antigen assays to confirm exposure and quantify maternal antibody interference in puppies. These diagnostics support emergency protocols by verifying passive transfer success post-monoclonal antibody administration.

Trends toward rapid ELISA formats streamline workflow in high-volume clinics managing infectious outbreaks. In June 2025, the USDA granted conditional approval to Elanco’s Canine Parvovirus Monoclonal Antibody for preventive use in exposed puppies. This milestone positions the market for sustained growth by emphasizing reliable antibody-antigen testing in prophylactic veterinary care.

Key Takeaways

- In 2024, the market generated a revenue of US$ 531.3 million, with a CAGR of 5.2%, and is expected to reach US$ 882.1 million by the year 2034.

- The product type segment is divided into kits, instruments & readers, and reagents & controls, with kits taking the lead in 2023 with a market share of 54.2%.

- Considering animal type, the market is divided into companion animals and livestock animals. Among these, companion animals held a significant share of 61.4%.

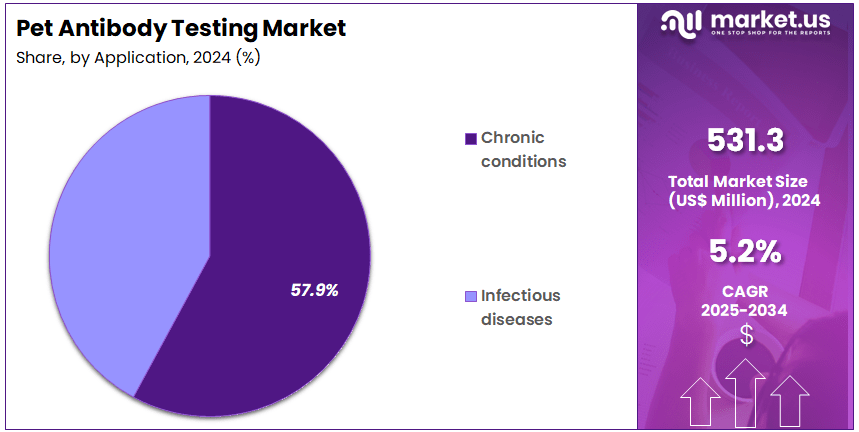

- Furthermore, concerning the application segment, the market is segregated into chronic conditions and infectious diseases. The chronic conditions sector stands out as the dominant player, holding the largest revenue share of 57.9% in the market.

- The end-user segment is segregated into veterinary clinics, veterinary hospitals & specialty centers, and diagnostic laboratories, with the veterinary clinics segment leading the market, holding a revenue share of 48.7%.

- North America led the market by securing a market share of 39.8% in 2023.

Product Type Analysis

Kits account for 54.2% of the Pet Antibody Testing market and are projected to dominate due to their ease of use, high efficiency, and suitability for in-clinic testing. Veterinary professionals increasingly adopt antibody testing kits for quick, point-of-care diagnostics to support immediate treatment decisions. The growing prevalence of chronic and infectious diseases in pets drives the demand for reliable, ready-to-use diagnostic kits.

Technological advances have led to the development of rapid immunoassay and ELISA-based kits with improved specificity and sensitivity. Manufacturers focus on creating species-specific testing kits that ensure accurate antibody detection in both dogs and cats. Increasing pet ownership and heightened awareness among pet owners about preventive health management strengthen the market growth. Kits designed for home testing are gaining attention among pet owners seeking convenient health monitoring options.

Rising partnerships between veterinary product manufacturers and clinics expand product accessibility. As diagnostic workflows shift toward quick and cost-effective testing, kits remain the preferred choice for veterinarians managing large patient volumes in clinical settings.

Animal Type Analysis

Companion animals account for 61.4% of the Pet Antibody Testing market and are expected to maintain dominance as global pet ownership and veterinary care expenditure continue to rise. Growing awareness about zoonotic diseases, preventive vaccinations, and wellness diagnostics contributes to increased testing frequency. Dogs and cats, being the most commonly owned pets, represent the majority of antibody testing demand.

The growing prevalence of chronic conditions such as autoimmune disorders, allergies, and renal diseases among companion animals further fuels testing needs. Veterinary clinics and specialty hospitals emphasize routine antibody monitoring for vaccinated pets to ensure immune protection levels. Pet insurance companies increasingly include diagnostic testing coverage, enhancing affordability and adoption.

Companion animal healthcare is witnessing technological integration through AI-assisted test interpretation and connected diagnostic platforms. The surge in adoption of advanced immunodiagnostic tools and increased spending on pet healthcare are anticipated to sustain market growth. As the humanization of pets accelerates globally, companion animal diagnostics remain a central pillar of preventive veterinary medicine.

Application Analysis

Chronic conditions represent 57.9% of the Pet Antibody Testing market and are projected to dominate due to the rising incidence of long-term health disorders among companion animals. Conditions such as arthritis, diabetes, hypothyroidism, and autoimmune diseases require regular antibody monitoring for disease management. Veterinarians increasingly rely on antibody tests to assess immune response and detect early-stage immune dysfunction.

The growing lifespan of pets, supported by better nutrition and healthcare access, contributes to a higher prevalence of chronic illnesses that require continuous diagnostics. Advanced antibody testing allows veterinarians to personalize treatment regimens and monitor therapeutic efficacy. The adoption of serological testing panels that track antibodies against multiple disease markers simultaneously enhances efficiency in chronic disease management.

Pharmaceutical companies developing long-term veterinary therapies use antibody tests for post-treatment monitoring. Rising demand for wellness testing packages offered by veterinary clinics also supports chronic condition diagnostics. As preventive healthcare continues to gain traction in veterinary practice, chronic condition testing remains a key growth area driving sustained market demand.

End-User Analysis

Veterinary clinics hold 48.7% of the Pet Antibody Testing market and are expected to remain the largest end-user segment due to their central role in providing accessible and routine animal healthcare services. Clinics increasingly integrate rapid antibody testing kits to enable immediate diagnosis and treatment within a single visit. The rise in preventive veterinary care encourages pet owners to visit clinics regularly for screening and antibody monitoring.

The growing number of independent veterinary practices and small animal clinics enhances accessibility in both urban and semi-urban areas. Clinics prefer cost-effective diagnostic solutions that require minimal infrastructure and deliver quick, reliable results. Collaboration between diagnostic manufacturers and veterinary clinics accelerates test adoption through bulk supply agreements and training programs.

The increasing use of point-of-care testing (POCT) in clinics minimizes dependency on external laboratories. With the growing trend of pet wellness programs and tele-veterinary consultations, clinics are expanding testing capabilities to meet real-time diagnostic needs. As personalized veterinary care gains momentum, veterinary clinics are anticipated to remain the primary testing hubs for antibody diagnostics in companion animals.

Key Market Segments

By Product Type

- Kits

- Instruments & Readers

- Reagents & Controls

By Animal Type

- Companion Animals

- Livestock Animals

By Application

- Chronic Conditions

- Infectious Diseases

By End-user

- Veterinary Clinics

- Veterinary Hospitals & Specialty Centers

- Diagnostic Laboratories

Drivers

Increasing Pet Ownership is Driving the Market

The rapid growth in pet ownership has significantly boosted the pet antibody testing market, as more households seek serological evaluations to confirm immunity status following vaccinations. Antibody testing for pets, primarily through ELISA kits, measures titers for diseases like rabies and parvovirus, ensuring protective levels and guiding booster schedules. This driver is fueled by the humanization of pets, where owners view them as family members, prioritizing preventive health checks.

Veterinary clinics are incorporating routine titer tests into wellness exams, enhancing early detection of susceptibility gaps. The trend is evident in urban areas, where busy lifestyles demand efficient, in-office diagnostics. Health campaigns by animal welfare groups promote titering over annual revaccination, reducing over-immunization risks.

The American Veterinary Medical Association reported 88.8 million dogs and 61.9 million cats in U.S. households in 2022, representing a 6% rise in pet ownership from 1988 levels. This expansion underscores the testing need, as owners invest in longevity through informed vaccination strategies. Innovations in rapid lateral flow assays simplify access, fitting diverse sample types like serum and whole blood. Economically, titer confirmation avoids unnecessary boosters, aligning with cost-conscious pet care.

Global veterinary associations standardize titer thresholds, facilitating cross-border pet travel requirements. This ownership surge not only heightens testing frequency but also embeds antibody assessments in holistic pet health routines. Ultimately, it spurs developments in user-friendly kits, coordinating diagnostics with lifestyle demands.

Restraints

High Development Costs for Specialized Assays is Restraining the Market

The substantial expenses involved in creating and validating pet-specific antibody tests continue to limit market growth, particularly for smaller veterinary labs facing budget constraints. These assays, requiring rigorous specificity for canine and feline immunoglobulins, demand advanced biotechnology that inflates production and regulatory hurdles. This barrier discourages innovation in niche diseases, confining offerings to major pathogens like distemper.

Reimbursement gaps in pet insurance further exacerbate affordability, with owners opting for basic wellness over comprehensive titering. Manufacturers navigate extended validation trials, diverting funds from scalability to compliance. The outcome sustains reliance on generic human-adapted tests, compromising accuracy for species-specific responses.

The U.S. Food and Drug Administration processed 18,800 medical device submissions in 2022, including veterinary diagnostics, where antibody assays underwent stringent performance reviews, prolonging market entry. These reviews expose procedural delays, as qualification demands exhaustive dossiers. Veterinarian preferences favor economical alternatives, marginalizing advanced titer options.

Campaigns for subsidized validations advance cautiously, restricted by funding priorities. These cost challenges not only curb expansion but also maintain disparities in test availability. Thus, they call for collaborative funding to merge affordability with precision objectives.

Opportunities

Advancements in Point-of-Care Antibody Detection is Creating Growth Opportunities

Innovations in portable antibody testing devices have revealed broad prospects for the pet antibody testing market, enabling immediate results in clinic settings to support on-the-spot vaccination decisions. These handheld analyzers, using fluorescence immunoassay, quantify rabies and feline leukemia titers within minutes, bypassing lab shipping delays. Opportunities arise in mobile veterinary services, where subsidies fund validations for remote rural practices.

Company-veterinary partnerships underwrite cartridge developments, filling gaps in multi-disease screening. This portability resolves access barriers, positioning tests as tools for proactive herd health in breeding facilities. Investments in compact formats accelerate adoptions, varying to integrated wellness panels. The North American Pet Health Insurance Association reported 5.4 million insured companion animals in the U.S. and Canada in 2022, up 22% from 4.4 million in 2021, spurring demand for affordable antibody verification.

This growth affirms viable models, with insurance expansions projecting higher kit procurements. Formulations with stable reagents improve shelf life, easing storage in field conditions. As connectivity features develop, device outputs generate trend insights for practices. These POC evolutions not only widen usage fields but also blend the market into convenient health services. Hence, they nurture ties with insurers, reinforcing coverage for preventive diagnostics.

Impact of Macroeconomic / Geopolitical Factors

Robust economic expansion and climbing disposable incomes among urban households propel pet owners toward proactive antibody testing for conditions like Lyme disease and heartworm, empowering veterinarians to deliver swift, tailored interventions that extend animal lifespans and deepen client loyalty. Escalating inflation, nonetheless, squeezes veterinary clinic budgets, prompting operators to ration advanced serological kits and defer upgrades to automated immunoassay platforms critical for high-volume practices.

Geopolitical strains, including the ongoing Russia-Ukraine conflict, fragment sourcing networks for monoclonal antibody reagents derived from European biotech hubs, forcing suppliers to contend with erratic freight rates and customs bottlenecks that undermine seasonal testing surges. Current US tariffs, levying a 10% baseline duty on imported diagnostic consumables such as ELISA plates and lateral flow devices effective since April 2025, compound these pressures by inflating procurement expenses for overseas-sourced panels, which threatens viability for independent labs serving rural pet communities.

Nevertheless, these import duties galvanize domestic innovation, spurring US firms to pioneer cost-efficient, blockchain-verified antibody assays that streamline compliance for cross-border pet travel and zoonotic risk assessment. In addition, surging pet insurance penetration—now covering diagnostics in over 30% of policies—shields owners from out-of-pocket hikes, channeling steady revenue into expanded testing protocols.

Latest Trends

FDA Clearance of BioStone’s AsurDx Rabies Antibody Test Kit is a Recent Trend

The approval of user-friendly rabies titer kits has highlighted a key development in pet antibody testing during 2024, streamlining post-vaccination verification for international travel compliance. BioStone Animal Health’s AsurDx, an ELISA-based assay, detects rabies virus neutralizing antibodies in mammalian serum with high sensitivity, supporting one-visit confirmations. This clearance embodies a transition to economical formats, fitting non-specialist operators in general practices.

Regulatory affirmations confirm its reliability, speeding guideline inclusions for export certificates. This convenience dovetails with mobility needs, linking results to digital passports for seamless border crossings. The kit tackles verification bottlenecks, emphasizing setups durable to sample variabilities.

BioStone Animal Health launched the AsurDx Rabies Antibody Test Kit in February 2024, providing a rapid, cost-effective screening tool for rabies antibodies in mammalian serum. These introductions underscore expandability, as field trials validate equivalence to gold standards.

Observers forecast protocol adoptions, enhancing its role in routine prophylactics. Progressive assessments show mismatch reductions, optimizing procedural efficiencies. The outlook envisions multiplex add-ons, anticipating polyvalent protections. This ELISA-focused innovation not only sharpens titer accuracy but also aligns with global pet mobility mandates.

Regional Analysis

North America is leading the Pet Antibody Testing Market

In 2024, North America secured a 39.8% share of the global pet antibody testing market, driven by surging demand for rabies serology assays amid heightened travel requirements and post-vaccination titer checks, as pet owners increasingly seek confirmation of protective immunity levels to comply with international import regulations.

Veterinary clinics expanded usage of ELISA-based kits for parvovirus antibody detection, enabling proactive assessments in puppies to guide booster schedules, particularly following USDA’s conditional approval of innovative monoclonal therapies that necessitate efficacy monitoring.

The American Veterinary Medical Association’s data highlighted rising veterinary visits, correlating with federal initiatives from the USDA to enhance zoonotic surveillance, where antibody profiling supports early intervention in companion animals exposed to emerging pathogens like avian influenza.

Demographic trends, including a 33% household dog ownership rate, amplified testing volumes in urban practices, where point-of-care platforms reduced turnaround times to under 30 minutes for feline leukemia virus screening. Technological advancements in multiplex immunoassays facilitated simultaneous detection of multiple antibodies, appealing to shelters for efficient herd health evaluations.

These factors exemplified the region’s focus on preventive veterinary serology. The American Veterinary Medical Association verified 202.4 million annual veterinary visits in the United States in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

National agencies across Asia Pacific project the pet antibody testing sector to flourish during the forecast period, as public health priorities emphasize serological surveillance to mitigate zoonotic risks in rapidly urbanizing pet-owning populations. Officials in China and India allocate resources to rabies titer kits, equipping municipal clinics to verify immunity in stray dog vaccination drives.

Diagnostic providers collaborate with regional labs to standardize parvovirus ELISA panels, anticipating broader adoption for breeding programs in high-density livestock zones. Oversight bodies in Japan and South Korea subsidize feline leukemia assays, positioning community centers to monitor antibody responses without advanced infrastructure. Administrative networks estimate integrating test data into digital pet health records, expediting interventions for avian influenza exposures in backyard flocks.

Regional veterinarians pioneer multiplex formats, coordinating with FAO hubs to profile cross-species antibody dynamics in tropical ecosystems. These initiatives cultivate a scalable framework for companion animal immunity assessment. The Food and Agriculture Organization reported 3.6 billion global ruminant livestock in 2022, with Asia Pacific hosting over 60% and driving demand for integrated pet testing.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Pet Antibody Testing Market drive growth by launching rapid point-of-care kits for vaccine and infection detection, boosting preventive veterinary care. They partner with pet insurers to bundle tests in wellness plans, enhancing accessibility. Companies develop multiplex panels for multiple antibodies, tackling zoonotic risks. Leaders acquire AI startups for accurate result analysis across breeds.

They expand in Asia-Pacific and Latin America via veterinary associations and subsidies. Additionally, they offer telehealth subscriptions for monitoring, ensuring loyalty and revenue. IDEXX Laboratories, Inc., founded in 1983 in Westbrook, Maine, leads veterinary diagnostics with SNAP tests for heartworm and Lyme, serving over 175 countries. CEO Jonathan J. Mazelsky oversees 9,200 employees, focusing on R&D and sustainability. The firm partners with clinics for efficient workflows, maintaining dominance through innovative, reliable solutions.

Top Key Players

- Wuhan J.H. Bio‑Tech Co., Ltd.

- TestLine Clinical Diagnostics

- Rohi Biotechnology Co., Ltd.

- Randox Laboratories

- IDEXX Laboratories

- Guangzhou Wondfo Biotech Co., Ltd.

- Getein Animal Medical Technology

- DRG Instruments GmbH

- Biogal-Galed Laboratories

- ALPCO

Recent Developments

- In June 2025, Elanco advanced its CPMA rollout with shelter-based sampling programs for parvo-exposed puppies. Beyond treatment, these programs strengthen Elanco’s footprint in diagnostic innovation by integrating antibody detection tools, encouraging broader adoption of antigen-based testing in companion animal health.

- In February 2024, BioStone Animal Health introduced the AsurDx™ Rabies Antibody Test Kit, an ELISA-based diagnostic tool enabling rapid and cost-effective antibody screening. This launch broadens access to point-of-care diagnostics, supporting vaccination verification and driving growth in the veterinary antibody and antigen testing market globally.

Report Scope

Report Features Description Market Value (2024) US$ 531.3 Million Forecast Revenue (2034) US$ 882.1 Million CAGR (2025-2034) Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Kits, Instruments & Readers, and Reagents & Controls), By Animal Type (Companion Animals and Livestock Animals), By Application (Chronic Conditions and Infectious Diseases), By End-user (Veterinary Clinics, Veterinary Hospitals & Specialty Centers, and Diagnostic Laboratories) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Wuhan J.H. Bio‑Tech Co., Ltd., TestLine Clinical Diagnostics, Rohi Biotechnology Co., Ltd., Randox Laboratories, IDEXX Laboratories, Guangzhou Wondfo Biotech Co., Ltd., Getein Animal Medical Technology, DRG Instruments GmbH, Biogal-Galed Laboratories, ALPCO. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pet Antibody Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Pet Antibody Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wuhan J.H. Bio‑Tech Co., Ltd.

- TestLine Clinical Diagnostics

- Rohi Biotechnology Co., Ltd.

- Randox Laboratories

- IDEXX Laboratories

- Guangzhou Wondfo Biotech Co., Ltd.

- Getein Animal Medical Technology

- DRG Instruments GmbH

- Biogal-Galed Laboratories

- ALPCO