Global Outpatient Care Market By Type (Public and Private), By Application (Hospitals, Ambulatory Surgical Centres, and Others), By Service Types (Ambulatory Surgical Centers, Urgent Care Centers, Diagnostic Imaging Centers, Primary Care Clinics, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152462

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

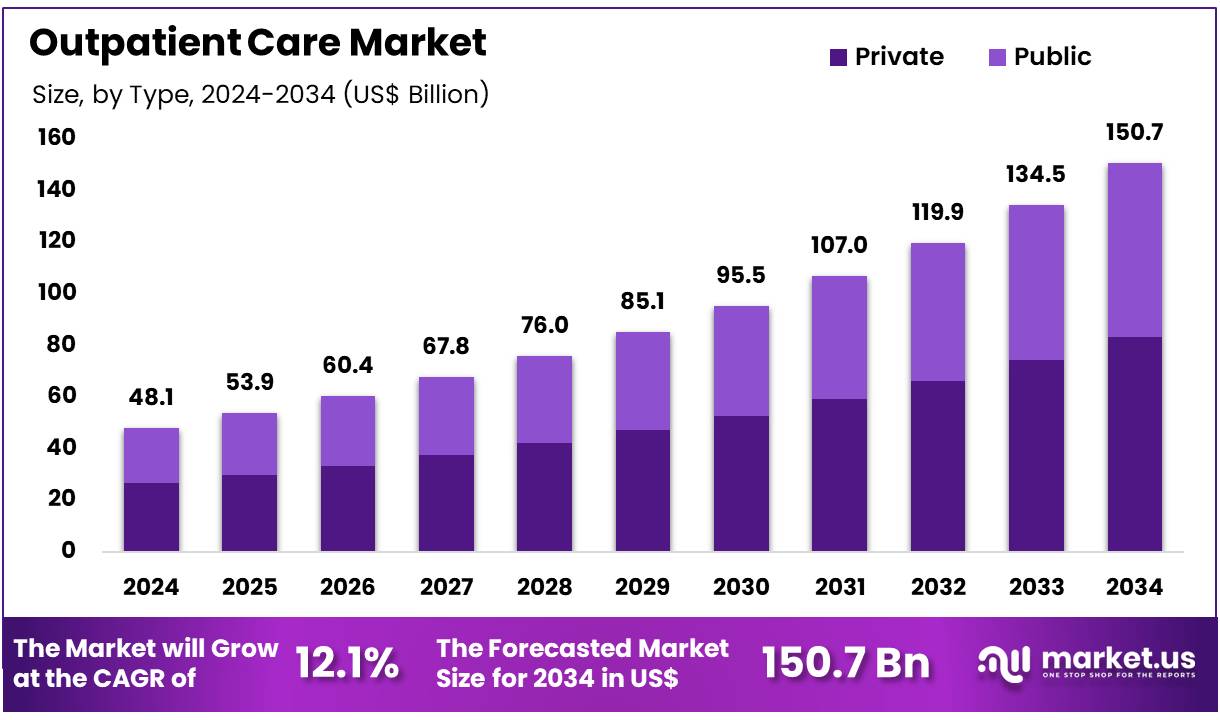

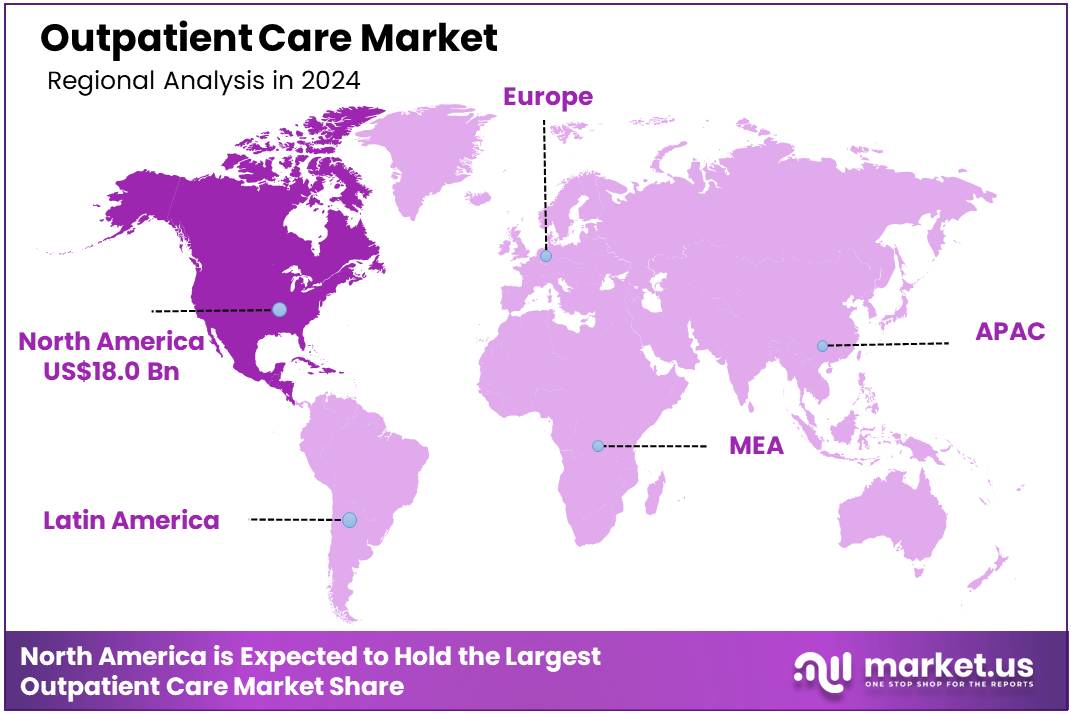

Global Outpatient Care Market size is expected to be worth around US$ 150.7 Billion by 2034 from US$ 48.1 Billion in 2024, growing at a CAGR of 12.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.4% share with a revenue of US$ 18.0 Billion.

Increasing preference for convenience, cost-effectiveness, and quicker access to healthcare services is driving the rapid growth of the outpatient care market. As patients seek more affordable and less time-consuming alternatives to inpatient care, healthcare providers are expanding outpatient services, ranging from diagnostic tests and imaging to surgery and rehabilitation. This trend is supported by advancements in medical technology, such as telemedicine, mobile health apps, and wearable devices, which allow for remote monitoring and virtual consultations, reducing the need for in-person visits.

The shift toward outpatient care also aligns with the growing demand for chronic disease management, preventative care, and wellness services, all of which can be effectively managed in an outpatient setting. In November 2024, Danaher Corporation announced the establishment of two new Centers of Innovation in Diagnostics, with the first opening in July 2025 in Newcastle, UK.

These centers aim to advance precision medicine, and the first will house the company’s first CLIA CAP lab. This focus on advanced diagnostics supports the shift towards outpatient care by enabling more precise and rapid diagnoses outside traditional hospital settings. With improved diagnostic capabilities, healthcare providers can offer earlier interventions and personalized treatment plans, which increases the demand for specialized outpatient services.

As outpatient care continues to evolve, the integration of new technologies, such as AI-driven diagnostics and robotic surgery, presents further opportunities for expansion. The increasing emphasis on reducing healthcare costs while maintaining high-quality care will continue to drive innovations and growth within the outpatient care market, offering greater accessibility and efficiency for both patients and healthcare providers.

Key Takeaways

- In 2024, the market for outpatient care generated a revenue of US$ 48.1 Billion, with a CAGR of 12.1%, and is expected to reach US$ 150.7 Billion by the year 2034.

- The type segment is divided into public and private, with private taking the lead in 2024 with a market share of 55.3%.

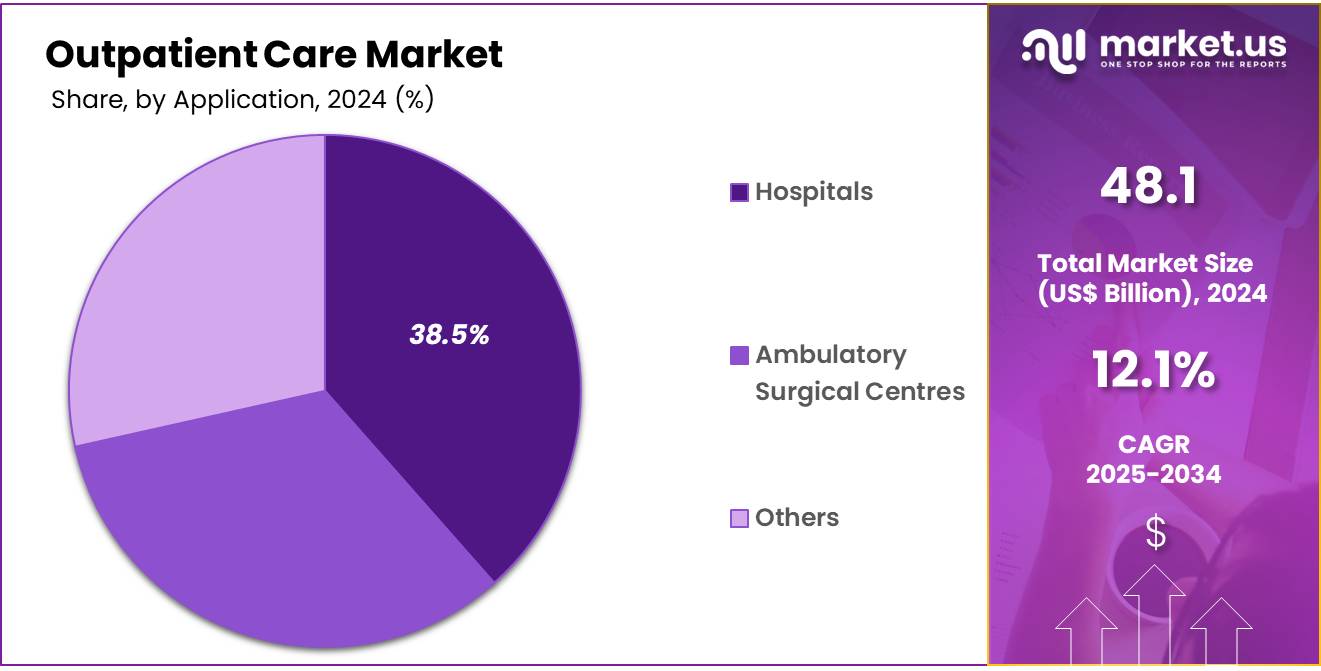

- Considering application, the market is divided into hospitals, ambulatory surgical centres, and others. Among these, hospitals held a significant share of 38.5%.

- Furthermore, concerning the service types segment, the market is segregated into ambulatory surgical centers, urgent care centers, diagnostic imaging centers, primary care clinics, and others. The ambulatory surgical centers sector stands out as the dominant player, holding the largest revenue share of 31.2% in the outpatient care market.

- North America led the market by securing a market share of 37.4% in 2024.

Type Analysis

Private outpatient care is expected to capture 55.3% of the market share, driven by the increasing demand for specialized, high-quality healthcare services. The growth of the private sector is largely due to patients’ growing preference for personalized care, faster service, and shorter wait times, which public systems may not always provide.

Private facilities often have the ability to invest in advanced technology, cutting-edge treatments, and high-quality patient services, making them more attractive to those willing to pay for superior care. Additionally, the rising middle class, particularly in emerging markets, is likely to continue fueling growth in the private healthcare market. The availability of private outpatient care options provides individuals with more choices and flexibility, contributing to this segment’s ongoing expansion.

Application Analysis

Hospitals are projected to account for 38.5% of the outpatient care market share. Hospitals continue to be a leading provider of outpatient services, offering a wide range of treatments, from diagnostic imaging to outpatient surgeries. The growing trend of hospital-based outpatient care is driven by technological advancements, including minimally invasive procedures, which allow patients to recover quickly and return home the same day.

As hospitals aim to reduce inpatient bed congestion, they are expanding their outpatient services. This expansion is expected to continue as hospitals adapt to the growing demand for more affordable and accessible care. In addition, the move toward outpatient care models helps hospitals improve patient throughput and operational efficiency, further contributing to the sector’s dominance.

Service Types Analysis

Ambulatory surgical centers (ASCs) are expected to capture 31.2% of the market share in the outpatient care sector. These centers specialize in same-day surgical procedures and have become increasingly popular due to their convenience, cost-effectiveness, and high-quality care. ASCs allow patients to undergo surgical procedures and return home the same day, which significantly reduces both the length of hospital stays and the overall cost of care.

With advancements in surgical technology and an increase in outpatient surgeries, ASCs are projected to continue growing in popularity. The ability to perform a wide variety of surgical procedures, including orthopedic, ophthalmic, and gastrointestinal surgeries, in an outpatient setting is expected to fuel ASC growth. As healthcare providers seek to improve efficiency and reduce costs, ASCs will likely become a primary destination for many surgical procedures.

Key Market Segments

By Type

- Public

- Private

By Application

- Hospitals

- Ambulatory Surgical Centres

- Others

By Service Types

- Ambulatory Surgical Centers

- Urgent Care Centers

- Diagnostic Imaging Centers

- Primary Care Clinics

- Others

Drivers

Demand for Accessible and Affordable Healthcare is Driving the Market

The increasing demand for accessible and affordable healthcare options is a primary driver for the expansion of the outpatient care market. Patients are progressively choosing outpatient facilities over traditional inpatient hospital stays due to the significant advantages these settings offer in terms of convenience and cost-effectiveness. This shift is deeply rooted in continuous advancements in medical technology, which now enable a broader array of procedures to be performed safely and efficiently outside of a hospital’s inpatient unit.

Such procedures often involve less invasive techniques, leading to quicker recovery times and reduced disruption to patients’ daily lives. The financial appeal of outpatient services is substantial for both patients and healthcare providers. These settings typically incur lower operational costs because they require fewer resources and eliminate the need for overnight stays, making them a more economical choice.

As per the Centers for Medicare & Medicaid Services (CMS) National Health Expenditures 2023 Highlights, published in December 2024, physician and clinical services expenditures, which largely encompass outpatient care, grew by 7.4% to US$978.0 billion in 2023, accelerating from a 4.6% growth in 2022. This consistent upward trend in spending on physician and clinical services underscores a fundamental reorientation in healthcare delivery, with patient volumes and financial flows increasingly moving towards outpatient settings. This necessitates that health systems strategically adapt their service models to cater to the evolving patient preferences for more convenient and cost-effective care.

Restraints

Staffing Shortages and Reimbursement Challenges are Restraining the Market

Persistent staffing shortages and complex reimbursement challenges are significantly restraining the growth and operational efficiency of the outpatient care market. Healthcare organizations across the US are experiencing substantial workforce gaps, which directly limit the capacity of outpatient facilities to operate at their full potential and expand their service offerings. This includes critical roles ranging from clinical staff to administrative personnel, impacting patient flow and billing processes.

A September 2023 report from the U.S. Department of Health and Human Services (HHS), titled “Review of Personnel Shortages in Federal Health Care Programs During the COVID-19 Pandemic,” highlights that “nurses and medical officers were the most commonly reported positions that experienced shortages during the pandemic,” a situation that has continued to affect the broader healthcare system, including outpatient settings.

The high turnover rate in healthcare, alongside difficulties in recruiting and retaining skilled professionals, continues to burden facilities with increased costs associated with recruitment, hiring, and training. Furthermore, inadequate reimbursement rates and increasingly complex payment models, particularly from government payers like Medicare and Medicaid, pose significant financial hurdles for outpatient clinics.

According to an American Hospital Association (AHA) infographic published in January 2024, Medicare paid hospitals a record low 82 cents for every dollar they spent caring for Medicare patients in 2022, resulting in nearly US$100 billion in Medicare underpayments. While this specifically references hospitals, outpatient departments often fall under similar reimbursement structures, facing comparable financial pressures. These combined challenges necessitate strategic innovation to improve operational efficiency and address the interconnected problems of workforce stability and sustainable financial models within the outpatient care ecosystem.

Opportunities

Telehealth Expansion and Technological Advancements are Creating Growth Opportunities

The robust expansion of telehealth services, coupled with continuous technological advancements, presents substantial growth opportunities within the outpatient care market. Telehealth leverages telecommunication systems and smart wearables to facilitate virtual consultations and remote patient monitoring, effectively dismantling geographical barriers and vastly improving access to care. This is particularly beneficial for the management of chronic conditions, allowing for continuous tracking of vital signs and symptoms, and enabling proactive care management that can prevent unnecessary in-person visits.

The Centers for Medicare & Medicaid Services (CMS) has significantly expanded the list of services payable under the Medicare Physician Fee Schedule when furnished via telehealth, reflecting the growing acceptance and integration of virtual care. As of June 20, 2025, CMS Data provides extensive “Medicare Telehealth Trends” data, showcasing the patterns and growth in utilization of telehealth services by Medicare beneficiaries from January 2020 through December 2024, indicating a substantial increase in adoption following the COVID-19 public health emergency.

Further technological integrations, such as artificial intelligence (AI)-powered diagnostic tools and predictive analytics, are enhancing diagnostic accuracy and enabling more personalized virtual care. The increasing integration of high-speed connectivity, such as 5G, also plays a crucial role by improving data transmission speeds and overall connectivity, especially in remote areas. As healthcare providers, insurers, and patients increasingly embrace the convenience, cost-effectiveness, and efficiency of virtual care, the telehealth segment within outpatient services is poised for continued robust growth, significantly expanding the reach and capabilities of healthcare delivery.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the outpatient care market, shaping both its challenges and its trajectory. Economic fluctuations, such as inflation and changes in disposable income, directly affect patient spending on healthcare services. During periods of economic downturn, patients might delay non-urgent appointments or opt for more affordable outpatient services over costly inpatient care, inadvertently boosting the demand for ambulatory settings.

For instance, inflationary pressures on medical supplies, equipment, and labor costs increase operational expenses for outpatient facilities, potentially leading to higher service charges or narrower profit margins. An American Hospital Association (AHA) report from April 2024 indicated that economy-wide inflation grew by 12.4% between 2021 and 2023, more than twice as fast as Medicare reimbursement for hospital inpatient care, illustrating the significant cost pressures faced by healthcare providers across all settings.

However, robust economic growth can lead to increased health insurance coverage and greater willingness among individuals to seek preventive and elective outpatient procedures, thereby stimulating market expansion. Simultaneously, geopolitical events, including trade disputes, conflicts, or global health crises, disrupt supply chains for medical devices and pharmaceuticals, driving up costs and potentially causing delays in service delivery for outpatient clinics.

Despite these challenges, such events can also accelerate the adoption of innovative solutions like telemedicine, as demonstrated during the recent global pandemic, compelling a shift towards more resilient and decentralized care models that benefit the outpatient sector by expanding its reach and flexibility.

Current US tariffs impose both direct and indirect impacts on the outpatient care market. Tariffs on imported medical devices, diagnostic equipment, and pharmaceutical components directly increase the cost of these essential items for US healthcare providers, including outpatient clinics. These higher input costs compel facilities to either absorb the additional expenses, pass them on to patients through higher service charges, or seek less expensive, potentially lower-quality alternatives. This can affect the range and quality of services offered.

For example, if tariffs make advanced imaging equipment more expensive, an outpatient diagnostic center might delay upgrades, thereby impacting its competitive edge and patient outcomes. Indirectly, these tariffs can strain manufacturer-provider relationships and limit the availability of certain specialized products if imports become economically unviable, potentially slowing down the adoption of cutting-edge treatments.

However, such policies also serve to incentivize domestic manufacturing and innovation within the US healthcare supply chain, fostering a more self-sufficient industry in the long term. This domestic focus can lead to new job creation and potentially more stable pricing for domestically produced goods, ultimately strengthening the resilience and independence of the US outpatient care infrastructure, ensuring continued access to vital services for the population.

Latest Trends

Integration of Artificial Intelligence (AI) in Clinical Workflows is a Recent Trend

The integration of Artificial Intelligence (AI) into various aspects of clinical workflows is a prominent recent trend in the outpatient care market, particularly observed in 2024 and continuing into 2025. Healthcare providers are increasingly leveraging AI to enhance efficiency, improve diagnostic accuracy, and personalize patient care in outpatient settings. This includes the deployment of AI-powered tools for tasks such as analyzing complex medical images, identifying subtle patterns in vast patient data to predict disease progression, and assisting with evidence-based treatment recommendations.

For instance, the National Center for Biotechnology Information (NCBI) Bookshelf’s “2025 Watch List: Artificial Intelligence in Health Care” highlights several key areas where AI is expected to impact healthcare, including AI for notetaking, AI tools to accelerate and optimize clinical training and education, AI for disease detection and diagnosis, and AI for disease treatment. This indicates a widespread and growing adoption across various clinical functions within the healthcare system, which will inevitably extend to outpatient settings.

The trend also encompasses the use of predictive analytics for optimizing patient scheduling, efficiently allocating resources, and even automating certain administrative tasks, thereby freeing up healthcare professionals to focus more directly on patient interaction. The continued development and strategic adoption of AI technologies are poised to further revolutionize outpatient care by making it more efficient, precise, and patient-centric, fundamentally transforming how services are delivered and managed.

Regional Analysis

North America is leading the Outpatient Care Market

North America dominated the market with the highest revenue share of 37.4% owing to a confluence of factors including increasing patient preference for convenient, accessible services, advancements in medical technology enabling complex procedures in non-hospital settings, and evolving reimbursement policies that favor value-based care. In the United States, national health expenditures are projected to have grown strongly at 8.2% in 2024, reflecting a continued rebound in the use of health care services and goods, with outpatient services playing a crucial role in this expansion.

The Centers for Medicare & Medicaid Services (CMS) has continued to support the shift to lower-cost settings, with policies influencing payment for services delivered in ambulatory surgical centers and physician offices. For instance, Medicare Advantage insurers made nearly 50 million prior authorization determinations in 2023, with the number of determinations per enrollee returning to pre-pandemic levels of 1.8 in 2023, indicating a high volume of managed care services that often include outpatient procedures.

In Canada, total health care spending is expected to increase by 5.7% in 2024, following a 4.5% rise in 2023 and 1.7% in 2022, as reported by the Canadian Institute for Health Information (CIHI), with a notable trend towards outpatient visits. CIHI data from the National Ambulatory Care Reporting System (NACRS) for 2023-2024 indicates a high volume of emergency department visits and day surgeries, reflecting significant utilization of ambulatory services.

Major healthcare providers are also expanding their outpatient footprints; for example, HCA Healthcare reported revenues of US$17.339 billion in the first quarter of 2024, with same facility equivalent admissions, which include outpatient visits, increasing, demonstrating the growing demand for services outside traditional inpatient settings.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing prevalence of chronic diseases requiring ongoing management, a growing middle class with rising disposable incomes, improving healthcare infrastructure, and government initiatives aimed at strengthening primary and community-based care. Countries across the region are actively investing in expanding access to care beyond large hospitals.

For instance, India’s Ministry of Health and Family Welfare continues to expand its network of Ayushman Bharat Health and Wellness Centers, with over 160,000 operational as of early 2023, significantly enhancing access to primary healthcare services at the community level. This initiative is likely to drive a substantial increase in first-contact and routine medical consultations. Japan’s Ministry of Health, Labour and Welfare is anticipated to further promote community-based care models to manage its aging population effectively, which will involve greater utilization of local clinics and specialized outpatient facilities.

China’s National Health Commission is likely to continue its efforts to decentralize healthcare services, encouraging patients to seek initial consultations at primary care institutions. Major healthcare providers in the region are also expanding their ambulatory networks; for example, IHH Healthcare, a leading private healthcare provider with a significant presence in Asia, is expected to continue investing in its outpatient clinics and specialized centers to cater to the increasing demand for accessible and affordable medical attention. This concerted effort to enhance primary and community care infrastructure will drive significant expansion in the ambulatory care sector across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the outpatient care market employ various strategies to drive growth. They focus on expanding their service offerings by developing novel therapies and research tools targeting outpatient care. Companies invest in automation and high-throughput technologies to improve scalability and reproducibility in treatment processes.

Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices. Additionally, players aim to strengthen their market presence by establishing facilities and distribution networks in key regions, ensuring timely and efficient delivery of services to support the growing demand for outpatient care solutions.

HCA Healthcare is a prominent player in the outpatient care market. Headquartered in Nashville, Tennessee, HCA Healthcare operates 190 hospitals and more than 2,400 outpatient care sites across 20 states and the United Kingdom. The company offers a wide range of services, including emergency care, diagnostic imaging, surgical procedures, and rehabilitation, through its extensive network of facilities. HCA Healthcare emphasizes patient-centered care and strives to improve health outcomes by leveraging advanced technologies and data analytics. The company’s commitment to quality care and operational efficiency has established it as a leader in the outpatient care industry.

Top Key Players

- Veradigm LLC

- Sutter Health

- Surgical Care Affiliates

- Quest Diagnostics Incorporated

- HEALWELL AI

- HCA Healthcare Inc

- Envision Healthcare Corporation

- Amsurg Corp

Recent Developments

- In May 2025, Veradigm LLC highlighted advancements in generating real-world evidence (RWE) from Electronic Health Record (EHR) data using AI. This innovation improves the depth of insights available from patient data, which directly enhances the ability of healthcare providers to make informed decisions in outpatient settings and develop more effective care pathways. This drives market growth by enabling better patient outcomes and more efficient resource allocation within outpatient services.

- In April 2025, the acquisition of Orion Health by HEALWELL AI created a significant global entity focused on healthcare data interoperability and artificial intelligence. This strategic consolidation aims to integrate AI technology with existing health systems to deliver actionable insights. This directly fuels the outpatient care market’s growth by providing more sophisticated tools for patient management, predictive analytics for resource planning, and personalized care strategies in non-hospital setting.

Report Scope

Report Features Description Market Value (2024) US$ 48.1 Billion Forecast Revenue (2034) US$ 150.7 Billion CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Public and Private), By Application (Hospitals, Ambulatory Surgical Centres, and Others), By Service Types (Ambulatory Surgical Centers, Urgent Care Centers, Diagnostic Imaging Centers, Primary Care Clinics, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Veradigm LLC, Sutter Health, Surgical Care Affiliates, Quest Diagnostics Incorporated, HEALWELL AI, HCA Healthcare Inc, Envision Healthcare Corporation, Amsurg Corp Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Veradigm LLC

- Sutter Health

- Surgical Care Affiliates

- Quest Diagnostics Incorporated

- HEALWELL AI

- HCA Healthcare Inc

- Envision Healthcare Corporation

- Amsurg Corp