Global Online Home Decor Market Size, Share, Growth Analysis By Product Type (Furniture, Home Textile, Home Decor, Kitchenware, Bathware, Garden Decor, Others), By Price Range (Premium Price, Medium Price, Low Price), By End User (Residential, Commercial), By Material Type (Wood, Glass, Metal, Plastic, Ceramic, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 151945

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

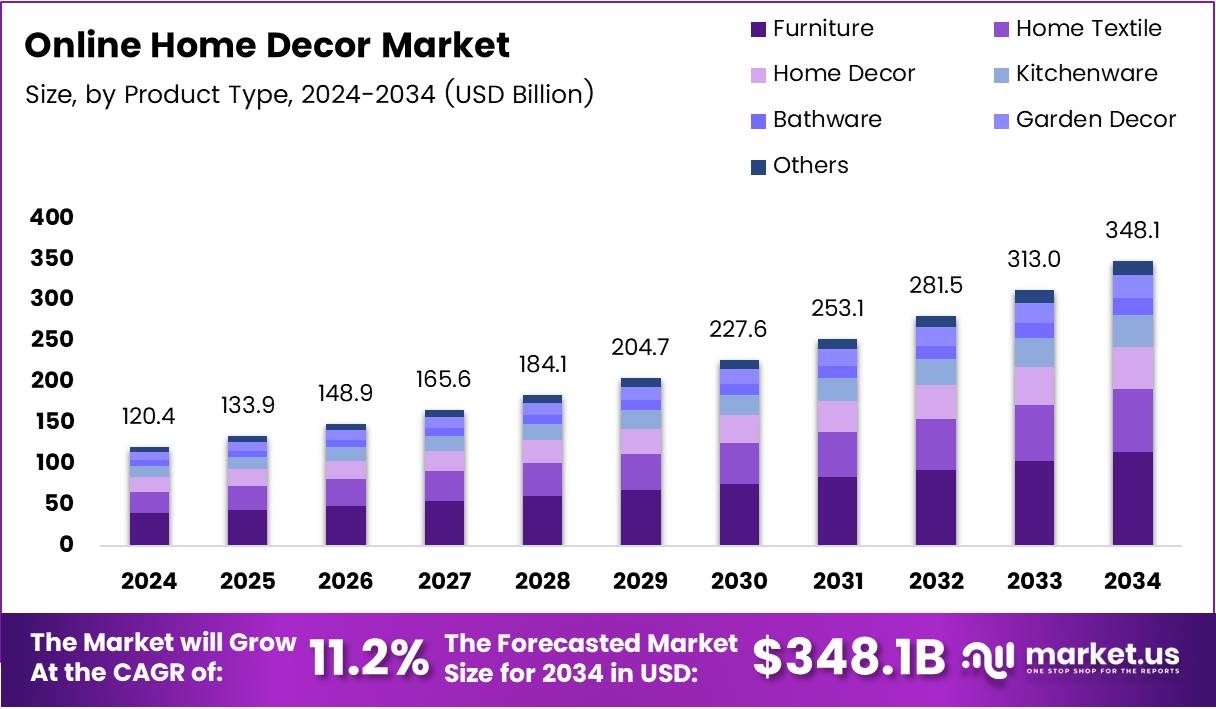

The Global Online Home Decor Market size is expected to be worth around USD 348.1 Billion by 2034, from USD 120.4 Billion in 2024, growing at a CAGR of 11.2% during the forecast period from 2025 to 2034.

The online home decor market refers to the digital marketplace where consumers purchase furniture, lighting, textiles, wall art, and decorative accessories for residential use. With rising internet penetration, increased smartphone usage, and improved logistics networks, this segment has experienced robust traction across developed and emerging economies. Buyers are now inclined to customize living spaces without visiting physical stores.

Driven by e-commerce integration and evolving aesthetics, the market continues to expand. Digital-first consumers are fueling this growth by preferring curated home decor solutions online. According to Calibray, more than 90% of the industry’s overall growth now stems from online sales, highlighting the channel’s dominance in the evolving furniture and décor space.

Opportunities in the space include AI-powered design tools, augmented reality apps for virtual room planning, and personalized buying experiences. As brands embrace omnichannel strategies, they bridge physical and digital touchpoints effectively. Additionally, the rise of social media influence and visual commerce is reshaping product discovery trends.

The ecosystem benefits from increased consumer expenditure on living standards. As per Times of India, in FY25, average monthly spending on consumer durables increased by 72%, up sharply from 6% in FY24. This jump reflects a strong consumer appetite for home ownership and home furnishing upgrades, especially post-pandemic.

Moreover, the U.S. stands out as a prime online decor market. As per Calibray, around 80% of U.S. consumers have purchased furniture online, signaling a preference for convenience and variety. Brands leveraging smart logistics, one-click checkout, and customization options are witnessing better conversion and retention rates.

Several governments also play a role in facilitating digital commerce. Initiatives promoting digital infrastructure, smart homes, and export of artisanal products have accelerated supply chain efficiencies. Compliance standards for sustainable sourcing and product safety regulations ensure buyer trust and long-term market credibility.

Looking ahead, the market is projected to thrive on innovation and personalization. Eco-friendly materials, digital payments, and fast delivery continue to redefine user expectations. As rural and Tier 2 regions get digital access, demand is likely to expand beyond metro cities, further broadening the customer base.

Key Takeaways

- The global online home decor market size is expected to reach USD 348.1 Billion by 2034, from USD 120.4 Billion in 2024, growing at a CAGR of 11.2%.

- Furniture holds a dominant market position in the By Product Type Analysis segment, driven by the trend of personalized and customizable items.

- Residential is the leading segment in the By End User Analysis, fueled by the rise in home renovations and interior design upgrades.

- Wood dominates the By Material Type Analysis segment, favored for its aesthetic, durability, and warmth.

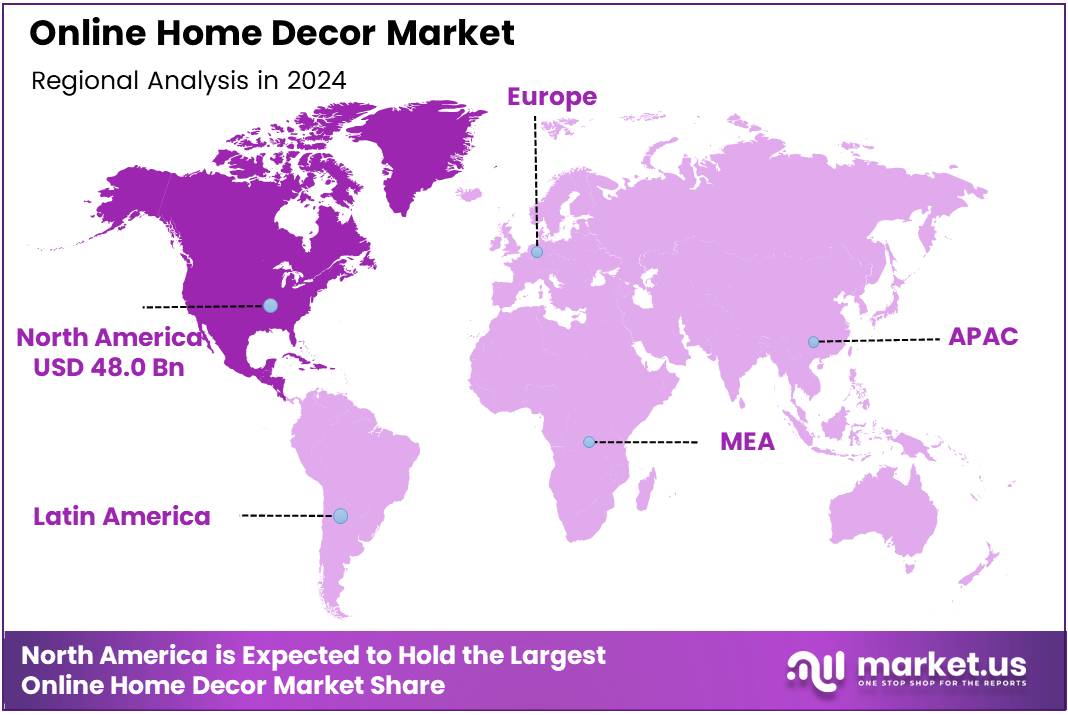

- North America leads the global market with a 39.8% share, valued at USD 48.0 Billion, driven by high consumer purchasing power and widespread internet access.

Product Type Analysis

Furniture leading the Online Home Decor Market due to its increasing demand for stylish and functional home furnishings

In 2024, Furniture held a dominant market position in the By Product Type Analysis segment of the Online Home Decor Market. This strong performance can be attributed to the rising trend of personalized and customizable furniture items, making them a key focus for online shoppers. As consumers increasingly seek to enhance the aesthetics and functionality of their living spaces, furniture continues to be a top priority for home decor enthusiasts.

Following Furniture, Home Textile holds a considerable market presence, driven by the growing interest in textiles for home comfort and style. Meanwhile, segments like Kitchenware, Bathware, and Garden Decor also show steady growth, catering to the diverse needs of online buyers looking to elevate various parts of their homes. However, Furniture remains the undisputed leader in this space due to its high demand and broad appeal across a wide range of consumer segments.

End User Analysis

Residential lead the largest segment in the Online Home Decor Market

In 2024, Residential held a dominant market position in the By End User Analysis segment of the Online Home Decor Market. The surge in residential demand can be attributed to the increasing trend of home renovations, interior design upgrades, and a heightened focus on creating personalized living spaces.

As people spend more time at home, particularly in post-pandemic years, the demand for home decor products has surged, making residential consumers a primary driver of market growth.

On the other hand, the Commercial segment also holds a significant market share, driven by demand from businesses seeking to enhance their office environments and public spaces. However, the Residential segment continues to lead, given the ever-growing trend of individuals investing in their homes for comfort, style, and well-being.

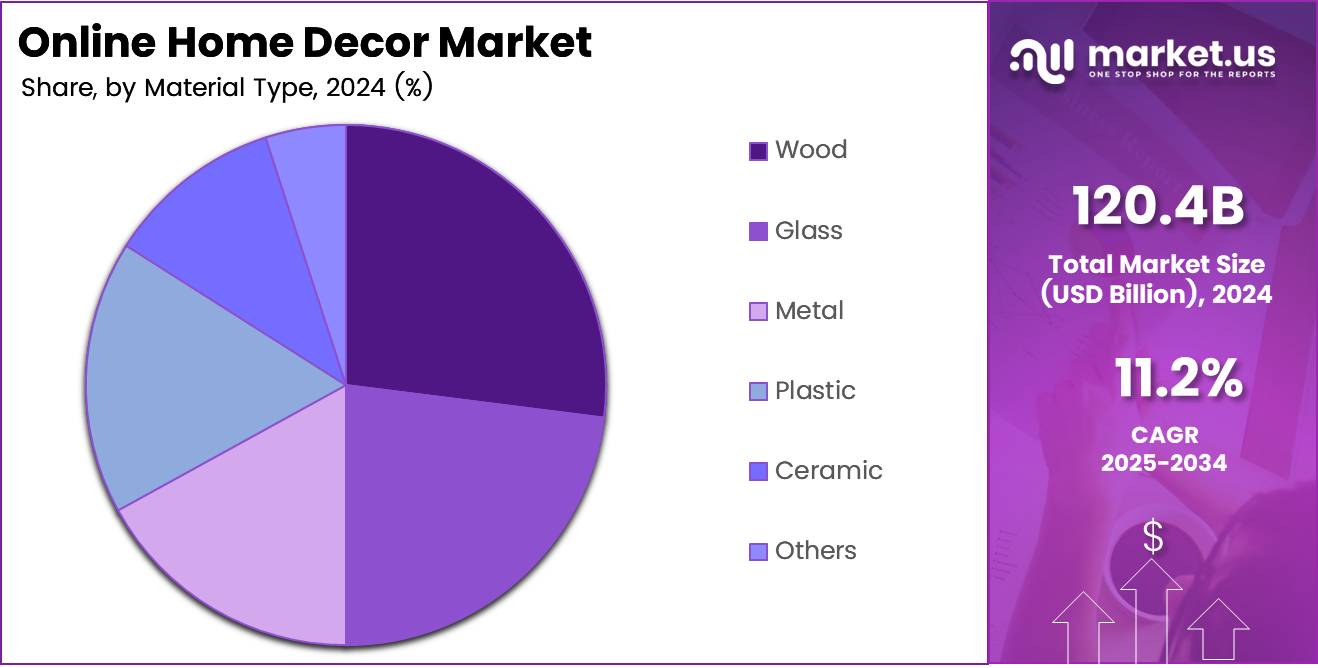

Material Type Analysis

Wood dominates maintaining a strong position in the Online Home Decor Market due to its classic appeal and versatility

In 2024, Wood held a dominant market position in the By Material Type Analysis segment of the Online Home Decor Market. The timeless appeal and versatility of wood in home decor have made it a preferred material for a wide variety of products, from furniture to decorative items. Consumers continue to choose wood for its natural aesthetic, durability, and the warmth it brings to indoor spaces.

Following wood, materials like Glass, Metal, and Plastic also maintain a solid presence, but none can surpass the dominance of wood. Glass, while popular for its sleek and modern look, and Metal, known for its industrial appeal, still lag behind in comparison to the natural elegance of wood.

Ceramic and other materials also contribute to the market but remain secondary players in terms of market share. The demand for wooden products remains a key driver in shaping the current trends in the online home decor market.

Key Market Segments

By Product Type

- Furniture

- Home Textile

- Home Decor

- Kitchenware

- Bathware

- Garden Decor

- Others

By Price Range

- Premium Price

- Medium Price

- Low Price

By End User

- Residential

- Commercial

By Material Type

- Wood

- Glass

- Metal

- Plastic

- Ceramic

- Others

Drivers

Growing Consumer Interest in Personalization Drives Market Growth

The online home decor market is gaining momentum as more consumers look for ways to personalize their living spaces. Shoppers today want more than just furniture—they seek items that reflect their personality and lifestyle. Online platforms offer a wide variety of design choices, color palettes, and customizable pieces that fit specific tastes, encouraging higher spending and customer loyalty.

Another major growth driver is the rapid expansion of e-commerce. With digital platforms becoming easier to use, and logistics networks improving, consumers are now more comfortable shopping for large or delicate decor items online. The convenience of browsing, comparing prices, and reading reviews makes e-commerce a preferred channel for many households, especially in urban areas.

Trends in home renovation are also influencing this market. People are investing more in their homes, whether through DIY upgrades or professional remodeling. This has increased demand for stylish decor items like wall art, lighting, and functional furniture. Online stores cater to this trend by offering curated collections and seasonal updates, making it easy for consumers to find what fits their current needs.

Restraints

High Competition from Offline Stores Limits Online Growth

One of the biggest hurdles for the online home decor market is the strong presence of offline stores. Many consumers still prefer to touch and feel items like cushions, curtains, or furniture before buying. Physical stores also offer immediate delivery and set-up services, which adds to their appeal over online options.

Fluctuating prices of raw materials such as wood, metals, and textiles also affect the profitability of online decor businesses. When costs rise, it’s challenging for online sellers to maintain competitive pricing, especially when offline stores can sometimes absorb costs more easily through bulk purchasing.

Environmental concerns are another growing restraint. Many consumers are becoming more aware of how products are made. If online brands are not transparent about sustainable practices or continue using materials that harm the environment, they risk losing environmentally conscious buyers. Regulations and pressure from advocacy groups may also impact supply chains and production costs for online retailers.

Growth Factors

Integration of Smart Home Decor Solutions Creates Growth Opportunities

Smart home decor is a key area unlocking new possibilities for the online market. Products like smart lighting, automated blinds, and voice-controlled art displays are drawing consumer interest. These high-tech options not only boost convenience but also align with modern home design trends, especially among tech-savvy buyers.

Augmented Reality (AR) is another major growth opportunity. Many online platforms are now using AR to help customers visualize how a product will look in their space. This reduces the chances of returns and boosts buyer confidence. As AR technology improves, it’s expected to become a standard feature across online decor platforms.

Sustainable and eco-friendly products are also becoming mainstream. Consumers are shifting toward brands that use recycled materials, offer biodegradable packaging, and promote ethical sourcing. This trend allows online home decor retailers to differentiate themselves and attract a growing segment of environmentally conscious buyers.

Emerging Trends

Popularity of Multi-functional Home Furnishings Drives Market Trends

The rising preference for multi-functional furniture is changing how people shop for home decor. Products that save space—like foldable tables, storage beds, or convertible sofas—are in high demand, especially among urban dwellers living in compact apartments. Online retailers are meeting this trend by offering innovative and practical solutions that appeal to space-conscious consumers.

Scandinavian and minimalistic designs are also trending. Clean lines, neutral tones, and simple aesthetics are favored for their ability to make homes feel more open and calming. These styles are particularly popular among younger demographics and professionals who want a modern, clutter-free environment.

Customizable decor is another significant trend. Shoppers want to choose their own fabric, colors, and layouts. Online platforms offer easy customization tools that allow buyers to design their own furniture or decorative items. This level of personalization helps brands build stronger relationships with customers and reduce product returns.

Regional Analysis

North America Dominates the Online Home Decor Market with a Market Share of 39.8%, Valued at USD 48.0 Billion

North America holds the leading position in the global online home decor market, accounting for a significant 39.8% market share, valued at USD 48.0 Billion. This dominance can be attributed to high consumer purchasing power, widespread internet penetration, and a strong culture of home personalization. The region benefits from a well-established e-commerce ecosystem, with consumers increasingly turning to online platforms for convenient access to a wide range of home decor products.

Europe Online Home Decor Market Trends

Europe remains a prominent market for online home decor, supported by rising urbanization, an increasing inclination toward stylish interiors, and a growing population of tech-savvy consumers. Sustainability and eco-conscious living are also influencing product preferences, driving demand for ethically sourced and locally produced items. Digital innovation in retail and a strong DIY culture continue to shape the market dynamics across the region.

Asia Pacific Online Home Decor Market Trends

Asia Pacific is witnessing rapid growth in the online home decor market, driven by expanding middle-class populations, rising disposable incomes, and increasing digital penetration. Consumers in emerging economies such as India and Southeast Asia are increasingly adopting e-commerce platforms for their home furnishing needs. Cultural diversity and a growing interest in modern living spaces further contribute to evolving consumption patterns.

Middle East and Africa Online Home Decor Market Trends

The Middle East and Africa region is gradually emerging as a notable player in the online home decor space, led by rising urban development and growing access to digital infrastructure. Consumers are becoming more design-conscious and are showing a preference for contemporary and luxury decor. E-commerce expansion, especially in the Gulf countries, is playing a pivotal role in supporting market growth.

Latin America Online Home Decor Market Trends

Latin America’s online home decor market is experiencing steady development, fueled by the increasing popularity of online shopping and a youthful, urban population seeking affordable and stylish decor options. Countries like Brazil and Mexico are at the forefront of this shift, with growing e-commerce platforms and a vibrant social media presence influencing consumer preferences.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Online Home Decor Company Insights

In 2024, the global online home decor market is witnessing strategic shifts and digital evolution among key players to cater to changing consumer preferences.

Walmart continues to strengthen its online presence by integrating advanced logistics and a broad product range, appealing to price-sensitive consumers seeking convenience and affordability. Its investments in e-commerce infrastructure are yielding consistent traffic growth in the home decor segment.

Pier 1 Imports, though previously facing store closures, has strategically repositioned itself as a digital-first brand. Its curated, globally inspired collections have found a niche among style-conscious consumers, allowing the brand to regain relevance online.

Crate & Barrel leverages its strong brand equity and design-focused product offerings to target upscale online shoppers. Its emphasis on digital personalization tools and high-quality visuals enhances the customer experience, contributing to steady online growth.

Target has effectively used its omnichannel capabilities to expand its share in the online home decor space. With exclusive designer collaborations and fast shipping options, it successfully blends trend-driven aesthetics with mass-market appeal, attracting a wide customer base.

Each of these companies plays a unique role in shaping the digital transformation of the home decor industry, with tailored strategies that align with their core brand positioning. As consumer expectations evolve, innovation in logistics, personalization, and design will remain central to sustaining competitiveness in this dynamic market.

Top Key Players in the Market

- Walmart

- Pier 1 Imports

- Crate & Barrel

- Target

- JCPenney

- Bed Bath & Beyond

- Macy’s

- Etsy

- Williams-Sonoma

- Home Depot

- IKEA

- HomeGoods

- Wayfair

- Lowe’s

- Restoration Hardware

- At Home

- Kohl’s

- Amazon

- Ebay

Recent Developments

- In December 2024, an Indian furniture startup secured $43 million in Series C funding to accelerate its growth, scale operations, and expand its digital presence. This investment highlights increasing investor confidence in India’s online furniture and home decor segment.

- In June 2025, Goldman Sachs participated in a $1.5 million funding round for an Indian furniture retailer, aiming to support the company’s strategic expansion and digital retail capabilities in a growing e-commerce market.

- In January 2024, home decor startup Vaaree raised $4 million in a funding round led by Surge and Peak XV Partners, enabling the company to enhance its product portfolio and strengthen supply chain logistics.

Report Scope

Report Features Description Market Value (2024) USD 120.4 Billion Forecast Revenue (2034) USD 348.1 Billion CAGR (2025-2034) 11.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Furniture, Home Textile, Home Decor, Kitchenware, Bathware, Garden Decor, Others), By Price Range (Premium Price, Medium Price, Low Price), By End User (Residential, Commercial), By Material Type (Wood, Glass, Metal, Plastic, Ceramic, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Walmart, Pier 1 Imports, Crate & Barrel, Target, JCPenney, Bed Bath & Beyond, Macy’s, Etsy, Williams-Sonoma, Home Depot, IKEA, HomeGoods, Wayfair, Lowe’s, Restoration Hardware, At Home, Kohl’s, Amazon, Ebay Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Walmart

- Pier 1 Imports

- Crate & Barrel

- Target

- JCPenney

- Bed Bath & Beyond

- Macy's

- Etsy

- Williams-Sonoma

- Home Depot

- IKEA

- HomeGoods

- Wayfair

- Lowe's

- Restoration Hardware

- At Home

- Kohl's

- Amazon

- Ebay