Global Decor Paper Market By Product (Printed, Solid, Woodgrain, Metallic), By Printing Technology (Rotogravure, Digital, Screen, Flaxographic), By Application (Furniture, Flooring, Wall-paneling), By End-User (Commercial, Residential, Industrial), By Basis of Weight (Heavy-weight, Lightweight, Medium-weight), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133467

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

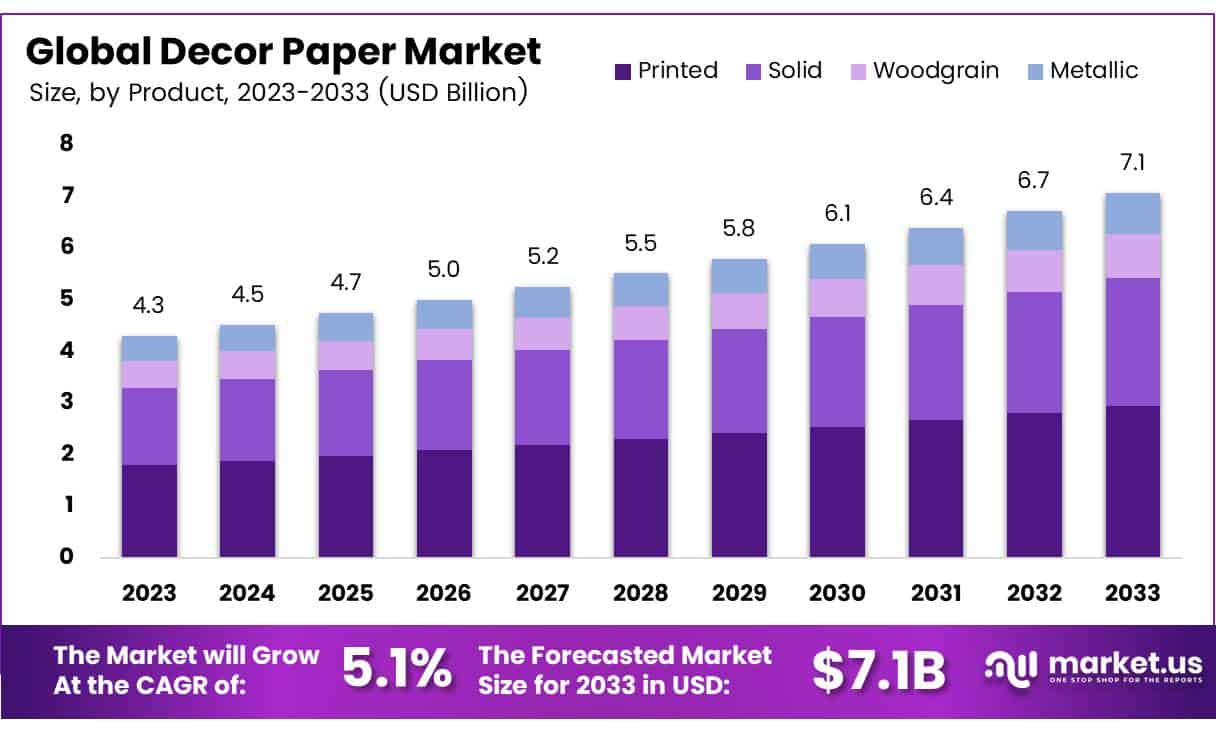

The Global Decor Paper Market size is expected to be worth around USD 7.1 Billion by 2033, from USD 4.3 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

Decor paper is a crucial material in the laminate industry, used mainly for decorative purposes in the production of furniture, flooring, and interior surfaces. This specialized paper, which features intricate patterns or designs, is coated with protective resin to create laminates.

The Decor Paper Market encompasses the production, distribution, and sale of these papers, ranging from lightweight decorative papers to durable, high-pressure laminates, playing a vital role in the interior design and manufacturing sectors.

The market is experiencing growth, driven by rising demand for aesthetically appealing and durable interior design solutions. With urbanization on the rise and a shift in consumer preferences towards sustainable and customizable options, the decor paper industry is set to expand.

Innovations like digital printing enhance design variety and production speed, increasing market flexibility and responsiveness. Additionally, the trend towards eco-friendly materials is leading to the use of eco-solvent and water-based inks that are less harmful to the environment.

Government regulations regarding the use of volatile organic compounds (VOCs) in manufacturing have spurred R&D investments into developing low-VOC decor papers. Incentives for sustainable manufacturing practices and the use of recycled materials are pushing the industry towards greener production methods.

These efforts not only comply with environmental standards but also open new growth avenues through eco-certification and the development of green product lines, making the market attractive to eco-conscious consumers.

Industry experts confirm that wallpaper and decor paper remain popular in both residential and commercial settings. According to Fixr, 96% of interior design experts view wallpaper as a significant trend in 2023. Data from Angi shows that the cost of a single roll of wallpaper typically ranges from $25 to $35, offering an affordable option for those looking to update their interiors without a complete overhaul.

The market also benefits from the durability and perceived value of decor paper. Research shows that lower-cost, thinner peel-and-stick wallpapers last about three years, catering to consumers prioritizing affordability.

However, there is a growing demand for premium decor paper products that offer greater durability and aesthetic value, appealing to those willing to invest more in long-lasting designs. Insights into product lifespan and consumer preferences are helping manufacturers adapt their products to meet varied consumer needs, from temporary decor solutions to permanent installations.

Key Takeaways

- The Global Decor Paper Market is projected to grow from USD 4.3 billion in 2023 to USD 7.1 billion by 2033, with a CAGR of 5.1%.

- Printed decor papers lead the product analysis segment, favored for their vibrant and intricate designs.

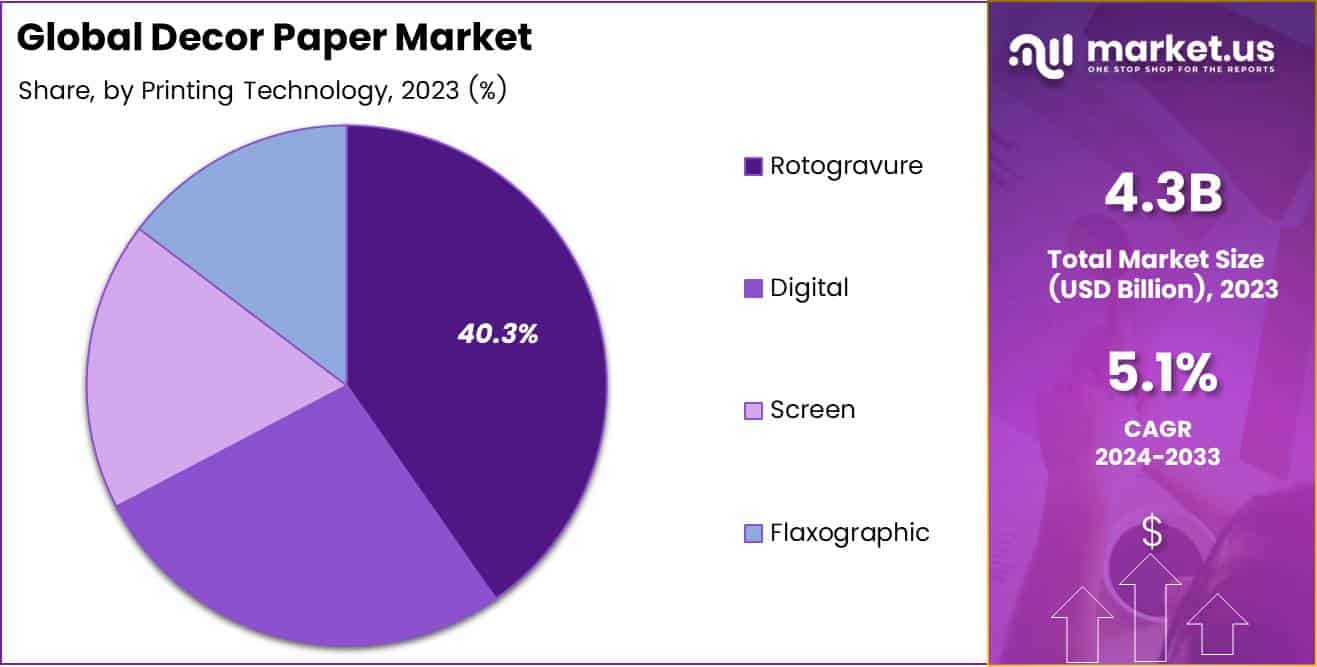

- Rotogravure printing technology dominates the printing technology segment with a 40.3% share due to its high-quality print capabilities.

- Furniture is the leading application in the Decor Paper Market, indicating significant consumer and manufacturing interest.

- The commercial sector is the predominant end-user, driving substantial market dynamics.

- North America leads the market, driven by demand for high-quality, sustainable decor solutions, with strong support from manufacturers and distribution networks.

Product Analysis segment

Printed Leads Product Segment in Decor Paper Market

In 2023, Printed decor papers firmly held the leading position in the By Product Analysis segment of the Decor Paper Market, showcasing a strong preference for vibrant and intricate designs among consumers. This category, which includes a variety of patterns and visuals that mimic textures and artistic prints, has been central in meeting the aesthetic demands of both residential and commercial sectors.

The popularity of printed decor papers stems from their ability to enhance interiors with visually appealing designs while offering a cost-effective alternative to natural materials.

Meanwhile, the Solid color segment followed, appreciated for its uniformity and simplicity, which appeals to contemporary and minimalist design trends. Woodgrain patterns, which mimic the natural appearance of wood, remained a staple in traditional and rustic interior designs, reflecting a continuous demand in markets emphasizing naturalistic and eco-friendly aesthetics.

The Metallic segment, although smaller, captured niche markets looking for a modern and futuristic feel within architectural and design projects. Each segment caters to distinct market needs, driving diverse applications across various industries and consumer preferences.

Printing Technology Analysis

Rotogravure Leads Decor Paper Market with 40.3% Share

In 2023, Rotogravure held a dominant market position in the By Printing Technology Analysis segment of the Decor Paper Market, with a 40.3% share. This printing technology’s prevalence is primarily attributed to its ability to efficiently produce high-quality prints, which is crucial in decorative paper applications where detail and color fidelity are essential.

Rotogravure’s deep-etched cylindrical printing, known for its precision and durability, supports large-volume production runs, making it cost-effective and popular among large-scale manufacturers.

Following Rotogravure, Digital printing technology captured a significant portion of the market. The adoption of Digital methods has been increasing due to their flexibility in handling short-run, customizable projects which are becoming more prevalent with the rise in personalized interior design trends.

Meanwhile, Screen printing remains relevant for its robustness in producing vibrant, full-coverage designs, especially valued in bespoke and high-end decor projects. Lastly, Flexographic printing, known for its fast production speeds and environmental efficiency by using water-based inks, continues to hold a steady market presence, albeit smaller compared to its counterparts.

Together, these technologies drive the evolution and growth trends within the Decor Paper Market, each catering to different needs based on quality, efficiency, and ecological considerations.

Application Analysis

Furniture Dominates Application Segment in Decor Paper Market

In 2023, Furniture held a dominant market position in the By Application Analysis segment of the Decor Paper Market, illustrating its pivotal role in consumer preferences and manufacturing trends.

As the primary choice for decorative surfacing materials, furniture applications leveraged decor paper to enhance aesthetic appeal and surface durability, making it a preferred option for both residential and commercial settings. This segment’s growth is propelled by the increasing demand for cost-effective and sustainable furnishing solutions that offer a wide range of design versatility and low maintenance.

Meanwhile, the Flooring segment also showed significant growth, driven by innovations in flooring solutions that mimic natural materials like wood and stone at a reduced cost and with enhanced durability. The adaptability of decor paper in flooring applications has allowed for creative designs and textures, thus broadening the market base.

Wall-paneling, although smaller in comparison to Furniture, is gradually expanding due to rising trends in interior customization and the use of sustainable materials. This segment benefits from the ease with which decor paper integrates into various architectural styles, supporting a shift towards more dynamic and environmentally friendly building practices.

Collectively, these segments underscore the diverse applications of decor paper, with Furniture leading the way in market impact and innovation potential in 2023.

End-User Analysis

Dominance of Commercial Segment in Decor Paper Market by End-User Analysis

In 2023, Commercial held a dominant market position in the By End-User Analysis segment of the Decor Paper Market, reflecting the segment’s robust contribution to market dynamics.

This leadership is attributed to escalating demand for aesthetic and durable paper solutions in commercial settings, including offices, retail spaces, and hospitality venues, where the emphasis on interior aesthetics is pronounced. The commercial segment’s preference for high-quality, customizable options that align with corporate branding has driven significant innovations and adoptions in this sector.

Following closely, the Residential segment also demonstrated substantial growth, fueled by rising homeowner interest in cost-effective and creative solutions for home décor. This trend is supported by an increasing number of do-it-yourself (DIY) projects and renovations, which have spiked due to more time spent at home during recent years.

The Industrial segment, while smaller in comparison, has seen steady demand, particularly from industries seeking durable and functional decor solutions for high-traffic areas. The focus in this sector is more on durability and maintenance ease rather than purely aesthetic qualities, catering to practical needs of the industrial environments.

Together, these segments underscore a diversified demand across the Decor Paper Market, with the Commercial sector leading the charge in innovation and application versatility.

Key Market Segments

By Product

- Printed

- Solid

- Woodgrain

- Metallic

By Printing Technology

- Rotogravure

- Digital

- Screen

- Flaxographic

By Application

- Furniture

- Flooring

- Wall-paneling

By End-User

- Commercial

- Residential

- Industrial

By Basis of Weight

- Heavy-weight

- Lightweight

- Medium-weight

Drivers

Rising Demand Boosts Decor Paper Market

The decor paper market is experiencing significant growth, primarily driven by the expanding furniture industry. As manufacturers increasingly focus on modular and flat-pack furniture, there is a heightened demand for decor paper, used extensively as a decorative surface material.

This trend is further supported by the robust development in the real estate sector, where both residential and commercial constructions are utilizing decor paper to enhance interior aesthetics.

Moreover, technological advancements in printing and embossing techniques have substantially improved the quality and appeal of decor paper, making it more attractive for consumers seeking stylish and durable interior solutions. These factors collectively contribute to the vibrant expansion of the decor paper market.

Restraints

Environmental Regulations Challenge Decor Paper Growth

Environmental regulations significantly impact the decor paper market. As governments worldwide impose stricter standards on paper production and waste management, manufacturers find it increasingly challenging to comply without incurring higher costs.

These regulations aim to reduce the environmental footprint of paper manufacturing, which involves considerable water and energy consumption, alongside chemical treatments that can harm ecosystems if not managed properly. Additionally, the decor paper market faces stiff competition from alternative materials such as direct laminates and vinyl, which are often perceived as more durable and cost-effective.

These alternatives appeal to consumers and industries looking for sustainable and longer-lasting decoration solutions, further constraining the demand for traditional decor paper. This shift challenges decor paper manufacturers to innovate and adapt to maintain their market share in an evolving industry landscape.

Growth Factors

Innovative Product Development Leads Market Growth

The decor paper market presents significant growth opportunities, primarily driven by the trend towards innovative product offerings. Companies in the sector are increasingly focusing on developing new patterns, textures, and eco-friendly materials to cater to evolving consumer preferences and environmental concerns.

By introducing unique and sustainable decor paper products, businesses can differentiate themselves in a competitive market and attract a more diverse customer base. Moreover, expanding the market reach through enhanced online marketing and distribution channels offers another substantial growth avenue. This approach allows companies to tap into global markets more efficiently and cater to the digital-savvy consumer base.

Additionally, forming partnerships with interior designers can be a strategic move, leveraging their expertise to create custom decor solutions that enhance brand visibility and foster higher adoption rates.

These collaborations can also provide insights into emerging trends and consumer preferences, further informing product development and marketing strategies. Together, these strategies position companies to capitalize on both current and emerging market trends, driving growth in the decor paper sector.

Emerging Trends

Digital Printing Transforms Decor Paper

Advances in digital printing technology are revolutionizing the decor paper market, driving significant growth and innovation. This trend allows manufacturers to produce decor paper with more complex and vibrant designs, catering to the increasing consumer demand for customized home decor solutions. The rise in DIY home decor projects further fuels this demand, as individuals increasingly opt for personalized interior styles that reflect their unique tastes.

Additionally, the integration of decor paper into smart home environments showcases how aesthetics can seamlessly blend with technology, enhancing the overall appeal and functionality of living spaces. This convergence of technology, personal expression, and practical application is setting new standards in the decor paper industry, promising continued growth and diverse applications.

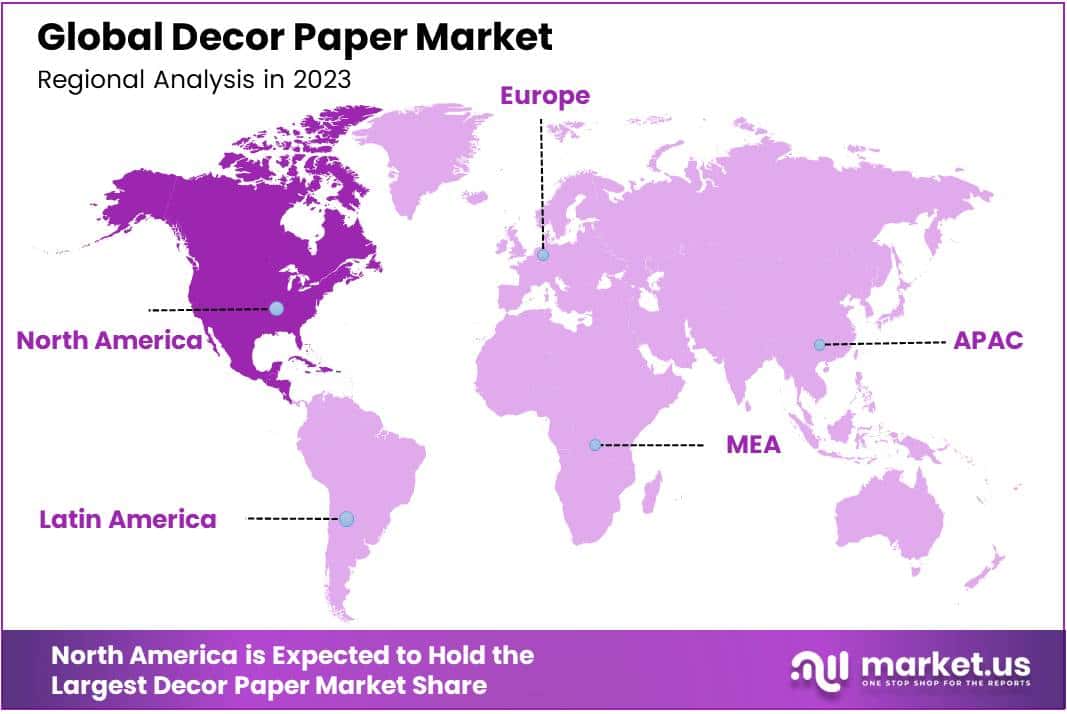

Regional Analysis

North America dominates Decor Paper Market

The Decor Paper Market showcases varied trends and market penetration across the globe, with North America, Europe, Asia Pacific, Middle East & Africa, and Latin America each presenting unique dynamics.

In North America, the market dominates due to a robust demand for high-quality and innovative decor solutions in both residential and commercial sectors. The region’s preference for sustainable and eco-friendly products has catalyzed the adoption of superior decor papers, particularly in the U.S. and Canada.

North America’s share is characterized by a strong presence of leading manufacturers and a well-established distribution network, enhancing market penetration and consumer accessibility.

Regional Mentions:

Europe follows closely, driven by an increasing trend towards interior customization and renovation activities. European consumers’ high disposable income facilitates greater expenditure on home decor, thereby boosting the demand for decor paper. The market in Europe benefits from stringent environmental regulations, pushing for products that comply with sustainability standards.

Asia Pacific is witnessing rapid growth due to expanding real estate sectors and urbanization, especially in China and India. The region’s growing middle-class population and rising standards of living are pivotal in increasing the demand for decor paper. Manufacturers are capitalizing on this by expanding their operational facilities and distribution channels in the region.

Middle East & Africa and Latin America markets are emerging, with growth fueled by increasing urban development and infrastructural investments. These regions present untapped potential with increasing consumer awareness about interior aesthetics and the availability of decor paper products.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Decor Paper Market witnessed significant contributions from key players, each displaying unique strategic positions and market influences.

ITC Limited and Andhra Paper Limited, renowned for their extensive market reach and diversified product offerings, continued to drive innovation with sustainable paper solutions, catering to the rising demand for eco-friendly decor materials. Similarly, Ahlstrom-Munksjö Oyj, with its global footprint, emphasized advanced materials that support digital printing technologies, enhancing the aesthetic appeal and functionality of decor paper.

Fakirsons Papchem Pvt Ltd and SILVERTON PULP & PAPERS PVT. LTD., both prominent in the Indian market, capitalized on local manufacturing advantages to deliver cost-effective and high-quality decor papers, focusing on domestic demands and export opportunities.

Felix Schoeller India and Pudumjee Paper Products leveraged their technical expertise to enhance product quality, focusing on specialty papers that offer superior printability and durability, aligning with global trends towards high-end, customized interiors.

Shah International and I.DECOR Exp.Imp Co., Ltd expanded their geographical reach by tapping into emerging markets, introducing innovative design patterns that reflect regional aesthetic preferences. WestCoast Paper Mills and Fortune Paper Mills strengthened their market positions through strategic partnerships and expansions, aiming to increase production capacity and meet the growing international demand.

Toppan Holdings Inc., a leader in technological integration, further developed its offerings in high-resolution decor paper, incorporating advanced digital technologies that enable realistic and high-definition designs, setting new standards in the decor paper market.

Top Key Players in the Market

- ITC Limited

- Fakirsons Papchem Pvt Ltd

- Andhra Paper Limited

- SILVERTON PULP & PAPERS PVT. LTD.

- Ahlstrom-Munksjö Oyj

- Felix Schoeller India

- Pudumjee Paper Products

- Shah International

- I.DECOR Exp.Imp Co., Ltd

- WestCoast Paper Mills.

- Fortune Paper Mills

- Toppan Holdings Inc.

Recent Developments

- In August 2023, Nordic Paper announced a substantial investment of $78 million at its Bäckhammar mill in Sweden, aiming to enhance production capabilities and efficiency.

- In December 2023, Black Paper Party secured a $250,000 investment deal following their successful appearance on the television show ‘Shark Tank’, marking a significant boost for the company’s growth and visibility.

- In May 2023, Chiyoda expanded its printing capabilities by acquiring a second InterioJet laminate decor paper inkjet printing press from Agfa, further strengthening its position in the high-quality printing market.

Report Scope

Report Features Description Market Value (2023) USD 4.3 Billion Forecast Revenue (2033) USD 7.1 Billion CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Printed, Solid, Woodgrain, Metallic), By Printing Technology (Rotogravure, Digital, Screen, Flaxographic), By Application (Furniture, Flooring, Wall-paneling), By End-User (Commercial, Residential, Industrial), By Basis of Weight (Heavy-weight, Lightweight, Medium-weight) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ITC Limited, Fakirsons Papchem Pvt Ltd, Andhra Paper Limited, SILVERTON PULP & PAPERS PVT. LTD., Ahlstrom-Munksjö Oyj, Felix Schoeller India, Pudumjee Paper Products, Shah International, I.DECOR Exp.Imp Co., Ltd, WestCoast Paper Mills., Fortune Paper Mills, Toppan Holdings Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ITC Limited

- Fakirsons Papchem Pvt Ltd

- Andhra Paper Limited

- SILVERTON PULP & PAPERS PVT. LTD.

- Ahlstrom-Munksjö Oyj

- Felix Schoeller India

- Pudumjee Paper Products

- Shah International

- I.DECOR Exp.Imp Co., Ltd

- WestCoast Paper Mills.

- Fortune Paper Mills

- Toppan Holdings Inc.