Global Online Gaming Security Solutions Market Report By Type (Multi-user Games Solutions, Single-user Games Solutions), By Application (Mobile Phone, PCs, Consoles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 128734

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

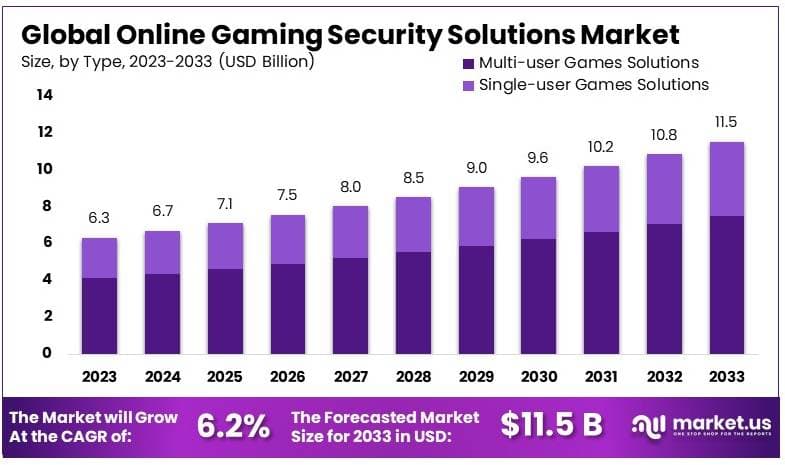

The Global Online Gaming Security Solutions Market size is expected to be worth around USD 11.5 Billion by 2033, from USD 6.3 Billion in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Online gaming security solutions refer to tools and technologies designed to protect online games from cyber threats. These solutions safeguard player data, prevent hacking, and ensure safe online transactions. They also protect gaming companies from fraud and help maintain a secure and enjoyable gaming environment.

The Online Gaming Security Solutions industry is expanding rapidly as the popularity of online gaming continues to grow. With more gamers connecting through online platforms, security threats such as hacking, data breaches, and fraud are increasing. This has created a high demand for robust security solutions to protect both players and gaming companies.

Cybersecurity providers are developing specialized solutions to address issues like identity theft, account hijacking, and payment fraud. As the online gaming sector becomes more sophisticated, security solutions will remain critical for maintaining trust and ensuring smooth operations.

The rise in online gaming has brought with it a surge in cheating and cyber threats, leading to a growing demand for robust security solutions. A survey by Irdeto revealed that 60% of online gamers have had their gaming experience negatively affected by other players’ cheating, with 33% reporting it happens sometimes, 18% often, and 8% stating it always impacts their experience.

This has prompted game developers to adopt anti-cheat software like Easy Anti-Cheat, which protects over 300 million players globally and is used by popular games like Fortnite and Apex Legends. The effectiveness of these solutions is underscored by Riot Games, which reported a 50% reduction in cheating after introducing kernel-level anti-cheat systems in games like Valorant.

Demand for online gaming security solutions is expected to increase as threats become more sophisticated. The use of kernel-level cheats by 10-15% of cheaters has led to the adoption of kernel-level anti-cheat software, a more advanced solution that monitors deeper system processes to prevent cheating.

Additionally, the rise in DDoS attacks, as noted in Gcore’s recent report, saw a 46% increase in attacks in 2023, with peak attack power now measured in terabits per second, highlighting the growing need for more robust defense mechanisms.

The opportunity for growth in this sector is significant, driven by the expansion of the online gaming industry and the rising number of cyber threats. With gaming companies investing heavily in security to protect both their platforms and player experience, the demand for advanced security solutions will continue to rise. Governments may also introduce regulations to safeguard online gaming environments, further encouraging the adoption of security technologies.

Key Takeaways

- The Online Gaming Security Solutions Market was valued at USD 6.3 billion in 2023, and is expected to reach USD 11.5 billion by 2033, with a CAGR of 6.2%.

- In 2023, Multi-user Game Solutions dominate with 65%, driven by the rising popularity of multiplayer online games.

- In 2023, Mobile Phones account for 48% of the application segment, reflecting the growing trend of mobile gaming.

- In 2023, North America leads with 38%, owing to increasing concerns over cybersecurity in the gaming industry.

Type Analysis

Multi-user Games Solutions dominate with 65% due to enhanced engagement and revenue generation models.

The online gaming security market is segmented by type into multi-user games solutions and single-user games solutions. Currently, multi-user games solutions hold the largest market share at 65%. This dominance can be attributed to the increasing popularity of multiplayer platforms that offer real-time interaction and competition, which significantly enhances user engagement.

Multiplayer gaming environments are particularly vulnerable to security threats, including data breaches and cyberattacks, which drives the demand for robust security solutions.

Multi-user games solutions are designed to secure servers that handle thousands of simultaneous connections, ensuring the integrity and confidentiality of in-game communications and transactions. These solutions often include advanced encryption protocols, real-time intrusion detection systems, and anti-cheating technologies.

In contrast, single-user games solutions, while important, cater to a smaller segment of the market. These solutions focus on protecting individual gamers from malware and phishing attacks but do not require the complex infrastructure necessary for multi-user environments.

Despite their smaller market share, single-user games solutions play a critical role in safeguarding gamers who engage in solo play, thereby supporting the overall growth of the online gaming security market by ensuring a safe environment across all gaming modalities.

Application Analysis

Mobile Phone dominates with 48% due to widespread accessibility and the increasing prevalence of mobile gaming.

Within the online gaming security solutions market, the application segment is crucial. It is further categorized based on the devices used for gaming, including mobile phones, PCs, and consoles. The dominant sub-segment here is mobile phone, which currently holds a 48% share of the market.

Mobile gaming presents unique security challenges, given the personal nature of these devices and the variety of ways they connect to the internet and other networks. Security solutions for mobile gaming must therefore not only prevent unauthorized access and fraud but also ensure data privacy and secure financial transactions. As smartphones continue to evolve, the integration of advanced biometric technology security features and end-to-end encryption has become critical in protecting users from potential security threats.

On the other hand, PCs and gaming consoles also represent significant segments of the market but with distinct security needs. PC gaming security solutions focus on protecting against malware and hacking attempts on personal computers, which are often more open systems than consoles.

Console security solutions, meanwhile, are tailored to the closed ecosystems of specific gaming consoles and often collaborate closely with manufacturers to ensure hardware and software security from design to gameplay.

Despite the current prominence of mobile gaming, the roles of PCs and consoles in the market are evolving with trends such as cross-platform play and the rise of esports, which blur the lines between different gaming devices.

Key Market Segments

By Type

- Multi-user Games Solutions

- Single-user Games Solutions

By Application

- Mobile Phone

- PCs

- Consoles

Driver

Growing Cyber Threats and Increased Online Gaming Adoption Drive Market Growth

The rising number of cyber threats is a major driver for the growth of the online gaming security solutions market. With the increasing popularity of online gaming, the risk of cyberattacks such as data breaches, hacking, and phishing is also growing. This has led to a heightened need for robust security measures to protect user data and gaming infrastructures.

Another significant factor driving market growth is the increasing adoption of online gaming platforms. As more people worldwide engage in online multiplayer games, the demand for secure gaming environments grows, pushing developers and gaming companies to invest in advanced security solutions.

The growth of mobile gaming is also fueling the demand for security solutions. As gaming moves to smartphones and tablets, mobile devices become more vulnerable to cyberattacks, increasing the need for comprehensive security services tailored to mobile platforms.

The integration of digital payment systems in gaming has further amplified security needs. With in-game purchases and digital currencies becoming more common, ensuring secure financial transactions is crucial for maintaining user trust. These factors drive the expansion of the online gaming security solutions market.

Restraint

High Costs and Evolving Cyber Threats Restraint Market Growth

One of the main restraints on the online gaming security solutions market is the high cost of implementing advanced security solutions. Smaller gaming companies may find it difficult to afford comprehensive security measures, limiting their adoption and leaving potential vulnerabilities.

The evolving nature of cyber threats is another significant restraint. As cybercriminals develop increasingly sophisticated methods of attack, security solutions must constantly be updated and improved, adding to operational costs and creating challenges in maintaining effective protection.

A lack of awareness among casual gamers regarding the importance of security also restrains market growth. Many users may not prioritize securing their gaming accounts or devices, which can result in lax security practices that expose vulnerabilities.

Finally, regional differences in data protection laws and regulations complicate the deployment of uniform security solutions globally. Companies must navigate these regulatory complexities, which can slow down the widespread adoption of security solutions across various gaming markets.

Opportunity

Growing Cloud Adoption and AI Integration Provides Opportunities for Growth

The growing adoption of cloud gaming platforms presents a key opportunity for the online gaming security solutions market. As more gaming content moves to the cloud, the need for secure cloud environments increases, offering new growth avenues for security solution providers.

Another opportunity lies in the integration of Artificial Intelligence (AI) and machine learning technologies. AI-driven security solutions can detect and respond to cyber threats in real-time, offering enhanced protection for gamers. This advanced approach to threat detection provides a competitive advantage for companies offering AI-powered security tools.

The increasing trend of subscription-based gaming services also presents opportunities. As more players opt for subscription models, security providers can offer integrated services that ensure data protection across multiple gaming platforms.

The rise of esports and live-streamed gaming tournaments creates opportunities for security solutions to protect these high-profile events. Ensuring a secure and fair gaming environment is crucial for maintaining the integrity of such events, presenting further growth potential for security providers in the gaming industry.

Challenge

Rapid Technological Changes and Complex User Authentication Challenges Market Growth

One of the primary challenges in the online gaming security solutions market is the rapid pace of technological changes. As new gaming platforms and technologies emerge, security providers must constantly update and evolve their solutions to keep up with the latest developments, which can be resource-intensive.

Another challenge is implementing effective user authentication. As the number of online gamers grows, ensuring secure and user-friendly authentication processes becomes critical. However, balancing strong security measures with convenience, such as multi-factor authentication, can be challenging, especially for casual gamers who prefer a simpler experience.

The increasing complexity of online games, which now often include real-time multiplayer interactions, digital currencies, and in-game purchases, further complicates security needs. Protecting these different aspects of the gaming environment while ensuring seamless gameplay requires sophisticated and multi-layered security solutions.

User resistance to additional security measures, such as frequent authentication prompts, can be a barrier to effective security implementation. Gamers may view these steps as a hindrance to their experience, creating a challenge for security providers to balance security with user experience.

Growth Factors

Rising Mobile Gaming and In-Game Purchases Are Growth Factors

The rapid expansion of mobile gaming is a major growth factor for the online gaming security solutions market. As more players shift to mobile platforms, the need for robust security solutions that protect mobile devices from malware and cyberattacks is growing. This trend is pushing demand for specialized security services that cater to mobile gaming.

The increase in in-game purchases is also driving market growth. With more players buying digital assets and making financial transactions within games, securing these transactions is becoming a top priority for developers and security providers. Protecting in-game currencies and personal payment information is critical for maintaining user trust and driving further market expansion.

The rise of real-time multiplayer gaming is another significant growth factor. As these games gain popularity, ensuring secure interactions between players becomes essential. This requires advanced encryption and real-time threat detection to protect users from hacking and other cyberattacks.

The growing integration of social features in online games, such as chat and voice communication, adds a new layer of complexity to security needs. Ensuring that these social interactions are protected from eavesdropping or data breaches drives demand for enhanced gaming security solutions.

Emerging Trends

Diversity in Characters and Settings Is Latest Trending Factor

The growing diversity in characters and settings within shooting games is a significant factor driving market growth. Game developers are increasingly offering a wider variety of characters, representing different cultures and backgrounds. This appeals to a broader audience, creating a more inclusive gaming environment.

In-game customization is allowing players to personalize their characters, weapons, and load-outs to suit individual playstyles. This enhances engagement and long-term player retention by providing a tailored experience. Players feel more connected to their avatars and invested in their progress.

Loot systems, featuring randomized rewards, continue to boost excitement. Players are incentivized to progress and explore further in the game. These mechanics increase retention as players seek rare and valuable items.

Anti-cheat measures ensure fair play, which is especially important in competitive multiplayer environments. These measures build trust in the game, increasing player satisfaction. Collectively, these factors contribute to the overall growth of the shooting games market.

Regional Analysis

North America Dominates with 38% Market Share

North America leads the Online Gaming Security Solutions Market with a 38% market share, valued at USD 2.38 billion. This dominance is driven by the region’s large gaming population, high awareness of cybersecurity risks, and the presence of leading security technology providers. The U.S. is a key player, with advanced infrastructure supporting both gaming and cybersecurity industries.

The region benefits from widespread internet connectivity, high smartphone penetration, and an increasing number of online gamers. These factors, combined with the growing sophistication of cyber threats, drive the demand for robust security solutions to protect personal data and financial transactions in the gaming world. North America’s regulatory environment also encourages businesses to invest in advanced cybersecurity.

North America’s role in the online gaming security market will continue to grow. As gaming platforms become more integrated with emerging technologies like blockchain and AI, the need for advanced security solutions will increase, ensuring the region’s market dominance.

Regional Mentions:

- Europe: Europe is a key market for online gaming security, driven by strict data privacy regulations and a growing focus on protecting user data across gaming platforms. This supports steady market growth.

- Asia Pacific: Asia Pacific is expanding rapidly, with a massive online gaming population. Countries like China and South Korea are investing heavily in security solutions to address increasing cyber threats.

- Middle East & Africa: The region is gradually adopting online gaming security solutions as internet infrastructure improves and online gaming becomes more popular, especially in urban areas.

- Latin America: Latin America is experiencing steady growth, with increasing demand for gaming security solutions as the gaming industry expands and more users engage in online multiplayer platforms.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Online Gaming Security Solutions Market is driven by major players that provide robust solutions for protecting gaming platforms from cyber threats. Among the top players, AWS, Cisco, and McAfee lead in terms of impact, strategic positioning, and market influence.

AWS (Amazon Web Services) is a dominant force in cloud security. Its scalable security services ensure gaming companies have access to advanced protection tools and real-time threat monitoring. AWS’s large market share and global infrastructure make it a key player in securing online gaming environments.

Cisco is well-positioned as a leader in network security. The company offers comprehensive protection with its cybersecurity solutions, including firewalls, threat intelligence, and secure networking for gaming platforms. Cisco’s influence stems from its ability to secure large-scale gaming networks, boosting reliability and performance.

McAfee holds a strong position in providing endpoint and antivirus solutions. The company’s focus on securing personal devices used by gamers helps prevent data breaches and malware attacks. McAfee’s long-standing presence in cybersecurity and consistent product development enhance its strategic importance in this market.

These top players continue to shape the future of online gaming security through innovation and strong market presence.

Top Key Players in the Market

- AWS

- Cisco

- McAfee

- Arxan

- BullGuard

- Reblaze

- NAGRA

- ScienceSoft

- OTELCO

- Symantec

- OneSpan

- Norton

- Other Key Players

Recent Developments

- AptPay and ILIXIUM: In August 2024, AptPay and ILIXIUM formed a strategic partnership to enhance real-time payments and account verification services for the Canadian online gaming industry. This collaboration aims to provide faster and more secure fund transfers, offering a seamless user experience for players.

- Synergy: In September 2024, Yorkshire-based security technology provider, Synergy, secured a £2.4 million contract to supply security systems for a major UK gaming resort. The deal emphasizes Synergy’s expertise in delivering high-end surveillance and access control solutions to large-scale entertainment venues, ensuring both visitor safety and operational efficiency.

- Respawn Entertainment: In August 2024, Respawn Entertainment, the developer of Apex Legends, increased in-game security measures following a security breach during a major tournament. The hack disrupted gameplay and exposed vulnerabilities, prompting the company to implement new protections to prevent future threats to the popular battle royale game.

- Bandai Namco: In March 2024, Bandai Namco Entertainment partnered with Google Cloud to leverage its secure, scalable infrastructure for seamless game launches across its franchises. This collaboration aims to improve game performance, enhance security, and better manage live services, allowing the company to handle increased player demand more effectively.

Report Scope

Report Features Description Market Value (2023) USD 6.3 Billion Forecast Revenue (2033) USD 11.5 Billion CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Multi-user Games Solutions, Single-user Games Solutions), By Application (Mobile Phone, PCs, Consoles) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AWS, Cisco, McAfee, Arxan, BullGuard, Reblaze, NAGRA, ScienceSoft, OTELCO, Symantec, OneSpan, Norton, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Online Gaming Security Solutions MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Online Gaming Security Solutions MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- AWS

- Cisco

- McAfee

- Arxan

- BullGuard

- Reblaze

- NAGRA

- ScienceSoft

- OTELCO

- Symantec

- OneSpan

- Norton

- Other Key Players