Global Onion Salt Market Size, Share, And Business Benefits By Type (Organic, Conventional), By Packaging (Jars, Bottles, Bulk Packaging, Pouches, Others), By Distribution Channel (Direct Sales/B2B, Indirect Sales/B2C (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail)), By End-user (Household, HoReCa, Food Processing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 136831

- Number of Pages: 384

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

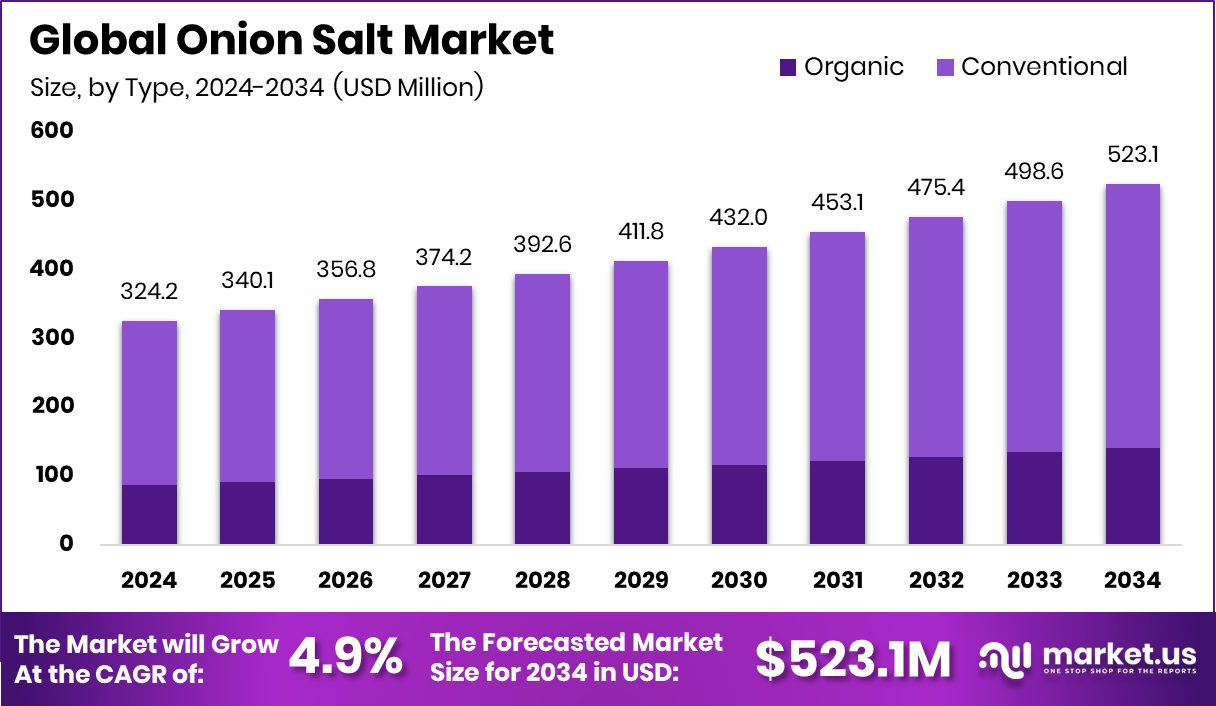

Global Onion Salt Market is expected to be worth around USD 523.1 million by 2034, up from USD 324.2 million in 2024, and grow at a CAGR of 4.9% from 2025 to 2034. High demand in the retail and food sectors boosted North America’s 44.6% market share.

Onion salt is a seasoned salt blend made by combining dried, ground onion with table salt. It is commonly used as a seasoning in kitchens around the world for its convenience and flavor-enhancing properties. Onion salt provides the pungent, slightly sweet taste of onion without the need for chopping or sautéing, making it ideal for quick cooking and seasoning meats, snacks, soups, and salad dressings.

The onion salt market refers to the global trade, production, and consumption of onion salt products. This market includes various forms, such as powdered, granulated, and coarse blends, sold through retail, foodservice, and industrial channels. It caters to consumers seeking convenience in cooking, as well as food manufacturers looking to enhance product flavor. The market spans both developed and emerging regions, driven by evolving food preferences and the increasing demand for packaged seasonings.

The growth of the onion salt market can be attributed to the increasing demand for convenient and ready-to-use food ingredients. As urbanization rises and more people adopt busy lifestyles, the preference for easy-to-prepare meals has surged, driving the popularity of pre-mixed seasonings like onion salt. Additionally, home cooking trends and online recipe sharing during and after the COVID-19 pandemic have further contributed to growth.

Rising demand for natural and versatile flavor enhancers in processed and ready-to-eat foods continues to support onion salt sales. Consumers are seeking ways to add authentic flavors without relying on artificial additives or complicated cooking steps. According to an industry report, Kerala-based banana chips brand Beyond Snack has raised $8.3 million in a Series A funding round.

Key Takeaways

- Global Onion Salt Market is expected to be worth around USD 523.1 million by 2034, up from USD 324.2 million in 2024, and grow at a CAGR of 4.9% from 2025 to 2034.

- In 2024, the conventional type dominated the Onion Salt Market, accounting for 73.4% market share.

- Bulk packaging led the Onion Salt Market by packaging segment in 2024, capturing 33.6% global share.

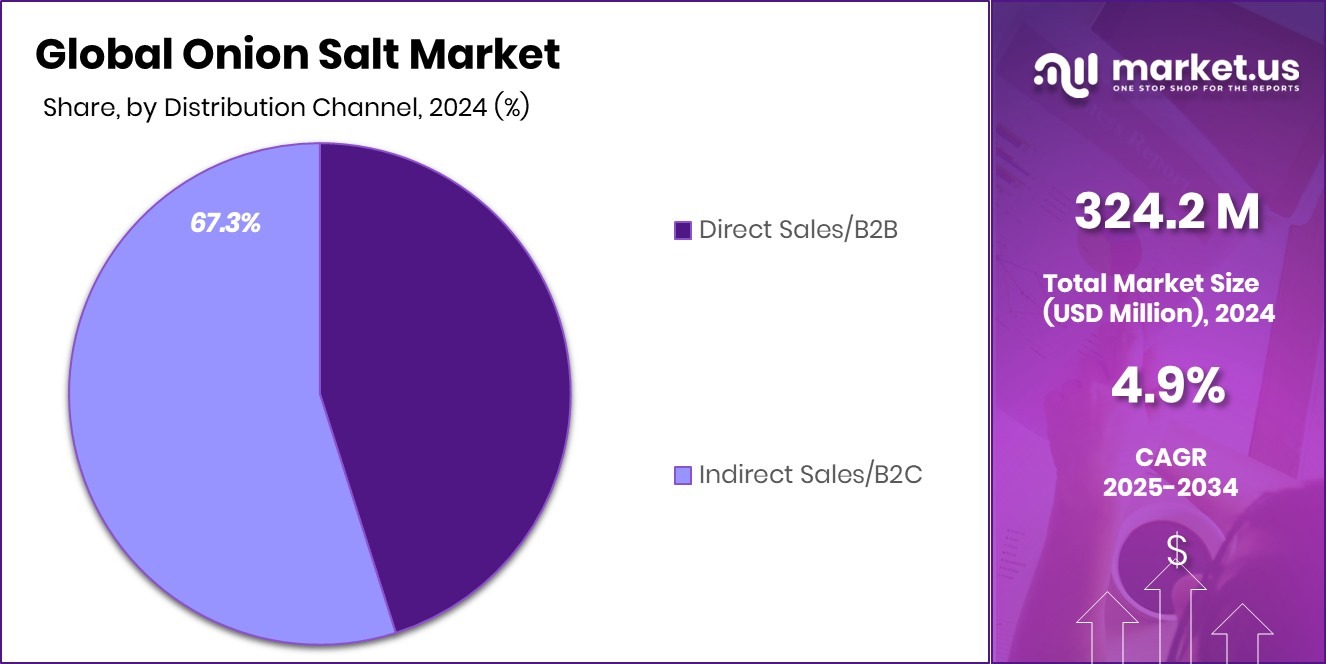

- Indirect Sales or B2C channels held 67.3% of the Onion Salt Market distribution in 2024 globally.

- Household end-users contributed the highest share of 43.3% in the Onion Salt Market during 2024.

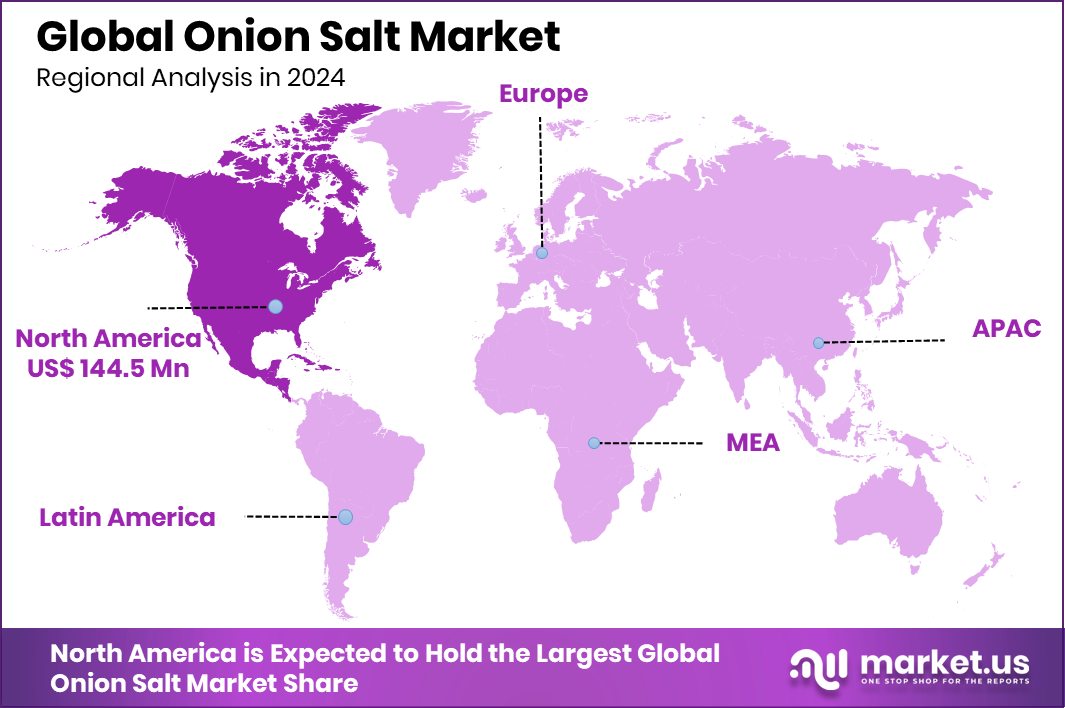

- North America generated revenue worth USD 144.5 million, showing strong consumer preference.

By Type Analysis

In 2024, Conventional onion salt held a 73.4% share, dominating market preferences.

In 2024, Conventional held a dominant market position in the By Type segment of the Onion Salt Market, with a 73.4% share. This dominance can be attributed to the widespread availability, cost-effectiveness, and familiarity of conventionally processed onion salt among both household and commercial users.

Conventional onion salt continues to be the preferred choice in mainstream food retail and bulk supply chains due to its consistent flavor profile and longer shelf life. It is commonly used across food processing industries, restaurants, and home kitchens, making it a staple in global spice and seasoning consumption.

The large share also reflects consumer comfort and longstanding trust in conventionally grown agricultural inputs, particularly in regions where organic certification is less emphasized or carries higher price sensitivity. Furthermore, the use of conventional onion salt in packaged food products, savory snacks, and instant meals has supported its sustained demand.

The segment’s performance is reinforced by stable sourcing channels and established manufacturing practices, allowing producers to meet growing demand at competitive prices. As global consumption of convenient and ready-to-use seasoning products rises, the conventional category continues to lead, backed by scale, accessibility, and product versatility across diverse food applications.

By Packaging Analysis

Bulk packaging captured a 33.6% share, driven by foodservice and commercial kitchen demand.

In 2024, Bulk Packaging held a dominant market position in the By Packaging segment of the Onion Salt Market, with a 33.6% share. This leading position reflects the strong preference from food processing units, restaurants, catering services, and institutional buyers who require large quantities of seasoning for consistent use in high-volume meal preparation. Bulk packaging offers operational efficiency and cost advantages, especially for commercial users who benefit from reduced per-unit cost and minimized packaging waste.

The segment’s strength also stems from its suitability for supply chains where onion salt is purchased in large lots for redistribution or industrial use. Warehousing and distribution centers prefer bulk formats for streamlined storage and handling. Moreover, bulk packaging supports stable demand in sectors that prioritize ingredient standardization, particularly in snack manufacturing and spice blending operations.

The segment’s ability to cater to high-demand clients with reliable volume supply and flexible integration into automated food production lines has reinforced its leading role. The 33.6% market share held by bulk packaging in 2024 highlights its continued relevance in ensuring scale, economy, and uninterrupted ingredient availability for commercial and institutional applications.

By Distribution Channel Analysis

Indirect sales accounted for 67.3%, reflecting strong B2C retail and online presence.

In 2024, Indirect Sales/B2C held a dominant market position in the By Distribution Channel segment of the Onion Salt Market, with a 67.3% share. This substantial share indicates the strong role of supermarkets, hypermarkets, grocery stores, and online platforms in driving retail sales of onion salt to end consumers.

The indirect sales channel benefits from high foot traffic, established distribution networks, and visibility across both modern and traditional retail formats, making it a key access point for household buyers.

The dominance of this channel also reflects the growing consumer shift toward convenient spice purchases during regular grocery shopping. Retailers continue to stock onion salt as a commonly used kitchen seasoning, responding to rising demand for flavor enhancers that are easy to use and store. The expansion of e-commerce platforms has further strengthened B2C sales, offering greater reach and ease of ordering for urban consumers.

Promotions, attractive packaging, and recipe-based marketing at the retail level have also contributed to this segment’s growth. The 67.3% share held by Indirect Sales/B2C in 2024 confirms its vital role in connecting onion salt manufacturers with the end-user market through established and increasingly digital retail ecosystems.

By End-user Analysis

Household usage led the end-user segment with 43.3%, supporting daily cooking convenience globally.

In 2024, Household held a dominant market position in the By End-user segment of the Onion Salt Market, with a 43.3% share. This dominance highlights the growing adoption of onion salt as a convenient seasoning solution in daily home cooking.

With its ease of use and ability to enhance flavor without the need for chopping or preparing fresh onions, onion salt has become a pantry staple in many households. Consumers appreciate its time-saving nature, especially in fast-paced urban lifestyles where quick meal preparation is a priority.

The household segment’s strong share is also linked to the rising popularity of home-cooked meals, fueled by health awareness, cost-saving preferences, and an interest in culinary experimentation. Onion salt serves as a versatile ingredient that can be sprinkled on snacks, added to marinades, or mixed into ready-to-eat dishes.

Its wide availability through retail stores and online platforms ensures that it remains accessible to consumers across different regions and income groups. The 43.3% market share held by the household segment in 2024 reflects its central role in driving consistent demand for onion salt products at the consumer level, reinforcing its position as a trusted and frequently used kitchen essential.

Key Market Segments

By Type

- Organic

- Conventional

By Packaging

- Jars

- Bottles

- Bulk Packaging

- Pouches

- Others

By Distribution Channel

- Direct Sales/B2B

- Indirect Sales/B2C

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

By End-user

- Household

- HoReCa

- Food Processing

Driving Factors

Rising Demand for Quick and Flavorful Cooking

One of the main reasons behind the growth of the onion salt market is the increasing need for easy and flavorful cooking ingredients. People today prefer simple ways to prepare meals without losing taste. Onion salt is a ready-to-use seasoning that saves time and gives food a rich onion flavor.

It removes the need to peel, chop, or sauté fresh onions, which makes it ideal for busy households and beginner cooks. As more consumers turn to homemade meals, especially after the pandemic, the use of onion salt has increased. Its long shelf life, ease of use, and versatility in many recipes—from soups to snacks—make it a popular choice in kitchens around the world.

Restraining Factors

Health Concerns Over High Salt Consumption Levels

A major factor holding back the growth of the onion salt market is growing awareness about health risks linked to high salt intake. Many consumers are becoming cautious about their daily sodium consumption due to rising cases of high blood pressure, heart disease, and other lifestyle-related illnesses. Since onion salt contains a high percentage of table salt, health-conscious individuals often avoid it or limit its use in daily cooking.

Medical professionals and health organizations also continue to advise reduced salt consumption, which has led some buyers to switch to low-sodium or salt-free seasoning alternatives. This shift in preference is slowing down the market’s growth among health-aware consumers who are seeking healthier ways to flavor their food.

Growth Opportunity

Rising Demand for Organic and Healthier Onion Salt

A significant growth opportunity exists in launching organic and healthier versions of onion salt. As demand for clean-label and healthier food choices grows, consumers are increasingly seeking seasonings made with natural, non-GMO, and organically cultivated ingredients. By developing onion salt blends with reduced sodium content, no artificial additives, and certified organic onions, manufacturers can address the needs of health-conscious buyers.

These products can be positioned as premium yet accessible options in health food stores, organic sections of supermarkets, and online wellness platforms. Marketing such onion salts through recipe suggestions and nutritional transparency can appeal to consumers pursuing healthier lifestyles.

Latest Trends

Creative Flavored Onion Salt Blends Gaining Popularity

A key trend emerging in the onion salt market is the growing interest in flavored blends. Consumers are now looking for more than just basic seasoning—they want exciting, multi-layered tastes. As a result, brands are experimenting with creative combinations like onion salt mixed with garlic, chili, herbs, or smoked flavors. These blends offer more flavor in a single product, making cooking easier and more enjoyable.

They are especially popular among younger consumers who enjoy trying new recipes at home. Flavored onion salts are also being used as finishing touches on snacks, grilled foods, and salads. This trend reflects a shift toward convenience without compromising on taste, helping to keep onion salt relevant and interesting in modern kitchens.

Regional Analysis

In 2024, North America led the onion salt market with a 44.6% share.

In 2024, North America held the dominant position in the global onion salt market, accounting for 44.6% of the total market share, with a recorded valuation of USD 144.5 million. This leadership can be attributed to the region’s high consumption of convenience foods and strong demand for ready-to-use seasonings among households and foodservice operators. The presence of established retail distribution networks and consumer familiarity with onion-based flavorings further support the segment’s growth.

In Europe, the market is shaped by culinary traditions that incorporate spice blends in daily cooking, contributing to steady demand across countries like the UK, Germany, and France. The Asia Pacific region is showing gradual adoption, driven by urbanization and changing dietary habits in emerging economies. The Middle East & Africa, along with Latin America, are witnessing modest traction, where onion salt is used increasingly in processed food and snack applications.

However, these regions remain largely price-sensitive, with conventional offerings gaining more attention than premium variants. While all regions contribute to global growth, North America remains the key revenue generator in 2024, backed by mature consumption behavior and widespread acceptance of onion salt as a common kitchen staple.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, McCormick & Company, Inc. maintained a strong position in the global onion salt market, leveraging its wide distribution network and trusted brand image. Known for its diverse range of seasoning products, the company continues to benefit from high consumer loyalty and shelf presence in major retail chains. Its focus on quality, consistency, and product availability across both developed and emerging markets supports steady market performance.

B&G Foods, Inc. also remains a notable player, capitalizing on its portfolio of pantry staples and seasoning products. The company’s efforts to align with shifting consumer preferences—particularly for everyday cooking essentials—have helped it maintain visibility in the competitive spice aisle. B&G’s established brands and packaging variety have enabled it to serve both bulk buyers and retail customers effectively.

Badia Spices brings strength from its widespread appeal in multicultural markets. Its onion salt offerings are well-positioned among diverse consumer groups who seek bold, flavorful, and affordable seasonings. The company’s emphasis on ethnic and traditional spice blends has carved a niche in regional and specialty food markets.

Meanwhile, Hoyts Food Manufacturing Industries Pty Ltd, based in Australia, supports the global onion salt landscape through its targeted presence in Oceania and selective international markets. With a focus on simple, no-frills spice packaging and value-for-money options, Hoyts remains relevant to everyday household consumers. Collectively, these companies contribute significantly to shaping consumer access, pricing strategies, and innovation trends in the evolving onion salt segment globally.

Top Key Players in the Market

- McCormick & Company, Inc.

- B&G Foods, Inc

- Badia Spices

- Hoyts Food Manufacturing Industries Pty Ltd

- The Kroger Co.

- Woodland Foods

- Redmond Life

- Schwartz

- Aum Agri Freeze Foods

- Tantara Farms

- Mars, Incorporated

- Starlight Herb & Spice Company

- San Francisco Salt Company

- Aloha Spice Company

- Other Key Players

Recent Developments

- In February 2025, McCormick launched its limited-edition Aji Amarillo Seasoning, which features onion alongside garlic, sea salt, and tropical notes. While not a pure onion salt, this blend underscores the ongoing importance of onion as a key flavor base.

- In August 2024, Mars announced its agreement to acquire Kellanova (operator of iconic snack brands such as Pringles, Cheez-It, Pop‑Tarts) for a total of US$35.9 billion (US$83.50 per share). The acquisition significantly expands Mars’ global snacking portfolio and is expected to close in the first half of 2025.

Report Scope

Report Features Description Market Value (2024) USD 324.2 Million Forecast Revenue (2034) USD 523.1 Million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Organic, Conventional), By Packaging (Jars, Bottles, Bulk Packaging, Pouches, Others), By Distribution Channel (Direct Sales/B2B, Indirect Sales/B2C(Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail)), By End-user (Household, HoReCa, Food Processing) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape McCormick & Company, Inc., B&G Foods, Inc, Badia Spices, Hoyts Food Manufacturing Industries Pty Ltd, The Kroger Co., Woodland Foods, Redmond Life, Schwartz, Aum Agri Freeze Foods , Tantara Farms, Mars, Incorporated, Starlight Herb & Spice Company, San Francisco Salt Company, Aloha Spice Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- McCormick & Company, Inc.

- B&G Foods, Inc

- Badia Spices

- Hoyts Food Manufacturing Industries Pty Ltd

- The Kroger Co.

- Woodland Foods

- Redmond Life

- Schwartz

- Aum Agri Freeze Foods

- Tantara Farms

- Mars, Incorporated

- Starlight Herb & Spice Company

- San Francisco Salt Company

- Aloha Spice Company

- Other Key Players