Global Nitro-infused Beverages Market Size, Share, And Industry Analysis Report By Product (Nitro Coffee, Nitro Tea, Nitro Soft Drinks, Others), By Distribution Channel (Supermarket and Hypermarkets, Convenience Stores, Online, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173384

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

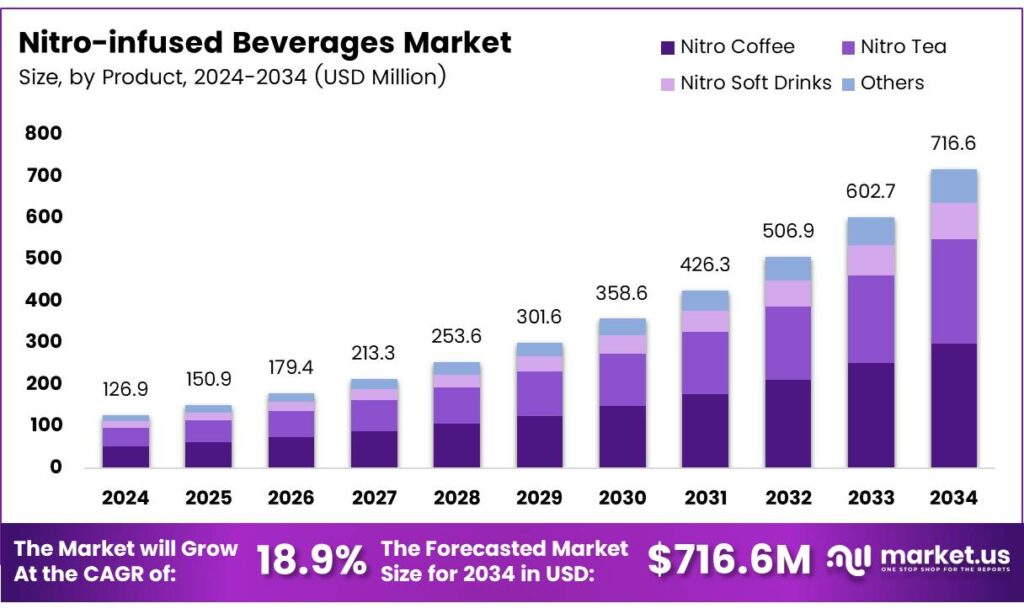

The Global Nitro-infused Beverages Market size is expected to be worth around USD 716.6 million by 2034, from USD 126.9 million in 2024, growing at a CAGR of 18.9% during the forecast period from 2025 to 2034.

The Nitro-infused Beverages Market represents a premium beverage segment using nitrogen to enhance texture, mouthfeel, and perceived freshness. Nitro infusion creates a smooth, creamy experience without added sugar or dairy, positioning these beverages within functional drinks, ready-to-drink coffee, and experiential beverage categories across cafés and retail channels.

Nitro-infused beverages include coffee, tea, and emerging non-coffee drinks infused with nitrogen gas. This process produces a cascading visual effect and velvety foam, improving sensory appeal. Nitro beverages align strongly with clean-label trends, indulgence without additives, and evolving consumer expectations for café-quality drinks.

The market benefits from premiumization and convenience trends across foodservice and packaged beverages. Operators increasingly favor nitro systems because bulk preparation reduces labor while maintaining consistency. Meanwhile, younger consumers associate nitro formats with craft quality, driving higher willingness to pay and repeat purchases in urban and on-the-go consumption environments.

- Toward the demand side, functional performance strongly influences adoption. According to FDA nutrition data, Nitro Cold Brew contains 30% more caffeine than regular drip coffee. A 12-oz nitro cold brew delivers 207 mg caffeine, versus 85 mg in a 12-oz vanilla latte, enhancing perceived energy benefits.

Nitro Technology is expanding beyond coffee into teas, functional drinks, and low-sugar beverages. This shift supports innovation in wellness positioning, including energy, focus, and reduced bitterness claims. Additionally, foodservice chains view nitro taps as space-efficient upgrades, enabling menu differentiation without significant footprint expansion or ingredient complexity.

Key Takeaways

- The Global Nitro-infused Beverages Market is projected to grow from USD 126.9 million in 2024 to USD 716.6 million by 2034, at a CAGR of 18.9% during 2025–2034.

- Nitro Coffee leads the product landscape with a dominant market share of 47.9%, supported by its premium positioning and higher perceived caffeine content.

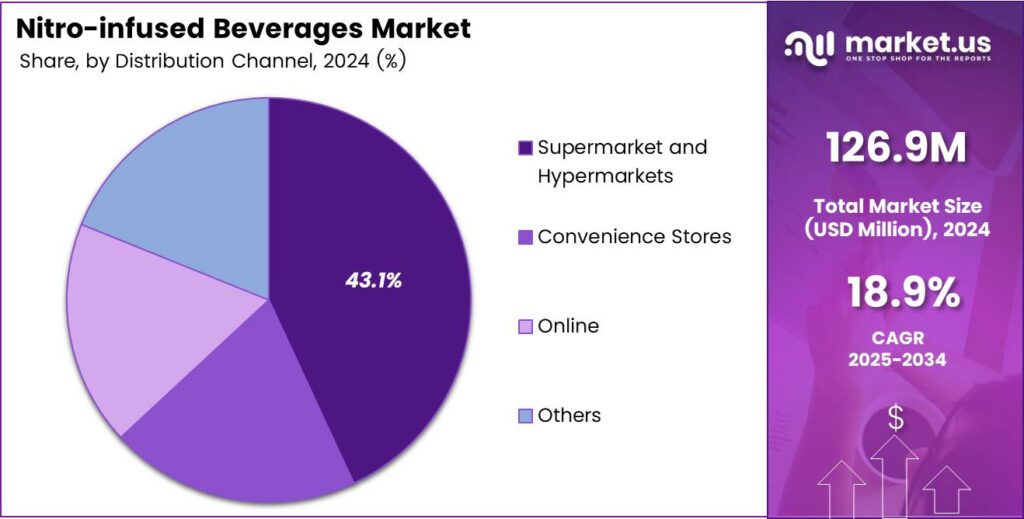

- Supermarkets and Hypermarkets represent the largest distribution channel, accounting for 43.1% of total market revenue due to strong visibility and volume sales.

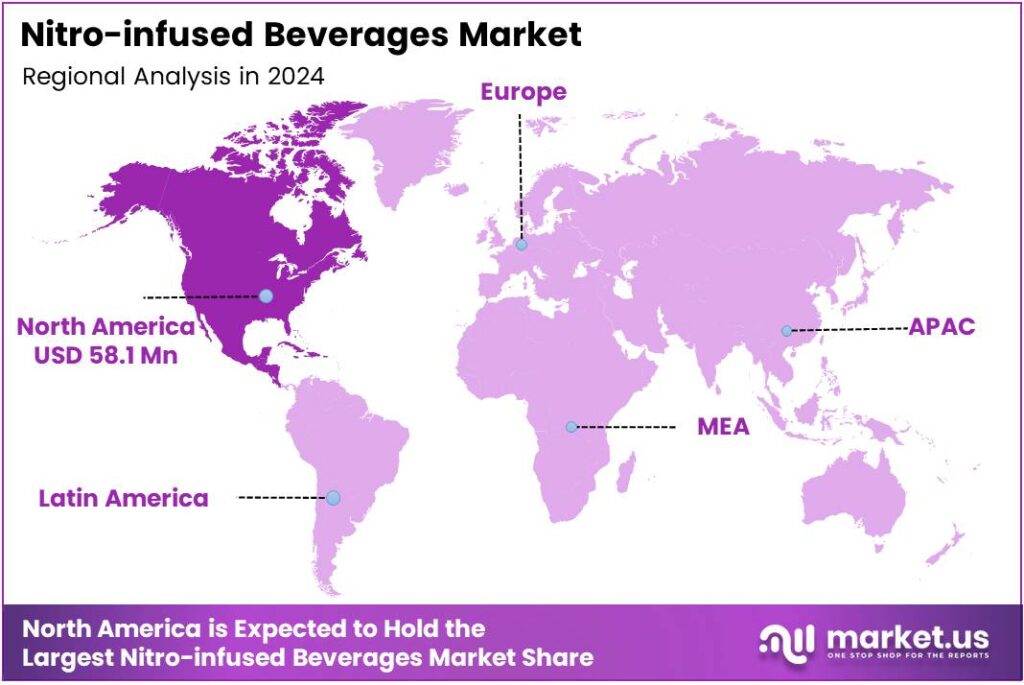

- North America dominates the regional market, accounting for 45.8% of the share, valued at USD 58.1 million, driven by the strong café culture and the adoption of ready-to-drink products.

By Product Analysis

Nitro Coffee dominates with 47.9% due to its smooth texture, higher caffeine impact, and growing café-to-retail adoption.

In 2024, Nitro Coffee held a dominant market position in the By Product Analysis segment of the Nitro-infused Beverages Market, with a 47.9% share. This leadership is supported by its creamy mouthfeel, natural sweetness, and strong demand from urban consumers seeking premium, ready-to-drink coffee experiences.

Nitro Tea held a notable position in the Product Analysis segment of the Nitro-infused Beverages Market. Gradually, consumers shifted toward nitro-infused teas for lighter caffeine intake, botanical flavors, and clean-label positioning. This sub-segment benefited from wellness trends and experimentation with cold-brewed, nitrogen-infused formulations.

Nitro Soft Drinks maintained steady traction in the By Product Analysis segment of the Nitro-infused Beverages Market. Increasingly, brands are leveraging nitrogen infusion to reduce sugar perception while enhancing mouthfeel. As a result, nitro soft drinks attracted younger consumers seeking novelty without traditional carbonation harshness.

By Distribution Channel Analysis

Supermarkets and Hypermarkets dominate with 43.1% due to strong shelf visibility and high-volume consumer footfall.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Nitro-infused Beverages Market, with a 43.1% share. This dominance reflects wide product availability, promotional pricing, and consumer preference for one-stop beverage shopping environments.

Convenience Stores played an important role in the By Distribution Channel Analysis segment of the Nitro-infused Beverages Market. Gradually, impulse purchases and single-serve packaging supported sales. Their proximity to workplaces and transit locations encouraged frequent consumption among time-conscious consumers.

Online channels expanded their presence in the By Distribution Channel Analysis segment of the Nitro-infused Beverages Market. Increasingly, direct-to-consumer models, subscription packs, and brand-led digital marketing have improved reach. This channel benefited from urban delivery networks and changing buying habits.

Others maintained a supporting role in the By Distribution Channel Analysis segment of the Nitro-infused Beverages Market. This includes cafés and specialty outlets. Gradually, experiential consumption and on-tap nitro formats helped build brand familiarity and trial-driven demand.

Key Market Segments

By Product

- Nitro Coffee

- Nitro Tea

- Nitro Soft Drinks

- Others

By Distribution Channel

- Supermarket and Hypermarkets

- Convenience Stores

- Online

- Others

Emerging Trends

Premiumization and Functional Beverage Integration Shape Market Trends

One major trend in the nitro-infused beverages market is premiumization. Brands are focusing on high-quality ingredients, artisanal positioning, and sleek packaging to attract premium consumers. Functional benefits are becoming increasingly important. Single-serve nitro cans designed for convenience are gaining popularity, especially among younger consumers, reinforcing long-term market relevance.

- In the International Food Information Council’s (IFIC) sugars and sweeteners tracking, 75% of Americans in 2025 reported they are trying to limit or avoid sugar in their diet. Among those limiting or avoiding sugars, 63% said they specifically target added sugars.

Nitro beverages are now being combined with added protein, adaptogens, or natural caffeine sources to meet wellness needs. Sustainability is another emerging trend. Companies are adopting recyclable cans and cleaner formulations to appeal to environmentally conscious buyers.

Drivers

Rising Consumer Preference for Smooth and Creamy Beverages Drives Market Growth

The nitro-infused beverages market is mainly driven by changing consumer taste preferences. Many consumers now prefer drinks with a smooth, creamy mouthfeel, and nitrogen infusion naturally delivers this experience without adding dairy or sugar. This makes nitro beverages attractive to health-conscious buyers.

The growing demand for premium and craft beverages. Nitro-infused coffee, tea, and soft drinks are often positioned as high-quality products, which appeals to urban consumers willing to pay more for unique experiences. The visual appeal of the cascading nitrogen bubbles also enhances customer interest.

Busy lifestyles are further supporting demand. Ready-to-drink nitro beverages offer convenience while still delivering café-style quality. This is especially popular among working professionals and younger consumers seeking quick energy boosts. The expansion of cafés, specialty coffee chains, and modern retail outlets has improved product visibility.

Restraints

High Production and Storage Complexity Limits Wider Market Adoption

One major restraint in the nitro-infused beverages market is the complex production process. Nitrogen infusion requires specialized equipment such as pressurized kegs, valves, and cans, increasing initial investment for manufacturers. Cold storage dependency is another challenge.

- Many nitro beverages require refrigeration to maintain texture and taste. This raises logistics and transportation costs, especially in regions with limited cold-chain infrastructure. Beverage makers must source the right grade and document it. A nitrous oxide product uses notes that food-grade nitrous oxide must meet a minimum purity threshold of 99.5%, and the purity range cited can run up to 99.999%.

Limited consumer awareness in developing markets also restricts growth. Many consumers are still unfamiliar with nitrogen infusion and may not understand the value compared to regular beverages, slowing adoption rates. A shorter shelf life compared to conventional drinks can discourage large-scale distribution.

Growth Factors

Product Innovation and Category Expansion Create Strong Growth Opportunities

The nitro-infused beverages market offers strong growth opportunities through product innovation. Beyond coffee, brands are experimenting with nitro teas, functional drinks, plant-based beverages, and low-sugar soft drinks to attract new consumers.

Health and wellness trends open another opportunity. Nitro beverages can deliver rich taste without added creamers or artificial ingredients, aligning well with clean-label and low-calorie demand. Emerging markets present untapped potential as urbanization increases café culture and premium beverage consumption.

Local brands entering the nitro space can accelerate adoption through affordable pricing. E-commerce and direct-to-consumer channels also support growth. Online platforms allow niche brands to reach targeted consumers, reducing dependence on traditional retail and enabling faster market expansion.

Regional Analysis

North America Dominates the Nitro-infused Beverages Market with a Market Share of 45.8%, Valued at USD 58.1 Million

North America remains the leading region in the nitro-infused beverages market, supported by strong café culture and rapid adoption of premium cold beverages. The region accounted for 45.8% of the global market, with a valuation of USD 58.1 million, reflecting high consumer acceptance of nitrogen-based textures and formats. Demand is driven by urban consumption, on-the-go lifestyles, and experimentation with café-style drinks at home.

Europe shows steady growth in nitro-infused beverages, driven by rising interest in specialty coffee and craft beverage experiences. Consumers across key markets are increasingly drawn to smoother mouthfeel and lower perceived bitterness offered by nitrogen infusion. Sustainability-focused packaging and premium positioning further support adoption. The region benefits from a mature café culture that encourages the trial of innovative beverage formats.

Asia Pacific represents an emerging growth region for nitro-infused beverages, supported by rapid urbanization and expanding café chains. Younger consumers are showing strong interest in novel beverage textures and international drink trends. Increasing disposable incomes and exposure to Western-style coffee culture are accelerating market awareness. The region is expected to witness broader product availability across metropolitan areas.

The Middle East and Africa market is at a developing stage, with growth concentrated in urban centers and premium foodservice outlets. Rising tourism, café expansion, and demand for differentiated cold beverages support gradual adoption. Consumers are increasingly open to premium, experience-driven drinks. Market penetration remains selective but shows positive long-term potential.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Rise Brewing Co. has stayed tightly focused on ready-to-drink nitro cold brew, using nitrogen to deliver a smooth mouthfeel without leaning on heavy sugars. In 2024, its positioning benefits from shoppers who want café-style texture in a portable format, making brand storytelling and consistent quality key competitive levers.

Starbucks Corporation influences category expectations by setting mainstream benchmarks for taste, safety, and serving consistency across formats. In 2024, its strength is the ability to scale nitro-style experiences through retail and foodservice touchpoints, which helps normalize nitro beverages beyond specialty coffee and supports higher consumer willingness to pay.

Lucky Jack plays to value-seeking consumers who still want a strong coffee hit with a creamy nitro finish. In 2024, the brand’s opportunity is to win repeat purchases through clear caffeine positioning and broad availability, while protecting freshness and texture so the product experience matches the “on-tap” promise.

Califia Farms brings a plant-forward image that fits well with nitro coffee and nitro latte styles, especially where dairy alternatives are already part of daily routines. In 2024, its advantage is pairing Nitro’s creamy perception with non-dairy formulations, creating a premium feel while meeting demand for simpler ingredient lists and modern lifestyle cues.

Top Key Players in the Market

- Rise Brewing Co.

- Starbucks Corporation

- Lucky Jack

- Califia Farms

- Caveman Coffee Co.

- Left Hand Brewing Co.

- Monster Energy Company

- PepsiCo

- Quivr

- Bona Fide Nitro Coffee and Tea

Recent Developments

- In 2024, Rise Brewing Co. continues to focus on its nitro-infused cold brew products, with ongoing availability of items like the Oat Milk Mocha Nitro Cold Brew Latte and Salted Caramel Nitro Cold Brew. The company released a Nitro Cold Brew Variety Pack, featuring smooth and velvety nitro cold brew options.

- In 2024, Starbucks maintains a strong presence in the nitro-infused beverages sector with its Nitro Cold Brew lineup, which uses nitrogen infusion for a velvety texture and is available in flavors like Dark Cocoa Sweet Cream. The product was listed in a Washington State government document, appearing in a correctional facility menu or inventory context.

Report Scope

Report Features Description Market Value (2024) USD 126.9 Million Forecast Revenue (2034) USD 716.6 Million CAGR (2025-2034) 18.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Nitro Coffee, Nitro Tea, Nitro Soft Drinks, Others), By Distribution Channel (Supermarket and Hypermarkets, Convenience Stores, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Rise Brewing Co., Starbucks Corporation, Lucky Jack, Califia Farms, Caveman Coffee Co., Left Hand Brewing Co., Monster Energy Company, PepsiCo, Quivr, Bona Fide Nitro Coffee and Tea Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Nitro-infused Beverages MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Nitro-infused Beverages MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Rise Brewing Co.

- Starbucks Corporation

- Lucky Jack

- Califia Farms

- Caveman Coffee Co.

- Left Hand Brewing Co.

- Monster Energy Company

- PepsiCo

- Quivr

- Bona Fide Nitro Coffee and Tea