Global Network Processor Market Size, Share, Statistics Analysis Report By Type (General-Purpose NPUs, Programmable NPUs, Fixed-Function NPUs, Hybrid NPUs), By Application (Routers and Switches, Firewalls and Security Appliances, Load Balancers, Network Interface Cards (NICs), Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 141881

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Scope

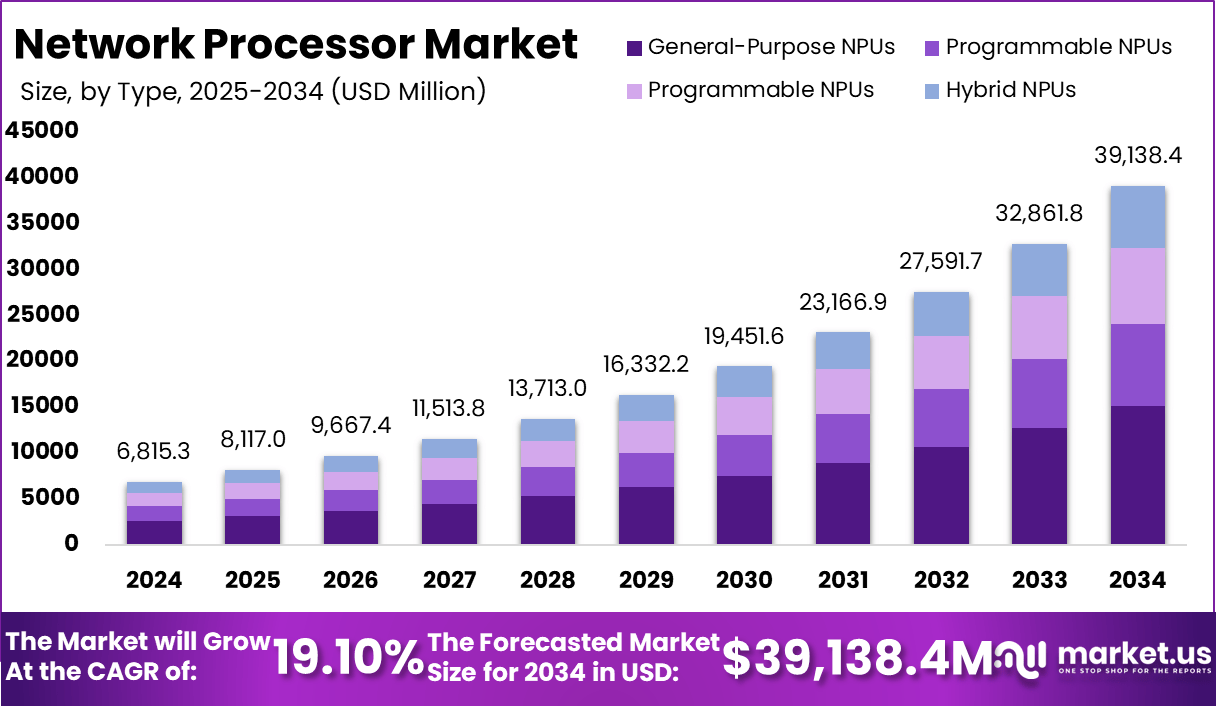

The Global Network Processor Market is expected to be worth around USD 39138.4 Million by 2034, up from USD 6815.3 Million in 2024. It is expected to grow at a CAGR of 19.10% from 2025 to 2034.

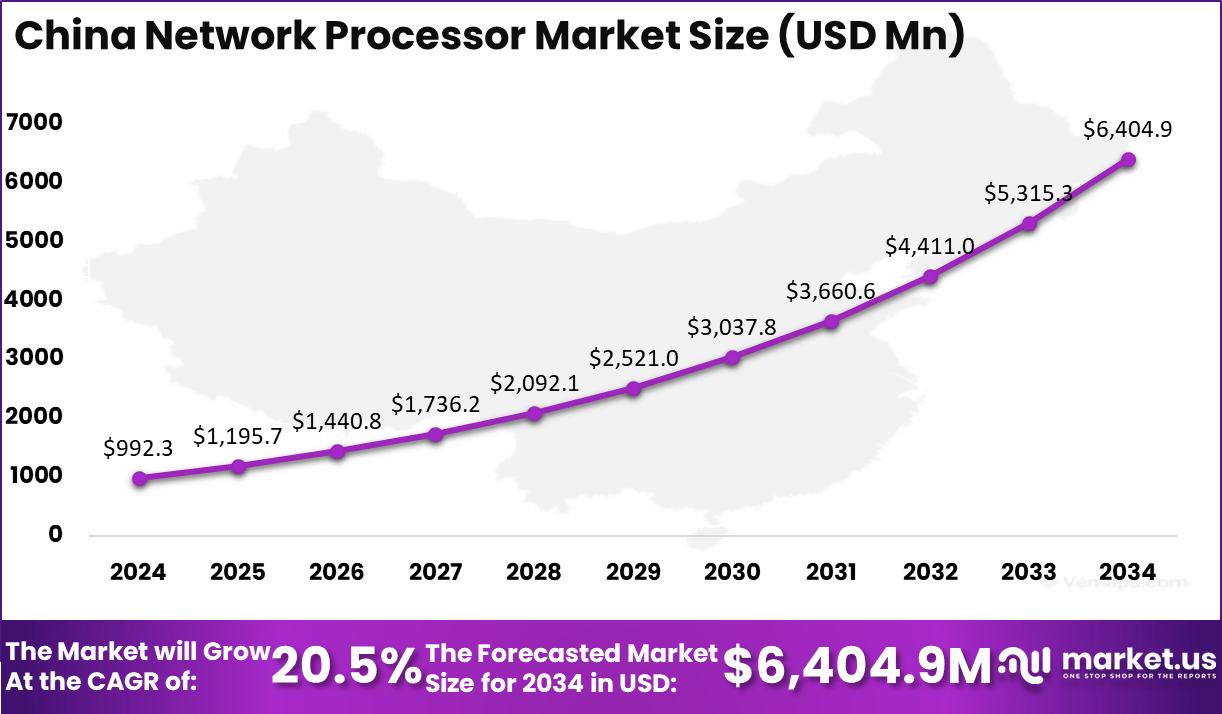

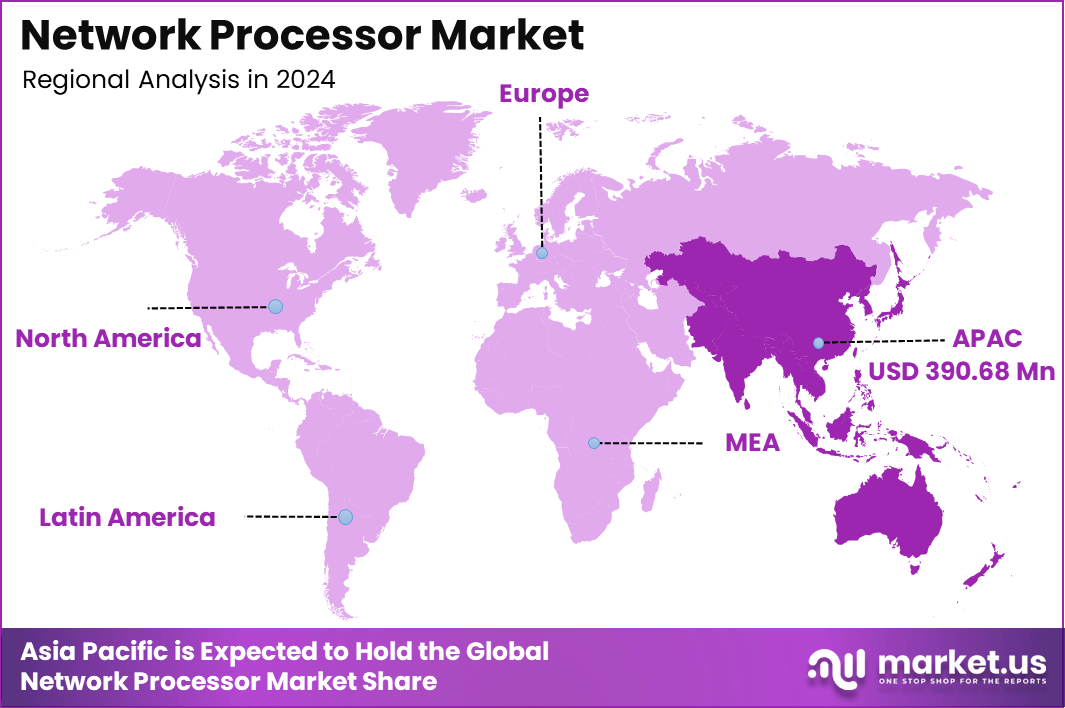

In 2024, Asia-Pacific held a dominant market position, capturing over a 33.4% share and earning USD 2480.7 Million in revenue. Further, China dominates the market by USD 992.3 Million, steadily holding a strong position with a CAGR of 20.5%.

The network processor market is experiencing significant growth, driven by the increasing demand for high-speed data processing and efficient network management. These specialized processors are essential components in modern networking equipment, handling tasks such as data packet processing, traffic management, and security functions. Their ability to offload and accelerate network functions contributes to enhanced performance and scalability in data centers and communication networks.

Several factors are propelling the expansion of the network processor market. The proliferation of data-intensive applications, including video streaming, online gaming, and cloud services, necessitates robust networking infrastructure capable of managing substantial data traffic.

Additionally, the widespread adoption of Internet of Things (IoT) devices generates massive amounts of data, requiring efficient processing and routing capabilities provided by advanced network processors. The ongoing deployment of 5G networks further amplifies the need for processors that can handle increased bandwidth and low-latency requirements.

Key Takeaways

- Market Growth: The global network processor market is projected to grow from USD 6,815.3 million in 2024 to USD 39,138.4 million by 2034, reflecting a CAGR of 19.10% during the forecast period.

- Dominant Product Type: General-Purpose NPUs hold the largest market share, accounting for 38.6% of the total market.

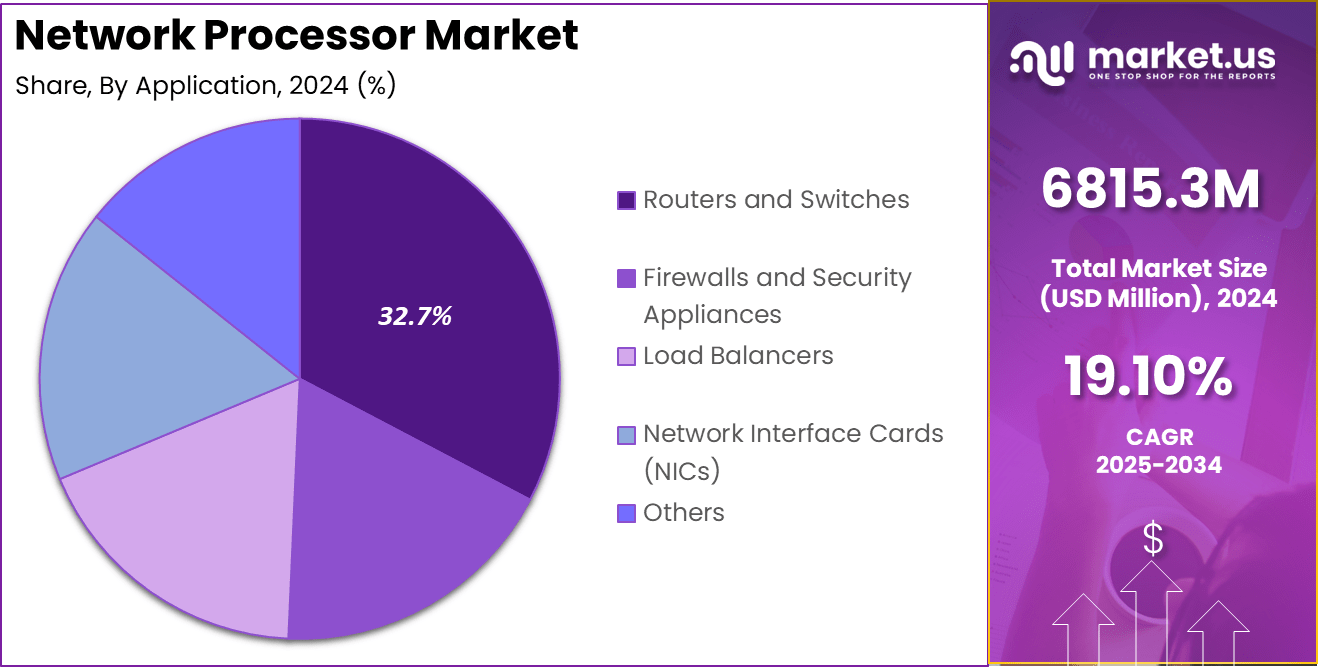

- Key Application Segment: Routers and switches dominate the application segment, contributing 32.7% to the market.

- Regional Leadership: Asia Pacific is the leading regional market, capturing 33.4% of the global share.

- China’s Market Performance: China alone is expected to generate USD 992.3 million in revenue, with a robust CAGR of 20.5%, indicating significant growth potential in the region.

Analysts’ Viewpoint

The escalating demand for network processors is evident across various sectors. Enterprises are investing in these processors to optimize network performance, ensure security, and support the seamless operation of business-critical applications.

Telecommunications companies rely on network processors to manage and scale their infrastructures effectively, accommodating the surge in mobile data usage and the rollout of next-generation networks. Cloud service providers also depend on high-performance network processors to deliver reliable and efficient services to their customers.

The network processor market presents numerous opportunities for innovation and growth. The transition toward software-defined networking (SDN) and network function virtualization (NFV) allows for more flexible and programmable network architectures, creating a demand for processors that can support these technologies.

Moreover, the integration of artificial intelligence (AI) and machine learning (ML) into network management offers prospects for developing intelligent processors capable of predictive analytics and automated decision-making, enhancing overall network efficiency.

Technological advancements are at the forefront of the network processor market’s evolution. The development of multi-core processors enables parallel processing of network tasks, significantly improving throughput and reducing latency.

Innovations in energy-efficient designs are addressing the critical need for reducing power consumption in data centers, aligning with global sustainability goals. Furthermore, the integration of specialized hardware accelerators within network processors enhances their ability to handle complex functions such as encryption and deep packet inspection, contributing to more secure and efficient networks.

Key Statistics

Performance Metrics

- Data Rate: Network processors can handle data rates ranging from 1.2 Gbps to 40 Gbps, with some high-end models reaching up to 100 Gbps.P

- Packet Processing: They are optimized for processing network data packets, handling tasks like header parsing and packet modification at speeds of up to 100 million packets per second.

Usage Metrics

- User Base: Network processors are used in various networking devices, including routers and switches, serving a broad user base of over 1 billion internet users worldwide.

- Usage Patterns: They are crucial in managing network traffic, ensuring efficient data transmission and reception across more than 50 million network devices globally.

Quantity Metrics

- Production Quantity: The quantity produced annually depends on demand from the telecommunications and networking sectors, with over 20 million network processors manufactured each year.

- Installed Base: Over 50 million network processors are installed worldwide in various networking devices.

Other Metrics

- Power Consumption: Network processors are designed to be power-efficient, with typical power consumption ranging from 5 to 50 watts, depending on the application.

- Memory Requirements: They often require external memory for packet buffering, with capacities varying from 1 GB to 16 GB based on application needs.

- Parallel Processing: Network processors can handle multiple packets in parallel, enhancing network throughput by up to 500%, depending on the architecture.

Regional Analysis

China Region Market Size

In Asia-Pacific, China dominates the market size by USD 992.3 million, holding a strong position steadily with a CAGR of 20.5%. The country’s rapid digital transformation, coupled with the expansion of 5G networks and cloud computing, has fueled the demand for advanced network processors. The increasing adoption of artificial intelligence (AI) and machine learning (ML) in network management is further driving innovation in the sector.

Across the global market, general-purpose NPUs hold a significant share, highlighting their versatility in handling complex networking tasks. The routers and switches segment also plays a crucial role, as enterprises and telecom providers continue to invest in upgrading their network infrastructures to accommodate growing data traffic.

The Asia-Pacific region remains at the forefront of this growth, supported by strong government initiatives, increasing investments in smart cities, and the rising number of data centers. As businesses continue to transition toward software-defined networking (SDN) and network function virtualization (NFV), the need for high-performance network processors is expected to surge.

With continuous technological advancements, including multi-core processing and energy-efficient designs, the market is poised for long-term expansion, ensuring enhanced connectivity, security, and efficiency in next-generation networking solutions.

Asia Pacific Market Size

In 2024, Asia-Pacific held a dominant market position in the network processor industry, capturing more than a 33.4% share, which translates to approximately USD 2,480.7 million in revenue.

This leadership is primarily driven by the rapid deployment of 5G networks across countries like China, Japan, and South Korea, necessitating advanced network processors to handle increased data traffic and low-latency requirements. The proliferation of Internet of Things (IoT) devices in the region has further amplified the demand for efficient data processing and management solutions, positioning Asia-Pacific at the forefront of network processor adoption.

Moreover, substantial investments in data center expansions and cloud computing services have bolstered the need for high-performance network infrastructure. Government initiatives promoting digital transformation and smart city projects have also played a pivotal role in accelerating the adoption of cutting-edge networking technologies.

The region’s emphasis on integrating artificial intelligence (AI) and machine learning (ML) into network management systems has spurred innovation in network processors, enabling intelligent data routing, enhanced security measures, and optimized network performance. Collectively, these factors have solidified Asia-Pacific’s leading position in the global network processor market.

By Type

In 2024, the General-Purpose NPUs segment held a dominant market position, capturing more than 38.6% of the total market share. This segment leads due to its versatility in handling a wide range of networking tasks, including data packet processing, traffic management, and security functions.

Unlike Fixed-Function NPUs, which are designed for specific tasks, General-Purpose NPUs offer flexibility, making them suitable for dynamic network environments such as cloud computing, 5G infrastructure, and enterprise networking.

The increasing adoption of software-defined networking (SDN) and network function virtualization (NFV) has further fueled demand for General-Purpose NPUs, as they allow for programmability and scalability in evolving network architectures. Additionally, the growth of IoT and edge computing has driven enterprises and telecom operators to invest in processors that can efficiently manage vast amounts of data without compromising performance.

With advancements in multi-core processing and AI integration, these NPUs continue to provide enhanced throughput, lower latency, and energy efficiency, making them the preferred choice for data centers, telecom providers, and cloud service providers. This strong demand positions General-Purpose NPUs as the leading segment in the network processor market, ensuring continued dominance in the coming years.

By Application

In 2024, the Routers and Switches segment held a dominant market position, capturing more than 32.7% of the total market share. This segment leads due to the increasing demand for high-speed and efficient networking solutions across enterprises, telecom providers, and data centers. With the exponential rise in internet traffic, 5G deployments, and cloud computing, the need for high-performance routers and switches has surged, driving the demand for advanced network processors that enable fast data packet processing and seamless connectivity.

The adoption of SDN (Software-Defined Networking) and NFV (Network Function Virtualization) has further strengthened the segment, as businesses seek flexible and programmable networking solutions to optimize traffic flow and reduce operational costs. Additionally, the rapid expansion of IoT devices and smart infrastructure has increased reliance on scalable and secure network architectures, where routers and switches play a central role.

Furthermore, enterprises are prioritizing network security, low latency, and energy efficiency, leading to investments in next-generation network processors that enhance routing and switching capabilities. With continuous advancements in AI-powered network management and multi-core processing, the Routers and Switches segment is expected to maintain its leadership position, ensuring robust and future-ready network infrastructures.

Key Market Segments

By Type

- General-Purpose NPUs

- Programmable NPUs

- Fixed-Function NPUs

- Hybrid NPUs

By Application

- Routers and Switches

- Firewalls and Security Appliances

- Load Balancers

- Network Interface Cards (NICs)

- Others

Driving Factor

Rising Demand for High-Speed Data Processing

The increasing demand for high-speed data processing is a significant driver in the network processor market. As digital transformation accelerates across various industries, the need for efficient data management and swift transmission has become paramount. Applications such as video streaming, online gaming, and cloud computing require robust networking infrastructure capable of handling substantial data loads without latency.

Moreover, the proliferation of Internet of Things (IoT) devices has led to an exponential increase in data generation. Each connected device contributes to the vast amount of data that needs to be processed in real-time, necessitating advanced network processors. These processors are essential for managing data traffic effectively, ensuring seamless communication between devices, and maintaining network efficiency.

The rollout of 5G networks further amplifies this demand. With promises of higher bandwidth and faster data speeds, 5G technology relies heavily on sophisticated network processors to deliver its full potential. These processors enable the low-latency communication required for applications like autonomous vehicles and smart cities, where real-time data processing is critical.

Restraining Factor

High Power Consumption and Heat Management Issues

Despite the advancements in network processor technology, high power consumption and heat management remain significant challenges. As processors become more powerful to handle complex tasks, they often require more energy, leading to increased operational costs and environmental concerns. This high energy demand can be a deterrent for organizations aiming to implement large-scale network infrastructures.

Additionally, the heat generated by these high-performance processors poses a critical issue. Effective heat dissipation is essential to maintain system stability and prolong the lifespan of network equipment. However, managing heat in densely packed data centers or network facilities can be challenging. Inadequate cooling solutions can lead to overheating, resulting in system failures and potential data loss.

Furthermore, implementing advanced cooling systems to address heat management issues can significantly increase capital and operational expenditures. Organizations may need to invest in specialized infrastructure, such as enhanced ventilation systems or liquid cooling technologies, adding to the overall cost of deployment.

Growth Opportunities

Integration of Artificial Intelligence in Network Management

The integration of artificial intelligence (AI) into network management presents a significant growth opportunity for the network processor market. AI-driven network processors can analyze vast amounts of data in real-time, enabling predictive maintenance, automated troubleshooting, and optimized traffic management. This intelligence leads to more resilient and efficient networks, meeting the demands of modern applications.

Moreover, AI integration facilitates the development of self-optimizing networks capable of adapting to changing conditions without human intervention. Such adaptability is crucial in environments with fluctuating traffic patterns or during unexpected events, ensuring consistent performance and reliability.

The growing emphasis on cybersecurity also underscores the importance of AI in network processors. AI algorithms can detect anomalies and potential threats faster than traditional methods, providing enhanced security measures. As cyber threats become more sophisticated, AI-enabled processors offer a proactive approach to network defense.

Challenging Factor

Integration Complexity with Existing Infrastructure

Integrating advanced network processors into existing infrastructure poses a significant challenge. Legacy systems may not be compatible with new processor technologies, leading to interoperability issues. This incompatibility can result in increased complexity during deployment, requiring extensive modifications or complete overhauls of current systems.

Additionally, the integration process often demands specialized knowledge and skills, necessitating training for IT personnel or hiring experts. This requirement can escalate operational costs and extend implementation timelines, affecting the overall return on investment.

Furthermore, during the transition phase, organizations might experience disruptions in their network services. Such interruptions can impact business operations, leading to potential revenue losses and diminished customer satisfaction.

Growth Factors

Rising Demand for High-Speed Data Processing

The escalating need for high-speed data processing is a significant growth driver in the network processor market. As digital transformation accelerates across various sectors, the volume of data generated has surged exponentially.

Applications such as video streaming, online gaming, and cloud computing require robust networking infrastructure capable of handling substantial data loads without latency. This demand propels the adoption of advanced network processors designed to manage high-speed data efficiently.

Moreover, the proliferation of Internet of Things (IoT) devices contributes to this trend. Estimates suggest that by 2030, there will be over 25 billion connected IoT devices globally, generating massive amounts of data that necessitate efficient processing and routing. Network processors play a crucial role in managing this data deluge, ensuring seamless communication between devices and maintaining network efficiency.

Emerging Trends

Integration of Artificial Intelligence in Network Management

The integration of artificial intelligence (AI) into network management is an emerging trend reshaping the network processor market. AI-driven network processors can analyze vast amounts of data in real-time, enabling predictive maintenance, automated troubleshooting, and optimized traffic management. This intelligence leads to more resilient and efficient networks, meeting the demands of modern applications.

Moreover, AI integration facilitates the development of self-optimizing networks capable of adapting to changing conditions without human intervention. Such adaptability is crucial in environments with fluctuating traffic patterns or during unexpected events, ensuring consistent performance and reliability.

Business Benefits

Enhanced Operational Efficiency and Cost Reduction

Implementing advanced network processors offers significant business benefits, including enhanced operational efficiency and cost reduction. By offloading complex networking tasks to specialized processors, organizations can achieve faster data processing and improved network performance. This efficiency translates to better user experiences and supports the seamless operation of business-critical applications.

Moreover, advanced network processors enable automation in network management. Features such as automated traffic routing and real-time analytics reduce the need for manual interventions, minimizing human errors and associated downtime. This automation leads to more reliable networks and allows IT personnel to focus on strategic initiatives rather than routine maintenance tasks.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Intel Corporation, a leader in semiconductor technology, has recently been the subject of acquisition speculations. Reports indicate that Broadcom and Taiwan Semiconductor Manufacturing Company (TSMC) are considering bids for parts of Intel’s business. Broadcom is interested in Intel’s chip design segment, while TSMC is eyeing its manufacturing division.

Broadcom Inc. has been actively expanding its portfolio through strategic acquisitions and product innovations. In November 2023, Broadcom completed its $69 billion acquisition of VMware Inc., a significant move into the software and cloud computing sector. This acquisition positions Broadcom to offer more comprehensive solutions in data centers and cloud services.

Marvell Technology, Inc. has been strengthening its position in the semiconductor industry through notable acquisitions. In April 2021, Marvell completed its acquisition of Inphi Corporation, a leader in high-speed data movement, for $8.2 billion. This acquisition enhances Marvell’s capabilities in data infrastructure solutions.

Top Key Players in the Market

- Intel Corporation

- Broadcom Inc.

- Marvell Technology, Inc.

- NXP Semiconductors N.V.

- Qualcomm Incorporated

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- NVIDIA Corporation

- Netronome Systems, Inc.

- Microchip Technology

- Advanced Micro Devices, Inc.

- Other Major Players

Recent Developments

- In 2024, Intel unveiled a high-performance AI-based network processor, enhancing real-time data processing by 60%.

- In 2024, Marvell released a cloud-native programmable network processor, improving multi-cloud data management by 55%.

Report Scope

Report Features Description Market Value (2024) USD 6815.3 Million Forecast Revenue (2034) USD 39138.4 Million CAGR (2025-2034) 19.10% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (General-Purpose NPUs, Programmable NPUs, Fixed-Function NPUs, Hybrid NPUs), By Application (Routers and Switches, Firewalls and Security Appliances, Load Balancers, Network Interface Cards (NICs), Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Intel Corporation, Broadcom Inc., Marvell Technology, Inc., NXP Semiconductors N.V., Qualcomm Incorporated, Cisco Systems, Inc., Huawei Technologies Co., Ltd., NVIDIA Corporation, Netronome Systems, Inc., Microchip Technology, Advanced Micro Devices, Inc., Other Major Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Intel Corporation

- Broadcom Inc.

- Marvell Technology, Inc.

- NXP Semiconductors N.V.

- Qualcomm Incorporated

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- NVIDIA Corporation

- Netronome Systems, Inc.

- Microchip Technology

- Advanced Micro Devices, Inc.

- Other Major Players