Global Telecom Network Infrastructure Market Size, Share, Statistics Analysis Report By Component (Product, Service), By Connectivity Technology (2G & 3G, 4G/LTE, 5G), By End-User (Telecom Operators, Enterprises), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: December 2024

- Report ID: 135434

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

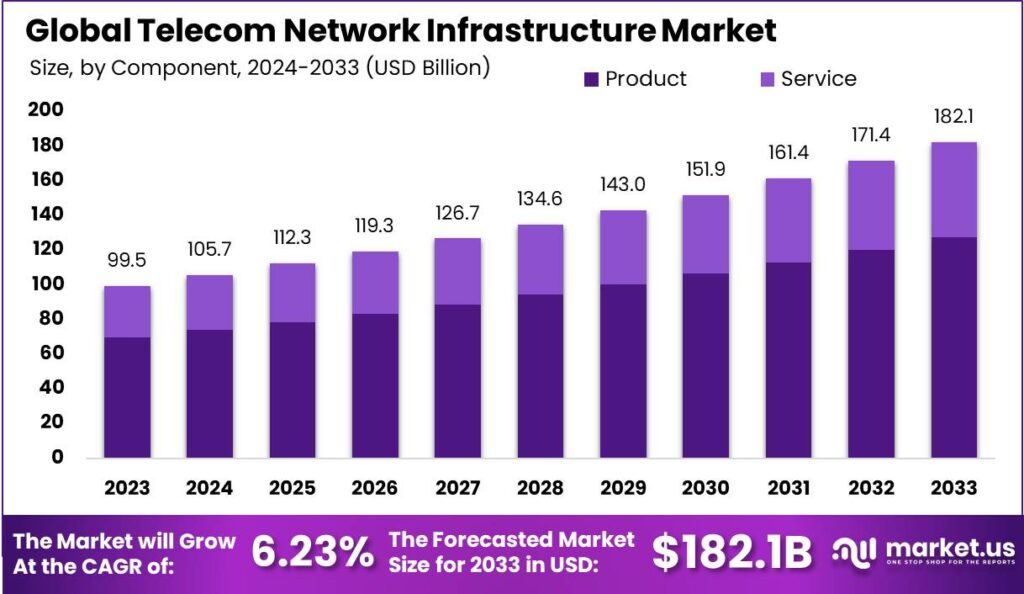

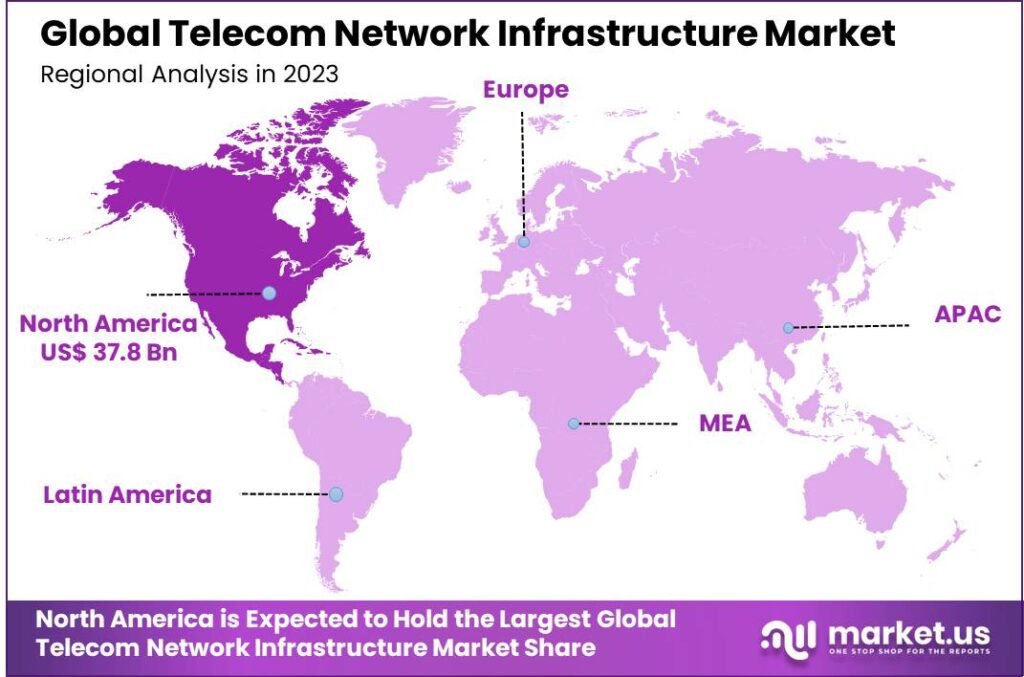

The Global Telecom Network Infrastructure Market size is expected to be worth around USD 182.1 Billion By 2033, from USD 99.48 Billion in 2023, growing at a CAGR of 6.23% during the forecast period from 2024 to 2033. In 2023, North America dominated the telecom network infrastructure market, accounting for more than 38% of the market share, with revenues totaling USD 37.8 billion.

Telecom network infrastructure forms the backbone of modern digital communication systems. It includes a range of physical and virtual technologies such as cables, switches, routers, and antennas designed to support the transmission and reception of data across vast distances. Whether it’s facilitating simple voice calls or complex broadband services, this infrastructure is crucial for both everyday communications and commercial operations.

The market for telecom network infrastructure is dynamic and expansive, driven by the continuous demand for more efficient and faster communication services. This sector encompasses a variety of components like cellular transmission gear, network cables, and telecommunication towers. The market has seen significant growth with the advent of technologies such as 5G, which requires extensive infrastructure upgrades to support higher data rates and reduced latency.

Several factors drive the telecom network infrastructure market. The surge in mobile data traffic due to increased smartphone usage and the expansion of wireless broadband services are significant contributors. Additionally, the global push towards digital transformation across industries is compelling businesses to invest in robust telecom networks to support IoT, cloud computing, and other tech-driven initiatives.

Market demand in the telecom infrastructure sector is robust, guided by the need for high-speed internet and the proliferation of connected devices. Urban areas, in particular, require continuous enhancements to existing telecom networks to cater to the growing expectations for seamless connectivity and the integration of smart city technologies.

Telecom network infrastructure enjoys widespread popularity due to its critical role in facilitating modern communication methods. As businesses and individuals increasingly rely on digital connections for everyday interactions, the underlying network infrastructure becomes even more integral to daily life. This popularity is also driven by the continuous innovation in telecom technologies, such as 5G and fiber optics, which promise faster speeds and more reliable connections.

The expansion of the telecom network infrastructure market is set to continue. Emerging markets, in particular, offer substantial expansion opportunities as governments and private entities invest in building telecom infrastructure to boost economic development. Moreover, the increasing trend towards smart cities and automated technologies necessitates continuous upgrades and expansion of existing telecom networks to accommodate new services and increasing data volumes.

Key Takeaways

- The Global Telecom Network Infrastructure Market size is projected to reach USD 182.1 billion by 2033, up from USD 99.48 billion in 2023, growing at a CAGR of 6.23% during the forecast period from 2024 to 2033.

- In 2023, the Product segment dominated the telecom network infrastructure market, holding more than 70% of the market share.

- The 4G/LTE segment led the market in 2023, capturing more than 46% of the telecom network infrastructure market share.

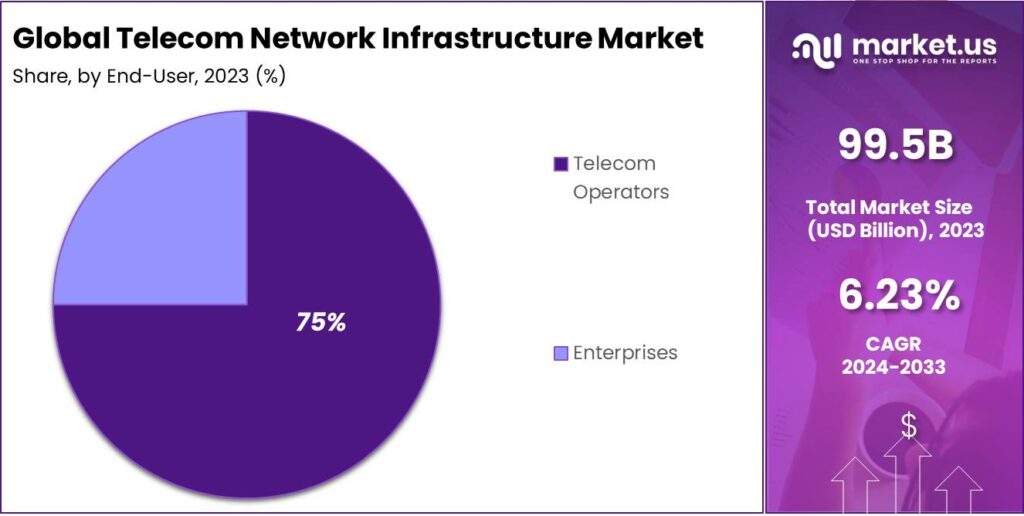

- The Telecom Operators segment held a dominant position in 2023, accounting for more than 75% of the market share.

-

North America led the telecom network infrastructure market in 2023, commanding more than 38% of the market share and generating revenues of USD 37.8 billion.

Component Analysis

In 2023, the Product segment of the telecom network infrastructure market held a dominant position, capturing more than a 70% share. This substantial market share can be primarily attributed to the ongoing global rollout of 5G networks, which necessitates extensive upgrades to existing infrastructure and the deployment of new technologies.

The dominance of the Product segment is fueled by continuous innovation in network technologies. As data consumption increases and connectivity needs grow, there is a rising demand for robust network components that enhance data processing and offer greater bandwidth, driving growth in this segment.

Moreover, regulatory changes and government policies supporting network expansion and modernization have also played a critical role in the ascendancy of the Product segment. Various government initiatives aimed at enhancing national broadband networks require significant input from physical telecom infrastructure products, thereby boosting the segment’s growth.

The increasing adoption of IoT devices and the expansion of connected services across industries require extensive support from advanced network infrastructure products. This trend is expected to continue propelling the demand for innovative telecom products, ensuring the Product segment maintains its leading position in the market.

Connectivity Technology Analysis

In 2023, the 4G/LTE segment held a dominant market position within the telecom network infrastructure market, capturing more than a 46% share. This leadership can be attributed to the widespread deployment and maturation of 4G technologies across both developed and emerging regions.

As the backbone of modern mobile internet, 4G/LTE has been pivotal in providing high-speed data services and enhancing mobile broadband accessibility. This technology continues to be integral in areas where 5G is still in the nascent stages of deployment, ensuring its dominance.

The superior coverage of 4G/LTE networks compared to the nascent 5G infrastructure is another significant factor driving its market leadership. In many regions, 4G remains the most reliable form of mobile connectivity available, offering stable and consistent internet services essential for both personal and business use.

Moreover, the compatibility of 4G/LTE with a vast array of consumer devices, including smartphones, tablets, and other IoT devices, has cemented its leading position in the market. Unlike 5G, which requires new handset and device capabilities, 4G/LTE can support a wide range of devices, making it a practical choice for consumers and businesses not yet ready to upgrade to the latest technology.

End-User Analysis

In 2023, the Telecom Operators segment held a dominant market position within the telecom network infrastructure market, capturing more than a 75% share. This substantial market share can be attributed primarily to the ongoing expansions and upgrades in telecom networks by operators globally.

As the demand for enhanced mobile services and broader network coverage intensifies, telecom operators continue to invest heavily in infrastructure to support high-speed data services and the deployment of 5G networks. These investments are crucial for maintaining competitiveness and meeting the evolving expectations of consumers and businesses alike.

The leadership of the Telecom Operators segment is further reinforced by the increasing need for advanced telecommunications infrastructure to support burgeoning technologies such as the Internet of Things (IoT), cloud computing, and artificial intelligence. Telecom operators are at the forefront of transforming network infrastructure to become more agile and scalable.

Moreover, regulatory policies and government initiatives aimed at enhancing communication services across various regions have favorably impacted the telecom operators’ market. Governments worldwide are facilitating the development of telecom infrastructure by providing subsidies and reducing barriers for network deployment.

Key Market Segments

By Component

- Product

- Service

By Connectivity Technology

- 2G & 3G

- 4G/LTE

- 5G

By End-User

- Telecom Operators

- Enterprises

Driver

Expansion of 5G Networks

The global deployment of 5G technology is a significant driver for telecom network infrastructure. 5G offers faster data speeds, reduced latency, and supports a higher density of connected devices, meeting the increasing demand for advanced mobile services.

Telecom operators are investing heavily in 5G infrastructure to enhance user experience and enable new applications such as the Internet of Things (IoT) and autonomous vehicles. For instance, in 2023, global 5G subscriptions reached 1 billion, with major telecom operators like Verizon, China Telecom, and Vodafone investing substantially in 5G infrastructure to meet the growing demand for high-speed mobile data services.

Restraint

High Capital Expenditure Requirements

The deployment of advanced telecom infrastructure, particularly 5G networks, necessitates substantial capital investment. Costs include acquiring spectrum licenses, upgrading existing equipment, and installing new base stations.

These financial demands can strain telecom operators, especially in markets with low average revenue per user. Additionally, the long return on investment periods can deter operators from committing to large-scale infrastructure projects, potentially slowing the pace of network expansion and modernization.

Opportunity

Infrastructure Sharing Among Operators

Infrastructure sharing presents a significant opportunity for telecom operators to reduce costs and expedite network deployment. By collaborating on the use of towers, base stations, and even spectrum, operators can lower capital expenditures and operational costs.

This approach is particularly beneficial in rural or underserved areas where individual network deployment may not be economically viable. Shared infrastructure can lead to improved coverage, enhanced service quality, and faster rollout of new technologies, benefiting both operators and consumers.

Challenge

Regulatory and Policy Hurdles

Telecom operators often face complex regulatory environments that can impede infrastructure development. Issues such as spectrum allocation, licensing requirements, and compliance with varying national policies can create uncertainties and delays.

For instance, in the UK, challenges related to planning permissions and insufficient financial returns on investments have been highlighted by industry leaders as obstacles to improving digital infrastructure. Navigating these regulatory landscapes requires strategic planning and can significantly impact the speed and efficiency of network deployment.

Emerging Trends

The telecom industry is transforming with advancements in technology and changing user demands. A key trend is the shift to cloud-native and virtualized networks, allowing providers to enhance scalability and flexibility, offering customized services tailored to customer needs.

Another important development is the increasing adoption of software-defined networking (SDN) and network functions virtualization (NFV). These technologies allow for more efficient network management by decoupling network functions from hardware, leading to improved resource utilization and reduced operational costs.

The rise of 5G technology is also reshaping network infrastructure. With its high-speed, low-latency capabilities, 5G supports a wide range of applications, from autonomous vehicles to smart cities, necessitating significant upgrades to existing networks to handle increased data traffic and connectivity demands.

Additionally, there is a growing emphasis on network programmability to enable service differentiation. By leveraging programmable networks, telecom operators can offer tailored services to meet the diverse needs of various customer segments, enhancing user experience and creating new revenue streams.

Business Benefits

Investing in advanced telecom network infrastructure offers several business advantages. Enhanced connectivity facilitates seamless communication within organizations and with clients, leading to increased productivity and efficiency.

Modern network infrastructure supports the deployment of innovative services and applications, enabling businesses to adapt to market changes and meet customer expectations effectively. This adaptability can provide a competitive edge in rapidly evolving industries.

Improved network infrastructure also enhances data security and reliability. Advanced networks are better equipped to handle cyber threats and ensure consistent service quality, which is crucial for maintaining customer trust and complying with regulatory requirements.

Furthermore, robust telecom infrastructure supports business scalability. As companies grow, modern networks can easily accommodate increased data traffic and the addition of new services, facilitating smooth expansion without significant overhauls.

Regional Analysis

In 2023, North America held a dominant market position in the telecom network infrastructure market, capturing more than a 38% share with revenues amounting to USD 37.8 billion.

North America’s leadership in technology and telecommunications is driven by major tech firms and telecom companies investing in network upgrades and innovation. The region, home to global giants, focuses on expanding capacities to handle rising data traffic and emerging technologies like 5G.

The regulatory environment in North America supports significant advancements in telecom network infrastructure. Governments in this region have implemented policies that encourage competition among telecom providers, fostering a dynamic market where continual improvements in network infrastructure are necessary to maintain competitive edges.

The high adoption rate of advanced technologies by consumers and businesses in North America also plays a crucial role in the region’s market leadership. With one of the highest penetrations of smartphones and internet services globally, there is a substantial demand for high-speed and reliable network services. This consumer demand pushes telecom operators to invest in network infrastructure to ensure customer satisfaction and retention.

Moreover, strategic partnerships and collaborations among hardware providers, telecom operators, and government bodies in North America catalyze the development of innovative and efficient networking solutions. These collaborations are often aimed at enhancing the connectivity infrastructure to support emerging technologies such as the Internet of Things (IoT) and cloud computing, which require robust and extensive network frameworks.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the landscape of telecom network infrastructure, several key players have established their dominance, contributing significantly to advancements in technology and market expansion.

Qualcomm Technologies Inc. plays a pivotal role in the global telecom network infrastructure market. As a leading developer and innovator in wireless technology, Qualcomm has been instrumental in the advancement of 5G technologies. The company’s chipsets and solutions are integral to the operation of modern telecom networks, driving better connectivity and enhanced performance.

Samsung Electronics Co. Ltd. is another major contributor to the telecom network infrastructure sector. Known primarily for its consumer electronics, Samsung also excels in providing comprehensive network solutions that encompass network equipment, servers, and storage systems.

Sprint Corporation, now part of T-Mobile US Inc. following their merger, has significantly influenced the telecom network infrastructure through its expansive network services. Prior to the merger, Sprint was known for its innovative approach to network management and data services, which has been further strengthened by the combined capabilities with T-Mobile.

Top Key Players in the Market

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- Sprint Corporation

- Cisco Systems Inc.

- Nokia Corporation Inc.

- Huawei Technologies Co. Ltd.

- Altiostar Networks Inc.

- Check Point Software Technologies Ltd.

- ZTE Corporation

- Ciena Corporation

- Fortinet Inc.

- CommScope Holding Company, Inc.

- Fujitsu

- Juniper Networks Inc.

- Other Key Players

Top Opportunities Awaiting for Players

- Private 5G Networks for Enterprises: There is a growing interest among businesses in deploying private 5G networks to meet specific operational needs, such as enhanced security, low latency, and high reliability. This trend opens avenues for telecom infrastructure providers to offer tailored solutions for sectors like manufacturing, healthcare, and logistics, facilitating the adoption of Industry 4.0 applications and the Internet of Things (IoT).

- Fiber Optic Network Expansion: The increasing demand for high-speed internet access is driving the expansion of fiber optic networks. Telecom companies are investing in fiber infrastructure to support both consumer broadband services and backhaul for mobile networks. This expansion is particularly significant in regions with growing data consumption, presenting opportunities for infrastructure providers specializing in fiber deployment.

- Network Virtualization and Software-Defined Networking (SDN): The shift towards network virtualization and SDN allows operators to manage and optimize their networks more efficiently. By decoupling hardware from software, telecom companies can reduce costs and improve service agility. Infrastructure providers offering virtualization solutions can benefit from this transition as operators seek to modernize their networks.

- Collaboration with Technology Companies: Partnerships between telecom operators and technology firms are becoming increasingly common. For instance, Ericsson has formed a joint venture with twelve telecom operators to develop and sell network API software, aiming to provide functionalities such as fraud prevention and enhanced gaming speeds. Such collaborations can lead to the development of new services and revenue streams.

- Emerging Markets and Rural Connectivity: Significant opportunities exist in expanding telecom infrastructure in emerging markets and rural areas. Initiatives aimed at bridging the digital divide are driving investments in network deployment in underserved regions. Companies that can provide cost-effective and scalable solutions for these markets stand to benefit from the increasing demand for connectivity.

Recent Developments

- In October 2024, TPG Telecom agreed to sell its government and enterprise fixed and fiber assets to Vocus for $5.25 billion. This strategic move allows TPG to concentrate on its consumer market, while Vocus enhances its fiber network infrastructure.

- In November 2024, MTN South Africa has teamed up with China Telecom and Huawei, signing a memorandum of understanding (MOU) to collaborate strategically. This partnership aims to enhance MTN’s 5G, cloud, AI, and business solutions offerings.

- In November 2024, Telecom Italia (TIM) announced plans to invest 130 million euros in expanding its cloud business, driven by rising demand, including from AI. The investment will upgrade existing cloud infrastructure and build a new data center near Rome, adding to TIM’s network of 16 data centers across Italy.

Report Scope

Report Features Description Market Value (2023) USD 99.48 Bn Forecast Revenue (2033) USD 182.1 Bn CAGR (2024-2033) 6.23% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Product, Service), By Connectivity Technology (2G & 3G, 4G/LTE, 5G), By End-User (Telecom Operators, Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Qualcomm Technologies Inc., Samsung Electronics Co. Ltd., Sprint Corporation, Cisco Systems Inc., Nokia Corporation Inc., Huawei Technologies Co. Ltd., Altiostar Networks Inc., Check Point Software Technologies Ltd., ZTE Corporation, Ciena Corporation, Fortinet Inc., CommScope Holding Company, Inc., Fujitsu, Juniper Networks Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Telecom Network Infrastructure MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Telecom Network Infrastructure MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd.

- Sprint Corporation

- Cisco Systems Inc.

- Nokia Corporation Inc.

- Huawei Technologies Co. Ltd.

- Altiostar Networks Inc.

- Check Point Software Technologies Ltd.

- ZTE Corporation

- Ciena Corporation

- Fortinet Inc.

- CommScope Holding Company, Inc.

- Fujitsu

- Juniper Networks Inc.

- Other Key Players