Global Next Generation Network Optimization Market Size, Share Analysis Report By Offering (Hardware (Router, Switch, Gateway, Others), Software (Software-Defined Network (SDN), Network Function Virtualization (NFV)), Services (Consulting Services, Integration Services, Managed Services), By Application (Internet Video, Iptv & Video on Demand, File Sharing, Gaming, and Web Data, Others), By End User (Telecom Service Provider, Internet Service Provider, Government, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 136795

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

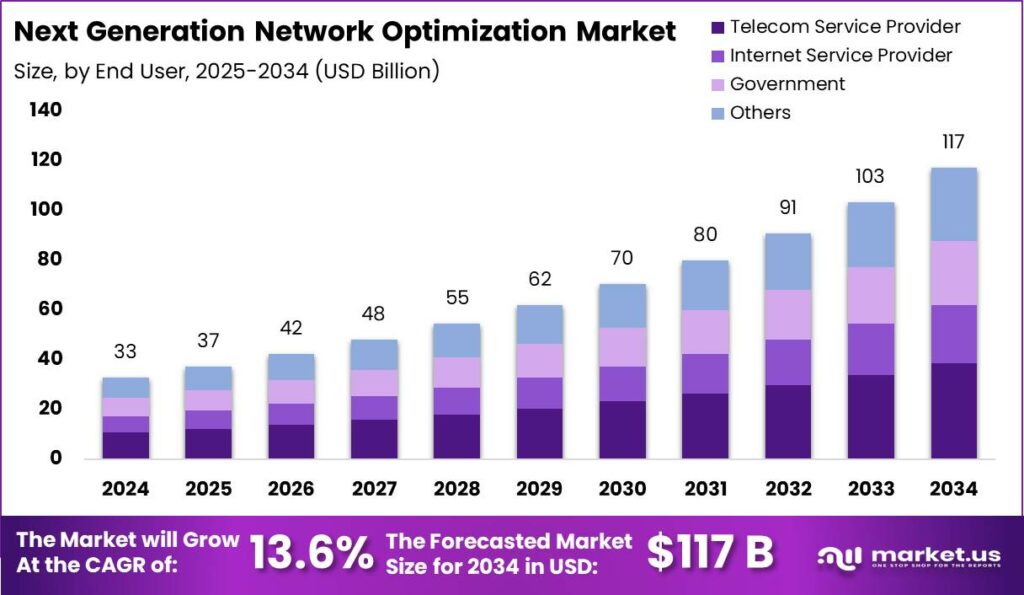

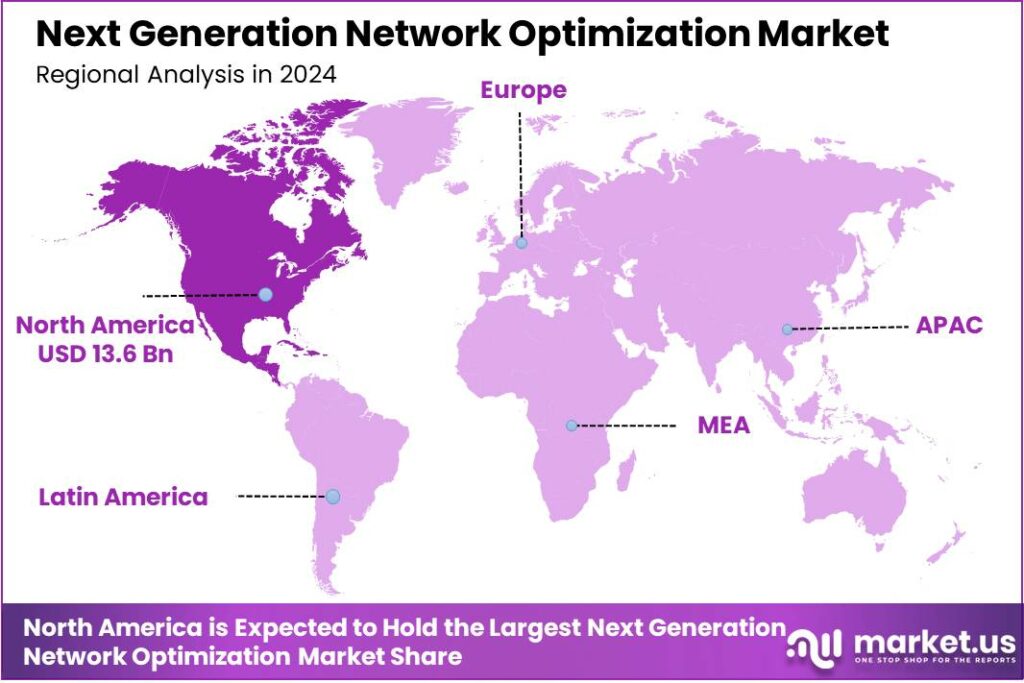

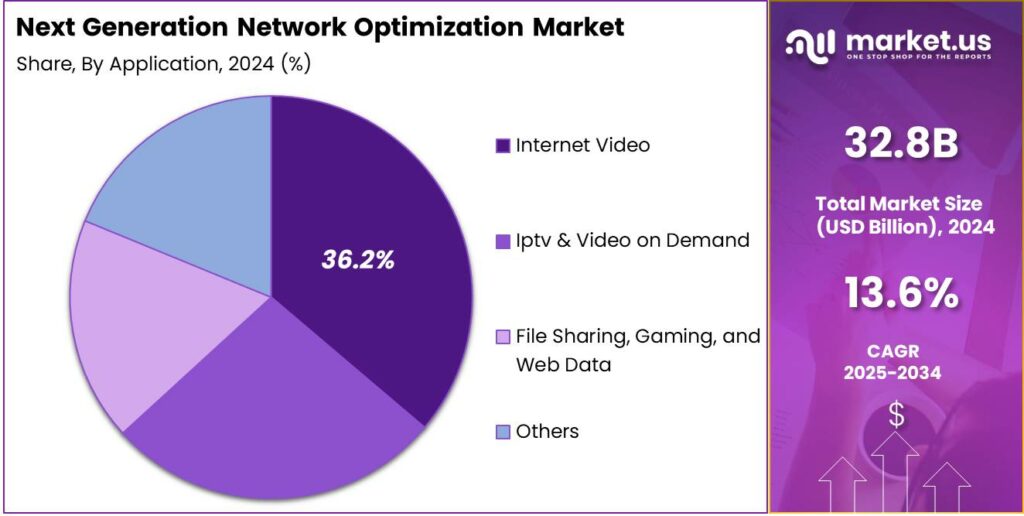

The Global Next Generation Network Optimization Market size is expected to be worth around USD 117 Billion By 2034, from USD 32.8 Billion in 2024, growing at a CAGR of 13.60% during the forecast period from 2025 to 2034. In 2024, North America dominated the Next Generation Network Optimization market, accounting for over 41.5% of the market share, with revenues reaching USD 13.6 billion.

Next Generation Network (NGN) optimization refers to the strategies and technologies employed to enhance the efficiency and performance of next-generation networks. These networks represent a significant evolution from traditional telecommunications networks, transitioning from distinct, hardware-based infrastructures to converged, software-driven architectures predominantly using Internet Protocol (IP).

The core objective of NGN optimization is to ensure seamless service delivery across this sophisticated, hybrid network structure, optimizing for factors like speed, reliability, and scalability. The Next Generation Network Optimization market is centered on improving the performance and efficiency of NGNs through advanced solutions and strategies.

This market has grown in response to the need for more sophisticated management tools that can handle the increased complexity and service demands of modern networks. Key areas of focus include traffic shaping, resource allocation, and quality of service management, aiming to enhance the overall functionality and reliability of telecommunications networks.

The primary drivers of the Next Generation Network Optimization market include the growing demand for higher bandwidth and lower latency in network communications. As businesses and services increasingly rely on cloud computing and Internet of Things (IoT) applications, the need for robust network infrastructures that can support vast amounts of data and provide near-instantaneous communication has become critical.

Additionally, the ongoing global shift towards remote work and digital collaboration tools has further propelled the demand for advanced network optimization solutions. The market demand for NGN optimization is driven by various sectors including telecommunications, IT services, and large enterprises, which require efficient and scalable network solutions.

According to Ericsson, Next-Generation Network (NGN) optimization has delivered significant advancements in performance, user experience, and operational efficiency. NGN optimization has resulted in a 31% reduction in cells with poor spectral efficiency, directly improving the overall quality of the network. Furthermore, there has been a 15% increase in downlink user throughput during peak busy hours, ensuring faster and more reliable connections for users.

Additionally, the need for unplanned carrier expansions has been cut by 10%, enabling more cost-effective network management. The benefits of NGN optimization extend to end users as well. Ericsson reports a 15% improvement in overall user experience, translating into smoother and more dependable connectivity. Network deployment capacity has increased by 20%, allowing faster rollouts in high-demand areas.

Notably, customer complaints have dropped by an impressive 70%, reflecting better service quality, while 90% of external benchmark tests are now being won, showcasing the competitive edge of optimized networks. Operational efficiencies have also seen substantial gains. With NGN optimization, operators can manage a network four times larger without needing to expand their workforce.

For operators, NGN optimization means doing more with less. Telecom providers now manage networks four times larger with the same team size, demonstrating incredible efficiency gains. Site acceptance processes are 50% faster, accelerating deployment timelines. Additionally, optimized sites consume 3.4% less power, contributing to lower operational costs and a smaller environmental footprint.

Technological advancements in the field of NGN optimization focus on enhancing network agility and security while reducing operational costs. Innovations such as Software-Defined Wide Area Networks (SD-WAN), Secure Access Service Edge (SASE), and next-generation firewalls are pivotal. These technologies help in simplifying network management, improving security protocols, and optimizing the performance of network traffic across diverse geographic and digital landscapes.

The opportunities in this market are expanding, particularly in areas involving the integration of artificial intelligence and machine learning technologies to predict and manage network behaviors proactively. The adoption of virtualized network functions and software-defined networking continues to offer new avenues for growth, opening up possibilities for more adaptive and intelligent network management systems.

Key Takeaways

- The Global Next Generation Network Optimization Market is projected to grow at a CAGR of 13.60% from 2025 to 2034, reaching a market size of USD 117 Billion by 2034, up from USD 32.8 Billion in 2024.

- In 2024, the Hardware segment dominated the Next Generation Network Optimization market, holding more than 47.8% of the market share.

- The Internet Video segment also held a significant position in 2024, capturing more than 36.2% of the market share.

- In 2024, the Telecom Service Provider segment maintained a dominant market share, capturing more than 32.9% of the market.

- North America led the Next Generation Network Optimization market in 2024, holding more than 41.5% of the market share and generating revenues of USD 13.6 billion.

US NGN Market Size

The U.S. Next-Generation Network (NGN) Optimization Market reached an impressive size of $11.7 billion in 2024, showcasing the growing demand for advanced network solutions. This reflects a significant investment in technologies that enhance performance, improve user experience, and streamline operations for telecom providers.

In 2024, North America held a dominant market position in the Next Generation Network Optimization market, capturing more than a 41.5% share, with revenues reaching USD 13.6 billion. This leading position can be attributed to several factors, primarily the region’s rapid deployment of 5G technology and the substantial presence of key telecommunications and technology firms.

North America has been at the forefront of technological advancements and has aggressively invested in upgrading its network infrastructure to support higher data rates and reduced latency, which are essential for modern applications such as autonomous vehicles, augmented reality, and IoT.

The region’s regulatory environment and policies that support innovation in digital communications also contribute significantly to its market dominance. Initiatives by governments to promote and fund the development of advanced network infrastructures have facilitated the early adoption of next-generation technologies.

Moreover, North America’s substantial investment in cloud services and big data analytics has spurred the growth of the network optimization market. As businesses in the region increasingly rely on cloud-based solutions, there is a growing need for robust network optimization to ensure seamless connectivity and performance.

Offering Analysis

In 2024, the Hardware segment held a dominant position in the Next Generation Network Optimization market, capturing more than a 47.8% share. This segment includes essential equipment such as routers, switches, gateways, and other related hardware that form the backbone of network infrastructures.

The Hardware segment leads due to the substantial initial investments needed for robust network infrastructure, particularly for 5G upgrades. It is essential for ensuring high performance and reliability to handle increasing data traffic and support modern applications’ high-speed demands.

The Software segment, including technologies like Software-Defined Networking (SDN) and Network Function Virtualization (NFV), is vital for Next Generation Network Optimization. SDN and NFV enhance network management by virtualizing services and centralizing control, enabling greater flexibility and efficiency.

Services associated with Next Generation Network Optimization, including consulting, integration, and managed services, support the deployment and ongoing management of both hardware and software components. These services are integral to ensuring that network optimization technologies are correctly implemented and fully operational.

Application Analysis

In 2024, the Internet Video segment held a dominant position within the Next Generation Network Optimization market, capturing more than a 36.2% share. This segment’s leadership is primarily due to the massive surge in online video consumption, driven by widespread access to broadband internet and the popularity of streaming platforms.

The IPTV & Video on Demand segment also plays a crucial role in this market. This area has experienced robust growth as traditional broadcasting methods continue to be supplemented or replaced by internet-based services that offer on-demand content.

File Sharing is another important application in the Next Generation Network Optimization market. With the increasing movement of large data across networks, especially in corporate and academic settings, efficient network management becomes essential to handle the significant load without compromising on speed or security.

Gaming and Web Data segments also contribute significantly to market dynamics. The gaming industry, with its need for real-time, fast-response network performance, relies heavily on advanced network optimization solutions to provide gamers with uninterrupted play sessions.

End User Analysis

In 2024, the Telecom Service Provider segment held a dominant market position within the Next Generation Network Optimization market, capturing more than a 32.9% share. This prominence can be attributed to the critical role telecom operators play in deploying, managing, and enhancing cellular and broadband networks.

The Internet Service Provider (ISP) segment is crucial for managing large data volumes and ensuring seamless internet access. As demand for higher broadband speeds and reliability grows, ISPs are turning to next-generation network optimization technologies to improve services and customer satisfaction.

The Government sector is another key end-user of network optimization solutions. Government initiatives to digitize public services and improve connectivity in rural and underserved areas have led to an increased need for robust network management. Optimization technologies are employed to ensure efficient and secure data transmission, which is crucial for government operations and services.

Other segments, including enterprises across various industries such as healthcare, finance, and education, also utilize network optimization solutions to support their digital activities. These sectors demand high network reliability and speed to facilitate operations and provide services without disruptions.

Key Market Segments

By Offering

- Hardware

- Router

- Switch

- Gateway

- Others

- Software

- Software-Defined Network (SDN)

- Network Function Virtualization (NFV)

- Services

- Consulting Services

- Integration Services

- Managed Services

By Application

- Internet Video

- Iptv & Video on Demand

- File Sharing, Gaming, and Web Data

- Others

By End User

- Telecom Service Provider

- Internet Service Provider

- Government

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Integration of Artificial Intelligence (AI) and Machine Learning (ML) in Network Optimization

The integration of AI and ML into next-generation network optimization is a significant driver transforming the telecommunications landscape. These technologies enable networks to analyze vast amounts of data in real-time, facilitating intelligent decision-making processes that enhance performance and efficiency.

AI and ML algorithms can predict traffic patterns, detect anomalies, and automate network configurations, leading to reduced latency and improved user experiences. For instance, AI-driven tools can automatically adjust routing protocols to optimize data flow, thereby minimizing congestion and enhancing overall network reliability.

Restraint

High Initial Investment Costs

Despite the advantages, the deployment of next-generation network optimization technologies requires substantial initial investments. The costs associated with upgrading existing infrastructure, acquiring advanced hardware, and implementing sophisticated software solutions can be prohibitive for many organizations.

Additionally, integrating new technologies with legacy systems often involves complex processes that further escalate expenses. These financial barriers may deter some service providers from adopting next-generation network solutions, potentially slowing the overall pace of technological advancement in the industry.

Opportunity

Expansion of Internet of Things (IoT) Applications

The proliferation of IoT devices presents a significant opportunity for next-generation network optimization. As more devices become interconnected, there is an increasing demand for networks that can efficiently manage and process the vast amounts of data generated.

Next-generation networks, optimized through advanced technologies, are well-positioned to support the scalability and performance requirements of IoT applications. This includes ensuring low latency, high reliability, and robust security measures to accommodate the diverse needs of IoT ecosystems.By seizing this opportunity, service providers can unlock new revenue streams and drive innovation in sectors like healthcare, manufacturing, and smart cities.

Challenge

Ensuring Security and Privacy in Complex Network Architectures

As networks evolve to incorporate advanced technologies and support a growing number of connected devices, ensuring security and privacy becomes increasingly challenging. The complexity of next-generation network architectures introduces multiple potential vulnerabilities that malicious actors may exploit.

Protecting sensitive data and maintaining user privacy require robust security protocols and continuous monitoring to detect and mitigate threats promptly. Additionally, compliance with regulatory standards adds another layer of complexity to network management. Addressing these challenges is essential to maintain user trust and safeguard the integrity of next-generation networks.

Emerging Trends

Next-generation network optimization is evolving rapidly, driven by several key trends. One significant development is the integration of artificial intelligence (AI) and machine learning (ML) into network management. These technologies enable networks to adapt in real-time, improving performance and efficiency.

Another emerging trend is the adoption of software-defined networking (SDN) and network function virtualization (NFV). These approaches decouple network control and services from hardware, allowing for more flexible and scalable network configurations.

Edge computing is also gaining prominence. By processing data closer to its source, edge computing reduces latency and bandwidth usage, enhancing the performance of applications that require real-time processing. This is particularly beneficial for Internet of Things (IoT) devices and services that demand immediate data analysis.

Business Benefits

Optimizing next-generation networks offers several business benefits. It enhances operational efficiency. By utilizing AI and ML, networks can self-manage and self-heal, reducing the need for manual interventions and minimizing downtime.

Improved network performance directly impacts user experience. Faster, more reliable connections lead to higher customer satisfaction and can provide a competitive advantage. For businesses that rely on digital services, this can translate into increased customer retention and revenue growth.

The scalability offered by SDN and NFV allows businesses to adapt quickly to changing demands. Whether expanding services or entering new markets, optimized networks can be scaled up or down with ease, supporting business agility and responsiveness.

Key Player Analysis

In the competitive landscape of Next Generation Network Optimization, several key players dominate, with Cisco Systems, Inc., Huawei, and ZTE leading the charge.

Cisco Systems, Inc. stands out as a prominent player in the Next Generation Network Optimization market. Known for its robust portfolio of networking hardware, Cisco has integrated advanced technologies such as AI and machine learning into its offerings to ensure optimal network performance and security.

Huawei is another significant player in this space, renowned for its innovative approach to telecommunications solutions. Huawei has made substantial strides in network technologies, particularly in developing regions where it has deployed large-scale network optimization projects.

ZTE is a key entity in the network optimization sector, particularly known for its agile and adaptive technology solutions in the fast-evolving telecom landscape. ZTE invests heavily in 5G technologies and network infrastructure, positioning itself as a critical player in markets that are rapidly transitioning to next-generation network standards.

Top Key Players in the Market

- Cisco Systems, Inc.

- Huawei

- ZTE

- Ericsson

- Nokia

- Juniper Network

- NEC Corporation

- Samsung Electronics

- IBM

- Ciena Corporation

- Hewlett Packard Enterprise

- At&T

- Adtran

- Teles

- Kpn International

- Others

Top Opportunities Awaiting for Players

The Next Generation Network Optimization market is poised for significant growth, presenting numerous opportunities for key players in the field.

- Integration of Artificial Intelligence and Machine Learning: There’s a growing trend towards integrating AI and ML in network management and optimization. These technologies facilitate intelligent decision-making and automated network management, enhancing operational efficiency and the effectiveness of network optimization solutions.

- Expansion of 5G Networks: The rapid deployment of 5G networks offers a substantial opportunity for network optimization. 5G technology supports higher data speeds, lower latency, and increased capacity, which requires sophisticated network optimization tools to ensure efficient operation and management.

- Internet of Things (IoT) Proliferation: As the IoT market expands, so does the need for robust network infrastructure to support the increased volume of data and connectivity demands. This creates significant opportunities for network optimization solutions that can ensure seamless connectivity and performance across IoT devices and platforms.

- Demand for Cloud-Based Services and Hybrid Network Deployments: The shift towards cloud services continues to drive the need for network optimization. Cloud-based and hybrid networks require effective management tools to ensure performance and security, offering a lucrative area for growth in network optimization solutions.

- Private 5G Networks and Green Telecommunication Solutions: The rise in private 5G network deployments for enterprises seeking high speed, security, and control is notable. Additionally, the shift towards greener telecommunications, powered by renewable energy, offers network providers a strategic opportunity to reduce their environmental impact and meet growing regulatory standards.

Recent Developments

- In December 2024, Ericsson secured a substantial agreement with India’s Bharti Airtel to enhance its 4G and 5G network coverage. The deployment of equipment is scheduled to commence in 2025.

- In 2024, Nokia entered into a five-year contract with AT&T to deploy next-generation fiber access technology capable of handling up to 100G. This agreement followed a previous major deal between AT&T and Ericsson.

Report Scope

Report Features Description Market Value (2024) USD 32.8 Bn Forecast Revenue (2034) USD 117 Bn CAGR (2025-2034) 13.60% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Offering (Hardware (Router, Switch, Gateway, Others), Software (Software-Defined Network (SDN), Network Function Virtualization (NFV)), Services (Consulting Services, Integration Services, Managed Services), By Application (Internet Video, Iptv & Video on Demand, File Sharing, Gaming, and Web Data, Others), By End User (Telecom Service Provider, Internet Service Provider, Government, Others), Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Cisco Systems, Inc., Huawei, ZTE, Ericsson, Nokia, Juniper Network, NEC Corporation, Samsung Electronics, IBM, Ciena Corporation, Hewlett Packard Enterprise, At&T, Adtran, Teles, Kpn International, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Next Generation Network Optimization MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Next Generation Network Optimization MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cisco Systems, Inc.

- Huawei

- ZTE

- Ericsson

- Nokia

- Juniper Network

- NEC Corporation

- Samsung Electronics

- IBM

- Ciena Corporation

- Hewlett Packard Enterprise

- At&T

- Adtran

- Teles

- Kpn International

- Others