Global Catering Services Market Size, Share, Growth Analysis By Service Type (On-site Catering: Event Catering, Corporate Catering, Wedding Catering, Residential Catering; Off-site Catering: Delivery-only Services, Catering with Setup and Service, Mobile Catering, Food Trucks, Pop-up Catering Services; Institutional Catering: School and University Catering, Hospital Catering, Corporate Cafeterias), By Catering Mode (Full-service Catering, Self-service Catering, Drop-off Catering), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137085

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

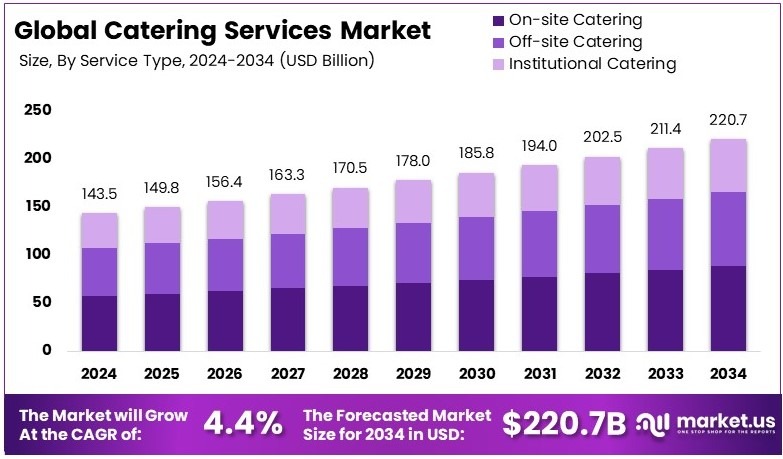

The Global Catering Services Market size is expected to be worth around USD 220.7 Billion by 2034, from USD 143.5 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Catering Services involve the provision of food and beverage solutions for various events and occasions. These services include menu planning, food preparation, delivery, and on-site service for events like weddings, corporate functions, and parties. Catering companies ensure high-quality dining experiences tailored to clients’ specific needs and preferences.

The Catering Services Market consists of businesses that supply food and beverage services for events and gatherings. This market covers a wide range of offerings, from small-scale private functions to large corporate events. It serves diverse clientele, including individuals, corporations, and organizations, focusing on delivering customized and high-quality culinary experiences.

Catering services in India are experiencing substantial growth. The industry currently employs approximately 8.55 million people, with projections indicating a rise to 10.32 million by 2028, according to the National Restaurant Association of India (NRAI). Technological advancements, particularly in AI and robotics, are drastically enhancing operational efficiencies. For example, companies such as Botinkit have introduced AI robot chefs that reduce labor costs by 30% and food waste by 10%.

The catering services market is competitively vibrant yet filled with opportunities, driven by innovative technology. Government regulations support this growth by creating a conducive environment for innovation. On a broader scale, the sector’s contribution to the GDP underscores its economic significance. Locally, technological advancements in areas such as cloud kitchens are setting new standards for operational efficiency.

The combination of favorable government policies, technological integration, and a strong demand for efficient catering solutions points to a flourishing future for India’s catering services industry. This sector not only supports economic growth but also leads innovations that redefine market dynamics.

Key Takeaways

- The Catering Services Market was valued at USD 143.5 Billion in 2024, and is expected to reach USD 220.7 Billion by 2034, with a CAGR of 4.4%.

- In 2024, Event Catering leads the service type segment, addressing high demand for tailored event solutions.

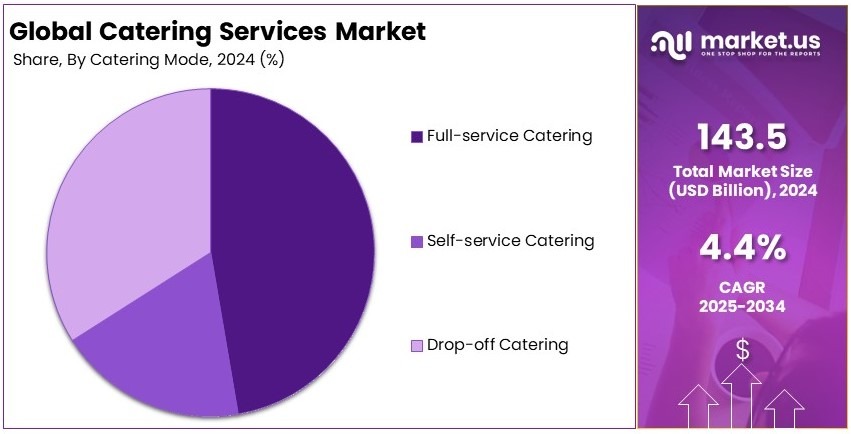

- In 2024, Full-Service Catering dominates the catering mode with significant preference for comprehensive offerings.

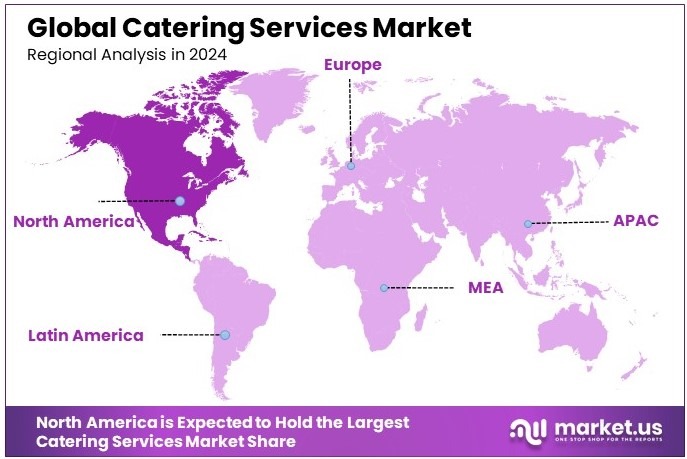

- In 2024, North America dominates the region with a significant market share, reflecting strong institutional and event catering demand.

Business Environment Analysis

The catering services market is reaching a point of saturation in many urban areas, where competition among providers is intense. Consequently, targeting the right demographic is critical; these services often appeal to corporate clients and large event organizers who prioritize reliability and quality of service.

Furthermore, differentiation through unique menu offerings or sustainable practices can significantly influence customer choice, setting a service apart in a crowded market.

Additionally, analyzing the value chain of catering services reveals that efficient logistics, high-quality suppliers, and skilled culinary staff are key components. Investing in these areas can enhance service delivery and client satisfaction. Moreover, there are growing opportunities for investing in technology that streamlines ordering and delivery processes, potentially increasing market reach and operational efficiency.

On the other hand, understanding the dynamics of imports and exports is vital for caterers who source ingredients internationally. Navigating these complexities can ensure the consistency and quality of food offerings. Similarly, adjacent markets such as event planning, culinary tourism and hospitality services provide opportunities for caterers to expand their offerings and create comprehensive package deals for clients.

Service Type Analysis

Event Catering dominates with a significant market share due to increasing demand for corporate and private events.

In the catering services market, event catering holds the largest share, driven by the increasing number of events such as conferences, corporate meetings, weddings, and social gatherings. The demand for professional catering services during such events has surged in recent years, as organizers and hosts recognize the value of providing high-quality food and seamless service to their guests.

Event catering services are specifically designed to meet the needs of large or small gatherings, offering a variety of food options, set-up, and cleanup services. In particular, corporate events and private social functions such as weddings require catering services that can handle specific dietary needs, diverse menus, and a sophisticated presentation.

The rise in corporate and social events has led to a steady growth in this segment. Companies hosting conferences, seminars, and product launches often turn to catering companies to handle meals, snacks, and beverages for attendees.

Other sub-segments within service types, such as corporate catering and wedding catering, also show significant growth but focus on more specific client needs. Corporate catering mainly serves office meetings, lunches, or company-wide events, offering a practical and efficient way to provide meals.

Wedding catering, on the other hand, specializes in high-end, customizable menus and unique food presentations tailored to the preferences of the couple and their guests. While these segments contribute substantially to the market, event catering overall stands out due to its broader reach and diverse applications in both corporate and private sectors.

Catering Mode Analysis

Full-service catering dominates due to its comprehensive offering, including food, set-up, and service.

In the catering services market, full-service catering is the dominant mode, as it provides an all-encompassing service that includes not just food preparation and delivery, but also the setting up, serving, and cleaning of the event.

Full-service catering is highly sought after for large-scale events such as weddings, corporate events, and banquets, where the host desires a seamless experience for their guests. This mode allows the event organizer to focus on other aspects of the event, while the catering service handles all food-related matters.

The full-service catering segment is particularly appealing for weddings, galas, and corporate events where guests expect high-quality food and excellent service. It includes everything from menu planning and custom requests to providing waitstaff and cleaning up after the event.

For example, at a corporate gala, full-service catering can manage everything from appetizers to dessert while ensuring that guests are attended to throughout the evening. As the demand for high-end, hassle-free experiences continues to rise, the growth of this segment is expected to maintain its strong position in the market.

On the other hand, self-service catering and drop-off catering are more cost-effective and convenient alternatives, especially for smaller events or businesses. Self-service catering is commonly seen in more casual settings, such as office meetings or informal gatherings, where guests can serve themselves from buffet-style tables.

Drop-off catering is used when clients prefer to have food delivered without the need for setup or serving staff. While these options are less expensive and suitable for certain events, they do not offer the same level of luxury or comprehensive service as full-service catering. As such, full-service catering remains the preferred choice for high-profile and large events.

Key Market Segments

By Service Type

- On-site Catering

- Event Catering

- Corporate Catering

- Wedding Catering

- Residential Catering

- Off-site Catering

- Delivery-only Services

- Catering with Setup and Service

- Mobile Catering

- Food Trucks

- Pop-up Catering Services

- Institutional Catering

- School and University Catering

- Hospital Catering

- Corporate Cafeterias

By Catering Mode

- Full-service Catering

- Self-service Catering

- Drop-off Catering

Driving Factors

Increasing Demand for Corporate Catering Services Drives Market Growth

With businesses hosting more meetings, conferences, and events (MICE), the need for professional catering services that can handle large volumes and diverse tastes is rising. Corporate catering offers a range of services, including buffet-style meals, packaged lunches, and custom menu options for office events.

This segment is growing as companies increasingly focus on employee engagement, client appreciation, and networking events, which often include catered meals. Catering services tailored for corporate clients are now expected to meet specific dietary requirements, such as gluten-free or low-carb options, catering to diverse preferences.

Corporate catering services can also support branding efforts, as the quality and style of meals offered at these events can reflect the company’s image. Additionally, companies are using catering services for employee wellness programs, providing healthy meals as part of corporate culture.

As organizations realize the value of high-quality catering for fostering good relationships, the demand for these services will continue to grow, further expanding the corporate catering market segment. Corporate clients’ preferences for convenience, quality, and professionalism are a driving force behind the ongoing expansion of catering services in the corporate sector.

Restraining Factors

High Competition and Rising Operational Costs Restrain Market Growth

The catering services market faces several challenges that are restraining its growth. One of the major factors is high competition, which leads to price sensitivity. With numerous catering businesses vying for attention, providers must constantly adjust pricing to remain competitive, often sacrificing margins to secure clients.

Additionally, rising operational costs, particularly for labor and ingredients, present a significant challenge. The increasing cost of high-quality ingredients, as well as labor shortages in the hospitality industry, contribute to rising expenses. Caterers must balance cost efficiency with maintaining high standards of quality, which can be difficult when prices of raw materials fluctuate.

Furthermore, maintaining food quality and safety standards is an ongoing concern. Catering businesses must adhere to strict regulations to ensure the safety of their food, which can involve significant costs related to training, equipment, and audits.

Lastly, the seasonality of demand for catering services adds another layer of complexity. Many catering businesses experience fluctuations in demand based on seasonal events, such as weddings and holidays, making it difficult to maintain consistent cash flow year-round.

Growth Opportunities

Expansion of Cloud Kitchens and AI-Driven Menu Customization Platforms Provides Opportunities

The expansion of cloud kitchens and AI-driven menu customization platforms presents exciting growth opportunities for catering services. Cloud kitchens, also known as ghost kitchens, are changing the way catering businesses operate by enabling them to cater to larger markets with reduced overhead costs.

These kitchens are focused exclusively on delivery and catering, without the need for a physical dining space. This business model allows catering companies to reach more clients by utilizing food delivery services and online platforms.

Additionally, AI-driven menu customization platforms are enabling caterers to offer highly personalized menus that cater to individual client preferences. Artificial intelligence can analyze customer data to suggest food options based on dietary preferences, previous orders, or trends. This innovation helps caterers create tailored experiences for their clients while improving operational efficiency.

Another opportunity is the growth of catering services in the luxury travel sector, including for private jets and luxury yachts. As luxury travel continues to expand, catering services are being increasingly sought to provide high-end, personalized meals for wealthy clients. These services allow caterers to tap into a niche but lucrative market segment, further enhancing their growth potential.

Emerging Trends

Rising Popularity of Fusion Cuisine and Digital Platforms Is Latest Trending Factor

Fusion cuisine, which blends flavors and techniques from various culinary traditions, is gaining traction among food enthusiasts looking for new and exciting dining experiences. Catering services offering fusion menus are appealing to clients who seek unique and creative dishes that combine different cultural influences.

Another key trend is the growth of digital platforms for real-time catering bookings, which is reshaping the way clients interact with catering services. Online platforms allow clients to easily browse menus, place orders, and customize their catering preferences in real time.

The convenience of digital platforms enables catering businesses to expand their reach and streamline their operations, reducing the reliance on traditional phone bookings and face-to-face consultations. This trend not only makes the booking process easier for clients but also allows caterers to manage orders more efficiently, reducing errors and improving customer satisfaction.

Additionally, the increasing use of locally-sourced and organic ingredients is trending, with more catering businesses offering fresh and sustainable food options that appeal to health-conscious consumers. This focus on sustainability and quality aligns with growing consumer demand for eco-friendly practices, further enhancing the appeal of modern catering services.

Regional Analysis

North America Dominates with Significant Market Share in Catering Services

North America holds a dominant share of the Catering Services Market, leading with a substantial market presence. This dominance is largely attributed to the high demand for corporate catering, social events like weddings, and large-scale events such as conferences.

The U.S. and Canada, with their large urban populations and thriving hospitality sectors, play a crucial role in driving this growth. Catering services in North America are highly diversified, ranging from casual meals to high-end gourmet services, catering to a variety of tastes and preferences.

Key factors driving North America’s market share include a robust economy, a high concentration of businesses that frequently require catering services for meetings and events, and a large number of affluent individuals willing to spend on premium catering experiences.

Additionally, the region’s hospitality industry is well-established, offering a solid infrastructure for catering services to flourish. The trend of health-conscious eating, along with a growing interest in organic and locally sourced ingredients, also contributes to the region’s market strength.

Regional Mentions:

- Europe: Europe also holds a strong position in the market, with a growing demand for catering services in events like weddings and corporate conferences. Countries such as the UK, France, and Germany are major players, where local catering trends are often influenced by regional cuisine and sustainable practices.

- Asia Pacific: The Asia Pacific region shows rapid growth in the catering services market, driven by increasing disposable incomes, urbanization, and a rising middle class. Countries like China and India are major contributors, with an expanding hospitality sector and a preference for traditional and modern catering options for large events.

- Middle East & Africa: Catering services in the Middle East and Africa are growing due to an increasing number of luxury events and large-scale conferences. Countries like the UAE and Saudi Arabia are key players, where high-end catering for corporate events, weddings, and tourism is in high demand.

- Latin America: In Latin America, the catering services market is expanding as middle-class populations grow, particularly in countries like Brazil and Mexico. Demand for catering in social events, along with corporate catering, is rising, driven by economic development and the growing importance of food culture in regional celebrations.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Catering Services Market is highly competitive, with large players offering diverse food services to corporate, healthcare, educational, and leisure sectors. Among the top companies, Compass Group, Sodexo, Aramark, and Elior Group are key leaders shaping the industry.

Compass Group is a global leader in food services, providing catering solutions across multiple sectors including business, healthcare, education, and leisure. Known for its extensive global presence and tailored services, Compass Group emphasizes high-quality food, sustainability, and technology-driven solutions. Its broad client base and focus on customization make it a dominant force in the market.

Sodexo also holds a significant position in the catering services market. Offering food services to clients in sectors like education, healthcare, and corporate offices, Sodexo is known for its focus on health and nutrition. The company is increasingly integrating technology and sustainability into its offerings. Sodexo’s strong focus on employee wellbeing and diverse food options positions it as a preferred partner for large institutions globally.

Aramark is another major player with a strong reputation in food services. The company offers catering to a wide variety of sectors, including education, healthcare, and business. Aramark’s services emphasize convenience, customization, and healthy eating options. With a global presence, the company’s ability to meet the unique needs of its clients makes it a leading force in the catering industry.

Elior Group is a prominent player in the catering services sector, providing food solutions to businesses, schools, hospitals, and more. Known for its focus on innovation and quality, Elior Group delivers customized catering services and promotes sustainability. With a strong emphasis on client satisfaction and food diversity, Elior remains a key competitor in the catering market.

These companies lead the industry through their vast networks, focus on customer satisfaction, and continuous adaptation to market trends like health-conscious options and sustainability. Their ability to cater to diverse sectors and regions positions them for continued growth in the catering services market.

Major Companies in the Market

- Compass Group

- Sodexo

- Aramark

- Elior Group

- Delaware North

- ISS World Services

- DO & CO

- BaxterStorey

- Thomas Franks

- Culinaire International

- Gategroup

- Catering by Michaels

- ABM Industries

Recent Developments

- CCMP Growth Advisors and Combined Caterers: In December 2024, CCMP Growth Advisors acquired Combined Caterers, a premium event management and catering services provider operating under brands like Best Impressions Caterers, Duvall Catering & Events, and Rocky Top Catering across the Southeast.

- Zomato: In April 2024, Zomato launched its all-electric “large order fleet” service designed to efficiently manage sizable orders for gatherings and events. This initiative aligns with Zomato’s sustainability goals and aims to improve the customer experience by addressing challenges associated with large-order logistics.

- Lunchbox: In June 2024, Lunchbox introduced ‘Cater,’ the first-ever community hub and council dedicated to catering executives. This platform is designed to support the growing restaurant catering sector by providing resources, industry updates, and a collaborative space for professionals to share best practices.

Report Scope

Report Features Description Market Value (2024) USD 143.5 Billion Forecast Revenue (2034) USD 220.7 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (On-site Catering: Event Catering, Corporate Catering, Wedding Catering, Residential Catering; Off-site Catering: Delivery-only Services, Catering with Setup and Service, Mobile Catering, Food Trucks, Pop-up Catering Services; Institutional Catering: School and University Catering, Hospital Catering, Corporate Cafeterias), By Catering Mode (Full-service Catering, Self-service Catering, Drop-off Catering) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Compass Group, Sodexo, Aramark, Elior Group, Delaware North, ISS World Services, DO & CO, BaxterStorey, Thomas Franks, Culinaire International, Gategroup, Catering by Michaels, ABM Industries Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Compass Group

- Sodexo

- Aramark

- Elior Group

- Delaware North

- ISS World Services

- DO & CO

- BaxterStorey

- Thomas Franks

- Culinaire International

- Gategroup

- Catering by Michaels

- ABM Industries