Global Near Infrared Imaging Market By Product Type (Devices (Standalone NIR Cameras and NIR Imaging Agents and Probes) and Spectroscopy & Imaging Sensors), By Application (R&D Applications, Medical Diagnostics, Biometrics and Access Control, Surveillance Applications, Industrial Applications and Others), By End-User (Healthcare Facilities, Agricultural and Environmental Agencies, Research & Academic Institutions, Pharmaceutical & Biotechnology Companies and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172219

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

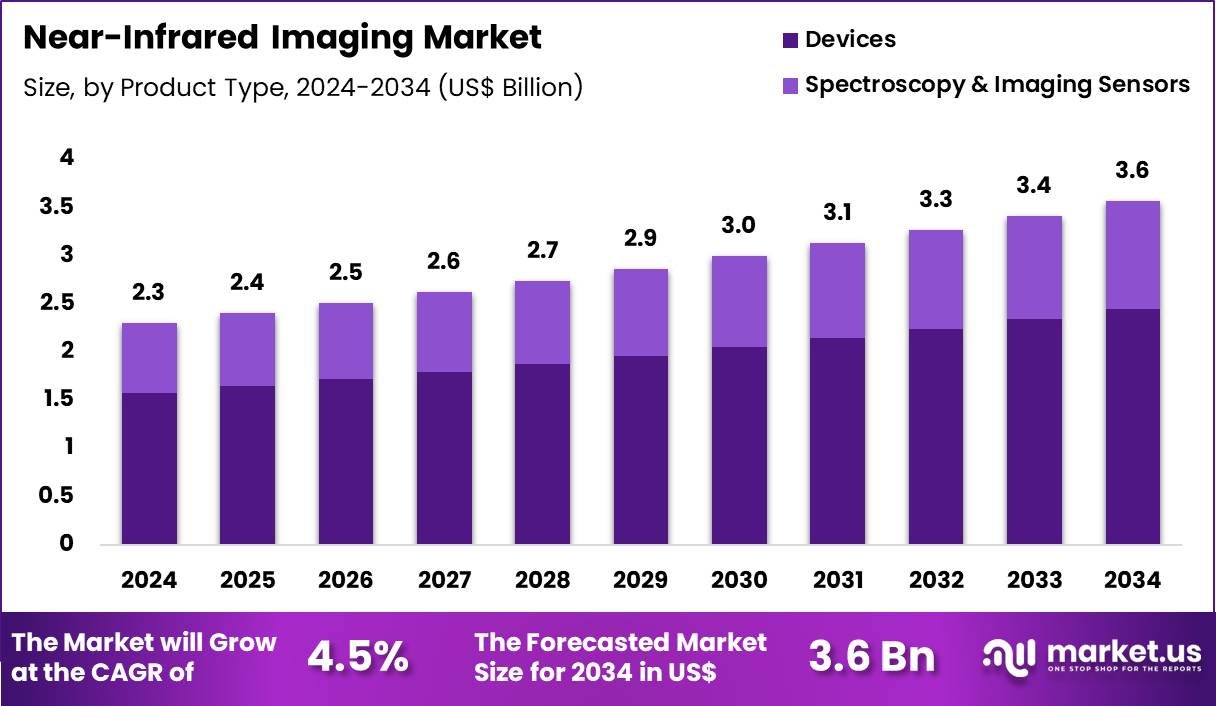

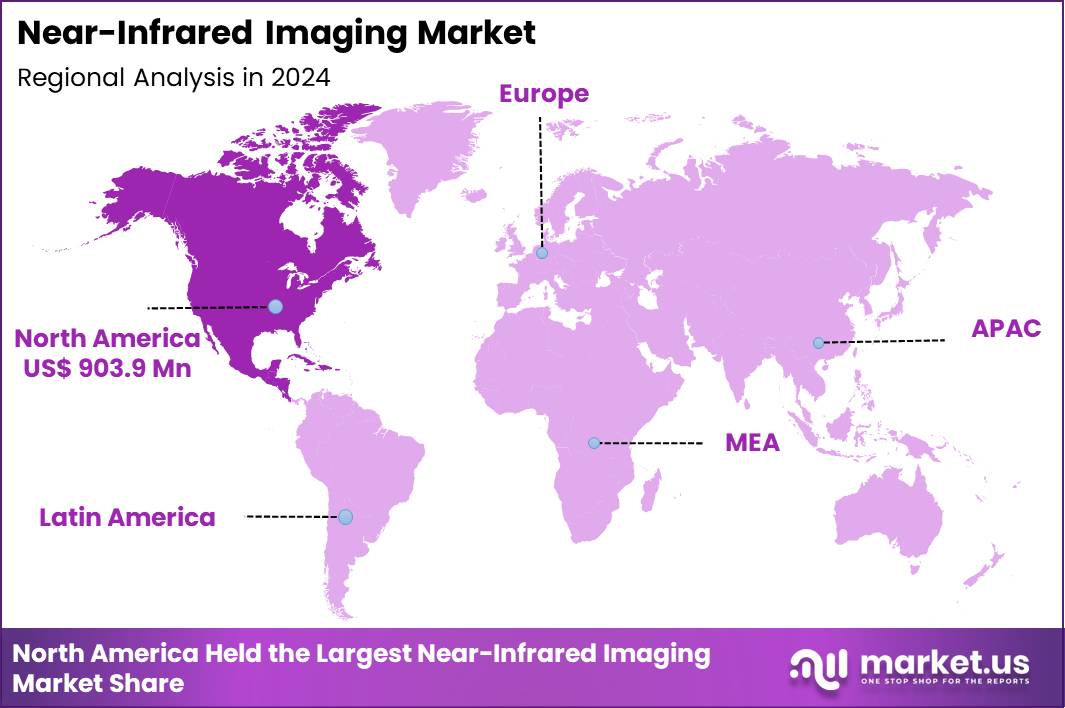

The Global Near Infrared Imaging Market size is expected to be worth around US$ 3.6 Billion by 2034 from US$ 2.3 Billion in 2024, growing at a CAGR of 4.5% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.3% share with a revenue of US$ 903.9 Million.

Growing adoption of non-invasive diagnostic techniques propels the near infrared imaging market as clinicians seek real-time visualization tools that penetrate biological tissues with minimal harm. Surgeons increasingly employ these systems during oncological resections to delineate tumor margins through fluorescence-guided procedures, enhancing complete excision rates. These modalities support vascular imaging by highlighting blood flow patterns and perfusion in reconstructive flaps post-surgery.

Researchers utilize near infrared spectroscopy for brain function monitoring, mapping hemodynamic responses during neurological assessments. Veterinarians apply these imaging platforms for intraoperative guidance in animal surgeries, identifying sentinel lymph nodes in oncology cases. In November 2024, Hamamatsu Photonics K.K. broadened its imaging technology base through the acquisition of BAE Systems Imaging Solutions, adding advanced CMOS sensor capabilities to its optoelectronics portfolio.

This move strengthens the near infrared imaging market by improving sensor performance required for low-light and high-sensitivity NIR applications. Enhanced CMOS technologies enable higher resolution, faster image capture, and broader spectral responsiveness, supporting demanding use cases in medical imaging, industrial inspection, and scientific research. The integration of these sensor technologies is expected to accelerate innovation and large-scale deployment of next-generation near infrared imaging systems across multiple industries.

Manufacturers pursue opportunities to refine indocyanine green-based fluorescence imaging for lymphatic mapping, aiding sentinel node biopsies in breast cancer and melanoma management. Developers integrate multispectral near infrared systems into endoscopic platforms, enabling deeper tissue penetration for gastrointestinal lesion detection. These technologies expand applications in wound healing assessments, quantifying oxygenation levels to predict chronic ulcer outcomes.

Opportunities arise in combining near infrared with photoacoustic imaging for hybrid modalities that provide structural and functional insights in dermatological evaluations. Companies advance portable handheld devices for point-of-care cerebral oximetry, monitoring oxygen saturation in critical care environments. Firms invest in contrast-enhanced near infrared probes targeting specific molecular markers, broadening utility in preclinical drug efficacy studies.

Industry specialists incorporate artificial intelligence algorithms to process near infrared hyperspectral data, automating tissue classification in intraoperative decision-making. Developers enhance quantum dot-based probes that extend emission wavelengths, improving signal-to-noise ratios in deep-tissue oncology imaging. Market participants launch wearable near infrared sensors for continuous hemodynamic monitoring in sports medicine and rehabilitation.

Innovators refine diffuse optical tomography reconstructions for three-dimensional breast cancer screening adjuncts. Companies prioritize dual-modality systems merging near infrared fluorescence with ultrasound for guided interventional procedures. Ongoing advancements emphasize biocompatible fluorophores with prolonged circulation times, elevating precision in cardiovascular plaque characterization.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.3 Billion, with a CAGR of 4.5%, and is expected to reach US$ 3.6 Billion by the year 2034.

- The product type segment is divided into devices and spectroscopy & imaging sensors, with devices taking the lead in 2024 with a market share of 68.5%.

- Considering application, the market is divided into R&D applications, medical diagnostics, biometrics and access control, surveillance applications, industrial applications and others. Among these, R&D applications held a significant share of 35.6%.

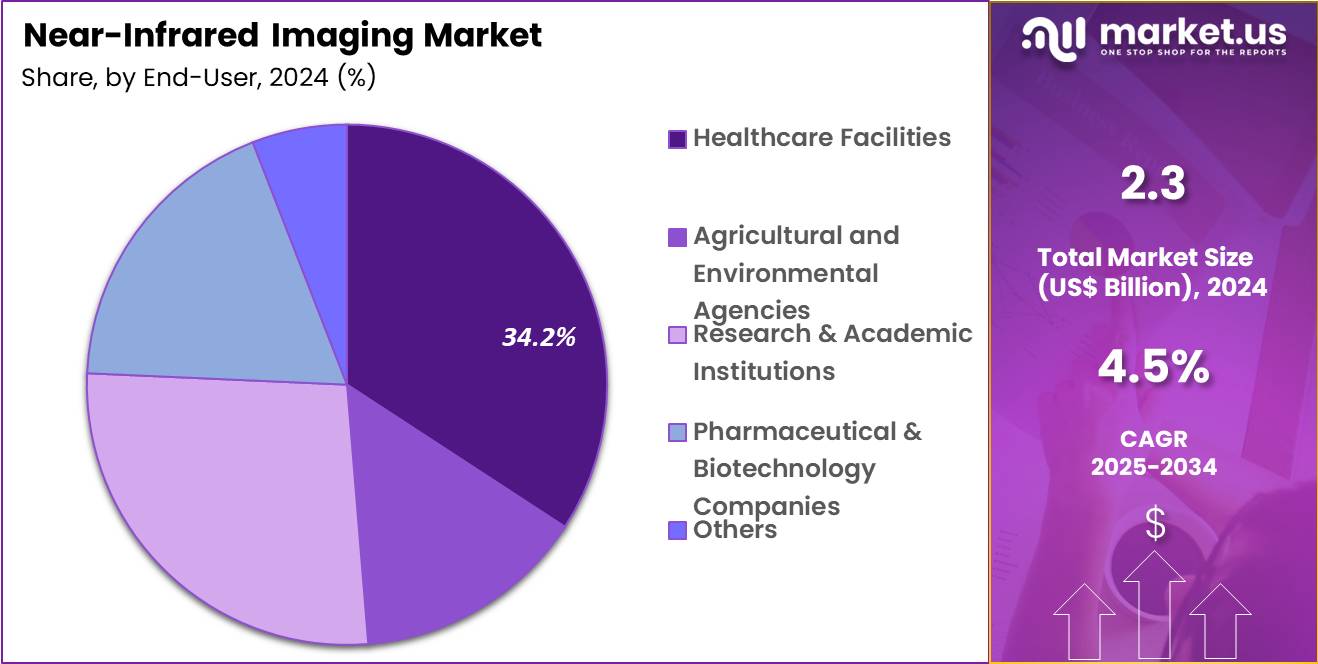

- Furthermore, concerning the end-user segment, the market is segregated into healthcare facilities, agricultural and environmental agencies, research & academic institutions, pharmaceutical & biotechnology companies and others. The healthcare facilities sector stands out as the dominant player, holding the largest revenue share of 34.2% in the market.

- North America led the market by securing a market share of 39.3% in 2024.

Product Type Analysis

Devices, accounting for 68.5%, are expected to dominate the product type segment as end users increasingly prefer complete, ready to deploy imaging solutions rather than standalone components. Integrated devices simplify adoption by combining light sources, detectors, optics, and software into a single system. Research laboratories and healthcare facilities value faster setup and reduced technical complexity.

Continuous improvements in spatial resolution, penetration depth, and real time imaging performance strengthen clinical and research utility. Portable and handheld device formats expand usage beyond traditional lab environments. Capital investment trends favor durable systems with multi year usability. Compatibility with data analytics and AI based interpretation enhances decision making.

Manufacturers focus on user friendly interfaces to widen adoption. Growing acceptance of noninvasive imaging supports sustained demand. These factors keep near infrared imaging devices anticipated to remain the dominant product category.

Application Analysis

R&D applications, holding 35.6%, are projected to lead because near infrared imaging plays a critical role in experimental validation and exploratory studies across life sciences and materials research. Researchers use this technology to study molecular interactions, tissue composition, and functional changes without damaging samples. Increased focus on translational research encourages early stage imaging adoption.

Pharmaceutical R&D programs rely on near infrared techniques for drug response monitoring and biomarker evaluation. Academic institutions expand imaging based research through public and private funding. High reproducibility and quantitative output strengthen confidence in experimental results. Integration with spectroscopy broadens analytical capabilities. Faster data generation accelerates research timelines. Cross disciplinary applications continue to emerge. These dynamics keep R&D applications likely to sustain leadership.

End-User Analysis

Healthcare facilities, representing 34.2%, are expected to dominate end user adoption as hospitals and diagnostic centers increasingly integrate near infrared imaging into routine clinical workflows. Surgeons use the technology to visualize tissue perfusion, vascular structures, and tumor margins during procedures. Demand rises alongside growth in minimally invasive and image guided surgeries.

Clinicians value real time feedback that improves precision and patient safety. Investment in advanced imaging aligns with hospital quality improvement goals. Training initiatives increase clinician familiarity and confidence. Adoption expands in oncology, cardiovascular care, and wound assessment.

Noninvasive diagnostics support faster recovery and reduced complications. Equipment standardization across departments boosts utilization rates. These factors keep healthcare facilities anticipated to remain the leading end user segment.

Key Market Segments

By Product Type

- Devices

- Standalone NIR Cameras

- NIR Imaging Agents and Probes

- Spectroscopy & Imaging Sensors

By Application

- R&D applications

- Medical diagnostics

- Biometrics and access control

- Surveillance applications

- Industrial applications

- Others

By End-User

- Healthcare Facilities

- Agricultural and Environmental Agencies

- Research & Academic Institutions

- Pharmaceutical & Biotechnology Companies

- Others

Drivers

Rising incidence of breast cancer is driving the market

The near infrared imaging market is driven by the rising incidence of breast cancer, which increases the demand for non-invasive diagnostic and intraoperative visualization tools to support early detection and precise surgical interventions. Near infrared fluorescence imaging assists surgeons in identifying tumor margins and sentinel lymph nodes during breast conserving surgeries, improving outcomes. Enhanced tissue penetration and real-time feedback from these systems align with clinical needs for accurate localization in oncologic procedures.

Healthcare providers prioritize technologies that minimize recurrence risks through better resection guidance. Epidemiological factors, including aging populations and lifestyle influences, contribute to sustained case growth. Research institutions explore NIR applications in multimodal imaging for comprehensive breast assessments. Regulatory support for fluorescence-guided surgery reinforces adoption in standardized protocols.

Pharmaceutical integrations with indocyanine green dyes expand utility in targeted therapies. According to the American Cancer Society’s Breast Cancer Facts & Figures 2024-2025, an estimated 310,720 new cases of invasive breast cancer were projected among women in the United States for 2024. This projection emphasizes the clinical imperative for advanced imaging solutions to address diagnostic and therapeutic challenges.

Restraints

High costs of advanced NIR imaging systems are restraining the market

The near infrared imaging market is restrained by the high costs of advanced systems, encompassing acquisition, maintenance, and operational expenses that limit accessibility for smaller healthcare facilities. Capital investments for integrated cameras, light sources, and software platforms pose financial challenges amid budget constraints in public health systems. Training requirements for specialized personnel add to implementation burdens, delaying widespread deployment.

Reimbursement limitations for certain NIR applications restrict economic viability in routine care. Manufacturers contend with elevated production costs due to precision optics and sensor technologies. Economic disparities across regions exacerbate adoption gaps in low-resource settings. Periodic upgrades to comply with evolving standards contribute to recurring expenditures.

Vendor dependencies for proprietary consumables, such as fluorescent agents, amplify long-term costs. Institutional procurement processes often favor cost-benefit analyses that disadvantage premium NIR equipment. These financial barriers collectively hinder market penetration and slow innovation diffusion in diverse clinical environments.

Opportunities

Increasing FDA clearances for NIR-based diagnostic aids is creating growth opportunities

The near infrared imaging market offers growth opportunities through increasing FDA clearances for devices that enhance diagnostic capabilities, such as those aiding in caries detection and intraoperative visualization. These clearances validate safety and efficacy, encouraging integration into dental and surgical practices. Developers can expand product lines with cleared technologies, targeting unmet needs in preventive and precision medicine.

Clinical adoption accelerates with evidence from post-market studies supporting broader indications. Partnerships between device manufacturers and healthcare networks facilitate real-world application data generation. Global regulatory trends toward harmonized evaluations open international markets for cleared systems. Investments in user-friendly designs align with clearance criteria for improved patient outcomes.

The U.S. Food and Drug Administration cleared the iTero Lumina Pro NIRI functionality on August 16, 2024, as a diagnostic aid for detecting interproximal carious lesions above the gingiva. Additionally, the Lumicell Direct Visualization System received approval on April 17, 2024, for fluorescence imaging in breast cancer surgery. These advancements position NIR technologies for diversified roles in early intervention and therapeutic monitoring.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends invigorate the near infrared imaging market as expanding healthcare budgets and persistent demand for non-invasive diagnostics drive hospitals and research labs to embrace advanced systems for oncology and cardiovascular applications. Leading manufacturers strategically launch compact, high-resolution devices, capitalizing on aging populations and biopharmaceutical expansions to broaden adoption across global sectors.

Stubborn inflation and economic slowdowns, however, escalate costs for sensors and software components, compelling providers to curtail upgrades and limit testing volumes in financially strained regions. Geopolitical tensions, particularly U.S.-China trade disputes and regional conflicts, repeatedly disrupt supplies of critical optics and electronics, creating production delays and sourcing uncertainties for internationally reliant suppliers.

Current U.S. tariffs impose elevated duties on imported medical imaging equipment, amplifying procurement expenses for American distributors and eroding competitive pricing in domestic channels. These tariffs also provoke reciprocal barriers from trading partners that constrain U.S. exports of innovative near infrared technologies and impede multinational R&D alliances. Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and diversified sourcing strategies, cultivating fortified infrastructures that promise accelerated innovation and steadfast market progression for the foreseeable future.

Latest Trends

Advancement in near-infrared II fluorophores is a recent trend

In 2025, the near infrared imaging market has featured a notable trend toward advancements in near-infrared II fluorophores, which offer deeper tissue penetration and reduced autofluorescence for superior imaging quality. These agents enable multiplexing capabilities, allowing simultaneous visualization of multiple biological targets in complex surgical fields. Integration with nanoparticle-based platforms enhances specificity and signal stability in oncologic applications.

Clinical studies demonstrate improved depth resolution in hepatopancreatobiliary and vascular surgeries. Developers prioritize activatable probes that respond to specific biomarkers, minimizing background noise. Regulatory considerations for biocompatibility support translational progress from preclinical models. Collaborative research between academia and industry refines spectral properties for robotic-assisted procedures.

Ethical frameworks address potential toxicity in long-term exposures. Publications emphasize automated interpretation through artificial intelligence to streamline workflows. This trend, as outlined in a 2025 review, promotes enhanced precision in general surgery and expands therapeutic horizons.

Regional Analysis

North America is leading the Near Infrared Imaging Market

In 2024, North America held a 39.3% share of the global near infrared imaging market, accelerated by the proliferation of minimally invasive surgical applications and heightened focus on real-time intraoperative guidance in oncology and cardiovascular interventions. Surgeons increasingly incorporate fluorescence-based systems to delineate tumor margins and vascular structures, improving precision during resections and reducing recurrence risks in high-volume cancer centers.

Regulatory endorsements from agencies like the Food and Drug Administration streamline approvals for indocyanine green-compatible devices, enabling seamless integration into hybrid operating theaters. Pharmaceutical research entities leverage spectral imaging for pharmacokinetic studies, optimizing drug distribution assessments in preclinical models amid expanding biologic pipelines.

Demographic pressures from rising chronic illnesses drive demand for portable spectrometers in diagnostic clinics, facilitating early detection of tissue oxygenation anomalies. Collaborative grants support advancements in hyperspectral cameras, enhancing resolution for neurosurgical navigation.

Supply optimizations ensure compatibility with existing endoscopic platforms, broadening accessibility in ambulatory settings. The Centers for Disease Control and Prevention reported 1,851,238 new cancer cases in the United States in 2022, illustrating the escalating need for advanced imaging modalities in oncological care.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Stakeholders project vigorous progression in near infrared imaging technologies across Asia Pacific throughout the forecast period, as nations confront mounting non-communicable disease burdens through infrastructural enhancements. Health authorities in Japan and the Philippines allocate resources to equip regional hospitals with fluorescence-guided systems, sharpening tumor excision accuracies in densely populated oncology wards.

Biotech innovators engineer compact spectrometers suited to tropical environments, empowering rural practitioners to monitor wound perfusion during reconstructive procedures. International consortia standardize protocols for lymphatic mapping, aiding breast cancer staging amid lifestyle-induced incidence spikes. Affluent urbanites seek premium diagnostic services, prompting private chains to adopt multispectral tools for cosmetic dermatology assessments.

Regulatory bodies expedite clearances for AI-augmented analyzers, optimizing data interpretation in resource-stretched facilities. Community programs train technicians on portable variants, bridging gaps in cardiovascular evaluations for aging cohorts. Global cancer statistics indicate that Asia accounted for 49.2% of all new cases worldwide in 2022, compelling intensified deployment of innovative visualization solutions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Near Infrared Imaging market accelerate growth by advancing high-sensitivity cameras, fluorescent dyes, and software analytics that enhance real-time visualization in surgery, oncology, and vascular procedures. Companies expand adoption by collaborating with surgeons and hospitals to integrate imaging platforms into minimally invasive workflows, improving precision and clinical confidence.

Product strategies emphasize interoperability with existing surgical systems, faster processing, and compact designs to lower adoption barriers and capital costs. Commercial teams pursue bundled offerings that combine hardware, consumables, training, and service contracts to create predictable revenue and long-term customer relationships.

Geographic expansion targets tertiary care centers in emerging markets where investment in advanced surgical technologies continues to rise. Stryker exemplifies leadership through its SPY imaging portfolio, global manufacturing and service footprint, and strong surgeon partnerships that position the company as a trusted provider of intraoperative visualization solutions.

Top Key Players

- Quest Diagnostics Incorporated

- Olympus Corporation

- Shimadzu Corporation

- KARL STORZ SE & Co. KG

- Hamamatsu Photonics K.K.

- Mizuho Medical Co., Ltd.

- Stryker Corporation

- PerkinElmer

- Medtronic

- Danaher Corporation

- FLUOPTICS SAS

- Carl Zeiss Meditec AG

- Li-COR, Inc.

- Teledyne DALSA

- VA-Imaging

- Tucsen Photonics

- OMNIVISION Technologies

Recent Developments

- In February 2025, Stryker completed its acquisition of Inari Medical, expanding its presence in peripheral vascular care with a particular focus on venous thromboembolism treatment. The transaction supports growth in the near infrared imaging market by reinforcing the shift toward image-guided, minimally invasive vascular procedures. As catheter-based thrombectomy and venous interventions become more common, clinicians increasingly rely on advanced visualization technologies to guide device placement, assess vessel anatomy, and improve procedural precision. The integration of vascular therapy platforms within Stryker’s portfolio is expected to stimulate greater investment in real-time imaging tools, including near infrared systems that enhance accuracy in endovascular workflows.

- In February 2025, Leica Microsystems strengthened its imaging ecosystem by acquiring ATTO TEC, a supplier of high-performance fluorescent dyes and reagents. This acquisition enhances Leica’s microscopy offerings and directly supports expansion of the near infrared imaging market by improving fluorescence-based visualization in biological research. Dyes engineered for near infrared wavelengths provide advantages such as deeper tissue imaging, reduced background interference, and clearer signal detection. The expanded reagent portfolio is expected to accelerate adoption of near infrared fluorescence techniques across life science research, diagnostics, and translational applications.

Report Scope

Report Features Description Market Value (2024) US$ 2.3 Billion Forecast Revenue (2034) US$ 3.6 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Devices (Standalone NIR Cameras and NIR Imaging Agents and Probes) and Spectroscopy & Imaging Sensors), By Application (R&D Applications, Medical Diagnostics, Biometrics and Access Control, Surveillance Applications, Industrial Applications and Others), By End-User (Healthcare Facilities, Agricultural and Environmental Agencies, Research & Academic Institutions, Pharmaceutical & Biotechnology Companies and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Quest Diagnostics Incorporated, Olympus Corporation, Shimadzu Corporation, KARL STORZ SE & Co. KG, Hamamatsu Photonics K.K., Mizuho Medical Co., Ltd., Stryker Corporation, PerkinElmer, Medtronic, Danaher Corporation, FLUOPTICS SAS, Carl Zeiss Meditec AG, Li-COR, Inc., Teledyne DALSA, VA-Imaging, Tucsen Photonics, OMNIVISION Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Near Infrared Imaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Near Infrared Imaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Quest Diagnostics Incorporated

- Olympus Corporation

- Shimadzu Corporation

- KARL STORZ SE & Co. KG

- Hamamatsu Photonics K.K.

- Mizuho Medical Co., Ltd.

- Stryker Corporation

- PerkinElmer

- Medtronic

- Danaher Corporation

- FLUOPTICS SAS

- Carl Zeiss Meditec AG

- Li-COR, Inc.

- Teledyne DALSA

- VA-Imaging

- Tucsen Photonics

- OMNIVISION Technologies