Global Molded Case Circuit Breakerā Market Size, Share, And Industry Analysis Report By Product Type (Miniature, Molded Case), By Power Range (0 to 75A, 75 to 250A, 250 to 800A, Above 800A), By End-use (Industrial, Residential, Commercial, Power Utilities), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176888

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

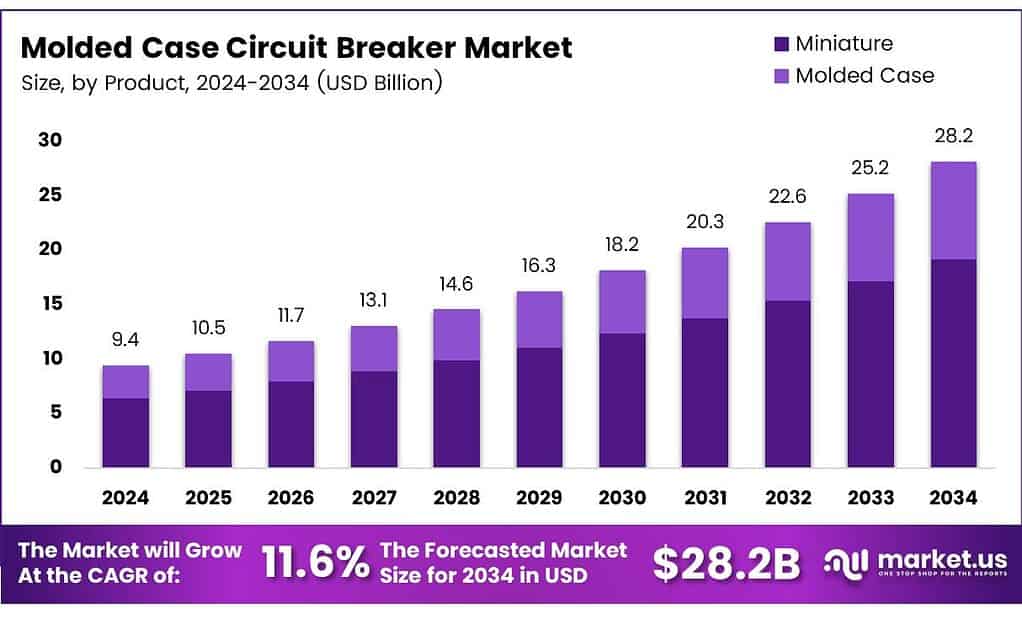

The Global Molded Case Circuit Breaker Market size is expected to be worth around USD 28.2 billion by 2034, from USD 9.4 billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034.

The molded case circuit breaker segment continues gaining traction as industries modernize power networks and adopt higher-capacity electrical systems. Demand rises steadily as companies prioritize safety, efficient load management, and compliance with tightening building regulations. Additionally, electrification trends and strong industrial expansion continue to stimulate long-term adoption across emerging economies.

The market experiences healthy growth as governments invest heavily in power infrastructure upgrades. Rapid urban expansion and new manufacturing plants strengthen MCCB deployment in distribution panels, motor control centers, and renewable installations. Furthermore, rising attention to workplace electrical safety drives organizations to replace outdated protection systems with modern MCCB technology.

- MCCBs undergo rigorous testing to ensure dependable performance in real-world electrical conditions. Their impulse withstand strength is validated using a 1.2/50µs surge waveform to confirm resistance to lightning-induced peaks and switching over-voltages. Thermal protection is assessed by applying 300% of the rated current, as mandated by IEC 60947-2, while magnetic protection is verified through high-current pulses to ensure rapid tripping during short-circuits.

Traditional air-break breakers typically operate up to 6.6 kV, oil-filled types cover 3.6–245 kV, vacuum breakers function up to 72.5 kV, and air-blast systems reach 275 kV. SF₆ breakers span an even wider 6.6–765 kV range. These voltage benchmarks emphasize how MCCBs are engineered specifically for reliable low- and medium-voltage protection within modern power systems.

Increasing opportunities emerge from smart circuit protection, IoT monitoring, and energy-efficient breaker designs. As industries shift toward automation and sustainable grids, MCCBs capable of communicating real-time load data gain importance. Moreover, digital substations and green buildings increasingly integrate MCCBs to optimize operational continuity and minimize electrical downtimes.

Key Takeaways

- The Global Molded Case Circuit Breaker Market is projected to grow from USD 9.4 billion in 2024 to USD 28.2 billion by 2034, at a CAGR of 11.6% during 2025 to 2034.

- The Miniature product type dominates the segment with a leading 78.3% share in 2025.

- The Power Range category, the 0 to 75A segment, leads with 45.9% market share.

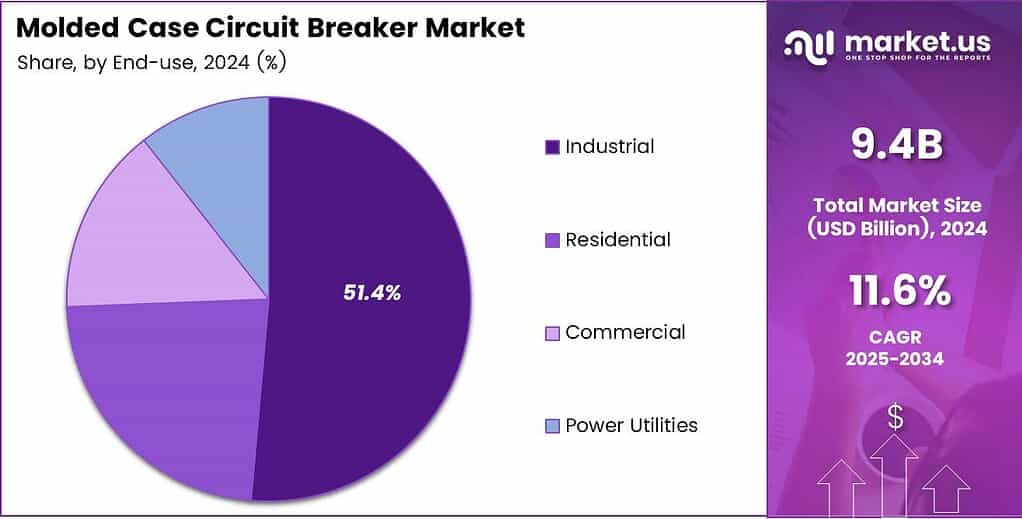

- The Industrial end-use segment captures the highest contribution at 51.4% in 2025.

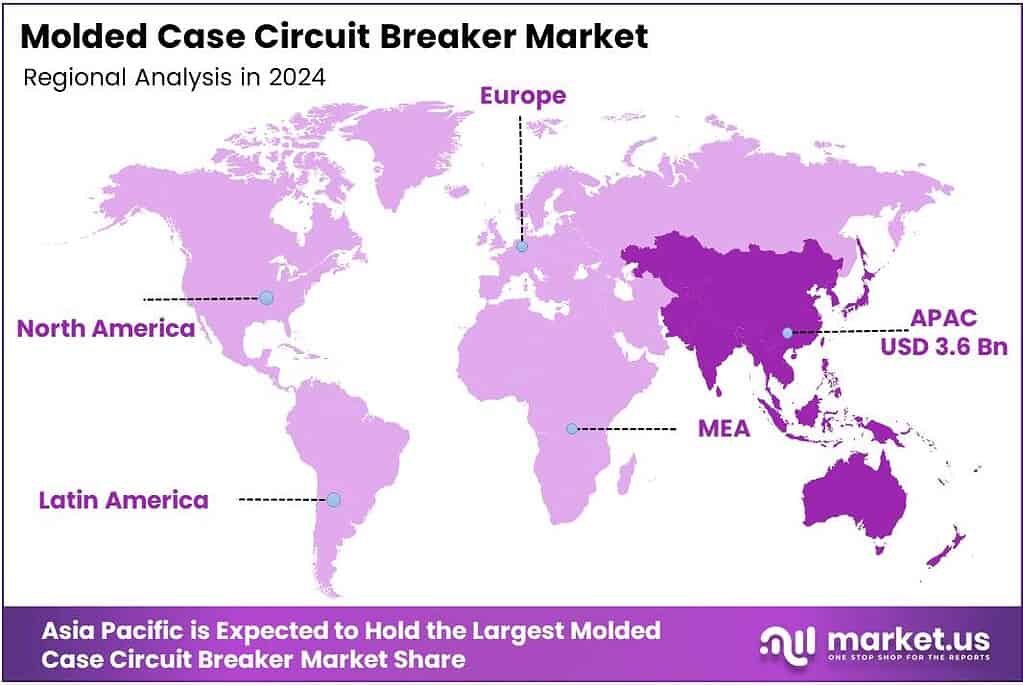

- Asia Pacific remains the largest regional market with 38.5% share, valued at USD 3.6 billion.

By Product Type Analysis

Miniature dominates with 78.3% due to its compact design and broad household and commercial adoption.

In 2025, Miniature held a dominant market position in the By Product Type segment of the Molded Case Circuit Breaker Market, with a significant 78.3% share. This category benefits from rising usage in low-voltage protection applications. Additionally, expanding residential construction and safety compliance standards continue to boost its long-term market relevance and demand.

The Molded Case sub-segment also shows steady traction as industries adopt higher-capacity solutions to safeguard electrical assets. Its usage expands with growing manufacturing facilities and infrastructure upgrades. Moreover, its durability and capability to handle higher loads keep this segment essential in industrial electrical architectures worldwide.

By Power Range Analysis

0 to 75A dominates with 45.9%, driven by high preference across residential and commercial installations.

In 2025, the 0 to 75A category held a dominant market position in the By Power Range segment of the Molded Case Circuit Breaker Market, securing a strong 45.9% share. This segment remains preferred due to its suitability for low-capacity circuits. Its adoption grows as smart home systems and commercial retrofitting activities increase globally.

The 75 to 250A sub-segment continues to grow as medium-capacity circuits gain traction. Its application strengthens across mid-scale industries and commercial buildings. Furthermore, expanding small manufacturing units drives consistent deployment of this power range to ensure operational efficiency and equipment safety.

The 250 to 800A category supports larger industrial operations requiring stable electrical distribution. It gains relevance as heavy machinery installations rise. With increasing investments in production facilities and automation, this sub-segment sees progressive adoption for securing higher-load operations reliably.

The Above 800A segment caters to high-demand users, including advanced industrial plants and utility-scale applications. Its relevance increases as countries upgrade grid systems. Moreover, expanding renewable energy integration amplifies the need for high-capacity protection systems, supporting this segment’s gradual yet essential market contribution.

By End-Use Analysis

Industrial dominates with 51.4% owing to large-scale electrical infrastructure requirements.

In 2025, the Industrial segment held a dominant market position in the By End-use category of the Molded Case Circuit Breaker Market, commanding a notable 51.4% share. Industrial plants rely heavily on MCCBs for equipment protection. Rising automation, manufacturing expansion, and machinery modernization continue to uplift this segment’s long-term growth trajectory.

The Residential sub-segment benefits from increasing household electrification. Growth in smart homes and rising safety awareness push more installations of circuit protection devices. Moreover, expanding urban housing projects ensure that demand for residential-grade MCCBs remains steady across developing regions.

The Commercial segment sees momentum as offices, retail facilities, and institutional buildings modernize their electrical systems. Increased investments in commercial real estate fuel greater adoption. Additionally, energy-efficiency initiatives encourage upgrades to safer and more reliable power distribution systems, strengthening the adoption of MCCBs.

The Power Utilities sub-segment plays a vital role in ensuring grid stability. As nations enhance transmission and distribution networks, MCCB usage expands. Furthermore, integrating renewable power sources requires robust protection equipment, enhancing the significance of MCCBs in utility-level operations.

Key Market Segments

By Product Type

- Miniature

- Molded Case

By Power Range

- 0 to 75A

- 75 to 250A

- 250 to 800A

- Above 800A

By End-use

- Industrial

- Residential

- Commercial

- Power Utilities

Emerging Trends

Shift Toward Smart and IoT-Enabled MCCBs Shapes Market Trends

One of the strongest trends in the MCCB market is the adoption of smart and IoT-enabled circuit breakers. These products offer real-time monitoring, predictive maintenance, and remote control, helping industries reduce downtime and improve operational efficiency. As automation grows, companies are shifting toward digitalized protection systems.

- Sustainability trends are also influencing product design. Manufacturers are using eco-friendly materials and energy-efficient technologies to meet global environmental standards. The International Energy Agency estimates global data-centre electricity consumption at around 415 TWh in 2024 (about 1.5% of global electricity), and notes it has grown at about 12% per year over the last five years.

Miniaturization is another major trend, as businesses prefer compact electrical components that save space without compromising performance. This has encouraged innovation in lightweight, high-capacity MCCBs. Customized solutions are gaining traction, especially in data centers, renewable energy plants, and heavy industries.

Drivers

Growing Focus on Electrical Safety Accelerates MCCB Market Demand

The molded case circuit breaker market is driven by the growing need to protect electrical systems against overloads and short circuits. As industries expand and power consumption rises, companies prefer MCCBs for their reliable protection and compact design. This growing shift toward safer electrical infrastructure boosts continuous product adoption.

Rapid industrialization, especially in manufacturing, construction, and utilities, plays a key role in demand. Many facilities are upgrading old power systems, and MCCBs offer an efficient solution due to their long service life and easy installation. The movement toward energy-efficient equipment also encourages companies to choose MCCBs with advanced protective features.

Urban development and commercial building projects are another major driver. High-rise buildings, data centers, and transportation networks require dependable circuit protection, making MCCBs a necessary component. Governments are also tightening safety regulations, pushing industries to invest more in certified electrical protection devices.

Restraints

High Installation and Maintenance Costs Limit Market Growth

A key restraint for the molded case circuit breaker market is the high initial cost of installation. Many small and medium businesses hesitate to upgrade their systems due to budget constraints, even though MCCBs offer long-term benefits. This cost pressure slows adoption in price-sensitive regions.

- Another challenge comes from the availability of low-quality and unregulated alternatives. These products attract buyers with low prices but do not meet global safety standards, reducing the demand for certified MCCBs. The IEA notes investment in electricity grids needs to average around USD 600 billion per year through 2030 to align with a net-zero pathway, compared with “current” levels around USD 300 billion per year.

Technical complexity is also a concern. MCCBs used in advanced industrial operations often require skilled professionals for installation and maintenance. In areas with a shortage of trained technicians, users may experience delays and added costs. This limits the market’s ability to expand smoothly.

Growth Factors

Rising Investments in Smart Grids Create New MCCB Opportunities

The shift toward smart grid development offers strong opportunities for molded case circuit breaker manufacturers. As utilities modernize power networks, MCCBs with digital monitoring and remote operation features are becoming highly valuable. These advanced models help improve system reliability and reduce downtime.

Electric vehicle (EV) infrastructure is another promising area. Charging stations require robust circuit protection due to high power loads, making MCCBs essential for safe operation. The global expansion of EV adoption creates a long-term opportunity for MCCB suppliers.

Growth in renewable energy installations, such as solar and wind power, also supports the market. These setups need dependable circuit protection for both grid-connected and off-grid systems. MCCBs help manage power fluctuations and ensure stable distribution, driving higher product demand.

Regional Analysis

Asia Pacific Dominates the Molded Case Circuit Breaker Market with a Market Share of 38.5%, Valued at USD 3.6 Billion

Asia Pacific leads the global Molded Case Circuit Breaker (MCCB) market, driven by rapid industrial expansion, rising energy consumption, and large-scale infrastructure upgrades. The region’s strong construction pipeline, along with increasing electrification in emerging economies, continues to support market demand. With a dominant share of 38.5% worth USD 3.6 billion, the Asia Pacific benefits from ongoing urbanization, grid modernization, and government-led investments in building safety standards.

North America shows steady growth due to the modernization of transmission networks, increased adoption of smart grid systems, and rising emphasis on electrical safety in industrial facilities. The U.S. contributes significantly as aging infrastructure is replaced with advanced protection systems. The region also benefits from stringent regulatory frameworks that mandate reliable circuit protection solutions across commercial and residential sectors.

Europe’s market is influenced by sustainability-driven infrastructure upgrades, renewable energy integration, and regulatory mandates for electrical safety compliance. Demand is further supported by industrial automation and the refurbishment of commercial buildings. Strong adoption of energy-efficient electrical components across Germany, France, and the U.K. reinforces steady growth in the region.

The Middle East & Africa region experiences rising MCCB demand due to expanding construction projects, utility-scale power developments, and investment in oil & gas infrastructure. Countries in the Gulf region are increasingly deploying advanced protection systems to support large industrial hubs. Meanwhile, Africa’s growing electrification initiatives contribute to gradual market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, the global Molded Case Circuit Breaker (MCCB) market shows steady expansion as electrification accelerates and industries strengthen safety standards. Market momentum is supported by leading players who continue to innovate, expand regional footprints, and improve product reliability to address rising power-system complexities.

ABB maintains strong leadership through its wide MCCB portfolio focused on energy efficiency and digital compatibility. The company’s strategy of integrating smart monitoring features into protection devices positions it well in industrial automation and utility modernization programs.

CNC Electric Group continues to gain traction in cost-competitive segments, supported by its expanding manufacturing capabilities and growing distribution networks across Asia and Africa. Its focus on compact, value-driven MCCBs helps address rising demand from small industries and commercial users.

Denor Industries strengthens its position by offering MCCBs designed for reliable protection in harsh operating environments. The company’s investment in improving product durability and thermal performance helps it attract industrial and construction-sector buyers seeking robust solutions.

Eaton remains one of the most influential players, leveraging its expertise in power management and safety technologies. With a strong presence in North America and Europe, Eaton benefits from infrastructure upgrades, renewable-energy integration, and rising adoption of intelligent circuit-protection systems.

Together, these companies shape competitive dynamics by balancing innovation, affordability, and performance reliability. As global energy systems grow more complex, MCCB manufacturers that can integrate digital diagnostics, support higher load capacities, and meet evolving safety standards are likely to see stronger growth and wider market acceptance in 2025.

Top Key Players in the Market

- ABB

- CNC Electric Group

- Denor Industries

- Eaton

- Fuji Electric

- GEYA Electrical Equipment Supply

- Hitachi

- Mitsubishi Electric

- Noark Electric

- Rockwell Automation

Recent Developments

- In 2025, ABB announced lifecycle management updates for its low-voltage products, including the discontinuation of Tmax T5-T6-T7 molded case circuit breakers (standard version up to 690VAC – 750VDC) by the end of 2025, with availability limited to ongoing projects until then. This includes a shift to the classic phase for related accessories like Fastline Adapters for MCCB Tmax (T2-T7)

- In 2025, CNC Electric introduced high-performance Arc Fault Circuit Interrupters (AFCI) breakers, enhancing electrical safety against fires caused by arc faults. While focused on AFCI, the announcement highlights their broader low-voltage portfolio, including robust Molded Case Circuit Breakers (MCCBs) for industrial applications like protecting heavy machinery in factories.

Report Scope

Report Features Description Market Value (2024) USD 9.4 Billion Forecast Revenue (2034) USD 28.2 Billion CAGR (2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Miniature, Molded Case), By Power Range (0 to 75A, 75 to 250A, 250 to 800A, Above 800A), By End-use (Industrial, Residential, Commercial, Power Utilities) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB, CNC Electric Group, Denor Industries, Eaton, Fuji Electric, GEYA Electrical Equipment Supply, Hitachi, Mitsubishi Electric, Noark Electric, Rockwell Automation Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Molded Case Circuit Breaker MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Molded Case Circuit Breaker MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- CNC Electric Group

- Denor Industries

- Eaton

- Fuji Electric

- GEYA Electrical Equipment Supply

- Hitachi

- Mitsubishi Electric

- Noark Electric

- Rockwell Automation