Global Milk Protein Concentrate Market Size, Share and Future Trends Analysis Report By Nature (Organic, Conventional), By Form (Powder, Liquid), By Concentration (Low, Medium, High), By Preparation ( Co-Precipitation, Ultrafiltration), By Application (Packaged Products, Nutritional Products, Infant Formula, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148720

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

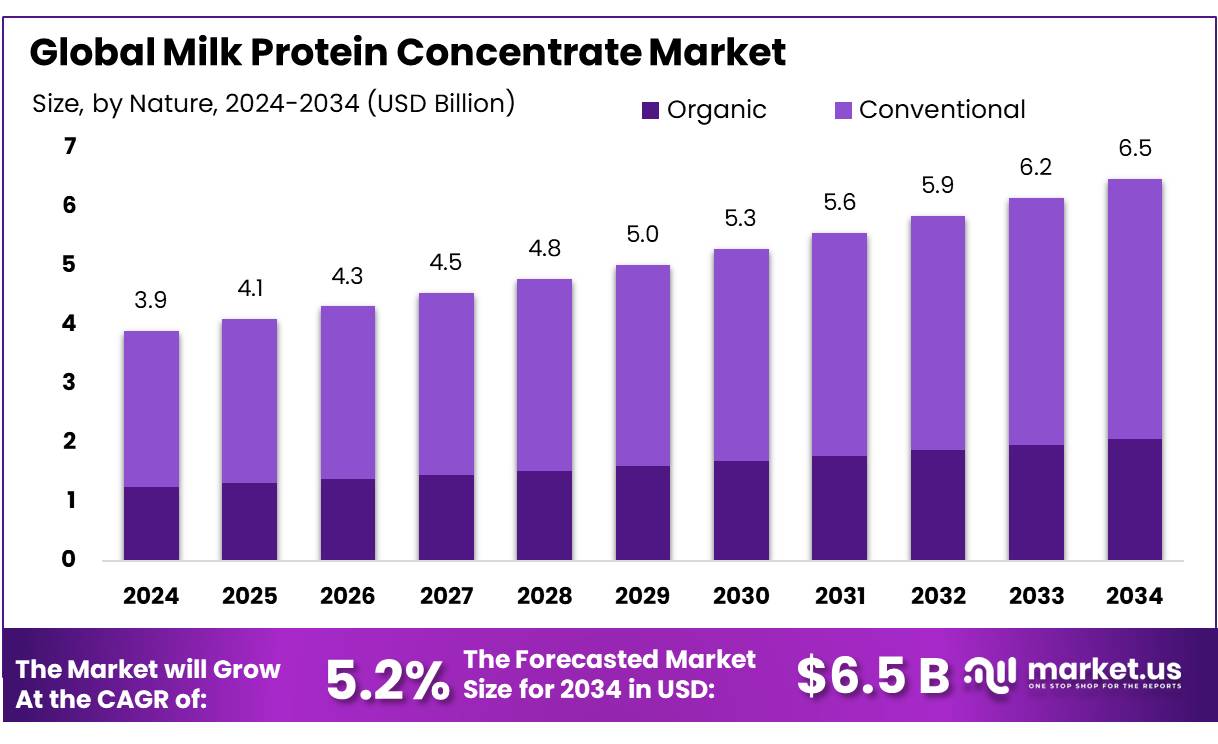

The Global Milk Protein Concentrate Market size is expected to be worth around USD 6.5 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Milk Protein Concentrates (MPCs) are dairy-derived ingredients containing 40% to 90% milk protein, primarily composed of casein and whey proteins. Produced through processes like ultrafiltration, MPCs retain the natural protein ratio found in milk while reducing lactose content. This makes them valuable in various applications, including nutritional beverages, infant formulas, and functional foods.

India’s fluid milk production is projected to reach 212.7 million metric tons (MMT) in 2024, a 3% increase from the previous year, according to the USDA Foreign Agricultural Service. This surge in milk production provides a robust foundation for MPC manufacturing.

Government programs like the National Dairy Plan and the National Programme for Dairy Development aim to boost milk production and infrastructure, thereby increasing the availability of milk protein-rich products. In Madhya Pradesh, the state government, in collaboration with the National Dairy Development Board (NDDB), plans to double its milk production share from 9% to 20% by enhancing dairy cooperatives, importing superior cattle breeds, and digitizing the dairy value chain.

These initiatives are expected to bolster MPC production capacity. The demand for MPC is further fueled by its applications in sports nutrition, functional foods, and infant formula, catering to consumers seeking high-quality protein sources. However, challenges such as price volatility due to fluctuations in raw milk supply and competition from plant-based protein alternatives persist. Despite these challenges, the MPC industry in India is poised for continued growth, supported by government policies, technological advancements in dairy processing, and a growing consumer base seeking protein-enriched products.

Key Takeaways

- Milk Protein Concentrate Market size is expected to be worth around USD 6.5 Billion by 2034, from USD 3.9 Billion in 2024, growing at a CAGR of 5.2%.

- Conventional milk protein concentrate (MPC) held a dominant position in the market, accounting for over 87.2% of total sales.

- Powder form of milk protein concentrate (MPC) dominated the market, capturing over 67.9% of total sales.

- High concentration milk protein concentrate (MPC) secured a leading position in the market, capturing more than 51.1% of total sales.

- Ultrafiltration emerged as the leading preparation method for milk protein concentrate (MPC), capturing more than 78.8% of the market share.

- Packaged products accounted for a dominant share of the milk protein concentrate (MPC) market, capturing more than 44.4% of total usage.

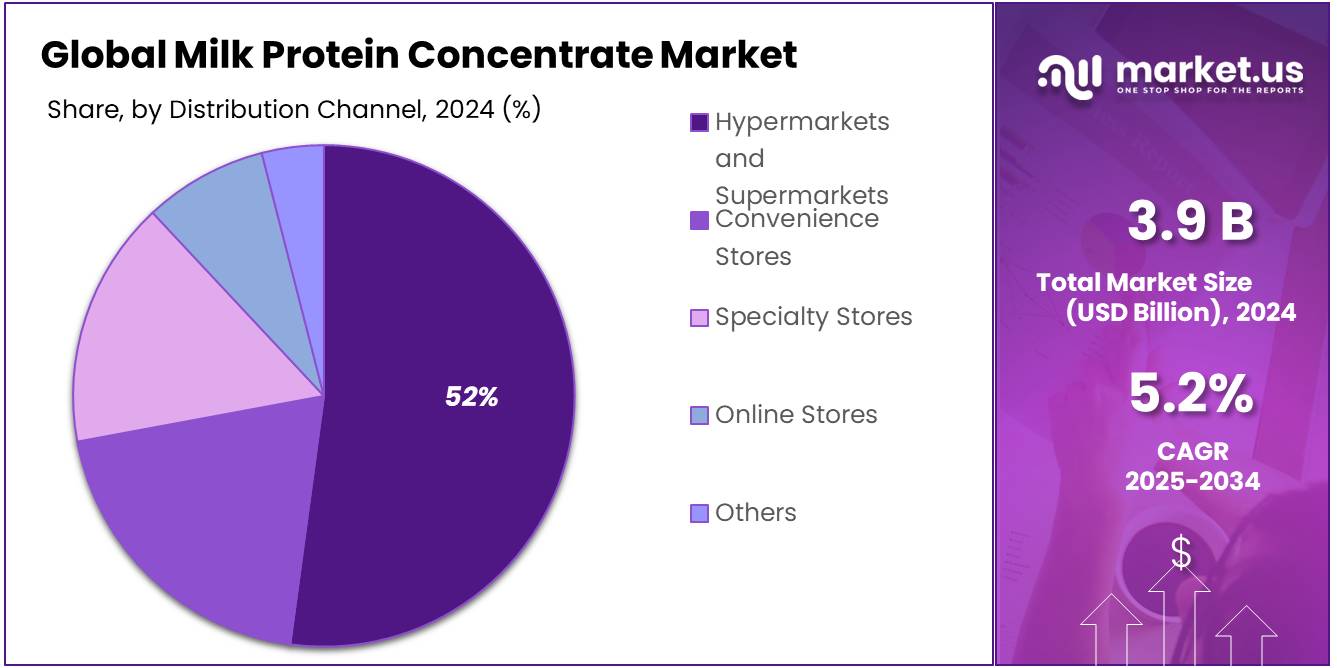

- Hypermarkets and supermarkets held a dominant position in the milk protein concentrate (MPC) distribution channel, accounting for more than 52.3% of the market share.

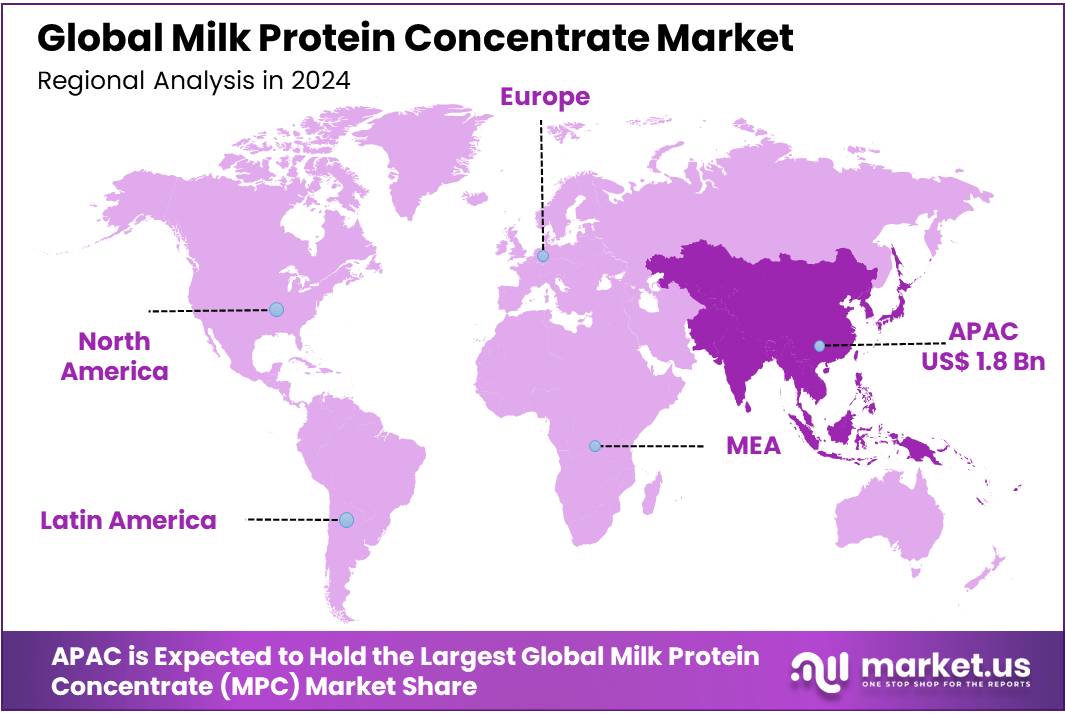

- Asia-Pacific (APAC) region led the global Milk Protein Concentrate (MPC) market, capturing a significant 47.3% share.

By Nature

Conventional Milk Protein Concentrate Leads Market with 87.2% Share in 2024

In 2024, conventional milk protein concentrate (MPC) held a dominant position in the market, accounting for over 87.2% of total sales. This strong preference reflects the widespread use of conventional MPC in various food and beverage applications due to its reliable protein content and cost efficiency. Year over year, conventional MPC has maintained a steady demand, driven largely by the dairy industry’s focus on traditional processing methods and consumer familiarity. The preference for conventional types is also supported by stable supply chains and established manufacturing processes that continue to meet the needs of manufacturers worldwide.

In 2025, this trend is expected to persist as conventional MPC remains the preferred choice for formulators aiming for consistent quality and performance in products such as dairy beverages, nutritional supplements, and bakery items. The market’s inclination toward conventional MPC underscores the importance of tried-and-true solutions amid evolving food innovation, highlighting its essential role in maintaining product texture, taste, and nutritional value.

By Form

Powder Form Dominates Milk Protein Concentrate Market with 67.9% Share in 2024

In 2024, the powder form of milk protein concentrate (MPC) dominated the market, capturing over 67.9% of total sales. This strong preference for powder MPC is driven by its ease of storage, longer shelf life, and versatility across various applications such as dairy products, nutrition bars, and beverages. Manufacturers favor the powder form because it offers convenience in transportation and handling, reducing costs associated with spoilage and packaging.

Throughout 2024 and into 2025, demand for powdered MPC continues to grow steadily as food producers focus on stable ingredients that maintain quality over time. The powder form also allows for better customization in product formulation, making it an ideal choice for companies developing specialized nutrition and functional food items. Overall, the powder segment’s dominance highlights its practicality and adaptability in meeting the evolving needs of the food industry.

By Concentration

High Concentration Milk Protein Concentrate Leads with 51.1% Market Share in 2024

In 2024, high concentration milk protein concentrate (MPC) secured a leading position in the market, capturing more than 51.1% of total sales. This preference reflects the growing demand for MPC products with higher protein content, favored by manufacturers looking to enhance nutritional value in dairy and food products. The high concentration variant is especially popular in applications such as protein supplements, sports nutrition, and fortified foods, where protein quality and quantity are critical.

The market has shown steady growth for high concentration MPC, driven by increased consumer awareness about protein benefits and clean-label trends. Its ability to deliver concentrated nutrition while maintaining functional properties makes it a preferred choice for product developers aiming to meet health-conscious consumer needs. This segment’s strong performance highlights its importance in the evolving landscape of nutritional ingredients.

By Preparation

Ultrafiltration Preparation Leads Milk Protein Concentrate Market with 78.8% Share in 2024

In 2024, ultrafiltration emerged as the leading preparation method for milk protein concentrate (MPC), capturing more than 78.8% of the market share. This dominance is largely due to the process’s ability to efficiently separate proteins while retaining their functional qualities, making it highly suitable for food and beverage manufacturers. Ultrafiltration offers advantages such as improved protein purity, consistent quality, and reduced processing time, which are critical factors for producers aiming to deliver high-performance ingredients.

Demand for ultrafiltration-prepared MPC has remained strong, supported by its widespread adoption in dairy product manufacturing and growing consumer interest in protein-enriched foods. The method’s efficiency and cost-effectiveness continue to drive its preference over alternative preparation techniques, reinforcing its leading position in the MPC market.

By Application

Packaged Products Lead Milk Protein Concentrate Market with 44.4% Share in 2024

In 2024, packaged products accounted for a dominant share of the milk protein concentrate (MPC) market, capturing more than 44.4% of total usage. This strong position reflects the growing demand for convenient, ready-to-consume food and beverage items that benefit from the nutritional and functional properties of MPC. Packaged products such as protein bars, nutrition drinks, and dairy-based snacks increasingly incorporate MPC to enhance protein content and improve texture.

The convenience factor, combined with rising health awareness among consumers, has propelled steady growth in this segment through 2024 and into 2025. Manufacturers favor MPC in packaged goods due to its ability to maintain product quality and shelf stability while meeting nutritional claims. This trend highlights the significant role that MPC plays in driving innovation and meeting consumer expectations in the packaged food market.

By Distribution Channel

Hypermarkets and Supermarkets Capture 52.3% Share in Milk Protein Concentrate Market in 2024

In 2024, hypermarkets and supermarkets held a dominant position in the milk protein concentrate (MPC) distribution channel, accounting for more than 52.3% of the market share. This strong presence is driven by the extensive reach and convenience these retail formats offer to consumers, making it easier for manufacturers to showcase and sell MPC-based products.

The growing popularity of health-focused and protein-enriched foods has encouraged retailers to expand their offerings, further boosting sales through these channels. Throughout 2024 and moving into 2025, hypermarkets and supermarkets have remained key outlets for MPC products, benefiting from established supply chains and consumer trust. Their ability to cater to a broad customer base, combined with in-store promotions and product visibility, continues to strengthen their role in the MPC market.

Key Market Segments

By Nature

- Organic

- Conventional

By Form

- Powder

- Liquid

By Concentration

- Low

- Medium

- High

By Preparation

- Co-Precipitation

- Ultrafiltration

By Application

- Packaged Products

- Nutritional Products

- Infant Formula

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Drivers

Rising Demand for High-Protein Foods Fuels Growth of Milk Protein Concentrate Market

One of the major driving factors behind the growth of the Milk Protein Concentrate (MPC) market is the increasing global demand for high-protein foods. Consumers are becoming more health-conscious, actively seeking products rich in protein to support muscle building, weight management, and overall wellness. This shift in consumer behavior has pushed food manufacturers to incorporate protein-rich ingredients like MPC into a wide range of products, including dairy, bakery, snacks, and nutritional supplements.

According to the U.S. Department of Agriculture (USDA), protein intake recommendations have been rising steadily, with the average American consuming approximately 91 grams of protein daily in 2023, up from 83 grams in 2019. This growing preference for protein-rich diets has directly influenced the demand for MPC, which is valued for its high protein content and functional benefits in food processing. MPC typically contains between 40% to 90% protein, making it an efficient ingredient for enhancing nutritional profiles.

Government initiatives and nutrition programs have also supported this trend. The USDA’s Dietary Guidelines for Americans 2020-2025 emphasize the importance of adequate protein intake, especially from dairy sources, as part of a balanced diet. Additionally, public health campaigns encouraging better nutrition and reduced consumption of sugars and fats are driving manufacturers to reformulate products with ingredients like MPC to meet these guidelines.

Restraints

High Production Costs Limit Growth of Milk Protein Concentrate Market

A significant restraining factor for the Milk Protein Concentrate (MPC) market is the relatively high production cost associated with its manufacturing process. MPC production involves advanced filtration techniques such as ultrafiltration and microfiltration, which require sophisticated equipment and consume considerable energy. These factors contribute to increased operational expenses, making MPC more expensive compared to other protein ingredients like whey protein concentrate or soy protein.

According to data from the International Dairy Federation (IDF), dairy processing costs, including energy consumption and membrane filtration, have increased by approximately 8% between 2020 and 2023 due to rising utility prices and equipment maintenance expenses. This escalation impacts the final pricing of MPC products, often limiting their affordability for small and medium-sized manufacturers, particularly in developing regions.

Moreover, the high cost of MPC can deter food producers who are price-sensitive or targeting budget-conscious consumers. This price barrier restricts MPC’s widespread use in lower-cost food products, narrowing its market penetration. Many manufacturers may opt for less expensive protein alternatives to maintain competitive pricing.

Government policies and subsidies also play a role in this challenge. In some countries, limited financial support for upgrading dairy processing facilities constrains the ability of producers to invest in cost-efficient technologies that could reduce MPC production costs. While countries like the United States offer some grants for dairy innovation through programs such as the Dairy Business Innovation Alliance, such initiatives are not uniformly available worldwide.

Opportunity

Government Support and Policy Initiatives Propel Growth of Milk Protein Concentrate Market

A significant growth opportunity for the Milk Protein Concentrate (MPC) market lies in the robust support and policy initiatives from the Indian government aimed at enhancing dairy production and processing capabilities. India, being the world’s largest milk producer, has witnessed a steady increase in milk production, reaching 239.3 million tonnes in 2023–24, up from 211.7 million tonnes in 2022–23. This growth is attributed to factors such as improved cattle genetics, better feed management, and advancements in dairy farming practices.

The government’s commitment to the dairy sector is evident through various schemes and programs. For instance, the National Dairy Development Board (NDDB) has been instrumental in implementing the National Dairy Plan, which focuses on increasing milk production and improving the quality of dairy products. Additionally, the Rashtriya Gokul Mission aims to conserve and develop indigenous bovine breeds, thereby enhancing milk yield and quality .

Financial support is also provided through schemes like the Dairy Entrepreneurship Development Scheme (DEDS), which offers subsidies for setting up dairy units, and the Animal Husbandry Infrastructure Development Fund (AHIDF), a ₹15,000 crore fund established to boost investment in dairy infrastructure . These initiatives not only improve production efficiency but also create a conducive environment for the growth of value-added products like MPC.

Furthermore, state-level policies complement national efforts. For example, Uttar Pradesh’s Dairy Development and Milk Products Promotion Policy-2022 provides grants for the creation and modernization of dairy units, fostering a favorable ecosystem for dairy processing.

Trends

Growth of Packaged Products Drives Milk Protein Concentrate Market Expansion

A significant trend propelling the growth of the Milk Protein Concentrate (MPC) market is the increasing incorporation of MPC into packaged food products. Consumers are becoming more health-conscious, leading to a surge in demand for convenient, ready-to-eat foods that offer enhanced nutritional profiles. MPC, known for its high protein content and functional properties, is increasingly used in the formulation of various packaged products such as protein bars, beverages, and dairy-based snacks.

Government initiatives also play a crucial role in supporting the dairy sector, thereby facilitating the growth of the MPC market. In India, for instance, the National Dairy Development Board (NDDB) has been instrumental in implementing the National Dairy Plan, which focuses on increasing milk production and improving the quality of dairy products. Additionally, the Rashtriya Gokul Mission aims to conserve and develop indigenous bovine breeds, thereby enhancing milk yield and quality .

This growth is largely attributed to the rising adoption of MPC as a key ingredient in packaged dairy products, including lassi, dahi, paneer, and cheese slices . The versatility of MPC allows it to enhance the nutritional value, texture, and taste of these products, making them more appealing to health-conscious consumers.

Regional Analysis

Asia-Pacific Dominates Milk Protein Concentrate Market with 47.3% Share in 2024

In 2024, the Asia-Pacific (APAC) region led the global Milk Protein Concentrate (MPC) market, capturing a significant 47.3% share, equating to approximately USD 1.8 billion in market value. This dominance is attributed to several key factors, including the region’s large and diverse dairy production base, increasing health consciousness among consumers, and a rising demand for protein-enriched food products.

Countries such as China, India, and Japan are at the forefront of this growth. China, in particular, holds a substantial portion of the APAC market, driven by its vast population and expanding middle class, which is increasingly inclined towards high-protein diets. The Indian market is also experiencing rapid growth, fueled by a large dairy industry and a growing awareness of the nutritional benefits of milk proteins. Japan’s demand is bolstered by the popularity of functional foods and beverages that incorporate MPC for its health benefits.

The APAC region’s preference for MPC is further supported by government initiatives aimed at enhancing dairy production and processing capabilities. For instance, the National Dairy Development Board (NDDB) in India has been instrumental in implementing the National Dairy Plan, which focuses on increasing milk production and improving the quality of dairy products. Additionally, the Rashtriya Gokul Mission aims to conserve and develop indigenous bovine breeds, thereby enhancing milk yield and quality.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AMCO Proteins specializes in producing high-quality milk protein concentrates and other dairy ingredients. The company focuses on sustainable dairy processing with advanced technologies to deliver consistent and nutritious protein solutions. Their portfolio serves diverse sectors including food, beverage, and nutritional supplements. AMCO’s emphasis on quality control and innovation positions it as a key player in the MPC market, catering to growing demand for protein-enriched products globally.

Atura is recognized for its expertise in developing milk protein concentrates with a focus on purity and functionality. The company supplies MPC for various applications, including sports nutrition, dairy products, and food manufacturing. Atura’s commitment to research and development enables it to provide tailored solutions that meet evolving consumer preferences for clean-label and high-protein ingredients, strengthening its market presence.

Cobot Creamery Cooperative is a dairy processing company that produces milk protein concentrate alongside other dairy ingredients. Known for its cooperative business model, it supports local dairy farmers while focusing on producing sustainable, high-quality protein products. Cobot emphasizes environmental responsibility and innovation, supplying MPC to food and beverage manufacturers seeking natural and nutritious protein solutions.

Top Key Players in the Market

- AMCO Proteins

- Atura

- Cobot Creamery Cooperative

- Dana Dairy Group

- Erie Foods International Inc.

- Fonterra Co-operative Group Limited

- Glanbia PLC

- Grassland Dairy Products Inc.

- Kerry Group plc

- Lactalis Group

- Nutrinnovate Australia

- Royal FrieslandCampina N.V.

- Sachsenmilch Leppersdorf Gmbh

- TATURA Milk Industries Pty. Ltd. (Bega Cheese Limited)

- Westland Milk Products

Recent Developments

In 2024, Cabot’s commitment to excellence was recognized with 18 first-place awards in national and international dairy competitions, underscoring its dedication to quality and innovation.++

In 2024 Dana Dairy Group, the company produced MPC variants with protein concentrations ranging from 40% to 80%, catering to diverse applications in the food and beverage industry.

AMCO’s product portfolio includes MPCs with varying protein concentrations, such as CMP-8500 (85%), CMP-8000 (80%), and CMP-9000 (90%), catering to diverse applications in food, beverage, and nutrition sectors. The company emphasizes quality and functionality, offering products that provide benefits like improved water binding, heat stability, emulsification, and solubility.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 6.5 Billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Nature (Organic, Conventional), By Form (Powder, Liquid), By Concentration (Low, Medium, High), By Preparation ( Co-Precipitation, Ultrafiltration), By Application (Packaged Products, Nutritional Products, Infant Formula, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AMCO Proteins, Atura, Cobot Creamery Cooperative, Dana Dairy Group, Erie Foods International Inc., Fonterra Co-operative Group Limited, Glanbia PLC, Grassland Dairy Products Inc., Kerry Group plc, Lactalis Group, Nutrinnovate Australia, Royal FrieslandCampina N.V., Sachsenmilch Leppersdorf Gmbh, TATURA Milk Industries Pty. Ltd. (Bega Cheese Limited), Westland Milk Products Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Milk Protein Concentrate MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Milk Protein Concentrate MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AMCO Proteins

- Atura

- Cobot Creamery Cooperative

- Dana Dairy Group

- Erie Foods International Inc.

- Fonterra Co-operative Group Limited

- Glanbia PLC

- Grassland Dairy Products Inc.

- Kerry Group plc

- Lactalis Group

- Nutrinnovate Australia

- Royal FrieslandCampina N.V.

- Sachsenmilch Leppersdorf Gmbh

- TATURA Milk Industries Pty. Ltd. (Bega Cheese Limited)

- Westland Milk Products