Global Kosher Food Market Size, Share, And Business Benefits By Type (Meat (Beef, Chicken, Sheep and Goats, Others), Dairy (Milk, Cheese, Butter, Yogurt, Desserts, Others), Pareve (Eggs and Fish, Plant-based Food, Bakery and Confectionery, Beverages, Culinary Products, Snacks and Savory, Others)), By Category (Vegan, Vegetarian, Non-Vegetarian), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145899

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

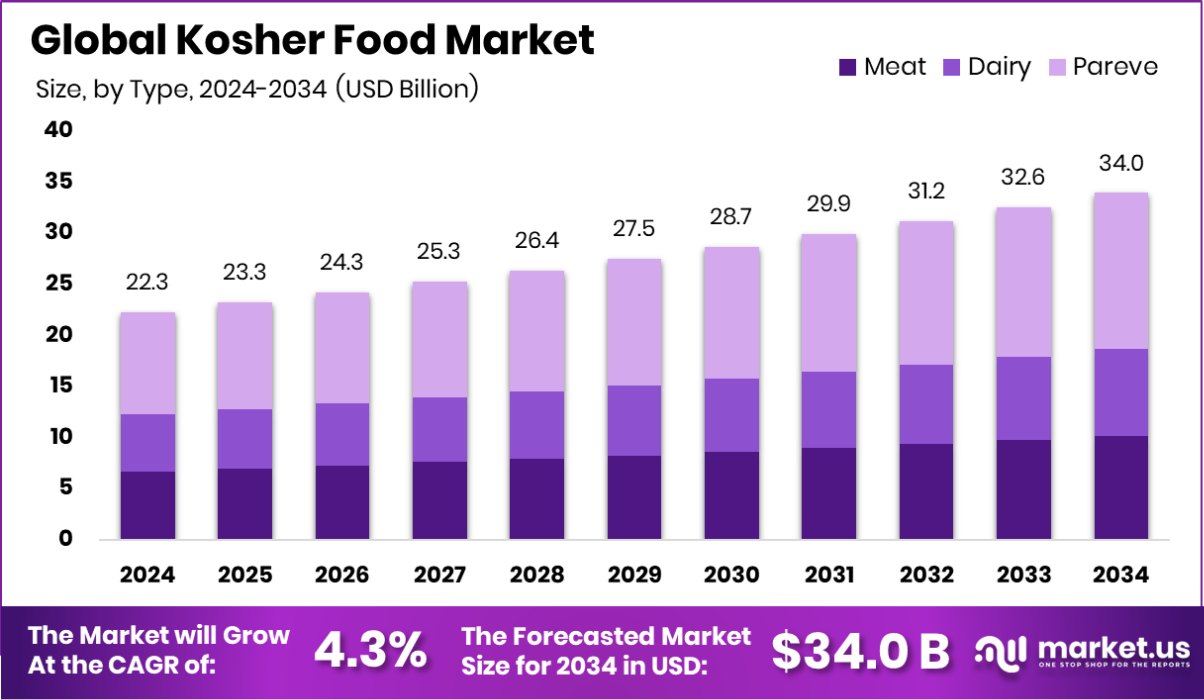

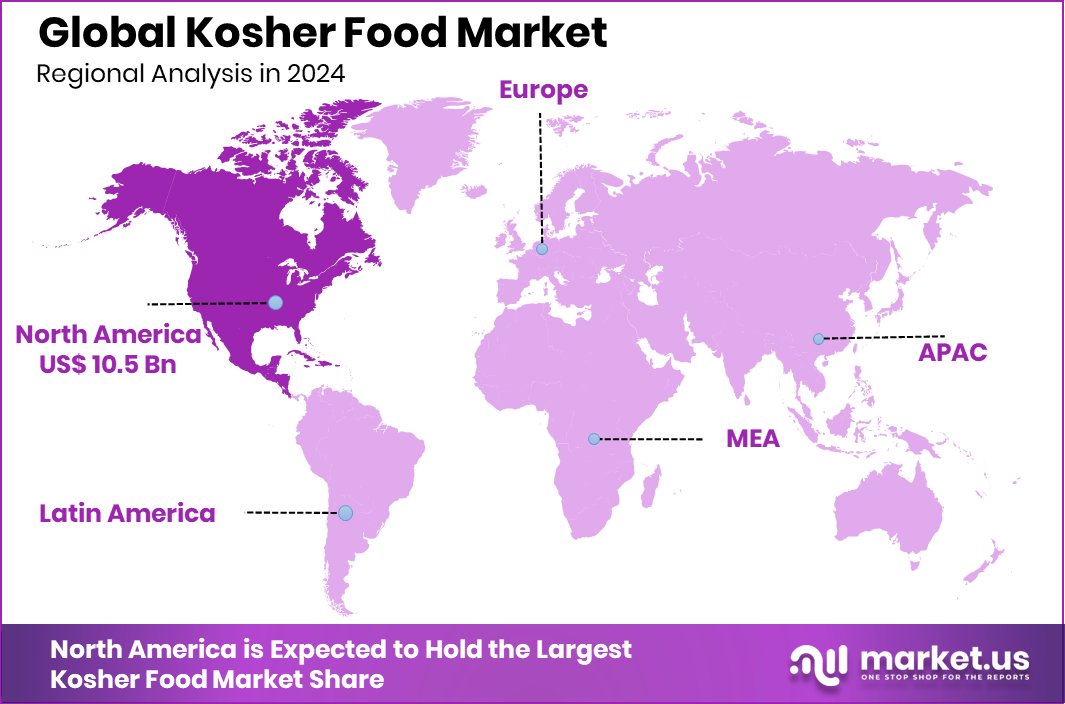

Global Kosher Food Market is expected to be worth around USD 34.0 billion by 2034, up from USD 22.3 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034. North America’s kosher food market holds a 47.30% share, valued at USD 10.5 billion.

Kosher food refers to food items that meet the dietary standards of Jewish law, as outlined in the Torah. These laws define which animals are permitted, how they must be slaughtered, and how different food groups like meat and dairy must be prepared and consumed separately. Common kosher practices include avoiding pork and shellfish, ensuring meat is slaughtered in a specific way (shechita), and consuming only certified products that have undergone rabbinical supervision.

The kosher food market consists of food and beverage products that have been certified as kosher by authorized religious bodies. While initially targeted at Jewish communities, the market has expanded widely due to rising interest in food safety, quality assurance, and health-conscious diets. This market spans across processed foods, packaged goods, snacks, beverages, and fresh produce. Many consumers who are not Jewish also buy kosher-certified products, believing them to be cleaner or more rigorously inspected.

The increasing global awareness about food transparency and ethical consumption is fueling kosher food. Many consumers perceive the Kosher certification as a sign of stricter food handling and purity standards. Additionally, globalization has amplified cultural food diversity, prompting mainstream retail chains to stock more kosher items. With increasing religious populations in urban centers and a growing interest in authenticity, kosher-certified food products are finding new shelf space in both specialty and general stores.

One major demand driver is the health-conscious consumer base seeking clean-label and allergen-free foods. Kosher food, by its nature, often avoids certain additives and includes detailed labeling, making it attractive for people with dietary restrictions like lactose intolerance or gluten sensitivity.

Additionally, rising urbanization and migration patterns are introducing kosher food to non-Jewish populations who are adopting it for perceived quality. Religious observance, particularly among growing Jewish communities in North America and Europe, continues to anchor steady demand.

Key Takeaways

- Global Kosher Food Market is expected to be worth around USD 34.0 billion by 2034, up from USD 22.3 billion in 2024, and grow at a CAGR of 4.3% from 2025 to 2034.

- Pareve products hold 45.30% market share, reflecting high demand for neutral kosher food options.

- Non-vegetarian kosher food leads with 56.50%, showing a growing interest in meat-based kosher offerings globally.

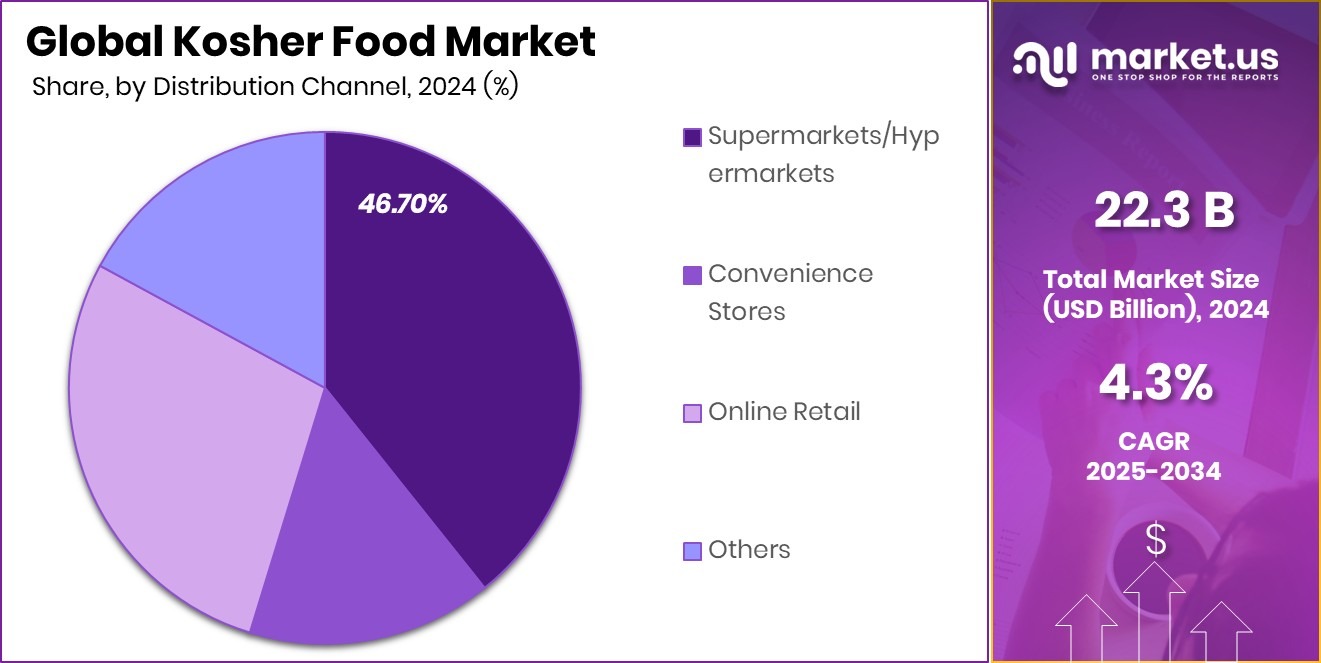

- Supermarkets and hypermarkets dominate distribution with 46.70%, making kosher products more accessible to mainstream consumers.

- The kosher food market in North America is valued at USD 10.5 billion.

By Type Analysis

Pareve foods lead with 45.30% due to broader consumer dietary flexibility.

In 2024, Pareve held a dominant market position in the By Type segment of the Kosher Food Market, with a 45.30% share. This significant share highlights strong consumer preference for neutral kosher food items that are neither meat nor dairy, making them suitable for a wider audience following kosher dietary laws. Pareve products offer high flexibility in meal preparation and are often seen as convenient and universally acceptable across kosher-observing households.

By Category Analysis

Non-vegetarian kosher category dominates at 56.50%, driven by rising meat preferences.

Within the By Category segment, Non-Vegetarian dominated with a 56.50% share in 2024. This reflects a growing demand for kosher-certified meat and poultry products, especially among consumers seeking religious compliance without compromising on taste and variety. Increased awareness of kosher slaughter practices, which many associate with cleanliness and quality, likely contributed to this high demand in the category.

By Distribution Channel Analysis

Supermarkets and hypermarkets capture 46.70%, ensuring easy access to kosher products.

By Distribution Channel, Supermarkets/Hypermarkets led the market with a 46.70% share. Their dominance indicates consumer inclination toward one-stop shopping experiences, where a broad range of kosher food products are readily available.

These retail formats offer strong visibility and shelf space to kosher products, enabling better access to everyday consumers. Collectively, these segments outline how consumer trust, product accessibility, and religious compliance are shaping the structure and growth of the kosher food market in 2024.

Key Market Segments

By Type

- Meat

- Beef

- Chicken

- Sheep and Goats

- Others

- Dairy

- Milk

- Cheese

- Butter

- Yogurt

- Desserts

- Others

- Pareve

- Eggs and Fish

- Plant-based Food

- Bakery and Confectionery

- Beverages

- Culinary Products

- Snacks and Savory

- Others

By Category

- Vegan

- Vegetarian

- Non-Vegetarian

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

Driving Factors

Health Awareness Boosting Kosher Food Demand

One major reason behind the growing kosher food market is increasing health awareness among consumers. Many people believe that kosher food is cleaner, safer, and prepared with more care.

This belief is attracting not just the Jewish population but also health-conscious consumers from other communities. Kosher labels often reflect strict hygiene, quality inspection, and better ingredient control, which is appealing in today’s food safety-focused world.

People with allergies or dietary restrictions also prefer kosher foods because of their detailed labeling and purity standards. As more people read food labels and seek trusted certifications, the demand for kosher-certified products continues to grow. This health-driven trend is expected to support long-term growth in the kosher food market globally.

Restraining Factors

High Certification Costs Limit Kosher Food Expansion

One big challenge in the kosher food market is the high cost of certification. For a product to be labeled kosher, it must follow very specific preparation rules and undergo strict inspections by authorized certifying bodies.

These processes require extra resources, trained staff, and regular audits, which can be expensive for food manufacturers, especially small and medium businesses. Many producers may avoid entering the kosher segment due to these added costs.

Additionally, maintaining separate production lines or equipment for Kosher food increases operational complexity. This financial and logistical burden can slow down new product launches and limit availability, particularly in emerging markets where kosher awareness and demand are still developing.

Growth Opportunity

Expanding Non-Jewish Consumer Base Fuels Growth

A major growth opportunity for the kosher food market lies in its increasing acceptance by non-Jewish consumers. Many people now associate Kosher products with high-quality, safe, and clean food.

This broader appeal is helping kosher food reach mainstream grocery shelves and restaurants around the world. Consumers with dietary needs, like vegetarians, vegans, and those with allergies, also trust kosher labels for transparency and strict standards.

As awareness grows, more people are buying kosher-certified products even without religious reasons. Food companies can tap into this wider audience by promoting kosher as a mark of quality and health. This shift in perception is creating fresh growth opportunities in global markets beyond the traditional Jewish communities.

Latest Trends

Modern Kosher Foods Embrace Innovation and Sustainability

A significant trend in the kosher food market is the shift toward innovation and sustainability. Traditional kosher foods are being reimagined to appeal to younger, health-conscious consumers.

Brands are introducing plant-based alternatives, such as vegan matzo ball soups and seitan-filled dumplings, catering to both kosher dietary laws and modern dietary preferences. Packaging is also evolving, with companies adopting vibrant, social-media-friendly designs to attract Gen Z shoppers.

Sustainability is another focus area, with products featuring recyclable packaging and ethically sourced ingredients. This modernization of kosher foods not only preserves cultural traditions but also makes them accessible and appealing to a broader audience, reflecting a blend of heritage and contemporary consumer values.

Regional Analysis

North America leads the kosher food market with a 47.30% share, valued at USD 10.5 billion.

In 2024, North America held the dominant position in the global kosher food market, accounting for 47.30% of the total market share, valued at approximately USD 10.5 billion. The region’s strong dominance can be attributed to a high concentration of Jewish population, well-established food processing infrastructure, and rising demand for certified and clean-label products among health-conscious consumers. The U.S. leads the regional consumption, with a broad consumer base including non-Jewish consumers preferring kosher for perceived food safety and purity.

Europe followed as a significant contributor to the kosher food market, driven by cultural diversity and demand for specialty food products. Meanwhile, Asia Pacific is emerging as a promising market due to increasing urbanization and awareness of kosher certification, particularly in countries like India and China.

In the Middle East & Africa, the market is shaped by religious practices and a rising middle class seeking premium food categories. Latin America is witnessing gradual growth, influenced by food export demands and niche consumer groups.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé S.A. maintained its robust presence in the kosher segment, leveraging its extensive global distribution network and diverse product portfolio. The company’s commitment to innovation and quality has solidified its position as a trusted provider of kosher-certified products, catering to a broad consumer base seeking health-conscious and ethically produced food options. Nestlé’s strategic focus on expanding its kosher offerings aligns with the growing demand for clean-label and allergen-free products, reinforcing its market leadership.

Hatov, established in 2000, has emerged as a leading kosher food distributor in the UK and is actively expanding across Europe. Specializing in frozen foods, Hatov offers a comprehensive range of over 1,000 products, including chilled, ambient, and wine selections.

The company’s state-of-the-art frozen facilities and dedicated logistics network ensure efficient service delivery, catering to a diverse clientele comprising national supermarket chains, independent retailers, and catering services. Hatov’s emphasis on customer service and adaptability to evolving consumer trends positions it as a dynamic player in the European kosher food market.

Charedi Milk has carved a niche in the kosher dairy segment, focusing on providing high-quality, strictly kosher dairy products. The company’s adherence to rigorous kosher standards and commitment to product excellence have earned it a loyal customer base. By addressing the specific dietary needs of the kosher-observant community, Charedi Milk plays a crucial role in the broader kosher food ecosystem.

Top Key Players in the Market

- Nestlé S.A.

- Hatov

- Charedi Milk

- The Hershey Company

- Crowdfunder LTD

- The Archer-Daniels-Midland Company

- ConAgra Foods

- Ferrero SpA

- The Kraft Heinz Company

- The Kellogg Company

- Mondelez International

- Unilever

- Empire Kosher Poultry, Inc.

- General Mills, Inc.

- PepsiCo, Inc.

- Other Key Players

Recent Developments

- In January 2025, Kayco, the world’s largest supplier of kosher and specialty foods, acquired Paramount Foods LLC, a family-owned business with a strong presence in the Northeast. This strategic acquisition enhances Kayco’s distribution capabilities and strengthens its market presence in the region.

- In February 2023, Hatov continues to offer a diverse selection of over 1,000 products, including frozen, chilled, and ambient food items, as well as wines and spirits. They maintain strong partnerships with suppliers and manufacturers worldwide, ensuring a comprehensive Kosher food supply solution.

Report Scope

Report Features Description Market Value (2024) USD 22.3 Billion Forecast Revenue (2034) USD 34.0 Billion CAGR (2025-2034) 4.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Meat (Beef, Chicken, Sheep and Goats, Others), Dairy (Milk, Cheese, Butter, Yogurt, Desserts, Others), Pareve (Eggs and Fish, Plant-based Food, Bakery and Confectionery, Beverages, Culinary Products, Snacks and Savory, Others)), By Category (Vegan, Vegetarian, Non-Vegetarian), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestlé S.A., Hatov, Charedi Milk, The Hershey Company, Crowdfunder LTD, The Archer-Daniels-Midland Company, ConAgra Foods, Ferrero SpA, The Kraft Heinz Company, The Kellogg Company, Mondelez International, Unilever, Empire Kosher Poultry, Inc., General Mills, Inc., PepsiCo, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nestlé S.A.

- Hatov

- Charedi Milk

- The Hershey Company

- Crowdfunder LTD

- The Archer-Daniels-Midland Company

- ConAgra Foods

- Ferrero SpA

- The Kraft Heinz Company

- The Kellogg Company

- Mondelez International

- Unilever

- Empire Kosher Poultry, Inc.

- General Mills, Inc.

- PepsiCo, Inc.

- Other Key Players