Global Microfluidics Market By Technology-Medical/Healthcare(PCR & RT-PCR, Gel Electrophoresis, Microarrays, ELISA, Others),Non-Medical, By Application(Lab-on-a-chip, Organs-on-chips, Continuous flow microfluidics, and more), By Material(Silicon, Glass, Polymer, PDMS, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 14146

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

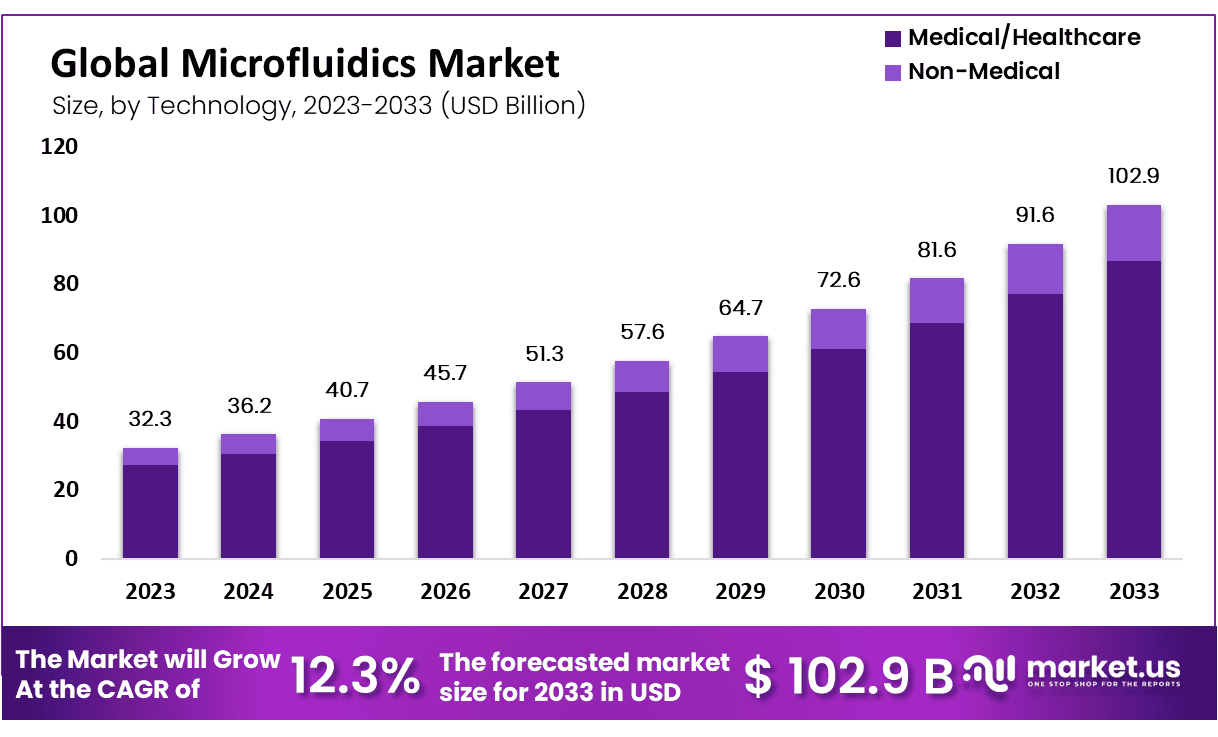

Global Microfluidics Market size is expected to be worth around USD 102.9 Billion by 2033 from USD 32.2 Billion in 2023 , growing at a CAGR of 12.3% during the forecast period from 2024 to 2033.

Microfluidics combines science and technology, including both fluid behavior research conducted within microchannels as well as device development for fluid flow using chambers and tunnels with microminiaturized devices featuring chambers and tunnels for fluid transport.

This field specifically deals with small fluid volumes – reaching as low as one quadrillionth of a liter! As more researchers realize its enormous capabilities, more are applying microfluidic technology across diverse disciplines for cost and time savings in research efforts.

Microfluidic systems find application in numerous procedures, from isoelectric focusing to capillary electrophoresis, flow cytometry and immunoassays as well as sample injection into mass spectrometry; DNA analysis via PCR amplification to cell patterning or manipulation and separation and manipulation of cells. With their wide adoption across numerous research fields and the public becoming more aware of its advantages, microfluidics has gained wide adoption resulting in advancements of many research endeavors.

Market growth is largely due to the increasing demand for low-volume samples analysis, high-throughput screen methodologies, In-vitro diagnostics, along with advanced labs-on-a-chip technologies. Additionally, microfluidics has a high rate of return and minimizes errors. This market report gives a detailed analysis of the Microfluidics Market size, share, growth factors, key trends, growth opportunities, competitive landscape, and other major factors.

Key Takeaways

- Market Size & Growth: Microfluidics Market size is expected to be worth around USD 102.9 Billion by 2033 from USD 32.2 Billion in 2023 , growing at a CAGR of 12.3%

- Technology Analysis: The microfluidics market’s largest segment Medical/Healthcare accounted for the highest revenue share at 84.2% in 2023.

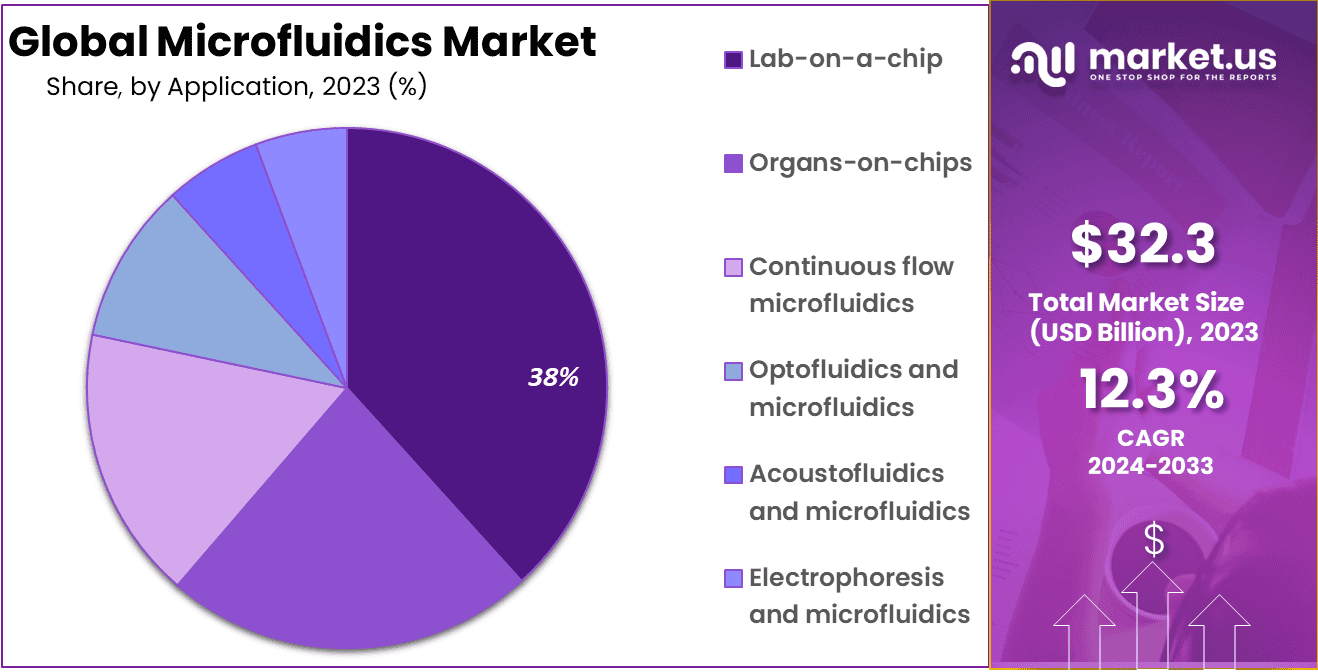

- Application Analysis: The microfluidics market’s dominant segment, ‘Lab-on–a-Chip’, accounted for 38.3% of revenue shares in 2023

- Material Analysis: The Polydimethylsiloxane (PDMS) segment is dominating 36.1% of share in 2023

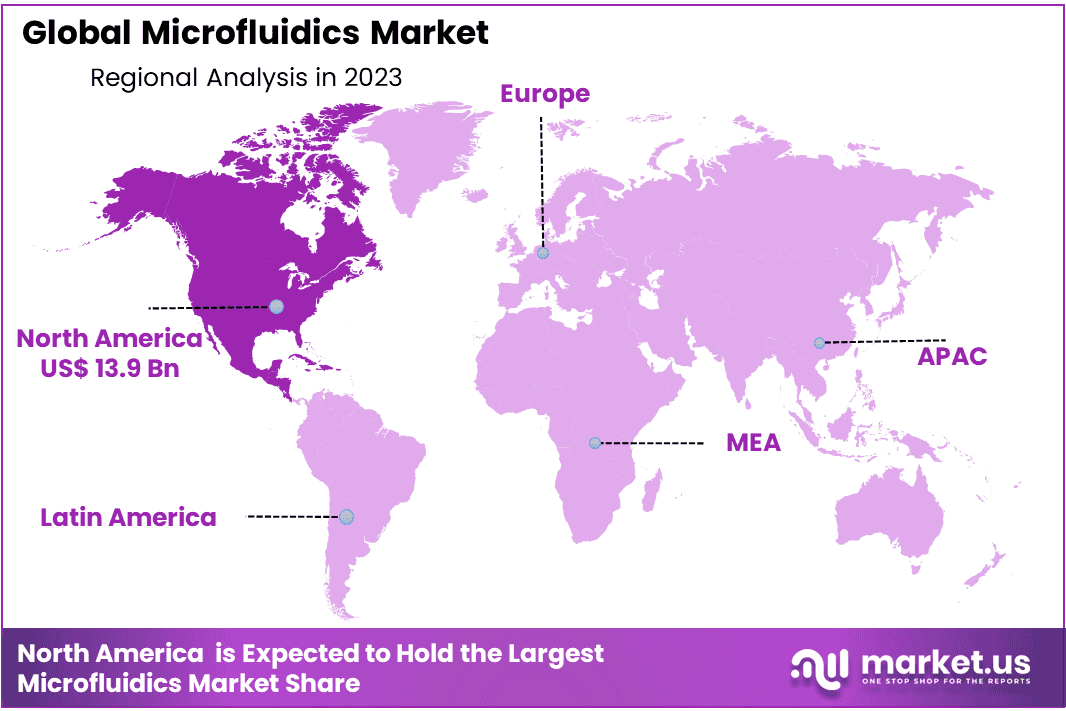

- Regional Analysis: North America accounted for the majority revenue share of 43% in 2023 and holding a USD 13.9 Billion value.

- Innovation of Product Portfolios: Innovation is one of the key drivers behind the rapid expansion of microfluidics market.

- Anticipated Market Growth: The microfluidics market is expected to experience substantial growth during the forecast period, driven by increasing adoption across various applications and technological advancements.

- Transformative Tool Recognition: Microfluidics has long been recognized for its transformative abilities in scientific and technological applications, contributing to enhanced efficiency and precision during research and diagnostic processes.

Technology Analysis

On the basis of ‘Technology’, the microfluidics market’s largest segment Medical/Healthcare accounted for the highest revenue share at 84.2% in 2023. Microfluidics is gaining ground in Point-of-Care (POC), diagnostics. This is because of its many advantages, which make it easier to develop new POC diagnostics. These advantages are slowly being leveraged to help develop POC diagnostics that can detect and diagnose a range of conditions, including cancerous diseases.

PCR and reverse PCR are the major contributors to the medical technology segment’s revenue. The former accounts for more than 30% in 2020. PCR is a robust and popular technique used in molecular diagnosing. There are two kinds of DNA amplification. One is isothermal, the other is non-isothermal. Both are compatible with the integration of microfluidics. PCR is a popular non-isothermal technique for DNA amplification that’s used in microfluidics.

The ‘Non-Medical’ segment is expected to grow at a 14.4% CAGR, between 2023-2032. For example, microfluidics can be used in the non-medical segment to extract crude oil from porous rocks and to detect plant pathogens. It also produces gas bubbles of different sizes. It’s difficult and challenging to visualize fluid flow in porous media.

Crude oil flow in rocks can be restricted by factors like connectivity, tortuosity, and connectivity. Complex interactions between fluids, geometry, and the pore structure can also limit oil flow. Microfluidics technology is ideal for developing techniques to extract crude oil and other pollutants from porous rock.

Application Analysis

In terms of ‘Application’, the microfluidics market’s dominant segment, ‘Lab-on–a-Chip’, accounted for 38.3% of revenue shares in 2023. Lab-on-a-chip offers high detection speed and the ability to maintain the required sensitivity in DNA or RNA amplification, detection procedures. This makes lab-on-a-chip suitable for molecular biologists. Lab-on-a-chip allows fast sequencing of DNA probes. The thermal cycles are critical for DNA amplification, so lab-on-a-chip performs high-speed thermal shifts at the microscale.

These systems allow for the control of single cells and the handling of large numbers of cells simultaneously in a short time. Elveflow’s Opto Reader is a high-throughput optical detector for the isolation of cells. These systems can be used in cell sorting, stem cell differentiation, as well as micro patch-clamp and flow cytometry at high speeds.

On the other side, the ‘Organs-on-Chips’ segment is expected fast growing over the forecast period. Organ-on-chip refers to a functional microchip that has embedded living cells. These cells are capable of mimicking various bodily processes like breathing, peristalsis, infection, and respiration. These models play a significant role in drug discovery, development, and testing.

The National Center for Advancing Translational Science’s Tissue Chip for Drug Screening Initiative, the FDA, and other National Institutes of Health centers or institutes focus their efforts on drug discovery. Human tissue chips are human representations of organs that can be used to create human tissue chips.

Material Analysis

With respect to ‘Material’, the Polydimethylsiloxane (PDMS) segment is dominating 36.1% of share in 2023 microfluidics market leader in microfluidics. In microfluidic devices requiring rapid prototyping, Polydimethylsiloxane is gaining significant popularity. This is due to its ease of use and affordability.

New PDMS surface modifications are also being introduced to address hydrophobicity issues associated with PDMS. Hydrophobicity makes microchannel operation challenging in aqueous solutions. This is due in part to the fact such analytes become adsorbed on PDMS surfaces and interfere with the analysis.

The ‘Glass’ segment occupied the 2nd spot in terms of revenue generation in 2023. Most glass-based microfluidics is used in analytical applications that use organic solvents and high temperatures. Glass is an amorphous substance that is optically transparent and electrically isolated.

Glass-based microfluidic devices can be processed using standard photolithography or wet/dry etching. Special etching processes are used to develop microfluidic device channels made of etched glasses with rounded sidewalls.

Key Market Segmentation

Technology

Medical/Healthcare

- PCR & RT-PCR

- Gel Electrophoresis

- Microarrays

- ELISA

- Others

Non-Medical

Application

- Lab-on-a-chip

- Organs-on-chips

- Continuous flow microfluidics

- Optofluidics and microfluidics

- Acoustofluidics and microfluidics

- Electrophoresis and microfluidics

Material

- Silicon

- Glass

- Polymer

- PDMS

- Others

Driving Factors

Technological Advancements in Healthcare Diagnostics

The microfluidics market is propelled by technological innovations in healthcare diagnostics. Microfluidic devices allow precise and rapid analysis of biological samples for early disease detection and personalized medicine. Microfluidic integration has resulted in lab-on-a-chip devices to facilitate point-of-care testing while improving patient outcomes.

Microfluidics can also be applied to wearable devices by requiring miniaturization. The concept of incorporating microfluidics to manufacture pocket-sized/wearable devices has encouraged various established companies such as F. Hoffmann-La Roche Ltd., BD (Becton Dickinson and Company), Fluidigm Corp., Illumina Inc., Agilent Technology Inc., and Abbott to expand their microfluidics portfolios across clinical, Point-of-Care (POC), and veterinary diagnostics.

Rising Demand for Point-of-Care Testing

Point-of-care testing has emerged as an essential element in driving growth in microfluidics markets. Microfluidic devices enable on-site testing, shortening turnaround times for results and providing increased patient convenience – and therefore further propelling this sector of industry forward. Performing diagnostic tests at remote or resource-limited settings makes microfluidic devices even more indispensable, further contributing to their market’s expansion.

Users can conduct pre-hospital analyses at home like routine blood glucose checks. This helps to reduce hospital visits and subsequent stays. The microfluidics market players introduced point-of-care diagnostics, which led to a decrease in hospital visits and early diagnosis. Advanced technologies allow industry players to differentiate their products using minimally invasive and precise features. Microfluidics, a pioneer in IVD technology, has now made its mark.

Trending Factors

Emergence of Organ-on-a-Chip Technology: An Evolution in Medicine

Organ-on-a-chip technology has emerged as a hallmark of microfluidics innovation. This groundbreaking approach involves replicating organ functions on microfluidic platforms. Organ-on-a-chip models provide more accurate depictions of human biology, revolutionizing drug testing processes while decreasing animal models used as test subjects.

Integration of Microfluidics and Nanotechnology: An Approach

Integration between microfluidics and nanotechnology is becoming an increasing trend, increasing both its sensitivity and precision of microfluidic devices, opening new avenues in diagnostics and therapeutics. Combining both disciplines enables highly efficient miniaturized systems that are utilized for tasks such as nanoparticle synthesis or biomarker detection.

Restraint

Submit Comments Now on our High Development and Manufacturing Cost Reducing Strategies.

One major barrier in the microfluidics market is its high development and manufacturing costs. Complex fabrication processes combined with stringent quality controls lead to elevated production expenses that impede widespread adoption in settings with limited resources.

Complex Integration Challenges

Integration of microfluidic devices into existing laboratory workflows presents a formidable challenge. Laboratories may experience difficulty in seamlessly incorporating them into their processes without incurring disruptions and slowing adoption rates; overcoming such integration hurdles is vital if this market is to realize its full potential.

Opportunity

Expansion in Personalized Medicine

An opportunity for microfluidics market participants is in expanding personalized medicine. Microfluidic devices provide personalized diagnostic and therapeutic solutions based on patient characteristics; this aligns with the growing trend towards precision medicine and represents an attractive opportunity for market players who contribute towards its advancements.

Expanding Environmental Monitoring Capability

Environmental monitoring with microfluidics offers great promise. Microfluidic devices can quickly and sensitively detect environmental pollutants, pathogens, and contaminants – something microfluidics excels at doing. Furthermore, as environmental concerns continue to escalate rapidly, efficient monitoring solutions such as microfluidics have found their place within this sector.

Regional Analysis

North America accounted for the majority revenue share of 43% in 2023 and holding a USD 13.9 Billion value for the Microfluidics Market. Researchers are taking part in the creation of novel microfluidics devices. This is expected to keep this region’s dominance in global markets. The U.S. was a significant contributor to the dominance of this region over the study period. The country has several new companies along with well-established players involved in microfluidics manufacturing.

Microfluidics in the U.S., for example, is a company that provides proprietary microfluidics technologies, such as microfluidizers. This microfluidic technology is used in the manufacture of high-shear liquid processors for efficient cell destruction, nanoemulsions, reduction of particle sizes, and other related applications. The Asia Pacific is expected to experience a lucrative growth rate of 17.1% over the forecast period.

Major participants in the microfluidics marketplace have implemented various strategies, including alliances through mergers and acquisitions as well as geographical expansion and strategic collaborations to increase the size of their market presence.

China is experiencing a boom in medical diagnostics, high throughput screening, biosensing, and other services. This is due to increased government support for infrastructure development and strong intellectual property ownership. A second driving factor is an increasing demand for diagnostics services. China, as a developing country with great potential for this market, is an attractive option.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

To improve their respective market position, companies are beginning to expand facilities and collaborate with other related players. Illumina, for instance, announced its latest cohort, which will operate in partnership with the company’s teams in San Francisco, and London in June 2021. This cohort includes WellSIM Biomedical Technologies Inc., an entity that specializes in high-throughput microfluidics. This company manufactures automated processors with high throughput-based microfluidics for analysis and the isolation of exosomes. Listed are prominent players in the microfluidics marketplace:

Market Key Players

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Abbott

- Thermo Fisher Scientific

- Standard BioTools

Recent Developments

- October 2023: Abbott Laboratories unveiled its innovative new diagnostic device i-STAT Alinity Analyzer- an on-demand diagnostics device using microfluidics technology to perform multiple tests with one sample sample.

- September 2023: Roche Diagnostics announced the debut of its Cobas Liat POC system utilizing microfluidics technology for HIV and syphilis testing at point-of-care diagnostic device.

- August 2023: Merck announced the introduction of its Verity Rapid Response System – an on-site diagnostic device utilizing microfluidics technology – designed to rapidly detect and identify bacteria responsible for bloodstream infections.

Report Scope

Report Features Description Market Value (2023) USD 32.2 Billion Forecast Revenue (2033) USD 102.9 Billion CAGR (2024-2033) 12.3% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Technology;Medical/Healthcare-(PCR & RT-PCR, Gel Electrophoresis, Microarrays, ELISA, Others),Non-Medical;Application-(Lab-on-a-chip, Organs-on-chips, Continuous flow microfluidics, and more); Material-(Silicon, Glass, Polymer, PDMS, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Illumina, Inc., F. Hoffmann-La Roche Ltd, PerkinElmer, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Abbott, Thermo Fisher Scientific, Standard BioTools Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- Abbott

- Thermo Fisher Scientific

- Standard BioTools