MENASA Commercial Vehicle Market Size, Share, Growth Analysis By Class Type (Light Duty, Medium Duty, Heavy Duty), By Vehicle Type (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles, Buses & Coaches, Specialty Vehicles), By Fuel Type (Diesel, Gasoline, Natural Gas (CNG/LNG), Electric), By End-Use (Logistics, Mining & Construction, Passenger Transportation, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159552

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

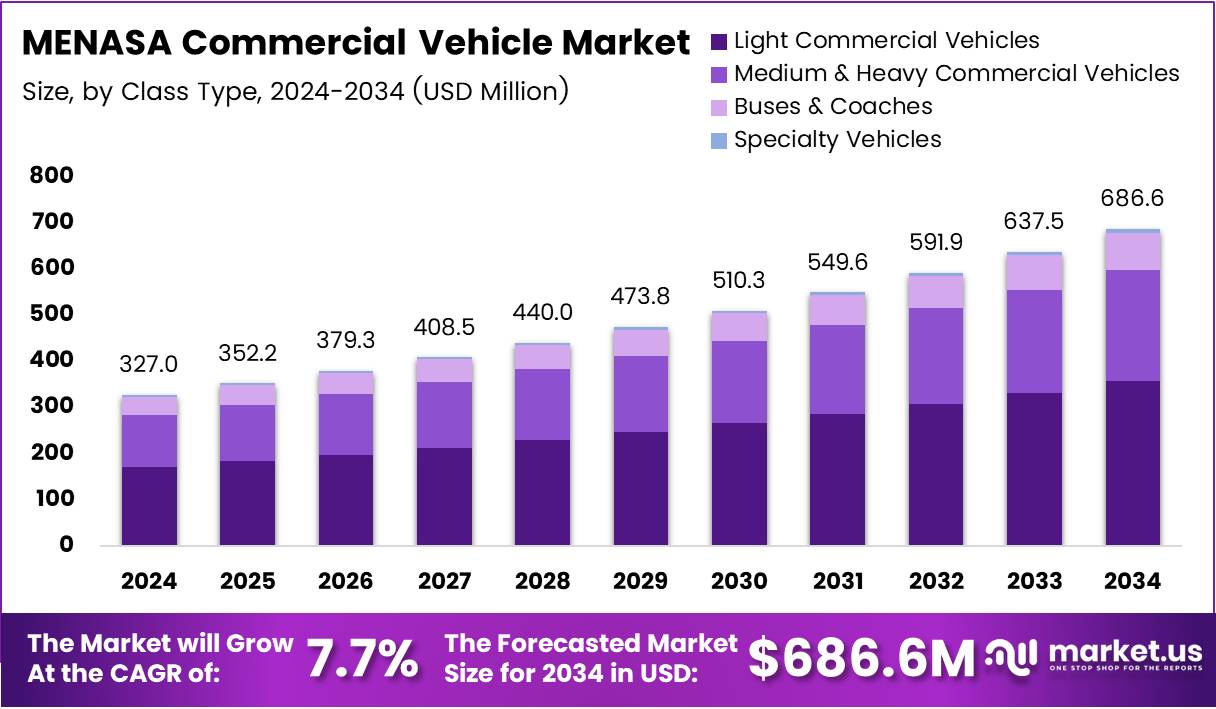

The MENASA Commercial Vehicle Market size is expected to be worth around USD 686.6 Million by 2034, from USD 327.9 Million in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034.

The MENASA (Middle East, North Africa, and South Asia) Commercial Vehicle Market is experiencing a notable transformation, driven by the increasing demand for transportation solutions in the region. Rapid urbanization and the expansion of infrastructure projects are playing a crucial role in boosting the market. These developments have created opportunities for both freight and passenger transport vehicles.

The commercial vehicle segment is evolving with a noticeable shift toward more sustainable and energy-efficient options. While internal combustion engine (ICE) vehicles have dominated the market, the growing interest in hybrid electric vehicles (HEVs) signals the beginning of a change in vehicle preferences. This presents an opportunity for manufacturers to diversify their product portfolios to meet the demand for cleaner vehicles.

Government investments and regulations are also pivotal in shaping the market’s future. Several countries in the MENASA region are implementing policies to support electric vehicles (EVs) and reduce carbon emissions. These regulatory frameworks are expected to encourage the adoption of HEVs and EVs, opening up new avenues for growth. Additionally, incentives for clean energy vehicles are likely to further accelerate the shift toward greener transportation solutions.

In Saudi Arabia, ICE vehicles represented over 90% of total vehicle sales in February 2025, with hybrid electric vehicles (HEVs) holding only a small share, according to industry reports. However, despite the dominance of ICE vehicles, the market is gradually introducing more energy-efficient alternatives, driven by both consumer demand and regulatory shifts.

Furthermore, in Saudi Arabia, vehicles priced under SAR 120,000 made up two-thirds of total sales in February 2025, with sedans accounting for 80% of this range. This trend highlights the strong potential of the entry-level sedan market, which offers lucrative opportunities for manufacturers targeting budget-conscious customers.

The MENASA region continues to witness growth in the commercial vehicle market, driven by infrastructure needs, government policies, and shifting consumer preferences towards more sustainable vehicle options.

Key Takeaways

- MENASA Commercial Vehicle Market size is expected to reach USD 686.6 Million by 2034, growing at a CAGR of 7.7% from USD 327.9 Million in 2024.

- Light Duty commercial vehicles dominate with a 58.9% market share in 2024, driven by their fuel efficiency and maneuverability in urban areas.

- Light Commercial Vehicles capture 52.6% of the market in 2024, benefiting from urbanization and the e-commerce boom.

- Diesel vehicles hold a dominant 67.3% market share in 2024, favored for their reliability, fuel efficiency, and established infrastructure.

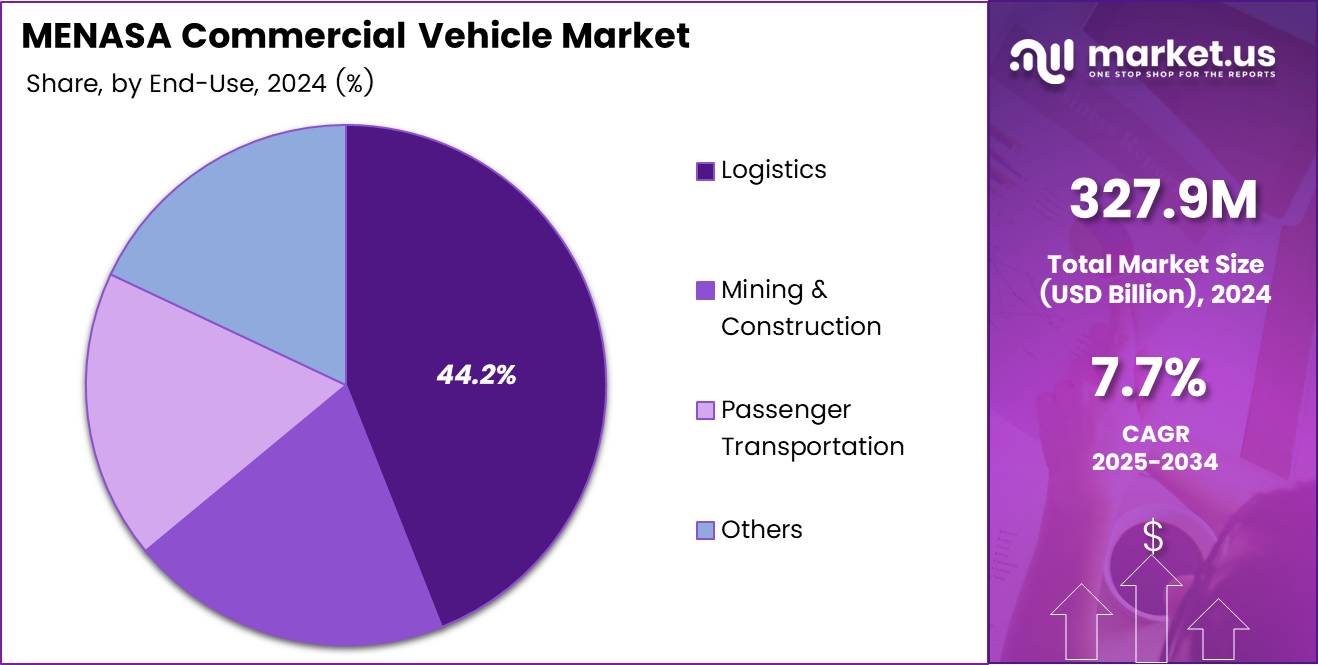

- Logistics applications account for 44.2% market share in 2024, fueled by the growth in e-commerce and regional trade.

Class Type Analysis

Light Duty dominates with 58.9% due to its widespread adoption in urban logistics and last-mile delivery operations.

Light Duty commercial vehicles maintain their leadership position in the MENASA region, capturing 58.9% market share in 2024. These vehicles excel in urban environments where maneuverability and fuel efficiency are paramount. E-commerce growth and last-mile delivery demands have significantly boosted their adoption across various industries.

Medium Duty vehicles serve as the backbone for regional transportation and mid-scale logistics operations. They bridge the gap between light and heavy-duty applications, offering optimal payload capacity for construction materials, food distribution, and manufacturing supply chains throughout the MENASA commercial vehicle market.

Heavy Duty trucks dominate long-haul transportation and heavy industrial applications. These robust vehicles handle substantial cargo loads across vast distances, supporting international trade corridors and major infrastructure projects. Their importance grows with expanding cross-border commerce and industrial development initiatives across the region.

Vehicle Type Analysis

Light Commercial Vehicles dominates with 52.6% due to their versatility in urban delivery and small business operations.

Light Commercial Vehicles secure 52.6% market dominance in 2024, driven by rapid urbanization and e-commerce expansion. These versatile vehicles perfectly suit small businesses, courier services, and urban delivery requirements. Their compact design enables efficient navigation through congested city streets while maintaining adequate cargo capacity.

Medium & Heavy Commercial Vehicles play crucial roles in industrial transportation and large-scale logistics operations. They support construction projects, manufacturing supply chains, and inter-city freight movement. These vehicles provide essential backbone support for infrastructure development and economic growth across MENASA regions.

Buses & Coaches facilitate public transportation and tourism sectors throughout the region. They connect urban and rural communities while supporting the growing tourism industry. Government initiatives promoting public transportation and sustainable mobility solutions continue driving demand for these passenger-focused vehicles.

Specialty Vehicles cater to niche applications including emergency services, utilities, and specialized industrial operations. These custom-built vehicles serve critical functions in healthcare, firefighting, and maintenance services, ensuring essential public services remain operational across diverse geographical locations.

Fuel Type Analysis

Diesel dominates with 67.3% due to its superior fuel efficiency and established refueling infrastructure across the region.

Diesel vehicles command 67.3% market share in 2024, maintaining their dominance through proven reliability and extensive infrastructure support. Their superior torque characteristics and fuel efficiency make them ideal for heavy-duty applications and long-distance transportation. Well-established supply chains and maintenance networks reinforce their market position.

Gasoline-powered commercial vehicles serve lighter applications and shorter-range operations. They offer advantages in urban environments with lower initial costs and reduced noise levels. However, their market presence remains limited compared to diesel alternatives due to lower fuel efficiency in commercial applications.

Natural Gas vehicles (CNG/LNG) represent an emerging clean fuel alternative gaining traction in urban fleets. They provide environmental benefits with reduced emissions while maintaining operational efficiency. Government incentives and environmental regulations increasingly support their adoption in public transportation and logistics sectors.

Electric commercial vehicles mark the future of sustainable transportation, though currently representing a smaller market segment. They excel in urban delivery applications with zero local emissions and lower operating costs. Expanding charging infrastructure and technological advancements continue accelerating their market penetration.

End-Use Analysis

Logistics dominates with 44.2% due to expanding e-commerce activities and regional trade growth.

Logistics applications capture 44.2% market share in 2024, reflecting the sector’s rapid expansion driven by e-commerce growth and regional trade development. Last-mile delivery services, warehousing operations, and supply chain management create substantial demand for commercial vehicles across various weight categories and configurations.

Mining & Construction sectors generate significant commercial vehicle demand through infrastructure development projects and resource extraction activities. These industries require specialized vehicles capable of operating in challenging environments while transporting heavy materials and equipment. Regional development initiatives continue supporting this sector’s growth trajectory.

Passenger Transportation encompasses public transit systems, school transportation, and tourism services. This segment supports social mobility and economic development through reliable transportation networks. Government investments in public infrastructure and growing tourism sectors sustain demand for buses and passenger-oriented commercial vehicles.

Others category includes diverse applications such as emergency services, utilities, waste management, and specialized industrial operations. These niche markets require customized vehicle solutions tailored to specific operational requirements. Their collective contribution supports overall market diversity and technological innovation within the commercial vehicle sector.

Key Market Segments

By Class Type

- Light Duty

- Up to 2.5 Tons

- 2.5T to 4.5T

- 4.5T to 6.5T

- Medium Duty

- 6.5T to 7.5T

- 7.5T to 9T

- 9T to 12T

- Heavy Duty

- 12T to 15T

- 15T & Above

By Vehicle Type

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

- Buses & Coaches

- Specialty Vehicles

By Fuel Type

- Diesel

- Gasoline

- Natural Gas (CNG/LNG)

- Electric

By End-Use

- Logistics

- Mining & Construction

- Passenger Transportation

- Others

Drivers

Increasing Demand for E-commerce and Logistics Services Drives Market Growth

The MENASA commercial vehicle market is experiencing strong growth due to several key factors. The rapid expansion of e-commerce platforms has created massive demand for delivery vehicles across the region. Online shopping growth means more packages need transportation from warehouses to customers’ doors.

Government support for clean transportation is another major driver. Many MENASA countries are offering incentives for electric commercial vehicles to reduce pollution and meet environmental goals. These policies include tax benefits and subsidies that make green vehicles more affordable for businesses.

Road infrastructure improvements across the region are making commercial vehicle operations more efficient. New highways, bridges, and transportation networks allow faster delivery times and reduced operational costs for logistics companies.

Growing cities in MENASA countries need better last-mile delivery solutions. As more people move to urban areas, the demand for quick delivery services increases. This trend pushes companies to invest in smaller, more agile commercial vehicles that can navigate crowded city streets and reach customers efficiently.

Restraints

Lack of Charging Infrastructure for Electric Commercial Vehicles Restrains Market Growth

Several challenges are slowing down the MENASA commercial vehicle market expansion. The biggest problem is the limited charging infrastructure for electric commercial vehicles. Most cities lack enough charging stations, making it difficult for companies to operate electric fleets reliably. This creates range anxiety and limits adoption rates.

Regulatory challenges around emissions standards also create barriers. Different countries in the region have varying rules about vehicle emissions, making it complicated for manufacturers to develop vehicles that meet all requirements. This regulatory uncertainty slows down investment and product development.

Fuel price volatility significantly impacts operational costs for commercial vehicle operators. When fuel prices spike unexpectedly, transportation companies face higher expenses that squeeze profit margins. This unpredictability makes it harder for businesses to plan budgets and invest in fleet expansion. The constant fluctuation in fuel costs also affects the competitiveness of traditional vehicles compared to electric alternatives.

Growth Factors

Growing Adoption of Autonomous and Connected Vehicle Technologies Creates Market Opportunities

The MENASA commercial vehicle market offers exciting growth opportunities driven by technological advancement. Autonomous and connected vehicle technologies are gaining traction, promising to reduce driver costs and improve safety. These smart vehicles can optimize routes automatically and communicate with traffic systems for better efficiency.

Electric vehicle adoption in the commercial sector presents massive potential. As battery technology improves and costs decrease, more companies are considering electric fleets. Government incentives and environmental regulations are accelerating this transition toward cleaner transportation solutions.

Specialized commercial vehicles are seeing increased demand, particularly refrigerated trucks for food delivery and medical transport. The growing pharmaceutical and food industries require temperature-controlled transportation, creating niche market opportunities for specialized vehicle manufacturers.

Smart fleet management solutions offer another growth avenue. Companies need better ways to track vehicles, monitor driver behavior, and optimize routes. Advanced software platforms that provide real-time data and analytics are becoming essential tools for modern transportation businesses seeking competitive advantages.

Emerging Trends

Integration of AI and IoT in Commercial Vehicle Operations Shapes Market Trends

Current trends in the MENASA commercial vehicle market reflect technological transformation. Artificial Intelligence and Internet of Things integration are revolutionizing vehicle operations. These technologies enable predictive maintenance, real-time monitoring, and automated decision-making that improve efficiency and reduce costs.

Shared mobility and fleet services are changing how businesses approach transportation. Instead of owning vehicles, many companies are choosing fleet-as-a-service models. This trend reduces capital investment requirements and provides flexibility for growing businesses.

Sustainability focus is driving eco-friendly transportation adoption. Companies are prioritizing green solutions to meet corporate social responsibility goals and comply with environmental regulations. This includes using alternative fuels, electric vehicles, and carbon-neutral transportation options.

Vehicle-to-grid technology represents an emerging trend where commercial vehicles can store and sell excess energy back to electrical grids. This innovation creates new revenue streams for fleet operators while supporting renewable energy integration and grid stability.

Key MENASA Commercial Vehicle Company Insights

In 2024, Daimler AG remains a significant player in the MENASA Commercial Vehicle Market, driven by its extensive portfolio of heavy-duty trucks and the integration of advanced technologies in vehicle management. Daimler’s focus on innovation, such as electric trucks, enhances its competitive edge in this region.

PACCAR Inc. continues to lead in the manufacturing of premium commercial vehicles, particularly with its brands like Kenworth and Peterbilt. The company’s investment in fuel-efficient technologies and expansion of its service network in MENASA strengthens its market presence and customer base.

Hino, a subsidiary of Toyota Motor Corporation, plays a crucial role in the light and medium-duty vehicle segments. With its reputation for durability and reliability, Hino is expected to capture increased market share by aligning with the growing demand for eco-friendly commercial vehicles in MENASA.

Scania, known for its advanced commercial vehicles, focuses on sustainable solutions, including electric and hybrid trucks. Scania’s commitment to fuel efficiency and reduced emissions positions it as a strong contender in the MENASA market, especially with the rise of green logistics solutions across the region.

These companies, with their focus on technological advancements and tailored solutions for the MENASA market, are well-positioned to leverage the region’s infrastructure growth and demand for efficient, eco-friendly transportation. Their strategic investments in electric and hybrid vehicle technologies align with the global shift towards sustainability, making them key players in the evolving commercial vehicle landscape.

Top Key Players in the Market

- Daimler AG

- PACCAR Inc.

- Hino

- Scania

- Tata Motors

- Navistar International Corp

- BYD Auto Co., Ltd.

- AB Volvo

- Toyota Motor Corporation

Recent Developments

In 2024, Daimler AG remains a significant player in the MENASA Commercial Vehicle Market, driven by its extensive portfolio of heavy-duty trucks and the integration of advanced technologies in vehicle management. Daimler’s focus on innovation, such as electric trucks, enhances its competitive edge in this region.

PACCAR Inc. continues to lead in the manufacturing of premium commercial vehicles, particularly with its brands like Kenworth and Peterbilt. The company’s investment in fuel-efficient technologies and expansion of its service network in MENASA strengthens its market presence and customer base.

Hino, a subsidiary of Toyota Motor Corporation, plays a crucial role in the light and medium-duty vehicle segments. With its reputation for durability and reliability, Hino is expected to capture increased market share by aligning with the growing demand for eco-friendly commercial vehicles in MENASA.

Scania, known for its advanced commercial vehicles, focuses on sustainable solutions, including electric and hybrid trucks. Scania’s commitment to fuel efficiency and reduced emissions positions it as a strong contender in the MENASA market, especially with the rise of green logistics solutions across the region.

These companies, with their focus on technological advancements and tailored solutions for the MENASA market, are well-positioned to leverage the region’s infrastructure growth and demand for efficient, eco-friendly transportation. Their strategic investments in electric and hybrid vehicle technologies align with the global shift towards sustainability, making them key players in the evolving commercial vehicle landscape.

Report Scope

Report Features Description Market Value (2024) USD 327.9 Million Forecast Revenue (2034) USD 686.6 Million CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Class Type (Light Duty, Medium Duty, Heavy Duty), By Vehicle Type (Light Commercial Vehicles, Medium & Heavy Commercial Vehicles, Buses & Coaches, Specialty Vehicles), By Fuel Type (Diesel, Gasoline, Natural Gas (CNG/LNG), Electric), By End-Use (Logistics, Mining & Construction, Passenger Transportation, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Daimler AG, PACCAR Inc., Hino, Scania, Tata Motors, Navistar International Corp, BYD Auto Co., Ltd., AB Volvo, Toyota Motor Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  MENASA Commercial Vehicle MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

MENASA Commercial Vehicle MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-