Global Medication Management System Market By Product Type (Clinical Decision Support Systems, Medication Dispensing Systems, Medication Reconciliation Solutions, Medication Administration Systems, and Electronic Health Records Integration), By Technology (Cloud-based, Hybrid. and On-premises), By Component (Hardware, Software, and Services), By End-user (Hospitals, Home Care Settings, Outpatient Clinics, Pharmacies, and Long-term Care Facilities), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 45010

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

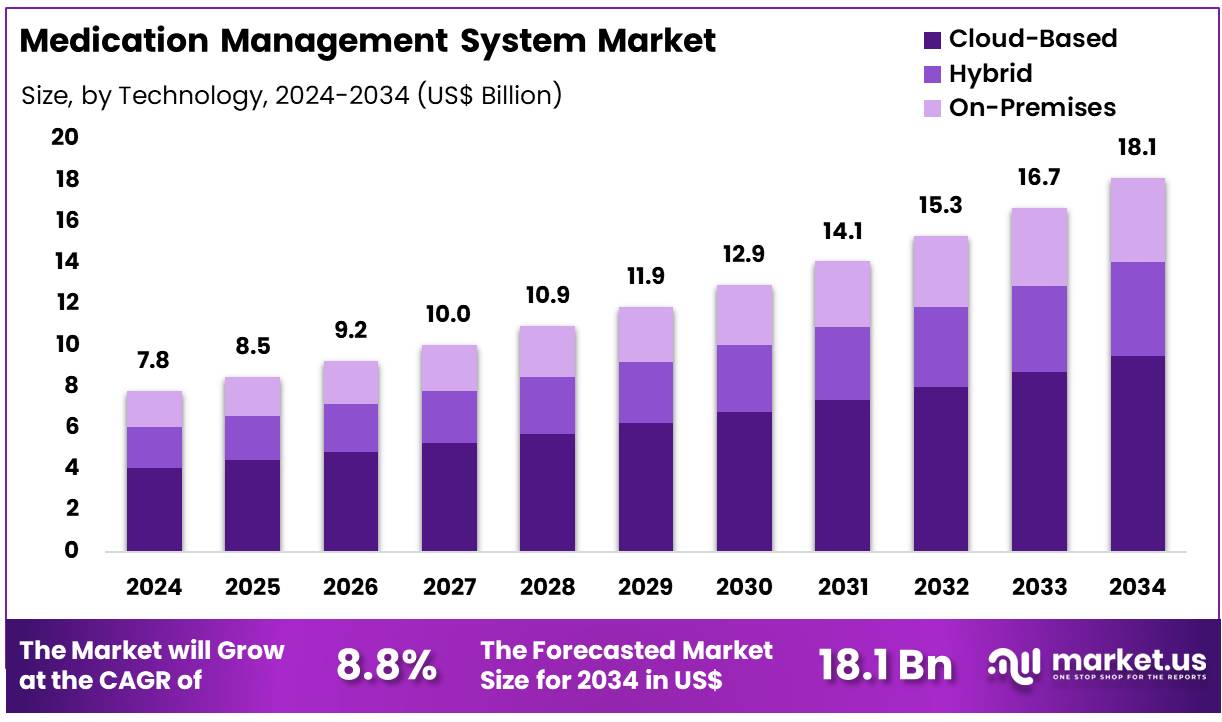

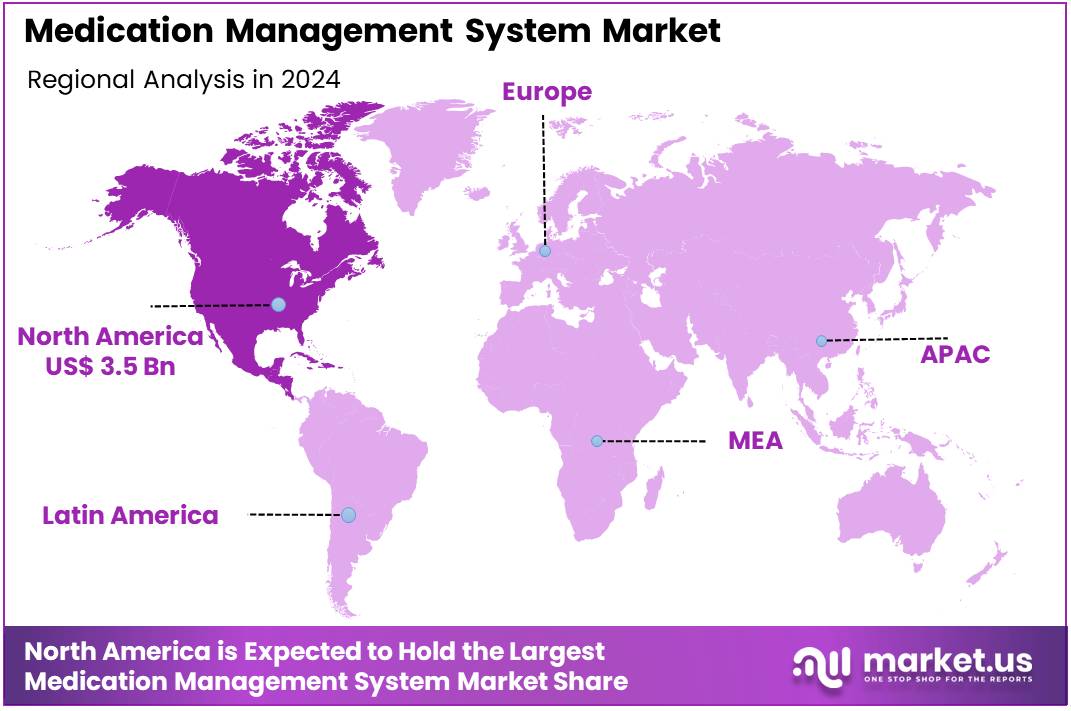

Global Medication Management System Market size is expected to be worth around US$ 18.1 Billion by 2034 from US$ 7.8 Billion in 2024, growing at a CAGR of 8.8% during the forecast period 2025 to 2034. North America led the market, achieving over 44.5% share with a revenue of US$ 3.5 Billion.

Increasing complexity in healthcare delivery and the rising need for efficient, error-free medication management are driving the growth of the medication management system market. These systems play a critical role in ensuring the safe and effective use of medications, particularly in environments like hospitals, pharmacies, and long-term care facilities.

Medication management systems streamline medication dispensing, track patient prescriptions, and monitor drug interactions, significantly reducing the risk of errors and improving patient outcomes. The growing demand for healthcare digitalization and the increasing adoption of electronic health records (EHRs) have further fueled market growth, as these systems integrate seamlessly with broader health IT infrastructures.

Additionally, the rise in chronic conditions and aging populations worldwide increases the need for precise medication management to handle polypharmacy and multiple comorbidities. In July 2023, Thoma Bravo, a private equity firm specializing in software investments, made a significant investment in Bluesight, focusing on preventing drug diversion and enhancing inventory management. This deal incorporated Medacist, a drug diversion analytics company, highlighting the increasing demand for software solutions that ensure regulatory compliance and optimize medication tracking.

Recent trends in the market include the integration of artificial intelligence and machine learning to predict medication usage patterns and optimize drug inventories. The growth in telemedicine and remote healthcare services also presents opportunities to expand medication management systems for virtual consultations and home healthcare. As healthcare providers seek to reduce costs, improve patient safety, and enhance operational efficiency, medication management systems are poised for continued innovation and widespread adoption.

Key Takeaways

- In 2024, the market for medication management system generated a revenue of US$ 7.8 billion, with a CAGR of 8.8%, and is expected to reach US$ 18.1 billion by the year 2034.

- The product type segment is divided into clinical decision support systems, medication dispensing systems, medication reconciliation solutions, medication administration systems, and electronic health records integration, with clinical decision support systems taking the lead in 2024 with a market share of 28.4%.

- Considering technology, the market is divided into cloud-based, hybrid, and on-premises. Among these, cloud-based held a significant share of 52.3%.

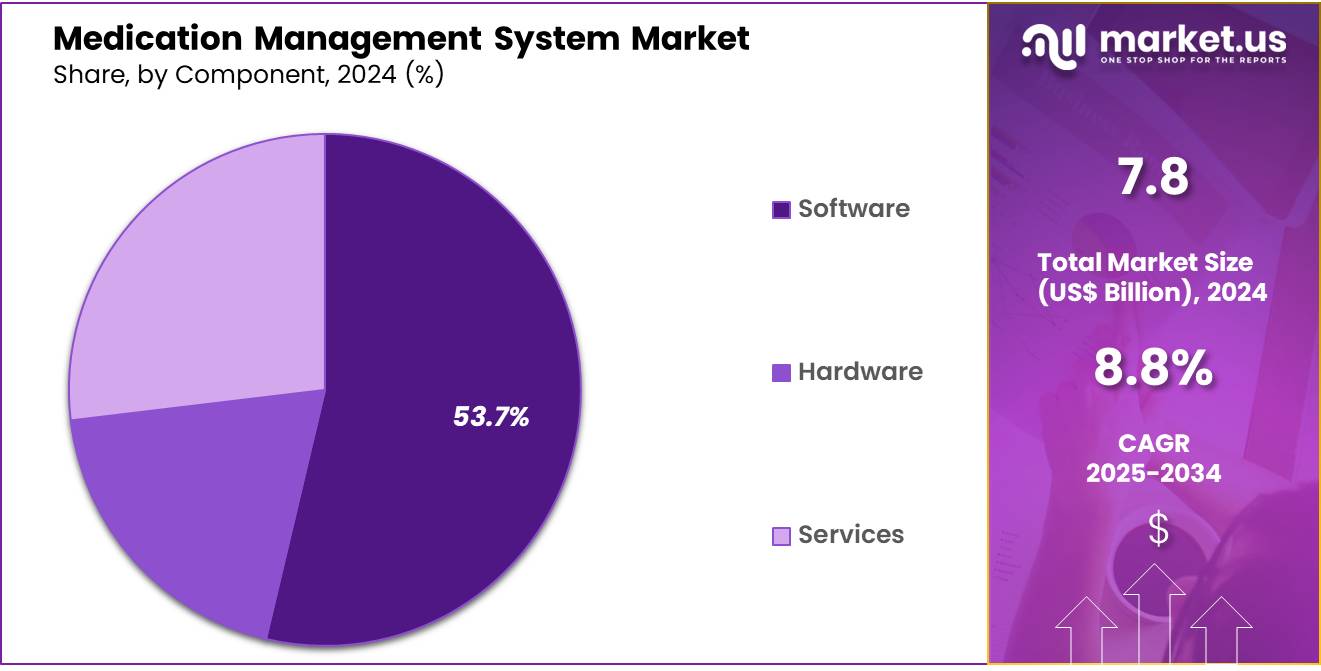

- Furthermore, concerning the component segment, the market is segregated into hardware, software, and services. The software sector stands out as the dominant player, holding the largest revenue share of 53.7% in the medication management system market.

- The end-user segment is segregated into hospitals, home care settings, outpatient clinics, pharmacies, and long-term care facilities, with the hospitals segment leading the market, holding a revenue share of 38.8%.

- North America led the market by securing a market share of 44.5%.

Product Type Analysis

Clinical decision support systems (CDSS) dominate the medication management system market with a share of 28.4%. This growth is expected to continue as healthcare providers increasingly rely on CDSS to improve decision-making in patient care. These systems provide real-time clinical alerts, guidance, and recommendations, which enhance the accuracy and efficiency of medical decisions, leading to better patient outcomes.

The increasing complexity of medication regimens and the need for personalized treatment plans are anticipated to drive the adoption of CDSS. As healthcare systems focus on reducing medication errors, improving patient safety, and optimizing care delivery, CDSS is projected to see higher demand. The growing integration of artificial intelligence (AI) and machine learning into these systems is also expected to enhance their capabilities, allowing for more precise and dynamic decision support.

Furthermore, the rise of electronic health records (EHRs) and their integration with CDSS is likely to enhance the system’s ability to provide comprehensive and accurate decision-making support across a patient’s entire care continuum.

Technology Analysis

The cloud-based technology segment holds a dominant share of 52.3% in the medication management system market. This growth is driven by the increasing adoption of cloud computing in healthcare, offering several benefits such as scalability, cost-effectiveness, and the ability to access data remotely. Cloud-based systems enable healthcare providers to securely store and access patient information, which improves communication, coordination, and patient care across different care settings.

The widespread use of cloud solutions is expected to be further propelled by the increasing demand for data storage solutions that comply with regulatory standards like HIPAA. Moreover, the ease of integration with other healthcare systems and devices, coupled with the ability to continuously update and maintain cloud software, makes cloud-based technology highly attractive.

As healthcare systems transition toward digitalization, the demand for flexible and efficient cloud-based medication management systems is expected to increase. The growing adoption of telemedicine and remote care is also likely to drive further growth in this segment.

Component Analysis

The software component holds a dominant share of 53.7% in the medication management system market. This growth is expected to continue due to the increasing demand for software solutions that streamline medication administration, tracking, and reconciliation processes. Software solutions provide healthcare providers with powerful tools to manage complex medication regimens, reduce errors, and ensure the safe administration of drugs.

The continued push for digital health records and the increasing adoption of electronic prescribing systems are projected to drive demand for software in the medication management system market. The ability of software to integrate seamlessly with other healthcare IT systems, such as EHRs and CDSS, is likely to increase its adoption.

Additionally, the increasing emphasis on data analytics and reporting in healthcare is expected to drive the development of more advanced software solutions that can monitor patient medication history, identify potential risks, and ensure compliance with treatment protocols. With healthcare organizations continuously looking for ways to improve efficiency and reduce costs, software solutions will play a critical role in meeting these demands.

End-User Analysis

Hospitals hold a significant share of 38.8% in the medication management system market. This segment’s growth is expected to be driven by hospitals’ need for advanced solutions to manage the complexities of patient care, particularly when dealing with multiple medications, patients, and treatment protocols. The increasing prevalence of chronic diseases and the growing number of patients requiring long-term medications will likely contribute to the demand for medication management systems in hospitals.

Hospitals are also under increasing pressure to reduce medication errors, improve patient safety, and comply with regulatory standards, all of which can be achieved through effective medication management systems. The adoption of electronic health records and clinical decision support systems in hospitals is expected to drive the growth of medication management systems, as they help streamline workflows, improve communication, and ensure proper medication administration.

Furthermore, the push toward digital transformation and data-driven healthcare is expected to accelerate the use of advanced medication management solutions in hospitals worldwide.

Key Market Segments

By Product Type

- Clinical Decision Support Systems

- Medication Dispensing Systems

- Medication Reconciliation Solutions

- Medication Administration Systems

- Electronic Health Records Integration

By Technology

- Cloud-based

- Hybrid

- On-premises

By Component

- Hardware

- Software

- Services

By End-user

- Hospitals

- Home Care Settings

- Outpatient Clinics

- Pharmacies

- Long-term Care Facilities

Drivers

Growing Need to Reduce Medication Errors and Enhance Patient Safety is Driving the Market

The increasing global recognition of the critical need to reduce medication errors and enhance patient safety is a primary driver propelling the medication management system market. Medication errors, which can occur at various stages including prescribing, dispensing, and administrationare a leading cause of preventable harm in healthcare settings.

These errors often result in adverse drug events, increased hospital stays, higher healthcare costs, and, in severe cases, patient fatalities. Medication management systems, such as computerized physician order entry (CPOE), electronic medication administration records (eMAR), and automated dispensing systems, provide essential tools to minimize human error, automate workflows, and ensure the right medication is administered to the right patient at the correct time and dose.

The World Health Organization (WHO) has actively addressed this issue through its Global Patient Safety Challenge, “Medication Without Harm,” which aims to reduce severe, avoidable medication-related harm. A February 2024 review in StatPearls noted that medication errors are the most common and preventable cause of patient injury, with a reported incidence of approximately 6.5 errors per 100 hospital admissions.

The persistent risk of medication errors necessitates continuous investment in advanced management systems to improve clinical workflows and enhance overall patient outcomes, driving substantial market growth.

Restraints

High Implementation Costs and Challenges with Integration are Restraining the Market

The substantial initial implementation costs associated with medication management systems, coupled with significant challenges in integrating these systems with existing healthcare IT infrastructure and legacy systems, pose a considerable restraint on market growth. Acquiring comprehensive medication management solutions, including hardware for automated dispensing and software for clinical decision support, requires a significant capital outlay, which can be a deterrent, particularly for smaller hospitals, clinics, or long-term care facilities with limited budgets.

Furthermore, integrating new systems seamlessly with disparate electronic health records (EHRs), pharmacy information systems, and other clinical platforms often involves complex technical processes, potential data discrepancies, and workflow disruptions. A 2025 study in the JMIR Human Factors journal, which evaluated the implementation of medication-related technology, highlighted that challenges in integrating these systems often stem from existing system failures and the complexity of coordinating across different hospital departments.

Additionally, the manual transfer of data from one electronic system to another, as noted in a July 2025 PubMed Central article discussing medication management challenges in home care, remains a source of potential error. These financial and technical hurdles limit the adoption of advanced medication management systems, thereby restraining the market’s full potential.

Opportunities

Integration of Artificial Intelligence (AI) and Machine Learning for Enhanced Decision Support is Creating Growth Opportunities

The integration of Artificial Intelligence (AI) and machine learning (ML) capabilities within medication management systems for enhanced clinical decision support is creating significant growth opportunities in the market.

AI and ML algorithms analyze vast amounts of patient data, including medication histories, lab results, and patient demographics, to identify potential drug interactions, allergies, contraindications, and optimize dosing regimens. These sophisticated systems provide real-time alerts and recommendations to healthcare providers, improving the safety and effectiveness of medication therapy.

AI also streamlines complex tasks such as inventory management and predicting medication adherence. For example, in March 2024, NVIDIA Healthcare announced the launch of generative AI microservices designed to advance drug discovery, MedTech, and digital health, signifying a strong push towards leveraging AI in medication-related processes.

Furthermore, the development of predictive analytics allows healthcare facilities to anticipate and prevent medication errors before they occur, optimizing workflows and patient outcomes. This integration of intelligent technologies enhances the capabilities of medication management systems, offering a compelling value proposition that drives adoption and fosters substantial market growth.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic shifts, including persistent inflation and fluctuating national healthcare budgets, influence the medication management system market by affecting both operational costs for software providers and IT investment capacities of healthcare organizations. The development and maintenance of complex medication management systems require significant investment in specialized labor, cloud infrastructure, and cybersecurity, all of which are sensitive to economic fluctuations.

For instance, the US Centers for Medicare & Medicaid Services (CMS) reported in its National Health Expenditure Accounts data for December 2024 that national health spending grew by 7.5% in 2023, reaching US$4.8 trillion. This significant increase in overall health spending indicates a dynamic financial environment where hospitals and healthcare systems are simultaneously managing rising costs while also having a growing budget to allocate for essential technology upgrades.

Furthermore, geopolitical uncertainty, such as regional conflicts or trade disputes, can disrupt the global supply chains for hardware components necessary for automated dispensing systems. This creates volatility in sourcing and can lead to higher costs or delays in system implementation.

However, these challenges also compel healthcare providers to seek more efficient solutions that optimize workflows and reduce errors, driving demand for robust medication management systems that can mitigate financial risks and improve patient safety, ultimately fostering market innovation and resilience.

Evolving US trade policies, including the strategic application of tariffs, are shaping the medication management system market by influencing the cost of imported components and incentivizing a shift towards domestic manufacturing. While medication management systems are primarily software and services, the hardware components such as automated dispensing units, servers, and specialized medical peripherals often rely on globally sourced inputs.

Tariffs on these imported components can increase the operational costs for manufacturers and implementation costs for healthcare facilities. A July 2025 report discussing the impact of US tariffs on healthcare and life sciences noted that rising input costs and supply shortages due to trade policies are accelerating the urgency for digital transformation and operational redesign. This rise in expenses can compel system providers to adjust pricing or absorb higher costs, potentially impacting their profitability and investment in research and development.

Conversely, US trade policies and related government initiatives are increasingly focused on enhancing national resilience and promoting domestic manufacturing within the healthcare and technology sectors. This drive towards domestic production aims to create a more secure and reliable supply chain for critical medical technologies, reducing reliance on potentially volatile international sources and fostering a robust ecosystem for medication management systems in the US.

Latest Trends

Shift Towards Cloud-Based Solutions and Remote Monitoring is a Recent Trend

A prominent recent trend significantly impacting the medication management system market in 2024 and continuing into 2025 is the accelerating shift towards cloud-based solutions and the increasing demand for remote medication management capabilities. Healthcare organizations are migrating from traditional on-premise systems to cloud-based platforms due to the advantages of enhanced scalability, reduced IT infrastructure costs, and improved accessibility.

Cloud deployments facilitate real-time data sharing and synchronization across different healthcare settings, which is crucial for managing medication transitions of care. Concurrently, the rise of remote patient monitoring and telemedicine is driving the need for systems that support medication adherence and tracking in home and community settings.

For instance, in June 2024, PatchRx, a US-based medication adherence technology company, introduced PatchRx Connect, a solution designed to integrate real-time medication adherence data into existing care management platforms, allowing clinical teams to monitor patient behaviors without disrupting workflows. This trend towards remote management and cloud deployment reflects a broader industry movement to enhance accessibility, improve operational efficiency, and support decentralized healthcare models, making it a key development in the medication management system market.

Regional Analysis

North America is leading the Medication Management System Market

North America dominated the market with the highest revenue share of 44.5% owing to a concerted effort to enhance patient safety, reduce medical errors, and improve efficiency within healthcare settings. A key factor contributing to this expansion is the ongoing push for digital transformation in hospitals and healthcare systems, aiming to streamline medication workflows from prescribing to administration.

According to the Centers for Medicare & Medicaid Services (CMS), the Medicare Promoting Interoperability Program for eligible hospitals and Critical Access Hospitals (CAHs) continued through 2024, with the calendar year 2024 EHR reporting period running from January 1, 2024, to December 31, 2024. This program incentivizes the meaningful use of electronic health records (EHRs), which often integrate with or lay the groundwork for advanced medication management systems.

Furthermore, the Agency for Healthcare Research and Quality (AHRQ) reported that adverse events experienced by Medicare patients in hospitals decreased from 7.1% of stays in 2021 to 6.2% in 2022, with medication-related adverse events being a focus of patient safety initiatives.

Companies like Omnicell, a key player in medication management automation, noted in their February 2024 earnings call that while 2023 bookings were down, the overall addressable market for medication management remains large, and they are investing in platform enhancements to drive improved medication outcomes. This indicates a sustained demand for solutions that mitigate risks associated with medication handling, thereby fueling market growth as healthcare providers seek to improve patient safety and operational efficiency.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare digitalization, a rising prevalence of chronic diseases necessitating complex medication regimens, and government support for health technology adoption. Countries across the region are actively implementing digital health strategies to modernize their healthcare infrastructure and improve patient care.

For instance, India’s Ayushman Bharat Digital Mission (ABDM) aims to create a nationwide digital health ecosystem, with over 730 million Ayushman Bharat Health Accounts (ABHA) successfully created by January 2025, as reported by the Press Information Bureau. This initiative directly supports the digital integration of healthcare services, including medication records.

In China, digital healthcare is rapidly transforming the landscape, with online medical users increasing to 363 million by December 2022, according to a research, and online pharmacies improving access to medications. The Australian Digital Health Agency’s Corporate Plan for 2023-2024 includes a significant investment of over US$1 billion over four years to upgrade the My Health Record system and support real-time information sharing, which will undoubtedly benefit medication management.

These governmental efforts, combined with a growing emphasis on patient safety and the increasing complexity of pharmaceutical care in a large and aging population, mean that demand for automated dispensing, electronic prescribing, and clinical decision support tools will significantly increase across hospitals and pharmacies in the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the medication management system market employ various strategies to drive growth and enhance patient safety. They focus on integrating advanced technologies such as Clinical Decision Support Systems (CDSS) and Computerized Physician Order Entry (CPOE) to reduce medication errors and improve clinical outcomes.

Companies also prioritize the development of cloud-based solutions, offering scalability, real-time data access, and interoperability across healthcare settings. Strategic partnerships with healthcare providers and technology firms enable these companies to expand their reach and enhance service offerings.

Additionally, they invest in user-friendly interfaces and mobile applications to improve medication adherence and patient engagement. Expanding into emerging markets with growing healthcare infrastructure further contributes to their growth trajectory. Continuous innovation and adherence to regulatory standards ensure these systems meet evolving healthcare needs.

One key player, Omnicell, Inc., is a leading provider of automated medication management solutions. Headquartered in Mountain View, California, Omnicell offers a range of products, including automated dispensing systems, medication adherence packaging, and patient engagement software.

The company focuses on enhancing medication safety and operational efficiency in healthcare settings. Omnicell’s commitment to innovation and customer-centric solutions has solidified its position as a market leader in medication management technologies.

Top Key Players

- Swisslog Healthcare

- RMS Omega

- Impinj, Inc

- GUARDIAN RFID

- Epic Systems Corporation

- Bluesight

- BD

- Baptist Health

Recent Developments

- In February 2024, GUARDIAN RFID, a leader in inmate tracking systems, partnered with the Amazon Web Services (AWS) Partner Network (APN) and the AWS Public Sector Partner (PSP) Program. The APN is a global network of AWS Partners that leverage a range of expertise, programs, and resources to develop, promote, and distribute their solutions to customers.

- In November 2023, Baptist Health, a healthcare provider based in Kentucky, joined forces with Omnicell’s Central Pharmacy Dispensing Service. The partnership aimed at enhancing pharmacy services and improving control over the medication supply chain.

Report Scope

Report Features Description Market Value (2024) US$ 7.8 Billion Forecast Revenue (2034) US$ 18.1 Billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Clinical Decision Support Systems, Medication Dispensing Systems, Medication Reconciliation Solutions, Medication Administration Systems, and Electronic Health Records Integration), By Technology (Cloud-based, Hybrid. and On-premises), By Component (Hardware, Software, and Services), By End-user (Hospitals, Home Care Settings, Outpatient Clinics, Pharmacies, and Long-term Care Facilities) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Swisslog Healthcare, RMS Omega, Impinj, Inc, GUARDIAN RFID, Epic Systems Corporation, Bluesight, BD, Baptist Health. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medication Management System MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Medication Management System MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Swisslog Healthcare

- RMS Omega

- Impinj, Inc

- GUARDIAN RFID

- Epic Systems Corporation

- Bluesight

- BD

- Baptist Health