Clinical Decision Support System Market By Product Type (Standalone CDSS, Integrated EHR with CDSS, Integrated CPOE with CDSS, and Integrated CDSS with CPOE & EHR), By Delivery Mode (Web-based, Cloud-based, and On-premise), By Application (Drug-drug Interactions, Drug Dosing Support, Drug Allergy Alerts, Clinical Reminders, Clinical Guidelines, and Others), By End-user (Hospitals & Clinics, Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140137

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

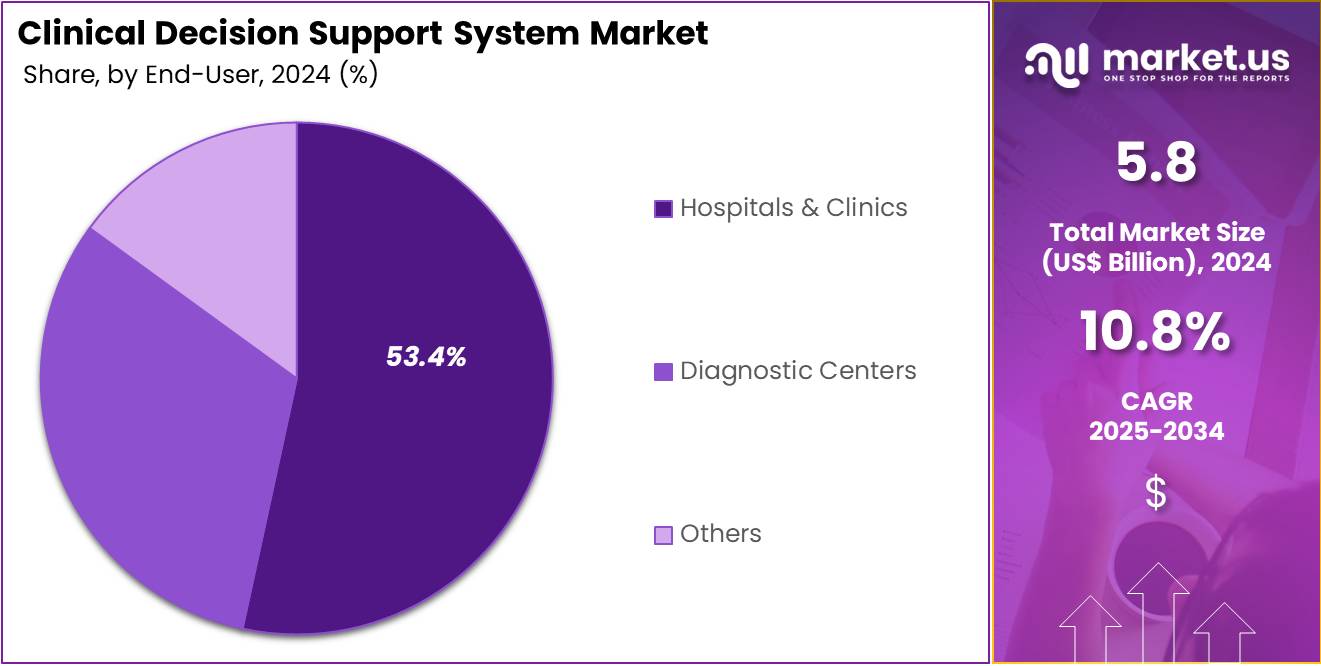

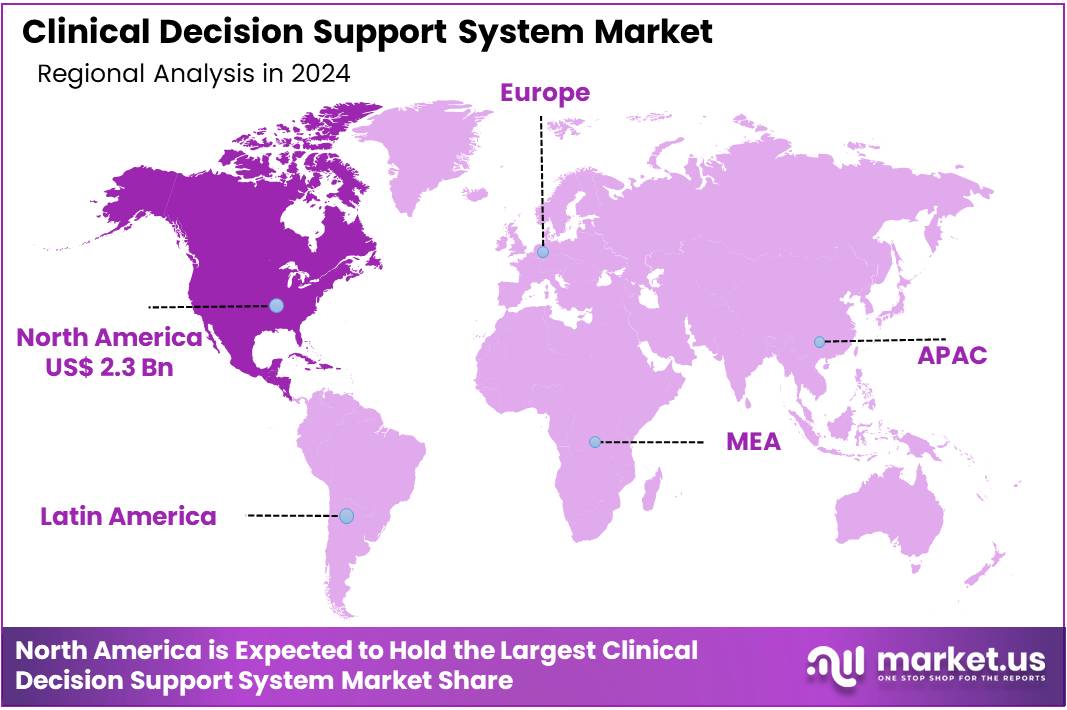

The Clinical Decision Support System Market Size is expected to be worth around US$ 16.2 billion by 2034 from US$ 5.8 billion in 2024, growing at a CAGR of 10.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40.3% share and holds US$ 2.3 Billion market value for the year.

Growing adoption of artificial intelligence and big data analytics in healthcare is driving the expansion of the clinical decision support system (CDSS) market. The increasing need for accurate, data-driven decision-making in patient care is accelerating demand for advanced CDSS solutions that enhance diagnostic accuracy and treatment planning.

Rising healthcare digitization, including the widespread integration of electronic health records (EHRs), is facilitating seamless data exchange and improving the effectiveness of CDSS in clinical workflows. In December 2022, researchers at the University of Texas at Austin’s Dell Medical School introduced an AI-powered clinical decision support system (CDSS) designed to assist healthcare professionals in guiding patients toward healthier dietary choices.

The system enhances patient-provider discussions by offering tailored nutritional recommendations based on medical data. The growing focus on personalized medicine is driving the development of CDSS platforms that provide evidence-based treatment recommendations based on genetic and clinical profiles. The increasing prevalence of chronic diseases, such as diabetes and cardiovascular disorders, is fueling demand for CDSS solutions that optimize disease management strategies.

Expanding telemedicine services are integrating CDSS to assist remote healthcare providers in making informed clinical decisions. The rising emphasis on reducing medical errors and improving patient safety is encouraging hospitals and healthcare facilities to adopt CDSS tools that alert clinicians to potential drug interactions and contraindications.

The growing role of machine learning and predictive analytics in CDSS is enhancing early disease detection and risk assessment capabilities. Increasing government support and regulatory incentives for healthcare IT adoption are creating opportunities for market growth. The development of cloud-based and interoperable CDSS platforms is enabling seamless collaboration among healthcare providers.

The rising need for cost-effective healthcare solutions is driving CDSS implementation to optimize resource utilization and improve patient outcomes. Expanding applications of CDSS in radiology, oncology, and critical care are strengthening its market presence. As healthcare organizations continue to prioritize precision medicine and data-driven decision-making, the CDSS market is expected to experience sustained growth in the coming years.

Key Takeaways

- In 2024, the market for Clinical Decision Support System generated a revenue of US$ 5.8 billion, with a CAGR of 10.8%, and is expected to reach US$ 16.2 billion by the year 2034.

- The product type segment is divided into standalone CDSS, integrated EHR with CDSS, integrated CPOE with CDSS, and integrated CDSS with CPOE & EHR, with standalone CDSS taking the lead in 2024 with a market share of 40.7%.

- Considering delivery mode, the market is divided into web-based, cloud-based, and on-premise. Among these, on-premise held a significant share of 46.8%.

- Concerning the application segment, the drug allergy alerts sector stands out as the dominant player, holding the largest revenue share of 38.5% in the Clinical Decision Support System market.

- The end-user segment is segregated into hospitals & clinics, diagnostic centers, and others, with the hospitals & clinics segment leading the market, holding a revenue share of 53.4%.

- North America led the market by securing a market share of 40.3% in 2024.

Product Type Analysis

The standalone CDSS segment led in 2024, claiming a market share of 40.7%. As standalone systems are often deployed in smaller healthcare settings that do not yet have integrated EHR or CPOE systems, they offer an accessible and cost-effective solution. The growing demand for clinical decision support to improve patient care and reduce errors, particularly in non-hospital healthcare environments, is anticipated to drive the adoption of standalone CDSS systems.

Additionally, as healthcare organizations seek to enhance clinical decision-making capabilities without the complexity of integration, standalone systems are likely to become more appealing. The simplicity of implementation, lower upfront costs, and improved patient outcomes through enhanced clinical decision-making will further contribute to the growth of this segment.

Delivery Mode Analysis

The on-premise held a significant share of 46.8% due to its perceived benefits in data security, control, and integration. On-premise systems allow healthcare organizations to maintain full control over their data, which is especially crucial in environments that require strict compliance with data privacy regulations.

The increase in demand for more customized and secure systems for managing sensitive patient data is projected to fuel the expansion of the on-premise segment. Furthermore, healthcare providers looking for system performance reliability and quicker response times are likely to favor on-premise solutions. As healthcare organizations invest in their own infrastructure, the demand for on-premise deployment models is expected to rise steadily in the coming years.

Application Analysis

The drug allergy alerts segment had a tremendous growth rate, with a revenue share of 38.5% owing to increasing concerns over patient safety and the growing complexity of drug regimens. As the number of medications prescribed continues to rise, the risk of adverse drug reactions, particularly drug allergies, has become a critical issue.

Healthcare providers are increasingly relying on CDSS solutions with drug allergy alerts to help identify potential risks before they occur, reducing hospital readmissions and improving patient outcomes. The integration of drug allergy alerts into clinical decision-making processes, particularly in high-risk environments like hospitals and urgent care, is expected to increase. This growth is anticipated to be driven by the need for enhanced patient safety measures, regulatory compliance, and improvements in overall care quality.

End-user Analysis

The hospitals & clinics segment grew at a substantial rate, generating a revenue portion of 53.4% as healthcare providers seek to optimize clinical workflows and improve patient care. Hospitals and clinics are the primary end-users of CDSS solutions due to their critical role in patient care, and they require efficient systems to support clinical decision-making processes.

As healthcare facilities face rising patient volumes and increasingly complex medical cases, the demand for clinical decision support systems that can provide real-time insights is projected to rise. Additionally, as hospitals and clinics invest in technologies that enable better coordination between departments and improve patient safety, the adoption of CDSS tools is expected to increase, thus driving the growth of this segment.

Key Market Segments

By Product Type

- Standalone CDSS

- Integrated EHR with CDSS

- Integrated CPOE with CDSS

- Integrated CDSS with CPOE & EHR

By Delivery Mode

- Web-based

- Cloud-based

- On -premise

By Application

- Drug-drug Interactions

- Drug Dosing Support

- Drug Allergy Alerts

- Clinical Reminders

- Clinical Guidelines

- Others

By End-user

- Hospitals & Clinics

- Diagnostic Centers

- Others

Drivers

Rising Innovation Driving the Clinical Decision Support System Market

Increasing technological advancements are projected to drive the demand for clinical decision support systems, enhancing diagnostic accuracy and patient outcomes. In May 2022, Epocrates rolled out a specialized tool aimed at addressing long COVID-19, incorporating the latest clinical guidelines to support healthcare providers in diagnosing and managing prolonged symptoms associated with the condition.

The integration of cloud computing, big data analytics, and real-time decision-making tools is transforming medical workflows. Healthcare organizations are prioritizing investments in advanced decision-support technologies to improve patient safety and minimize errors. The growing adoption of evidence-based medicine is fueling the demand for intelligent support solutions that assist in clinical decision-making.

Automation in healthcare is expected to reduce physician burnout by streamlining repetitive processes and minimizing manual workload. The expansion of interoperability between electronic health records (EHR) and decision-support platforms is improving care coordination. AI-driven recommendations are assisting clinicians in selecting optimal treatment pathways based on patient-specific data.

The rise in precision medicine is increasing the demand for tailored decision-support solutions to personalize treatment approaches. Regulatory bodies are encouraging the adoption of AI-powered decision-support tools to enhance healthcare efficiency. The development of cloud-based platforms is facilitating remote access to clinical insights, improving diagnostic capabilities in underserved areas. The growing need for standardized healthcare protocols is further driving the expansion of decision-support solutions in hospitals and clinics.

Restraints

Data Privacy and Security Concerns

Rising concerns over data privacy and cybersecurity risks are expected to hinder the widespread adoption of clinical decision support systems. The integration of AI-driven tools with electronic health records increases vulnerability to data breaches and unauthorized access. Healthcare organizations must comply with stringent regulations, such as HIPAA and GDPR, to safeguard patient information.

The risk of cyberattacks targeting clinical decision support platforms poses challenges in maintaining data integrity and confidentiality. Many healthcare providers hesitate to adopt cloud-based decision-support systems due to potential security threats. The need for continuous monitoring and compliance measures raises operational costs for hospitals and medical institutions.

Ensuring seamless interoperability between decision-support tools and existing healthcare IT infrastructure adds complexity to implementation. Addressing these security challenges requires ongoing investments in encryption technologies, secure access controls, and cybersecurity training for healthcare professionals.

Opportunities

Rising AI Integration Creating Opportunities in the Clinical Decision Support System Market

Growing AI integration is expected to present significant opportunities in the clinical decision support system industry. In February 2024, Elsevier Health introduced ClinicalKey AI, a next-generation clinical decision support (CDS) system designed to integrate real-time medical knowledge with generative AI. This advanced tool enhances clinician efficiency by providing instant, evidence-based insights at the point of care.

AI-powered decision-support solutions are improving diagnostic accuracy by analyzing vast datasets and identifying patterns in patient conditions. Machine learning algorithms are enabling predictive analytics to forecast disease progression and recommend personalized treatment plans. AI-driven automation is reducing administrative burdens, allowing healthcare professionals to focus on direct patient care.

The expansion of natural language processing (NLP) is enhancing clinical documentation and improving the retrieval of relevant medical literature. AI-enhanced decision-support tools are facilitating faster identification of adverse drug interactions and potential treatment conflicts. The integration of AI with telemedicine platforms is streamlining remote patient monitoring and virtual consultations.

Healthcare providers are increasingly adopting AI-based decision-support technologies to improve workflow efficiency and reduce diagnostic errors. As AI capabilities continue to evolve, their role in decision support systems is projected to transform the future of clinical practice.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a significant impact on the clinical decision support system (CDSS) market. On the positive side, increasing investments in healthcare infrastructure, particularly in emerging economies, provide new growth opportunities for the market. The rising demand for cost-effective healthcare, driven by the need to reduce medical errors and improve patient outcomes, accelerates the adoption of clinical decision support technologies.

Additionally, the global shift toward digital healthcare and the implementation of electronic health records (EHRs) further boost market growth. However, economic downturns and budget constraints in healthcare systems can limit spending on advanced technological solutions like CDSS. Geopolitical factors, such as regulatory variations across regions and trade restrictions, could disrupt the development and supply of these systems.

Despite these challenges, the continuous focus on improving healthcare efficiency, reducing costs, and enhancing patient safety ensures long-term growth for the clinical decision support system market.

Trends

Surge in Mergers and Acquisitions Driving the Clinical Decision Support System Market

Increasing mergers and acquisitions is a recent trend significantly driving the clinical decision support system market. High demand for more comprehensive healthcare solutions has led companies to consolidate resources and integrate innovative technologies to enhance their offerings. Mergers and acquisitions are expected to facilitate the development of more advanced, integrated systems that improve decision-making capabilities for healthcare professionals.

The trend is likely to lead to stronger market players, fostering greater innovation in AI-driven clinical decision support and personalized care solutions. These strategic moves also allow companies to expand their product portfolios and extend their reach to a broader customer base. In October 2022, Beckman Coulter Diagnostics strengthened its clinical decision support portfolio by acquiring StoCastic, LLC, a company specializing in evidence-based decision-making solutions for hospital emergency departments.

This acquisition expanded Beckman Coulter’s capabilities in streamlining emergency care processes. As mergers and acquisitions continue to shape the landscape, the clinical decision support system market is projected to experience significant expansion.

Regional Analysis

North America is leading the Clinical Decision Support System Market

North America dominated the market with the highest revenue share of 40.3% owing to advancements in artificial intelligence and the increasing adoption of electronic health records (EHR). In April 2023, the U.S. government introduced a policy proposal aimed at expanding healthcare providers’ access to EHR data, optimizing CDSS algorithms and enhancing clinical decision-making.

This initiative streamlined data integration, allowing for real-time analytics and improved patient outcomes. The growing prevalence of chronic diseases, including cardiovascular conditions and diabetes, further fueled demand for AI-driven decision support tools that assist physicians in personalized treatment planning. Increased investments in healthcare IT infrastructure and strategic partnerships between technology firms and hospitals contributed to market expansion.

Additionally, the rising focus on value-based care and regulatory support for interoperability encouraged wider adoption of CDSS across healthcare networks. Enhanced cybersecurity measures and cloud-based solutions also improved data security and accessibility, reinforcing North America’s leadership in digital health innovation.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare digitalization and expanding clinical research initiatives. In June 2023, AffaMed Therapeutics, in collaboration with the International Headache Center of the Chinese PLA General Hospital, launched the Headache CDSS to improve the diagnosis and management of headache disorders.

The rising burden of neurological and chronic diseases in countries like China, India, and Japan is likely to drive demand for advanced diagnostic and treatment recommendation platforms. Government initiatives promoting AI integration in healthcare systems are anticipated to accelerate market expansion. Collaborations between global technology providers and regional healthcare institutions are projected to enhance software development and accessibility.

The increasing adoption of cloud-based medical solutions is expected to improve data sharing and real-time analytics. Additionally, rising investments in smart hospitals and personalized medicine are likely to further support market growth, positioning Asia Pacific as a key player in digital health advancements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the clinical decision support system market focus on integrating artificial intelligence and real-time analytics to improve diagnostic accuracy and patient management. Companies invest in developing seamless interoperability with electronic health records (EHRs) to enhance workflow efficiency for healthcare providers.

Strategic collaborations with hospitals and research institutions drive innovation and expand adoption across various medical specialties. Emphasis on regulatory compliance and data security ensures adherence to healthcare standards while maintaining patient confidentiality. Many players also enhance cloud-based and customizable solutions to support scalability and personalized clinical decision-making.

Epic Systems Corporation is a leading company in this market, offering advanced decision support tools integrated within its EHR platforms. The company prioritizes innovation and partnerships with healthcare organizations to deliver data-driven insights that enhance treatment decisions. Epic’s commitment to improving clinical workflows and patient care establishes it as a key player in the industry.

Top Key Players in the Clinical Decision Support System Market

- Wolters Kluwer Health

- Siemens Healthineers GmbH

- Oracle

- McKesson Corporation

- IBM Corporation

- GE HealthCare

- Allscripts Healthcare, LLC

- Agfa-Gevaert Group

Recent Developments

- In October 2023, Wolters Kluwer Health unveiled AI Labs, an initiative focused on embedding generative AI into its UpToDate clinical decision support platform. This integration aims to empower healthcare providers with AI-enhanced insights, streamlining decision-making and improving patient outcomes.

- In August 2023, GE HealthCare introduced CardioVisio for Atrial Fibrillation, a digital CDS tool designed to support precision medicine in cardiology. This patient-centered platform assists healthcare professionals in optimizing treatment strategies for atrial fibrillation by leveraging advanced analytics and clinical insights.

Report Scope

Report Features Description Market Value (2024) US$ 5.8 billion Forecast Revenue (2034) US$ 16.2 billion CAGR (2025-2034) 10.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Standalone CDSS, Integrated EHR with CDSS, Integrated CPOE with CDSS, and Integrated CDSS with CPOE & EHR), By Delivery Mode (Web-based, Cloud-based, and On-premise), By Application (Drug-drug Interactions, Drug Dosing Support, Drug Allergy Alerts, Clinical Reminders, Clinical Guidelines, and Others), By End-user (Hospitals & Clinics, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wolters Kluwer Health, Siemens Healthineers GmbH, Oracle, McKesson Corporation, IBM Corporation, GE HealthCare, Allscripts Healthcare, LLC, and Agfa-Gevaert Group. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Decision Support System MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Decision Support System MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wolters Kluwer Health

- Siemens Healthineers GmbH

- Oracle

- McKesson Corporation

- IBM Corporation

- GE HealthCare

- Allscripts Healthcare, LLC

- Agfa-Gevaert Group