Global Healthcare Predictive Analytics Market By Component (Hardware and Software & Services), By Application (Operational Analytics (Demand Forecasting, Workforce Planning & Scheduling, Inpatient Scheduling, and Outpatient Scheduling), Financial Analytics (Revenue Cycle Management, Fraud Detection, and Others), Population Health (Population Risk Management, Patient Engagement, Population Therapy Management, and Others), and Clinical Analytics (Quality Benchmarking, Patient Care Enhancement, and Clinical Outcome Analysis & Management)), By Mode of Deployment (On-premise and Cloud-based), By End-user (Payers, Providers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141641

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

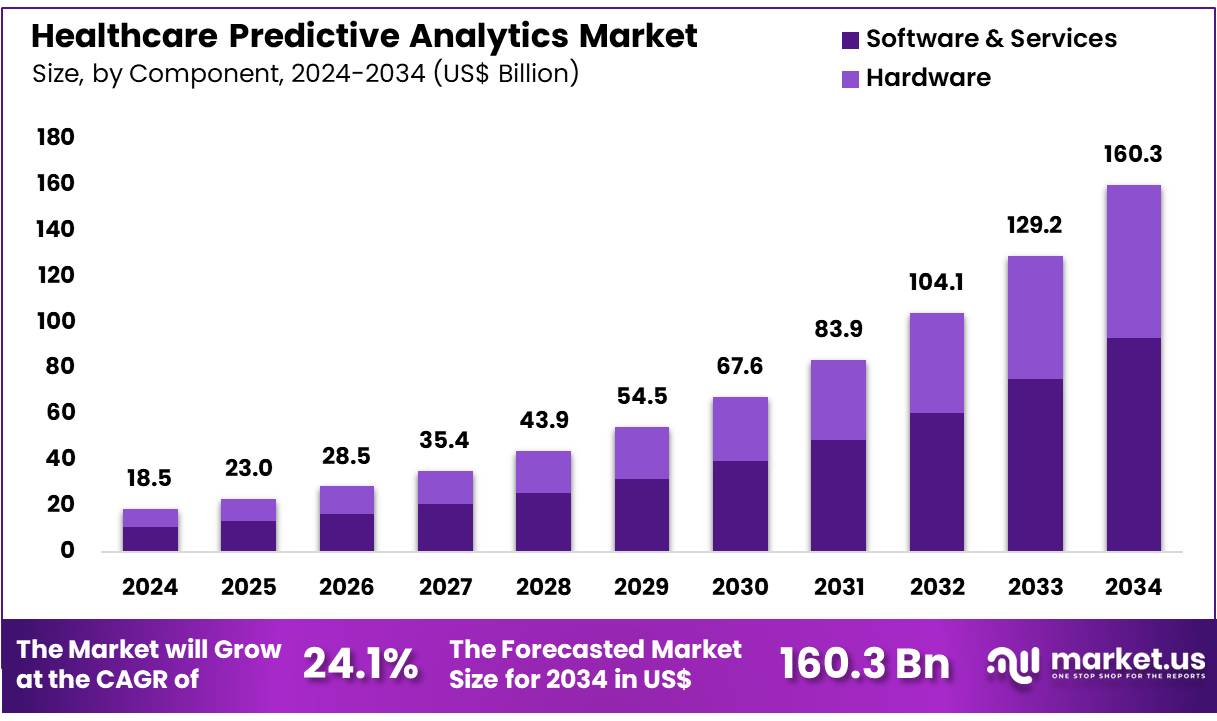

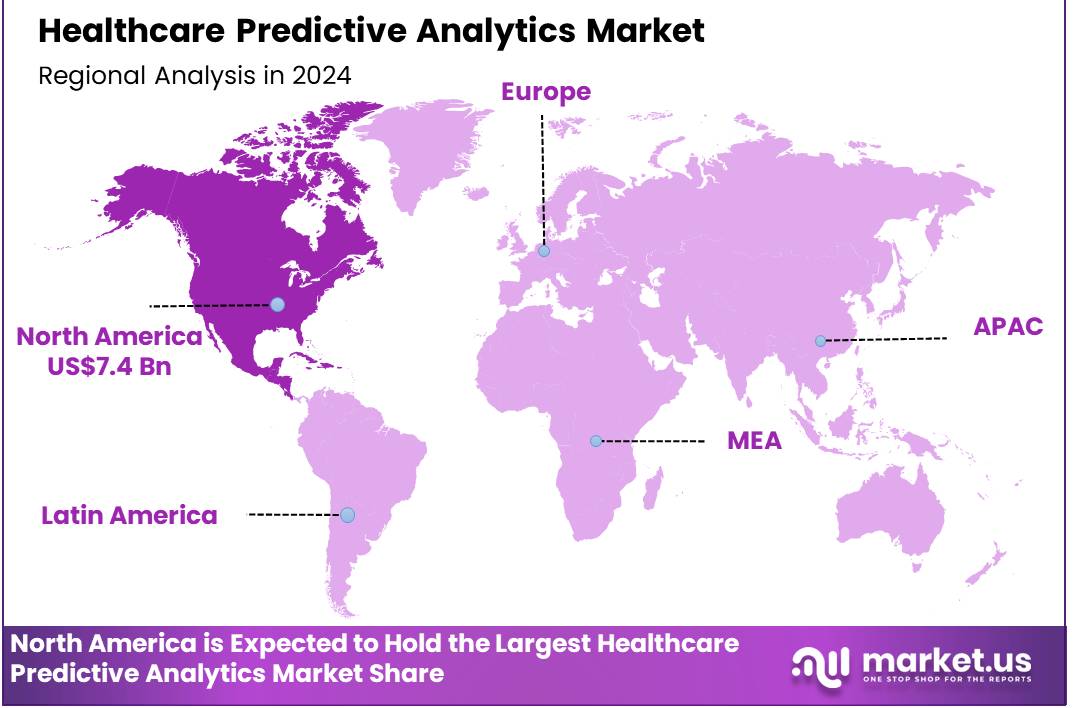

Global Healthcare Predictive Analytics Market size is expected to be worth around US$ 160.3 billion by 2034 from US$ 18.5 billion in 2024, growing at a CAGR of 24.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.1% share with a revenue of US$ 7.4 Billion.

Growing adoption of artificial intelligence and machine learning in healthcare is driving the expansion of the healthcare predictive analytics market. The increasing need for data-driven insights to enhance clinical decision-making, optimize resource allocation, and reduce healthcare costs is fueling demand for advanced predictive analytics solutions.

Rising prevalence of chronic diseases, including diabetes, cardiovascular disorders, and cancer, is prompting healthcare providers to leverage predictive analytics for early disease detection and risk stratification. In December 2023, Guidehealth acquired Arcadia’s managed service organization and value-based care service division to expand its tools and services for providers, focusing on developing predictive analytics tools. This strategic move underscores the growing emphasis on predictive analytics in improving population health management and personalized patient care.

The expanding role of predictive analytics in hospital operations, including bed occupancy forecasting and emergency department workflow optimization, is enhancing healthcare efficiency. Increasing integration of predictive analytics with electronic health records (EHRs) is enabling real-time data analysis, improving treatment outcomes, and reducing readmission rates.

The growing importance of value-based care models is driving demand for predictive analytics solutions that help providers identify high-risk patients and implement proactive interventions. Rising cybersecurity concerns in healthcare are encouraging the use of predictive analytics for threat detection and fraud prevention. The increasing use of wearable devices and remote monitoring technologies is generating vast amounts of patient data, further accelerating the adoption of predictive analytics for continuous health monitoring.

Expanding applications of predictive analytics in genomics and precision medicine are facilitating personalized treatment approaches and drug discovery. Healthcare payers are leveraging predictive analytics to assess claims data and predict healthcare utilization trends, optimizing cost management strategies. The development of cloud-based and AI-driven predictive analytics platforms is enabling seamless data integration and scalability.

Growing regulatory support for healthcare IT advancements is creating opportunities for innovation and adoption. As healthcare organizations continue to prioritize data-driven decision-making and preventive care, the healthcare predictive analytics market is expected to witness substantial growth in the coming years.

Key Takeaways

- In 2024, the market for healthcare predictive analytics generated a revenue of US$ 18.5 billion, with a CAGR of 24.1%, and is expected to reach US$ 160.3 billion by the year 2033.

- The component segment is divided into hardware and software & services, with software & services taking the lead in 2023 with a market share of 58.3%.

- Considering application, the market is divided into operational analytics, financial analytics, population health, and clinical analytics. Among these, financial analytics held a significant share of 39.4%.

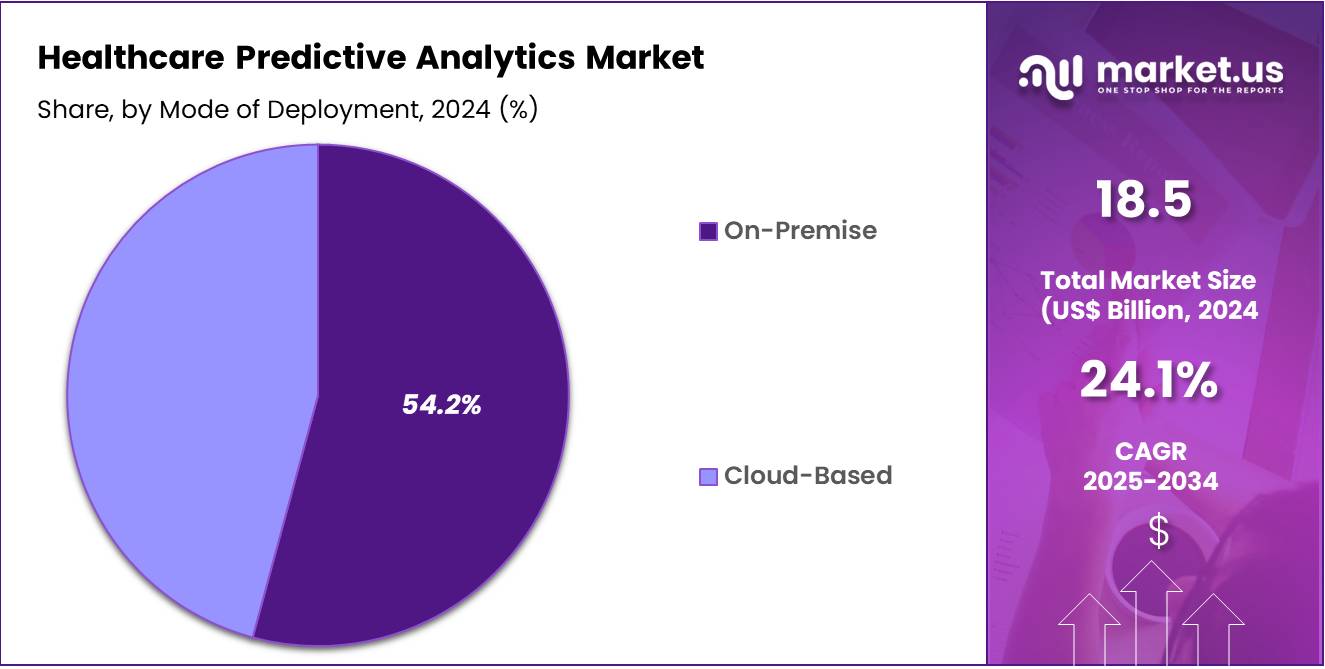

- Furthermore, concerning the mode of deployment segment, the market is segregated into on-premise and cloud-based. The on-premise sector stands out as the dominant player, holding the largest revenue share of 54.2% in the healthcare predictive analytics market.

- The end-user segment is segregated into payers, providers, and others, with the payers segment leading the market, holding a revenue share of 47.6%.

- North America led the market by securing a market share of 40.1% in 2023.

Component Analysis

The software & services segment led in 2023, claiming a market share of 58.3%. The increasing demand for data-driven insights to improve patient outcomes, reduce costs, and optimize healthcare delivery is driving the adoption of software solutions. Healthcare providers are increasingly relying on software that integrates predictive analytics to offer personalized treatment plans, improve operational efficiency, and enhance decision-making.

Additionally, as healthcare organizations continue to digitize, they require integrated software systems that include predictive models to forecast patient trends, resource needs, and financial outcomes. As the complexity of healthcare operations increases, healthcare organizations are projected to increasingly invest in predictive analytics software and services, driving the segment’s growth.

Application Analysis

The financial analytics held a significant share of 39.4% due to the increasing pressure on healthcare providers to reduce operational costs and improve revenue cycle management. Healthcare organizations are placing a greater emphasis on understanding and optimizing their financial performance. Financial analytics solutions enable healthcare providers to analyze financial data in real-time, track spending, and ensure proper reimbursement rates.

With the ongoing need for cost-effective care and the focus on value-based care models, this segment is likely to benefit from the rising demand for insights that can optimize pricing strategies, reduce administrative costs, and improve financial planning across healthcare organizations.

Mode of Deployment Analysis

The on-premise segment had a tremendous growth rate, with a revenue share of 54.2% as healthcare providers increasingly prioritize data security, control, and regulatory compliance. On-premise deployment models allow healthcare organizations to maintain full control over sensitive patient data, which is especially crucial with the rise in cyber threats and the strict requirements of healthcare regulations such as HIPAA.

Additionally, on-premise systems provide faster data processing and minimize data latency, making them an attractive option for healthcare organizations that need to process large datasets in real-time. As organizations look to secure their infrastructures and have more control over their analytics tools, the demand for on-premise deployment solutions is expected to increase in the coming years.

End-user Analysis

The payers segment grew at a substantial rate, generating a revenue portion of 47.6% as insurance providers adopt predictive analytics to improve underwriting, claims processing, and fraud detection. With healthcare costs rising, payers are increasingly utilizing predictive models to assess risk and forecast potential claims more accurately.

By using data analytics, insurance companies can create more accurate pricing models, identify high-risk patients, and implement preventive care strategies. Additionally, payers can better manage cost structures and optimize care management, which drives demand for predictive analytics solutions. As the focus on value-based care increases, the payers segment is projected to experience robust growth in the healthcare predictive analytics market.

Key Market Segments

Component

- Hardware

- Software & Services

Application

- Operational Analytics

- Demand Forecasting

- Workforce Planning & Scheduling

- Inpatient Scheduling

- Outpatient Scheduling

- Financial Analytics

- Revenue Cycle Management

- Fraud Detection

- Others

- Population Health

- Population Risk Management

- Patient Engagement

- Population Therapy Management

- Others

- Clinical Analytics

- Quality Benchmarking

- Patient Care Enhancement

- Clinical Outcome Analysis & Management

Mode of Deployment

- On-premise

- Cloud-based

End-user

- Payers

- Providers

- Others

Drivers

Rising Focus on Preventive Healthcare Driving the Healthcare Predictive Analytics Market

Growing emphasis on preventive healthcare is expected to accelerate the demand for healthcare predictive analytics, allowing providers to intervene early and improve patient outcomes. In May 2024, Cohere Health launched an advanced predictive analytics system designed to identify early trends in medical service utilization. This innovative tool helps healthcare insurers anticipate fluctuations in medical expenses, allowing for proactive adjustments in resource allocation and cost management.

Predictive analytics enables early detection of chronic diseases, reducing hospitalization rates and treatment costs. Healthcare organizations are leveraging data-driven insights to develop personalized wellness programs, encouraging healthier lifestyles among patients. The integration of wearable health devices and electronic health records enhances real-time monitoring, improving preventive care strategies.

Population health management is benefiting from predictive models that identify at-risk individuals and optimize resource distribution. Insurers are using analytics to detect fraud, control costs, and refine coverage plans based on patient risk profiles. Digital health solutions are increasingly incorporating AI-powered predictive tools to enhance care coordination.

Advancements in big data processing enable more precise forecasting of disease outbreaks and emergency room visits. Pharmaceutical companies utilize predictive analytics to optimize drug development and identify patient populations that may benefit from targeted treatments. As preventive healthcare gains prominence, demand for advanced analytics solutions is anticipated to rise significantly in the coming years.

Restraints

High Implementation Costs

High implementation costs are expected to hinder the widespread adoption of healthcare predictive analytics. Developing and deploying advanced analytics systems require substantial investments in data infrastructure, software, and skilled personnel. Many healthcare organizations struggle with budget constraints, making it difficult to justify the upfront expenses associated with predictive analytics integration.

Smaller hospitals and clinics often lack the financial resources to adopt these technologies, limiting their ability to leverage data-driven insights. The cost of maintaining and upgrading analytics platforms adds to the financial burden on healthcare institutions. Compliance with regulatory requirements further complicates implementation, increasing operational expenses.

Data security concerns necessitate additional investments in cybersecurity measures, further driving up costs. To overcome these challenges, organizations must explore scalable solutions, strategic partnerships, and cloud-based analytics platforms that reduce infrastructure expenses.

Opportunities

Rising AI and Machine Learning Advancements Creating Opportunities in the Healthcare Predictive Analytics Market

Increasing advancements in AI and machine learning are anticipated to present significant opportunities for the healthcare predictive analytics market. In April 2023, Children’s Mercy, in partnership with GE Healthcare, unveiled a state-of-the-art Patient Flow Optimization Center at its Kansas City facility. Spanning 6,000 square feet, the center utilizes artificial intelligence, real-time data tracking, and predictive modeling to streamline patient care from hospital admission to discharge.

AI-driven predictive analytics is enhancing early disease detection by analyzing vast datasets and identifying complex patterns in patient health records. Machine learning algorithms improve diagnostic accuracy, enabling physicians to recommend personalized treatment plans. Predictive models powered by AI help hospitals anticipate patient admissions, reducing wait times and optimizing bed management.

AI-based analytics solutions assist in identifying potential medication errors, improving patient safety. Healthcare providers are adopting predictive tools to enhance operational efficiency, reduce costs, and allocate resources more effectively. As AI and machine learning technologies continue to evolve, their role in predictive healthcare analytics is expected to expand, transforming the future of medical decision-making.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the healthcare predictive analytics market. On the positive side, increased government investments in healthcare technology and infrastructure, especially in emerging markets, provide new opportunities for growth. Rising healthcare costs, coupled with the global need to improve care quality and patient outcomes, drive demand for predictive analytics to optimize resource allocation and treatment plans.

Furthermore, healthcare reforms and the increasing adoption of electronic health records (EHRs) contribute to the growth of analytics solutions. However, economic downturns can lead to budget constraints, limiting spending on advanced technologies. Geopolitical factors such as regulatory changes and trade restrictions can disrupt the availability of data or delay technology deployment across borders.

Despite these challenges, the growing emphasis on improving operational efficiency, reducing costs, and enhancing patient care ensures sustained expansion in the healthcare predictive analytics market.

Latest Trends

Predictive Analytics for Operational Efficiency Driving the Healthcare Predictive Analytics Market:

The rising focus on predictive analytics for operational efficiency is driving the healthcare predictive analytics market. High demand for improved healthcare management and cost reduction has led to the adoption of analytics tools that enhance operational processes. These tools are expected to streamline workflows, optimize staffing, and reduce unnecessary expenditures in healthcare facilities.

As the healthcare industry increasingly relies on data-driven decision-making, predictive analytics will likely become essential in improving overall system efficiency and patient care. The need for real-time data insights and actionable intelligence is anticipated to fuel the market’s growth, helping healthcare providers make informed decisions and enhance service delivery.

In May 2024, mPulse introduced a data-driven analytics platform aimed at improving patient engagement and healthcare service evaluations. This system integrates predictive modeling with consumer health surveys to enhance the assessment of healthcare providers and overall patient outcomes. The growing integration of predictive analytics for operational efficiency will continue to drive the expansion of the healthcare predictive analytics market.

Regional Analysis

North America is leading the Healthcare predictive analytics Market

North America dominated the market with the highest revenue share of 40.1% owing to advancements in artificial intelligence and increasing investments in remote patient monitoring. The launch of a remote patient monitoring and tele-ICU initiative by Cleveland Clinic in collaboration with Masimo in July 2024 underscored the region’s commitment to AI-enabled predictive analytics in cardiology.

The rising prevalence of chronic diseases, including heart disease and diabetes, fueled the demand for data-driven decision-making tools that improve early diagnosis and treatment planning. Healthcare providers increasingly adopted predictive models to optimize hospital resource allocation and reduce patient readmissions. The integration of machine learning in electronic health records enhanced patient risk stratification, allowing for more personalized interventions.

Additionally, government support for value-based care models and data interoperability policies encouraged the widespread adoption of predictive analytics. Expanding partnerships between healthcare institutions and technology firms accelerated innovation, further strengthening North America’s leadership in AI-driven healthcare solutions.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare digitalization and a rising focus on preventive medicine. Expanding telehealth infrastructure in countries like China, India, and Japan is expected to enhance the adoption of predictive modeling tools for early disease detection. Government-led initiatives promoting AI integration in healthcare systems are anticipated to accelerate market expansion.

Collaborations between technology firms and regional hospitals are likely to improve access to advanced data analytics solutions. The rising burden of non-communicable diseases is projected to drive demand for predictive tools that assist in clinical decision-making. Increasing investments in cloud computing and big data analytics are expected to enhance real-time patient monitoring and risk assessment capabilities.

Additionally, the growing presence of smart hospitals and digital healthcare ecosystems is likely to strengthen market growth, positioning Asia Pacific as a key hub for AI-driven innovations in medical diagnostics and patient management.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the healthcare predictive analytics market focus on integrating artificial intelligence and machine learning to enhance clinical decision-making and patient outcomes. Companies invest in real-time data processing and cloud-based platforms to improve accessibility and efficiency for healthcare providers. Strategic collaborations with hospitals and research institutions drive innovation and expand the adoption of data-driven solutions.

Emphasis on value-based care models encourages the development of predictive tools that optimize resource allocation and reduce healthcare costs. Many players also prioritize regulatory compliance and cybersecurity to ensure data privacy and seamless integration with electronic health records.

Optum is a leading company in this market, offering advanced analytics solutions that support population health management and personalized treatment planning. The company focuses on innovation through AI-driven insights and strategic partnerships with healthcare organizations. Optum’s commitment to improving predictive modeling and patient care establishes it as a key player in the industry.

Top Key Players

- SAS

- Oracle

- Innovacer

- INFRAGISTICS

- Health Catalyst

- Cohere Health

- Cloudera

- ABOUT Healthcare

Recent Developments

- In August 2024, Innovacer launched a Government Health AI Data and Analytics Platform (GHAAP) focusing on Public Health and Medicaid Modernization. This platform improves the unifying clinical and non-clinical data while leveraging built-in AI to drive progressive health IT outcomes and transformation.

- in April 2024, ABOUT Healthcare acquired AI analytics company Edgility to offer patient progression solutions with predictive and prescriptive analysis.

- In May 2024, Cohere Health introduced early trend signal intelligence for predicting medical utilization. This enables health plans to anticipate shifts in their medical loss ratio and prepare for potential increases in utilization and associated costs.

Report Scope

Report Features Description Market Value (2024) US$ 18.5 billion Forecast Revenue (2034) US$ 160.3 billion CAGR (2025-2034) 24.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware and Software & Services), By Application (Operational Analytics (Demand Forecasting, Workforce Planning & Scheduling, Inpatient Scheduling, and Outpatient Scheduling), Financial Analytics (Revenue Cycle Management, Fraud Detection, and Others), Population Health (Population Risk Management, Patient Engagement, Population Therapy Management, and Others), and Clinical Analytics (Quality Benchmarking, Patient Care Enhancement, and Clinical Outcome Analysis & Management)), By Mode of Deployment (On-premise and Cloud-based), By End-user (Payers, Providers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SAS, Oracle, Innovacer, INFRAGISTICS, Health Catalyst, Cohere Health, Cloudera, and ABOUT Healthcare. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Predictive Analytics MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Healthcare Predictive Analytics MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SAS

- Oracle

- Innovacer

- INFRAGISTICS

- Health Catalyst

- Cohere Health

- Cloudera

- ABOUT Healthcare