Global Generative AI in Pharmaceutical Market By Technology (Deep Learning Models, Natural Language Processing (NLP), Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), Transformer Architecture, High-Performance Computing (HPC), Privacy-Preserving AI, and Others), by Method (Text Generation, Image Generation, Audio Generation, and Others), By Method (Commercial, Research and Development, Drug Discovery, Clinical Development, Operations, and Others) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143458

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

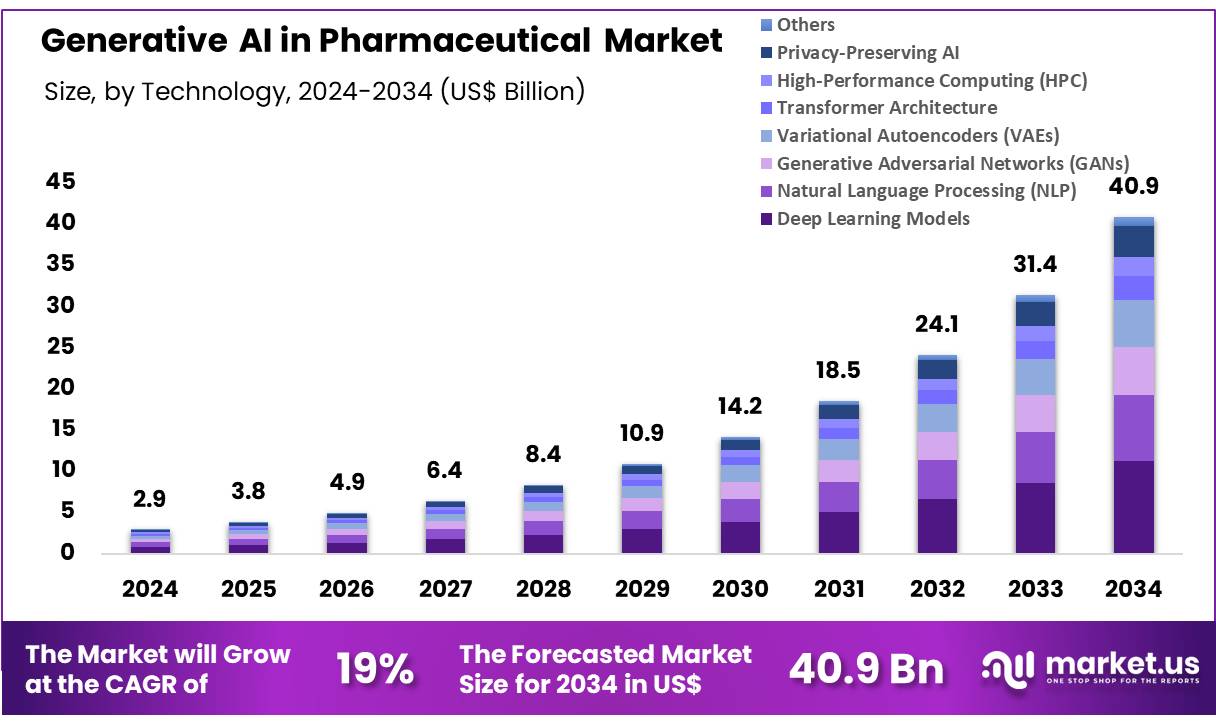

Global Generative AI in Pharmaceutical Market size is expected to be worth around US$ 40.88 billion by 2034 from US$ 2.92 billion in 2024, growing at a CAGR of 30.2% during the forecast period 2025 to 2034. Generative AI is transforming the pharmaceutical industry by accelerating drug discovery, optimizing clinical trials, and enhancing personalized medicine.

It leverages advanced machine learning models, such as Generative Adversarial Networks (GANs) and Transformer models, to generate novel molecular structures, predict drug efficacy, and identify potential therapeutic targets. In drug discovery, AI helps design new compounds with improved bioactivity and reduced toxicity, speeding up the development process. Additionally, AI-driven tools optimize clinical trial designs, enabling faster patient recruitment and more accurate outcome predictions.

In personalized medicine, generative AI analyzes genetic data to create tailored treatments, improving patient outcomes. Beyond drug development, AI is also used for drug repurposing, identifying existing medications for new therapeutic uses. As AI technology continues to evolve, its applications in the pharmaceutical market are expected to expand, providing innovative solutions for disease treatment, improving efficiency, and reducing costs in the drug development lifecycle.

In March 2024, NVIDIA unveiled over two dozen new microservices designed to help healthcare organizations worldwide leverage the latest advancements in generative AI, accessible from any location and cloud platform. This new suite of healthcare microservices includes optimized NVIDIA NIM AI models and workflows, equipped with industry-standard APIs to serve as foundational components for developing and deploying cloud-native applications. These services cover a range of functions such as advanced imaging, natural language and speech recognition, and digital biology tasks like generation, prediction, and simulation.

Additionally, NVIDIA’s accelerated software development kits and tools—including Parabricks, MONAI, NeMo, Riva, and Metropolis—are now available as CUDA-X microservices, designed to accelerate healthcare workflows in areas like drug discovery, medical imaging, and genomics analysis.

Key Takeaways

- In 2024, the market for Generative AI in Pharmaceutical generated a revenue of US$ 2.92 billion, with a CAGR of 30.2%, and is expected to reach US$ 40.88 billion by the year 2034.

- The Technology segment is divided into Deep Learning Models, Natural Language Processing (NLP), Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), Transformer Architecture, High-Performance Computing (HPC), Privacy-Preserving AI, and Others with Deep Learning Models taking the lead in 2024 with a market share of 27.4%.

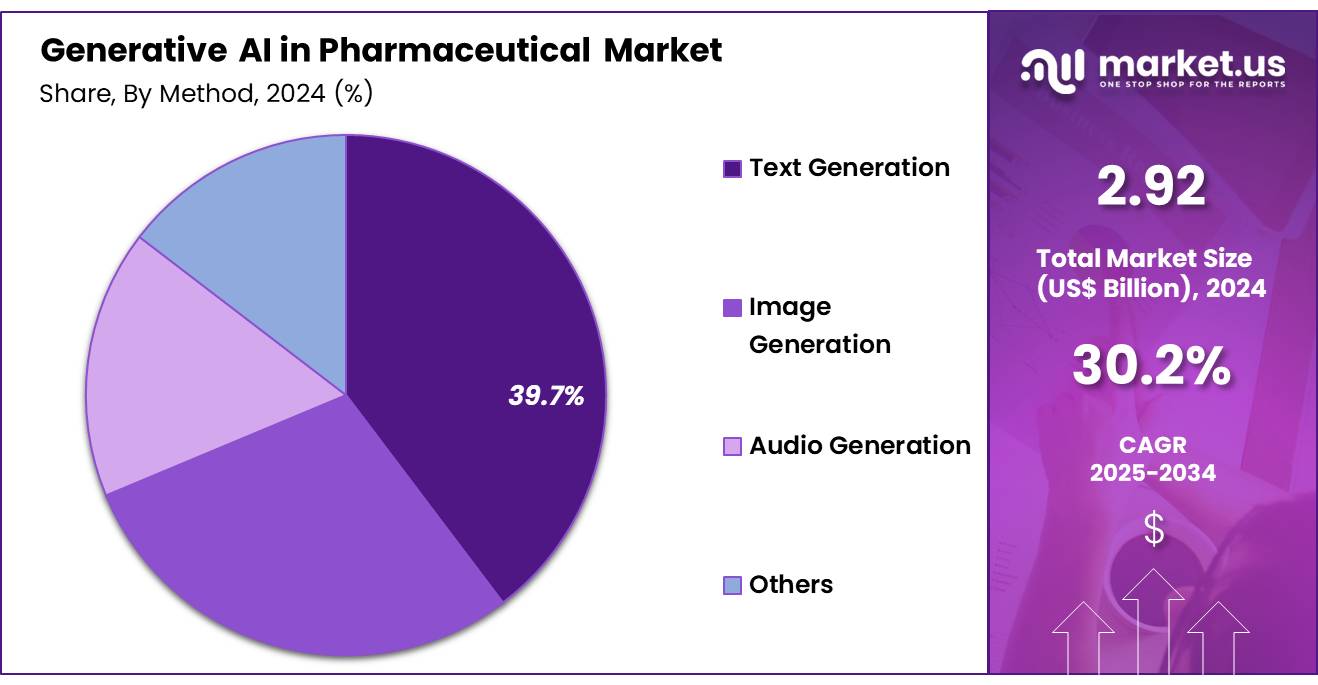

- Considering Method, the market is divided into Text Generation, Image Generation, Audio Generation, and Others. Among these, Text Generation held a significant share of 39.7%.

- Furthermore, concerning the Method, the market is segregated into Commercial, Research and Development, Drug Discovery, Clinical Development, Operations, and Others. The Research and Development stands out as the dominant segment, holding the largest revenue share of 22.4% in the Generative AI in Pharmaceutical market.

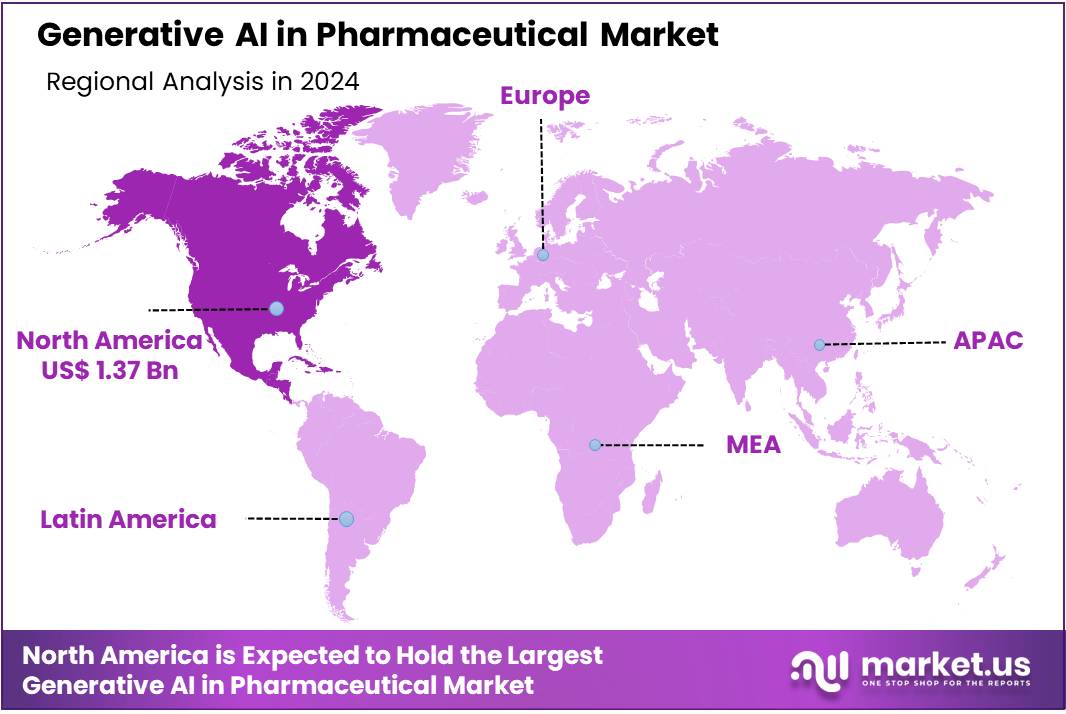

- North America led the market by securing a market share of 46.8% in 2024.

Technology Analysis

On the basis of Technology, deep learning models segment dominated the market in 2024 with a market share of 27.4%. In the pharmaceutical market, deep learning models dominate the generative AI landscape due to their ability to process vast amounts of complex data and predict molecular behaviors. These models are pivotal in drug discovery, enabling the design of novel compounds and enhancing target identification.

Natural Language Processing (NLP) is also significant, particularly for mining scientific literature, patents, and clinical data to uncover insights and accelerate research. Generative Adversarial Networks (GANs) are widely applied in generating synthetic molecular data, improving drug efficacy predictions, and facilitating drug repurposing.

For instance, in November 2024, PhaseV, a leader in software and machine learning (ML) for optimizing clinical trials, announced that seven global pharmaceutical companies are now using its ML platforms to enhance drug development. The company is also in advanced discussions with five more top pharma firms. This milestone, just two years after PhaseV’s founding, underscores the increasing adoption of AI and ML in the pharmaceutical industry and signals a significant shift towards more data-driven and efficient drug development processes.

The pharmaceutical giants are utilizing PhaseV’s two platforms: the AdaptV Platform, which optimizes adaptive trial design and execution, and the Causal Platform, which leverages causal ML to uncover hidden signals in clinical data for more accurate drug development. PhaseV’s technology is also being employed by top pharma companies to inform indication selection and expansion across a variety of therapeutic areas, including oncology, immunology, CNS, respiratory disorders, and more.

Method Analysis

By Method, the text generation segment is the dominant segment withy 39.7% market share. In the pharmaceutical market, text generation is the dominant method of generative AI, playing a critical role in automating content creation such as scientific literature summaries, regulatory documentation, and clinical trial reports. It also aids in creating synthetic patient data for research purposes.

Image generation is increasingly important, particularly for drug discovery and medical imaging, where AI models generate and enhance molecular structures or predict how drugs will interact with biological targets. This method is also used in creating realistic visual representations for research presentations or drug formulation simulations. Audio generation is a growing segment, with applications in creating synthetic voices for virtual assistants or AI-driven patient interactions. It can also be used for generating medical podcasts or voice-activated systems in healthcare.

In May 2024, Yseop, a global leader in Artificial Intelligence (AI) software and a pioneer in Generative AI, announced the development of an enhanced Generative AI application for the Biopharma industry, with support from Amazon Web Services (AWS).

As a member of the AWS Partner Network (APN), Yseop has relied on AWS for its security and scalability from the start and is now expanding its use to enhance its Large Language Model (LLM) ecosystem, infrastructure, and technical capabilities. With AWS’s support, Yseop is helping leading Biopharma companies accelerate the development and market introduction of pharmaceuticals and vaccines.

Application Analysis

Based on application, the R&D segment dominated the market with 22.4% market share. Research and Development (R&D) is the leading application of generative AI, driving innovation in drug discovery and clinical development.

AI models are used to accelerate drug discovery by designing new molecules, predicting their efficacy, and identifying potential drug candidates faster and more efficiently. Within drug discovery, generative AI aids in generating novel compounds, simulating their biological activity, and optimizing their properties, reducing the time and costs associated with traditional methods.

Key Market Segments

Technology

- Deep Learning Models

- Natural Language Processing (NLP)

- Generative Adversarial Networks (GANs)

- Variational Autoencoders (VAEs)

- Transformer Architecture

- High-Performance Computing (HPC)

- Privacy-Preserving AI

- Others

Method

- Text Generation

- Image Generation

- Audio Generation

- Others

Application

- Commercial

- Research and Development

- Drug Discovery

- Clinical Development

- Operations

- Others

Drivers

Advancements in AI Models and Technology

The continuous advancements in AI models, such as deep learning, Generative Adversarial Networks (GANs), and Transformer architectures, are significant drivers in the pharmaceutical market. These models have demonstrated an ability to process vast amounts of data, identify complex patterns, and generate novel molecular structures, making them invaluable in drug discovery and development.

By leveraging AI’s capability to simulate molecular behavior and predict drug efficacy and toxicity, pharmaceutical companies can accelerate the development process, reduce the time-to-market, and enhance precision in drug development.

This drive towards more sophisticated AI models allows for faster and more efficient drug discovery cycles, ultimately improving the pharmaceutical industry’s ability to address unmet medical needs. Additionally, AI models are also optimizing clinical trials by enhancing patient recruitment, reducing costs, and predicting trial outcomes, further contributing to the market’s growth.

c Airbyte, the leading open data movement platform, today shared updates and year-end results, revealing that its growing user community is now synchronizing over 2 petabytes of data each month, with more than 7,000 daily active companies. The company’s revenue has quadrupled, driven by the increasing demand from organizations using Airbyte to collect data for their artificial intelligence (AI) needs.

Restraints

Data Privacy and Regulatory Challenges

Despite the promise of generative AI, significant concerns surrounding data privacy and regulatory compliance serve as key restraints. Pharmaceutical companies rely heavily on sensitive patient data to train AI models, but this raises concerns about data protection, especially with stringent regulations like GDPR and HIPAA in place. Ensuring AI models comply with these regulations while maintaining patient privacy remains a challenge.

Additionally, AI-generated data must meet regulatory approval from agencies like the FDA or EMA, which can be a lengthy and uncertain process. The lack of standardized guidelines for AI-driven drug development further complicates regulatory pathways. This combination of privacy concerns, data security issues, and regulatory hurdles slows the pace of AI adoption in the pharmaceutical sector, as companies must navigate these complexities carefully to avoid potential legal and ethical issues.

For instance, in January 2025, Cisco published its 2024 Data Privacy Benchmark Study, an annual report that examines key privacy issues and their impact on businesses. Released ahead of International Data Privacy Day, the findings spotlight rising concerns around Generative AI, trust challenges related to AI usage, and the strong returns generated from investing in privacy.

Based on responses from 2,600 privacy and security professionals across 12 regions, the seventh edition of the Benchmark emphasizes that privacy is no longer just a regulatory compliance issue, but a critical business concern.

Opportunities

Personalized Medicine and Targeted Treatments

Generative AI presents a significant opportunity for the pharmaceutical industry to advance personalized medicine. By analysing vast genetic, clinical, and demographic data, AI can generate tailored treatment plans for individual patients, offering a higher level of precision in therapeutic outcomes. This capability can revolutionize how diseases are treated, especially complex conditions like cancer, rare diseases, and genetic disorders.

Generative AI can assist in identifying biomarkers and predicting patient responses to specific therapies, improving the chances of successful treatment outcomes. The ability to personalize medicine not only enhances patient care but also helps pharmaceutical companies optimize drug formulations and reduce the risk of adverse effects. This shift toward individualized treatment represents a massive growth opportunity, as healthcare increasingly moves away from a one-size-fits-all approach and toward more targeted, data-driven solutions that better meet patients’ specific needs.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly impact the generative AI market in pharmaceuticals. Economic downturns or global recessions can lead to reduced R&D budgets for pharmaceutical companies, slowing the adoption of advanced AI technologies. On the other hand, periods of economic growth can foster increased investment in AI innovation and infrastructure.

Geopolitical instability, such as trade tensions or conflicts, can disrupt global supply chains, hindering the availability of critical resources for AI model training or pharmaceutical production. Additionally, varying regulatory landscapes across regions—especially in areas like the U.S., EU, and Asia—can create challenges in standardizing AI tools and ensuring compliance with local data privacy and approval laws.

However, geopolitical collaborations or agreements between countries may also drive cross-border research initiatives, accelerating AI adoption in drug development. Overall, while macroeconomic and geopolitical factors can present challenges, they also offer opportunities for strategic growth and innovation in the generative AI space.

Latest Trends

AI-Driven Drug Repurposing

A growing trend in the pharmaceutical industry is the use of AI-driven drug repurposing. Generative AI is being leveraged to identify new therapeutic uses for existing drugs, often with much faster timelines and reduced costs compared to developing entirely new drugs. By analyzing large datasets, AI can uncover patterns and connections that were previously undetected, suggesting that an already-approved drug may be effective in treating different diseases.

This trend is particularly relevant in response to urgent public health challenges, such as the COVID-19 pandemic, where rapid development of effective treatments is critical. AI models can simulate interactions between existing drugs and various disease targets, accelerating the repurposing process.

This approach not only speeds up the time to market but also reduces the financial burden of drug development, as repurposed drugs typically require less research and testing than new compounds, offering significant economic and therapeutic value to the pharmaceutical industry.

For instance, in January 2025, Every Cure, a leading nonprofit focused on identifying and validating new uses for existing drugs, announced an expanded collaboration with Google Cloud to advance AI-driven drug repurposing. By utilizing Google Cloud’s AI tools, including the Gemini 2.0 large language models to enhance Every Cure’s MATRIX platform, the organization aims to accelerate the discovery, validation, and global distribution of life-saving treatments for diseases that currently lack effective therapies.

Regional Analysis

North America is leading the Generative AI in Pharmaceutical Market

North America is a leading region with 46.8% market share as it leads in the adoption and advancement of generative AI in the pharmaceutical market. The U.S., in particular, is home to some of the world’s largest pharmaceutical companies, biotech firms, and cutting-edge AI research institutions, fostering a vibrant ecosystem for AI-driven drug discovery and development. Generative AI models are increasingly used for drug design, clinical trial optimization, and personalized medicine, improving efficiency and reducing time-to-market.

Additionally, major technology companies like Google, Microsoft, and IBM are heavily involved in providing AI infrastructure and tools to the pharmaceutical industry. The U.S. regulatory environment, including agencies like the FDA, is also progressively adapting to AI innovations, creating a conducive environment for the widespread adoption of generative AI in drug development. This combination of innovation, resources, and regulatory support positions North America as a dominant player in the field.

In September 2024, Deloitte announced the launch of AI Factory as a Service, a comprehensive, scalable suite of Generative AI (GenAI) capabilities powered by the NVIDIA AI platform. This includes NVIDIA AI Enterprise software, NVIDIA NIM Agent Blueprints, and accelerated computing, alongside Oracle’s enterprise AI technology.

In a rapidly changing market, AI Factory as a Service offers a holistic, multi-disciplinary approach that combines Deloitte’s expertise in data science, model design, and industry insights with the NVIDIA AI platform. This collaboration fosters a strong ecosystem of technology providers to deliver tailored GenAI workflows.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Insilico Medicine, BenevolentAI, Atomwise, Exscientia, Recursion Pharmaceuticals, Zymergen, Schrödinger, BioXcel Therapeutics, Bayer AI, Cloud Pharmaceuticals, Vir Biotechnology, PathAI, Sanofi AI, AstraZeneca, DeepMind and other key players.

Insilico Medicine is a leading AI-driven biotechnology company that specializes in drug discovery and development. The company leverages generative AI models, including deep learning and reinforcement learning, to accelerate the identification of novel drug candidates. BenevolentAI uses artificial intelligence to accelerate the discovery and development of new drugs, with a focus on repurposing existing drugs for new diseases.

The company utilizes machine learning, natural language processing (NLP), and generative AI to analyze vast datasets, including scientific literature, clinical data, and biological information. BenevolentAI’s platform helps identify novel therapeutic targets and predict the efficacy of existing drugs in treating new indications. Atomwise is a prominent AI company that specializes in using deep learning and generative AI for drug discovery.

Atomwise’s platform, AtomNet, uses AI to predict how small molecules will interact with biological targets, significantly accelerating the process of drug discovery. The company focuses on using AI for virtual screening to identify promising drug candidates, especially in the areas of cancer, infectious diseases, and neurological conditions.

Top Key Players

- Insilico Medicine

- BenevolentAI

- Atomwise

- Exscientia

- Recursion Pharmaceuticals

- Zymergen

- Schrödinger

- BioXcel Therapeutics

- Bayer AI

- Cloud Pharmaceuticals

- Vir Biotechnology

- PathAI

- Sanofi AI

- AstraZeneca

- DeepMind

- Other Key Players

Recent Developments

- In September 2024, Gilead Sciences, Inc. and Genesis Therapeutics, Inc. announced a strategic collaboration aimed at discovering and developing innovative small molecule therapies targeting multiple areas. Genesis is at the forefront of using generative and predictive artificial intelligence (AI) technologies to create therapeutics for complex and difficult targets.

- In June 2024, Eli Lilly and Company announced a collaboration with OpenAI to utilize OpenAI’s generative AI in the discovery of novel antimicrobials aimed at combating drug-resistant pathogens. Antimicrobial resistance (AMR) is recognized as one of the most significant public health and development challenges worldwide.

- In December 2023, Merck, a leading science and technology company, introduced its AIDDISON drug discovery software, the first software-as-a-service platform designed to bridge the gap between virtual molecule design and real-world manufacturability. This is made possible through the integration of Synthia retrosynthesis software application programming interface (API).

- In June 2023, Insilico Medicine, a clinical-stage biotechnology company driven by generative artificial intelligence (AI), announced that it has administered the first dose to patients in the Phase II clinical trial of INS018_055. This marks the world’s first anti-fibrotic small molecule inhibitor discovered and designed using generative AI, with the Phase II trials now underway for further evaluation.

Report Scope

Report Features Description Market Value (2024) US$ 2.92 billion Forecast Revenue (2034) US$ 40.88 billion CAGR (2025-2034) 30.2% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Deep Learning Models, Natural Language Processing (NLP), Generative Adversarial Networks (GANs), Variational Autoencoders (VAEs), Transformer Architecture, High-Performance Computing (HPC), Privacy-Preserving AI, and Others), by Method (Text Generation, Image Generation, Audio Generation, and Others), By Method (Commercial, Research and Development, Drug Discovery, Clinical Development, Operations, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Insilico Medicine, BenevolentAI, Atomwise, Exscientia, Recursion Pharmaceuticals, Zymergen, Schrödinger, BioXcel Therapeutics, Bayer AI, Cloud Pharmaceuticals, Vir Biotechnology, PathAI, Sanofi AI, AstraZeneca, DeepMind and others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Generative AI in Pharmaceutical MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Generative AI in Pharmaceutical MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Insilico Medicine

- BenevolentAI

- Atomwise

- Exscientia

- Recursion Pharmaceuticals

- Zymergen

- Schrödinger

- BioXcel Therapeutics

- Bayer AI

- Cloud Pharmaceuticals

- Vir Biotechnology

- PathAI

- Sanofi AI

- AstraZeneca

- DeepMind

- Other Key Players