Global Point of Care Connectivity Solutions Market By Type (Software and Services), By Application (Glucose Monitoring, Coagulation Monitoring, Electrolyte and Blood Gas Analysis, Infectious Disease Devices, Cardio Metabolic Monitoring, and Others), By End Use (Hospitals/Clinic, Diagnostic/Specialty Centers, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139713

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type Analysis

- Application Analysis

- End-User Analysis

- Key Segments Analysis

- Rising Prevalence of Cardiovascular Diseases

- Market Restraints

- Market Opportunities

- Impact of macroeconomic factors / Geopolitical factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

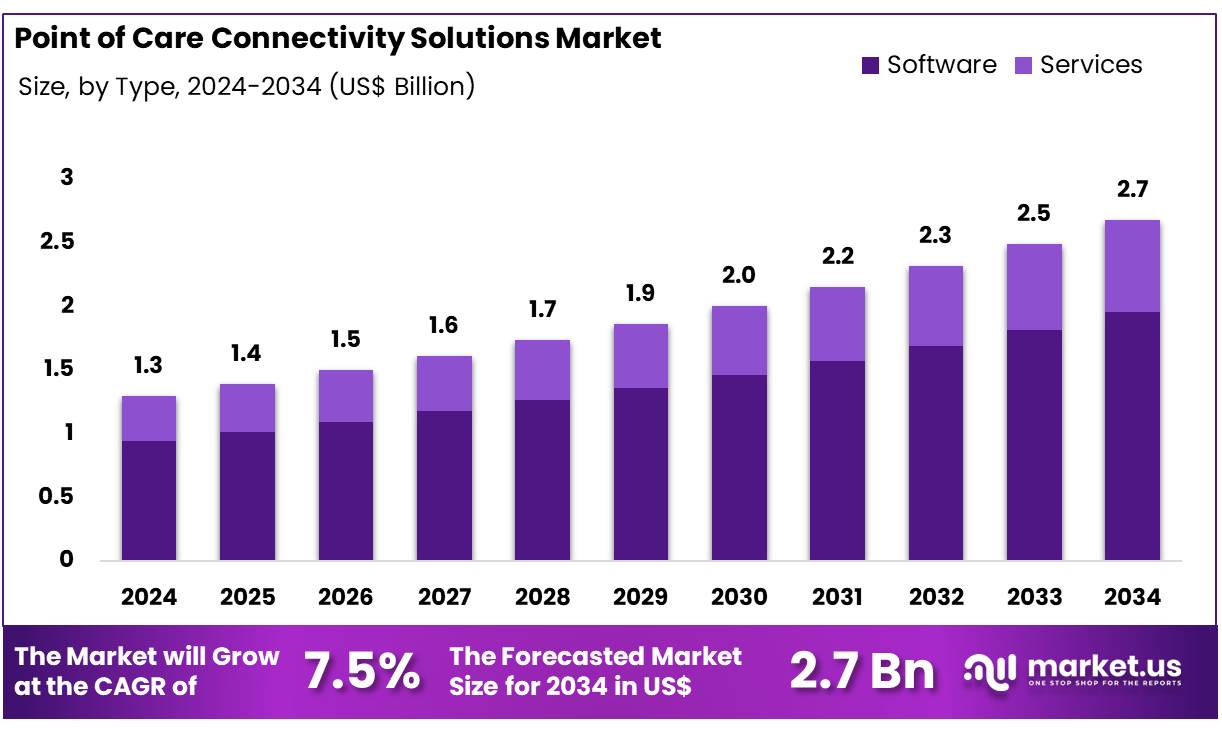

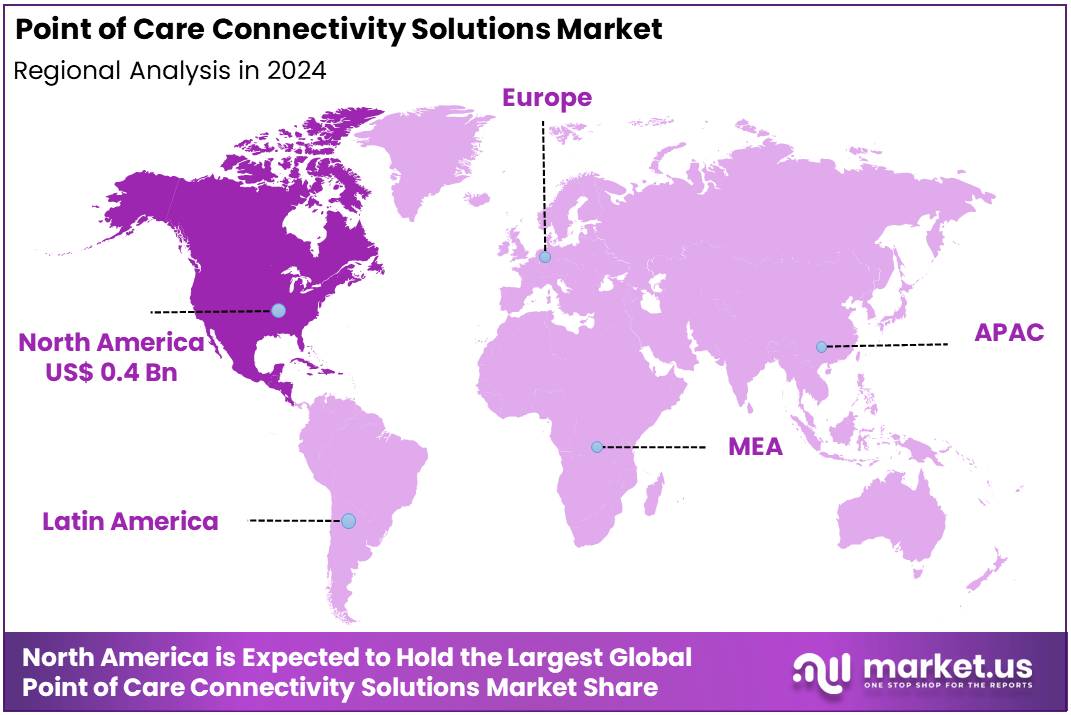

Global Point of Care Connectivity Solutions Market size is expected to be worth around US$ 2.7 Billion by 2034 from US$ 1.3 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2024 to 2034. In 2023, North America led the market, achieving over 31% share with a revenue of US$ 0.4 Billion.

The global point of care connectivity solutions market is driven by the increasing prevalence of cardiovascular diseases, rising geriatric populations, and advancements in wearable health technology. With healthcare systems focusing on reducing hospital admissions and enabling more proactive care, remote monitoring provides a cost-effective solution.

The growing adoption of smartphones and connected devices also supports the expansion of the market, facilitating real-time data transmission and patient monitoring. Furthermore, the shift towards telemedicine and home-based healthcare services accelerates the demand for point of care connectivity solutions. Regulatory approval of wearable ECG and heart rate monitors, coupled with advancements in artificial intelligence and data analytics, enhances diagnostic accuracy and personalized treatment plans.

However, challenges such as data security concerns, reimbursement issues, and the need for regulatory alignment across regions may hinder market growth. Despite these challenges, the market is expected to witness steady expansion as healthcare systems worldwide continue to embrace digital health solutions.

- According to the CDC, Heart disease is the leading cause of death in the globally, responsible for around 17.9 million deaths each year, which accounts for 32% of all global deaths with approximately 697,000 deaths attributed to cardiovascular diseases in 2020.

Key Takeaways

- The global Point of Care Connectivity Solutions market was valued at USD 1.3 billion in 2024 and is anticipated to register substantial growth of USD 2.7 billion by 2034, with 7.5% CAGR.

- In 2024, the software segment took the lead in the global market, securing 73% of the total revenue share.

- The hospitals and clinics segment took the lead in the global market, securing 32% of the total revenue share.

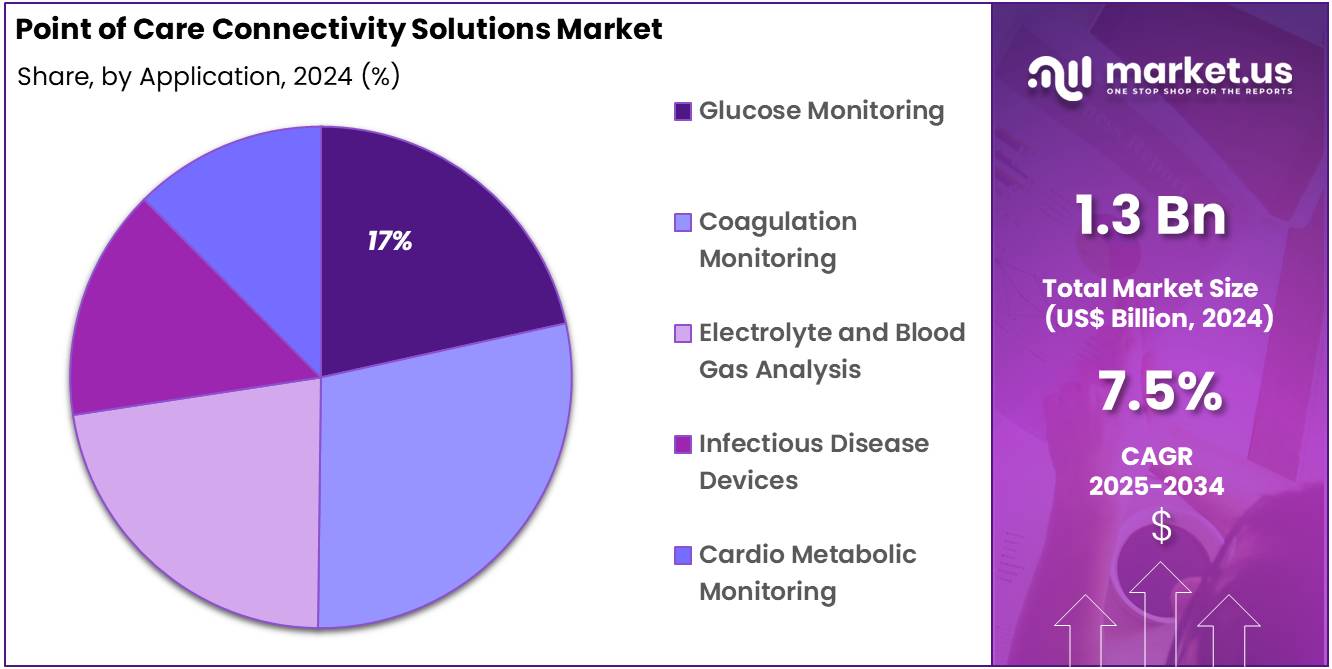

- The glucose monitoring segment took the lead in the global market, securing 17% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 31% of the total revenue.

Type Analysis

Based on type the market is fragmented into software and services. Amongst these, software dominated the global point of care connectivity solutions market capturing a significant market share of 73% in 2024. Software has dominated the global point of care (PoC) connectivity solutions market due to its crucial role in enhancing data management, interoperability, and patient care.

With the increasing shift towards digital healthcare, software solutions enable seamless integration of diagnostic devices, medical instruments, and electronic health records (EHR) in real-time. This allows healthcare professionals to access patient data quickly and make informed decisions at the point of care.

Software platforms also facilitate remote monitoring, data analysis, and decision support, contributing to more personalized and efficient care. Additionally, the rise of cloud-based solutions has made software more scalable and cost-effective, supporting the adoption of PoC connectivity solutions in both small clinics and large hospitals.

Application Analysis

Based on application the market is fragmented into glucose monitoring, coagulation monitoring, electrolyte and blood gas analysis, infectious disease devices, cardio metabolic monitoring, and others. Amongst these, glucose monitoring segment held significant segment in the global point of care connectivity solutions market capturing a significant market share of 17% in 2024 due to the increasing prevalence of diabetes worldwide and the growing demand for real-time, personalized healthcare management.

Point of care glucose monitoring systems, integrated with connectivity solutions, allow for immediate, accurate glucose readings and seamless transmission of data to healthcare providers for timely intervention. These solutions enable continuous monitoring of glucose levels, reducing the risks of complications associated with diabetes, such as hypoglycemia and hyperglycemia.

The rise of chronic disease management, especially diabetes, is driving healthcare providers to adopt PoC glucose monitoring solutions to improve patient outcomes and enhance treatment adherence.

- According to World Health Organization (WHO), diabetes is a major cause of blindness, kidney failure, heart attacks, stroke, and lower limb amputation. Approximately 422 million people worldwide have diabetes, with the majority living in low- and middle-income countries.

End-User Analysis

The market is fragmented by end-user into hospitals/clinic, diagnostic/specialty centers, and others. Hospitals/clinics dominated the global point of care connectivity solutions market capturing a significant market share of 32% in 2024 due to their critical role in providing immediate, high-quality healthcare services. These healthcare settings require seamless integration of diagnostic devices, patient monitoring systems, and health records to deliver efficient and accurate care.

PoC connectivity solutions allow real-time transmission of patient data, improving clinical decision-making and enabling more personalized treatment plans. The adoption of these solutions in hospitals and clinics supports better management of acute conditions, chronic disease monitoring, and enhanced patient outcomes.

Furthermore, the rising need for digital health solutions, including telemedicine and remote patient monitoring, has made PoC connectivity an essential component in modern healthcare systems. With the growing focus on reducing healthcare costs, improving patient satisfaction, and enhancing operational efficiency, hospitals and clinics continue to lead the demand for PoC connectivity solutions, driving their growth in the healthcare sector.

Key Segments Analysis

By Type

- Software

- Services

By Application

- Glucose Monitoring

- Coagulation Monitoring

- Electrolyte and Blood Gas Analysis

- Infectious Disease Devices

- Cardio Metabolic Monitoring

- Others

By End Use

- Hospitals/Clinic

- Diagnostic/Specialty Centers

- Others

Rising Prevalence of Cardiovascular Diseases

The rising prevalence of cardiovascular diseases (CVDs) is significantly driving the growth of the point of care (PoC) connectivity solutions market. As CVDs remain the leading cause of mortality globally, the demand for timely, accurate, and continuous monitoring of patients’ heart health is increasing.

PoC connectivity solutions enable real-time data collection from diagnostic devices, such as electrocardiograms (ECGs) and blood pressure monitors, which are crucial in the early detection and management of heart conditions. By integrating these devices with hospital information systems, healthcare providers can access patient data instantly, improving clinical decision-making and reducing the time between diagnosis and treatment.

- Cardiovascular diseases such as Heart disease is the leading cause of death in the United States, accounting for 697,000 deaths in 2020. Approximately 18.2 million adults in the U.S. aged 20 and older have coronary artery disease. One in four deaths in the U.S. is due to heart disease, making it the most significant health threat. Globally, chronic diseases like CVDs are expected to rise dramatically, with a projection of 25% more deaths due to CVD by 2030.

Market Restraints

Data Security and Privacy Concerns

The data security and privacy concerns associated with the integration of healthcare devices and patient data systems. As PoC solutions rely on the collection, transmission, and storage of sensitive patient information, there is an increased risk of data breaches, cyberattacks, and unauthorized access. Healthcare organizations must ensure that all systems comply with stringent data protection regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. or the General Data Protection Regulation (GDPR) in Europe.

The complexity of securing data across interconnected devices and platforms can be costly and resource-intensive. Moreover, lack of trust in the security of these systems may hinder the adoption of PoC connectivity solutions, especially among smaller healthcare providers with limited cybersecurity capabilities. Ensuring robust encryption, secure data transmission, and adherence to regulatory standards are critical to mitigating these concerns and enabling market growth.

Market Opportunities

Growing Adoption of Telemedicine and Remote Patient Monitoring

Healthcare systems increasingly shifting towards decentralized care models and for that PoC connectivity solutions offer an ideal way to remotely monitor patients, especially those with chronic conditions or those in rural areas with limited access to healthcare facilities. These solutions allow for continuous data transmission from diagnostic devices to healthcare providers, enabling timely interventions without requiring patients to visit hospitals or clinics frequently.

The COVID-19 pandemic has accelerated the acceptance of telehealth services, and this trend is expected to continue as patients and providers embrace more convenient, cost-effective care models. Additionally, advancements in wearable health technologies, such as smartwatches and patches that can integrate with PoC systems further drive the demand for remote monitoring solutions. This growing telemedicine adoption presents significant growth potential for PoC connectivity providers.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly impact the growth and dynamics of the point of care (PoC) connectivity solutions market. Economic downturns or recessions can lead to reduced healthcare spending, limiting investments in advanced PoC technologies, particularly in low- and middle-income countries. Conversely, periods of economic growth may encourage greater adoption of digital health solutions as healthcare systems modernize and expand.

Geopolitical factors, such as trade restrictions, political instability, and regulatory changes, can disrupt supply chains, affecting the availability of key components for PoC devices or delaying product rollouts in certain regions. Additionally, varying healthcare policies and reimbursement systems across countries influence the adoption of PoC solutions, with some regions offering incentives and funding, while others face barriers due to strict regulations. In the long term, economic recovery and geopolitical stabilization may encourage innovation and greater investment in PoC technologies, fostering market growth across global regions.

Latest Trends

The latest trends in the Point of Care (PoC) connectivity solutions market highlight a significant shift toward integration with wearable health technologies and cloud-based platforms. Wearables such as smartwatches and fitness trackers, which monitor vital signs like heart rate and blood glucose, are increasingly connected to PoC systems, enabling real-time data transmission to healthcare providers. This integration facilitates continuous, personalized monitoring and improves patient outcomes, especially for chronic conditions.

Another emerging trend is the use of Artificial Intelligence (AI) and machine learning to enhance diagnostic accuracy and decision-making at the point of care. AI-driven analytics can identify patterns in patient data, predict health risks, and recommend treatment options in real-time. Additionally, there is a growing focus on telemedicine and remote patient monitoring, driven by the demand for home-based care and the need to reduce hospital visits, especially in the wake of the COVID-19 pandemic. These trends are transforming how healthcare is delivered, making it more efficient, accessible, and patient-centric.

Regional Analysis

North America held a significant share in the Point of Care (PoC) connectivity solutions market, driven by advanced healthcare infrastructure, high adoption rates of digital health technologies, and substantial healthcare investments. The U.S., in particular, benefits from a well-developed healthcare system that prioritizes innovation, enhanced patient care, and operational efficiency.

The region’s focus on reducing healthcare costs and improving patient outcomes further accelerates the adoption of PoC connectivity solutions. Additionally, the integration of cloud services with healthcare facilities is fuelling market growth. These trends in cloud adoption, combined with favourable reimbursement policies and a strong regulatory framework, contribute to North America’s dominance in the market.

- The increased use of public cloud platforms, as highlighted by the HIPAA Journal, exemplifies this trend. In 2019, healthcare organizations utilized an average of 19 public cloud services, which rose to 24 by 2022, reflecting the growing reliance on cloud technologies to manage and transmit patient data securely.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The point of care connectivity solutions market is characterized by intense competition, driven by the presence of both established healthcare technology companies and emerging players offering innovative solutions. Key market leaders, including Abbott Laboratories, Medtronic, Philips Healthcare, and Roche, dominate the space by providing integrated PoC solutions that combine diagnostic devices, monitoring equipment, and connectivity platforms.

These companies leverage their expertise in healthcare devices and data management to create seamless, real-time monitoring systems for hospitals, clinics, and home care settings. Additionally, smaller startups and technology firms specializing in cloud-based platforms, wearable health devices, and AI-powered analytics are intensifying competition by offering flexible, cost-effective solutions.

F. Hoffmann-La Roche Ltd. is a global leader in pharmaceuticals and diagnostics, headquartered in Basel, Switzerland. Roche is renowned for its innovative solutions in personalized healthcare, focusing on diagnostics, oncology, immunology, and infectious diseases. In the PoC connectivity solutions market, Roche offers advanced diagnostic instruments and integrated connectivity platforms that enable real-time data transfer and improve patient care.

In addition, Siemens Healthineers, a division of Siemens AG, is a leading global medical technology company based in Germany. It specializes in imaging systems, diagnostics, laboratory diagnostics, and healthcare IT solutions. Siemens Healthineers plays a significant role in the PoC connectivity solutions market with its advanced diagnostic tools and software that integrate with healthcare IT systems.

Top Key Players

- Hoffmann-La Roche Ltd.

- Siemens Healthineers AG

- Abbott

- GE HealthCare

- Masimo

- Capsule Technologies, Inc.

- Spacelabs Healthcare

- Honeywell International Inc.

- NXGN Management, LLC.

- EKF Diagnostics Holdings plc.

Recent Developments

- In February 2023, EKF Diagnostics showcased its innovative solution, EKF Link, at Medlab Middle East 2023 in Dubai. EKF Link is a centralized platform designed to streamline the management of point-of-care (POC) analyzers and enhance data integration. This platform improves the efficiency of POC testing by enabling seamless device management and data sharing across healthcare systems.

- In May 2022, EKF Diagnostics introduced its POC Connect middleware solution, aimed at enhancing data connectivity between POC testing devices and healthcare systems. POC Connect facilitates the seamless integration of diagnostic instruments with laboratory information systems (LIS) and electronic medical records (EMR), ensuring real-time patient data transfer for improved diagnostic workflows.

Report Scope

Report Features Description Market Value (2024) US$ 1.3 billion Forecast Revenue (2034) US$ 2.7 billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Software and Services), By Application (Glucose Monitoring, Coagulation Monitoring, Electrolyte and Blood Gas Analysis, Infectious Disease Devices, Cardio Metabolic Monitoring, and Others), By End Use (Hospitals/Clinic, Diagnostic/Specialty Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape F. Hoffmann-La Roche Ltd., Siemens Healthineers AG, Abbott, GE HealthCare, Masimo, Capsule Technologies, Inc., Spacelabs Healthcare, Honeywell International Inc., NXGN Management, LLC., EKF Diagnostics Holdings plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Point of Care Connectivity Solutions MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Point of Care Connectivity Solutions MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Hoffmann-La Roche Ltd.

- Siemens Healthineers AG

- Abbott

- GE HealthCare

- Masimo

- Capsule Technologies, Inc.

- Spacelabs Healthcare

- Honeywell International Inc.

- NXGN Management, LLC.

- EKF Diagnostics Holdings plc.