Medical Telepresence Robots Market By Type (Stationary and Mobile), By Component (Camera, Display, Speaker, Microphone, Power Source and Sensors & Control System) and End-Use (Hospitals & Assisted Living Facilities and Home Use), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 138513

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

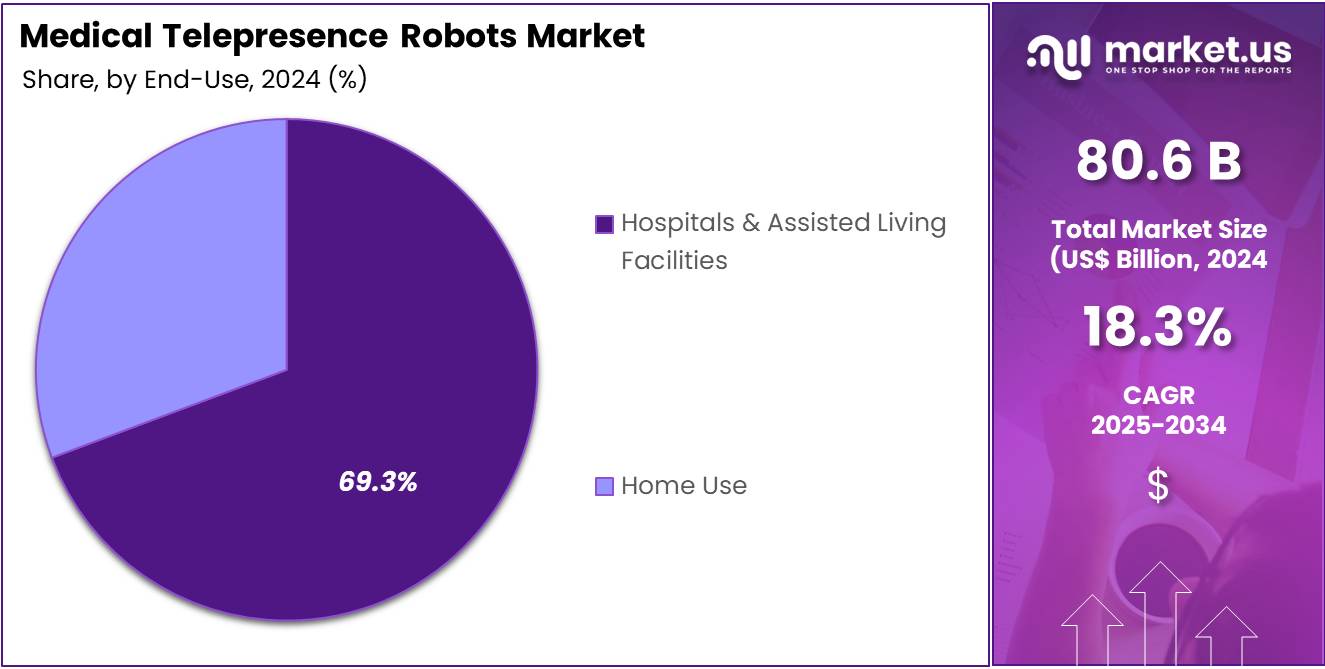

The Global Medical Telepresence Robots Market Size is expected to be worth around US$ 439.3 Billion by 2034, from US$ 80.6 Billion in 2024, growing at a CAGR of 18.3% during the forecast period from 2025 to 2034.

The global medical telepresence robots market is witnessing remarkable growth, fueled by advancements in robotics, the proliferation of healthcare digitization, and a growing demand for remote patient care solutions. Medical telepresence robots integrate cutting-edge communication technologies, AI-powered navigation, and mobility features to enable healthcare professionals to perform tasks such as remote consultations, patient monitoring, and collaborative care across geographic boundaries. These robots are proving to be a vital tool in modern healthcare, addressing the dual challenges of enhancing patient outcomes and optimizing resource utilization.

One of the primary growth drivers is the rising adoption of telemedicine, which has surged globally, particularly in underserved regions where access to specialized medical professionals is limited. Medical telepresence robots offer real-time audio and visual interactions, effectively simulating face-to-face consultations and bridging the gap between patients and healthcare providers.

Moreover, technological advancements in artificial intelligence, robotics, and sensor integration have dramatically improved the functionality and efficiency of these robots, equipping them with autonomous navigation, facial recognition, and advanced imaging capabilities that cater to diverse medical applications.

The COVID-19 pandemic further accelerated the adoption of telepresence robots as healthcare systems worldwide sought to minimize physical contact while maintaining continuity of care. These robots have been pivotal in reducing exposure risks for healthcare workers and ensuring effective patient management in high-risk scenarios.

- Approximately 80% of individuals have used telemedicine services at least once in their lifetime.

- According to a survey conducted among Doximity’s telemedicine users, nearly 84% of physicians utilize telemedicine on a weekly basis, with 40% integrating it into their daily clinical routines. Psychiatrists reported the highest daily usage at 84%, followed by endocrinologists at 57%.

Despite its immense potential, the market faces challenges such as high initial costs, technical complexities, and limited interoperability with existing healthcare systems. Nonetheless, the integration of AI and machine learning is creating significant opportunities, enabling predictive analytics, enhanced automation, and improved operational efficiency.

Partnerships between robotics manufacturers and healthcare providers are fostering innovation, leading to more sophisticated and user-friendly solutions. The global medical telepresence robots market is poised for robust growth, reflecting the broader trend of digital transformation in healthcare. By improving accessibility, reducing costs, and enhancing efficiency, medical telepresence robots are set to revolutionize the delivery of healthcare services, shaping the future of patient care worldwide.

Key Takeaways

- The Medical Telepresence Robots market generated a revenue of US$ 80.60 Billion and is predicted to reach US$ 439.64 Billion, with a CAGR of 18.3%.

- Based on the Type, the Mobile segment generated the most revenue for the market with a market share of 55.2%.

- Based on the Component, the Camera segment generated the most revenue for the market with a market share of 23.8%.

- Based on the End-Use, the Hospitals & Assisted Living Facilities segment generated the most revenue for the market with a market share of 69.3%.

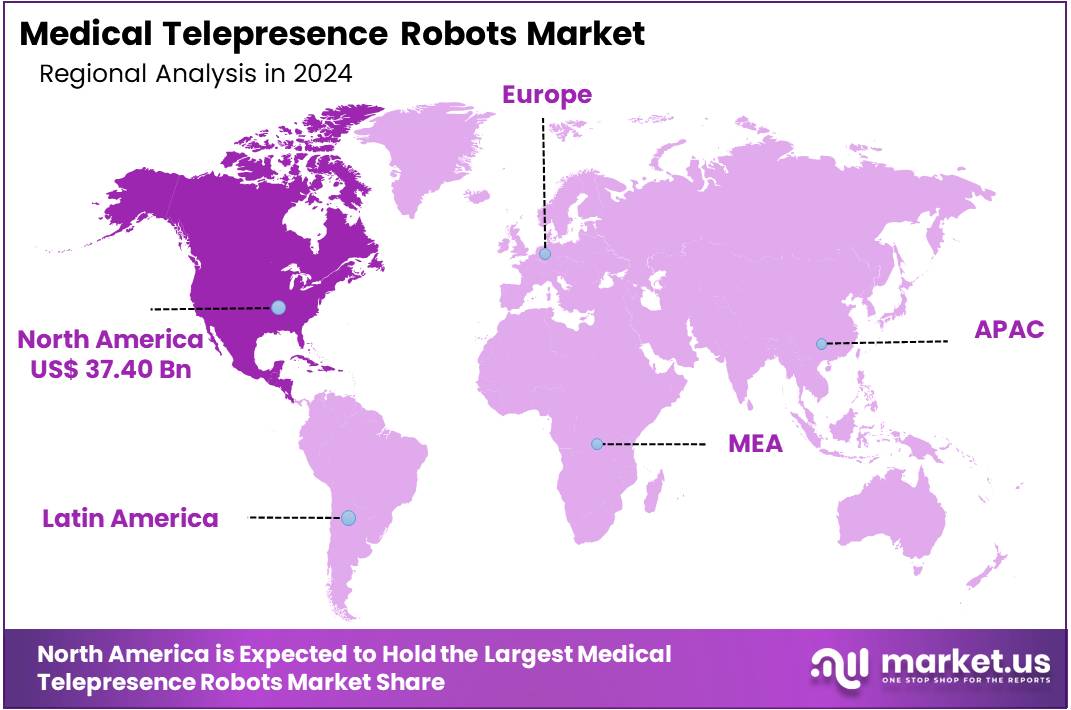

- Region-wise, North America remained the lead contributor to the market, by claiming the highest market share, amounting to 46.40%.

Type Analysis

In 2024, the mobile segment emerged as the market leader and is anticipated to grow at a robust CAGR throughout the forecast period. Mobile telepresence robots offer advanced features such as obstacle avoidance, adjustable height, head motion, autonomous navigation, and virtual monitoring, ensuring efficient service delivery and seamless teleconsultation experiences. These capabilities make mobile robots highly effective for healthcare applications, driving their widespread adoption and fueling market expansion. Their ability to deliver smooth and autonomous operations enhances patient care and optimizes healthcare workflows.

The increasing integration of mobile telepresence robots in healthcare settings is a significant factor contributing to market growth. These robots enable remote interactions and consultations, particularly in environments requiring minimal physical contact. For instance, in August 2021, Hill-Rom Services Inc., a prominent medical technology company, expanded its reach in sales and educational processes by employing telepresence robots developed by Ava Robotics Inc.

These robots were deployed in Hill-Rom’s product showrooms located in Irvine, California, and Batesville, Indiana, allowing the company to enhance its operations while leveraging innovative technology. Such advancements and growing adoption across healthcare facilities underscore the pivotal role of mobile telepresence robots in transforming medical practices and meeting the demands of modern healthcare.

The stationary segment is projected to experience significant growth at a strong CAGR during the forecast period, driven by its cost-effectiveness. Stationary telepresence robots are more affordable compared to their mobile counterparts, which has contributed to their increasing adoption. These robots are easy to operate and feature a screen that users can control, allowing them to observe their surroundings effectively.

Component Analysis

In 2024, the camera segment led the market, accounting for the largest revenue share of 23.8%. Cameras play a crucial role in enhancing remote communication through features like clarity and visualization. These robots are autonomously monitored and equipped with motorized stands connected to monitors.

Advanced cameras integrated into these robots enable clear, live video communication between healthcare providers and patients, which is critical for accurate diagnoses and efficient monitoring. The demand for high-definition cameras with zoom, pan, and tilt functions is rising, as they enhance healthcare specialists’ ability to perform remote examinations effectively.

Meanwhile, the sensors and control systems segment is expected to achieve the fastest CAGR during the forecast period, driven by increasing investments in IoT and AI technologies. For instance, in January 2023, the European Commission and national funding agencies allocated USD 65.1 million to the Testing and Experimentation Facility for Health AI and Robotics (TEF-Health). This initiative aims to advance the validation and certification of robotics and AI in medical devices, further boosting the adoption of innovative technologies in healthcare.

End-Use Analysis

The hospitals and assisted living facilities segment led the market in 2024, driven by the expansion of healthcare infrastructure and the adoption of advanced telepresence robots. These robots enable effective teleconsultation and monitoring through two-way communication from any location, significantly contributing to segment growth.

Additionally, they support essential functions such as medication management, social interaction, and routine health check-ups, promoting the well-being of elderly residents. By facilitating remote monitoring and virtual visits, telepresence robots help address staff shortages and ensure residents receive prompt medical care when needed, further propelling market expansion.

The home use segment is projected to achieve the fastest CAGR during the forecast period. The increasing geriatric population and the growing prevalence of chronic diseases are key factors driving demand for telepresence robots for regular monitoring. The rising need for remote healthcare solutions allows patients to access medical care and monitor their health from the comfort of their homes. This is particularly advantageous for individuals with chronic conditions or mobility challenges, enhancing their access to timely and convenient healthcare.

Key Market Segments

By Type

- Stationary

- Mobile

By Component

- Camera

- Display

- Speaker

- Microphone

- Power Source

- Sensors & Control System

By End-Use

- Hospitals & Assisted Living Facilities

- Home Use

Drivers

Increasing Demand for Remote Healthcare

The growing demand for remote healthcare services is a significant driver of the telepresence robot market, particularly in rural and underserved regions. As healthcare access remains a challenge in many remote areas, telemedicine has emerged as a vital solution to bridge the gap. Telepresence robots enable healthcare providers to offer consultations, diagnostics, and even therapeutic services without the need for physical proximity.

This technology has proven especially valuable in locations with limited access to specialized healthcare professionals, as it allows for timely and effective intervention. Additionally, with the increasing prevalence of chronic diseases and the aging population in these regions, the need for remote healthcare has become more pronounced.

Telepresence robots not only provide cost-effective solutions but also reduce the burden on healthcare facilities by allowing doctors to extend their services to multiple locations simultaneously. This trend is accelerating as more people seek accessible, reliable healthcare, driving the adoption of telepresence robots.

Restrains

High Initial Cost of Telepresence Robots

The high initial cost of telepresence robots is a major factor limiting their adoption, particularly in healthcare systems with constrained budgets or smaller institutions. These robots, while offering advanced features such as real-time remote consultations and diagnostic capabilities, come with significant upfront expenses for purchase, installation, and maintenance. For many healthcare providers, especially in developing regions or rural areas, the cost can be a deterrent despite the long-term benefits of improving patient access and care quality.

Smaller healthcare institutions may find it difficult to justify such an investment, particularly if they lack the financial resources or infrastructure to support these technologies. As a result, telepresence robots are often seen as a luxury rather than a necessity, and their adoption tends to be slower in environments where financial constraints are more prominent. Addressing these cost barriers through more affordable solutions or government support could help increase adoption rates.

Opportunities

Integration with AI and Machine Learning is Staging Growth Opportunities

The integration of artificial intelligence (AI) and machine learning (ML) into telepresence robots holds immense potential to revolutionize healthcare delivery. By leveraging AI and ML, these robots can significantly enhance diagnostic capabilities, allowing for more accurate and timely assessments of patient conditions. Machine learning algorithms can analyze medical data, such as imaging or patient history, to assist in diagnosis and treatment planning, improving overall decision-making.

Furthermore, AI-powered telepresence robots can automate routine healthcare tasks, such as monitoring vital signs or assisting with remote patient management, which can free up healthcare professionals’ time and reduce human error. As these technologies evolve, they have the potential to improve treatment outcomes by offering personalized care based on real-time data and predictive analytics. This fusion of AI and ML with telepresence robots is expected to drive increasing demand for these devices, as healthcare providers seek more efficient, effective, and data-driven solutions for remote care delivery.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the medical telepresence robots market. Economic instability or recessions in certain regions can lead to reduced healthcare budgets, limiting the adoption of high-cost technologies like telepresence robots. Geopolitical tensions, trade restrictions, or international conflicts may also disrupt the supply chain for critical components, increasing production costs or delaying deliveries.

Additionally, differing healthcare policies and regulations across countries can either facilitate or hinder market growth, particularly in regions with stringent regulations or limited funding for technological healthcare solutions. These external factors can create challenges but also present opportunities for innovation and adaptation within the market.

Trends

The medical telepresence robots market is experiencing several emerging trends driven by technological advancements and the increasing demand for remote healthcare solutions. One notable trend is the integration of artificial intelligence (AI) and machine learning (ML) to enhance diagnostics and automate routine healthcare tasks. These technologies enable telepresence robots to provide more accurate assessments, personalized treatment plans, and improve decision-making.

Another trend is the growing adoption of telepresence robots in tele-surgery and remote specialist consultations, facilitating more complex medical interventions without the need for physical proximity. Additionally, the development of more user-friendly, cost-effective robots is making them accessible to a wider range of healthcare providers, including smaller institutions and those in developing regions.

Cloud-based telemedicine platforms are also gaining traction, as they allow telepresence robots to integrate seamlessly into existing healthcare systems, improving scalability and data sharing. These trends reflect the expanding role of telepresence robots in transforming healthcare delivery globally.

Regional Analysis

North America Dominates the Global Medical Telepresence Robots Market

In 2024, North America led the global medical telepresence robots market, capturing the largest revenue share of 46.40%. This dominant share can be attributed to the region’s robust healthcare infrastructure and supportive government initiatives. Additionally, factors such as increasing disposable incomes, the growing adoption of robotic technologies including service robots in healthcare settings and frequent product launches are expected to further fuel regional market growth.

The U.S. holds the largest market share within North America, driven by expanding government initiatives, rising investments, and the presence of leading market players. For example, Vecna Healthcare, a U.S.-based provider, offers the VGo telepresence robot, enabling real-time audio and video communication for remote interaction in hospitals, long-term care facilities, and educational environments.

Meanwhile, Canada’s medical telepresence robots market is expected to experience the fastest compound annual growth rate (CAGR) during the forecast period. The country’s aging population and the increasing prevalence of chronic diseases are major factors contributing to this growth. According to a Springer Nature article, the senior population (aged 65+) in Canada is projected to rise from 16.3% in 2016 to 25.4% by 2060, further driving demand for telepresence robots in healthcare.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the global medical telepresence robots market is characterized by the presence of several key players offering advanced robotic solutions for remote healthcare. Leading companies such as OhmniLabs, Vecna Healthcare, and InTouch Health dominate the market, providing telepresence robots designed to improve patient care and enhance healthcare professionals’ capabilities through remote consultations and diagnostics.

The market is also witnessing increased competition from technology giants and robotics companies investing in telemedicine solutions, integrating AI, machine learning, and cloud-based platforms into their products for enhanced functionality. In addition to established players, smaller innovative companies and startups are emerging with specialized solutions tailored to specific healthcare needs, including robots for long-term care, surgical assistance, and patient monitoring.

Strategic collaborations, partnerships, and acquisitions are common strategies to expand market presence and enhance product offerings. The growing demand for remote healthcare services and technological advancements continues to drive competitive dynamics in this rapidly evolving market.

Recent Developments

- August 2024: VSee collaborated with Ava Robotics to develop telepresence solutions for inpatient intensive care environments.

- May 2024: At Automate 2024, ABB unveiled a new modular robot arm, capable of handling 70 to 620 kilograms.

- March 2024: Bomet and World Tele-Health launched telemedicine robots in Longisa County Referral Hospitals and other Kenyan healthcare facilities.

- April 2022: OhmniLabs partnered with Lovell Government Services to offer Ohmni Telepresence and OhmniClean robots for government contracts.

- February 2021: The U.S. government launched the National Robotics Initiative, dedicating $14 million in 2021 for foundational robotics research.

Top Key Players in the Medical Telepresence Robots Market

- Ava Robotics Inc.

- Amy Robotics

- Guangzhou Yingbo Intelligent Technology Co., Ltd.

- Axyn Robotics

- Blue Ocean Robotics

- Teladoc Health, Inc. (InTouch Health)

- OhmniLabs, Inc.

- VGo Communications, Inc.

- Rbot

- Xandex Inc.

Report Scope

Report Features Description Market Value (2023) US$ 80.60 Billion Forecast Revenue (2033) US$ 439.64 Billion CAGR (2024-2033) 18.3% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type- Stationary and Mobile, By Component- Camera, Display, Speaker, Microphone, Power Source and Sensors & Control System and End-Use- Hospitals & Assisted Living Facilities and Home Use. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ava Robotics Inc., Amy Robotics, Guangzhou Yingbo Intelligent Technology Co., Ltd., Axyn Robotics, Blue Ocean Robotics, Teladoc Health, Inc. (InTouch Health), OhmniLabs, Inc., VGo Communications, Inc., Rbot, Xandex Inc and others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Telepresence Robots MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Telepresence Robots MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ava Robotics Inc.

- Amy Robotics

- Guangzhou Yingbo Intelligent Technology Co., Ltd.

- Axyn Robotics

- Blue Ocean Robotics

- Teladoc Health, Inc. (InTouch Health)

- OhmniLabs, Inc.

- VGo Communications, Inc.

- Rbot

- Xandex Inc.