Global Medical Grade Silicone Market By Type (Gels, Medical Coatings, Medical Adhesives, Liquid Silicon Rubbers, and Other Types), By Applications (Prosthetics & Orthopedic, Medical Tapes, Medical Devices, Contact Lenses, and Other Applications), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: July 2024

- Report ID: 14349

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

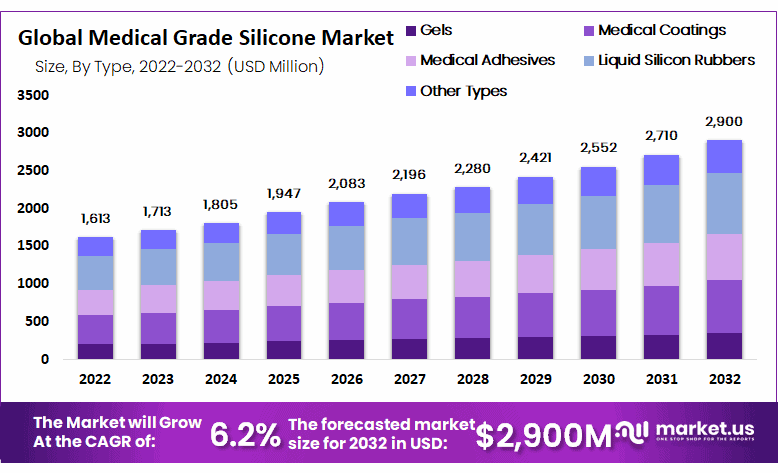

The Global Medical Grade Silicone Market size is expected to be worth around USD 2,900 Million by 2032 from USD 1,713 Million in 2023, growing at a CAGR of 6.20% during the forecast period from 2023 to 2032.

Due to its pleasing appearance and lightweight, silicone is becoming a preferred material for medical device manufacturers. Additionally, silicone is biocompatible and can be utilized in orthopedic and prosthetic surgical procedures. Prosthetic liners are made of soft, flexible materials made with this polymer. To keep the patient’s residual limb from coming into contact with a prosthetic, these liners are molded over it.

Due to its rapid curing capability and high compatibility with a variety of sterilization procedures, silicone rubber has seen a significant rise in demand. Products like feeding tubes, balloon catheters, compression bars, drainage, introducer tips, earplugs, stoppers, septum, and valves all make use of these rubbers. As a result, the wide range of applications is expected to increase the demand for sterilization products made of medical-grade silicone rubber.

Key Takeaways

- The Global Medical Grade Silicone Market size is predicted to reach USD 2,900 Million by 2032.

- The market was valued at USD 1,613 Million in 2022.

- The growth rate (CAGR) is estimated to be 6.20% from 2023 to 2032.

- Silicone rubber has seen increased demand due to its rapid curing capability.

- Market growth is influenced by the rise in the number of geriatric patients.

- The rising cost of silicone-based medical devices can restrain market growth.

- Increased expenditure in healthcare sectors, especially in countries like China and India, can boost demand.

- Liquid silicone rubber is projected to hold the largest market share of 28%.

- Silicone gels, due to their unique properties, are expected to gain substantial market share in the upcoming years.

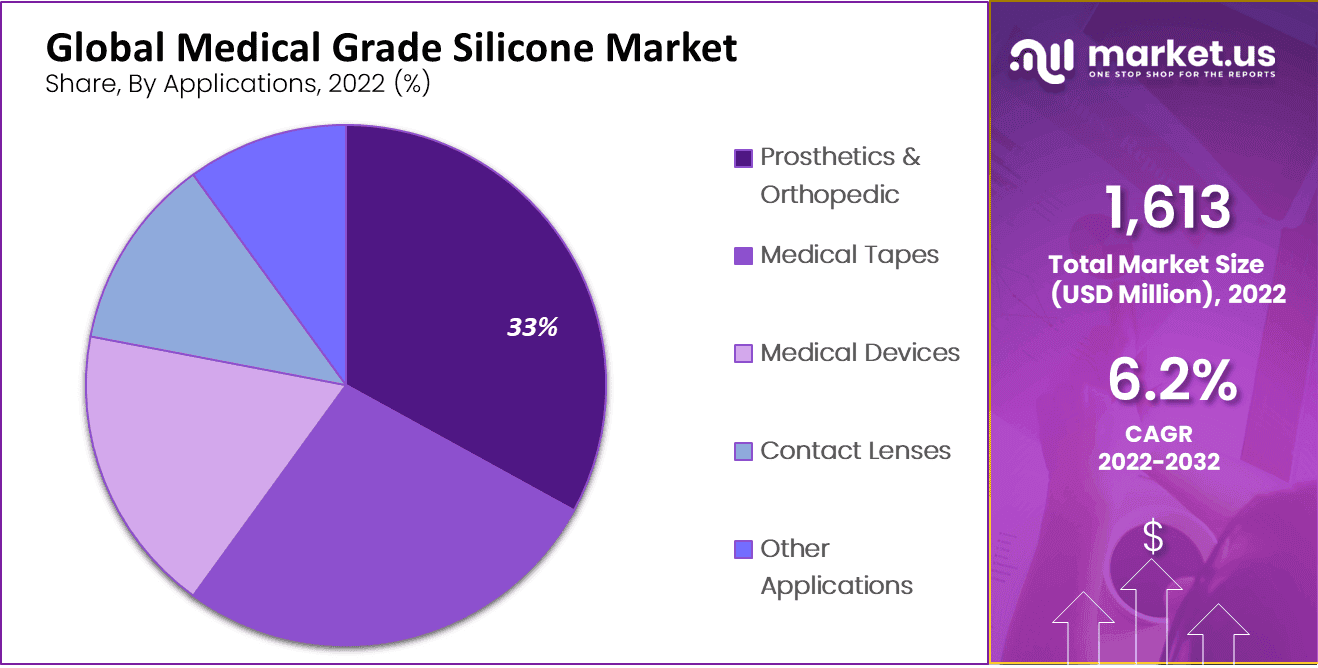

- The prosthetics & orthopedic segment has the largest revenue share at 33% for medical grade silicone applications.

- Medical tape is often used to manage scars and on sensitive skin.

- Silicone hydrogel lenses are more porous, leading to higher oxygen permeability, driving their demand.

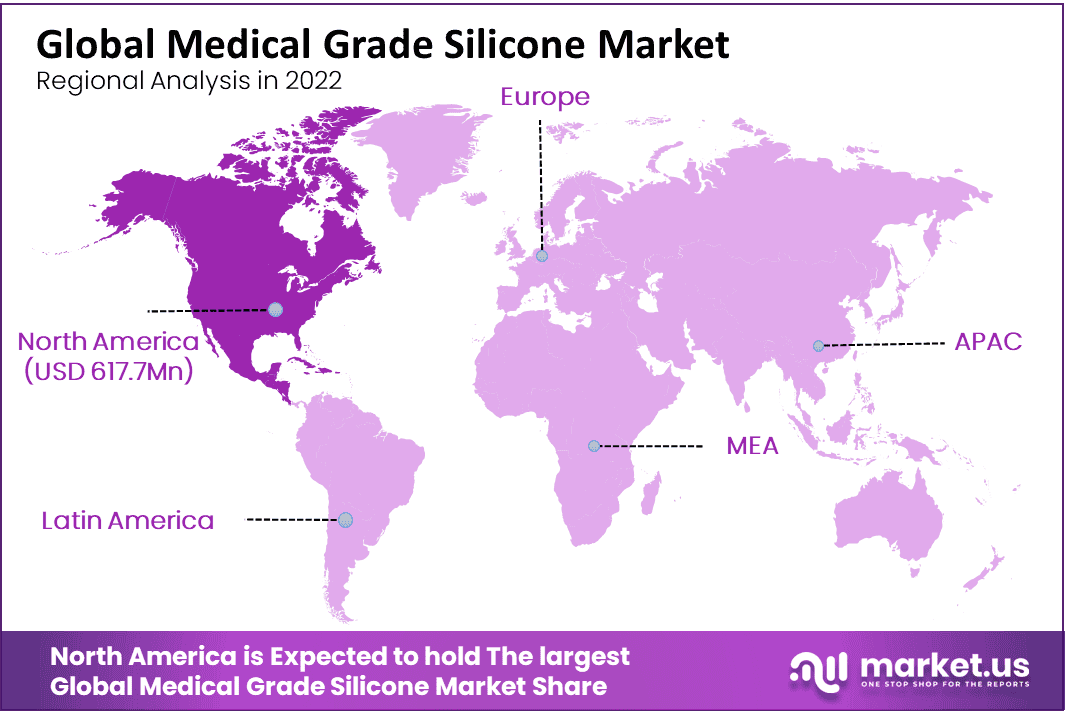

- North America held the most significant market share of 38.3% in 2022.

- In North America, a key trend influencing the market is the rising healthcare spending per capita.

- The Asia Pacific is expected to see substantial growth due to increased healthcare expenditure and continuous R&D activities.

Type Analysis

Liquid silicone rubber is anticipated to hold the largest market share of 28%

Based on product form the global medical grade silicone market size is segmented into gels, medical coatings, medical adhesives, liquid silicon rubbers, and other products. Silicone rubber with its diverse properties has the potential to propel market expansion. Liquid silicone rubber is expected to acquire the largest market share due to its improved biocompatibility, resistance to higher temperatures, chemical resistance, and bacterial resistance. Thus it heightened interest in silicone devices of a medical grade.

Numerous characteristics and properties of medical devices resulted in increased production and manufacturing of medical components with improved performance. Sterilization, self-adhesiveness, and water resistance are all features of silicone rubber. An increase in demand for silicone rubber could boost the medical grade silicone market growth and bring in more money.

Silicone gels are typically made of a silicone elastomer that has been lightly cross-linked and has had its polymer network expanded by silicone fluids or, less frequently, nonsilicone fluids like mineral oil. Due to a number of properties, including resistance, high and low temperature, excellent hydrophobicity, and high dielectric breakdown, the product is expected to gain a lot of market share in the coming years. The rising demand for medical adhesives is subjected to the ability to stop fluid leaking from surgical incisions and wounds. There will be a greater potential for the expansion of medical adhesives and sealants that have been clinically demonstrated to shorten healing times and are also inexpensive.

On the other hand, the benefits associated with medical coatings such as flame resistance, waterproofing, weldability, thermal resistance, durability, abrasion resistance, air holding capabilities, and noise abatement capabilities are expected to drive the growth of this segment.

Applications Analysis

The prosthetics & orthopedic segment dominated the market with the largest revenue share of 33%

Based on application, the market for medical grade silicone market share is divided into prosthetics & orthopedic, medical tapes, medical devices, contact lenses, and other applications. Among these segments, prosthetics & orthopedics held the largest market share and are predicted to grow more over the forecast period. The market for medical grade silicone market size is significantly fueled by rising demand for prosthetics, breast implants, and replacement joints made of arthritic or destroyed silicone. Additionally, it is anticipated that the worldwide rise in the number of knee replacement surgeries will increase the demand for orthopedics over the forecast period.

People who have lost limbs can live better and function better with prostheses. When medical grade silicone is used, major prosthetic applications include implants and limbs. Due to their physical properties of chemical inertness, dimensional stability, thermal stability, flexibility, elasticity, and skin-like texture, medical grade silicones are utilized in the production of prosthetics. Silicone of a medical grade is used in orthopedic components to provide support and comfort over time. Silicone has excellent shock absorption, is non-toxic, has high strength, and is crystalline. It relieves pain and discomfort by releasing the impact and force on the joints, heels, and back. Long-term medical implants for orthopedic surgeries and sports medicine make use of medical grade silicone.

Medical tape can be used as a secondary dressing or as a window tape to keep devices, tubing, or dressings in place and keep the surface and edge seal waterproof. It is used on skin that is sensitive and to help manage scars. Compared to standard hydrogel lenses, silicone hydrogel lenses are a type of soft contact lens that is more porous, allowing more oxygen to enter the cornea. It improves the lenses’ oxygen permeability by combining hydrogel and silicone. They are an excellent option for long-term use. Due to this feature, the contact lens segment is predicted to grow more in the coming years.

The growth of the medical devices sector in the United States is anticipated to be fueled by demand for medical grade silicone rubber, which in turn is anticipated to be fueled by rising demand for advanced healthcare services as a result of the availability of well-developed healthcare infrastructure and reimbursement coverage.

Key Market Segments

Based on Type

- Gels

- Medical Coatings

- Medical Adhesives

- Liquid Silicon Rubbers

- Other Types

Based on Applications

- Prosthetics & Orthopedic

- Medical Tapes

- Medical Devices

- Contact Lenses

- Other Applications

Driving Factors

An increasing number of medical-grade silicone-based implantable devices.

Medical devices that are used in surgery, implantation, or to replace biological parts are in advanced development. The requirements for newly developed medical devices are met either internally or externally and a greater emphasis on the creation of medical devices and medications that support the body’s ability to function. Utilization of medical grade silicone in orthopedics, cardiovascular disorders, neuropathic disorders, and other therapeutic disorders in various clinical settings which contributes to expanding the market for medical grade silicone market growth by increasing demand and revenue share.

Prevalence of the chronic disorder

An increase aids market expansion in the number of chronic disorders among the population. The medical grade silicone market growth sees an increase in the number of devices it sells as a result of an increase in the number of geriatric patients, an increase in the number of accidents, and an increase in the demand for disposable medical devices and surgical instruments. In addition, the healthcare industry’s demands are growing, and the market is expanding.

Restraining Factors

Higher cost of the medical-grade silicone devices

The integration of medical components in the body that support the organs and tissues, as well as the advanced development of new technologies with enhanced features and performance for surgical devices, resulted in an increase in the price of disorders-related medical devices and components. The market for medical-grade silicone may be more severely affected by the rising cost of silicone-based medical devices.

Trending Factors

Increasing expenditure and rising infrastructure in healthcare sectors

The demand for silicone in the medical devices market in developing nations like China, India, Thailand, Malaysia, and others is anticipated to rise as a result of rising expenditures and a greater emphasis on healthcare, rising construction of hospitals and clinics, and growing establishment of public health insurance.

It is anticipated that the expansion of healthcare infrastructure will be fueled by the aging population and rising income levels in developing nations. Additionally, it is anticipated that the global harmonization of standards and regulatory requirements will aid in the overall expansion of the medical silicone market.

Lack of Skills

With new developments integrated into medical devices, there has been an increase in the number of surgeries performed, including knee arthroplasty, cardiovascular disorders, and other surgeries. These surgeries use new medical components designed with more functions and procedures. The individuals’ lack of skill may impede the market’s expansion.

Availability of alternative medical devices

There are a number of alternatives to medical grade silicone based devices, and the market’s current advanced technologies have the potential to alter the medical grade silicone market share, resulting in a lower revenue share for medical grade silicone-based devices.

Growth Opportunities

Rising healthcare facilities

Improved facilities in hospitals for medical component development, including new developments and expanded functions in various disorders like cardiovascular, orthopedic, prosthetic, and other complications, emerged alongside the emerging opportunities in the market for medical grade silicone. A greater number of medical grade silicone based components contributes to the expansion of the market.

Increasing government support

Market share is increased by rising demand for new technologies and infrastructures created through the development of medical grade silicone devices. Increased investment in new innovative developments in medical grade silicone devices with improved results and good response, as well as increased government interest in developing new medical devices based on silicone material with increased benefits like reduced weight, contributes to the generation of more opportunities.

Regional Analysis

North America is anticipated to emerge as a lucrative market

Based on region, the market for medical grade silicone market growth is classified into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Among these regions, North America dominated the market holding the largest market share of 38.3% in 2022.

One of the major trends that have had an impact on the market for medical grade silicone rubber in North America is the rising healthcare spending per capita in the form of health insurance in the United States. The demand for medical grade silicone rubber in the region is expected to rise as a result of this rising demand for surgical instruments, disposable devices, catheters, and other medical devices in the coming years.

The Asia Pacific is predicted to witness substantial growth in the coming years due to the surge in healthcare expenditure and continuous R & D activities. Over the next ten years, Europe is expected to experience significant growth.

It is anticipated that the region will emerge as a lucrative market for implants, led by nations like Germany and the United Kingdom. Government drives to further develop medical care framework and broad use of clinical level silicone in medical procedures is supposed to support market development in the region.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to the presence of numerous manufacturers, particularly in the United States, Germany, and China, the market is highly competitive. Numerous major players dominate the industry. There are a lot of different manufacturers competing for the same share of the global market.

Prosthetics, orthopedic components, devices, tapes, and oral care products all make use of medical silicone. To expand their market share, major players employ tactics like strategic innovations, production capacity expansions, distribution and branding, mergers, joint ventures, and acquisitions.

Market Key Players

Listed below are some of the most prominent medical grade silicone market players

- Dow Corning Corporation

- Momentive Inc.

- Wacker Chemie AG

- KCC Corporation

- Elkem Silicones

- NuSil Technology LLC

- Shin-Etsu Chemical Co., Ltd.

- Wynca Group

- Compagnie de Saint-Gobain S.A.

- Primasil Silicones Limited

- Other Key Players

Recent Developments

- Dow Corning Corporation (April 2024): Dow Corning Corporation acquired Silicones Inc., a specialty silicone manufacturer. This acquisition aims to enhance Dow Corning’s product offerings in the medical grade silicone market, providing advanced solutions for medical device manufacturing and healthcare applications.

- Momentive Inc. (May 2024): launched SilPlus 9400, a new high-performance medical grade silicone, in May 2024. This product is designed for use in medical devices, offering superior biocompatibility, durability, and ease of processing, meeting stringent medical industry standards.

- Wacker Chemie AG (March 2024): Wacker Chemie AG announced a merger with Medical Silicone Inc. in March 2024. This merger aims to combine their expertise and expand their product portfolio, enhancing their capabilities in providing high-quality medical grade silicones for various healthcare applications.

- KCC Corporation (February 2024): KCC Corporation acquired Specialty Silicone Products Inc. in February 2024. This strategic acquisition is expected to strengthen KCC’s position in the medical grade silicone market by expanding its product range and improving its global market presence.

- Elkem Silicones (April 2024): Elkem Silicones introduced the Bluesil MED 6800 series in April 2024, a range of medical grade silicones designed for implantable devices. These products offer excellent biocompatibility, mechanical properties, and long-term stability, addressing the needs of the medical device industry.

- NuSil Technology LLC (January 2024): NuSil Technology LLC merged with Avantor, Inc. This merger aims to leverage Avantor’s extensive distribution network and NuSil’s expertise in medical grade silicones to deliver innovative solutions and enhance their market reach in the healthcare sector.

Report Scope:

Report Features Description Market Value (2023) USD 1,713 Million Forecast Revenue (2032) USD 2,900 Million CAGR (2023-2032) 6.2% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type – Gels, Medical Coatings, Medical Adhesives, Liquid Silicon Rubbers, and Other Types; By Applications – Prosthetics & Orthopedic, Medical Tapes, Medical Devices, Contact Lenses, and Other Applications Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Dow Corning Corporation, Momentive Inc., Wacker Chemie AG, KCC Corporation, Elkem Silicones, NuSil Technology LLC, Shin-Etsu Chemical Co., Ltd., Wynca Group, Compagnie de Saint-Gobain S.A., Primasil Silicones Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is medical grade silicone?Medical grade silicone is a high-purity, biocompatible material used in medical devices and healthcare applications. It is known for its flexibility, durability, and resistance to extreme temperatures and chemicals.

How big is the Medical Grade Silicone Market?The global Medical Grade Silicone Market size was estimated at USD 1,713 Million in 2023 and is expected to reach USD 2,900 Million in 2032.

Who are the key companies/players in the Medical Grade Silicone Market?Some of the key players in the Medical Grade Silicone Markets are Dow Corning Corporation, Momentive Inc., Wacker Chemie AG, KCC Corporation, Elkem Silicones, NuSil Technology LLC, Shin-Etsu Chemical Co., Ltd., Wynca Group, Compagnie de Saint-Gobain S.A., Primasil Silicones Limited, Other Key Players.

What are the benefits of using medical grade silicone?Benefits include excellent biocompatibility, high flexibility, durability, resistance to sterilization processes, and minimal risk of allergic reactions. These properties make it ideal for medical and healthcare applications.

What factors drive the growth of the medical grade silicone market?Factors driving market growth include increasing demand for medical devices, advancements in medical technology, rising healthcare expenditures, and the growing aging population. The unique properties of medical grade silicone also contribute to its widespread adoption.

What challenges does the medical grade silicone market face?Challenges include high production costs, stringent regulatory requirements, and competition from alternative materials. Ensuring consistent quality and performance of silicone products is also crucial for maintaining market trust and compliance.

How is the medical grade silicone market expected to evolve?The market is expected to grow with continuous advancements in medical technology and increased investments in healthcare infrastructure. Innovation in silicone formulations and new applications in emerging medical fields will further drive market expansion.

Medical Grade Silicone MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Medical Grade Silicone MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Dow Corning Corporation

- Momentive Inc.

- Wacker Chemie AG

- KCC Corporation

- Elkem Silicones

- NuSil Technology LLC

- Shin-Etsu Chemical Co., Ltd.

- Wynca Group

- Compagnie de Saint-Gobain S.A.

- Primasil Silicones Limited

- Other Key Players