Global Maternal Nutrition Supplement Market Size, Share, And Industry Analysis Report By Product Type (Vitamins, Minerals, Proteins, Omega-3 Fatty Acids, Probiotics), By Form (Tablets, Capsules, Powders, Liquids), By End User (Pregnant Women, Lactating Mothers), By Distribution Channel (Online Stores, Pharmacies, Supermarkets and Hypermarkets, Specialty Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169845

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

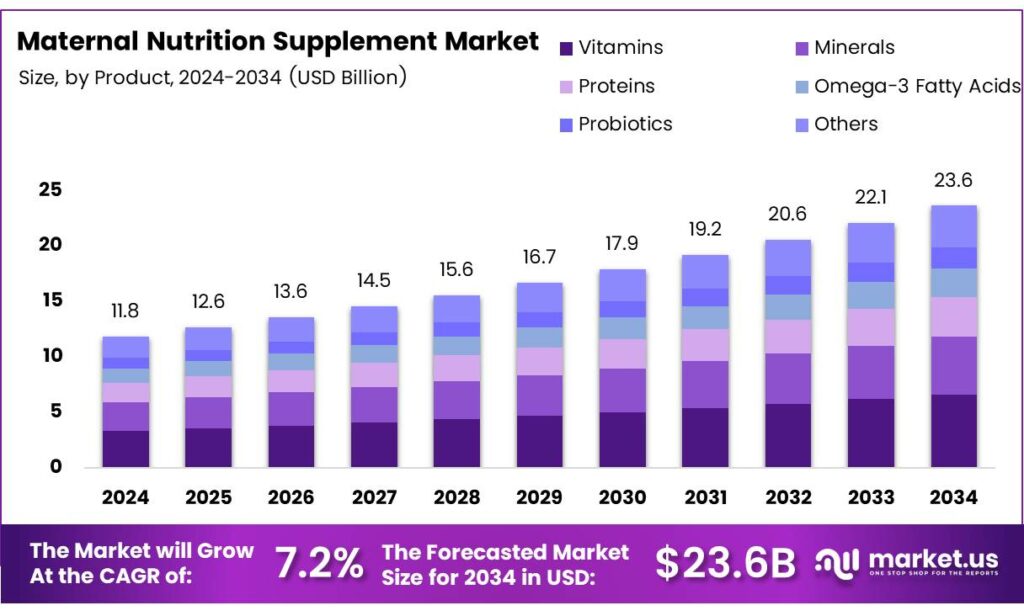

The Global Maternal Nutrition Supplement Market size is expected to be worth around USD 23.6 billion by 2034, from USD 11.8 billion in 2024, growing at a CAGR of 7.2% during the forecast period from 2025 to 2034.

The maternal nutrition supplement market refers to products designed to support women before, during, and after pregnancy. These supplements deliver essential vitamins, minerals, and micronutrients that improve maternal health outcomes. As awareness of prenatal nutrition rises, the market increasingly aligns with preventive healthcare, maternal wellness, and healthy infant development strategies.

The market benefits from rising institutional focus on maternal and child health nutrition. Governments, NGOs, and development agencies increasingly integrate prenatal supplementation into national nutrition programs. Consequently, demand strengthens across antenatal care centers, public distribution systems, and pharmacies, supported by nutrition education and wider healthcare access in emerging economies.

Evidence from WHO, The Lancet, and UNICEF-supported research shows that multiple micronutrient supplementation during pregnancy delivers strong maternal and newborn health benefits. Prenatal MMS reduces low birthweight by 12–14%, preterm births by 6–8%, small-for-gestational-age births by 2–9%, and stillbirths by 8%, with greater effects seen among nutritionally vulnerable mothers.

- Among anemic or underweight women, the risk of low birthweight drops by 19%, while infant mortality at six months declines by 29%. In addition, MMS lowers stunting by 9%, underweight by 13%, wasting by 10%, and small head circumference by 12% at birth, with the combined risk of stunting or underweight falling by 14% by three months, confirming sustained early-life growth benefits.

The Copenhagen Consensus ranks MMS among the top development investments, delivering returns above 37 USD for every dollar spent. MMS TAG modeling across 25 low- and middle-income countries estimates avoidance of 3,514,594 low birthweight births and economic gains between USD 7.1 billion and USD 107.6 billion. Replacement costs remain modest at 0.5–3.0% of nutrition budgets, with UNIMMAP MMS costing about USD 2.5 per pregnancy.

Key Takeaways

Key Takeaways

- The Global Maternal Nutrition Supplement Market is projected to reach USD 23.6 billion by 2034, growing from USD 11.8 billion in 2024 at a 7.2% CAGR.

- Vitamins dominate the product landscape with a market share of 34.8%, reflecting their essential role in prenatal and postnatal nutrition.

- Tablets lead the dosage form segment, accounting for 33.4% of total market demand due to dosing convenience and clinical preference.

- Pregnant women represent the largest end-user group, holding a dominant share of 67.9% driven by higher nutrient requirements.

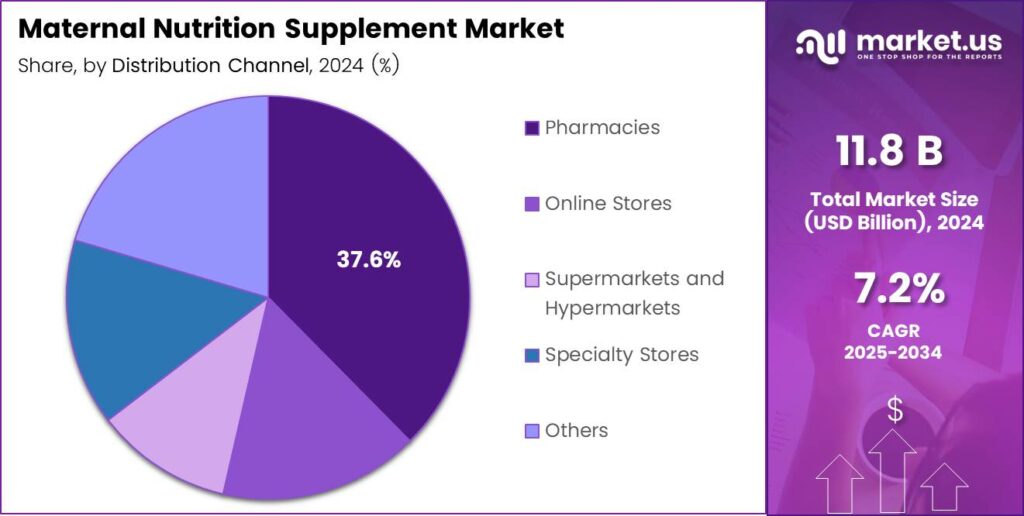

- Pharmacies remain the primary distribution channel with a market share of 37.6%, supported by professional guidance and trust.

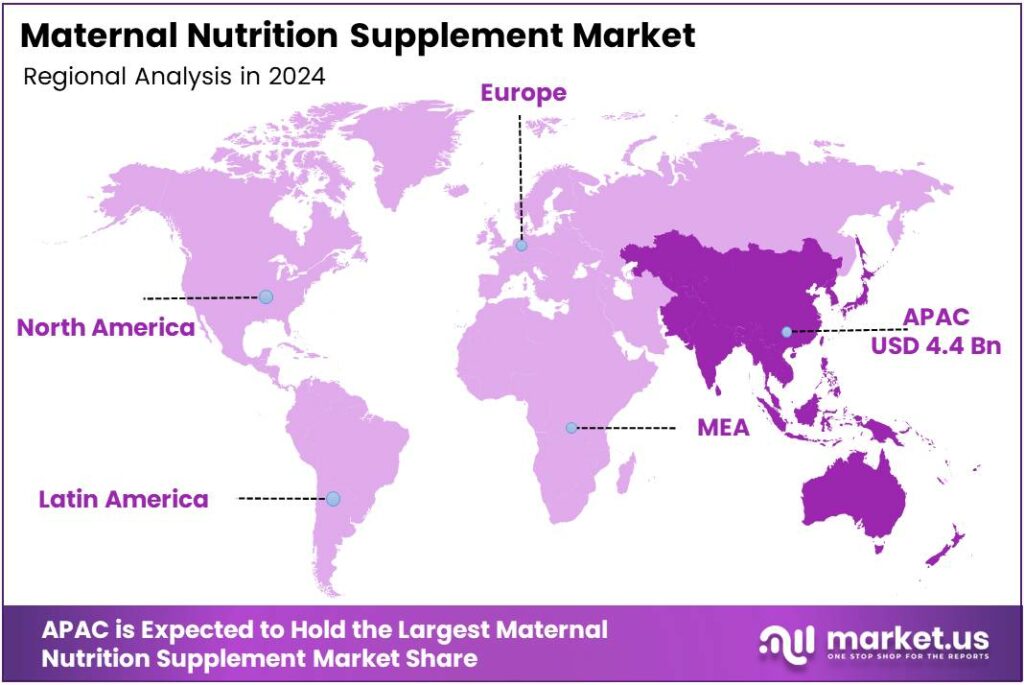

- Asia Pacific emerges as the leading regional market with a share of 37.5%, valued at USD 4.4 billion, driven by high birth rates and public nutrition programs.

By Product Type Analysis

Vitamins dominate with 34.8% due to their essential role in supporting maternal and fetal health throughout pregnancy.

In 2024, Vitamins held a dominant market position in the By Product Type Analysis segment of the Maternal Nutrition Supplement Market, with a 34.8% share. Vitamins are widely recommended to address common deficiencies during pregnancy. Moreover, they support immunity, fetal development, and energy needs, making them a trusted daily choice.

Minerals continue to hold a meaningful position as they help meet increased iron, calcium, and zinc needs. They are frequently prescribed to support bone health and prevent anemia. As awareness grows, mineral supplements are becoming a routine part of prenatal nutrition planning.

Proteins play a supportive role by aiding tissue growth and fetal development. Expectant mothers increasingly recognize protein supplements as convenient options when dietary intake falls short. Therefore, this segment supports balanced maternal nutrition alongside traditional diets.

Omega-3 Fatty Acids are valued for supporting brain and eye development of the fetus. Their role in reducing pregnancy-related complications improves their acceptance. Gradually, healthcare guidance is encouraging expectant mothers to include omega-based supplements.

By Form Analysis

Tablets dominate with 33.4% owing to ease of dosing and widespread medical acceptance.

In 2024, Tablets held a dominant market position in the By Form Analysis segment of the Maternal Nutrition Supplement Market, with a 33.4% share. Tablets are easy to store, prescribe, and consume daily. As a result, they remain the preferred option among healthcare providers.

Capsules offer improved absorption and reduced aftertaste, appealing to sensitive users. They are especially preferred for oil-based nutrients such as omega supplements. Hence, capsules continue gaining attention for comfort-led consumption. Powders provide flexibility in intake, allowing mixing with food or beverages.

Liquids are favored for faster absorption and ease of consumption. They are suitable for women experiencing nausea. Gradually, liquids are becoming popular for rapid nutritional support during pregnancy. Others include gummies and chewables that enhance compliance. These formats focus on taste and ease.

By End User Analysis

Pregnant Women dominate with 67.9% due to increased nutritional requirements during pregnancy.

In 2024, Pregnant Women held a dominant market position in the by end-user analysis segment of the Maternal Nutrition Supplement Market, with a 67.9% share. This group requires higher nutrient intake to support fetal growth. Consequently, supplementation becomes a medical priority.

Lactating Mothers represent an important segment focused on postnatal recovery and infant nutrition. Supplements support milk quality and maternal energy needs. Therefore, this segment ensures continuity of nutritional care after childbirth.

By Distribution Channel Analysis

Pharmacies dominate with 37.6% as trusted and accessible points of purchase.

In 2024, Pharmacies held a dominant market position in the By Distribution Channel Analysis segment of the Maternal Nutrition Supplement Market, with a 37.6% share. They offer professional guidance and prescription-based access. Hence, consumers rely on pharmacies for safety assurance.

Online Stores are steadily expanding due to convenience and home delivery. Expectant mothers value easy access and privacy. As digital health awareness increases, online channels continue to strengthen. Supermarkets and Hypermarkets provide wide product visibility and affordability.

Specialty Stores focus on premium and tailored nutrition solutions. They attract consumers seeking expert advice. Gradually, they contribute to informed purchasing decisions. Others include clinics and direct sales channels supporting localized access. These channels serve specific communities. As a result, they complement mainstream distribution networks.

Key Market Segments

By Product Type

- Vitamins

- Minerals

- Proteins

- Omega-3 Fatty Acids

- Probiotics

- Others

By Form

- Tablets

- Capsules

- Powders

- Liquids

- Others

By End User

- Pregnant Women

- Lactating Mothers

By Distribution Channel

- Online Stores

- Pharmacies

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Emerging Trends

Personalized and Clean-Label Products Shape Emerging Market Trends

Personalization is becoming a major trend in the maternal nutrition supplement market. Women increasingly look for products that match their age, stage of pregnancy, and health condition. This drives interest in customized nutrient blends and condition-specific supplements.

- Clean-label and natural ingredients are another strong trend. Consumers prefer products with fewer additives and clearer ingredient sourcing. According to the World Health Organization (WHO), around 37% of pregnant women worldwide are affected by anemia, mostly due to iron deficiency. This means more than 1 in every 3 pregnant women needs targeted iron support rather than a general supplement.

Digital tools also influence trends. Mobile apps track nutrition intake and suggest supplements, improving daily compliance. Social media and online communities spread shared experiences, shaping buying behavior. These trends reflect a shift toward informed, personalized, and lifestyle-friendly maternal nutrition solutions.

Drivers

Rising Awareness of Maternal Health and Nutrition Drives Market Growth

Growing awareness about the importance of proper nutrition during pregnancy and lactation is a key driver of the maternal nutrition supplement market. Health organizations, doctors, and midwives increasingly educate women about the role of vitamins and minerals in supporting fetal growth and maternal well-being. This awareness helps women understand how nutrition affects birth outcomes and long-term child development.

- Urbanization and better access to healthcare services also support this trend. More women now attend prenatal checkups, where supplements are often recommended as part of routine care. The Food and Agriculture Organization (FAO) and WHO jointly recommend at least 200 mg of DHA per day during pregnancy for healthy brain and eye development of the baby.

Government-supported maternal health programs further encourage supplement use, especially in developing regions. These initiatives aim to reduce anemia, low birth weight, and nutrient deficiencies. Together, education, medical guidance, and public health focus continue to push steady demand for maternal nutrition supplements worldwide.

Restraints

High Cost and Limited Access Create Barriers to Market Expansion

Despite growing demand, high product costs remain a major restraint in the maternal nutrition supplement market. Premium formulations with multiple nutrients or organic ingredients are often expensive, limiting adoption among middle- and low-income populations. Price sensitivity is especially strong in rural and developing areas.

- Limited healthcare access also restricts market growth. In some regions, women lack regular prenatal visits where supplements are recommended. This reduces both awareness and trust in nutritional products. The UNICEF Nutrition Strategy (2020–2030) promotes micronutrient personalization to reduce low-birth-weight cases. UNICEF reports that 20 million babies are born with low birth weight each year, many linked to poor maternal nutrition.

Inconsistent regulations and quality concerns also pose challenges. Poor-quality or counterfeit products can weaken consumer confidence. Without strong regulation and education, some women remain unsure about product safety. These combined issues slow broader adoption, even as health needs continue to rise.

Growth Factors

Expansion of Preventive Healthcare Opens New Growth Opportunities

The shift toward preventive healthcare creates strong growth opportunities for maternal nutrition supplements. Governments and health systems increasingly focus on preventing complications rather than treating them later. Supplements fit well into this approach by supporting healthy pregnancies from early stages.

- Online consultations and e-pharmacies make it easier for women to receive advice and buy trusted products. This is especially helpful where physical healthcare facilities are limited. The WHO reports that iron deficiency is responsible for nearly 50% of anemia cases in pregnant women globally. Anemia during pregnancy increases the risk of premature birth and low birth weight, making iron supplementation essential.

Innovation also brings new opportunities. Companies are developing targeted supplements based on trimester needs, dietary preferences, and specific deficiencies. Fortified foods and drinkable supplements attract consumers who dislike pills. These product improvements, combined with healthcare modernization, support long-term market growth.

Regional Analysis

Asia Pacific Dominates the Maternal Nutrition Supplement Market with a Market Share of 37.5%, Valued at USD 4.4 billion

Asia Pacific remains the leading region in the maternal nutrition supplement market, driven by high birth rates and growing nutrition awareness. Public health programs and improving access to prenatal supplements continue to support demand. The region accounts for 37.5% of the market, with a total value of USD 4.4 billion, reflecting its strong consumption base. Rising urbanization further strengthens routine supplementation adoption across maternal populations.

North America shows steady growth supported by high healthcare spending and strong prenatal care standards. Awareness around maternal health outcomes encourages consistent supplement usage before and during pregnancy. Preventive nutrition practices and clinician-led recommendations remain central to market stability. The region benefits from structured distribution across retail and clinical channels.

Europe’s market is supported by well-established maternal healthcare systems and nutrition guidelines. Emphasis on balanced prenatal diets encourages supplement intake across different pregnancy stages. Regulatory focus on product quality also supports consumer confidence. Demand remains stable across both Western and Eastern European countries.

The United States market is shaped by strong prenatal care practices and high consumer awareness. Supplement use is well-integrated into routine pregnancy planning and monitoring. Healthcare provider guidance plays a key role in sustained demand. Innovation in formulation also supports long-term market maturity.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé S.A. remains a pivotal force in the maternal nutrition supplement space, leveraging its deep expertise in infant and maternal health brands and strong R&D capabilities. The company focuses on clinically backed formulations that address micronutrient gaps during pregnancy and lactation, while expanding in high-growth emerging markets. Its omni-channel presence, including e-commerce and telehealth-linked nutrition programs.

Unilever plc approaches maternal nutrition through a broader health and wellness portfolio, increasingly aligning products with clean-label, sustainable, and affordable positioning. The company capitalizes on its strong presence in Asia, Africa, and Latin America to promote fortified powders, drinks, and functional foods targeted at women of reproductive age. Unilever’s focus on responsible marketing and behavior-change campaigns supports long-term category growth and brand trust.

Bayer AG brings strong pharmaceutical and nutraceutical credentials to the maternal nutrition supplement market, emphasizing evidence-based prenatal vitamins and mineral complexes. With a global footprint in pharmacies and healthcare channels, Bayer is well placed to benefit from physician and obstetrician recommendations. Its investments in clinical data, clear labeling, and risk–benefit communication align with tightening regulations around nutrient claims for pregnant women.

Abbott Laboratories plays a strategic role by integrating maternal nutrition supplements with broader women’s and infant nutrition portfolios. The company utilizes strong clinical research and hospital networks to position its prenatal and perinatal offerings as part of comprehensive care pathways. Abbott’s focus on medical detailing, digital education tools for healthcare professionals, and targeted innovations for gestational diabetes and anemia reinforces its competitive edge in 2024.

Top Key Players in the Market

- Nestlé S.A.

- Unilever plc

- Bayer AG

- Abbott Laboratories

- GSK plc

- Danone S.A.

- Reckitt Benckiser Group PLC

- Hindustan Unilever Limited

- Amway Corp.

Recent Developments

- In 2024, Nestlé introduced two new nutritional solutions under its Materna brand. Materna Pre is a patented blend based on the NiPPeR study (a landmark clinical trial on preconception and pregnancy nutrition), aimed at supporting women’s fertility and early pregnancy health. Materna Nausea targets common pregnancy symptoms like nausea with specialized nutrients.

- In 2025, in India, Bayer entered the prenatal market with Supradyn Mom’s (a comprehensive IFA+ supplement with iron, folic acid, B vitamins, copper, and zinc for maternal health) and Supradyn Naturals Calcium+ (calcium, vitamin D2, and magnesium for bone development).

Report Scope

Report Features Description Market Value (2024) USD 11.8 Billion Forecast Revenue (2034) USD 23.6 Billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vitamins, Minerals, Proteins, Omega-3 Fatty Acids, Probiotics, Others), By Form (Tablets, Capsules, Powders, Liquids, Others), By End User (Pregnant Women, Lactating Mothers), By Distribution Channel (Online Stores, Pharmacies, Supermarkets and Hypermarkets, Specialty Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Nestlé S.A., Unilever plc, Bayer AG, Abbott Laboratories, GSK plc, Danone S.A., Reckitt Benckiser Group PLC, Hindustan Unilever Limited, Amway Corp. Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Maternal Nutrition Supplement MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Maternal Nutrition Supplement MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé S.A.

- Unilever plc

- Bayer AG

- Abbott Laboratories

- GSK plc

- Danone S.A.

- Reckitt Benckiser Group PLC

- Hindustan Unilever Limited

- Amway Corp.