Global Marine Nutraceutical Market Size, Share, And Industry Analysis Report By Form (Liquids, Powder), By Product Type (Functional Foods, Probiotics Fortified Foods, Omega Fatty Acid Fortified Foods, Functional Beverages, Energy Drinks, Health Drinks, Fortified Juices), By Sales Channel (Direct Sales, Indirect Sales), By Active Compounds (Fatty Acids, Vitamins, Minerals, Carotenoids, Marine Collagen), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170562

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

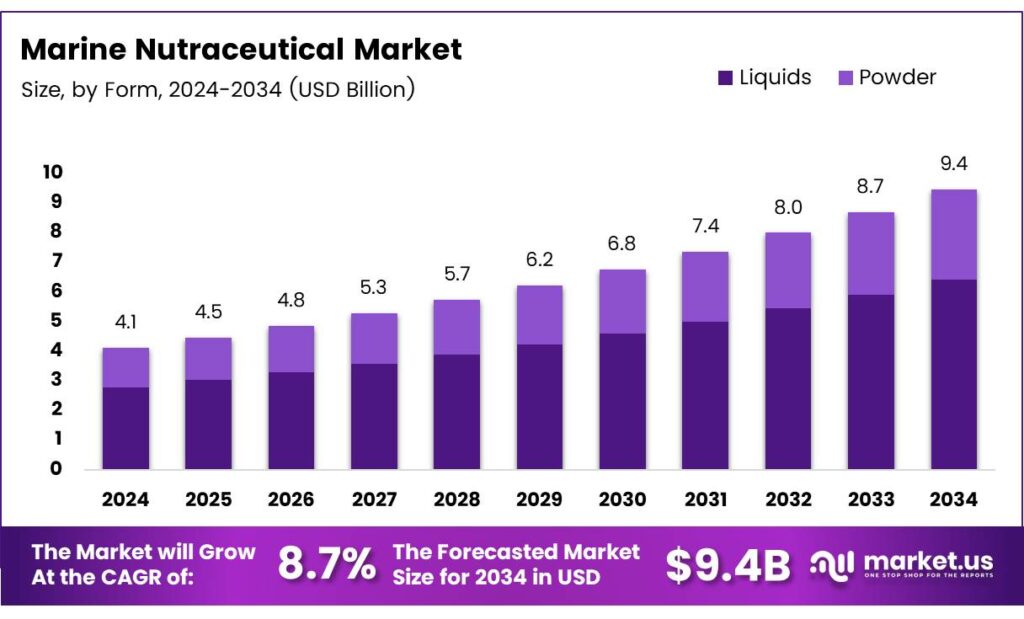

The Global Marine Nutraceutical Market size is expected to be worth around USD 9.4 billion by 2034, from USD 4.1 billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

The marine nutraceutical market covers health-focused ingredients derived from oceans, including algae, fish, crustaceans, and marine microorganisms. These products support preventive healthcare, functional nutrition, and wellness applications. As lifestyles change, marine nutraceuticals increasingly complement pharmaceuticals through bioactive compounds, clean-label positioning, and strong links to natural marine ecosystems.

Marine nutraceuticals themselves represent a category of high-value bioactives such as omega-3s, marine collagen, chitosan, carotenoids, and algae extracts. These ingredients are used in dietary supplements, functional foods, and medical nutrition, offering immunity, cognitive, cardiovascular, and anti-aging benefits, while supporting personalized nutrition strategies and premium wellness positioning.

- Marine ecosystems are widely described as the Natural Medicine Chest of the New Millennium. The global market for marine-derived compounds exceeded 10 billion US dollars and is expected to reach 22 billion US dollars by 2025, highlighting strong commercial momentum.

- The National Institutes of Health, the antioxidant performance of chitosan varies by molecular weight and deacetylation degree. The 1–5 kDa chitosan with 90% deacetylation showed superior O2−, OH, and DPPH radical scavenging, reinforcing marine nutraceutical efficacy and product differentiation.

Market growth is driven by rising health awareness, aging populations, and a preference for natural nutraceutical ingredients. Moreover, marine biodiversity offers unique compounds unavailable in terrestrial sources, strengthening long-term innovation pipelines. Investment interest continues rising across marine biotechnology, sustainable harvesting, algae farming, and advanced extraction technologies.

Marine nutraceutical markets operate under food supplement and novel food frameworks. Authorities emphasize quality control, contaminant limits, and sustainability claims. Therefore, companies align with marine conservation policies, responsible fishing standards, and algae cultivation guidelines to ensure long-term regulatory acceptance and stable international trade flows.

Key Takeaways

- The Global Marine Nutraceutical Market is projected to grow from USD 4.1 billion in 2024 to USD 9.4 billion by 2034, at a CAGR of 8.7%.

- Liquid marine nutraceuticals dominate the market with a share of 61.6%, driven by higher bioavailability and ease of consumption.

- Functional foods lead the product type segment, accounting for a market share of 27.3% in 2024.

- Direct sales remain the primary sales channel, contributing approximately 67.2% of total market revenue.

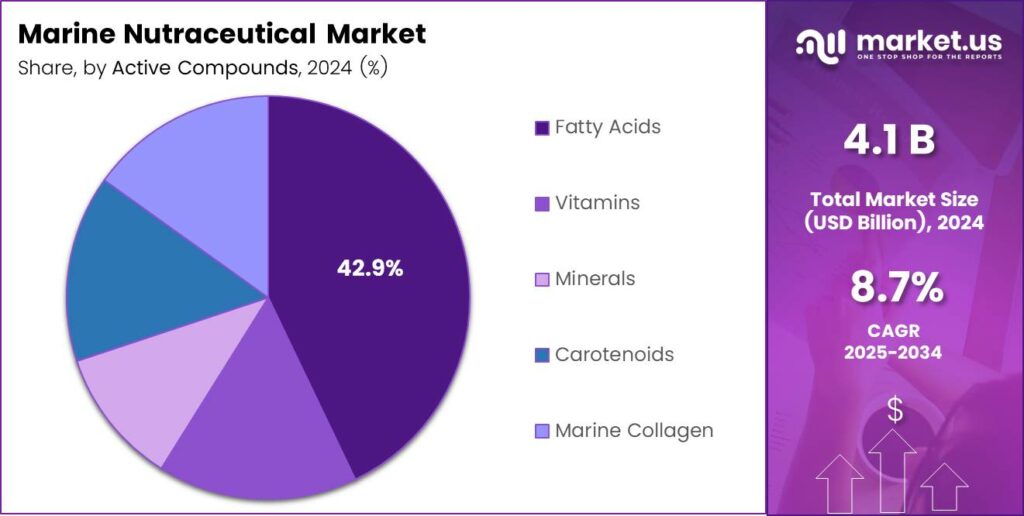

- Fatty acids represent the largest active compound segment, holding a dominant share of 42.9% in the overall market.

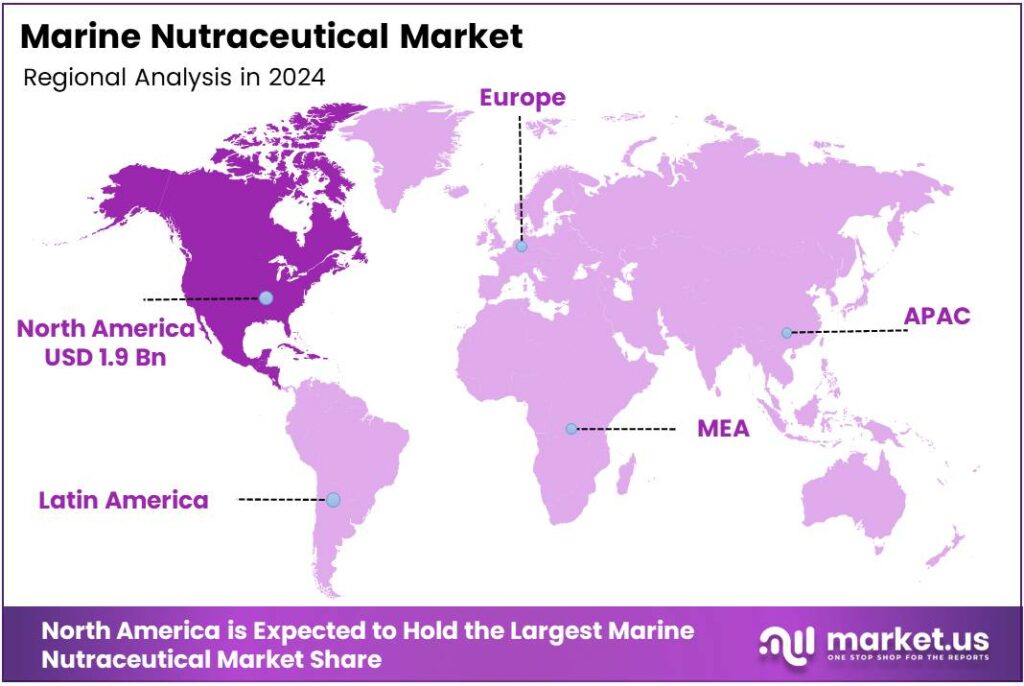

- North America is the leading regional market with a share of 48.5%, valued at around USD 1.9 billion.

By Form Analysis

Liquids dominate with 61.6% due to faster absorption, ease of formulation, and strong demand in functional beverages.

In 2024, Liquids held a dominant market position in the By Form analysis segment of the Marine Nutraceutical Market, with a 61.6% share. This leadership is driven by better bioavailability and convenience. Moreover, liquid formats integrate easily into drinks, supplements, and clinical nutrition, supporting consistent daily consumption.

Powder forms continue to play an important supporting role despite a smaller share. They offer longer shelf life and flexible dosing options. Additionally, powders are widely used in capsules, sachets, and fortified foods, making them attractive for manufacturers targeting cost efficiency and global distribution.

By Product Type Analysis

Functional Foods lead with 27.3% as consumers prefer nutrition integrated into everyday diets.

In 2024, Functional Foods held a dominant market position in the By Product Type analysis segment of the Marine Nutraceutical Market, with a 27.3% share. This dominance reflects rising awareness of preventive health. Marine-based ingredients are increasingly added to daily food products for long-term wellness benefits.

Probiotics Fortified Foods are gaining steady traction as gut health becomes a priority. Marine-derived bioactives complement probiotics, supporting digestion and immunity. Consequently, food producers are expanding marine-based probiotic offerings across dairy alternatives and nutrition bars.

Omega-3 Fatty Acid Fortified Foods remain essential due to strong links with heart and brain health. These products are widely accepted across age groups. Meanwhile, demand stays resilient in bakery, spreads, and ready-to-eat nutrition products.

Functional Beverages benefit from on-the-go consumption trends. Marine nutrients enhance product differentiation. Similarly, Energy Drinks use marine compounds for endurance positioning, while Health Drinks focus on immunity and recovery. Fortified Juices appeal to mainstream consumers, and Others cover niche formats and emerging applications.

By Sales Channel Analysis

Direct Sales dominate with 67.2%, supported by stronger brand control and consumer trust.

In 2024, Direct Sales held a dominant market position in the By Sales Channel analysis segment of the Marine Nutraceutical Market, with a 67.2% share. This channel benefits from transparent communication and personalized offerings. Additionally, companies leverage direct platforms to educate consumers about marine-based health benefits.

Indirect Sales continue to expand through pharmacies, specialty stores, and online marketplaces. They help brands reach wider geographies efficiently. However, reliance on intermediaries limits margin control, making indirect channels more supportive rather than leading in overall market contribution.

By Active Compounds Analysis

Fatty Acids lead with 42.9% due to strong clinical backing and broad consumer awareness.

In 2024, Fatty Acids held a dominant market position in the By Active Compounds analysis segment of the Marine Nutraceutical Market, with a 42.9% share. Their dominance is supported by extensive use in cardiovascular and cognitive health products, reinforcing trust among healthcare professionals and consumers.

Vitamins derived from marine sources support immunity and metabolic health. They are commonly blended into supplements and foods. Meanwhile, Minerals from marine origins attract interest for bone and electrolyte balance, especially in sports nutrition.

Carotenoids are valued for their antioxidant properties and skin health applications. Their natural marine origin adds premium appeal. In parallel, Marine Collagen sees rising adoption in beauty-from-within products, supporting joint, skin, and anti-aging nutrition trends.

Key Market Segments

By Form

- Liquids

- Powder

By Product Type

- Functional Foods

- Probiotics Fortified Foods

- Omega Fatty Acid Fortified Foods

- Functional Beverages

- Energy Drinks

- Health Drinks

- Fortified Juices

- Others

By Sales Channel

- Direct Sales

- Indirect Sales

By Active Compounds

- Fatty Acids

- Vitamins

- Minerals

- Carotenoids

- Marine Collagen

Emerging Trends

Shift Toward Clean-Label and Algae-Based Solutions Shapes Market Trends

A key trend in the marine nutraceutical market is the growing demand for clean-label products. Consumers prefer supplements with simple ingredients, clear sourcing, and minimal processing. This pushes manufacturers to improve transparency and traceability.

- Algae-based omega-3 products are gaining popularity as alternatives to fish oil. They support sustainability goals and meet the needs of vegetarian and vegan consumers. The United Nations’ Food and Agriculture Organization (FAO), global fisheries and aquaculture production reached 223.2 million tonnes, up 4.4% compared with 2020.

Personalized nutrition is also trending, with marine nutraceuticals being used in customized health solutions. Innovation in delivery formats, such as gummies, powders, and ready-to-mix sachets, is enhancing consumer convenience. These trends collectively enhance product appeal and support long-term market development.

Drivers

Rising Consumer Focus on Preventive Healthcare Drives Market Growth

The marine nutraceutical market is mainly driven by growing awareness about preventive healthcare. Consumers are increasingly choosing natural supplements to manage long-term health concerns such as heart health, joint mobility, and immunity. Marine-based ingredients like omega-3 fatty acids, marine collagen, and algae extracts are seen as clean and trustworthy options.

Another strong driver is the rising aging population worldwide. Older consumers prefer nutraceuticals that support bone strength, cognitive health, and inflammation management. Marine nutraceuticals fit well into this demand due to their high bioavailability and functional benefits.

In addition, scientific studies supporting the health benefits of marine compounds continue to build confidence among healthcare professionals and consumers. This improves acceptance across pharmacies, wellness stores, and online platforms. Growing disposable income and lifestyle-related health issues further support steady market demand.

Restraints

High Production Costs and Sustainability Concerns Limit Market Expansion

One major restraint in the marine nutraceutical market is the high cost of sourcing and processing marine raw materials. Extracting active compounds from fish, algae, or crustaceans requires advanced technology, which increases product prices. This limits adoption in price-sensitive markets.

- Sustainability concerns also create challenges. Overfishing, marine pollution, and strict environmental regulations affect the availability of raw materials. The World Health Organization advises regular fish intake equivalent to 200 – 500 mg of EPA and DHA per day, roughly matching 1 to 2 servings of seafood per week for heart health.

Companies must invest in responsible sourcing and certifications, which add to operational costs. Regulatory differences across countries slow down product approvals. Complex labeling rules and health-claim restrictions make it difficult for new brands to enter the market quickly. Limited consumer awareness in developing regions further restricts market growth.

Growth Factors

Expansion of Functional Foods Creates New Growth Opportunities

The integration of marine nutraceuticals into functional foods offers strong growth opportunities. Food and beverage brands are adding marine ingredients into snacks, dairy alternatives, and fortified drinks to meet daily nutrition needs. This expands usage beyond traditional supplements.

Algae-based nutraceuticals present another opportunity due to their plant-like positioning and sustainable appeal. They attract vegan and environmentally conscious consumers. Technological advancements are also improving extraction efficiency, reducing costs over time.

Emerging markets in Asia-Pacific and Latin America offer untapped potential as awareness of marine nutrition grows. Online retail and direct-to-consumer models enable brands to reach a wider audience with targeted education and marketing.

Regional Analysis

North America Dominates the Marine Nutraceutical Market with a Market Share of 48.5%, Valued at USD 1.9 Billion

North America leads the marine nutraceutical market, holding a dominant share of 48.5% and reaching a value of USD 1.9 billion. This strong position is supported by high consumer awareness of preventive healthcare, growing demand for omega-3 supplements, and widespread acceptance of functional foods. The region also benefits from advanced marine ingredient processing and strong regulatory clarity.

Europe represents a mature and well-regulated market for marine nutraceuticals, driven by strong interest in heart health, cognitive wellness, and natural nutrition solutions. Consumers across the region increasingly prefer clean-label and sustainably sourced marine ingredients. Supportive food safety frameworks and emphasis on traceability further strengthen market confidence. Additionally, growing adoption of marine collagen and algae-based supplements supports stable regional demand.

Asia Pacific is emerging as a high-growth region due to expanding middle-class populations and rising health awareness. Traditional diets rich in seafood, combined with increasing use of nutraceutical supplements, support market expansion. Urbanization and growing disposable incomes are accelerating demand for marine-based functional foods. The region also benefits from abundant marine resources, which enhance supply-side potential.

Latin America shows moderate growth in marine nutraceutical consumption, driven by rising interest in natural health products and dietary supplements. Increasing focus on cardiovascular health and fitness supports demand for marine-derived nutrients. Expanding retail access and improving consumer education are helping the market gain traction. However, price sensitivity continues to influence purchasing behavior across several countries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

GFR Pharma benefits from steady demand for marine-sourced actives used in premium supplements, especially where buyers want cleaner labels and traceable inputs. An analyst watchpoint is its ability to secure consistent raw-material quality and document origin across batches. Faster product development cycles and tighter compliance support stronger positioning with brand owners.

Amway Corp. remains influential because its direct-selling scale can quickly translate ingredient trends into high-volume nutraceutical programs. The company’s advantage is consumer education and repeat purchasing, which helps launch marine-based formats without relying only on retail shelf competition. Execution risk lies in maintaining strong science-backed claims while tailoring products to diverse regional regulations.

General Mills Inc. is more of a strategic ecosystem player, with the capability to connect functional nutrition themes to mainstream food and beverage platforms. The key opportunity is bridging “everyday wellness” with marine-derived ingredients through convenient formats and trusted household brands. The constraint is ensuring taste, stability, and transparent messaging so marine actives feel approachable to mass consumers.

Abbott Laboratories is well-placed where marine nutraceuticals overlap with clinical nutrition and evidence-led health positioning. Its strength is rigorous validation, disciplined formulation, and strong channel access in healthcare-adjacent settings. The near-term edge comes from converting research into differentiated benefits while managing stringent labeling, safety, and substantiation standards across markets.

Top Key Players in the Market

- GFR Pharma

- Amway Corp.

- General Mills Inc.

- Abbott Laboratories

- Roquette Kloetze

- AlgaNovo International Co., Ltd.

- EID Parry

- BASF

- Cyanotech

Recent Developments

- In 2025, GFR Pharma, a Canadian GMP-certified contract manufacturer specializing in natural health products (NHPs) such as tablets, capsules, powders, and liquids, continues to focus on high-quality supplement production. GFR Pharma holds a current NHP manufacturer site licence from Health Canada, emphasizing GMP compliance for marine and other NHP categories.

- In 2025, Amway’s product catalog features Nutrilite Advanced Omega, a premium fish oil supplement providing EPA/DHA for heart, brain, and eye health. This product is bundled in the Everyday Nutrition Solution, alongside multivitamins and plant protein, targeting daily nutrient gaps. It supports Amway’s focus on omega-3 fatty acids from marine algae and fish oils.

Report Scope

Report Features Description Market Value (2024) USD 4.1 Billion Forecast Revenue (2034) USD 9.4 Billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquids, Powder), By Product Type (Functional Foods, Probiotics Fortified Foods, Omega Fatty Acid Fortified Foods, Functional Beverages, Energy Drinks, Health Drinks, Fortified Juices, Others), By Sales Channel (Direct Sales, Indirect Sales), By Active Compounds (Fatty Acids, Vitamins, Minerals, Carotenoids, Marine Collagen) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape GFR Pharma, Amway Corp., General Mills Inc., Abbott Laboratories, Roquette Kloetze, AlgaNovo International Co., Ltd., EID Parry, BASF, Cyanotech Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Marine Nutraceutical MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Marine Nutraceutical MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GFR Pharma

- Amway Corp.

- General Mills Inc.

- Abbott Laboratories

- Roquette Kloetze

- AlgaNovo International Co., Ltd.

- EID Parry

- BASF

- Cyanotech