Global Malt Extracts And Ingredients Market Size, Share, And Business Benefits By Product (Extracts, Ingredients), By Form (Dry, Liquid), By Source (Barley, Wheat, Rye, Others), By Grade (Standard Malt, Specialty Malt (Crystal, Roasted, Dark, Others)), By Application (Beverages (Alcoholic, Non-alcoholic), Food, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150778

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

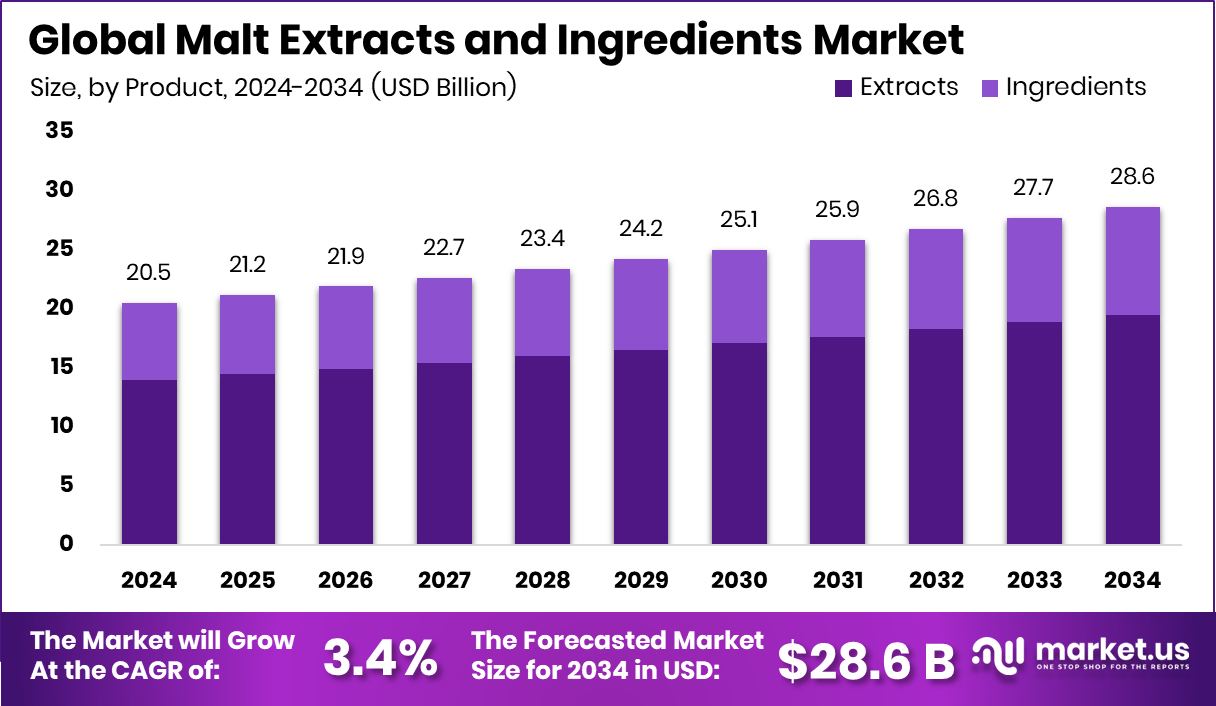

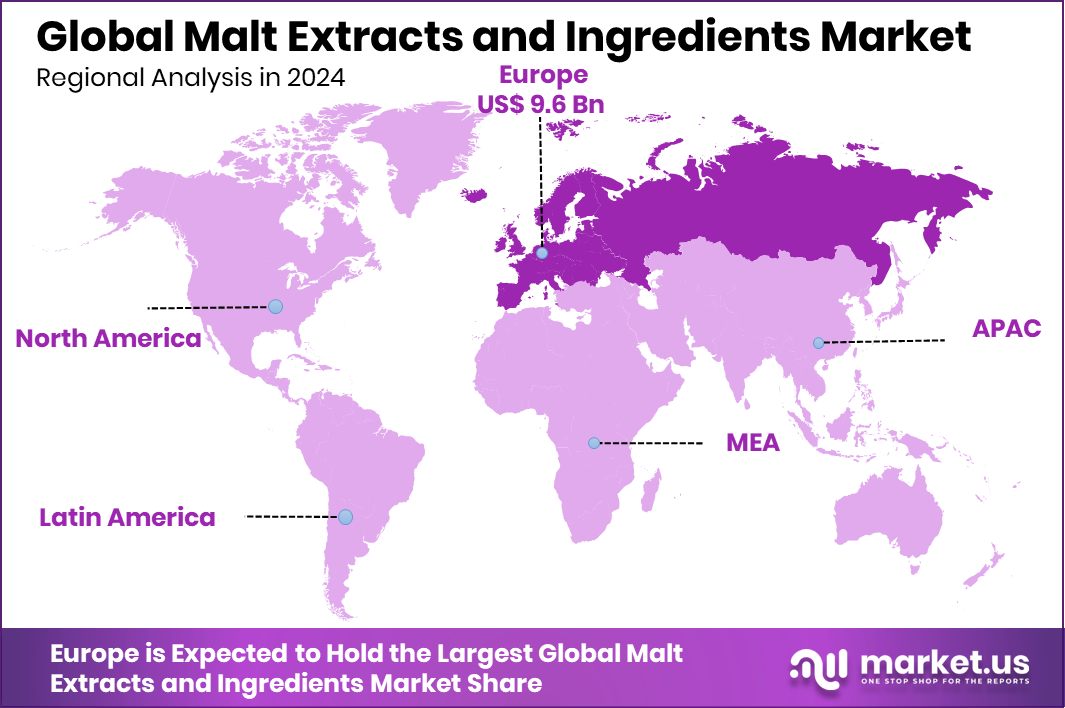

Global Malt Extracts and Ingredients Market is expected to be worth around USD 28.6 billion by 2034, up from USD 20.5 billion in 2024, and grow at a CAGR of 3.4% from 2025 to 2034. Strong demand in food and beverages boosted Europe’s USD 9.6 billion market lead.

Malt extracts and ingredients are derived from malted grains, primarily barley, and are commonly used in the food, beverage, and pharmaceutical industries. These extracts are rich in natural sugars, proteins, vitamins, and minerals, making them highly valuable for enhancing flavor, color, and nutritional content in a wide range of products. They come in liquid and powdered forms and are known for their ability to improve texture and shelf-life, especially in baked goods, cereals, and health supplements.

The malt extracts and ingredients market is steadily growing due to rising consumer preference for natural and clean-label products. Manufacturers are turning to malt-based alternatives as people become more health-conscious and demand transparency in food ingredients. Their versatility and natural origin make them ideal for traditional and modern product formulations. This market is expanding across various regions, particularly where craft food and beverages are gaining popularity.

Growth factors include increasing awareness about the health benefits of malt-based products, such as improved digestion and energy boosting properties. Additionally, the booming bakery and brewing industries continue to drive steady demand. The plant-based food trend also encourages the use of malt as a natural sweetener and flavor enhancer. According to an industry report, a Family-owned malt company unveils a £73 million expansion plan.

Opportunities lie in innovation, such as developing malt extracts tailored for vegan, gluten-free, or fortified products. With growing emphasis on functional foods and clean nutrition, malt ingredients are being explored for their potential in energy bars, infant food, and dietary supplements. This opens new avenues for product development across multiple consumer segments.

Key Takeaways

- Global Malt Extracts and Ingredients Market is expected to be worth around USD 28.6 billion by 2034, up from USD 20.5 billion in 2024, and grow at a CAGR of 3.4% from 2025 to 2034.

- Malt Extracts and Ingredients Market sees 68.2% share dominated by extracts, highlighting product preference.

- Dry form holds 59.1% of the market, favored for its longer shelf life and versatility.

- Barley remains the leading source with a 73.9% share, valued for its rich nutritional profile.

- Standard malt accounts for 68.7% of the market, supporting consistent quality across food and beverage sectors.

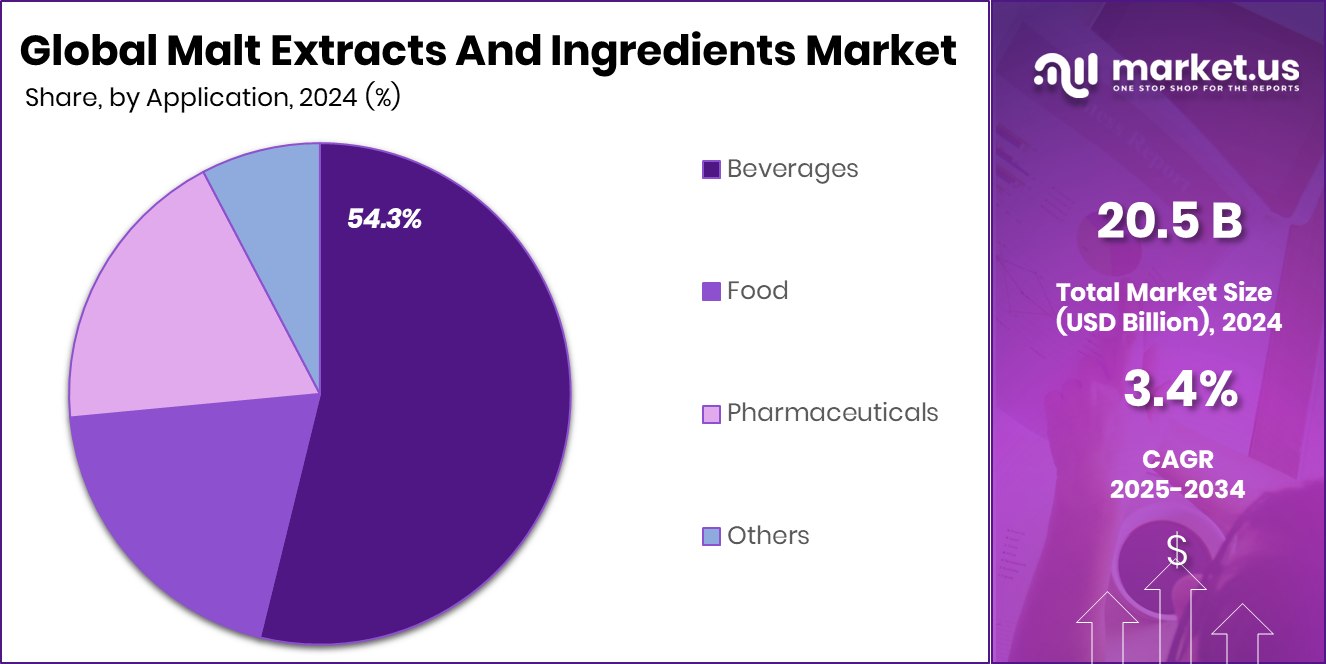

- Beverages drive 54.3% of market demand, reflecting malt’s popularity in drinks like beer and health tonics.

- The market in Europe reached a value of USD 9.6 billion overall.

By Product Analysis

Malt extracts dominate the market, accounting for 68.2% of total sales.

In 2024, Extracts held a dominant market position in the By Product segment of the Malt Extracts and Ingredients Market, with a 68.2% share. This significant lead highlights the widespread adoption of malt extracts across various applications, particularly in the food and beverage industry.

The dominance of extracts is largely attributed to their versatile functionality, offering natural sweetness, rich flavor, and nutritional enhancement. Their ability to improve texture, extend shelf-life, and contribute to clean-label product development has made them a preferred choice among manufacturers aiming to meet evolving consumer preferences.

The high market share of extracts also reflects growing demand in baking, brewing, and health-oriented product lines. Consumers increasingly favor natural ingredients, and malt extracts deliver both flavor and function without synthetic additives.

Their ease of incorporation into diverse formulations such as cereals, energy bars, and dairy products further supports their widespread usage. The 68.2% market share in 2024 underscores extracts’ strong market position, driven by a mix of health trends, product versatility, and consumer trust in naturally-derived ingredients.

By Form Analysis

Dry form of malt ingredients holds a significant 59.1% market share.

In 2024, Dry held a dominant market position in the By Form segment of the Malt Extracts and Ingredients Market, with a 59.1% share. This notable market presence reflects the rising preference for dry malt forms due to their extended shelf life, ease of handling, and transportation benefits.

Dry malt extracts offer better stability compared to liquid forms, making them a favorable option for manufacturers looking to streamline storage and logistics. Their powder consistency also allows precise dosing and uniform blending in a variety of applications, especially in baking, nutritional supplements, and beverage premixes.

The 59.1% share indicates a strong shift towards more durable and easily manageable malt ingredients, especially in large-scale production environments. The convenience of dry malt forms in maintaining consistency during formulation, along with reduced spoilage risks, has contributed to their increased adoption.

Moreover, dry malt’s ability to retain flavor and nutritional value during processing has made it a preferred form in many sectors using malt-based inputs. As manufacturers continue to prioritize efficiency and product consistency, the dry form is expected to maintain its leading position in the By Form segment.

By Source Analysis

Barley remains the primary source of malt extracts at 73.9% globally.

In 2024, Barley held a dominant market position in the By Source segment of the Malt Extracts and Ingredients Market, with a 73.9% share. This substantial share highlights barley’s strong role as the most widely used raw material for malt extract production.

Known for its high enzyme activity and balanced sugar profile, barley continues to be the preferred source among manufacturers aiming for consistent quality and performance in malt-based ingredients. Its natural composition and compatibility with traditional malting processes make it a reliable and cost-effective choice.

The 73.9% market share indicates broad industry reliance on barley due to its well-established supply chain and processing efficiency. Barley’s ability to yield a rich, flavorful malt extract with desirable color and fermentation properties contributes to its widespread application.

Additionally, barley-derived malt extracts are favored for their nutritional content, which includes essential vitamins, minerals, and dietary fiber. The continued dominance of barley in this segment reflects its long-standing reputation, technical advantages in extract production, and strong alignment with market expectations for product consistency and functionality.

By Grade Analysis

Standard malt grade leads the market with a 68.7% market share.

In 2024, Standard Malt held a dominant market position in the By Grade segment of the Malt Extracts and Ingredients Market, with a 68.7% share. This significant market share reflects the widespread use and acceptance of standard malt across various industrial and commercial applications.

Standard malt offers a well-balanced profile of enzymes, sugars, and nutrients, making it suitable for consistent and scalable production needs. Its reliable performance and ease of integration into established manufacturing processes have made it a preferred choice for producers seeking cost-effective and proven ingredient solutions.

The 68.7% share indicates a strong industry inclination toward using standard malt due to its availability, processing familiarity, and stable quality. It caters effectively to applications requiring dependable flavor, color, and texture contributions without the need for specialized or customized malt grades.

Manufacturers continue to favor standard malt for its predictable behavior during processing and compatibility with a wide range of product formulations. This segment’s dominance underscores the value placed on consistency, efficiency, and versatility, all of which are essential for high-volume and repeat production environments.

By Application Analysis

Beverages use malt extracts most, accounting for 54.3% of applications.

In 2024, Beverages held a dominant market position in the By Application segment of the Malt Extracts and Ingredients Market, with a 54.3% share. This strong share highlights the significant role of malt extracts and ingredients in beverage formulation, where they are widely used for their flavor-enhancing, coloring, and nutritional properties. Malt extracts contribute a natural sweetness, rich taste profile, and smooth mouthfeel, making them a key ingredient in both traditional and modern beverage products.

The 54.3% market share reflects steady demand from beverage manufacturers who prioritize natural and functional ingredients. Malt extracts are particularly valued in the preparation of health drinks, flavored milk, and fermented beverages, where consistency and nutritional enrichment are essential. Their ability to enhance the sensory appeal of beverages without the use of synthetic additives further boosts their preference in this segment.

This dominance underscores the continuing relevance of malt ingredients in delivering both taste and health benefits, aligning well with consumer expectations. The beverage segment’s lead position in 2024 is a result of long-standing industry trust in malt’s performance and its established role in product formulation.

Key Market Segments

By Product

- Extracts

- Ingredients

By Form

- Dry

- Liquid

By Source

- Barley

- Wheat

- Rye

- Others

By Grade

- Standard Malt

- Specialty Malt

- Crystal

- Roasted

- Dark

- Others

By Application

- Beverages

- Alcoholic

- Non-alcoholic

- Food

- Pharmaceuticals

- Others

Driving Factors

Rising Demand for Natural and Clean Ingredients

One of the top driving factors in the Malt Extracts and Ingredients Market is the growing consumer preference for natural and clean-label ingredients. People are becoming more health-conscious and are carefully reading food labels before making a purchase. They want products with simple, recognizable ingredients and fewer artificial additives.

Malt extracts fit perfectly into this trend because they are derived from natural sources like barley and offer sweetness, flavor, and nutritional value without the need for chemicals or synthetic enhancers. This demand is pushing food and beverage companies to use more malt-based ingredients in their recipes.

Restraining Factors

Limited Shelf Life and Storage Handling Issues

A key restraining factor in the Malt Extracts and Ingredients Market is the limited shelf life and storage challenges, especially for liquid malt extracts. These products are sensitive to moisture, temperature, and contamination, which can reduce their quality over time. Proper storage conditions are necessary to prevent spoilage, making it harder for small manufacturers or those in regions with less advanced storage facilities.

This adds to the cost and complexity of handling, particularly during transportation or in bulk storage. If not stored correctly, the extract can thicken, crystallize, or lose flavor. These issues can discourage potential users, especially in industries where long shelf life and easy handling are critical.

Growth Opportunity

Expanding Use in Health and Wellness Products

A major growth opportunity in the Malt Extracts and Ingredients Market is the rising use of malt extracts in health and wellness products. With more people looking for foods that support energy, digestion, and overall health, malt extracts are gaining attention for their natural nutritional benefits. They contain vitamins, minerals, and easily digestible sugars, making them ideal for energy bars, nutritional drinks, and dietary supplements.

Health-focused brands are exploring malt as a clean-label ingredient that adds both taste and value to their products. This growing interest in functional foods creates new possibilities for malt extract applications.

Latest Trends

Rising Popularity of Plant-Based Malted Products

One of the latest trends in the Malt Extracts and Ingredients Market is the growing popularity of plant-based malted products. Consumers are increasingly choosing plant-based diets, either for health reasons or lifestyle preferences. This has led to a higher demand for malt extracts in products like dairy-free beverages, vegan snacks, and plant-based nutritional supplements.

Malt extracts made from grains like barley offer a natural way to boost flavor, color, and nutrition in these items without using animal-derived ingredients. As more brands create plant-based options, malt is becoming a go-to ingredient for adding richness and balance. This trend reflects how malt extracts are evolving beyond traditional uses to fit into modern, plant-forward food and beverage innovations.

Regional Analysis

In 2024, Europe led the Malt Extracts Market with 47.3% regional share.

In 2024, Europe held a dominant position in the Malt Extracts and Ingredients Market, accounting for 47.3% of the global share, valued at USD 9.6 billion. This leadership is driven by the region’s long-standing brewing and baking traditions, combined with growing demand for clean-label and natural ingredients in food and beverage production.

North America followed closely, with steady growth supported by increasing consumer interest in functional foods and natural sweeteners. The Asia Pacific region is emerging as a high-potential market, backed by rapid urbanization, rising health awareness, and expanding food processing industries across countries like China and India.

Meanwhile, the Middle East & Africa region shows moderate growth, driven by increasing consumption of malt-based beverages and bakery products. Latin America presents a stable market outlook with growing use of malt extracts in nutritional supplements and processed foods. Europe’s dominance highlights its advanced manufacturing capabilities, established malt ingredient supply chains, and strong consumer preference for traditional and artisanal food products.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players such as Agraria, Barmalt, and Boortmalt continued to play pivotal roles in shaping the global Malt Extracts and Ingredients Market through their strategic focus on quality, capacity expansion, and product versatility. These companies have maintained strong positions by aligning with evolving consumer trends, particularly the shift toward natural, clean-label, and health-oriented products.

Agraria is recognized for its consistent supply of high-quality malt extracts sourced from well-selected grains. The company’s emphasis on sustainable production and traceable sourcing appeals to manufacturers seeking reliable, transparent suppliers. Its responsiveness to custom formulation demands also strengthens its market relevance.

Barmalt, with its deep-rooted presence in the malt processing industry, leverages its experience to deliver tailored malt solutions. In 2024, Barmalt’s focus on efficiency and scale allowed it to meet rising demand across emerging markets. Its efforts in expanding its dry malt extract segment positioned it well to serve the bakery, beverage, and health food sectors more effectively.

Boortmalt remains a major global player, known for its extensive malting network and production expertise. In 2024, the company continued to leverage its international reach and robust infrastructure to maintain a steady supply of malt ingredients across regions. Its wide portfolio and strong relationships with brewers and food producers further reinforce its leadership in the global market.

Top Key Players in the Market

- Agraria

- Barmalt

- Boortmalt

- Cerex

- Diastatische Producten

- EDME Ltd.

- Graincorp Limited

- Holland Malt

- Imperial Malt

- IREKS

- Malt products

- Malteurop Group

- Maltexco

- Maltproducts

- Muntons PLC

- Puremalt

- Simpsons

- Viking Malt

Recent Developments

- In November 2024, GrainCorp released its FY24 annual report, reporting an underlying EBITDA of AUD 268 million and underlying net profits of AUD 77 million, highlighting its robust performance in the malt and agribusiness sectors amidst challenging conditions.

- In June 2024, Ag Growth International (AGI) confirmed it supplied key malting equipment to Agraria’s new malt plant complex, further solidifying the facility’s operational setup and readiness ahead of production commencement.

Report Scope

Report Features Description Market Value (2024) USD 20.5 Billion Forecast Revenue (2034) USD 28.6 Billion CAGR (2025-2034) 3.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Extracts, Ingredients), By Form (Dry, Liquid), By Source (Barley, Wheat, Rye, Others), By Grade (Standard Malt, Specialty Malt (Crystal, Roasted, Dark, Others)), By Application (Beverages (Alcoholic, Non-alcoholic), Food, Pharmaceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agraria, Barmalt, Boortmalt, Cerex, Diastatische Producten, EDME Ltd., Graincorp Limited, Holland Malt, Imperial Malt, IREKS, Malt products, Malteurop Group, Maltexco, Maltproducts, Muntons PLC, Puremalt, Simpsons, Viking Malt Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Malt Extracts And Ingredients MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Malt Extracts And Ingredients MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agraria

- Barmalt

- Boortmalt

- Cerex

- Diastatische Producten

- EDME Ltd.

- Graincorp Limited

- Holland Malt

- Imperial Malt

- IREKS

- Malt products

- Malteurop Group

- Maltexco

- Maltproducts

- Muntons PLC

- Puremalt

- Simpsons

- Viking Malt