Global Low Calorie Food Market Size, Share, And Industry Analysis Report By Product (Aspartame, Sucralose, Stevia, Saccharin, Cyclamate), By Application (Food and Beverages, Dairy Products, Bakery Products, Snacks, Confectionery, Dietary Beverages, Pharmaceutical, Tabletop), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169984

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

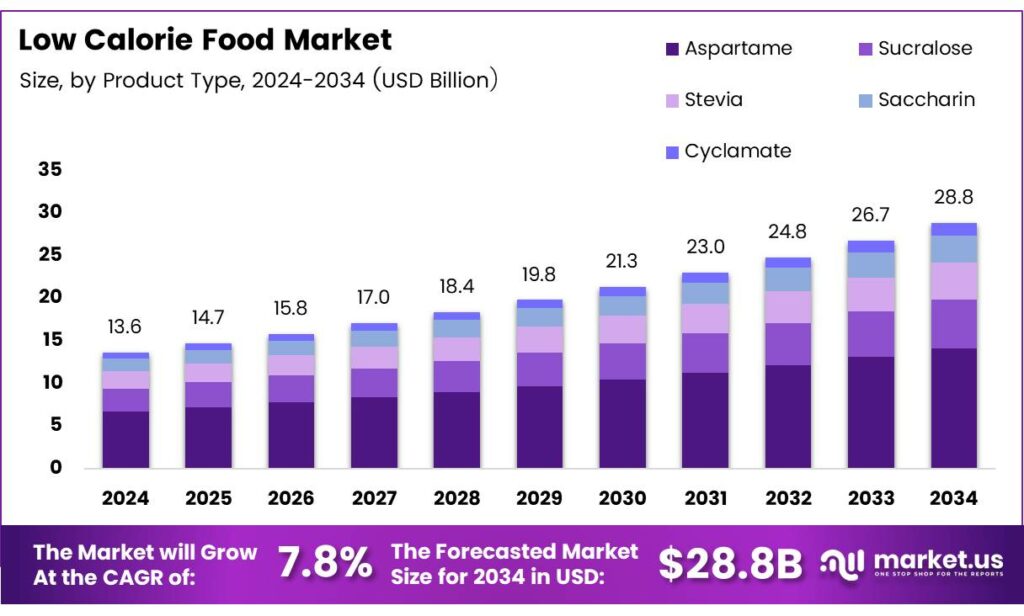

The Global Low Calorie Food Market size is expected to be worth around USD 28.8 billion by 2034, from USD 13.6 billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034.

Low-calorie food refers to nutritionally rich items that offer fewer calories while supporting satiety and metabolic balance. As consumers shift toward healthier diets, these foods gain relevance in weight-management routines, preventive health, and balanced lifestyles. Their naturally lower energy density improves dietary planning without reducing nutritional value, supporting wider wellness goals.

Transitioning to consumer behavior, awareness of calorie-controlled eating continues rising across urban and semi-urban regions. People increasingly choose fruits and vegetables, whole grains, and plant proteins to reduce overall calorie load. This shift aligns with broader movements around clean-label preferences, digestive health, and wellness-oriented choices supported by public health campaigns that promote mindful eating patterns.

- Shifting to nutritional drivers, low-calorie foods deliver measurable benefits. According to the USDA, a large watermelon slice of 152 grams contains only 46 calories, while a cup of spinach offers just 6.9 calories. Cucumbers remain extremely light, with half a cup holding around 15 calories, supporting calorie-restricted meal plans and hydration-focused diets.

- Functional low-calorie foods boost market demand because they offer high nutrition with a low energy density. USDA data shows chia seeds provide 138 calories per ounce, oats offer 154 calories per half cup, and lentils supply 116 calories per 100 g. Hydrating foods also help. Grapefruit has 64 calories, carrots, around 25, and popcorn, just 30 per cup.

Low-calorie foods unlock opportunities by strengthening demand for functional nutrition. Brands use this shift to innovate around portion-controlled categories, fortified snacks, and water-dense produce offerings. Governments also encourage such adoption through community nutrition programs, school meal guidelines, and national dietary recommendations that position low-calorie foods as essential components of long-term public health strategies.

Key Takeaways

- The Global Low Calorie Food Market is valued at USD 13.6 billion by 2024 and is projected to reach USD 28.8 billion by 2034. at a strong CAGR of 7.8% from 2025 to 2034.

- Aspartame leads the product segment with a dominant 31.6% share in 2024.

- Food and Beverages is the top application segment, capturing 35.9% of the market.

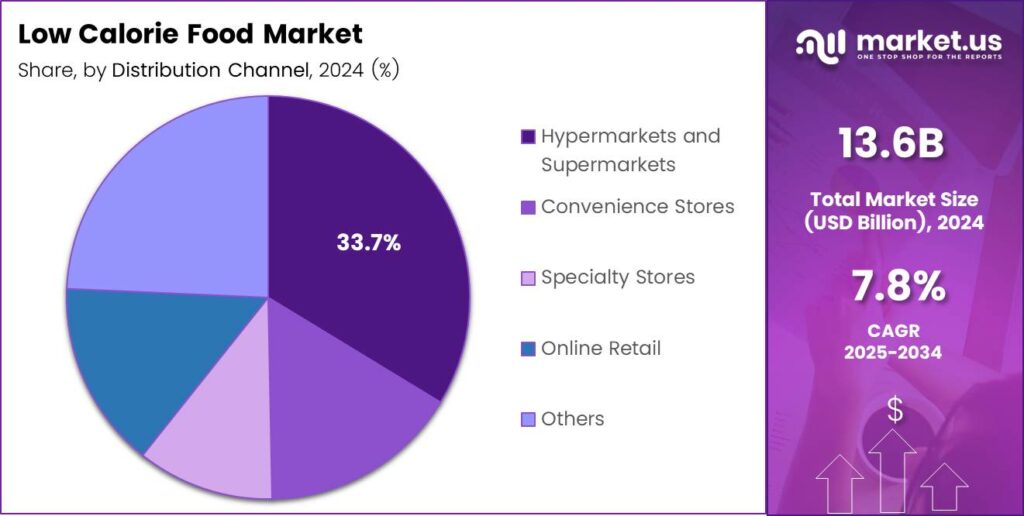

- Hypermarkets and Supermarkets dominate distribution channels with a 33.7% share.

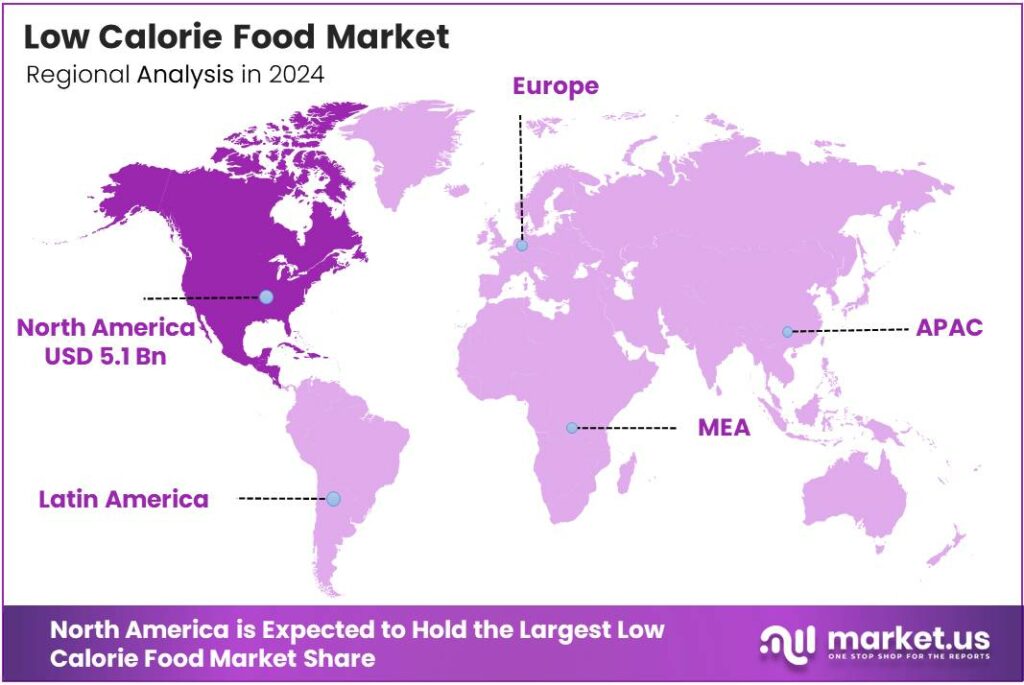

- North America remains the leading region with a 37.5% market share, valued at USD 5.1 billion in 2024.

By Product Analysis

Aspartame dominates with a 31.6% share due to its wide use in processed foods and beverages needing stable low-calorie formulations.

In 2024, Aspartame held a dominant market position in the By Product Analysis segment of the Low Calorie Food Market, with a 31.6% share. It remains widely adopted because it offers strong sweetness intensity, low cost, and reliable functional performance, especially in beverages and packaged snacks seeking reduced sugar levels.

Sucralose continued gaining traction as brands sought heat-stable sweeteners for bakery and dairy applications. Its clean taste and global regulatory approvals encouraged broader product reformulations. Manufacturers expanded their use in low-calorie confectionery, flavored yogurts, and ready-to-drink beverages, supporting their steady rise in modern health-focused food categories.

Stevia advanced due to strong consumer demand for plant-based sweeteners. Its natural origin positioned it favourably in clean-label and organic product lines. Companies optimized blending technologies to reduce bitterness, enabling greater use in diet beverages, tabletop formats, and fruit-based snacks while aligning with consumer preferences for botanical, zero-calorie sugar alternatives.

By Application Analysis

Food and Beverages lead with a 35.9% share due to high consumption of diet products across global markets.

In 2024, Food and Beverages held a dominant market position in the By Application Analysis segment of the Low Calorie Food Market, with a 35.9% share. Rising consumer preference for reduced-sugar items and healthier packaged foods strongly boosted reformulations across carbonated drinks, juices, snacks, and ready meals.

Dairy Products used low-calorie sweeteners to improve flavored yogurt, ice-cream alternatives, and lactose-free beverages. Producers focused on maintaining mouthfeel while reducing calories. Growth was driven by consumers seeking protein-rich yet low-calorie dairy choices, expanding the role of sweetener systems in product innovation and taste enhancement.

Bakery Products increasingly integrate alternative sweeteners to lower calorie counts without compromising texture. Low-calorie cakes, breads, biscuits, and pastries gained appeal among weight-conscious consumers. Manufacturers refined baking-stable sugar substitutes, enabling wider use in heat-processed items while supporting regulatory sugar-reduction initiatives.

By Distribution Channel Analysis

Hypermarkets and Supermarkets dominate with a 33.7% share due to higher product visibility and bulk purchasing.

In 2024, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of the low-calorie food Market, with a 33.7% share. Their wide assortments, promotional pricing, and strong shelf visibility encouraged consumers to explore various low-calorie product formats.

Convenience Stores expanded their low-calorie assortments as busy consumers sought quick, healthier options. Ready-to-drink beverages, bars, and on-the-go snacks performed well. Small-format retail benefits from impulse purchases, supporting segment growth across urban areas.

Specialty Stores appealed to health-conscious buyers seeking premium sweeteners, organic low-calorie foods, and diabetic-friendly formulations. Their curated assortments and nutritional transparency encouraged adoption among educated consumers who prioritize wellness-aligned product choices.

Key Market Segments

By Product

- Aspartame

- Sucralose

- Stevia

- Saccharin

- Cyclamate

By Application

- Food and Beverages

- Dairy Products

- Bakery Products

- Snacks

- Confectionery

- Dietary Beverages

- Pharmaceutical

- Tabletop

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Emerging Trends

Growing Preference for Clean-Label Low-Calorie Foods Shapes Market Trends

A clear trend in the market is consumers’ desire for clean-label, simple, and naturally derived low-calorie foods. People want fewer artificial ingredients and prefer products sweetened with plants or whole-food alternatives. The rise of plant-based diets also shapes the market. Low-calorie plant-based snacks, beverages, and dairy substitutes are becoming more popular as consumers seek healthier and sustainable options.

- The World Health Organization reports that adults consume around 95 grams of sugar per day, which is far above its recommended limit of 25 grams for better long-term health. The FAO reports global plant-protein consumption has climbed to 9% of total protein intake, reflecting a steady movement toward sustainable, low-calorie dietary patterns.

Portion-controlled and ready-to-eat low-calorie products are trending as busy lifestyles push people toward convenient yet healthier eating habits. Small serving packs and calorie-counted meals support mindful consumption. Technology-driven nutrition apps are influencing food choices. Consumers increasingly track calories and macros, which naturally boosts the demand for low-calorie products aligned with digital wellness goals.

Drivers

Growing Health Awareness Among Consumers Drives Market Growth

Rising health awareness is pushing people to choose low-calorie foods as they look for better weight control and improved daily wellness. Consumers now pay attention to food labels, sugar levels, and calorie counts, increasing demand for lighter meal and snack options.

- The USDA encourages people to limit added sugars to less than 10% of daily calories, reinforcing the need for better substitutes. Governments and health organizations are actively promoting healthier food choices through campaigns and guidelines.

These initiatives make consumers more aware of the benefits of lowering calorie intake, supporting market expansion. Food companies are also innovating faster to meet rising expectations. They are launching products with cleaner ingredients, natural sweeteners, and improved taste without adding extra calories.

Restraints

Limited Taste Acceptance Restricts Market Expansion

One major restraint in the low-calorie food market is the taste gap between regular and reduced-calorie products. Many consumers feel that low-calorie items lack flavor or sweetness, reducing repeat purchases and affecting overall growth. Artificial sweeteners and sugar substitutes often receive mixed reactions.

- Some people experience aftertastes or digestive discomfort, making them hesitant to use these products regularly in their diets. The FAO notes that global production of natural sweeteners passed 140,000 tons, reflecting how quickly the food industry is switching to cleaner, plant-based sugar alternatives.

Higher production costs also act as a barrier. Creating low-calorie foods that still taste good requires advanced processing and specialty ingredients, making these products more expensive than standard options. Consumer distrust toward artificial components is another challenge. Many people prefer natural ingredients and may avoid low-calorie packaged items if they believe the product contains chemicals or unfamiliar additives.

Growth Factors

Rising Demand for Natural Low-Calorie Ingredients Creates New Opportunities

Growing interest in natural sweeteners such as stevia, monk fruit, and plant-based sugar alternatives is opening strong opportunities for manufacturers. Consumers are shifting toward clean-label, chemical-free solutions, encouraging companies to expand natural formulations.

- Food brands can gain a market advantage by improving product taste and texture. Better-tasting low-calorie snacks, dairy alternatives, beverages, and bakery items have high demand, especially among young and fitness-focused consumers. According to the World Health Organization, over 1 billion people worldwide are currently living with obesity, including 650 million adults, 340 million adolescents, and 39 million children.

Low-calorie proteins, meal replacements, and functional foods are seeing strong adoption across gyms, wellness centers, and digital health platforms. E-commerce growth is helping brands reach new customers. Online channels allow companies to promote niche low-calorie products to wider audiences and offer detailed nutritional information that builds consumer trust.

Regional Analysis

North America Dominates the Low-Calorie Food Market with a Market Share of 37.5%, Valued at USD 5.1 Billion

North America leads the global low-calorie food market, supported by strong consumer preference for healthier and sugar-reduced diets. The region’s high awareness of lifestyle-related diseases and increased adoption of functional, low-calorie packaged foods drive demand. In 2024, North America secured a dominant 37.5% share, generating USD 5.1 billion, driven by rising obesity-control programs, clean-label trends, and wider product availability across retail channels.

Europe continues to experience steady growth due to stringent nutrition regulations and strong consumer interest in plant-based, reduced-sugar foods. The region benefits from government-led health campaigns promoting balanced diets and calorie-controlled consumption. Demand is particularly high across Western Europe, where consumers are shifting from conventional snacks to low-calorie, high-fiber, and functional alternatives.

Asia Pacific is emerging as one of the fastest-growing regions due to rising urbanization, higher disposable incomes, and expanding health-conscious consumer bases. Increasing adoption of low-calorie beverages, sugar substitutes, and diet snacks is boosting market penetration. Countries such as China, Japan, and India are experiencing rapid growth as consumers prioritize weight management and preventive nutrition.

The U.S. represents the largest national market within North America, driven by strong consumer demand for clean-label, low-sugar, and plant-based products. High awareness of calorie intake and increased preference for diet-specific products, such as keto-friendly and low-carb foods, support growth. The market continues to benefit from innovation in alternative sweeteners and fortified low-calorie formulations.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ingredion Inc. continued to strengthen its position by expanding plant-based sweeteners and clean-label texturizers, driven by rising consumer demand for calorie-controlled functional foods. Its focus on stevia, allulose, and specialty fibers aligns with reformulation trends across beverages, bakery, and nutrition bars.

Zydus Wellness Ltd remained influential in shaping sugar-substitute preferences in emerging markets. The company leveraged its established low-calorie product lines and expanding distribution to meet growing interest in diet-focused sweeteners and fortified foods. Its investments in R&D and brand repositioning further enhanced its health-centric portfolio.

PepsiCo Inc. accelerated low- and zero-calorie innovations across beverages and snacks, supported by long-term commitments to sugar reduction. Reformulations using natural sweeteners and portion-controlled offerings helped the company tap into rising consumer interest in healthier refreshment choices, especially in North America and urban Asia.

Ajinomoto U.S.A. Inc. played a strategic role by advancing amino-acid-based sweeteners and flavor-enhancement technologies, enabling manufacturers to maintain taste while lowering calories. Its portfolio supported clean-label and functional-nutrition developments, particularly in ready-to-drink beverages and processed foods.

Top Key Players in the Market

- Ingredion Inc

- Zydus Wellness Ltd

- PepsiCo Inc.

- Ajinomoto U.S.A. Inc.

- Abbott Laboratories

- Bernard Food Industries

- Galam Ltd.

- Beneo Group

Recent Developments

- In 2025, Ingredion partnered with Swiss biotech startup Cosaic to commercialize Neo, a yeast-based sugar alternative, in the U.S. This collaboration aims to expand Ingredion’s portfolio for low-calorie formulations and co-develop new products focused on natural sweetness without calories.

- In 2025, the company reported strong alignment with global health trends via Zydus Fit products, which enable consumers to cut calorie intake by half for easier weight management. This includes low-fat, prebiotic-enriched options supporting digestion and reduced-calorie diets.

Report Scope

Report Features Description Market Value (2024) USD 13.6 billion Forecast Revenue (2034) USD 28.8 billion CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Aspartame, Sucralose, Stevia, Saccharin, Cyclamate), By Application (Food and Beverages, Dairy Products, Bakery Products, Snacks, Confectionery, Dietary Beverages, Pharmaceutical, Tabletop), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ingredion Inc., Zydus Wellness Ltd, PepsiCo Inc., Ajinomoto U.S.A. Inc., Abbott Laboratories, Bernard Food Industries, Galam Ltd., Beneo Group Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Low Calorie Food MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Low Calorie Food MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ingredion Inc

- Zydus Wellness Ltd

- PepsiCo Inc.

- Ajinomoto U.S.A. Inc.

- Abbott Laboratories

- Bernard Food Industries

- Galam Ltd.

- Beneo Group