Global Liquid Soap Market Reckitt Benckiser Group plc., Godrej Consumer Products, NEW AVON LLC., Procter & Gamble, Kao Chemicals, Bluemoon Bodycare, Unilever, 3M, Lion Corporation, GOJO Industries, Inc., By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135244

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

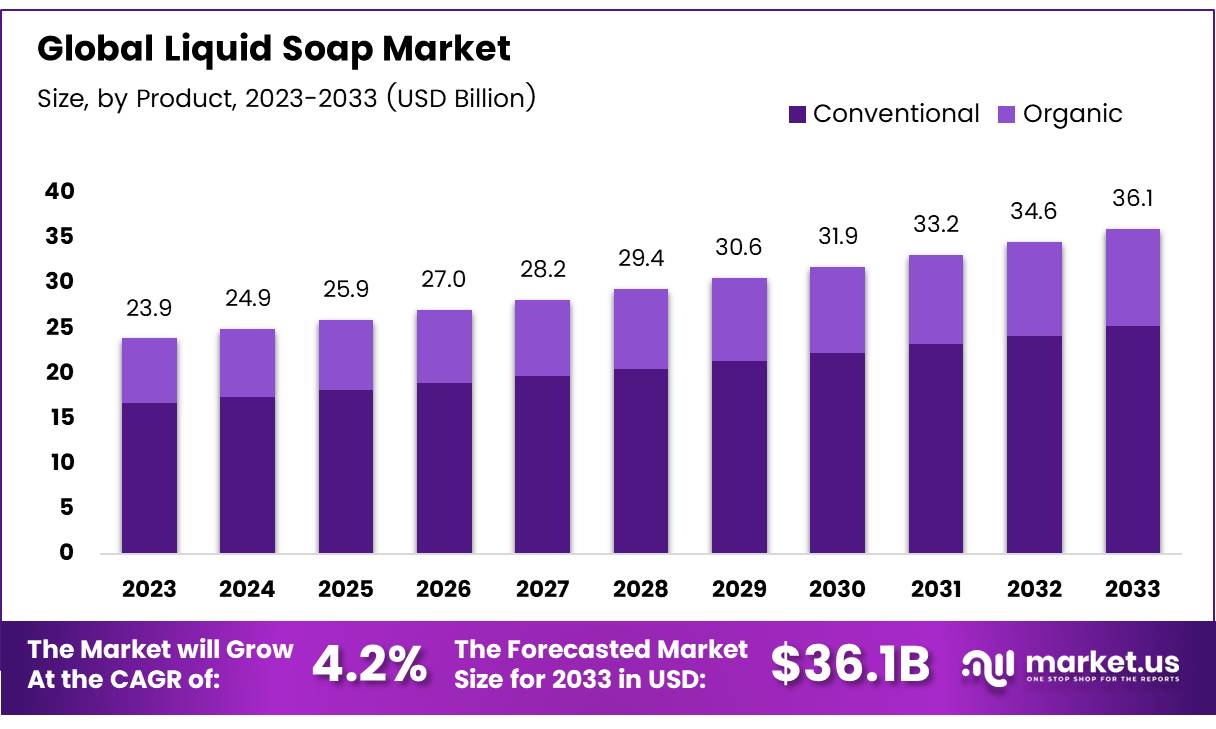

The Global Liquid Soap Market size is expected to be worth around USD 36.1 Billion by 2033, from USD 23.9 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

Liquid soap is a cleaning product designed for personal hygiene, home care, and various industrial applications. It is a water-based formula that often combines surfactants, moisturizers, and fragrances to provide effective cleaning while being gentle on the skin. Unlike traditional bar soap, liquid soap offers the benefit of ease of use, hygienic application, and more precise control over the quantity used.

Liquid soap is commonly available in hand soaps, body washes, dishwashing liquids, and specialized cleaning products for households and businesses. The liquid soap market has expanded in recent years due to a growing awareness of hygiene, convenience, and premium product offerings.

The liquid soap market is a dynamic sector within the global personal care and cleaning products industry. It encompasses various sub-categories such as hand soaps, body washes, dishwashing liquids, and more. The market has experienced steady growth, driven by changing consumer preferences toward liquid formulations over traditional bar soaps.

In 2022, the U.S. soap market was valued at $3.64 billion, with liquid body wash leading the category in sales, according to Media Market US. In 2020, nearly 301.87 million Americans used liquid hand soap, with projections estimating that the number will rise to 309.61 million by 2024.

The growth of the liquid soap market presents substantial opportunities for manufacturers and suppliers. With increased consumer awareness of hygiene, especially in the wake of the COVID-19 pandemic, liquid soap usage for handwashing and personal care has become a daily habit.

The World Health Organization’s estimates highlight that washing hands with soap can reduce the risk of diarrhea by 47% and respiratory infections by 23%, reinforcing the essential role of liquid soap in maintaining public health.

Additionally, the U.S. saw 600 million body wash units sold in 2022, significantly outperforming the 210 million bar soap units sold, according to Joan Morais. These statistics underscore the growing preference for liquid soap across various consumer segments.

The opportunity for growth in the liquid soap market lies in several factors, including the increasing focus on hygiene, consumer demand for eco-friendly products, and the rise of innovative formulations. With consumers shifting toward more sustainable and natural ingredients, manufacturers have an opportunity to innovate by introducing organic, cruelty-free, and eco-conscious liquid soap options.

Governments across the globe are investing in sanitation and public health programs, further driving the consumption of liquid soap products. In regions like North America and Europe, strict regulations surrounding hygiene and cleaning standards provide a conducive environment for growth.

According to Yeserchem, dishwashing liquids typically contain between 65% to 90% water, a factor that contributes to their relatively lower manufacturing costs and high-volume production, making them a lucrative segment within the liquid soap market.

At the same time, regulatory frameworks concerning product safety, labeling, and environmental sustainability will continue to influence market dynamics. For instance, as consumers demand more sustainable packaging solutions, government regulations around plastic waste and recycling will prompt brands to innovate with biodegradable or refillable packaging formats.

Manufacturers must also adhere to strict guidelines for ingredient transparency, especially with the growing consumer demand for clean beauty and wellness products. The market is also poised to benefit from continued public health campaigns, as liquid soap plays a key role in disease prevention, with global initiatives ensuring its widespread adoption.

Key Takeaways

- The global liquid soap market is projected to reach USD 36.1 billion by 2033, growing at a CAGR of 4.2% from 2024 to 2033.

- Conventional liquid soaps held a dominant market share of 72% in 2023, driven by affordability and consumer familiarity.

- Bath & Body Soaps led the product type segment with a 60% market share in 2023, owing to their widespread use in personal care routines.

- Hypermarkets & Supermarkets dominated the distribution channel segment in 2023, offering a wide range of products at competitive prices.

- The household end-use segment held the largest market share in 2023, driven by the convenience and versatility of liquid soap in daily cleaning and hygiene.

- Asia Pacific was the dominant region in 2023, accounting for 37% of the global market share, valued at USD 8.8 billion, fueled by population growth and rising hygiene awareness.

Product Analysis

Conventional Segment Dominates Liquid Soap Market with 72% Share in 2023

In 2023, Conventional products held a dominant market position in the By Product Analysis segment of the Liquid Soap Market, with a 72% share. This continued market leadership can be attributed to the affordability, wide availability, and consumer familiarity with conventional liquid soaps.

These products, typically formulated with synthetic ingredients, offer effective cleaning and lathering properties, making them the preferred choice for a large segment of the consumer base. Conventional liquid soaps are available in a variety of scents, textures, and formulations, catering to a broad range of consumer preferences.

In contrast, the Organic segment, which encompasses soaps made with natural and eco-friendly ingredients, represented a smaller share of the market. Organic liquid soaps appeal to consumers increasingly prioritizing sustainability and health-conscious products. While organic alternatives are growing in popularity due to rising environmental and wellness awareness, they face challenges such as higher prices and limited availability compared to conventional options.

Despite these challenges, the organic soap segment continues to gain traction, with consumer trends gradually shifting toward more sustainable and natural products. However, the conventional segment remains the dominant force within the market for the foreseeable future.

Product Type Analysis

Bath & Body Soaps Lead the Liquid Soap Market with 60% Share in 2023

In 2023, Bath & Body Soaps held a dominant market position in the By Product Type Analysis segment of the Liquid Soap Market, with a 60% share. The strong performance of Bath & Body Soaps is primarily driven by their widespread use in everyday personal care routines.

Consumers prefer these soaps for their effective cleansing properties, as well as for their availability in a variety of fragrances, formulations, and skin care benefits. The increasing trend of self-care and hygiene, combined with the growing demand for premium and multifunctional bath products, has further bolstered the segment’s market position.

Dish Wash Soaps represented the second-largest category in the market. These soaps are formulated to provide effective grease-cutting properties and are commonly used in households and commercial kitchens. Despite facing strong competition from alternative cleaning products, dish wash soaps maintain steady demand, especially in regions with strong cooking cultures.

Laundry Soaps, while occupying a smaller portion of the market, continue to benefit from the growing preference for liquid laundry detergents over powders due to their convenience and efficiency. Other products in the Liquid Soap Market, such as hand sanitizers and specialty soaps, contribute to the remaining share but represent niche markets with specific consumer demands. Overall, the Bath & Body Soaps segment remains the largest and most influential in the market.

Product Type Analysis

Hypermarkets & Supermarkets Lead Liquid Soap Market Distribution with Strong Consumer Reach

In 2023, Hypermarkets & Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Liquid Soap Market. These retail formats accounted for the largest share of the market, driven by their ability to offer a wide variety of liquid soap products at competitive prices.

Hypermarkets and supermarkets provide consumers with one-stop shopping experiences, making them a preferred choice for purchasing liquid soaps. Their expansive shelf space allows for the display of both mass-market and premium products, catering to diverse consumer preferences. Additionally, frequent promotional offers and discounts in these channels further contribute to their market leadership.

Convenience Stores, while representing a smaller segment, continue to attract consumers seeking quick and easy access to liquid soaps. These stores’ locations in high-traffic areas make them convenient for impulse purchases, particularly for smaller quantities or specific product types.

Online retail platforms have experienced significant growth in recent years, spurred by the increasing preference for e-commerce. Online sales provide consumers with the convenience of home delivery and access to a broader range of products, including niche or specialty items. While the online segment is expanding, it still represents a smaller proportion of the market compared to physical retail formats.

Overall, Hypermarkets & Supermarkets remain the leading distribution channels, but the convenience of online and specialty channels is driving shifts in consumer purchasing patterns.

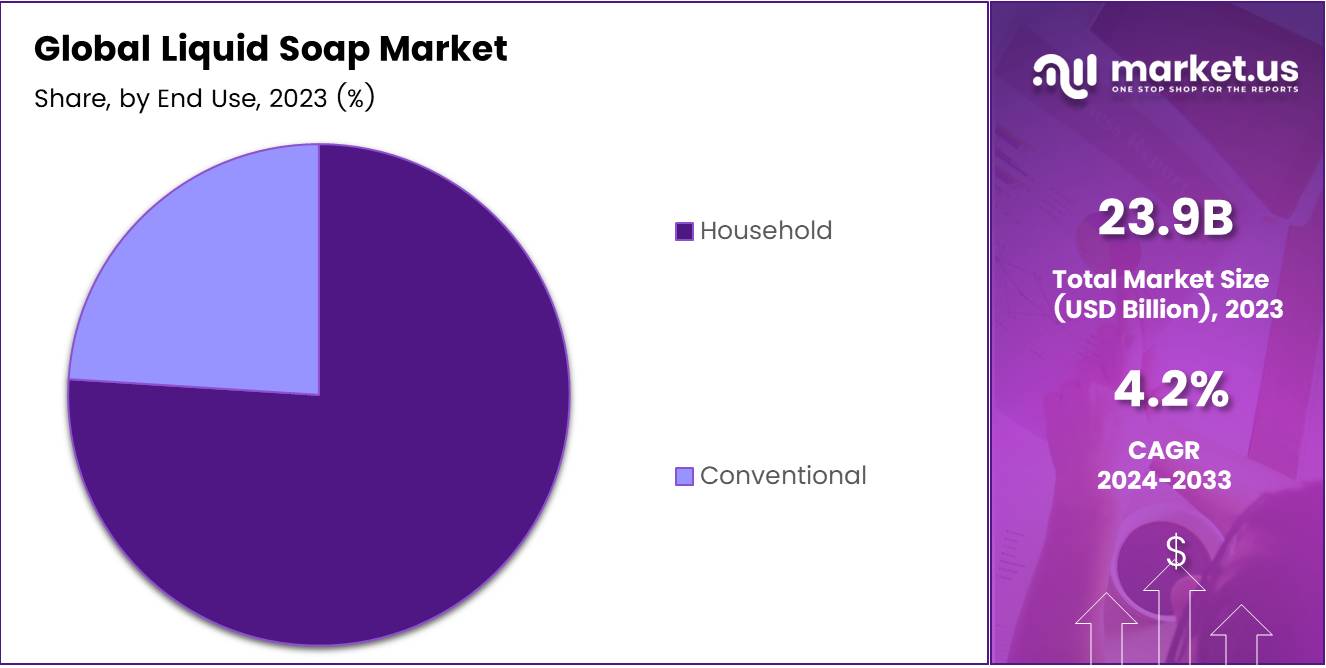

By End Use Analysis

Household Segment Dominates Liquid Soap Market in 2023

In 2023, Household held a dominant market position in the By End Use Analysis segment of the Liquid Soap Market. This segment accounted for the largest share, primarily driven by the widespread use of liquid soaps for daily cleaning and hygiene in homes. Household consumers continue to favor liquid soap for its convenience, versatility, and effectiveness in various applications, such as handwashing, bathing, and surface cleaning.

The growing emphasis on hygiene, particularly in the wake of the global pandemic, has further accelerated demand for household liquid soaps. Additionally, the variety of formulations and packaging options available, catering to different skin types and preferences, has reinforced their popularity in residential settings.

The Conventional segment, while representing a smaller share compared to household use, continues to maintain a steady demand due to its established presence in the market.

Conventional liquid soaps, often characterized by their affordability and accessibility, are widely used in both household and commercial applications. These products, typically formulated with synthetic ingredients, offer effective cleansing properties and are favored for their ease of use in large-scale environments, such as offices, schools, and hospitals.

Overall, the Household segment remains the largest contributor to the Liquid Soap Market, though Conventional products continue to serve essential roles across both residential and commercial sectors.

Key Market Segments

By Product

- Conventional

- Organic

By Product Type

- Bath & Body Soaps

- Dish Wash Soaps

- Laundry Soaps

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

By End Use

- Household

- Conventional

Drivers

Key Drivers Behind the Growth of the Liquid Soap Market

The growth of the liquid soap market can be attributed to several key factors. First, rising consumer awareness of hygiene, especially in the wake of the COVID-19 pandemic, has significantly increased the demand for liquid soaps as an essential hand-cleaning solution. As people become more conscious of cleanliness and germs, liquid soaps are favored for their effectiveness in maintaining hygiene.

Additionally, the convenience and ease of use offered by liquid soaps contribute to their widespread adoption. Liquid formulations provide a mess-free, easy-to-dispense option, making them ideal for both residential and commercial use. This ease of use has prompted consumers to move away from traditional bar soaps in favor of liquid alternatives.

Another driver is the shift toward natural and organic products. As consumers become more environmentally conscious, there is a growing preference for liquid soaps made from natural ingredients and free from harsh chemicals. This shift has led brands to innovate and introduce eco-friendly formulations, expanding their market presence.

Finally, the growth of e-commerce platforms has made liquid soaps more accessible to a wider audience. Online retail channels provide consumers with the convenience of purchasing a variety of liquid soap brands from the comfort of their homes, driving overall market growth. Collectively, these factors contribute to the ongoing expansion of the liquid soap market globally.

Restraints

Challenges Facing the Liquid Soap Market

Despite the growth of the liquid soap market, several restraints hinder its full potential. One of the primary concerns is environmental impact, particularly regarding the packaging of liquid soaps.

Although many liquid soap products are made with natural ingredients, they are often packaged in plastic bottles, which raise concerns among environmentally conscious consumers. The use of non-recyclable or single-use plastic bottles creates waste and contributes to pollution, impacting the sustainability image of many brands.

Additionally, the liquid soap market faces intense competition, with numerous established brands and low-cost alternatives flooding the market. This high level of competition makes it challenging for premium and niche brands to stand out. Consumers may prioritize affordability over quality or brand loyalty, making it difficult for smaller, specialized companies to secure market share.

As a result, brands must continually innovate and find ways to differentiate themselves, whether through product ingredients, packaging, or marketing strategies, to maintain a competitive edge. These factors combine to create challenges that could limit the growth of the liquid soap market, despite increasing consumer demand.

Growth Factors

Growth Opportunities in the Liquid Soap Market

The liquid soap market holds several growth opportunities, especially in emerging markets. As urbanization accelerates and living standards improve in developing economies, the demand for personal hygiene products, including liquid soaps, is set to rise.

This presents an opportunity for manufacturers to expand their presence in these regions, tapping into a growing middle class that is increasingly concerned with hygiene and health. Additionally, product diversification plays a crucial role in market growth.

Manufacturers have the chance to develop specialized liquid soaps, such as those formulated for specific skin types, medical purposes, or eco-friendly options. These innovations can help brands capture new customer segments and meet evolving consumer preferences for personalized or sustainable products. Furthermore, there is significant growth potential in the professional and industrial segments.

The rising use of liquid soaps in commercial spaces, such as public restrooms, restaurants, hospitals, and office buildings, offers manufacturers an avenue to cater to non-consumer markets.

As hygiene standards continue to improve globally, the demand for liquid soaps in these settings is expected to grow, creating a lucrative opportunity for suppliers to diversify their customer base beyond households. Collectively, these factors present a broad range of opportunities for liquid soap brands to expand and innovate, ultimately supporting continued market growth.

Emerging Trends

Key Trends Shaping the Liquid Soap Market

Several key trends are influencing the growth and direction of the liquid soap market. First, there is an increasing demand for natural and organic ingredients in liquid soaps. Consumers are becoming more conscious of the ingredients they use, preferring plant-based formulations that include ingredients like aloe vera, coconut oil, and shea butter, which are known for their skin-nourishing properties.

Additionally, with heightened awareness of hygiene due to the COVID-19 pandemic, antibacterial and antiviral liquid soaps are gaining significant popularity. These products are seen as essential for maintaining health and wellness, driving consumer preference for soaps that offer added protection.

Another growing trend is the move towards sustainable and eco-friendly packaging. As environmental concerns rise, many brands are opting for biodegradable and recyclable packaging materials to reduce their environmental impact. This trend reflects the growing demand for products that are not only good for personal health but also for the planet. Moreover, the popularity of vegan and cruelty-free products is on the rise.

Consumers are increasingly seeking products that align with their ethical and environmental values, driving brands to incorporate certifications that guarantee their products are free from animal testing and animal-derived ingredients. Together, these trends are shaping the liquid soap market, pushing companies to innovate and cater to a more environmentally and socially conscious consumer base.

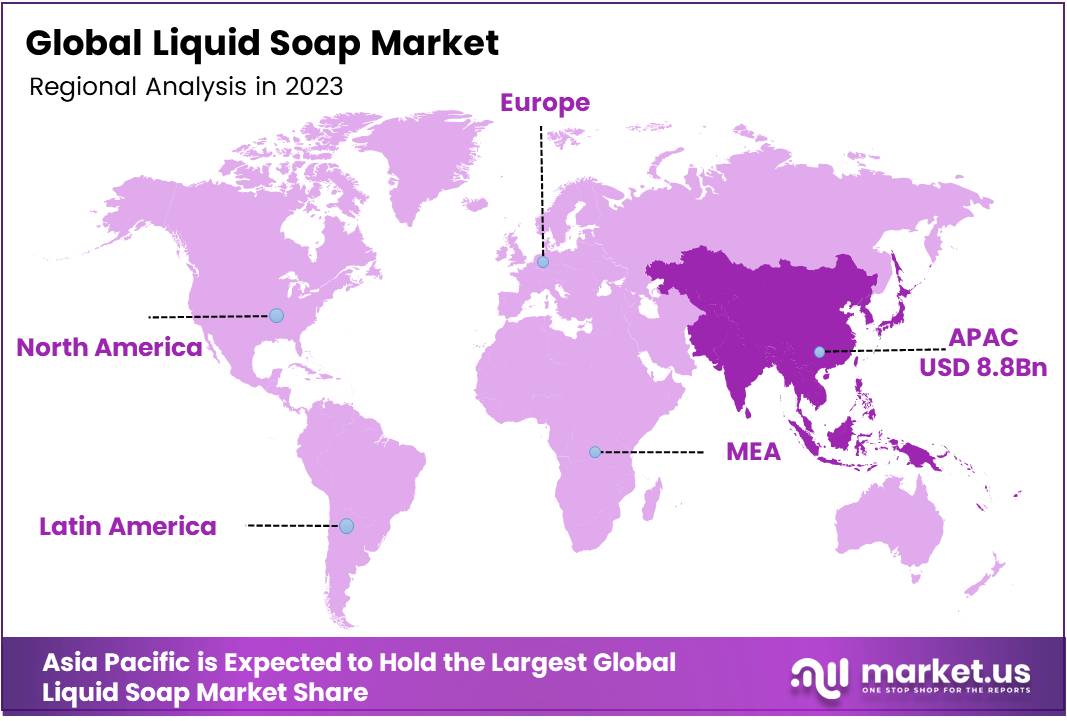

Regional Analysis

Asia Pacific emerging as the dominant Market, accounting for approximately 37% of the global market share, valued at USD 8.8 billion

The liquid soap market exhibits considerable regional differentiation, with Asia Pacific emerging as the dominant region, accounting for approximately 37% of the global market share, valued at USD 8.8 billion. This growth is primarily attributed to the region’s large and growing population, rapid urbanization, and increasing consumer awareness about hygiene and personal care.

Countries such as China and India are witnessing heightened demand for liquid soaps, driven by rising disposable incomes, shifts towards premium products, and an increasing preference for natural and eco-friendly formulations.

Regional Mentions:

In North America, the liquid soap market is characterized by a strong consumer preference for high-quality, skin-friendly, and sustainable personal care products. The region continues to experience steady growth, supported by rising health and hygiene consciousness among consumers. The demand for organic, dermatologically tested, and eco-friendly liquid soap variants is contributing to the region’s market expansion, with continued emphasis on innovation in product formulations.

Europe’s liquid soap market is also experiencing significant growth, with demand driven by consumers’ increasing focus on premium, natural, and multifunctional personal care products. Strong consumer awareness regarding skin health and the rising adoption of eco-friendly and sustainable products in countries such as Germany, France, and the UK are key factors fueling market demand. The European market remains an essential contributor to the global liquid soap industry, driven by both value and volume growth.

Meanwhile, the Middle East & Africa and Latin America regions, though smaller in comparison, are witnessing gradual growth. The Middle East is seeing a surge in demand for high-end, luxury liquid soaps, while Latin America is driven by demand for affordable, functional products. These regions are expected to grow at a slower pace, contributing to the overall market expansion in the coming years.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global liquid soap market continues to be shaped by a range of key players, each driving innovation, operational scale, and consumer demand in distinct ways.

Leading companies such as Reckitt Benckiser Group plc., Procter & Gamble, and Unilever dominate the market through their strong brand portfolios and widespread distribution networks. These companies leverage their vast consumer reach and established reputations to capture significant market share across both the premium and value segments of liquid soap.

Reckitt Benckiser, with brands like Lysol and Dettol, has capitalized on the heightened demand for hygiene products post-pandemic, further consolidating its position in the global liquid soap market. Similarly, Procter & Gamble and Unilever continue to innovate within both the personal care and household segments, offering a wide range of liquid soap products that cater to varying consumer preferences, including antibacterial and natural variants.

Godrej Consumer Products and NEW AVON LLC have also made notable contributions, expanding their regional footprints and tapping into emerging markets where personal hygiene and skin care are rapidly growing priorities. Meanwhile, Kao Chemicals and Bluemoon Bodycare focus on incorporating advanced formulations, often emphasizing eco-friendly and sustainable ingredients, which align with the increasing consumer shift towards natural and environmentally responsible products.

3M and Lion Corporation bring technological advancements and research-based solutions to the market, particularly in the professional and industrial cleaning segments. These players are investing in smart cleaning technologies and antimicrobial formulations, further differentiating their offerings.

Top Key Players in the Market

- Reckitt Benckiser Group plc.

- Godrej Consumer Products

- NEW AVON LLC.

- Procter & Gamble

- Kao Chemicals

- Bluemoon Bodycare

- Unilever

- 3M

- Lion Corporation

- GOJO Industries, Inc.

Recent Developments

- In August 2023, Dettol launched the Dettol 5 Litre (5L) Pro Cleanse Liquid Hand Wash, targeting professional and commercial use with a focus on hygiene and large-scale consumption. The product was introduced to meet the growing demand for effective sanitization in various sectors.

- In July 2022, Godrej introduced an eco-friendly Ready-to-Mix Body Wash, positioned at an affordable “Magic” price point. This move aligns with the company’s commitment to sustainability while catering to price-sensitive consumers seeking eco-conscious alternatives.

- In December 2024, bids were invited for the acquisition of Eucliptate Alcohol and Liquid Soap, indicating potential market consolidation or strategic expansion in the hygiene and personal care segment. The transaction is expected to enhance the product portfolio of the acquiring company.

- In December 2024, Wipro Consumer Care acquired three soap brands from VVF Ltd, a strategic move to strengthen its position in the personal care market. The acquisition is anticipated to expand Wipro’s product offerings and market reach.

Report Scope

Report Features Description Market Value (2023) USD 23.9 Billion Forecast Revenue (2033) USD 36.1 Billion CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Reckitt Benckiser Group plc., Godrej Consumer Products, NEW AVON LLC., Procter & Gamble, Kao Chemicals, Bluemoon Bodycare, Unilever, 3M, Lion Corporation, GOJO Industries, Inc. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape By Product (Conventional, Organic), By Product Type (Bath and Body Soaps, Dish Wash Soaps, Laundry Soaps, Others), By Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Online, Others), By End Use (Household, Conventional) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Reckitt Benckiser Group plc.

- Godrej Consumer Products

- NEW AVON LLC.

- Procter & Gamble

- Kao Chemicals

- Bluemoon Bodycare

- Unilever

- 3M

- Lion Corporation

- GOJO Industries, Inc.