Global Lipid Nanoparticles Market By Type, Liposomes (Solid Lipid Nanoparticles (SLNs), Nanostructured Lipid Carriers (NLCs), Others) By Molecule Type (mRNA, siRNA, Others) By Application (Therapeutics, Research) By End-User (Pharmaceutical & Biopharmaceutical Companies, CDMOs, Academic & Research Institutes, Hospitals & Clinical Centers) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165822

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

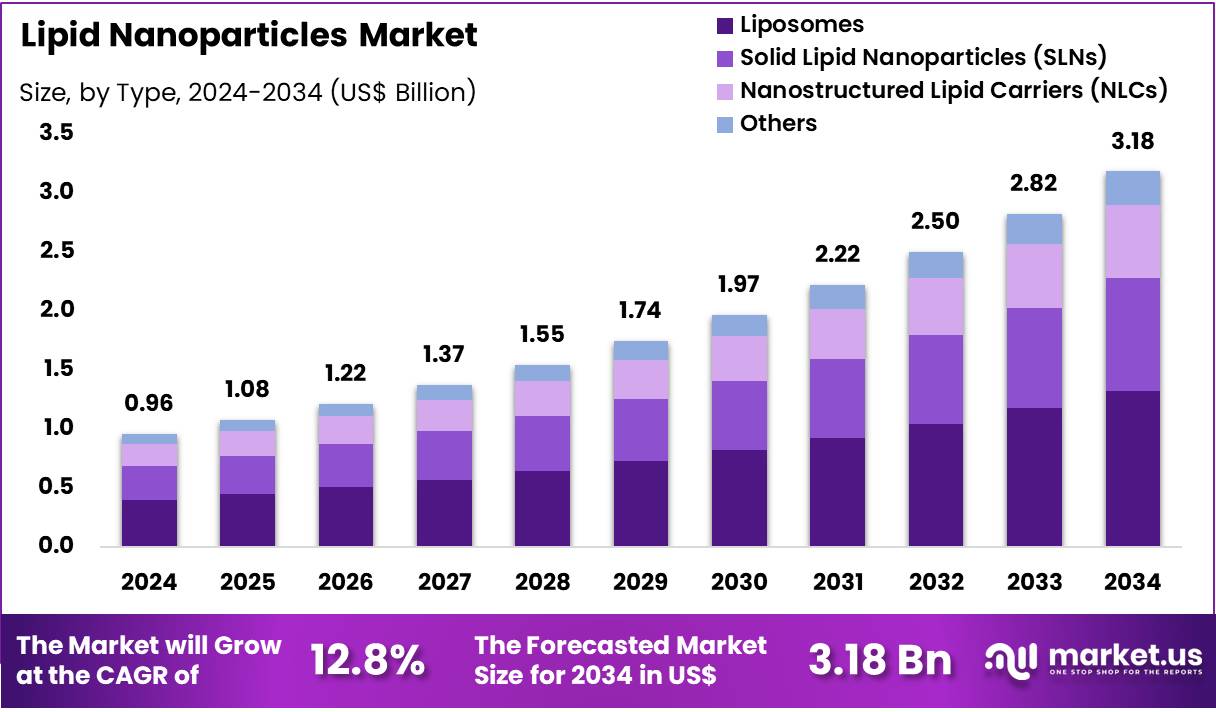

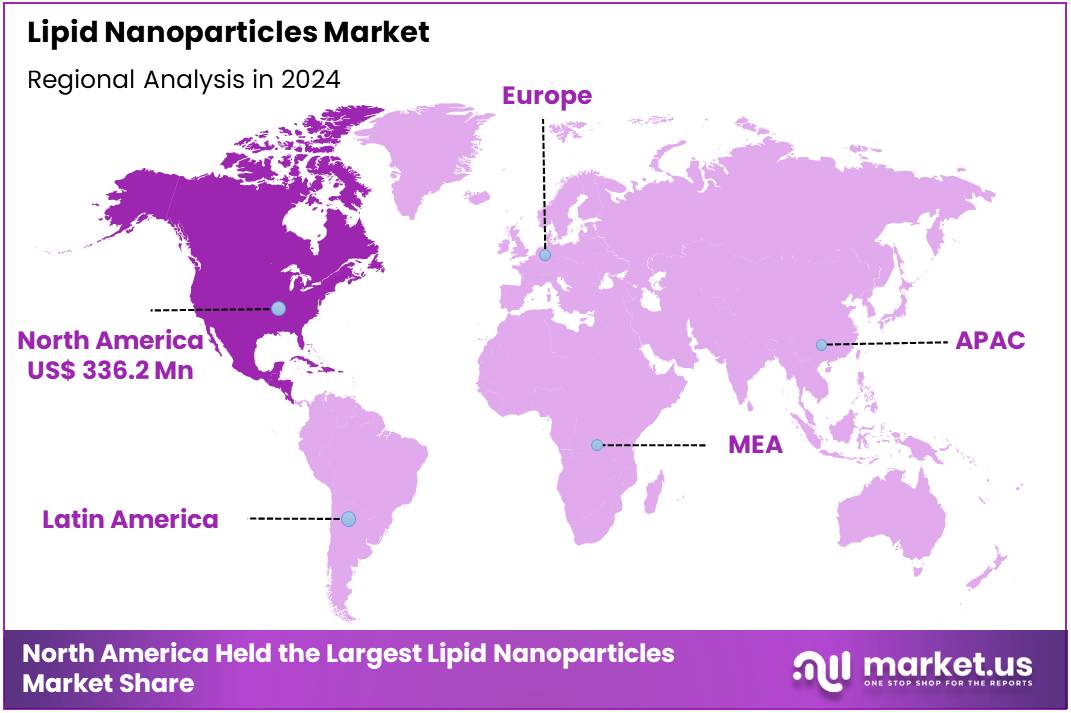

Global Lipid Nanoparticles Market size is expected to be worth around US$ 3.18 Billion by 2034 from US$ 0.96 Billion in 2024, growing at a CAGR of 12.8% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 35.2% share with a revenue of US$ 336.2 Million.

The global lipid nanoparticles (LNPs) sector is undergoing a sustained expansion phase, driven by scientific validation, rising therapeutic demand and supportive regulatory conditions. Market assessments indicate that LNP revenues are increasing at a double-digit compound annual growth rate, broadly estimated at 12–14%. This momentum reflects the transition of LNPs from a specialized delivery option to a core enabling platform for vaccines and nucleic-acid–based therapeutics. The growth of the market can be attributed to increasing acceptance of RNA modalities, expanding clinical pipelines and strengthening public health preparedness.

A major catalyst has been the demonstrated performance of LNP-formulated mRNA vaccines during the COVID-19 pandemic. The successful global deployment of the Pfizer-BioNTech and Moderna vaccines validated the scalability, safety and efficacy of LNP systems at population level. This real-world evidence has reduced technology uncertainty and encouraged significant investment in LNP-based product development. Pharmaceutical and biotechnology companies have consequently adopted LNPs as a default carrier for many emerging RNA candidates.

Public health initiatives are reinforcing this trajectory. The World Health Organization has launched an mRNA Vaccine Technology Transfer Programme and a global biomanufacturing training hub aimed at expanding regional capabilities in mRNA production, fill-finish operations and LNP formulation. These programmes have elevated LNP expertise as an essential component of future pandemic response, increasing demand for manufacturing capacity, raw materials, analytical tools and specialized technical services.

Applications for LNPs are broadening beyond COVID-19 vaccines. Their effectiveness in delivering mRNA and siRNA has enabled development in oncology, rare genetic diseases, cardiovascular disorders and infectious diseases such as influenza, dengue, malaria and HIV. As the prevalence of chronic and complex diseases increases, the need for targeted and programmable delivery systems is rising, stimulating further growth in LNP-enabled pipelines.

Regulatory clarity is strengthening the operating environment. The United States FDA and the European Medicines Agency have issued guidance and horizon-scanning reports outlining expectations for nanomaterial-based drug products, including LNP systems. Clearer regulatory pathways are reducing developmental risk and attracting greater capital allocation.

Advances in formulation science and manufacturing technologies are also accelerating adoption. Progress in lyophilized, thermally stable mRNA-LNP vaccines, as well as continuous and modular manufacturing approaches, has improved stability, reduced production costs and enhanced scalability. Parallel scientific work on ionizable lipid design continues to refine efficacy and safety profiles.

Collectively, these drivers—scientific validation, diversified applications, regulatory support and expanding investments are creating a robust and sustained growth outlook for the global LNP market.

Key Takeaways

- Market Size: Global Lipid Nanoparticles Market size is expected to be worth around US$ 3.18 Billion by 2034 from US$ 0.96 Billion in 2024.

- Market Growth: The market growing at a CAGR of 12.8% during the forecast period from 2025 to 2034.

- Type Analysis: Liposomes accounted for approximately 41.6% of the global market share in 2024.

- Molecule Type Analysis: mRNA accounted for nearly 56.4% of the global market share in 2024, and this leading position has been supported by its extensive application in vaccines, protein-replacement therapies, and emerging immuno-oncology programs.

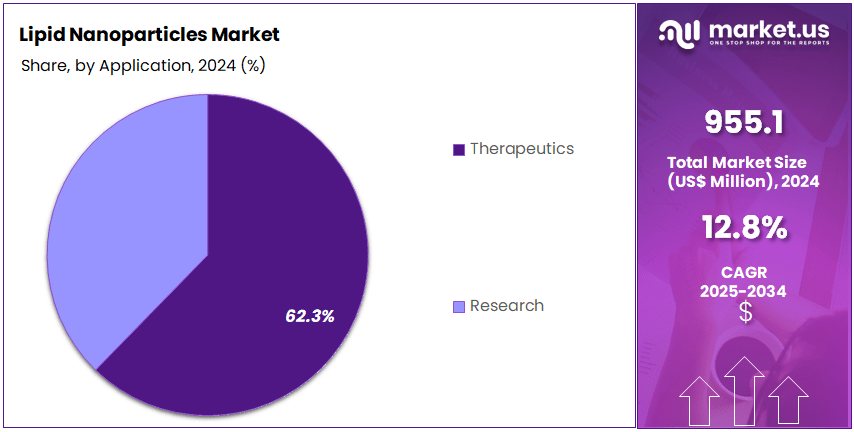

- Application Analysis: The therapeutics segment accounted for 62.3% of the global market in 2024, reflecting strong demand from pharmaceutical and biotechnology companies.

- End-Use Analysis: The pharmaceutical and biopharmaceutical companies segment accounted for 50.7% of the total market share in 2024, establishing its position as the leading end-user category.

- Regional Analysis: In 2024, North America led the market, achieving over 35.2% share with a revenue of US$ 336.2 Million.

Type Analysis

The lipid nanoparticles market has been segmented by type into Liposomes, Solid Lipid Nanoparticles (SLNs), Nanostructured Lipid Carriers (NLCs), and Others. The market structure in 2024 has been shaped by the established use of lipid-based delivery systems in pharmaceuticals, vaccines, and advanced therapeutics.

Liposomes accounted for approximately 41.6% of the global market share in 2024, and their dominance can be attributed to their proven biocompatibility, high drug-loading capacity, and extensive clinical adoption. Their widespread use in oncology, antiviral therapies, and mRNA vaccine formulations has further reinforced their leading position. The sustained demand for liposomal formulations in both commercialized drugs and pipeline candidates has supported steady revenue growth.

Solid Lipid Nanoparticles (SLNs) held a significant share due to their stability profile, controlled release characteristics, and suitability for both hydrophilic and lipophilic molecules. Growth in topical and oral delivery applications has contributed to increased utilization. Nanostructured Lipid Carriers (NLCs) have been gaining traction, driven by improved drug-loading efficiency and enhanced release kinetics compared with SLNs. The “thers” category, which includes nanoemulsions and lipid–polymer hybrids, has recorded steady interest as research into multifunctional delivery platforms expands.

Molecule Type Analysis

The lipid nanoparticles market has been segmented by molecule type into mRNA, siRNA, and Others. The structure of this segment has been shaped by rapid advances in nucleic acid therapeutics and the expanding portfolio of RNA-based drug candidates.

mRNA accounted for nearly 56.4% of the global market share in 2024, and this leading position has been supported by its extensive application in vaccines, protein-replacement therapies, and emerging immuno-oncology programs. The commercial success of mRNA vaccines established a strong technological foundation, and continued investment in next-generation formulations has sustained the dominance of this category. The high efficiency of lipid nanoparticle systems in protecting mRNA and facilitating intracellular delivery has further reinforced this growth trajectory.

The siRNA segment has recorded steady expansion due to the increasing number of approved RNA interference therapies and a robust pipeline targeting metabolic, genetic, and rare diseases. The demand for precise gene-silencing mechanisms has strengthened the adoption of siRNA-LNP combinations in both clinical and preclinical settings. The “Others” category, which includes DNA, microRNA, and various oligonucleotides, has remained smaller but continues to benefit from ongoing research in gene modulation and regenerative medicine.

Application Analysis

The application landscape of lipid nanoparticles has been shaped by their expanding use across therapeutic delivery and research settings. The market has been driven primarily by the adoption of these carriers in drug formulation and advanced treatment modalities. The dominance of the therapeutics segment has been reinforced by the widespread integration of lipid-based systems in mRNA vaccines, gene therapies, and targeted drug delivery products.

As a result, the therapeutics segment accounted for 62.3% of the global market in 2024, reflecting strong demand from pharmaceutical and biotechnology companies. The growth of this segment has been supported by rising investment in nucleic acid–based therapies and an increasing number of clinical trials utilizing LNP platforms.

The research segment has also contributed meaningfully to market expansion, although on a smaller scale relative to therapeutics. Its growth has been linked to increasing academic and commercial research activities focused on developing next-generation delivery technologies and improving formulation stability. The segment has been supported by government funding and collaborative R&D initiatives in genomics, vaccine development, and molecular diagnostics. Although its share remains lower, steady growth is expected as research applications continue to broaden within early-stage drug discovery and preclinical studies.

End-User Analysis

The end-user structure of the lipid nanoparticles market has been shaped by the increasing integration of these delivery systems into commercial drug development pipelines and research frameworks. The pharmaceutical and biopharmaceutical companies segment accounted for 50.7% of the total market share in 2024, establishing its position as the leading end-user category.

This dominance has been attributed to the rising adoption of lipid nanoparticle systems in mRNA vaccines, gene therapies, oncology drugs, and targeted delivery products. The accelerated investment in nucleic acid–based modalities and expanding clinical pipelines have reinforced the reliance of major companies on LNP technologies for scalable, controlled, and efficient therapeutic delivery.

The research segment, comprising academic institutes, research laboratories, and early-stage biotech entities, has also played a significant role in the market’s development. Growth within this category has been driven by increasing scientific exploration around next-generation delivery platforms, improved lipid formulations, and nanoparticle engineering.

Public funding programs and collaborative research initiatives have supported the expansion of this segment. Although its share remains smaller relative to pharmaceutical and biopharmaceutical companies, the research end-user group is expected to experience steady growth as innovation in gene editing, vaccine development, and molecular biology continues to advance.

Key Market Segments

By Type

- Liposomes

- Solid Lipid Nanoparticles (SLNs)

- Nanostructured Lipid Carriers (NLCs)

- Others

By Molecule Type

- mRNA

- siRNA

- Others

By Application

- Therapeutics

- Cancer

- Infectious Disease & Antiviral

- Rare & Genetic Disorders

- Others

- Research

By End-User

- Pharmaceutical & Biopharmaceutical Companies

- CDMOs

- Academic & Research Institutes

- Hospitals & Clinical Centers

Driving Factors

The adoption of lipid nanoparticle (LNP) technology as an advanced delivery mechanism has been propelled by the success of mRNA-based vaccines, which clearly demonstrated that LNPs can stabilise fragile nucleic acid payloads and enable efficient intracellular release.

Regulatory agencies such as the U.S. Food & Drug Administration (FDA) now include specific guidance addressing drug products with nanomaterials, emphasising the importance of size, encapsulation and stability control when using LNP systems. The implication for the LNP market is that this proven technology fuels demand across vaccines, gene-therapy and targeted therapeutics, making LNPs a key enabler in next-generation biopharmaceuticals.

Trending Factors

A clear trend in the LNP domain is increasing sophistication in formulation design and manufacturing. For example, continuous manufacturing platforms are now being developed to enable reproducible production of lipid-based nanoparticles with controlled quality attributes (size, polydispersity, encapsulation) at scale.

Concurrently, regulatory frameworks are evolving: the World Health Organization (WHO) regulatory considerations for mRNA vaccines explicitly define LNPs as encapsulation systems to stabilise mRNA and facilitate cellular uptake. These developments indicate that standardisation, regulatory alignment and manufacturing scalability are shaping the LNP market trajectory.

Restraining Factors

Despite progress, LNP technology faces significant hurdles in regulatory and safety-assessment domains. The FDA guidance for nanomaterials emphasises that while the usual standards of safety, efficacy and quality apply, the nanoscale size and engineered behaviour of LNPs introduce unknowns in characterisation and risk management.

In addition, biodistribution, immunogenicity and long-term toxicity of novel lipid excipients remain under evaluation; regulatory documents note that LNPs must both protect the cargo and release it efficiently without undue immune responses or accumulation. These factors can slow product development and impose higher R&D costs, restraining faster market growth.

Opportunity

The breadth of therapeutic applications for LNPs opens significant growth opportunities beyond vaccines. As indicated in scientific reviews, LNPs are being explored for delivery of RNA therapeutics, gene editing payloads, and targeted cancer treatments, thereby opening new indications and patient populations.

Furthermore, with regulatory bodies issuing more detailed frameworks and manufacturing technologies becoming more robust, firms can capitalise on the “platform technology” status of LNPs to accelerate pipeline assets and repurpose formulations across indications. These dynamics point to a strategic opportunity for companies to leverage LNPs as a modular delivery system across a range of innovative therapies.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 35.2% share and holding a US$ 336.2 Million market value for the year. The region’s leadership can be attributed to its advanced biotechnology ecosystem. Strong research infrastructure supported the rapid adoption of lipid nanoparticle technologies. Extensive clinical activity in nucleic acid-based therapies further reinforced this position. A robust regulatory framework also promoted safe development and evaluation of LNP-based products.

Widespread use of mRNA vaccine platforms created sustained demand for improved delivery systems. Academic institutions and federal health agencies encouraged continuous innovation in lipid-based formulations. This environment accelerated scientific progress and industry collaborations. Public investment in biomedical research strengthened regional manufacturing capacity as well. As a result, North America remained a central hub for LNP development. The region is expected to preserve its influence as new therapeutic applications expand globally.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape is shaped by organizations that focus on advanced drug-delivery platforms, nucleic acid therapeutics, and formulation engineering. Continuous investment in research has enabled these players to refine lipid structures, improve encapsulation efficiency, and enhance stability profiles. Many entities emphasize scalable manufacturing systems to support clinical and commercial demand. Partnerships with academic centers and public health agencies are frequently used to accelerate validation of new delivery platforms.

A strong emphasis on regulatory compliance is evident, as leading participants align closely with evolving guidelines for nanomaterial-based products. Innovation pipelines often include next-generation RNA therapies, targeted oncology applications, and gene-editing delivery systems. Firms are also prioritizing sustainable sourcing of lipids and improved quality-control frameworks. This coordinated advancement across technology, safety, and production has strengthened the competitive position of key contributors within the lipid nanoparticle ecosystem.

Market Key Players

- Moderna, Inc.

- NanoVation Therapeutics

- Evonik Industries AG

- Wacker Biotech GmbH

- Fujifilm Pharma Co. Ltd.

- CordenPharma Corp.

- NOF Corporation

- Merck KGaA

- Gattefossé

- Precision NanoSystems

- Creative Biolabs

- Lipoid GmbH

- Touchlight

- IOI Oleo GmbH

- Cyman Chemical

- Acuitas Therapeutics Inc.

Recent Developments

- NanoVation Therapeutics (Sept 2024): NanoVation announced a multi-target partnership with Novo Nordisk to use its long-circulating LNP technology for cardiometabolic and rare disease genetic medicines (up to US$600 m) and extra-hepatic delivery.

- Evonik Industries AG (Sept 2025): Evonik and Ethris entered a strategic collaboration to co-develop a novel LNP platform (SNaP LNP®) for nucleic-acid delivery, expanding Evonik’s CDMO offerings into RNA-based therapeutics.

- Wacker Biotech GmbH (Apr 2025): Wacker Biotech announced a strategic collaboration with RNAV8 Bio combining Wacker’s pDNA/mRNA manufacturing and LNP-formulation capabilities with RNAV8’s mRNA-UTR engineering to enhance mRNA-LNP therapies.

- Merck KGaA (Sept 2025): Merck KGaA entered into an agreement with Biocytogen Pharmaceuticals to evaluate antibody-conjugated lipid-based delivery systems for nucleic-acid payloads, granting Merck an exclusive option to acquire selected antibody assets.

Report Scope

Report Features Description Market Value (2024) US$ 0.96 Billion Forecast Revenue (2034) US$ 3.18 Billion CAGR (2025-2034) 12.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type, Liposomes (Solid Lipid Nanoparticles (SLNs), Nanostructured Lipid Carriers (NLCs), Others) By Molecule Type (mRNA, siRNA, Others) By Application (Therapeutics, Research) By End-User (Pharmaceutical & Biopharmaceutical Companies, CDMOs, Academic & Research Institutes, Hospitals & Clinical Centers) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Moderna, Inc., NanoVation Therapeutics, Evonik Industries AG, Wacker Biotech GmbH, Fujifilm Pharma Co. Ltd., CordenPharma Corp., NOF Corporation, Merck KGaA, Gattefossé, Precision NanoSystems, Creative Biolabs, Lipoid GmbH, Touchlight, IOI Oleo GmbH, Cyman Chemical, Acuitas Therapeutics Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Moderna, Inc.

- NanoVation Therapeutics

- Evonik Industries AG

- Wacker Biotech GmbH

- Fujifilm Pharma Co. Ltd.

- CordenPharma Corp.

- NOF Corporation

- Merck KGaA

- Gattefossé

- Precision NanoSystems

- Creative Biolabs

- Lipoid GmbH

- Touchlight

- IOI Oleo GmbH

- Cyman Chemical

- Acuitas Therapeutics Inc.