Global Language Services Market Size, Share, Statistics Analysis Report By Service Type (Translation, Interpretation, Localization, Subtitling and Transcription, Others), By End-User Industry (Life Sciences (Pharmaceuticals, Medical Devices, Biotechnology, CROs), Media and Entertainment (OTT, Games, Box Office, Pay TV), Legal, Finance, and Patents, E-commerce, Other End-user Verticals), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Mar 25

- Report ID: 142645

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Scope

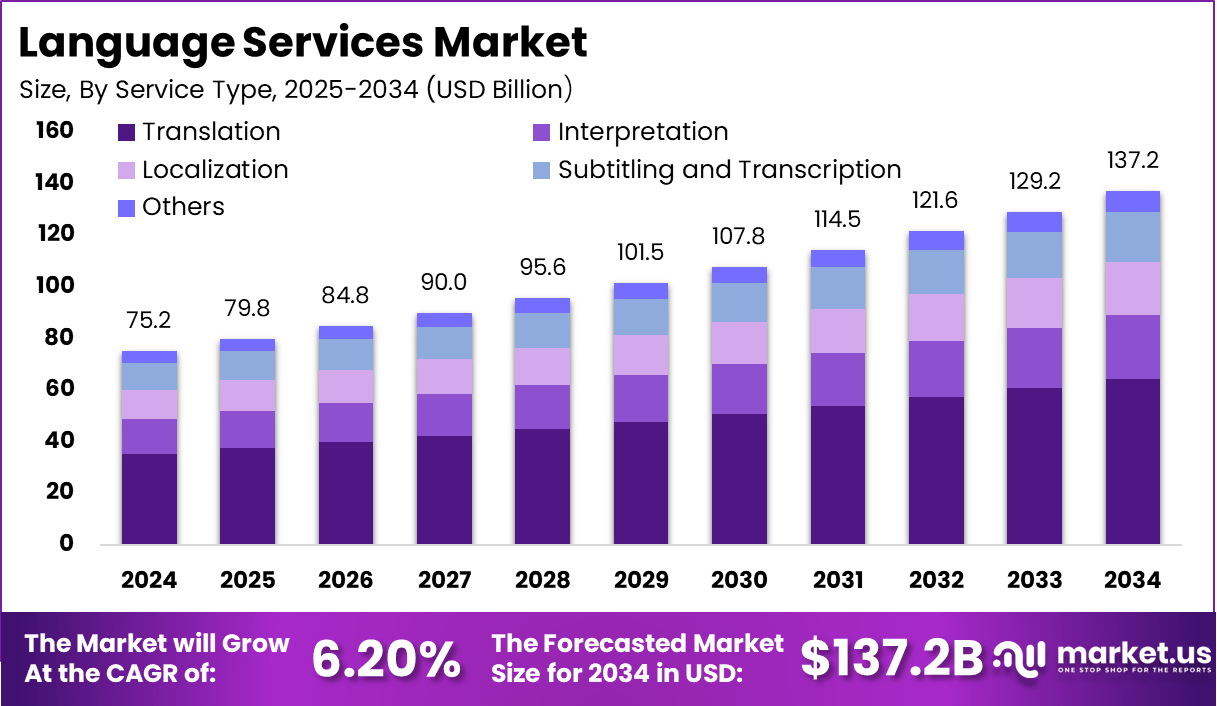

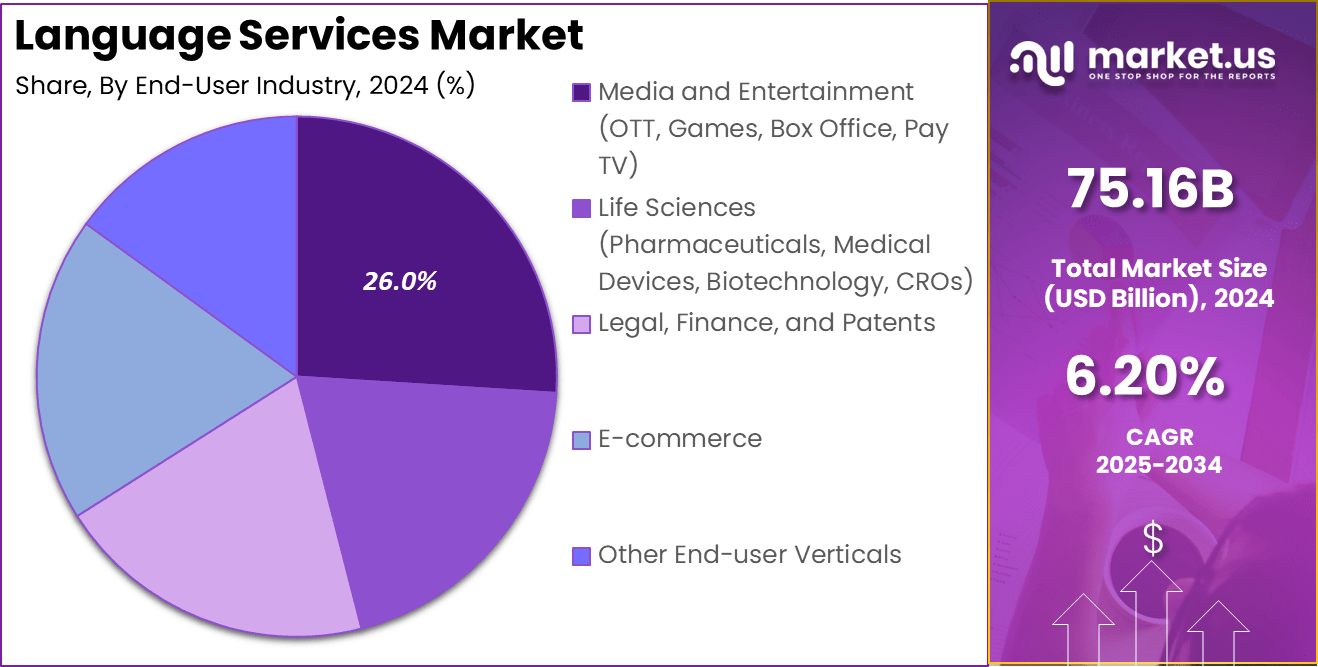

The Global Language Services Market is expected to be worth around USD 137.2 Billion by 2034, up from USD 75.16 Billion in 2024. It is expected to grow at a CAGR of 6.20% from 2025 to 2034.

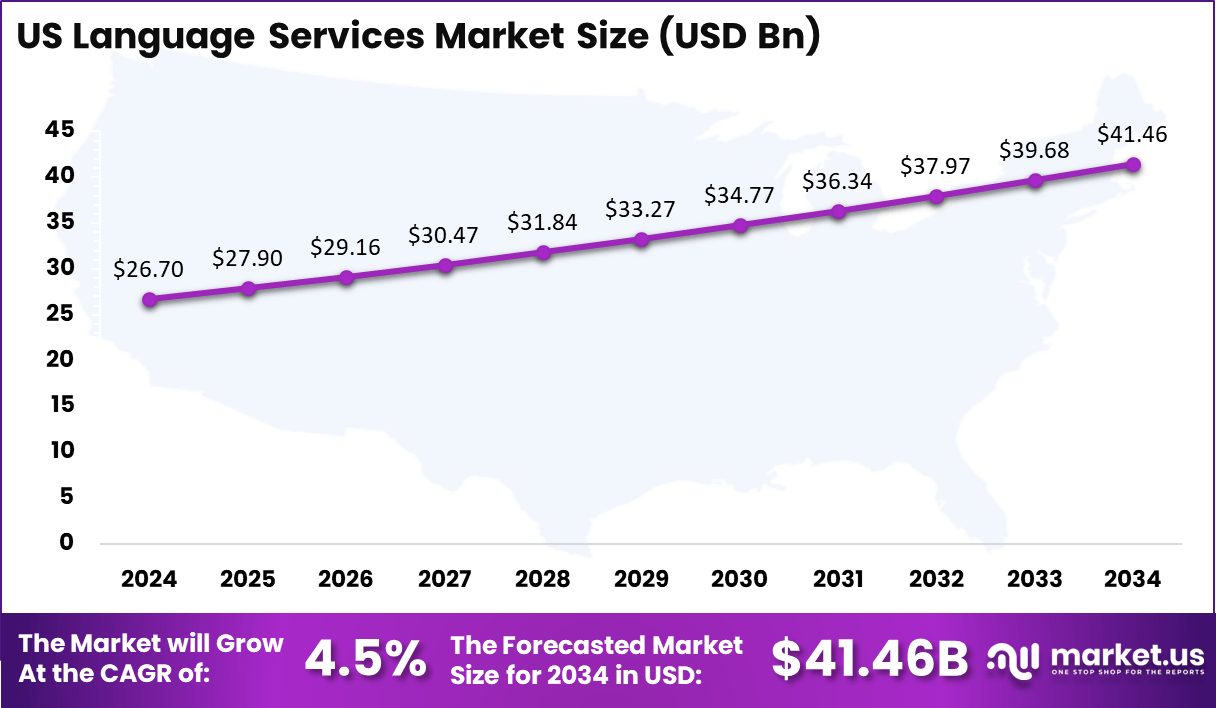

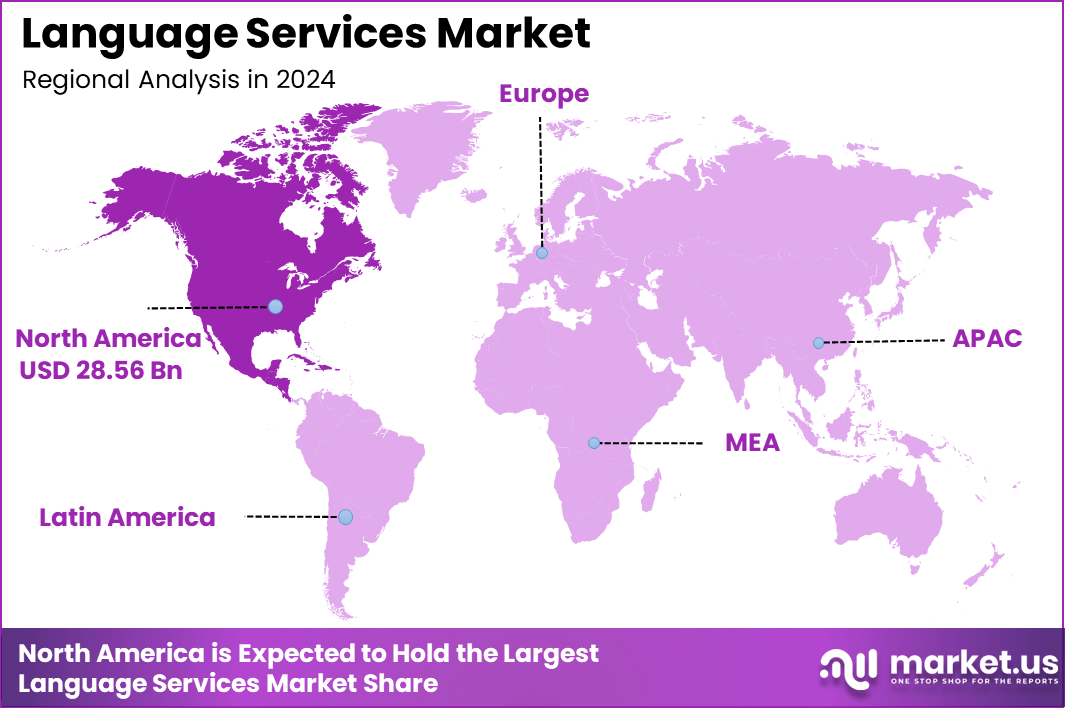

In 2024, North America held a dominant market position, capturing over a 38% share and earning USD 28.56 Billion in revenue. Further, the United States dominates the market by USD 26.7 Billion, steadily holding a strong position with a CAGR of 4.5%.

The global language services market encompasses a range of services aimed at facilitating communication across different languages and cultures. These services include translation, interpretation, localization, and language training, all of which are essential in our interconnected world.

As businesses expand globally and digital content reaches diverse audiences, the demand for language services has surged, making this market both dynamic and essential.

Several key factors are propelling the growth of the language services market. Firstly, globalization has led businesses to operate in multiple countries, necessitating accurate translation and localization to engage effectively with local markets.

Secondly, the digital transformation has resulted in an explosion of online content across various formats—text, audio, and video—which requires localization to resonate with global audiences. Additionally, advancements in artificial intelligence (AI) and machine translation technologies have enhanced the efficiency and accuracy of language services, further fueling market growth.

Key Takeaways

- Market Size Growth: The global Language Services Market is valued at USD 75.16 Billion in 2024 and is projected to reach USD 137.2 Billion by 2034, reflecting a CAGR of 6.20%.

- Service Type Breakdown: Translation services account for 47% of the overall market share, indicating its dominant role in the industry.

- End-User Industry: The Media and Entertainment sector (comprising OTT, games, box office, and pay TV) is the largest contributor to the market, representing 26% of the total market share.

- Regional Distribution: North America holds the largest market share with 38% of the global language services market.

- US Market: The US alone represents a significant portion of the market, valued at USD 26.7 Billion.

- US Market Growth: The US language services market is expected to grow at a CAGR of 4.5% over the forecast period.

Analyst’s Review

The demand for language services is robust and expanding across various sectors. In the business realm, companies seek to localize their products and marketing materials to penetrate new markets and connect with local consumers. The e-commerce boom has intensified this need, as online retailers strive to provide localized shopping experiences.

In education, the increasing mobility of students and educators has heightened the demand for translation and interpretation services. Moreover, sectors like healthcare, legal services, and technology require precise language services to ensure compliance, clarity, and effective communication across borders.

The language services market presents numerous opportunities, particularly in emerging markets where digital adoption is accelerating. As more businesses venture into these regions, the need for localization services to adapt content to local languages and cultural nuances becomes critical.

Furthermore, the rise of e-learning platforms offers opportunities for language training services, catering to individuals and professionals seeking to enhance their language skills. The integration of AI and machine learning in language processing also opens avenues for developing advanced translation tools and services, meeting the growing demand for real-time and accurate language solutions.

Technological innovations are significantly transforming the language services industry. The integration of AI and machine learning has led to the development of sophisticated translation tools that offer real-time processing and improved accuracy. Natural language processing (NLP) technologies enable machines to understand and generate human language, enhancing the quality of automated translations.

Additionally, the advent of neural machine translation has resulted in more fluent and contextually appropriate translations, bridging gaps between languages more effectively. These technological advancements not only streamline the translation process but also cater to the increasing demand for swift and reliable language solutions in various sectors.

Key Statistics

General Usage and Preferences

- Languages on the Internet: English dominates with 52.6% of websites, followed by Spanish (5.4%), German (4.7%), Russian (4.6%), French (4.3%), Japanese (4.2%), and Portuguese (3%).

- Consumer Preferences: 76% of global consumers prefer purchasing products in their native language, while **40% avoid websites not in their preferred language.

- Cross-Border Shopping: 57% of online shoppers engage in international shopping, with 87% reluctant to buy from websites offering content only in English.

Professional Translators and Tools

- Freelance Translators: 63% of professionals work exclusively as freelancers, while others combine translation with interpretation or editing.

- Translation Speed: On productive days, 36% of translators translate between 1,500 and 3,000 words, with some exceeding this threshold.

- CAT Tools Usage: 88% of translators use Computer-Assisted Translation tools, boosting productivity by at least 30%.

Machine Translation Statistics

- Adoption Rate: Machine translation is used in over 30% of professional translation businesses, with projections indicating majority usage by 2030.

- Google Translate Output: Handles an impressive 146 billion words daily, surpassing human translators globally in a month.

Industry Composition

- LSP Market Share: The top 100 largest Language Service Providers represent only 19.6% of the industry, with most services provided by small to mid-sized companies.

- Regional Headquarters: Europe hosts the majority (39.4%) of medium-to-large LSPs, followed by North America (**37.6%) and Asia (**17.6%).

Regional Analysis

United States Market Size

In North America, the United States dominates the Language Services market size by USD 26.7 Billion, holding a strong position steadily with a strong CAGR of 4.5%. The country’s dominant market share highlights its significant role in the global industry.

The demand for language services is driven by the increasing need for translation, localization, and multilingual content services across various sectors. This growth is particularly fueled by the expanding media and entertainment industry, where services such as OTT platforms, video games, and pay TV require extensive language support to cater to diverse audiences.

As the largest segment, the media and entertainment sector significantly influences the language services market, particularly in North America, where English-language content often needs to be localized for international markets. The proliferation of digital content and streaming platforms also necessitates continuous language support, making language services crucial to global business expansion.

Moreover, North America’s leadership in the language services market is attributed to the region’s highly developed infrastructure, technology advancements, and the presence of major industry players offering comprehensive solutions. These factors position the United States as a strong market leader, with a growing demand for language services and an optimistic outlook for the industry’s continued expansion.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 38% share, with USD 28.56 Billion in revenue. The region’s leadership is primarily driven by the robust demand for language services across various sectors, including media, entertainment, healthcare, and technology. North America’s market dominance is further bolstered by its highly developed infrastructure, widespread adoption of digital technologies, and a growing emphasis on globalization and multilingual communication.

The presence of major industry players in the region, offering a wide range of services such as translation, interpretation, and localization, contributes significantly to the overall market growth. Additionally, the expanding media and entertainment industry, especially OTT platforms and video games, fuels the demand for language services to cater to diverse audiences worldwide.

Europe follows as a key market in the language services sector, with a diverse and multilingual population driving demand across multiple industries. The European Union’s multilingual policies and the region’s focus on international trade and diplomacy necessitate the need for continuous language support. However, Europe’s market share remains slightly lower than North America’s, with an increasing emphasis on cross-border communication, digital content localization, and translation services.

The Asia-Pacific (APAC) region is expected to see substantial growth in the coming years, driven by the rise in digital content consumption and the expanding e-commerce sector. This market is particularly expanding due to the increasing number of businesses seeking to localize their services and products for emerging markets like China, India, and Southeast Asia.

Latin America, the Middle East, and Africa are growing markets but have a relatively smaller share of the overall market. These regions are expected to experience steady growth, with language services becoming more essential for global businesses entering these markets. Economic growth, an increasing number of multinational companies, and the rise in digital platforms in these areas will likely drive demand for translation, interpretation, and localization services shortly.

By Service Type

In 2024, the Translation segment held a dominant market position, capturing more than a 47% share of the Language Services Market. Translation services lead the market due to their broad applicability across industries and sectors, including legal, healthcare, business, and technology.

As globalization continues to expand, companies need to translate their content, communications, and product offerings to reach diverse international audiences. Additionally, with the rise of digital platforms and e-commerce, businesses require translation services to localize websites, marketing materials, and product descriptions in multiple languages to cater to global customers.

The increasing demand for accurate and culturally relevant translations in sectors such as legal, medical, and technical also contributes to the segment’s growth. Furthermore, advancements in translation technology, including AI-powered translation tools, have made services more efficient and cost-effective, which has driven further adoption. As a result, translation services are essential for companies looking to expand their global presence and maintain competitive advantages in foreign markets.

By End-User Industry

In 2024, the Media and Entertainment (OTT, Games, Box Office, Pay TV) segment held a dominant market position, capturing more than a 26% share of the Language Services Market. This segment is leading due to the rapid growth of digital content consumption and the globalization of entertainment.

Over-the-top (OTT) platforms, online gaming, and international film markets require extensive language services to localize content for diverse audiences, making it a crucial industry for translation, subtitling, and dubbing.

The surge in demand for multilingual content across streaming platforms like Netflix, Amazon Prime, and YouTube has significantly contributed to this growth. Moreover, the global expansion of video games and the need for localized in-game content and voiceovers further boosts the segment’s market share.

The need for accurate and culturally relevant language services in the entertainment industry has become critical as companies seek to enhance user experience and appeal to global audiences. As digital platforms continue to grow, the Media and Entertainment sector will remain a key driver in the language services market.

Key Market Segments

By Service Type

- Translation

- Interpretation

- Localization

- Subtitling and Transcription

- Others

By End-User Industry

- Life Sciences (Pharmaceuticals, Medical Devices, Biotechnology, CROs)

- Media and Entertainment (OTT, Games, Box Office, Pay TV)

- Legal, Finance, and Patents

- E-commerce

- Other End-user Verticals

Driving Factor

Technological Advancements in Language Services

The integration of advanced technologies, particularly artificial intelligence (AI) and machine learning (ML), has significantly propelled the growth of the language services market. These technologies have transformed traditional translation and interpretation processes, enhancing efficiency, accuracy, and scalability.

Enhanced Translation Accuracy and Efficiency

AI-powered tools, such as neural machine translation (NMT) systems, have revolutionized the translation landscape. NMT models analyze vast amounts of data to provide contextually relevant translations, reducing errors and improving fluency. This advancement has enabled businesses to process large volumes of content swiftly, meeting the demands of global audiences.

Real-Time Interpretation Services

Machine learning algorithms facilitate real-time speech recognition and interpretation, bridging communication gaps instantly. This capability is crucial in international business meetings, conferences, and diplomatic engagements, where timely and accurate interpretation is essential. The reduction in latency and improvement in contextual understanding have made real-time interpretation more reliable and accessible.

Automation of Repetitive Tasks

AI and automation have streamlined various aspects of language services, such as data processing and content categorization. By automating repetitive tasks, language service providers can allocate human resources to more complex and nuanced projects, thereby increasing overall productivity and reducing operational costs.

Integration with Other Technologies

The convergence of language services with other technological advancements, such as chatbots and virtual assistants, has opened new avenues for multilingual support. Businesses can now offer customer service in multiple languages through automated systems, enhancing user experience and expanding global reach.

Restraining Factor

Shortage of Skilled Linguists

Despite technological advancements, the language services industry faces a significant challenge due to the shortage of qualified linguists. This scarcity hampers the ability to meet the growing demand for high-quality, culturally nuanced translations and interpretations.

Impact on Quality Assurance

The lack of skilled professionals can lead to inconsistencies and errors in translations, affecting the quality of communication. In sectors where precision is critical, such as legal and medical fields, the availability of qualified linguists is essential to maintain standards and ensure compliance with regulatory requirements.

Challenges in Specialized Domains

Certain languages and specialized domains, such as indigenous languages or highly technical subjects, require experts with deep contextual and subject matter knowledge. The limited pool of such specialists makes it challenging to provide accurate and effective language services in these areas.

Impact on Global Business Expansion

Businesses aiming to expand into new international markets rely heavily on accurate and culturally appropriate language services. The shortage of qualified linguists can impede market entry strategies, affect customer engagement, and limit global reach, thereby affecting revenue growth and competitiveness.

Growth Opportunity

Integration of AI and Machine Learning in Language Services

The convergence of AI and machine learning with language services presents a significant growth opportunity, offering enhanced efficiency, scalability, and personalization.

Development of AI-Powered Translation Tools

Investments in developing AI-driven translation tools have led to more sophisticated and contextually aware translations. These tools can adapt and learn from new data, improving over time and providing businesses with scalable solutions to meet global communication needs.

Personalization of Language Services

Machine learning algorithms enable the analysis of user preferences and behaviors, allowing for the customization of language services. This personalization enhances user experience, making content more relevant and engaging to diverse audiences.

Expansion of Multilingual Content Delivery

AI and ML facilitate the efficient localization of content across multiple languages, enabling businesses to reach broader audiences. This capability is particularly beneficial in the e-commerce sector, where product descriptions, reviews, and marketing materials need to be accessible to global consumers.

Enhancement of Speech Recognition Technologies

Advancements in speech recognition, powered by AI, have improved voice-activated services and virtual assistants, making them more accurate and responsive. This development enhances customer interactions and supports the growing demand for voice-based language services.

Challenging Factor

Data Privacy and Security Concerns

As language services increasingly involve the processing of sensitive and personal data, ensuring data privacy and security has become a paramount concern.

Compliance with Regulatory Standards

Language service providers must navigate complex data protection regulations, such as the General Data Protection Regulation (GDPR), to ensure compliance. Non-compliance can result in legal penalties and damage to reputation.

Risk of Data Breaches

Handling large volumes of sensitive data exposes language service providers to the risk of data breaches. Protecting against unauthorized access and cyber threats requires significant investment in security infrastructure and protocols.

Challenges in Cross-Border Data Transfers

Operating across multiple jurisdictions with varying data protection laws complicates the transfer and storage of data. Language service providers must implement robust mechanisms to ensure that data handling practices meet the legal requirements of all regions involved.

Building and Maintaining Customer Trust

Clients entrust language service providers with sensitive information, expecting stringent confidentiality and security measures. Any lapses can lead to loss of business and harm to professional relationships.

Growth Factors

Technological Advancements in Language Processing

The integration of artificial intelligence (AI) and machine learning (ML) into language services has revolutionized the industry, enhancing efficiency and accuracy. AI-driven tools, such as neural machine translation (NMT), have significantly improved translation quality by providing contextually relevant translations. This technological evolution has expanded the scope of language services, making them indispensable for businesses aiming to communicate effectively across diverse markets.

Globalization and Cross-Border Business Expansion

As businesses extend their reach globally, the demand for language services has surged to facilitate seamless communication in diverse linguistic and cultural landscapes. This expansion necessitates accurate translation, localization, and interpretation services to effectively engage with international audiences and navigate complex regulatory environments.

Emerging Trends

Rise of AI-Powered Language Tools

The development of AI-powered language tools, such as chatbots and virtual assistants, has transformed customer service operations. These tools provide real-time, multilingual support, enhancing customer engagement and satisfaction while reducing operational costs.

Integration of Speech Recognition Technologies

Advancements in speech recognition technologies have led to the development of applications capable of understanding and processing multiple languages. This integration facilitates real-time translation and transcription services, supporting global communication and collaboration.

Focus on Localization for Global Reach

Businesses are increasingly focusing on content localization to resonate with local cultures and preferences. This trend involves adapting marketing materials, websites, and products to meet the linguistic and cultural nuances of target markets, thereby enhancing brand loyalty and market penetration.

Business Benefits

Enhanced Global Market Reach

Investing in language services enables businesses to penetrate international markets by overcoming language barriers. This expansion leads to increased brand visibility, access to new customer bases, and diversified revenue streams, contributing to overall business growth.

Improved Customer Experience and Satisfaction

Providing services and content in customers’ native languages enhances their experience, fostering trust and loyalty. This personalized approach leads to higher customer satisfaction, positive reviews, and repeat business, which are crucial for long-term success.

Compliance with Regulatory Requirements

In industries such as healthcare, legal, and finance, adhering to local regulations is mandatory. Language services ensure that businesses comply with regional laws and standards by accurately translating legal documents and contracts, thereby avoiding potential legal issues and penalties.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

Atlas Language Services Inc. is a prominent player in the global language services market, recognized for its comprehensive translation and localization solutions. The company has strategically expanded its global footprint by establishing a significant presence in key international markets, enhancing its ability to serve diverse client needs. Atlas’s commitment to quality and customer satisfaction has positioned it as a trusted partner for businesses seeking to navigate the complexities of global communication.

Globe Language Services Inc. has distinguished itself in the language services industry through a focus on delivering tailored translation and localization services across various sectors. The company has actively pursued growth opportunities by expanding its service offerings and entering new markets. Globe’s dedication to embracing emerging technologies and understanding cultural nuances has enabled it to effectively bridge communication gaps for its clients worldwide.

Lionbridge Technologies Inc., headquartered in Waltham, Massachusetts, is a leading provider of translation and localization services with a global presence spanning 26 countries. In 2015, Lionbridge expanded its capabilities by acquiring CLS Communication, a Zurich-based translation services provider, enhancing its expertise in financial and legal translations.

Top Key Players in the Market

- Atlas Language Services Inc.

- Globe language Services Inc.

- Lionbridge Technologies Inc.

- RWS Holdings PLC

- SDL PLC

- Semantix AB

- Summa Linguae Technologies

- Teleperformance SE

- TransPerfect Global Inc.

- Welocalize Inc.

- Hogarth Worldwide

- Keywords Studios Plc

- Mission Essential Personnel

- Other Key Players

Recent Developments

- In 2024, The language services market saw significant growth, driven by advancements in AI-powered translation tools and increased demand for multilingual digital content.

- In 2024, Companies increasingly adopted machine learning and AI technologies to streamline translation processes, improving both accuracy and efficiency across industries.

Report Scope

Report Features Description Market Value (2024) USD 75.16 Billion Forecast Revenue (2034) USD 137.2 Billion CAGR (2025-2034) 6.20% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Translation, Interpretation, Localization, Subtitling and Transcription, Others), By End-User Industry (Life Sciences (Pharmaceuticals, Medical Devices, Biotechnology, CROs), Media and Entertainment (OTT, Games, Box Office, Pay TV), Legal, Finance, and Patents, E-commerce, Other End-user Verticals) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Atlas Language Services Inc., Globe language Services Inc., Lionbridge Technologies Inc., RWS Holdings PLC, SDL PLC, Semantix AB, Summa Linguae Technologies, Teleperformance SE, TransPerfect Global Inc., Welocalize Inc., Hogarth Worldwide, Keywords Studios Plc, Mission Essential Personnel, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Atlas Language Services Inc.

- Globe language Services Inc.

- Lionbridge Technologies Inc.

- RWS Holdings PLC

- SDL PLC

- Semantix AB

- Summa Linguae Technologies

- Teleperformance SE

- TransPerfect Global Inc.

- Welocalize Inc.

- Hogarth Worldwide

- Keywords Studios Plc

- Mission Essential Personnel

- Other Key Players