Global Kitchenware Market Size, Share, Growth Analysis By Product (Tableware, Bakeware, Cookware, Others), By Application (Residential, Commercial), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Store, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jul 2025

- Report ID: 153296

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

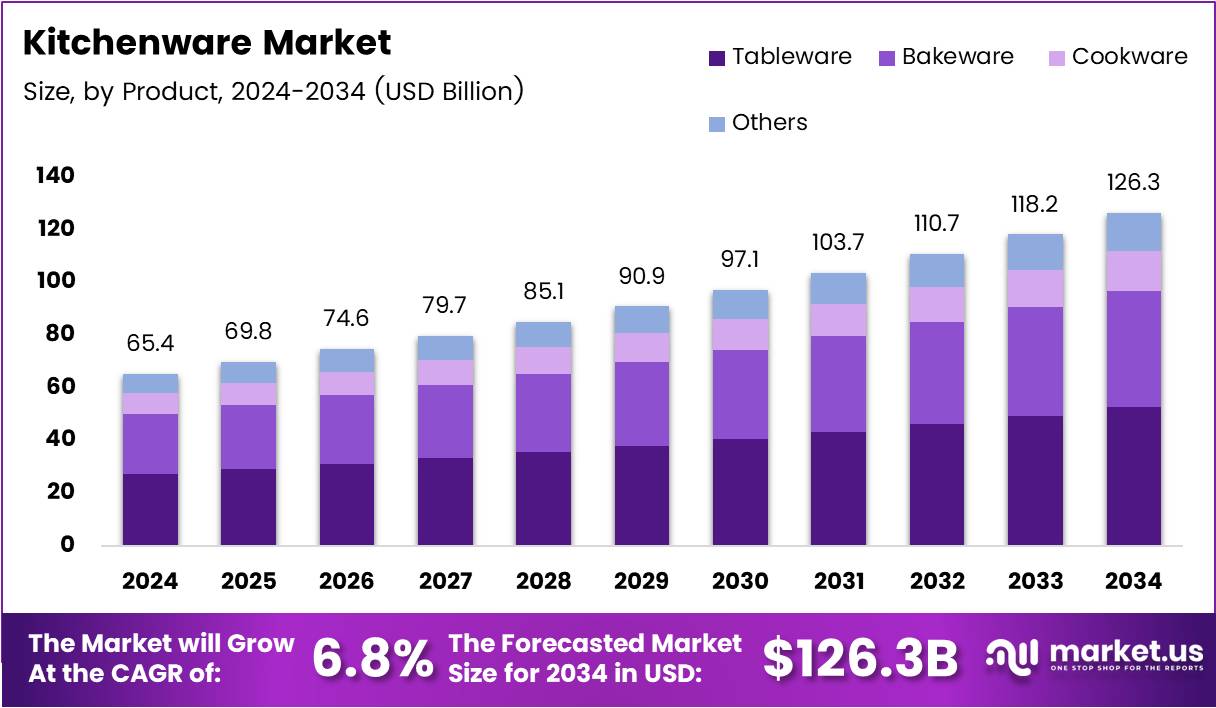

The Global Kitchenware Market size is expected to be worth around USD 126.3 Billion by 2034, from USD 65.4 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

The kitchenware market includes a wide range of tools, utensils, appliances, and cookware used for food preparation, cooking, and serving. From everyday household use to professional kitchens, it spans stainless steel cookware, non-stick pans, silicone utensils, and more. This essential industry serves both B2C and B2B segments globally.

As lifestyles evolve and dining habits shift, demand for modern, multi-functional kitchen tools is increasing. Urbanization, smart homes, and convenience cooking are pushing product innovations. Growth in e-commerce and direct-to-consumer models has made kitchenware more accessible, stimulating consistent market expansion across regions.

According to industry report, spatulas and measuring spoons are present in at least 90% of Americans’ kitchens, highlighting the universal presence and recurring demand of basic kitchen tools. This everyday utility factor adds long-term product stickiness in consumer homes.

The segment is also seeing material preference trends. As per CHC Metal, stainless steel kitchenware makes up 40% of the overall market, indicating a strong demand for durability, heat resistance, and hygienic properties in cookware and utensils.

In procurement, supplier evaluation has become more strategic. A study by industry report, found that 83% of procurement professionals prioritize product quality when selecting kitchen accessories and cookware suppliers. This highlights a strong B2B quality orientation and creates market entry barriers for low-grade suppliers.

Meanwhile, rising disposable incomes, particularly in Asia-Pacific, are fueling higher kitchenware spending. Consumers are opting for branded, sustainable, and aesthetic products that match modern kitchen interiors, boosting premium product categories.

Transitioning to government influence, several emerging economies are offering subsidies for domestic stainless steel production, which directly lowers raw material costs for kitchenware manufacturers, especially in India and China. This encourages local sourcing and cost competitiveness.

In contrast, government regulations surrounding food-grade safety standards and BPA compliance are tightening, particularly in Europe and North America. These regulations are reshaping the design and material choices in cookware and utensils, favoring compliance-ready brands.

Manufacturers are now investing in eco-friendly kitchenware, like bamboo and recycled plastics, aligning with global climate goals. This shift is attracting a new wave of conscious consumers.

The kitchenware industry also benefits from expanding culinary tourism and cooking content on digital platforms, which influences buying decisions. DIY cooking trends are encouraging repeat purchases of niche tools and appliances.

Globally, retail chains and online platforms are expanding product lines under private labels, intensifying competition. However, differentiation through innovation, ergonomic design, and sustainable packaging is unlocking significant margins.

Key Takeaways

- The Global Kitchenware Market is projected to reach USD 126.3 Billion by 2034, growing from USD 65.4 Billion in 2024 at a CAGR of 6.8% from 2025 to 2034.

- In 2024, Tableware led the Product segment with a 54.8% market share, driven by its widespread household and dining establishment use.

- Residential applications dominated in 2024 due to a shift towards home-prepared meals, influenced by cost-efficiency and health consciousness.

- Hypermarkets/Supermarkets held the top position in Distribution Channels in 2024, thanks to wide product variety and in-store item inspection.

- The Asia Pacific region leads the market due to rapid urbanization, rising middle-class income, and increasing modular kitchen adoption in countries like China and India.

Product Analysis

Tableware dominates with 54.8% due to its frequent use in everyday dining and hosting needs.

In 2024, Tableware held a dominant market position in the By Product Analysis segment of the Kitchenware Market, with a 54.8% share. Its widespread usage across households and dining establishments contributed significantly to this leadership. The increasing popularity of aesthetic table setups and casual dining trends also fueled demand for innovative and stylish tableware.

Bakeware maintained a steady presence, driven by a growing home baking trend. The rise in cooking shows, online tutorials, and an increasing preference for homemade bakery items led consumers to invest in quality bakeware.

Cookware also saw consistent demand, especially with the rise of health-conscious cooking. The adoption of multi-functional pots and pans that work across stovetops and ovens added to its appeal.

The Others category includes niche products with specialized uses, which are gradually growing as consumers experiment with global cuisines and unique cooking styles.

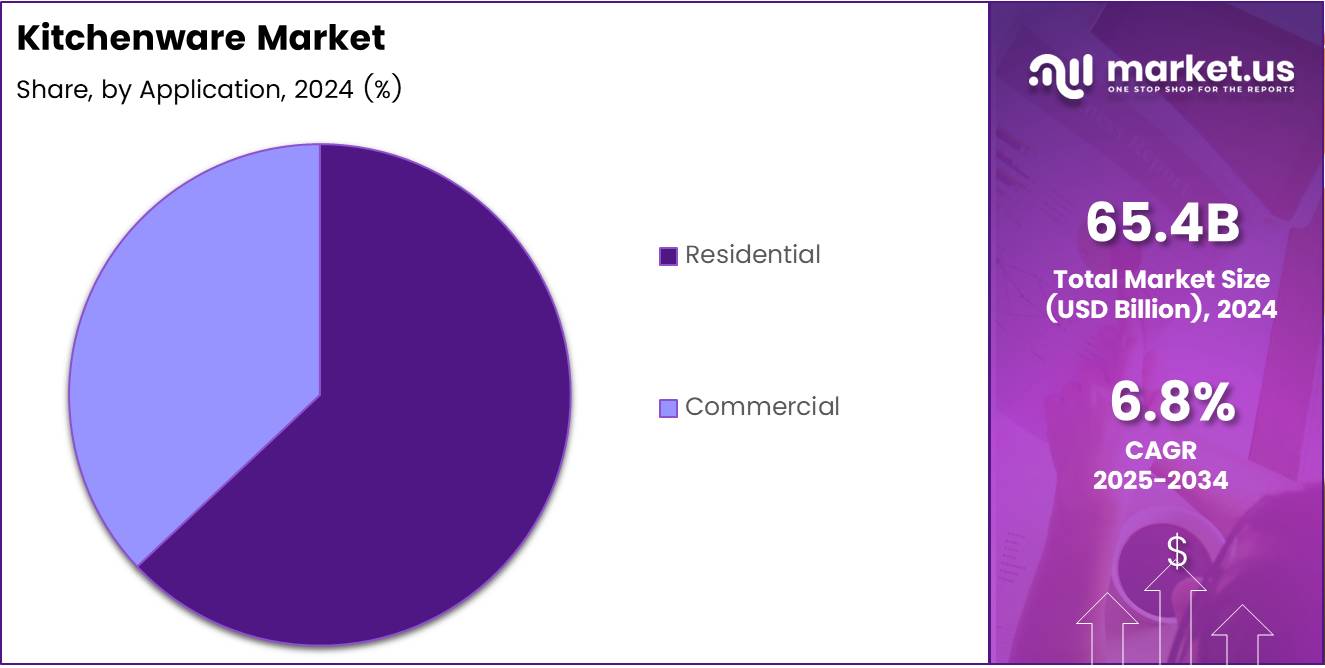

Application Analysis

Residential sector leads due to growing home cooking trends and lifestyle changes.

In 2024, Residential held a dominant market position in the By Application Analysis segment of the Kitchenware Market. A shift toward home-prepared meals, driven by cost-efficiency and health awareness, boosted residential demand.

The increase in apartment living and smaller households also led to the purchase of compact, efficient kitchen tools tailored for personal use.

Commercial applications remained relevant, primarily from restaurants, bakeries, and catering services. However, their market share was comparatively lower, as bulk procurement tends to be cyclical and affected by economic fluctuations.

Distribution Channel Analysis

Hypermarkets/Supermarkets lead the way due to their extensive reach and in-store shopping experience.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of the Kitchenware Market. Their ability to offer a wide product range under one roof, coupled with the option to physically inspect items, gave them a strategic edge.

Specialty Stores followed, catering to niche audiences looking for premium and branded kitchenware. These outlets attracted customers through product quality and exclusive offerings.

The Online channel saw a growing user base due to convenience, promotions, and increasing smartphone penetration. However, tactile evaluation remains a challenge in online shopping for kitchenware.

Others include local retail outlets and pop-up markets, which hold minimal but consistent presence in certain regional markets.

Key Market Segments

By Product

- Tableware

- Bakeware

- Cookware

- Others

By Application

- Residential

- Commercial

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Store

- Online

- Others

Drivers

Rising Health-Conscious Consumer Demand for Non-Toxic and Eco-Friendly Cookware

Modern consumers are becoming more aware of the health impact of their cooking tools. The demand for non-toxic, BPA-free, ceramic, and eco-friendly cookware is growing rapidly, especially in urban households. This shift is pushing manufacturers to innovate using sustainable materials.

Culinary shows, food influencers, and celebrity chefs are also playing a big role in encouraging people to explore new recipes and cookware styles. As a result, there is a noticeable rise in cookware purchases, especially branded and premium kitchen tools.

Urbanization is reshaping kitchen spaces. As more people live in compact apartments, the market is responding with space-saving kitchenware like stackable cookware, collapsible tools, and compact electric appliances that are easy to store and multifunctional.

Technology is transforming the kitchenware landscape. Smart tools like app-controlled cooking devices, precision thermometers, and timers are trending. Consumers are interested in appliances that offer both convenience and precision, helping to reduce cooking time and energy use.

Restraints

Volatility in Raw Material Prices Impacting Production Costs

The kitchenware industry is highly dependent on materials like stainless steel, aluminum, and plastic. Fluctuating raw material prices significantly affect production costs, forcing brands to either absorb losses or raise prices, which can limit consumer demand.

In many developing markets, counterfeit and low-quality kitchenware is widely available. These products undercut reputable brands, mislead consumers, and reduce trust in the category overall.

Many consumers, especially in rural and semi-urban regions, lack awareness about kitchenware safety and durability. This leads to poor buying decisions and higher product turnover, slowing the shift toward quality cookware.

Distribution challenges, particularly in emerging markets, further hamper the industry’s reach. Without reliable retail infrastructure or e-commerce logistics, it’s hard for leading brands to capture full market potential.

Growth Factors

Growth in Online Retailing and Direct-to-Consumer Sales Models

Online platforms have opened new doors for kitchenware companies. Brands are now directly reaching customers through e-commerce websites and social media, bypassing traditional retail and improving margins.

In Asia-Pacific, rising disposable incomes and urban lifestyles are pushing demand for premium and luxury kitchenware. This includes cast iron cookware, chef-grade knives, and sleek designer appliances.

There is a growing appetite for customized and modular kitchen tools that suit individual cooking styles, home sizes, and aesthetic preferences. Brands are tapping into this niche with tailor-made solutions.

Millennials are embracing multi-functional kitchen tools like air fryers, blender combos, and all-in-one cookers that offer value for money and save space. This segment continues to be a key growth engine.

Emerging Trends

Growing Trend of Aesthetic and Designer Kitchenware for Home Decor

Kitchenware is no longer just functional—it’s a part of home design. Consumers now prefer aesthetic cookware in trendy colors and finishes that complement their kitchens and dining setups.

The induction cookware trend is growing due to energy efficiency and faster cooking. Consumers are actively replacing traditional sets with compatible, eco-conscious alternatives.

There’s increasing adoption of innovative materials like food-grade silicone and ceramic coatings. These materials are safer, non-stick, and more durable, offering better value to end users.

The rise of the DIY cooking culture and subscription-based meal kits has driven demand for tools like prep sets, precision knives, and measuring equipment that enhance the home cooking experience.

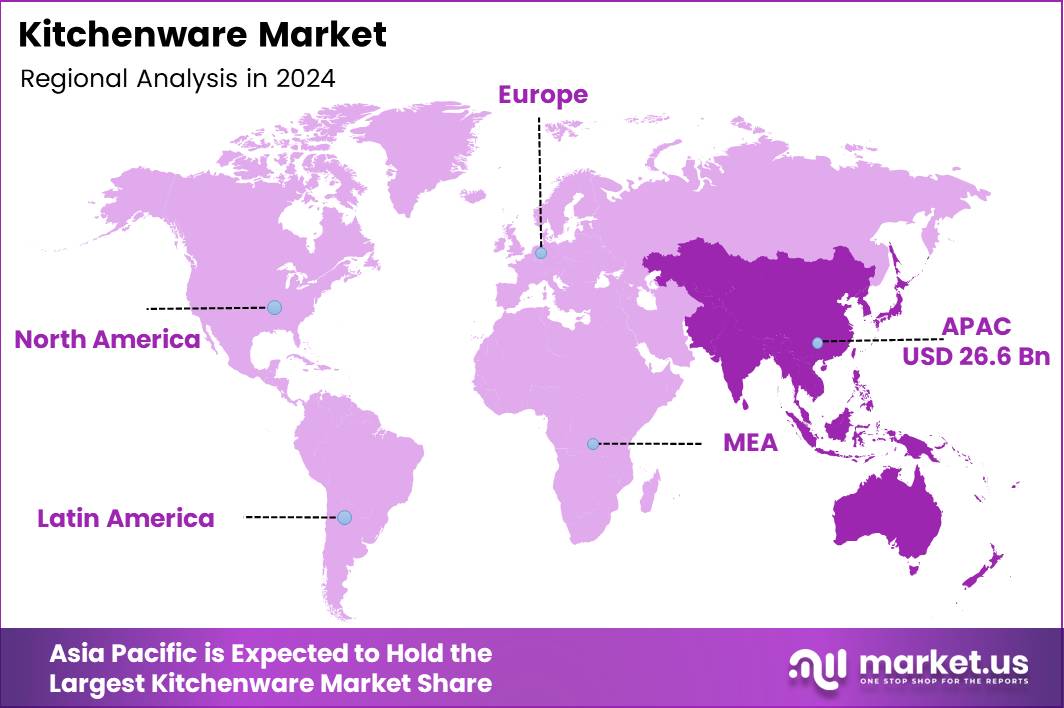

Regional Analysis

Asia Pacific Dominates the Kitchenware Market with a Market Share of 40.7%, Valued at USD 26.6 Billion

The Asia Pacific region leads the global kitchenware market, driven by rapid urbanization, growing middle-class income, and changing lifestyles. Increasing homeownership and rising demand for modular kitchens in countries like China and India have further accelerated regional growth. The demand for affordable and innovative cookware products remains high across urban and semi-urban households.

North America Kitchenware Market Trends

North America continues to demonstrate strong performance in the kitchenware segment, particularly due to increased consumer interest in premium and sustainable cookware solutions. The growing influence of health-focused cooking and adoption of modern kitchen gadgets are shaping product choices. The U.S. remains a key revenue contributor within this region.

Europe Kitchenware Market Trends

Europe’s kitchenware market is characterized by strong consumer preference for high-quality, durable, and eco-friendly kitchen tools. The market is shaped by evolving culinary preferences and the resurgence of home cooking across major countries such as Germany, France, and the UK. Sustainability and design-led innovation are key growth drivers here.

Middle East and Africa Kitchenware Market Trends

The Middle East and Africa region is gradually witnessing growth in the kitchenware sector due to rising disposable incomes and modern retail penetration. Consumers are showing increased interest in modern cooking solutions that blend tradition with innovation. Urban centers are particularly driving demand for premium and branded kitchen products.

Latin America Kitchenware Market Trends

In Latin America, kitchenware demand is being propelled by urban lifestyle shifts and the expansion of the foodservice sector. Local consumer behavior favors cost-effective and multifunctional kitchen tools. Brazil and Mexico are among the notable contributors to the market’s steady development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Kitchenware Company Insights

In 2024, the global kitchenware market is witnessing dynamic shifts, driven by innovation, evolving consumer lifestyles, and increasing emphasis on sustainability and aesthetics. Among the key players, GROUPE SEB continues to dominate with its wide portfolio of premium and mid-range kitchen products. Its strong global presence and emphasis on smart kitchen innovations keep it ahead in both developed and emerging markets.

Wilh. Werhahn KG has maintained a strong foothold through its subsidiary brands, combining traditional German craftsmanship with modern functionality. Their commitment to durability and sustainable materials resonates well with eco-conscious consumers, particularly in Europe.

Target Brands, Inc. leverages its vast retail network and private label strength to offer stylish yet affordable kitchenware. The company’s ability to adapt to trends quickly, such as minimalist or multifunctional tools, gives it an edge in the mass-market segment.

Meyer International focuses on quality and innovation, catering to both professional and home chefs. Its global manufacturing capabilities and collaborations with renowned culinary figures have helped expand its reach across premium consumer segments.

These companies continue to shape the kitchenware industry through a mix of heritage, innovation, and customer-centric strategies, reflecting broader trends in lifestyle, functionality, and design.

Top Key Players in the Market

- GROUPE SEB

- Wilh. Werhahn KG

- Target Brands, Inc.

- Meyer International

- Fissler

- Tramontina

- Newell Brands

- SCANPAN

- TTK Prestige Ltd.

- The Vollrath Company, LLC

Recent Developments

- In Feb 2025, TTK Prestige announced plans to increase its store count by up to 30% over the next four years. The company is optimistic that recent income tax reliefs by the government will enhance disposable incomes and boost retail demand.

- In Dec 2024, The Indus Valley raised ₹23.1 Crore in Pre-Series A funding to fuel the growth of its toxin-free kitchenware range. The capital will be used to expand operations, strengthen product R&D, and accelerate brand visibility in India’s health-conscious market.

- In Jul 2025, Cumin Co. introduced India’s first 100% toxin-free enamel cast iron cookware, setting a new benchmark in healthy cooking. The launch positions the brand as a pioneer in smart, sustainable cookware for modern Indian kitchens.

Report Scope

Report Features Description Market Value (2024) USD 65.4 Billion Forecast Revenue (2034) USD 126.3 Billion CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Tableware, Bakeware, Cookware, Others), By Application (Residential, Commercial), By Distribution Channel (Hypermarkets/Supermarkets, Specialty Store, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape GROUPE SEB, Wilh. Werhahn KG, Target Brands, Inc., Meyer International, Fissler, Tramontina, Newell Brands, SCANPAN, TTK Prestige Ltd., The Vollrath Company, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GROUPE SEB

- Wilh. Werhahn KG

- Target Brands, Inc.

- Meyer International

- Fissler

- Tramontina

- Newell Brands

- SCANPAN

- TTK Prestige Ltd.

- The Vollrath Company, LLC