Global Glass Tableware Market Size, Share, Growth Analysis By Product Type (Drinkware, Tableware, Cookware, Serveware, Decorative Items), By End User (Residential, Commercial), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145127

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

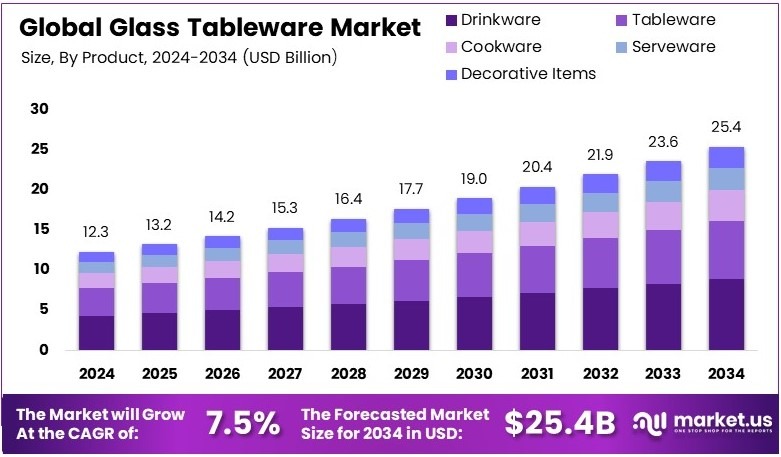

The Global Glass Tableware Market size is expected to be worth around USD 25.4 Billion by 2034, from USD 12.3 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

Glass tableware refers to items made of glass used for serving and dining. These include plates, bowls, glasses, and other table accessories. Glass tableware is popular for its elegant appearance and durability. It is commonly used in households, restaurants, and hotels. The material is easy to clean and often dishwasher safe.

The glass tableware market involves the production and sale of glass-based dining products. It includes manufacturers, suppliers, and retailers. The market is driven by the demand for aesthetically pleasing and durable tableware. Innovations in design and increasing consumer preferences for sustainable materials also influence growth. Major segments include household, commercial, and premium glass tableware.

Glass tableware serves a diverse range of industries, including hospitality, household, and commercial sectors. The demand for stylish and durable glass products is rising as consumers increasingly prefer aesthetically pleasing options.

In India, glass and glassware exports reached approximately $1.08 billion in 2023, according to the United Nations COMTRADE database. Conversely, imports during the same period amounted to around 73.03 billion INR, reflecting the country’s active participation in the global glassware market. Consequently, local manufacturers are motivated to improve quality and compete internationally.

The market is expanding primarily due to growing disposable incomes and urbanization, which boost household purchases of glass tableware. Moreover, the hospitality sector, particularly restaurants and cafes, significantly contributes to this growth.

According to the National Restaurant Association’s 2025 State of the Restaurant Industry report, the U.S. restaurant industry is projected to achieve $1.1 trillion in sales this year, marking a 4% increase from the previous year. This surge in restaurant activities naturally drives demand for quality glassware, emphasizing its importance in the food and beverage sector.

Furthermore, the increasing focus on sustainability is positively impacting the glass tableware market. Consumers are gradually shifting from plastic alternatives to glass due to environmental concerns. As a result, manufacturers are investing in producing eco-friendly and recyclable glass products.

Additionally, the rise of handcrafted and uniquely designed glass items appeals to niche markets, fostering innovation and variety within the industry. In contrast, competition from cheaper materials like plastic and melamine remains a challenge, especially in price-sensitive markets.

The market’s competitive landscape is shaped by both established players and new entrants who focus on innovative and sustainable designs. Recently, mergers and acquisitions have played a significant role in market consolidation. For instance, in August 2024, Calibre Scientific acquired Industrial Glassware, a U.S.-based manufacturer of laboratory supplies. As a result, companies aim to strengthen their foothold by broadening product offerings and improving production efficiency.

Key Takeaways

- The Glass Tableware Market was valued at USD 12.3 billion in 2024 and is expected to reach USD 25.4 billion by 2034, with a CAGR of 7.5%.

- In 2024, Drinkware dominates the product type segment with 65.7% due to its everyday use in households and commercial settings.

- In 2024, Residential leads the end-user segment with 58.3%, reflecting growing consumer preference for aesthetic table settings.

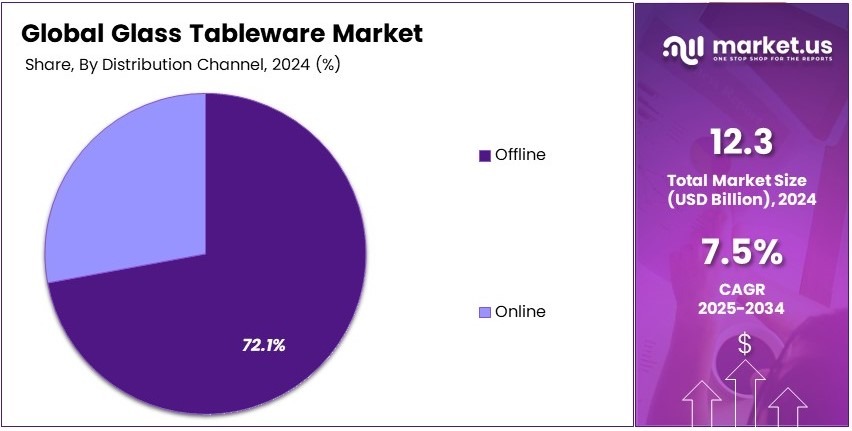

- In 2024, Offline channels dominate distribution with 72.1%, as customers prefer to inspect quality and design before purchasing.

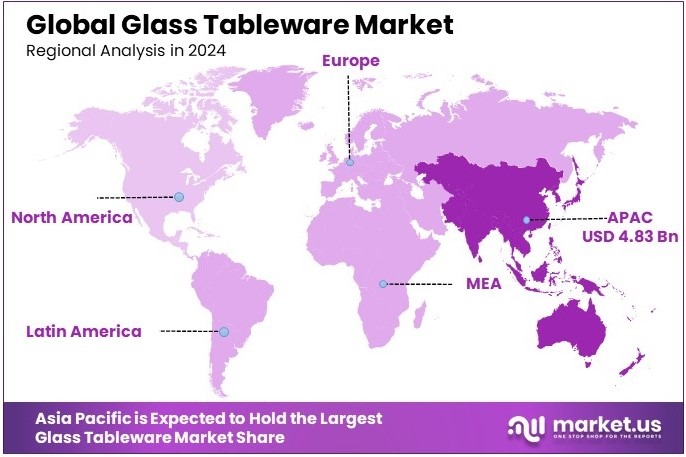

- In 2024, Asia Pacific holds the largest share at 39.3% and valued at USD 4.83 billion, supported by a large population and rising disposable incomes.

Type Analysis

Drinkware dominates with 65.7% due to its essential role in everyday life.

The glass tableware market can be segmented by product type, within which Drinkware emerges as the dominant sub-segment, commanding a significant market share of 65.7%. This prominence is attributed to the universal daily use of drinkware items such as glasses and mugs, essential for both residential and commercial settings. The demand for high-quality, durable glass drinkware, which can offer aesthetic appeal alongside practicality, fuels its market leadership.

Serveware, another vital sub-segment, holds a market role by serving as an integral part of table setting and food presentation, contributing significantly to aesthetic value and functionality in both home and hospitality environments.

Tableware, encompassing plates and bowls, remains critical for daily meals and special occasions, supporting consumer needs across varied socioeconomic segments.

Cookware and decorative items, though smaller in market share, play essential roles. Glass cookware offers health benefits and aesthetic appeal, while decorative items enhance the ambiance and style of living spaces, contributing to the market’s diversity and growth potential.

End User Analysis

Residential leads with 58.3% due to the increasing number of households preferring quality and aesthetic tableware.

In the end-user segmentation of the glass tableware market, the Residential segment stands out, holding a predominant share of 58.3%. This segment’s growth is driven by the rising number of individual households and the growing consumer emphasis on interior aesthetics and quality living. As homes become a focal point for personal style, glass tableware’s role in enhancing dining and kitchen environments becomes pivotal.

The Commercial segment, though not dominating, is crucial, supporting industries such as hospitality and catering, where the demand for durable and appealing tableware is consistent.

Distribution Channel Analysis

Offline distribution dominates with 72.1% due to consumer preference for physical product verification.

Within the distribution channels of the glass tableware market, Offline channels take precedence with a market share of 72.1%. This dominance is largely due to consumer preferences for touching, feeling, and visually inspecting products before purchase, which is particularly important in the case of glassware, where look and feel play significant roles in consumer decision-making.

Online channels, while growing, offer the convenience of easy browsing and home delivery, which are increasingly appreciated by a technologically savvy consumer base.

Each segment of the glass tableware market presents unique dynamics and growth drivers. By focusing on these segments, businesses can tailor their strategies to meet the most lucrative opportunities and respond effectively to consumer preferences and market trends.

Key Market Segments

By Product Type

- Drinkware

- Tableware

- Cookware

- Serveware

- Decorative Items

By End User

- Residential

- Commercial

By Distribution Channel

- Offline

- Online

Driving Factors

Rising Demand for Aesthetic and Sustainable Glass Tableware Drives Market Growth

The growing preference for aesthetically pleasing and elegant glass tableware is boosting the market. Fine dining and the hospitality industry favor glass tableware for its visual appeal. Restaurants and hotels are increasingly opting for stylish glass pieces to enhance the dining experience.

At the same time, homeowners are investing in premium glass tableware to match contemporary home decor trends. This shift reflects a desire for sophisticated and elegant dining settings. Additionally, the rising awareness of sustainable living is influencing purchasing decisions. Consumers are moving away from plastic alternatives in favor of recyclable glass.

Glass tableware is considered eco-friendly and reusable, making it a preferred choice among environmentally conscious buyers. The expansion of online retail is also a significant factor. E-commerce platforms offer diverse collections of glass tableware, catering to various tastes and preferences. These platforms make it easier for consumers to explore new designs and styles.

Furthermore, social media influences buying behavior by showcasing modern glass tableware trends. As a result, more people are inclined to purchase glass items for home and hospitality use. All these factors collectively fuel the growth of the glass tableware market, driven by aesthetic appeal, sustainability, and ease of access through online channels.

Restraining Factors

Fragility and Competition Restrains Market Growth

Despite its appeal, the glass tableware market faces challenges. One significant issue is the high fragility of glass products. Glass items are prone to breakage, leading to frequent replacements. This increases maintenance costs for both households and commercial users.

The risk of damage during transportation also adds to the costs, impacting profitability for manufacturers and retailers. Additionally, glass faces tough competition from ceramic, porcelain, and stainless steel tableware. These alternatives are often more durable and less prone to breakage. As a result, many consumers choose these options over glass.

Price volatility of raw materials, such as silica and soda ash, further complicates production. Fluctuating costs impact pricing strategies and profit margins. Moreover, the energy-intensive nature of glass manufacturing raises environmental concerns. High energy consumption and emissions during production can deter eco-conscious buyers.

Supply chain disruptions also play a role, causing delays and increased expenses. These challenges collectively restrain the growth of the glass tableware market, as consumers and manufacturers weigh the costs and environmental impacts against the aesthetic benefits.

Growth Opportunities

Innovation and Customization Provides Opportunities

The glass tableware market has significant growth potential driven by innovation. Manufacturers are developing lightweight and scratch-resistant glass, which enhances durability. This innovation addresses concerns about fragility and appeals to both residential and commercial buyers.

Tempered glass tableware, in particular, offers increased resistance to breakage, making it suitable for everyday use. Additionally, the demand for customizable and personalized glassware is on the rise. Consumers seek unique designs, especially for gifting and special events. Customized engravings and color variations add a personal touch, attracting buyers who value individuality.

The rise of smart glass tableware is another opportunity. Products that withstand microwaving and dishwashing are gaining popularity. This functionality adds convenience to daily use. Moreover, the development of eco-friendly and lead-free glass aligns with health-conscious consumer preferences.

Such innovations position manufacturers to cater to a broader audience, including those focused on sustainability. These factors collectively present opportunities for market growth, as innovation meets evolving consumer demands.

Emerging Trends

Minimalist and Luxury Designs Are Latest Trending Factor

The glass tableware market is experiencing trends shaped by modern aesthetics. One notable trend is the rise of minimalist designs. Consumers are opting for simple and clean glassware that fits contemporary dining settings. Scandinavian-inspired pieces, known for their subtle elegance, are especially popular.

This trend aligns with the growing preference for uncluttered and functional table setups. On the other hand, handcrafted and artisanal glassware is gaining traction in luxury dining. Unique, hand-blown items appeal to consumers looking for exclusivity. Such glassware is often featured in upscale restaurants and boutique hotels.

Another trend is the use of colored and textured glass. These designs add a vibrant touch to dining experiences, catering to younger and style-conscious buyers. Furthermore, compact living spaces drive the demand for stackable glassware. These space-saving designs are practical for urban households.

As compact living becomes more common, functional yet stylish glass pieces gain importance. These trends highlight the evolving consumer preferences toward both minimalism and artistic expression in glass tableware.

Regional Analysis

Asia Pacific Dominates with 39.3% Market Share

Asia Pacific leads the Glass Tableware Market with a 39.3% share and valuation of USD 4.83 Billion, making it the largest regional market. This dominance is fueled by the region’s large population, rising middle class, and increasing urbanization, which boost demand for glass tableware in both household and commercial settings.

The region benefits from strong local manufacturing bases in countries like China and India, where production costs are lower, and the tradition of glass craftsmanship is strong. Moreover, the increasing number of hotels and restaurants due to tourism and business travel further drives the demand for high-quality glass tableware.

Looking forward, Asia Pacific’s influence in the glass tableware market is expected to continue growing. The ongoing urbanization and economic growth are likely to sustain the high demand, while innovations in glassware design and functionality could attract a broader consumer base, potentially increasing the region’s market share further.

Regional Mentions:

- North America: North America holds a significant market share in the Glass Tableware Market, driven by high consumer spending power and a preference for premium glassware products. The region’s focus on sustainable and aesthetically pleasing tableware options also contributes to its market stability.

- Europe: Europe maintains a robust demand for glass tableware, supported by a long-standing tradition of dining etiquette and a strong preference for quality craftsmanship. European consumers tend to favor eco-friendly and artisanal glassware, aligning with the region’s environmental consciousness.

- Middle East & Africa: The Middle East and Africa are experiencing growth in the glass tableware market, spurred by increasing urban development and a growing hospitality industry. The region’s rich culture and luxury dining experiences play a crucial role in this upward trend.

- Latin America: Latin America shows potential for growth in the glass tableware market, particularly due to its rising urban middle class and increasing disposable income. The region’s vibrant culture and emphasis on family gatherings fuel the demand for quality tableware.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

In the global Glass Tableware Market, four key players stand out due to their market share, innovation, and brand reputation. These are Libbey Inc., Arc International, Bormioli Rocco Group, and The Oneida Group. Each of these companies has contributed significantly to shaping the competitive landscape of the glass tableware industry.

Libbey Inc. is renowned for its extensive range of glassware products designed for both home and professional use. Its commitment to quality and design excellence makes it a preferred choice for consumers worldwide. Arc International, based in France, operates on a global scale, offering a wide array of glass tableware products. Known for its innovative approach, Arc International frequently introduces new technologies and designs that set industry trends.

Bormioli Rocco Group, an Italian manufacturer, combines traditional craftsmanship with modern design, providing products that are both functional and stylish. Their glassware is particularly popular in European markets. The Oneida Group, although originally famous for its silverware, has made significant inroads into the glass tableware market with products that are both durable and aesthetically pleasing, catering to a variety of consumer needs.

These companies not only dominate due to their size but also influence the market through strategic marketing, extensive distribution networks, and continuous product innovation. Their ability to adapt to consumer preferences and global market trends allows them to maintain a significant presence in the industry.

Major Companies in the Market

- Libbey Inc.

- Arc International

- Bormioli Rocco Group

- The Oneida Group

- Riedel Crystal

- Lenox Corporation

- Krosno Glass S.A.

- Ocean Glass Public Company Limited

- Pasabahce (Sisecam Group)

- Luigi Bormioli

Recent Developments

- Aldi: On March 2025, Aldi introduced a 4-pack of fluted highball glasses under its Crofton brand. The glasses, available in two colors, are designed with a vintage-inspired aesthetic and offer an affordable alternative to more expensive brands. They are ideal for various beverages and praised for their combination of style and practicality.

- Cello World: On April 2024, Cello World, an Indian houseware company, announced plans to establish a glassware manufacturing facility in Falna, Rajasthan. The facility, expected to begin operations by the end of Q1 FY25, will use European-made machinery to improve productivity and design precision. This expansion aims to meet the demands of diverse consumer segments across various price points and quality standards.

Report Scope

Report Features Description Market Value (2024) USD 12.3 Billion Forecast Revenue (2034) USD 25.4 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Drinkware, Tableware, Cookware, Serveware, Decorative Items), By End User (Residential, Commercial), By Distribution Channel (Offline, Online) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Libbey Inc., Arc International, Bormioli Rocco Group, The Oneida Group, Riedel Crystal, Lenox Corporation, Krosno Glass S.A., Ocean Glass Public Company Limited, Pasabahce (Sisecam Group), Luigi Bormioli, La Opala RG Limited, Borosil Glass Works Ltd., Anchor Hocking Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Libbey Inc.

- Arc International

- Bormioli Rocco Group

- The Oneida Group

- Riedel Crystal

- Lenox Corporation

- Krosno Glass S.A.

- Ocean Glass Public Company Limited

- Pasabahce (Sisecam Group)

- Luigi Bormioli