Global Keratin Products Market By Product Type (Hair Care Products, Skin Care Products, Others), By Keratin Type (Alpha-keratin, Beta-keratin), By Keratin Source (Animal, Plant), By Distribution Channel (Supermarkets And Hypermarkets, Specialty Beauty Stores, Pharmacies And Drugstores, Online, Others), By Gender (Men, Women, Unisex), By End-use (Individuals, Professionals) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151421

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

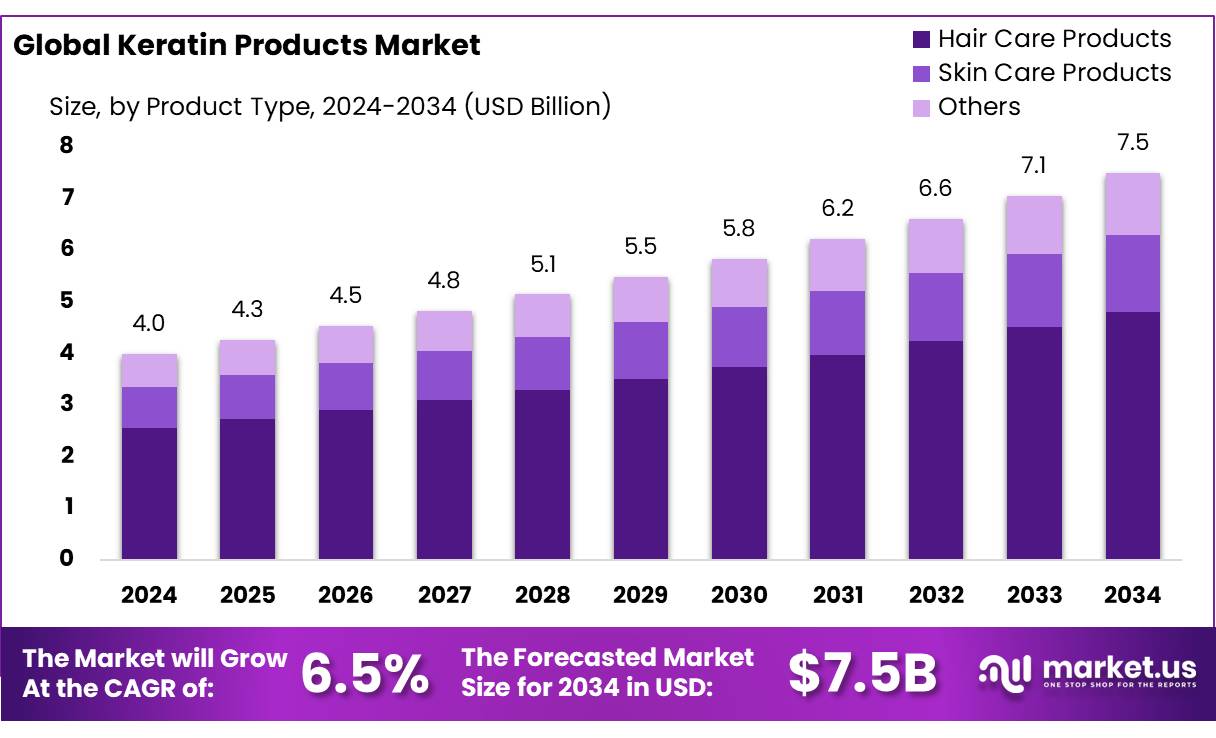

The Global Keratin Products Market size is expected to be worth around USD 7.5 Billion by 2034, from USD 4.0 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

Keratin concentrates are high purity protein formulations derived from keratin—a structural fibrous protein abundant in hair, feathers, nails, and wool. These concentrates are processed into hydrolysates, amino acid blends, or recombinant proteins. They are used extensively in personal care (hair and skin treatments), biomaterials, textiles, and emerging bioenergy applications. Recent research has demonstrated applications such as wound healing keratin nanoparticles and bio electric systems powered by keratin hydrolysates.

According to the Food and Agriculture Organization (FAO), over 40 million tonnes of poultry feathers are generated annually across the globe, of which less than 10% is valorized for keratin recovery, highlighting a large untapped potential. Moreover, India alone produces approximately 3.5 million tonnes of poultry waste per year, with initiatives such as the National Bio-Energy Mission encouraging the conversion of agro-waste into value-added products, including proteins like keratin.

Governmental bioenergy programmes encourage valorisation of such agricultural wastes via waste-to-energy strategies. For example, the International Energy Agency (IEA) projects that global biogas potential from waste streams could supply nearly 1 trillion m³ of natural gas equivalent per year (~25% of global natural gas demand). Integrated systems coupling keratin hydrolysate-based microbial fuel cells are already being piloted for electricity and biohydrogen generation.

This trend is supported by government policies such as the Production Linked Incentive (PLI) Scheme for the pharmaceutical and chemical sectors, promoting domestic bio-based ingredient production. Additionally, the US Department of Agriculture (USDA) has included keratin-based bio-products under its BioPreferred Program, facilitating their market penetration by offering procurement preference to federal agencies.

Biomedical innovations involving keratin have also seen significant advancements. Keratin-based hydrogels, scaffolds, and wound healing patches are under active research and commercialization. The National Institutes of Health (NIH) in the United States has funded multiple projects focusing on keratin biomaterials for drug delivery and tissue repair, allocating over USD 15 million in 2023 towards regenerative medicine that includes keratin applications.

Key Takeaways

- Keratin Products Market size is expected to be worth around USD 7.5 Billion by 2034, from USD 4.0 Billion in 2024, growing at a CAGR of 6.5%.

- Hair Care Products held a dominant market position, capturing more than a 64.20% share of the total keratin products market.

- Alpha-keratin held a dominant market position, capturing more than a 76.30% share in the global keratin products market.

- Animal held a dominant market position, capturing more than a 83.20% share in the keratin products market.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 36.60% share in the keratin products market.

- Men held a dominant market position, capturing more than a 67.30% share in the keratin products market.

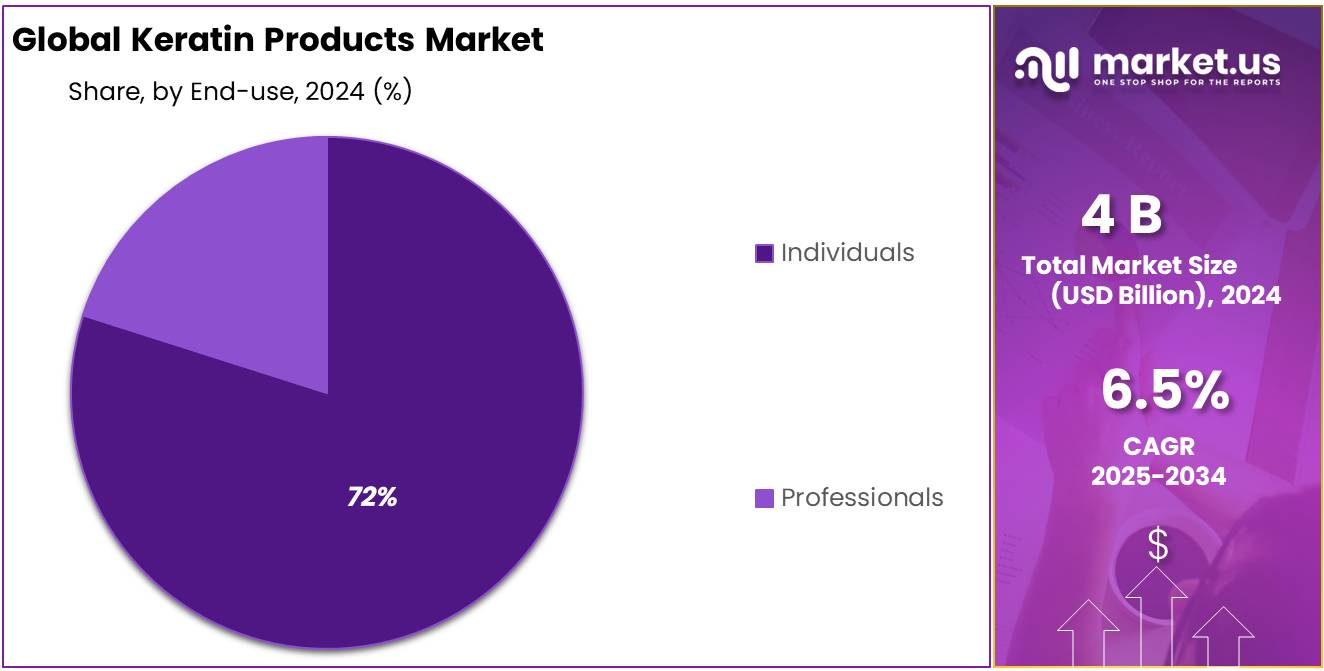

- Individuals held a dominant market position, capturing more than a 72.30% share in the global keratin products market.

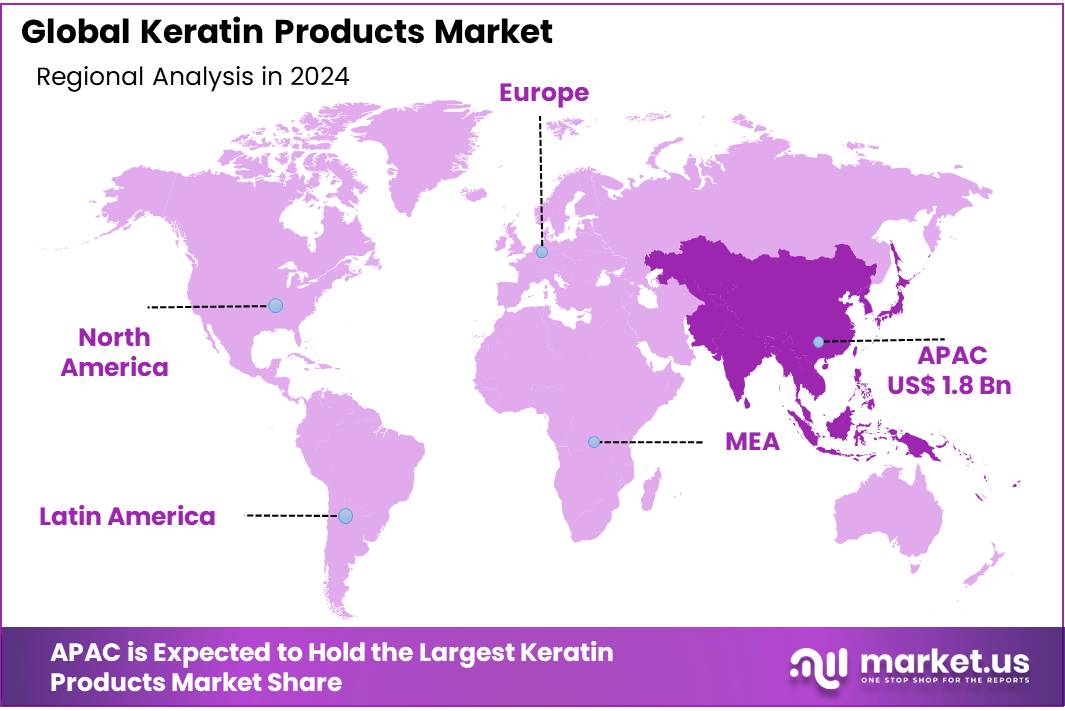

- Asia Pacific (APAC) region emerged as the dominant market for keratin products, holding a commanding share of 45.60% and generating revenue of approximately USD 1.8 billion.

By Product Type

Hair Care Products lead with 64.20% share in 2024, driven by strong consumer demand for hair repair solutions.

In 2024, Hair Care Products held a dominant market position, capturing more than a 64.20% share of the total keratin products market. This strong lead can be attributed to the growing global focus on hair damage repair, frizz control, and smoothing treatments, especially in urban regions. Consumers are increasingly turning to keratin-based shampoos, conditioners, and hair masks due to their visible effects in restoring hair strength and shine. The trend has been particularly strong in countries with rising middle-class populations, where spending on personal grooming products has seen consistent growth. In 2025, the demand for keratin-infused hair care solutions is expected to grow steadily, supported by product innovation and wider availability through e-commerce and salons.

By Keratin Type

Alpha-keratin dominates with 76.30% share in 2024, favored for its natural compatibility with human hair and skin.

In 2024, Alpha-keratin held a dominant market position, capturing more than a 76.30% share in the global keratin products market. This high share reflects the growing preference for formulations that closely mimic the structural protein found in human hair, nails, and skin. Alpha-keratin’s natural origin and high biocompatibility have made it the top choice for cosmetic applications, especially in hair care treatments where it helps repair damage and improve texture. Its use is also expanding in skin-care and biomedical fields due to its non-toxic and bioactive properties. Looking into 2025, alpha-keratin is expected to maintain its leading role as brands continue to promote its restorative benefits and safety for sensitive users.

By Keratin Source

Animal-sourced keratin leads with 83.20% share in 2024, backed by its strong presence in traditional hair and skin care formulations.

In 2024, Animal held a dominant market position, capturing more than a 83.20% share in the keratin products market. This overwhelming preference is mainly due to the long-established use of animal-derived keratin extracted from wool, feathers, hooves, and horns, which provides a rich source of structural proteins ideal for cosmetic formulations. Despite the rise of plant-based and recombinant alternatives, animal-based keratin remains widely used due to its proven effectiveness, ease of processing, and cost-efficiency. In 2025, the segment is expected to retain its leading position, although slight shifts may occur as ethical sourcing and sustainability concerns continue to influence consumer choices.

By Distribution Channel

Supermarkets & Hypermarkets lead with 36.60% share in 2024, driven by high consumer footfall and easy product visibility.

In 2024, Supermarkets & Hypermarkets held a dominant market position, capturing more than a 36.60% share in the keratin products market. This leadership is largely due to the convenience they offer—shoppers can easily access a wide variety of keratin-based shampoos, conditioners, and treatment kits while doing their routine grocery shopping. These large retail formats also provide promotional space, discounts, and product sampling, encouraging impulse buying and brand switching. In 2025, the segment is expected to remain strong as keratin product manufacturers continue to focus on shelf space, packaging visibility, and seasonal promotions to attract a broader consumer base.

By Gender

Men dominate the keratin products market with 67.30% share in 2024, fueled by rising awareness of grooming and hair care.

In 2024, Men held a dominant market position, capturing more than a 67.30% share in the keratin products market. This significant share is driven by the growing focus among men on hair strength, styling, and scalp health. With increased exposure to grooming products and a shift in cultural norms around self-care, keratin-based hair solutions have gained popularity for addressing hair thinning, dryness, and overall appearance. Products specifically tailored to men—like anti-hair fall shampoos and strengthening conditioners—have seen higher uptake across both urban and semi-urban areas. Looking into 2025, this trend is expected to continue as more men incorporate keratin-rich products into their daily routines.

By End-use

Individuals lead with 72.30% share in 2024, driven by personal grooming needs and at-home hair care routines.

In 2024, Individuals held a dominant market position, capturing more than a 72.30% share in the global keratin products market. This strong presence reflects the growing trend of at-home hair care and styling, where people increasingly seek salon-like results using personal grooming products. The ease of access to keratin-based shampoos, conditioners, and DIY treatment kits through retail and online platforms has empowered individuals to manage their hair concerns independently. As awareness around hair health and self-care continues to rise, especially among younger and working-age consumers, the individual end-user segment is expected to hold its lead into 2025.

Key Market Segments

By Product Type

- Hair Care Products

- Shampoo

- Conditioner

- Hair Mask

- Serum & Oil

- Others

- Skin Care Products

- Moisturizers

- Skin Serums

- Others

- Others

By Keratin Type

- Alpha-keratin

- Beta-keratin

By Keratin Source

- Animal

- Plant

By Distribution Channel

- Supermarkets & Hypermarkets

- Specialty Beauty Stores

- Pharmacies & Drugstores

- Online

- Others

By Gender

- Men

- Women

- Unisex

By End-use

- Individuals

- Professionals

Drivers

Rising Demand for Natural and Organic Keratin Products

A significant driving force behind the growth of the keratin products market is the increasing consumer preference for natural and organic ingredients in personal care products. As consumers become more conscious of the ingredients in their beauty and personal care items, there is a marked shift towards products that are perceived as safer, more sustainable, and effective.

This trend is further supported by advancements in extraction technologies, which have made it possible to obtain keratin from renewable and sustainable sources, including plant-based materials and agricultural waste. Such innovations not only cater to the growing demand for ethical and cruelty-free products but also align with global sustainability goals.

In response to this demand, governments and regulatory bodies are promoting the use of natural and organic ingredients in personal care products. For example, the European Union’s Cosmetics Regulation encourages the use of safe and sustainable ingredients, providing a framework that supports the inclusion of natural proteins like keratin in cosmetic formulations. Similarly, the U.S. Food and Drug Administration (FDA) monitors and regulates the safety of personal care products, ensuring that ingredients such as keratin meet safety standards for consumer use.

Restraints

High Production Costs and Limited Raw Material Availability

One of the primary challenges facing the keratin products market is the high cost of production and the limited availability of raw materials. Keratin, a fibrous protein naturally found in hair, skin, and nails, is primarily sourced from animal by-products such as wool, feathers, and hooves. The extraction and purification processes for keratin are complex and resource-intensive, leading to elevated production costs. Keratin is typically derived from sources like human hair, wool, and feathers, which require meticulous processing to obtain pure keratin proteins. Specialized equipment and chemicals drive up production expenses when applying these extraction methods.

The intricate production process for keratin makes it less accessible for widespread utilization across different industries. This cost burden may limit the market’s growth, particularly in price-sensitive regions or among budget-conscious consumers.

In response to these challenges, some companies are exploring alternative sources of keratin, such as plant-based keratin derived from wheat or corn. These alternatives aim to reduce costs and appeal to consumers seeking vegan or cruelty-free products. However, the development and scaling of plant-based keratin are still in the early stages, and these products currently represent a small segment of the market.

Additionally, the limited availability of raw materials can lead to supply chain disruptions, affecting the consistency and reliability of keratin supply. This variability can impact manufacturers’ ability to meet demand and maintain product quality.

Opportunity

Expansion of Keratin-Based Nutraceuticals

A significant growth opportunity in the keratin products market lies in the expansion of keratin-based nutraceuticals. Keratin, a fibrous protein naturally found in hair, skin, and nails, is increasingly being utilized in dietary supplements aimed at enhancing hair and nail health. This trend is driven by rising consumer awareness of the benefits of keratin supplementation, coupled with a growing preference for natural and protein-based ingredients in wellness products.

In response to this demand, companies are investing in research and development to formulate keratin supplements that are both effective and appealing to consumers. These supplements are often marketed as part of a holistic approach to beauty and wellness, aligning with the growing trend of integrating personal care with overall health. Additionally, the rise of e-commerce platforms has facilitated broader access to these products, enabling consumers to easily find and purchase keratin supplements that meet their specific needs.

Government initiatives also play a role in supporting the growth of the keratin nutraceuticals market. For instance, the U.S. Food and Drug Administration (FDA) regulates dietary supplements to ensure they are safe and accurately labeled, providing consumers with confidence in the products they choose. Such regulatory frameworks help maintain product quality and safety standards, which are crucial for consumer trust and market expansion.

Trends

Rise of Plant-Based and Sustainable Keratin Alternatives

A significant trend shaping the keratin products market is the increasing demand for plant-based and sustainable keratin alternatives. As consumers become more conscious of environmental issues and animal welfare, there is a growing preference for products that align with these values. This shift is prompting manufacturers to explore and develop keratin substitutes derived from plant sources, such as wheat, corn, and soy, as well as from agricultural by-products.

In response to consumer demand for cruelty-free and eco-friendly products, companies are investing in research and development to create plant-based keratin alternatives that mimic the properties of animal-derived keratin. These innovations not only cater to the ethical concerns of consumers but also offer sustainable solutions to the beauty and personal care industry.

Government initiatives are also playing a role in promoting the use of sustainable ingredients in personal care products. For instance, the European Union’s Horizon 2020 program has facilitated collaborative research and development projects between universities, research institutes, and beauty companies, focusing on sustainable and bio-based ingredients . Such programs provide funding and support for the development of alternative ingredients, encouraging innovation in the industry.

Regional Analysis

Asia Pacific Leads the Keratin Products Market with 45.60% Share, Valued at USD 1.8 Billion

In 2024, the Asia Pacific (APAC) region emerged as the dominant market for keratin products, holding a commanding share of 45.60% and generating revenue of approximately USD 1.8 billion. This strong regional performance is largely supported by a rapidly growing middle-class population, increased urbanization, and heightened consumer awareness about personal grooming and hair care. Countries such as China, India, Japan, and South Korea are witnessing a significant rise in demand for keratin-based shampoos, conditioners, and hair treatments, particularly as consumers seek advanced solutions for hair repair, frizz control, and scalp nourishment.

Government initiatives in countries like Japan and South Korea that promote biotechnology and ethical sourcing are also indirectly fostering innovation in keratin production, especially in plant-based and recombinant keratin alternatives. As e-commerce and social media campaigns play an increasing role in product discovery and brand engagement, APAC continues to outpace other regions in keratin product adoption. Given its consumer base and evolving beauty standards, the region is expected to retain its leadership position through 2025, offering ample opportunities for both multinational and domestic players to expand their market presence.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

L’Oréal offers a prominent keratin lineup under its Professional and Paris brands, featuring keratin-enriched shampoos and treatments that strengthen hair by up to 70%, according to product descriptions. The company emphasizes scientifically backed ingredients like Pro Keratin and Incell to restore damaged hair. Its global salon network and robust R&D infrastructure enable rapid rollout of advanced keratin formulations. In 2024, L’Oréal continued to innovate in sulfate free, protein-rich products to meet rising hair health demands.

Unilever leverages decades of hair care research to create keratin-focused solutions aimed at repairing hair fibres from within. The firm integrates keratin into its mass-market Dove and professional hair brands, emphasizing bond-strengthening technologies. Unilever’s extensive distribution reach and digital presence allow keratin product innovation to access global consumers swiftly. In 2024, the company continued its investment in transformational hair-repair formulations to address concerns from damage, breakage, and frizz control across diverse markets.

Keratin Complex specializes in salon-grade keratin treatments and at-home maintenance kits. Their formulations are recognized in professional hair smoothing and straightening services, offering long-lasting frizz control and shine restoration. Investment in salon partnerships and stylist training enables Keratin Complex to maintain strong presence in the premium treatment segment. With growing interest in self-care and home solutions, the brand is expanding its retail and online channels to meet consumer demand in 2024.

Top Key Players in the Market

- L’Oréal S.A.

- Unilever PLC

- Keratin Complex

- Henkel AG & Co. KGaA

- Cliove Organics

- Kerotin Hair Care

- GK Hair USA

- Gussi Hair LLC

- Nutree Cosmetics

- Novex Hair Care

- Wella Professionals

- Johnson & Johnson

- Ouai Haircare

- Peter Coppola

- Rich Daddy International

- Other Key Players

Recent Developments

In 2024, L’Oréal’s total sales reached €43.48 billion, marking a 5.6% increase from the previous year.

In fiscal year 2024, Henkel reported total sales of €21.6 billion, with the Consumer Brands business unit, encompassing hair care brands like Schwarzkopf Professional, contributing €10.5 billion to this figure.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Bn Forecast Revenue (2034) USD 7.5 Bn CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Hair Care Products, Skin Care Products, Others), By Keratin Type (Alpha-keratin, Beta-keratin), By Keratin Source (Animal, Plant), By Distribution Channel (Supermarkets And Hypermarkets, Specialty Beauty Stores, Pharmacies And Drugstores, Online, Others), By Gender (Men, Women, Unisex), By End-use (Individuals, Professionals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape L’Oréal S.A., Unilever PLC, Keratin Complex, Henkel AG & Co. KGaA, Cliove Organics, Kerotin Hair Care, GK Hair USA, Gussi Hair LLC, Nutree Cosmetics, Novex Hair Care, Wella Professionals, Johnson & Johnson, Ouai Haircare, Peter Coppola, Rich Daddy International, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- L'Oréal S.A.

- Unilever PLC

- Keratin Complex

- Henkel AG & Co. KGaA

- Cliove Organics

- Kerotin Hair Care

- GK Hair USA

- Gussi Hair LLC

- Nutree Cosmetics

- Novex Hair Care

- Wella Professionals

- Johnson & Johnson

- Ouai Haircare

- Peter Coppola

- Rich Daddy International

- Other Key Players