Global Intracardiac Echocardiography Market By Product Type (Catheter, Ultrasound System and Others), By Application (Electrophysiology, Left Atrial Appendage Closure and Others), By End-user (Hospitals, ASCs and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176323

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

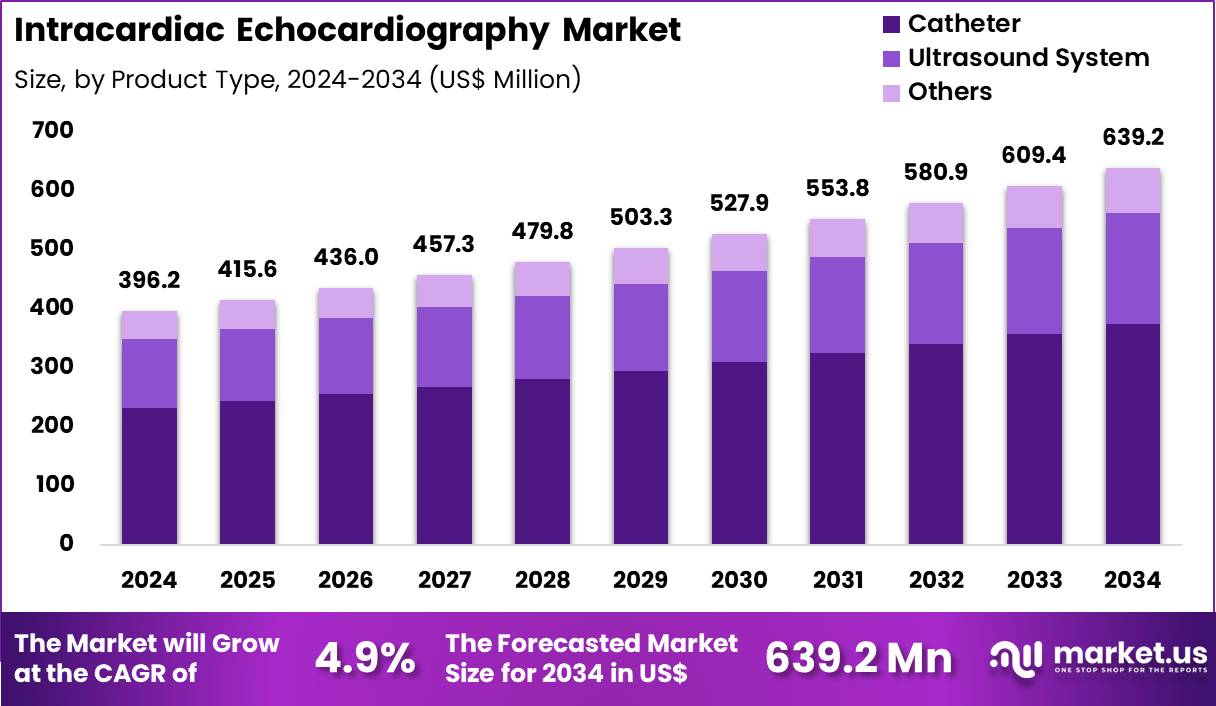

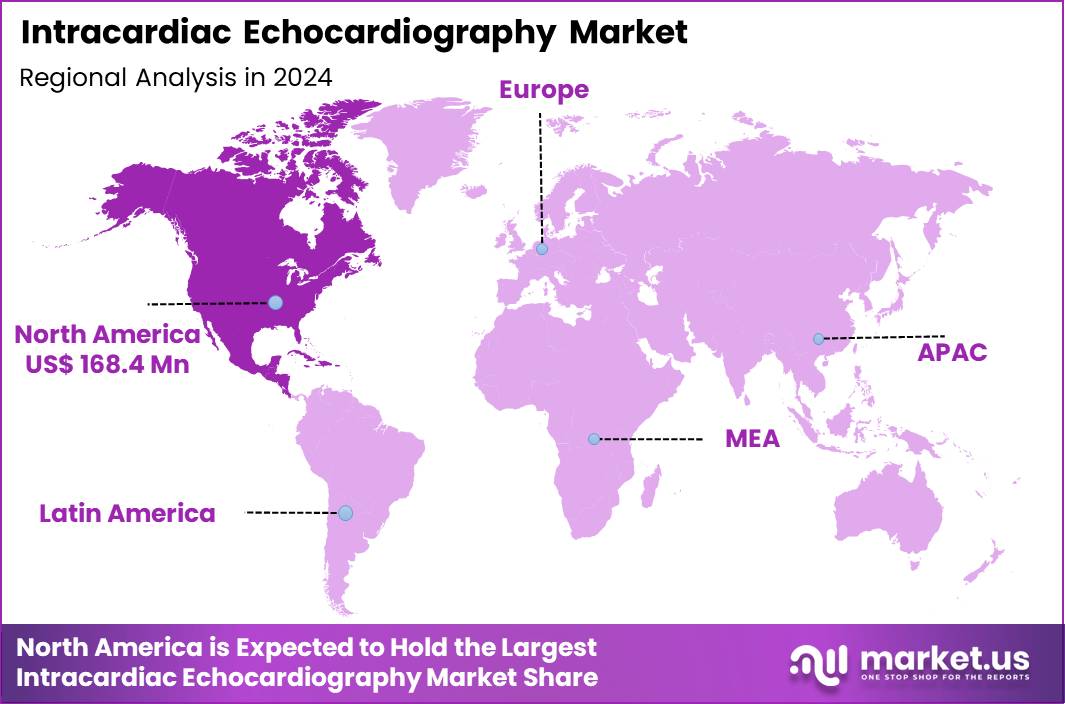

Global Intracardiac Echocardiography Market size is expected to be worth around US$ 639.2 Million by 2034 from US$ 396.2 Million in 2024, growing at a CAGR of 4.9% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 42.5% share with a revenue of US$ 168.4 Million.

Increasing adoption of minimally invasive cardiac interventions drives the intracardiac echocardiography market as cardiologists seek real-time, high-resolution imaging to guide precise procedures without fluoroscopy overexposure. Electrophysiologists increasingly utilize ICE catheters during atrial fibrillation ablations, visualizing cardiac structures and catheter positions to avoid complications like pulmonary vein stenosis.

These devices support transcatheter aortic valve replacements by providing detailed views of valve anatomy and paravalvular leaks, ensuring optimal prosthesis deployment in high-risk patients. Interventionalists apply ICE in left atrial appendage closures, confirming device placement and thrombus absence to reduce stroke risk in non-valvular atrial fibrillation cases.

Structural heart specialists employ ICE for patent foramen ovale closures, assessing shunt severity and guiding occluder positioning with minimal contrast use. Pediatric cardiologists leverage ICE in congenital defect repairs, offering superior imaging of small intracardiac structures during septal defect closures.

Manufacturers pursue opportunities to integrate artificial intelligence algorithms that enhance image processing and automate anatomical recognition, expanding applications in complex hybrid procedures combining ablation and structural interventions. Developers advance miniaturized, steerable ICE probes with 3D capabilities, broadening utility in outpatient settings for diagnostic evaluations of arrhythmias and valvular diseases.

These innovations facilitate fusion with other modalities like computed tomography, improving navigation accuracy in electrophysiology labs. Opportunities emerge in wireless ICE systems that reduce procedural clutter and enhance mobility during lengthy interventions.

Companies invest in biocompatible materials that minimize thrombus formation, supporting prolonged use in high-acuity cases. Recent trends emphasize point-of-care ICE platforms with cloud connectivity, enabling remote expert consultation and data sharing to optimize outcomes across diverse cardiac applications.

Key Takeaways

- In 2024, the market generated a revenue of US$ 396.2 Million, with a CAGR of 4.9%, and is expected to reach US$ 639.2 Million by the year 2034.

- The product type segment is divided into catheter, ultrasound system and others, with catheter taking the lead with a market share of 58.7%.

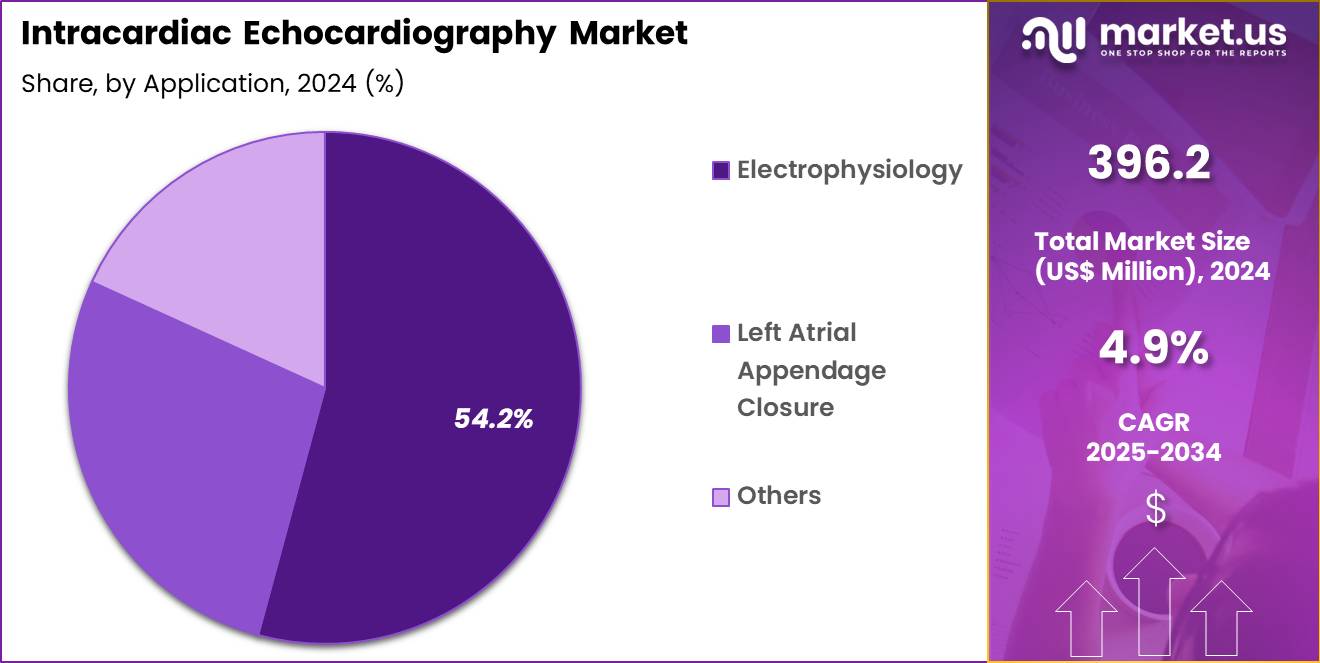

- Considering application, the market is divided into electrophysiology, left atrial appendage closure and others. Among these, electrophysiology held a significant share of 54.2%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, ASCs and others. The hospitals sector stands out as the dominant player, holding the largest revenue share of 63.5% in the market.

- North America led the market by securing a market share of 42.5%.

Product Type Analysis

Catheters contributed 58.7% of growth within product type and led the intracardiac echocardiography market due to their central role in real-time, high-resolution cardiac imaging during minimally invasive procedures. Interventional cardiologists rely on ICE catheters to visualize cardiac anatomy directly from within the heart, which improves procedural precision and safety.

Growing adoption of complex structural and electrophysiology procedures increases catheter utilization per case. Single-use catheter preference also raises repeat demand across hospitals and cardiac centers.Technological advancements enhance catheter maneuverability, imaging depth, and integration with mapping systems.

Physicians value improved visualization without dependence on general anesthesia or transesophageal probes. Reduced procedure time supports higher lab throughput. Training familiarity and standardized procedural protocols further reinforce catheter adoption. The segment is projected to remain dominant as procedural volumes increase and intracardiac imaging becomes a standard of care in interventional cardiology.

Application Analysis

Electrophysiology generated 54.2% of growth within application and emerged as the leading segment due to rising prevalence of atrial fibrillation and other cardiac arrhythmias. ICE supports precise catheter navigation and real-time monitoring during ablation procedures, which improves clinical outcomes. Electrophysiologists prefer intracardiac imaging to reduce fluoroscopy dependence and enhance anatomical accuracy. Expanding use of advanced ablation techniques increases reliance on ICE-guided workflows.

Growth strengthens as healthcare systems emphasize radiation reduction strategies for both patients and staff. Integration of ICE with electroanatomical mapping platforms improves procedural confidence. Increasing referral volumes for rhythm management elevate imaging utilization. Training programs standardize ICE use within electrophysiology labs. The segment is anticipated to maintain leadership as arrhythmia management procedures continue to expand globally.

End-User Analysis

Hospitals accounted for 63.5% of growth within end-user and dominated the intracardiac echocardiography market due to their advanced interventional cardiology infrastructure and high procedure volumes. Hospitals manage complex electrophysiology and structural heart cases that require comprehensive imaging support. Availability of specialized cardiac catheterization labs strengthens adoption. Multidisciplinary cardiac teams further increase procedural demand within hospital settings.

Investment in advanced imaging technologies supports sustained hospital-based growth. Reimbursement alignment and clinical guideline adoption reinforce ICE utilization. Teaching hospitals expand usage through training and research activities. Centralized patient referral networks increase case concentration. The segment is expected to remain the primary growth driver as hospitals continue to anchor advanced cardiac intervention services.

Key Market Segments

By Product Type

- Catheter

- Ultrasound System

- Others

By Application

- Electrophysiology

- Left Atrial Appendage Closure

- Others

By End-user

- Hospitals

- ASCs

- Others

Drivers

Increasing prevalence of cardiovascular diseases is driving the market.

The growing global incidence of cardiovascular diseases has significantly heightened the demand for advanced imaging technologies such as intracardiac echocardiography to support precise interventional procedures. Enhanced screening initiatives and demographic aging have led to more identifications of structural heart conditions requiring real-time visualization.

According to the Centers for Disease Control and Prevention, in 2023, 919,032 people died from cardiovascular disease in the United States, representing one in every three deaths. This mortality burden underscores the critical need for tools that improve procedural accuracy in electrophysiology and valve interventions. Intracardiac echocardiography provides superior imaging of cardiac anatomy, reducing complications in catheter-based therapies.

Healthcare institutions are prioritizing these devices to address the rising caseload of atrial fibrillation and valvular disorders. The direct relationship between disease prevalence and procedural volumes propels investments in echocardiography systems.

Recognized organizations emphasize early detection strategies to curb long-term healthcare costs. Prominent manufacturers are expanding production capacities to align with this escalating clinical requirement. This driver continues to foster technological refinements for better patient management in cardiology.

Restraints

High cost of intracardiac echocardiography systems is restraining the market.

The substantial pricing of intracardiac echocardiography consoles and catheters poses a notable barrier to adoption in facilities with limited capital budgets. Complex engineering for high-resolution transducers and integration software contributes to elevated manufacturing expenditures. Smaller hospitals often encounter difficulties in justifying investments amid competing equipment priorities. Oversight requirements for device sterilization and maintenance further increase operational overheads. In environments with constrained reimbursement, these costs limit procedural accessibility for patients. Clinicians may resort to alternative imaging modalities to optimize resource allocation. This restraint curtails expansion in public health sectors globally. Joint procurement efforts seek to negotiate better terms, though effectiveness varies. Despite diagnostic advantages, financial considerations impede universal implementation. Enhancing value-based pricing models is essential to counter this market limitation.

Opportunities

Strong growth in cardiology segment revenues is creating growth opportunities.

The robust expansion in cardiology-related revenues among leading manufacturers signals potential for increased deployment of intracardiac echocardiography in interventional suites. Strategic focus on structural heart programs supports the incorporation of these devices in high-volume centers.

Boston Scientific reported cardiology net sales of 8.344 billion dollars in 2024, reflecting a 24.4 percent increase from the previous year. This financial uplift demonstrates sustained investment in technologies that enhance procedural efficacy.

Alliances with healthcare networks enable tailored solutions for emerging electrophysiology demands. The substantial procedural base in developed economies amplifies prospects for system upgrades. Policy advancements in cardiac care reimbursement bolster infrastructure enhancements.

Primary corporations are initiating regional expansions to leverage economic upturns. This opportunity corresponds with initiatives to elevate standards in minimally invasive interventions. Concentrated developments can yield notable progress in specialized applications.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions affect the intracardiac echocardiography market through hospital capital allocation, procedure volumes, and reimbursement discipline that executives monitor closely. Inflation and elevated interest rates tighten budgets for cath labs, which slows adoption of new consoles and single use catheters. Geopolitical tensions disrupt supplies of ultrasound components, semiconductors, and medical grade materials, increasing lead times and planning risk.

Current US tariffs on imported electronics and catheter components raise manufacturing and landed costs, which compresses margins and complicates pricing strategies. These pressures can delay purchasing decisions at cost sensitive centers and strain smaller suppliers. On the positive side, trade pressure encourages local assembly, supplier diversification, and stronger quality oversight.

Growing use of minimally invasive electrophysiology and structural heart procedures sustains clinical demand for real time imaging. With disciplined sourcing, workflow efficiency, and continued clinical innovation, the market remains positioned for durable growth.

Latest Trends

Launch of real-time 3D intracardiac echocardiography catheters is a recent trend in the market.

In 2025, the introduction of advanced 3D intracardiac echocardiography catheters has elevated imaging capabilities for minimally invasive cardiac interventions. These devices feature miniaturized probes that deliver high-quality 2D and 3D visualizations in real time. Philips launched the VeriSight Pro 3D Intracardiac Echocardiography catheter in Europe on May 19, 2025, designed for structural heart and electrophysiology procedures.

The catheter’s 3-millimeter diameter facilitates navigation through vascular systems while supporting features like simultaneous multi-plane imaging. Integration with ultrasound and image-guided therapy platforms streamlines workflows in interventional settings. Clinical applications include transcatheter valve repairs and atrial appendage closures with reduced anesthesia needs.

The trend prioritizes patient comfort by minimizing recovery times and procedural risks. Regulatory clearances in key markets have facilitated broader commercialization. Sector partnerships optimize features for enhanced cardiac structure delineation. These innovations aim to address growing volumes of complex heart disease cases effectively.

Regional Analysis

North America is leading the Intracardiac Echocardiography Market

North America holds a 42.5% share of the global Intracardiac Echocardiography market, reflecting pronounced expansion in 2024 owing to escalating procedural volumes in electrophysiology labs and structural heart interventions, where real-time imaging guides catheter placements with superior precision.

Esteemed corporations like Boston Scientific and Johnson & Johnson have debuted refined catheters with 4D visualization features, minimizing radiation exposure and improving outcomes in atrial fibrillation ablations and valve repairs. The domain’s mature reimbursement landscape has incentivized hospitals to upgrade to hybrid systems combining echocardiography with mapping technologies, optimizing workflow for complex arrhythmias.

Efforts by the Centers for Medicare & Medicaid Services have streamlined coverage for ICE-guided procedures, spurring utilization among cardiologists treating aging demographics prone to valvular diseases. A proliferation of specialized training programs has equipped more practitioners with skills to leverage ICE for transseptal punctures, reducing perforation risks. Synergies between device makers and clinical societies have produced evidence-based protocols, elevating procedural safety and efficacy.

Furthermore, heightened scrutiny on minimizing contrast agents has favored ultrasound-based modalities in patients with renal impairments. The National Institutes of Health provided $2.77 billion in funding for cardiovascular research in fiscal year 2024, advancing imaging modalities integral to procedural innovations.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Specialists predict vigorous progression in the cardiac ultrasound arena across Asia Pacific over the forecast period, because policymakers amplify allocations to modernize catheter labs with integrated visualization tools. Enterprises in Singapore and Malaysia engineer slim-profile probes that enhance maneuverability during septal defect closures, while practitioners in Indonesia standardize protocols to tackle rampant rheumatic heart conditions.

Hospitals in Vietnam procure hybrid consoles that fuse real-time echoes with fluoroscopy, streamlining workflows for congenital anomaly corrections. Donors in Cambodia finance skill-building seminars that certify technicians in probe handling, elevating precision in arrhythmia mappings. Officials in Brunei mandate upgrades to diagnostic suites, incorporating volumetric rendering for better lesion assessments.

Clinicians in Bhutan merge local datasets with advanced algorithms, refining visualizations for hypertensive cardiomyopathies. Manufacturers in Fiji adapt transducers for portable use, supporting outreach in island communities. The Pharmaceuticals and Medical Devices Agency in Japan approved nearly 800 new medical devices in fiscal year 2024, facilitating broader access to sophisticated cardiac tools.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the intracardiac echocardiography market build momentum by investing in higher-resolution imaging catheters, integrating real-time 3D visualization software, and refining miniaturized probes that enhance procedural precision and clinician confidence during complex interventions. They also expand through strategic partnerships with electrophysiology labs and cardiac centers, ensuring their solutions align with evolving procedural workflows and training needs across global regions.

Firms strengthen position by tailoring go-to-market approaches that combine clinical education, flexible financing, and post-sales service support to accelerate adoption among hospitals and specialty clinics. Geographic expansion into emerging healthcare systems complements penetration in North America and Europe, balancing growth amid rising cardiovascular disease prevalence.

GE HealthCare stands out as a leading diversified medical technology company headquartered in the United States with a broad cardiovascular imaging portfolio and deep sales and service networks that support advanced cardiac procedures worldwide. The company champions growth through disciplined R&D investment, multi-channel commercialization, and sustained engagement with cardiology stakeholders to translate clinical trends into marketable innovations.

Top Key Players

- Boston Scientific

- Abbott Laboratories

- Medtronic

- BIOTRONIK

- Biosense Webster

- Siemens Healthineers

- GE HealthCare

- Philips Healthcare

- Canon Medical Systems

- Terumo Corporation

Recent Developments

- In March 2024, FUJIFILM Healthcare Americas Corporation aligned with Us2.ai to embed AI-based automation into cardiovascular ultrasound imaging. The collaboration enables Us2.ai’s automated echocardiography workflow to operate on Fujifilm’s LISENDO 800 system, supporting standardized measurements and streamlined cardiac imaging processes.

- In August 2024, Siemens Healthineers secured FDA authorization for ACUSON Origin, a cardiovascular ultrasound platform designed specifically for cardiac care. The system incorporates AI functions to support interventional and diagnostic cardiology use cases. It is also the exclusive host for the AcuNav Lumos 4D ICE catheter, which enables high-definition intracardiac visualization during complex heart procedures.

Report Scope

Report Features Description Market Value (2024) US$ 396.2 Million Forecast Revenue (2034) US$ 639.2 Million CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Catheter, Ultrasound System and Others), By Application (Electrophysiology, Left Atrial Appendage Closure and Others), By End-user (Hospitals, ASCs and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Boston Scientific, Abbott Laboratories, Medtronic, BIOTRONIK, Biosense Webster, Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems, Terumo Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Intracardiac Echocardiography MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Intracardiac Echocardiography MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Boston Scientific

- Abbott Laboratories

- Medtronic

- BIOTRONIK

- Biosense Webster

- Siemens Healthineers

- GE HealthCare

- Philips Healthcare

- Canon Medical Systems

- Terumo Corporation